Potpourri

==> I explain why I think Carl Menger still added to our understanding of the origin of money, although Adam Smith definitely anticipated most of the explanation.

==> I side with David R. Henderson in thinking Scott Sumner has put forth an untenable view on how to settle questions of morality.

==> Since I’m linking to my EconLog comments, let’s do a full triple-play and go back to my discussion of Les Misfrom a while ago.

==> Larry Reed is stepping down as the head of FEE.

==> I know a lot of “hardcore” libertarians who give grief to Tyler Cowen for watering down his positions in order to curry favor with the establishment and remain “respectable” with the NYT etc. But maybe, just maybe, Tyler has been keeping his powder dry in order to get out the truth on the most important issue.

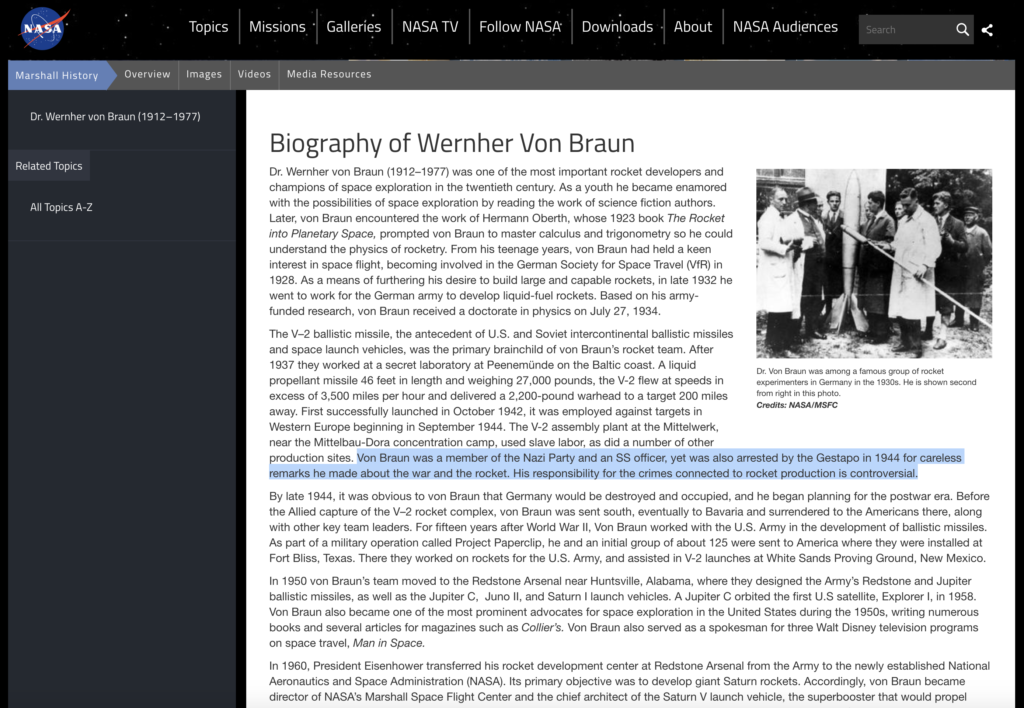

==> That’s as good as segue as any to point this out: I was listening with amusement to Benjamin Owen make some bold claims on Dave Smith’s show. One of the things Owen said was that “NASA was founded by S. S. Nazis.” I thought, “That seems like it must be a bit of an exaggeration,” but, uh, here’s what NASA itself says about it:

Re: Scott on truth. Or morality. Or free markets.

I have had considerable expertise in Excel programming and for a company that I worked for I built a model to report and project a billion dollar portfolio. For my efforts, I now know more about modeling and model behavior than probably the majority of climate “scientists.” (Also, from my grade school studies, l also know what “science is.)

On this, alone, I have very little confidence in “free market truth.” A common mistake I see when reading feminist ideology is the assurance of equality being measured solely on how much women make. Good economics has yet to quantify qualitative choices. Likewise, truth is not at a stage where it can be quantified.

I, therefore, stand with David and Bob.

Your comment makes no sense as written – there is no explanation why based solely because you know about modelling some things and have a grade school level of understanding about the criterion of what is science, you have little confidence “free market truth”. We are left to fill in the gaps.

