Hayek and the Regression Theorem

Hayek had a controversial plan for privately issued, competing fiat currencies. (I talk about it here.) But uh oh, here’s a giant in Austrian economics who might be throwing cold water on the proposal:

It is probably impossible for pieces of paper or other tokens of a material itself of no significant market value to come to be gradually accepted and held as money unless they represent a claim on some valuable object. To be accepted as money they must at first derive their value from another source, such as their convertibility into another kind of money. In consequence, gold and silver, or claims for them, remained for a long time the only kinds of money between which there could be any competition…

Bad news for Hayek and his privately issued “ducats,” huh?

Exceeeeeeeept, the above quotation is from Hayek himself, in his “The Denationalization of Money,” just 15 pages before he unveils his plan for ducats.

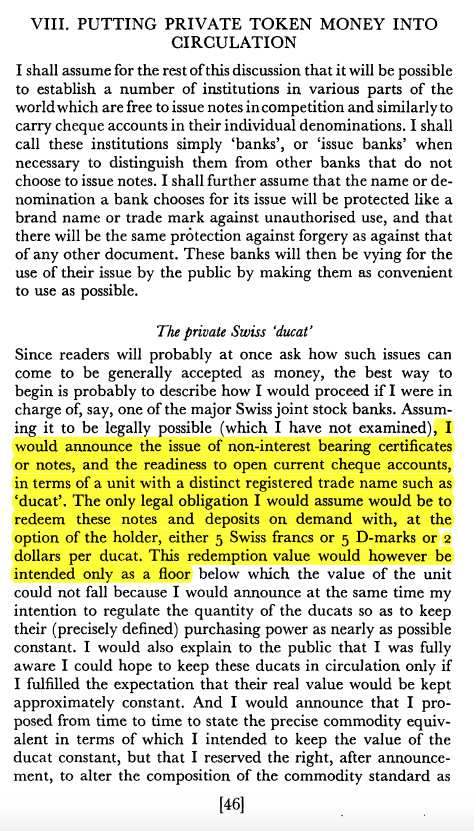

So what’s happening here is that Hayek was fully aware of (what we call) Mises’ regression theorem, and in fact apparently believed it himself. His proposal for “ducats” included a redemption pledge to get the private token money off the ground, so that the public would have a non-arbitrary way of initially valuing the notes:

From my reading some years ago of “The Denationalization of Money” I recollected that Hayek has seen convertibility (into other currencies or baskets of a commodities) as a long term necessity for private currencies.

I think that view is consistent with the quote provided.

Is there evidence that Hayek actually saw convertibility just as a way to get ‘private token money off the ground’ after which it would not be needed ?

“Is there evidence that Hayek actually saw convertibility just as a way to get ‘private token money off the ground’ after which it would not be needed ?”

Yeah I think he explicitly says that. I mean, in the quote itself he says it’s just a floor. Over time he expects that the ducat would appreciate against the other government currencies, so as time passed, that redemption pledge would be less and less significant. It would be like if Satoshi originally said “I’ll give you a pizza for any bitcoins you return to me.”

He thought the issuer needed to maintain the exchange value of the ducat in terms of a basket of commodities, but that’s not the same as a legal pledge of redeemability.

I probably need to reread “The Denationalization of Money” to find the exact context of that quote.

When he says that the “issuer needed to maintain the exchange value of the ducat in terms of a basket of commodities”, how did he envisage this would happen without the issuer being prepared to buy and sell their currency to maintain the stated exchange value ? If this is what they commit to doing how does that differ in any real way from offering convertibility where the holders of the currency can go to the issuer and ask for their holding to be converted to the commodity equivalent ?

Its a bit confusing why two convertabilities are needed (one into existing currency and one into commonalities) – but that may be explained in the book.

last para: commonalities = commodities

Transformer, maybe I’m missing some subtlety, but: We can imagine two types of monetary policies:

(A) The Treasury stands prepared to give an ounce of gold to anybody who turns in $35 worth of currency.

(B) The Fed says it is targeting 0% Consumer Price Inflation.

