The Adults in the Room Can’t Stand That Schoolyard Bully Trump

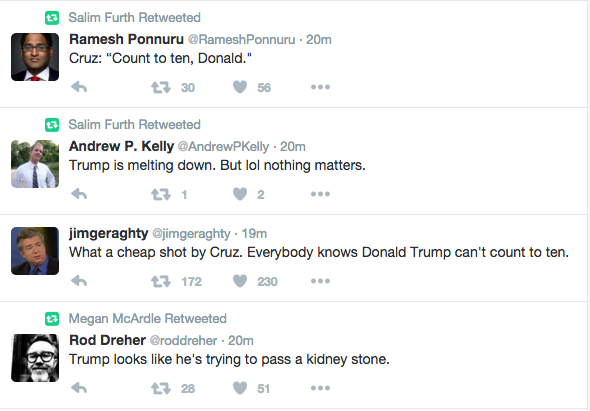

I believe this is how Socrates dealt with a boor, as well:

(I didn’t cut and paste. The reason I made this post is that the above happened to be contiguous in my Twitter feed.)

I’m being dead serious. I couldn’t stand Trump in the beginning of this thing. But seeing people call him Hitler day in and day out, and continue to talk about “stopping Trump” when really they mean “stopping the vast number of people who keep voting for him,” makes me no longer detest the guy. I have to think this barrage of smug attacks is having the same effect on other people too.

Callahan vs. Murphy: Only One Will Stand

I am happy to die on this hill: If you take my worldview to the extreme, then people really do have rights and if, for some crazy reason, most Earthlings refused to contribute to a project to stop a killer asteroid, then it would be immoral to take their money against their will.

Gene Callahan thinks that I’m very wrong. He also thinks that it would be moral to use coercion to make people polite; you don’t have a right to use insulting language, for example. The only reason we might not want the State to prevent people from saying offensive things is that it would produce worse results than the offensive speech.

(Go ahead and click the link. You think surely I’m misrepresenting Gene. Nope.)

Another Interesting Facebook Misunderstanding

A while ago I posted about the misunderstanding people had when on Facebook I said something like, “Has anyone tried sending ISIS the Carpenters’ Christmas album? I’m not saying it would work, but we should at least try.” I meant that Karen’s voice was so sweet and lovely that it would calm even the angriest of fanatics. But several people thought I meant that it would kill ISIS, along the lines of, “Ha ha let’s force them to listen to Nickelback.”

We have another such incident when I recently posted something like, “The people who are flipping out about Donald Trump strike me as akin to going nuts when ‘Halloween 5’ came out. Sure, I’m not disagreeing with your critique, but you’re just *now* noticing these things?”

So what I meant is that the American police state has been coming along quite nicely for some time now. (See my video from 2013 below.)

Yet several people patted themselves on the back and said, “Well Bob, *I* was on to Trump’s awfulness from the get-go. Not my fault if the rest of the people are just waking up to it.”

To be clear, the point of my post isn’t to criticize those people; I can see how my joke was ambiguous. I just think it’s interesting how people with different worldviews reach totally different conclusions.

Arguing With People On Twitter Is Stupid

…but every once in a while I have to remind myself why.

Seriously, this guy is a force of nature. Unfortunately not all of our exchange is captured in this link (I think maybe I spared Miles Kimball at some point, and so Twitter didn’t put those tweets in the same thread), but let me summarize for you what happened:

- Complete stranger jumps into a friendly disagreement I’m having with Miles Kimball, calls me an idiot, and says James Madison supported large-scale redistribution of wealth.

- I express surprise that Madison favored federal government levying taxes on rich individuals in order to make payments to poor individuals.

- He again points out how ignorant libertarians are, says I need to stop everything and spend 2 years reading Madison.

- I find one of his blog posts that he says has all the details. It quotes Madison laying out 5 concrete steps that (among other things) will reduce inequality. None of them involves taxing rich people, and Madison explicitly says he doesn’t want to interfere with the rights of property and wants equality before the law. I ask the guy if he has any other quotes where Madison clearly supports redistribution.

- The guy reiterates that I’m an idiot and a scoundrel.

- I say if that’s the case, it should be easy to produce a quote where Madison supports a federal tax on rich individuals.

- Guy asks, “How else can you reduce inequality except by a tax on rich people?”

- I am astounded and say, “So this whole time you’ve been *deducing* his support for redistribution?” I point out that it took a Constitutional amendment for federal government to be able to levy taxes on individuals. I also point out that if he re-reads his own blog post, he’ll see a list of measures that Madison supported which would reduce inequality, without involving a federal tax on rich people.

- He asks, “so what?”

I’m starting to understand what forces drive a man to become someone like Brad DeLong.

Efficient Market Bubbles and Why Is Scott Sumner a Libertarian?

I am really swamped with work stuff so I can’t do this justice. But I couldn’t ignore this recent Scott Sumner post at EconLog, in which he asks, “If you believe in bubbles, then why are you a libertarian?” Here’s his argument:

I don’t believe in bubbles. In addition, I’m a libertarian. I see those two facts as being related. If asset markets are efficient, then the case for government intervention is weaker…

Here’s what I don’t understand. I often talk to libertarians who seem to see bubbles all over the place. But this implies that markets are not pricing assets at the proper level. Often this will be attributed to outside factors such as monetary policy. It would be like excusing inefficiency in soybean pricing by pointing to the fact that it was windy and rainy last week…

If markets are not efficient when monetary policy is off course, there is absolutely no reason to assume that [markets] would be efficient when monetary policy is not off course. Inefficiency results from irrational pricing, it’s either a problem or it isn’t. People don’t become irrational just because the fed funds rate is set at 2% rather than 3%. Either markets are irrational or they aren’t.