You imply that people who study climate are not doing science and you know this because of grade school level knowledge. Can you confirm this is the case?

It is probably true that you know more about models than the majority of climate scientists, because most are not modellers. Do you think you know more about models than the expert modellers who apply their models to climate?

What do you think the experts think of people who do their models in Excel and assume they know more about GCM’s than they do?

The grade school science was more of a comment on politicians and members of the media. Consider, for example, that each time you hear the word “settled” in the context of “science,” the person putting those two words together does not have a grade school understanding of science.

As for modeling, anyone who has built a model knows how useless projections are beyond a year or so in the future. Just listening to the arrogance of those who claim otherwise is painful. Modeling in Economics and Modeling in Climate Science are not significantly different in that regard.

Does Climatology have a better grasp of its discipline than Economics? Not when every nonsensical contradiction is claimed to be based on climate change, regardless of how tenuous the claim.

“anyone who has built a model knows how useless projections are beyond a year or so in the future.”

That is odd, because I am sure there are models predicting sunrise times, eclipses and suchlike extending centuries into the future. Many models are useful for eons.

You must know this, so I presume you are thinking of certain types of model. I like to think of a rock bouncing down a steep rocky hill. It is very difficult to predict the exact position at any time, but the trend is very easy to predict. If you wanted to shoot the rock with a lazer at a particular time, you would need an incredibly accurate model to predict the exact position at that specified time, taking account of all the bounces. That is like predicting the weather. However, if you want to predict in general terms where the rock is heading you need a much less complicted model. That is like predicting the climate. A very simple model would be useful for predicting the gemeral trajectory of the rock.

“Does Climatology have a better grasp of its discipline than Economics?”

I don’t really know what you mean, but there are similarities. Climate scientists and economists make projections rather than predictions. They say “if this happens, then the result will be this.” Economists make such projections with great confidence. They say things like “if you raise taxes then it will dampen the economy. If you raise minimum wage too much it will result in reduced low-skilled employment.” Economists feel a justified frustration when lay-people comment that because they missed the crash, they cannot know anything about these effects of tax policy or minimum wage policy.

The equivalent for climate scientists is “if you raise CO2 it will get warmer.” Climate scientists feel a similar frustration to the above mentioned economists when lay-people weigh in with stuff like “you cant even say what the weather will be in a fortnight, let alone what the climate will be in 10 years.”

The economists projections are based on well understood principles, what we could call settled principles. Such as supply and demand and economics 101, which are not really disputed.

” that each time you hear the word “settled” in the context of “science,” the person putting those two words together does not have a grade school understanding of science.”

So you don’t consider the issue of phlogiston to be settled? Perhaps we should re-consider earth, fire, water and air to be the basic elements? Is matter infinitely divisible, or are there such things as atoms? The germ theory of disease? The Earth is not a flat disc?

I think you would accept that these are all settled. We do not need to establish these basic things with every paper published – they are accepted without needing justification. A medic publishing research on the spread of infection does not need to include a long introduction on how diseases are spread by microscopic things called “bacteria” and show all the evidence for their existence. That was settled a long time ago.

That does not mean that physics, chemistry and biology are settled and we don’t need to do them any more.

As with climate science, where some things are settled. The greenhouse effect is real and results in higher surface temperatures. CO2 is a greenhouse gas and ceteris paribus, higher CO2 will result in higher temperatures. These things are settled. There are some non-scientists that dispute these facts, as there are some that dispute germs or believe the Earth is flat. However these things are settled science.

So imagine some politician says “this Govt. will increase taxes and everyone will have more money!”

Economists will point out that this is nonesense. How can you know? ask the nay-sayers. “We understand some principles of economics very well. They are settled – they were worked out by economists over centuries.” “Hah! you can’t even predict the crash! All your models are useless!”

This I think gives something of the flavor of the “settled science” thing. Some principles are very well understood and accepted by pretty much all economists, as are some principles by climate scientists.

First, I do not consider myself a climatologist, I do not affirm or deny anything about climatology nor do I really care. My comment was relative to truth and you pretty much affirmed my point.