Those are different things. The former is a legally enforceable promise, and the Treasury has to stockpile gold to maintain it. The latter is not enforceable, and the Fed doesn’t stockpile bread, apartments, gasoline, etc. to maintain it.

I see that A and B are different things. But the way that the value of the currency is maintained is the same in both cases: the currency issues has to match the quantity supplied to the desire to hold at the required value.

In your post are you expressing the view that Hayek’s Ducats will be launched in a form close to A (to give it ‘claim on some valuable object’), then once it has gained some market share as a viable currency its value against the basket of commodities will be maintained with a policy more similar to B ? Is that a correct understanding ?

In terms of the regression theorem: If Ducat’s take off as money and if the quantity stays fixed then (even with no inflation) its value will rise against the floor currency (is ‘claim on some valuable object’, in Hayek’s words) because of it additional value as money. The issuer will then have to expand the supply to maintain the peg against the chosen basket of goods. Would you agree ?

Yes to all of your questions.

Thanks for responding to my comments, Bob !

For what its worth it helped me to both understand “The Denationalization of Money,” and your own views on monetary theory a bit better.

Sure thing. BTW later in the book(let), Hayek does say something like, “An issuing bank with a very large circulation might even find it advantageous to maintain stockpiles of the various commodities, to make adjusting their prices more exact.” So that may have been what you remembered. But to be clear, in general the note-issuers aren’t buying and selling the particular goods that form the basket.

I think I was using the term ‘ convertibility ‘ too loosely – just to mean that the currency issuer would maintain the currency’s target value. As long as it is serious about this, and successful, then covertability is a bit of a mute point – anyone could buy the bundle of commodities (or wherever is being targeted) for themselves totally independently of any convertibility offered by the issuer.

Transformer wrote: ” then covertability is a bit of a mute point”

I believe Hayek would have said “then convertibility is a bit of a moot point.”

Yes I went there.

So he wouldn’t have also said that the ability to covert is something we should be silent on ?

You’re both wrong. https://m.youtube.com/watch?v=fLwYpSCrlHU

In theory a government could say, “Hey we will accept tax payments in multiple different privately issued currencies, we don’t care what you want to use.”

Admittedly, maybe they are reluctant to do that, but suppose they just wanted to get on with the business of ruling over people, and didn’t want to get into that fiddly figuring out inflation and stuff. Is there any reason why not?

In order to figure out exchange rates between private currencies for tax purposes, the government could run an auction where people being paid BY government (e.g. employees, contractors, etc) could specify their preferred mix of pay, which would give the government a pretty good idea of what they needed to collect in order to make that pay.

After that, the private currency issuers can figure out what works for them. No more struggling with monetary policy, and that’s one part of government we won’t be sad to say goodbye to.

“It is probably impossible for pieces of paper or other tokens of a material itself of no significant market value to come to be gradually accepted and held as money unless they represent a claim on some valuable object.”

Hayek thinks is is only probably impossible. The regression theorem seems to me to simply explain one way that such objects can be accepted as money. It does not rule out other ways. Another way is for a general agreement to somehow arise.

If you use acting man as the operating unit and basis of the whole philosophy then the regression theory may be valid. Individuals cannot on their own reach such an agreement, so this is impossible.

However, if you allow for units larger than individuals then such agreements are quite reasonable. Hayek describes a method for establishing such an agreement by issuing guarantees, but there is not reason why this could not be established by other means. Once established the thing takes off on its own Clinging to the regression theory is necessary if you wish to base everything in acting man and reject social effects.

This sometimes seems to require re-defining money from something that is commonly used as a store of value and a medium of exchange to something that is a store of value, a medium of exchange *and* has a use value.

Bitcoin appears to satisfy most definitions of money, yet some reject it as such because not does not have use value.

For physical objects it is very likely that anything that fulfills the requirements to serve as money – scarcity, durability, small size etc. will not have some use. If it is tough enough to be durable it will probably be useful for something. This is why using soil as a counter-example is not convincing because it does not satisfy any of these requirements. It is not scarce, durable or convenient.