Scott Sumner’s Incredible Arguments on the Swiss Currency Peg

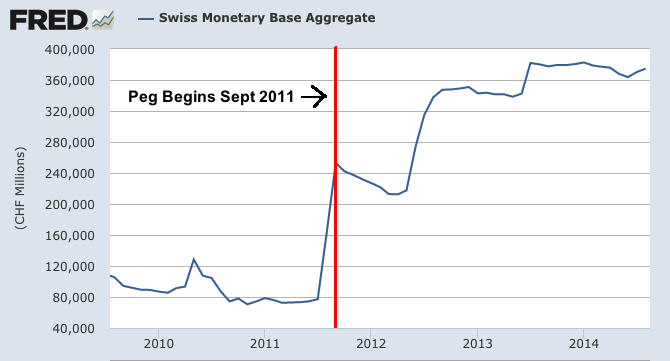

My latest at Mises CA. If you’re in a rush, here’s the graph to accompany Scott Sumner’s defense (made in December before the dropped it) where he said it was a piece of cake to maintain the peg:

I found some monetary base data that is quite interesting. From January to September 2011 the Swiss monetary base soared from 79b SF to 253b SF. That’s Zimbabwean money printing, and it shows why Krugman is so contemptuous of the inflationistas. Switzerland got essentially zero inflation. But then something interesting happened; after the currency was depreciated and pegged at 1.2 SF/euro, the base actually fell to 215b by May 2012. Once investors stopped thinking the SF was going to move ever higher, they no longer had a strong incentive to speculate in that asset. It became easier to defend the currency.

Alas, there was one more attack in mid-2012, as eurozone investors worried about a collapse in the euro. Naturally, in that environment the SF would be attractive at even a zero expected rate of return. The base rose again to 349b SF in September 2012, at which point growth slowed sharply (it’s 376b today.) More importantly, the 1.2 SF/euro peg held. Krugman was wrong, currency depreciation is not difficult if it is followed up with a level targeting regime.

Do you see how odd that is? As I summarize Scott’s position in my post:

As long as speculators don’t attack you, you should be fine.

Amd we leep getting more of his writing (e.g., he is now permanent at econlib). I find his other stuff ok, .but the monetary policy posts (most stuff he writes) is sloppy, too_clever-by-half type argument.

The Swiss economy is pretty strong and the peg was always probably of somewhat marginal significance to it. I don’t think anyone really thinks that its abandonment will have a major impact on the Swiss economy. On balance the Swiss CB probably just decided that the political implication of holding the peg just weren’t worth it.

Having said that its not really clear to me why the CB having a large balance sheet as it “prints” more francs matters much from an economic perspective. Had the Swiss CB adopted Sumner’s preferred policy of NGDP targeting rather than a currency peg the short-term disruption of EU QE starting up wouldn’t have been a big deal, and the (probably relatively minor) consequent downturn in the Swiss economy could have been avoided.

Ah so that monetary policy will work OK, but only if the economy has not had to endure that same policy in the past and thus weakening it.

Kind of like drinking turpentine.

Transformer,

3 Questions:

What is the “political implication” you speak of that made them think it is better to stop the peg?

And so you really think this increase in the balance sheet does not pose any additional risk for the CB, so an 80 times increase would have been just as fine?

Finally what do you think has the SNB accomplished with this peg other than delay the inevitable by two years and the blowing up of their balance sheet (increase in the value of the CHF)? (On the contrary if they hadn’t done that then most likely they wouldn’t have seen a 20% FX move in one day, and their economy would have had more time to adjust to the new situation).

BTW: It seems the SNB accomplished one more thing. This peg pushed rates even lower, which means Swiss are starting to save more and more directly in cash. The 1000 CHF note makes 61% now of all the value of the cash out there, so the SNB assumes that people don’t hold them for shopping… I gueess this is just another point which the CB had not in mind when starting the peg.

http://www.snb.ch/en/iabout/cash/id/cash_circulation

-> And this chart only includes 2013 at the moment.

Q:What is the “political implication” you speak of that made them think it is better to stop the peg?

Mainly just people freaking out about the size of the balance sheet.

Q:And so you really think this increase in the balance sheet does not pose any additional risk for the CB, so an 80 times increase would have been just as fine?

Yes, I don’t see the size of the balance sheet as an issue. I suppose the worse thing that could happen is that the SNB buys up load of assets for new francs, and then those asset lose money so if and when it has to reduce the number of francs in circulation by selling those assets it runs out, and has to produce new ones of its own.