I do not really trust climatologists: economics states that incentives matter and there is abundant evidence that pushing climate change pays while questioning it is career destroying.

You apparently have no real experience modeling. Your examples reminds me of a rather bad movie (Christmas tornado(?)) where the protagonist says “fire up the algorithm.” A rock bouncing down a hillside is – to a model – an algorithm. It is one tiny piece of a geomorphology model, as are sunrises, sunsets, and tides. Put the pieces together and it either (a) adequately describes what is happening or (b) climatologists pile up excuses for their failure. Not a description of Truth.

von Neuman said ” By a model is meant a mathematical construct which, with the addition of certain verbal interpretations, describes observed phenomena.”

The mathematicl description of the solar system is a model which is used to predict events millenia in the future.

If we were to try to predict the location of a ball rolling down a smooth hill we would use a model. If we wanted to predict the location of a rock bouncing down a bumpy hill we would use a model. A rock bouncing down a hillside is the observed phenomenon we are attemting to model.

An algorithm is a process or set of rules to be followed. This does not describe the rock bouncing down a hill.

This is so obviously wrong I don’t understand why you wrote it.

” It is one tiny piece of a geomorphology model, as are sunrises, sunsets, and tides. Put the pieces together and it either (a) adequately describes what is happening or (b) climatologists pile up excuses for their failure. Not a description of Truth.”

This again makes no sense. We can model ball on an inclined plane without modelling the whole universe.

You said models were useless for projecting more than a year in the future. Obviously and patently wrong.

You said the words “settled” and “science” would not be used together by anyone with a grade school level of education. Wrong again.

Khodge, a physicist that questioned if gravity exists would also ruin their career, but this is not evidence that the theory of gravity is wrong nor does it mean that you shouldn’t trust physicists.

So Isaac Newton invented gravity with no knowledge of maths?

My mistake…I had no idea.

Einstein questioned the entire fabric of the universe … as well as effectively denying that gravity exists, in the form of a force at least … which is how earlier physicists had seen gravity before the idea of curved space was introduced.

His career did OK.

Oh, and filling in the gaps has always been one of my weak points.

They don’t make em like that anymore. You better stay healthy … don’t read any more feminist stuff. Some day we might need you in good shape.

Bob also thought I was a lot younger before we met on the cruise a couple years ago. I’m an old guy with a Santa Claus beard. (No beard at the time because I had stopped growing it many decades ago when it first came in grey.)

On rereading ths thread Harold changed the topic from truth by vote to am I better than a climatologist. He inadvertently strengthens my point by suggesting real climatologists might reject me. (Therefore my vote/interpretation-of-the-truth is not valid? I don’t get to vote?)

As soon as you mentioned teaching science in schools I could roughly pin down your age. My beard still has a bit of colour in it and I went through right around the turning point where scientific principles were gradually getting phased out and replaced with chanting and angst-ridden political correctness, post-normal consensus science.

Try asking young people about “Scientific Method” and they have no idea what you are talking about. Ask what happens if the rest of the class saw two fingers in their experiment but you saw three fingers … what do you write down, two or three?

I did not change the topic, you brought it up.

On truth by vote, if you read my comment below I am also with Bob. The view put forward by Sumner to settle issues of both truth and morality is to me untenable. Rorty is essentially a postmodern thinker. He said “Truth cannot be out there—cannot exist independently of the human mind—because sentences cannot so exist, or be out there. The world is out there, but descriptions of the world are not. Only descriptions of the world can be true or false. The world on its own unaided by the describing activities of humans cannot.”

So he has a view of truth that does not coincide with realist interpretations, so if you are essentially a realist then you will not agree with Rorty.

Sumner’s first point is perhaps more subtle. He does not claim that there is no truth in the realist sense, but that there is no useful distinction between realist truth and peceived truth (Maybe that is Rorty’s position too). He then applies this to morality, and I think the same flaw applies to both.

Sumners second point was, given that there is no useful distinction to be made between truth and perceived truth, there are still versions of perceived truth. Individual, democratic, expert and market truth. Whatever you think about the distinction between truth and perceived truth, it does remain that peceived truth is all we actually have to deal with. He said market truth was better than expert truth.

