Ben Bernanke Blogging

Former Federal Reserve Chair Ben Bernanke has a new blog hosted at the Brookings Institution. What interests me is the reverence with which we are to hold the former Fed officials. Here’s how Bernanke describes why he’s happy about this opportunity:

The ability to shape market expectations of future policy through public statements is one of the most powerful tools the Fed has. The downside for policymakers, of course, is that the cost of sending the wrong message can be high. Presumably, that’s why my predecessor Alan Greenspan once told a Senate committee that, as a central banker, he had “learned to mumble with great incoherence.”

On January 31, 2014, I left the chairmanship of the Fed in the capable hands of Janet Yellen. Now that I’m a civilian again, I can once more comment on economic and financial issues without my words being put under the microscope by Fed watchers.

What bugs me about this is that in other arenas, the public would be upset at officials so brazenly admitting that they are deliberately obfuscating. Or, at the very least, if it were deemed a matter of national security, a CIA chief would very soberly explain why he had to be vague in an answer.

Yet when it comes to Greenspan, the feel of the remarks is, “Oh you! That Greenspan was such a card.”

This is significant, when many economists–not just Austrians, but also John Taylor, the economist after whom the famous “Taylor Rule” is named–blame Alan Greenspan’s artificially low interest rates after the dot-com crash for fueling the housing bubble.

And turning to Bernanke himself, here’s how the Brookings website describes him:

Ben S. Bernanke is a Distinguished Fellow in Residence with the Economic Studies Program at the Brookings Institution. From February 2006 through January 2014, he was Chairman of the Board of Governors of the Federal Reserve System. Dr. Bernanke also served as Chairman of the Federal Open Market Committee, the System’s principal monetary policymaking body.

A very respectable and honored position, to be sure. And yet, there are many economists–again, not just Austrians, but including Market Monetarists–who think that the Federal Reserve under Bernanke did a terrible job.

Remember, it’s not just disagreement about what Bernanke’s Fed did after the crisis hit. He was systematically wrong (or lying) every step of the way, going into the crisis (and note that in the beginning of this clip Bernanke wasn’t at that point Fed chair, but was chairman of Bush’s Council of Economic Advisors):

On this point, listen to Tom Woods interview Mark Thornton who has a new paper showing just how wrong the Fed was in 2007.

Of course this is nothing new. Richard Nixon was an absolute pariah, but then later eventually somehow became an “elder statesman.”

It is important in the mythology of the modern American State that its leading officials are a different (and higher) category of human, no matter how abysmal their actual performances. Just the fact that they held that much raw power is enough to command the respect and awe of our media and academic institutions.

Hot Button Phrase: “FEMA Camp”

Second perhaps only to “chemtrails,” when the responsible, sober libertarians on Facebook want to mock the paranoid ones, they bring up “FEMA camps.” A relative sent me the following video, which apparently shows footage from Florida of a drill in which U.S. military pretend to march U.S. citizens into a detention camp. Then the anchor (Franchi) goes on to give other reasons that he doesn’t think this is a paranoid theory.

As the Onion asks: What do you think?

Sean Hannity vs. Pat Buchanan

The realpolitik-ish von Pepe sends me this awesome exchange:

Make sure you watch to the end when Hannity plays the Hitler card.

Stephan Kinsella Discusses Argumentation Ethics With Tom Woods

Here. Let me emphasize that I really do think I get what Hoppe is trying to do here, and I appreciate how awesome a project it is. It’s like Aquinas’ arguments for God; they are really hardcore and so much more fundamental than the usual thing you hear in a debate.

I just think Hoppe’s argument doesn’t work, I’m sorry. It’s not that I have a grudge against Hoppe’s style; for example, I love his Economic Science and the Austrian Method–he says the action axiom solved the mind-body problem. Absolutely blew my mind. But I just don’t think the argumentation ethics works.

==> Gene Callahan and I have at least three independent objections to it in this article that, in my opinion, are devastating. If just one of them goes through, it’s dead.