If they are irrational, then the case for government intervention is much stronger.

For brevity I took out some of his caveats and nuances, but that’s definitely his argument. Here are some responses:

==> The most obvious one, which people in the comments harped on, is that government regulators are no more likely to get it right than private investors. However, even though it’s important to make that point, I think it doesn’t take on Scott’s argument directly. He actually acknowledges that point, and claims he just means that the case for markets surely is weaker if we admit markets are often prone to bubbles.

==> Why does Scott continually claim that efficient markets would rule out bubbles? At NYU we studied formal models–where all the agents obeyed Bayes’ Law and had rational expectations in Lucas’ sense–where there could be “informational cascades” and thus herd behavior. The intuition is that people have private signals that are noisy, and they observe other people’s actions to gain more information. If it just so happens that the first few people get a “buy” signal even though the asset is a dud, then each subsequent agent–even though most of them will get a “don’t buy” signal–will look at the string of buyers and conclude that his or her own signal is faulty. So you can get a whole population buying an asset even though if you polled them, collectively their aggregate information knows that the asset is a dud.

Extending that idea, I never published it but I wrote up a model one time dealing with the popular “rational expectations” objection to Austrian business cycle theory. If you view market prices as providing noisy information to investors, and if you think the Fed intervening will make the signal noisier–even though investors act perfectly rationally to compensate for Fed policy–then it is pretty straightforward to build a Chicago-Approved model where you get more booms over a period of time with Fed intervention.

==> There is a whole tradition in classical liberalism and modern libertarianism of people who actually believe humans have natural rights, and that it is immoral to violate someone’s rights. Not everyone is a crude utilitarian.

==> I wonder too why someone who is in favor of a carbon tax (can’t find good link but he is), 80% consumption tax rates on rich people, who thinks that if Republicans delayed a 40% surtax on employers who offer expensive health insurance policies it proves they don’t like poor people, who really wants to be able to support a federal Guaranteed Annual Income but just can’t get the numbers to work, who jokingly refers to his preferred policies as debasing the currency, and who proposes a single-payer health care system for catastrophic medical expenses…calls himself a libertarian? Seems to be a lot more strikes than someone who believes asset prices can be in a bubble when the Fed floods the markets with trillions of dollars.

Appeal to Scientism in the Climate Change Policy Debate

My latest at FEE. I think I have some funny lines in here that you haven’t seen before; this was not my usual piece. An example:

The “statistical analysis” did not establish that the critics’ claims were false. It is undeniably true that the official NASA GISS records showed, for example, that the average annual global temperature in 2008 was lower than the annual temperature in 1998, and that’s why people at the time were saying, “There has been no global warming in the last ten years.”

Here is a NASA-affiliated scientist arguing that such claims are misleading, and perhaps they were, but it is similarly misleading to turn around and claim that the pause didn’t exist.

If you asked a bunch of Americans whether they gained weight over the last 10 years, their natural interpretation of that question would be, “Do I weigh morenow than I weighed 10 years ago?” They wouldn’t think it involved construction of moving averages since birth. In that sense, the people referring to the pause were not acting dishonestly; they were pointing out to the public a fact about the temperature record that would definitely be news to them, in light of the rhetoric of runaway climate change.

Join Liberty Classroom, Get Free *Choice*

You believe in free choice, right? Prove it. You are powerless to resist Tom’s offer.

But for real, you have to sign up TODAY, Feb. 29. Don’t let your reason interfere with what your emotions want. Act now before it’s too late.

That Voodoo, That Krug Do

The punchline from my latest blog post at The Beacon:

Are these really the most outrageous examples of “voodoo economics” to come out of a keyboard in the last few years? Does a projection of 5.3 percent average real GDP growth really deserve three question marks? After all, Krugman is the one who has argued the following:

- The Obama Administration could’ve sidestepped the debt ceiling standoff by having the Treasury issue a trillion-dollar platinum coin. (This was such a palpably absurd suggestion that Jon Stewart saw the comedy in it.)

- The people warning about speculators attacking a nation’s bonds are wrong, because (a) it would never happen for responsible governments like Japan and the U.S. but (b) it would actually be agood thing for their economies if speculators attacked their currencies.

- In 2011, it would have been good for the EPA to force businesses to spend money complying with new environmental regulations, even setting aside and environmental benefit, because we were in a liquidity trap. In Krugman’s words: “This puts us in a world of topsy-turvy, in which many of the usual rules of economics cease to hold. Thrift leads to lower investment; wage cuts reduce employment; even higher productivity can be a bad thing. And the broken windows fallacy ceases to be a fallacy: something that forces firms to replace capital, even if that something seemingly makes them poorer, can stimulate spending and raise employment.”

- Although he was being intentionally provocative with his language, Krugman quite seriously recommended solving America’s long-term fiscal imbalance through “death panels and sales taxes.”

- And of course the masterpiece: In light of Republican obstinancy, a fake alien invasion would have been good economically by prodding politicians into supporting deficit spending (on a nonexistent threat) adequate to restoring Aggregate Demand, and fixing the slump within 18 months.

Looking over the above positions that Krugman has taken just in the past five years, are we really going to take Gerald Friedman out to the woodshed for saying Big Government spending can achieve 5.3 percent real GDP growth? Who’s the real voodoo witch doctor here?

Recent Comments