“I believe that market truth is almost always the most reliable method of identifying the truth.”

I was unclear as to which point you were adressing.

Your initial comment discussed your doubts about expert truth as a reason to doubt free market truth, yet Sumner made a clear distinction between these. You then say that your comment about grade school related to politicians and media, which would be about what Sumner calls individual truth and democratic truth. This has no bearing on expert truth, but may affect market truth. It is hard to un-pick what you mean.

Sumner thinks free market truth will always be better than expert truth, yet as you say, politics and media are bad at truth and can feed into market truth. To my mind that would make expert truth still the most reliable for matters of scientific truth.

Sumner says “Markets are giant engines for generating true statements about the world—the most efficient truth engines ever discovered.” Well, the scientific method is also a giant engine to generate true statements about the world. I am not sure that his claim that markets are the most efficient, or the most succesful, stands up, but it is an interesting discussion.

Popper spent a lot of time wondering what science is. He came up with some criteriaon the demarcation of science, but these are not the end of the story. There is still much discussion in philosophical circles about exactly what science is or isn’t.

It is absurd to suggest that grade school studies would equip one to rule definitively on this topic.

Sumner’s initial claim is that the distinction between true and believed to be true is not useful, not that the difference does not exist.

The problem with his examples is that he is not even discussing truth. Before the event it was neither true nor false that the Higg’s Boson was announced in 2008. Truth is not prediction. He is arguing that markets are better predictors than experts, but that is not the same as truth.

Other examples: “Earlier questions might have included: “How many moons will Voyager discover around Saturn?”

The question about truth is “how many moons does Saturn have?” Say for arguments sake it has 70 moons according to some specific definition. The truth would be Saturn has 70 moons. Experts may guess at 62, the markets are probably going to roughly follow the experts. However, both can be wrong. There is a difference between truth and both market and expert opinions. The key claim Sumner makes is that this distinction is not useful. Is this distinction useful? Yes, of course. After we discover 62 moons, if there were no useful distinction we could just stop looking. Because we recognise a useful distinction between actual truth and either market or expert opinion, we still look. There is a useful distinction between truth and what people believe to be true.

Another example. Was the market about to crash in 2007? Expert and market opinion said no. We know the truth – yes it was. Both were wrong.

Do vaccines cause autism? There is a truth. The distinction between that truth and what some hypothetical market would price futures contracts at is a useful distinction.

His problem is that even if you accept fully EMT, it still only reflects what is known. The market cannot be the same as the truth because lots of things are not known.

This is exactly the same argument you offer for morality. He is not discussing morality, but peoples’ opinion of morality. Unless we can say that it is moral to eat meat in California, not in Gujarat, which seems to be an extreme case of moral relativism, then this is no way to resolve questions of morality. Just as opinion cannot resolve issues of truth.

His error is summed up in his closing paragraphs.

“Some people distinguish between scientific truth and moral “opinions”. I don’t. We can be more confident that murder will still be regarded as wrong in the year 2119 than we can be that current models of quantum mechanics and relativity will still be true 100 years from now.”

This is just wrong. Scientific truth is not the same as what we understand about science right now. We do not say that it was scientifically true in 1880 that the universe followed Newton’s laws. We do not say that QM as we understand it is the truth – just that it is our best understanding at the moment. Also he is wrong about murder – some aspects (abortion, execution, warfare, euthanasia, self defence) are very uncertain.

Tom Lehrer on Wernher Von Braun:

https://m.youtube.com/watch?v=TjDEsGZLbio

Great stuff! The song really nails it.

Whilst NASA were apparently quite happy to use Nazis, it seems a stretch to say that NASA was founded by SS Nazis.

It seems that von Braun was really prepared to suck up to whoever could fund his rocket stuff. “Its not my department, where they come down.” as Lehrer puts it.

It seems he was a Nazi of convenience rather than someone who was commited to the Nazi cause.

This does not absolve NASA of serious ethical considerations. One could also argue that Mengele was similarly ineterested only in the pursuit of science. Both conducted research with a blatant dirsregard to the effects on individuals. In Mengeles case it was direct, with von Braun it was removed.