==> The very act of debating presupposes that we freely control our bodies and are standing on a piece of real estate. By making that observation, did I just prove that every non-criminal needs to own a plot of land in a just society? Of course not. But yet I’m pretty sure Stephan thinks it proves that every non-criminal needs to own his or her body. How?

==> At several points in his analysis, Stephan has to appeal to the fact that libertarian rights are reasonable and make sense, otherwise his argument doesn’t go through. For example, at about the 80% mark of the interview, Stephan discusses a guy who goes on a rampage on a farm, and the farmer imprisons the guy in his house while figuring out what to do next (like notify the law enforcement people). Stephan says the prisoner could demand, “How do you justify imprisoning me while you’re free?” and the farmer could say, “Because you just attacked my family!” Stephan’s point is that that is a legitimate reason, not like the arbitrary and/or non-universalizable reasons that social democrats would give to justify why they are using coercion to (say) imprison Wesley Snipes for tax evasion. But of course, the reason it seems reasonable to Stephan to imprison a guy for trying to steal private property, while it seems arbitrary and illegitimate to put a rich guy in a cage for not paying taxes, is that Stephan is a Rothbardian. Leo Tolstoy might think imprisoning the first guy would be arbitrary (especially if he was trying to take food or animals, not just hurting people and breaking stuff), and most Americans don’t think it’s arbitrary to lock up a selfish citizen who doesn’t pay his fair share of taxes. So in other words, to get anything out of argumentation ethics, you have to say, “First, let’s stipulate that libertarianism is right. Now, I can show you that anybody who denies libertarianism is wrong…”

==> Something that didn’t occur to me until listening to this podcast: Hoppe got the idea for this approach from his teacher, Habermas. Apparently Habermas himself used the approach to justify not the libertarian ethic, but a broader social democratic one. I haven’t looked it up, but I wonder if it goes something like this? “To properly debate, you need to be educated, have access to a good diet and exercise regimen, not be exhausted from working 80-hour weeks with no vacation or childcare, etc. So clearly, anybody arguing against the modern welfare state is contradicting himself.” So whatever methods Stephan uses to show why that is wrong, will also show why we don’t get to retain full-blown libertarianism either. As I said before, the only way you get libertarianism, is if you already believe it for independent reasons.

==> I’m exaggerating a bit (and hence being a bit unfair), but I want to make my above claims clear: Imagine somebody said, “2+2 = 4, therefore libertarianism is the only ethical system.” Then I say that’s a non sequitur, and the guy who proposed it is stunned. “But Bob, you’re a libertarian. So why are you playing dumb and pretending you think maybe there is a rival system that’s just as ethical? Or are you now saying math can be whatever people assert? Do you support Common Core?”

DeLong Gives Me Whiplash

[Two UPDATEs below, one embedded and one at the end.]

I have to be brief, so if you’re a newcomer to this blog, you won’t get much from this. But back in early 2009, Brad DeLong was very skeptical about the ability of the Federal Reserve to rescue the world economy from the ravages of the Great Recession. Here’s DeLong from January 2009: “The fact that monetary policy has shot its bolt and has no more room for action is what has driven a lot of people like me who think that monetary policy is a much better stabilization policy tool to endorse the Obama fiscal boost plan.”

[UPDATE: I realized I didn’t give a long enough quote to see why there is no wiggle room here. Earlier from DeLong’s January 2009 post:

The difference between now and 1982 was that back in 1982 the interest rate on Treasury bills was 13.68%–there was a lot of room for the Federal Reserve to cut interest rates and so reduce unemployment via monetary policy. Today the interest rate on Treasury bills is 0.03%–there is no room for the Federal Reserve to cut interest rates, and so monetary policy is reduced to untried “quantitative easing” experiments. [Bold added by RPM.]]