Q:Finally what do you think has the SNB accomplished with this peg other than delay the inevitable by two years and the blowing up of their balance sheet (increase in the value of the CHF)

Good question. I think the CNB perceived that upward pressure on the franc would introduce disequilibrium into its economy (prices wouldn’t adjust fast enough to an exchange rate shock) and the peg could avoid this. Their publicly stated reason for abandonment was that the economy was now strong enough to withstand an increase in the exchange rate. While disagreeing that increasing the supply of Swiss francs was a bad idea, I do agree that the peg itself was a bad idea – they should have chosen a better nominal target like NGDP.

Finally a disclaimer: Were currencies not controlled by CBs but supplied by the market – none of the this would be needed. Demand for liquidity would be better matched by supply and recessions caused by monetary disequilibrium could be avoided.

„Mainly just people freaking out about the size of the balance sheet.“

You really think that to be the only reason why the CB stopped it, they didn’t consider any actual economic reason? But I guess its only consistent given your answer on my question 2.

„I suppose the worse thing that could happen is that the SNB buys up load of assets for new francs, and then those asset lose money so if and when it has to reduce the number of francs in circulation by selling those assets it runs out, and has to produce new ones of its own.“

What do you mean with „those asset lose money“. I guess you mean the value of the assets fall and the CB can’t sell them for a high enough price to suck enough CHF out of the market. Your solution „and has to produce new ones of its own.“ does not work. A CB cannot create assets. Else tell me how that would work?

„I think the CNB perceived that upward pressure on the franc would introduce disequilibrium into its economy (prices wouldn’t adjust fast enough to an exchange rate shock) and the peg could avoid this. Their publicly stated reason for abandonment was that the economy was now strong enough to withstand an increase in the exchange rate. “

Actually they said that mainly because the EUR devalued against the USD and the economy adjusted to a stronger CHF they stopped the peg. At least the part with the economy is a lie. How could it adjust for a stronger CHF when the SNB every single time told the market how they would defend 1,20 line until well they changed their mind and SHOCKED the market with lifting the peg, hence the 20% FX move.

Well I can’t prove that the SNB got cold feet in prospect of QE by the ECB, but it is a strange coincidence to lift the peg just right before this announcement. On the other hand even you believe the SNB lied in their statement and actually stopped the peg merely for political reasons.

I do acknowledge your stance for NGDP targeting only as second best solution. However I think (see my question above how the CB should be able to create assets) you are gravely wrong in underestimating the dangers of a bloated CB balance sheet.

I should have said *…You really think that to be the only *significant* reason why the CB stopped it…*

“What do you mean with „those asset lose money“. I guess you mean the value of the assets fall and the CB can’t sell them for a high enough price to suck enough CHF out of the market. Your solution „and has to produce new ones of its own.“ does not work. A CB cannot create assets. Else tell me how that would work?”

Yes, I meant the value of the assets fall.

There are 2 ways the number of francs could be reduced – sell bonds or increase taxation. Both are fiscal policies admittedly, but both would work in the unlikely event the CB balance sheet was reduced to zero.

It’s not Scott Sumner’s argument that is incredible. It’s his claim to be a monetarist. If “Zimbabwean money printing” really doesn’t bother you at all, then, whether subsequent events go your way or not, you’ve no right to describe yourself as a monetarist.

Is the argument here that officials in the SNB would get carpal tunnel syndrome by typing in numbers in their computer? Or are we supposed to be worried about exhaustion by those working at the SNB trading desk, purchasing all of those foreign assets?

The demand for Swiss francs rose a lot and the SNB issued lots to meet the demand. What is wrong with that?

That said, I do think that charging banks to hold reserve balances at the SNB is a good way to dampen increased demand when purchasing lots of foreign assets that might depreciate.

And pegging exchange rates is a bad idea anyway.

Bill, your last comment is odd. You start out sarcastically wondering what the possible problem could be with setting a fixed exchange rate that drives your central bank’s holdings balance sheet up to 80% of GDP, like I’m a nutjob for even worrying about this.

Then you end by agreeing that pegging exchange rates is a bad idea.

That’s like saying, “Everyone’s freaking out about Dick Cheney shooting his hunting buddy, but I don’t see what the problem is. Did he sprain his trigger finger or something? Anyway, hunting is a bad idea, it hurts animals.”

For those who probably missed it a couple of weeks ago, Murphy made the point that just the Swiss dropping the peg meant that it was never credible, and Sumner replied that the Swiss dropping it had nothing to do with it being credible (on TheMoneyIllusion, I think, around January 18-21st). It is hard to argue with that!!

What Sumner is saying is:

As long as speculators don’t attack you, you should be fine and you have total control over the incentives that would make speculators attack you.