To me it seems a worse crime to actually directly harm people, as Mengele did, rather than allow your reseach to harm people, as von Braun did, but there are similarities.

I had thought that some of the Nazi research had proved useful. On looking it up it seems that Mengele’s work had about zero useful output. So von Braun was engaged in real technological stuff with useful applications, whereas Mengele was just being a sadistic Nazi prick.

Most of the statistical metrics that modern economists spend their life studying were originally invented by the Nazis.

https://adamtooze.com/books/statistics-and-the-german-state/

They were ruthless … but very good at inventing things: the assault rifle (Sturmgewehr); infra-red night vision (ZG 1229 Vampir); artificial stimulants to enhance combat and logistical performance (tank chocolate); population data collection and correlation for social control (see IBM and the Holocaust); various types of poison gas; jumping AP mines (Nazi S-mine, copied by US to become M16A2); rockets as mentioned above; code machines (Enigma, good try but ultimately defeated); conversion of coal to liquid fuel; insanely fast fighter aircraft (Messerschmitt Me 163 Komet, clocking 700 mph in 1944, almost supersonic, although 500 mph was considered normal operational speed); also first jet fighter aircraft (Messerschmitt Me 262, not as fast but still quick); early RPG personal anti-tank weapon (Panzerfaust).

You could also give honourable mention to the Gast gun but that was invented in 1915 and strangely never impressed the Nazi command so they didn’t use it … the Soviets liked the design (see Gryazev-Shipunov) and modern Russian fighter aircraft still use autocanon based on this. The Germans were also the first to build man-portable flamethrowers in 1911, although the same idea had been used on ships by the Byzantine Empire much earlier and was then lost.

War does lead to advances in techology. The allies also came up with many advances during WWII. Is there a way to distinguish between “Nazi science” and just “science?” Or pehaps we could try to distinguish whetehr somethin was invented by the Germns or the Nazis?

Start by figuring out what a Nazi is … by modern “Progressive” standards it would be anyone white (except themselves) and anyone of any colour who disagrees with the “Progressive” agenda. That’s a lot of people.

Take note that the Imperial German Army of the early 1900’s was every bit as ruthless and authoritarian as the Nazis who came after them and they learned their lessons well, at the hands of Napoleon in 1806 when the Prussian Army was defeated. People adopted strong central government not for entertainment reasons … but because after many wars we discovered that authoritarian governments usually end up winning by being ruthless, determined, and crushing their opponents. Then after the war a lot of people feel better about this uncomfortable fact telling themselves it’s really all for our own good, and those guys over there are bad guys … it’s never us. The word “Nazi” becomes a vague, fuzzy emotive cloud without any tangible features … totally disconnected from history or rational analysis.

Here’s yet another example, the Prussian education system of state controlled military schools designed to produce rows of obedient soldiers became the primary template for all government education, including the USA. You only need to research the “Bellamy Salute” from 1892 (long before any National Socialist came along) to see the strong linkage between state education and military training. Does this bother people? No, they simply look away, it’s easy.

“by modern “Progressive” standards it would be anyone white ”

This is just wrong. Nobody defines Nazi as “white.”

I think Hitler was attempting to create a white Germany, but, that aside, socialists keep pushinhg the idea that free markets are racist and that Nazi Germany was largely free market even though Nazis favored a heavily regulated economy.

And socialists also push the idea that America’s founders wanted freedom only for white people, even though they fought a slavery-sympathetic, white Britain for their freedom.

They couldn’t have been fighting for the right to keep slaves, because Britain was already OK with slavery. Whites were killing whites at the time.

So, the founders’ belief in freedom, although not completely consistent in application, was a separate issue from that of slavery.

And I like how race-baiters paint the founders as only selectively pro-freedom, but then do not go on to try to apply the founders’ ideas of freedom consistently to all races, now that slavery is over.

“socialists keep pushing the idea that free markets are racist ”

I think it is more common to say that the free market does not eliminate racism in the way proponents claim. It is not that free markets per se are racist, but in a racist society the market may not eliminate racism.