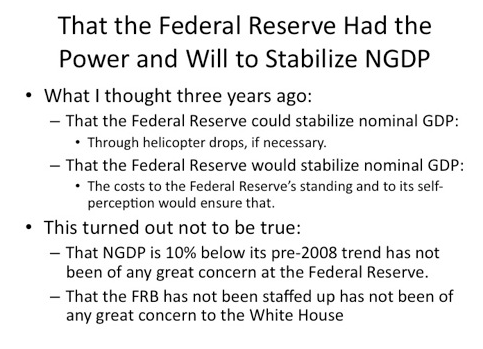

Then later, when Scott Sumner was the toast of the town, DeLong made it sound like he’d been on board with NGDP targeting all along. For example, in January 2011 DeLong put in a seminar paper:

So a bunch of us went nuts at the time, pointing out what a total rewrite of history this was. (E.g. here’s Sumner.) I can’t find the link, but at the time DeLong bit my head off for daring to suggest that he had ever cast aspersions on the power of the Fed in the beginning of the crisis.

And now we’ve come full circle. In a book review DeLong writes:

The dominance of Friedman’s ideas at the beginning of the Great Recession has less to do with the evidence supporting them than with the fact that the science of economics is all too often tainted by politics. In this case, the contamination was so bad that policymakers were unwilling to go beyond Friedman and apply Keynesian and Minskyite policies on a large enough scale to address the problems that the Great Recession presented.

Admitting that the monetarist cure was inadequate would have required mainstream economists to swim against the neoliberal currents of our age. It would have required acknowledging that the causes of the Great Depression ran much deeper than a technocratic failure to manage the money supply properly. And doing that would have been tantamount to admitting the merits of social democracy and recognizing that the failure of markets can sometimes be a greater danger than the inefficiency of governments.

The result was a host of policies based not on evidence, but on inadequately examined ideas. And we are still paying the price for that intellectual failure today.

Fortunately, we don’t need to speculate on how the above three positions all mesh perfectly, as I expect Daniel Kuehn will inform us in the comments.

UPDATE: Daniel Kuehn in the comments tries to defend DeLong by making a distinction between conventional and unconventional policy, and that’s what DeLong did back in 2011 when I noted the apparent inconsistency. But that won’t do. DeLong in 2011 is claiming that pre-crisis, he thought the Fed could and would do whatever it took to keep NGDP growing–including “helicopter drops.” In case it’s not clear, let me make it so: A “helicopter drop” means the Fed literally gives money to the public, without even bothering to buy assets. It is further from conventional monetary policy than QE is. You don’t rely on interest rate adjustments if you’re using helicopter drops to boost aggregate demand.

So, the only way to make sense of DeLong’s 2011 post, in light of what he said in 2009 (and now), is this: “Back before the crisis, I was convinced the Fed would ignore naysayers like me when it implemented unconventional policies. I am frankly astonished they took me seriously.”

Tom Woods and I Talk About Krugman and Keynesianism

It’s all here… BTW in the interview I implied that the tradition of explaining business cycles as due to purely real factors (as opposed to monetary) is centered in Chicago, but actually I think it’s more nuanced than that. (In contrast, the Efficient Markets Hypothesis is definitely associated with Chicago.)

A Critique of Jerry Taylor’s “Conservative Case for a Carbon Tax”

My latest at IER, though the team helped me a lot with this one. An excerpt, and keep in mind that Taylor is the president of the new Niskanen Center:

Although he doesn’t come out and say it, Taylor’s argument here rests on the belief that the hodge-podge of energy interventions currently exist because the Left really wants to limit carbon dioxide emissions, but gosh darn it those stubborn conservative Republicans are taking the efficient “market solution” of a carbon tax off the table, leaving only direct regulation. Taylor needs such a belief for his argument to work. The only reason we could possibly expect the environmental Left to honor a carbon tax deal, is if they said, “Phew! Now that we have an adequate mechanism in place for bringing emissions down to their socially optimal level as the economists inform us, we can decimate the EPA and tell everybody working at the Department of Energy to get a real job.”

Does Taylor actually believe that? What would William Niskanen have to say about the prospects of getting rid of huge bureaucracies once their apparent mission had been accomplished?

Recent Comments