A paper by Kenneth Arrow discusses this here:

https://www.csus.edu/indiv/c/chalmersk/econ251fa12/WhatDoesEconSayAboutDiscrimination.pdf

Whatever you think of Arrow, his credentials as an economist are impeccable and he cannot be dismissed simply as a socialist pushing an agenda.

Interesting Harold, I didn’t know about that Arrow paper. I’ll check it out.

The regression theorem of the origin of money can be used to eliminate the concepts of both cardinal and ordinal utility, and perhaps even of economic equilibrium.

Firstly, the tentative term “most saleable” or “most marketable”, needs to be replaced with something like “most money-like”. Even in a state of barter, goods would have different degrees of “moneyness”. Gold and silver finally emerged as money, but money started emerging in some form as soon as people learned to count.

Ideally, more money represents more wealth monotonically. In other words, it measures wealth, and enables economic calculation. This is not true of most things, for instance food, livestock, land or raw materials. Even ceteris paribus, having more of them doesn’t necessarily mean having more wealth, and can even become a liability, above some level.

Human action is inescapably uncertain and binary. Measuring, or ordinal ranking of utility makes no sense. However, enough people think that money measures the wealth it represents to explain how it has come to be used in the way it has. This bridges the gap between subjective value / human action on one side and economic calculation on the other.

“Measuring, or ordinal ranking of utility makes no sense.”

Ordinal ranking of ends (and, by extension, the means to achieve them) logically follows from

1) that all purposeful actions involve an attempted exchange (in order to substitute a less desirable state for a more desirable one), and

2) that ends, being subjective, are not the logically necessary result of an equation.

The first point implies that two states are being compared, and therefore ranked in order of preference.

The second rules out cardinal rankings of preferences, leaving us with only ordinal rankings.

Nice statement of the Austrian position, but I’m sticking to my guns.

Ranking of three or more choices cannot be deduced from the axiom of human action.

Every action is at the margin. All other possible actions are as irrelevant as all the butter and coal not involved in the action actually taken.

To say choosing a course of action ranks it top of the list is trivial.

But it is a verbal muddle to then say that a number of other possible courses of action, all not taken, are ranked at the same time.

3 more points about money.

(1) McCloskey and others have been trying to explain the Great Fact, the secular increase in average income since about 1800, starting in Britain. But Wikipedia tells us that the industrial production of stable money arrived for the first time ever in 1788, with the steam driven screw press for minting coins, followed in around 1820 by the Presse Monétaire.

(2) If stable money caused the Great Fact, then central bank inflation is a very great crime. The FED’s 2% inflation target can be seen for what it is: the fastest rate of stealing golden eggs without killing the goose that lays them.

(3) Why did it take until the 1870s for marginal utility to be discovered, and why was it then discovered independently by three economists? Because, for the first time in history, 100 years of stable money had provided the empirical evidence for it.

There is always risk in attributing change to one cause. Money surely was a factor, but as you say, this was possible only due to technological change (the steam screw-press). This technological change also allowed for many other “advances.” It is not ruled out that the money was simply a result, rather than a cause of the Great Fact.

It seems reasonable that it was something of both – it was one of the factors but not the only one. We had all sorts of political stuff going on as well. The Enclosure Acts, particularly of 1773 were making agriculture more efficient, but also displacing agricultural workers who were then available for industrial work. These factors all fed into one another.

” The Enclosure Acts, particularly of 1773 were making agriculture more efficient, but also displacing agricultural workers who were then available for industrial work.”

Propaganda, Meet Modern Research

[www]https://tomwoods.com/anti-capitalist-propaganda-meet-modern-research/

“Ferrara, as I feared, has embarrassed himself by simply adopting the fact-free distributist interpretation of enclosures: the wicked capitalists brought about the privatization of the commons, and this led to a reduction in the number of people who could be profitably engaged in agriculture. These poor displaced souls, in turn, had no choice but to work in the factories.

“This was a central socialist theme: the people must not be viewed as having chosen to abandon the land for the factory, having made a rational assessment of what was best for them. They must have been tricked or forced into it. …”

“J. R. Wordie has concluded that by 1760 some 75 percent of English land was already enclosed and that contrary to the earlier consensus, it was not during the eighteenth century but during the seventeenth that “England swung over from being mainly an open-field country to being a mainly enclosed one” (1983, 486, 488, 495). Thus, the bulk of enclosure had long since been accomplished by the time Belloc and other distributists [including Ferrara] seem to have thought it was busy creating the industrial proletariat. Moreover, the tenants themselves often initiated the enclosure, again contrary to the impression Belloc left, and even parliamentary enclosure operated on the basis of consensus.“

“Moreover, the tenants themselves often initiated the enclosure, again contrary to the impression Belloc left, and even parliamentary enclosure operated on the basis of consensus.“

Nothing I said contradicts that. I did not say wicked capitalists did it, only that it happened. In the context of this discussion it does not matter too much whether it was the Enclosure Acts or other factors.

The fact is that agriculture intensified during this period and fewer workers were required to make the same amount of food.

From the BBC.

“In 1750 English population stood at about 5.7 million. It had probably reached this level before, in the Roman period, then around 1300, and again in 1650. But at each of these periods the population ceased to grow, essentially because agriculture could not respond to the pressure of feeding extra people. Contrary to expectation, however, population grew to unprecedented levels after 1750, reaching 16.6 million in 1850, and agricultural output expanded with it.”

From the mid-18th century, use of legumes to fix nitrogen grew and between 1750 and 1850 the amount of nitrogen fixed tripled.

“in the century after 1750 is that as each agricultural worker produced more food, so the proportion of the workforce in agriculture fell. This falling proportion of workers in agriculture enabled the proportion working in industry and services to rise:”

By 1850 Britain had the smallest percentage of agricultural workers in the world at only 22%.

The point is that many factors fed into the Great Fact.

I agree with that interpretation … which is only what you would expect if you see central banks as a rational operator running a monopoly business of printing fiat currency.

To optimize overall returns, a monopolist will throttle supply such that the marginal profit on the next unit produced equals the amount of loss caused by driving down the price of those goods overall … presuming of course that demand curve slopes downwards, which it very likely does for fiat currency since printing too much currency will make that less attractive to hold. The “profit” of the central bank (per year) is the Seigniorage which equals the real value of the printed currency less printing costs (consider printing costs to be zero for simplicity). The “loss” to the central bank is the overall devaluation of all future currency that they could be printing.

Suppose you were thinking about buying a share in a central bank, and the value of that share was based on a claim to all future currency printed, you would probably be calculating along similar lines in terms of valuation.

Seems like 2% is the number they came up with between themselves. So I’m told, the trend started in New Zealand during a time when inflation was well above 2% and the government demanded that the bank make a clear target value, and they settled on 2% as a reasonable target. It’s not entirely a bad thing for currency to be handled like a business with rational incentives and constraints on the business operator. That is the “skin in the game” principle at work right there. We may complain about the monopoly aspect of this business, and the advantage it gives to some people over others … but complaints along those lines will be with us forever I’m sure, one way or another.

I’m not sure, but I think the 2-3% target is intended to mimic the price rise under a gold coin standard.

That one would want to mimic, with fiat money, something that generally already happens suggests that advocates of the targeting see, in gold, nothing but the math involved.

‘Anything that gold could possibly be doing, in their view, can be done with anything at all, really, so long as the public is convinced they’re holding money, and any supposed deficiencies of gold can be ironed out by fiddling with the fiat money supply.

My view is that, properly understood, the function of money is to convey the lower ordinal ranking of what is sold for money as against the higher ranking of what is bought with money.

The values of the goods at both ends of money transactions are linked by the arbitrage opportunities available in the money.

So inherent in the 2-3% rise in prices that is typical under a gold coin standard is a representation of the arbitrage opportunities that people find in gold, itself.

And that’s why the 2-3% can’t be mimicked by fiat money without giving rise to the business cycle. It’s the use-value of gold that’s causing the 2-3%, not the other way around.

When people hold real money (what I consider to be exclusively commodity money), they are doing nothing more than the first guy who decides to hold gold in order to trade specifically with a jeweler (who will melt it down and make jewelry with it), except that there happen to be more arbitrage opportunities to for others in the economy to exhaust before it will become profitable to trade it to the first guy.

This is not a new, independent source of demand for gold such that “the value of holding gold is higher than its use-value”, but rather the logical extension of barter.

The logical end of real money is to be consumed for its use-value after others have exhausted the arbitrage opportunities made possible by its value as a commodity.

Is the 2-3% inflation with a gold standard caused by gold mining?

That’s my understanding, yeah.

I’m just realizing that I should have been referring to the typical 2-3% rise in the *supply* of gold, not the rise in gold prices.

Oops.

🙁

If I boil it down, I’m trying to say that money, once it could no longer be easily forged or clipped, finally provided a good-quality measuring-stick for wealth for the masses, just as clocks and watches did for time and inch-rulers did for length, and the result seems to have been a massive, unprecedented rise in wealth around the world.

Money is the root of all … good?

Money was proably a factor, but I think we cannot say with any certainty that it was the fctor.

I had a look at Roman currency and cm across some interesting information. Coinage was continually debased in terns of silver content, yet the value seems to have remained very constant. From Wiki

” Estimates of the value of the denarius range from 1.6 to 2.85 times its metal content,[citation needed] thought to equal the purchasing power of 10 modern British Pound Sterling (US$15.50) at the beginning of the Roman Empire to around 18 Pound Sterling (US$28) by its end.”

That sounds likevery little inflation over hundreds of years.

Good information and obviously relevant since most of the people of imperial Rome were indigent to the end, in spite of what looks like a stable money supply. (Although, doesn’t it actually indicate deflation?)

I wonder about rarity, other denominations etc, but I guess ultimately it’s an empirical and historical question.

Anyway, I still reject both cardinal and ordinal utility as overwhelmed by uncertainty, and consider money the least worst tool for measuring wealth because more of it, ceteris paribus, is more wealth, with a lot of certainty .

It was moderately stable until the 3rd Century AD after which they had a financial crisis including rapid devaluation … also war, plague and breakdown of both central government and established trade patterns.

http://armchairprehistory.com/2016/10/12/third-century-romes-inflation-crisis-bad-leaders-or-plague/

There’s a chart showing the devaluation, as measured in Silver.

Emperor Diocletian handled the situation moderately well, creating a managed split in the empire instead of a catastrophic breakdown, and he concentrated on winning the wars and securing the borders which were probably the most immediate problems he was facing. He also attempted price controls to fix the inflation problem and these policies met with complete failure.

In the process, Diocletian felt the need to persecute a lot of Christians, although that was nothing new for Rome, but in times of crisis people need someone to blame for it and tend to revert to more conservative beliefs … along the lines of, “Oh we have become so corrupt and decadent by ignoring the Gods … Repent! Repent!” … so doubling down on rounding up Christians probably seemed like a good idea at the time. The Tetrarchy degenerated into civil war in the 4th Century, and at the Battle of the Milvian Bridge, Emperor Constantine achieved decisive victory, went on to become the first Christian Emperor and put Rome onto a gold standard as a currency reboot.

Very interesting.

“For the next hundred years, despite a constant tendency to try to keep the coins at around 80% silver, the average silver content declined by about 12%. Various academics have estimated annual inflation during this time at about 1% or a bit less (note: this means that there is no linear relationship between debasement and inflation).”

This seems to point away from the idea that “inflation” can refer to prices or money supply, as they are the same.

Marginal Utility is an economic law: The more units of a good you have, the less urgent is the need for which you will use it.

(For example, if you’re dehydrating in a desert, you’ll trade away jewelry for a glass of water, but if you’re stocked up on water at home, the less you’ll pay for the next unit of water).

So it is with money: The greater supply of money that someone has, the less urgent they will be to earn the next unit (that is, the less they will value the next unit).

As the first beneficiaries of monetary inflation spend their printed money, that puts greater supplies of money units into other people’s hands, which results in more money chasing after a more or less unchanged supply of goods.

That’s logic, and therefore no data can, by itself, disprove it.

As such, we’d say that a low price inflation just means that the printed money hasn’t gotten into as many hands as would be necessary to affect people’s spending on the margin.