In the Long Run, I Will Always Quibble With Krugman

Although Steve Landsburg is trying to talk me down from the ledge, I think there’s something rotten in economics. (Maybe this is true in every field and I just notice it here because it’s my area; I’m open to the possibility that “humans are disappointing.”)

For example, DeLong and Krugman have accused Mankiw of not simply choosing poor assumptions, but also of committing a basic math mistake. When several people said “no he didn’t,” DeLong tried to get out of by saying (see his tweets down the list here) that a “static analysis” of tax considerations means you allow behavior and hence the tax base to change. (!)

But back to the main point of the present post: In this intriguing post (and I don’t say that sarcastically), Krugman makes a neat argument to end up concluding that it could take “decades” for the U.S. rate of return on capital to be restored to the world’s average rate, following a cut in the U.S. corporate income tax rate. If true, you can see why Krugman (and DeLong and Summers etc.) are flipping out at the simple models from Mankiw et al., which take the baseline assumption that the U.S. is a small open economy and that international capital mobility is perfect.

However, I think there is a huge problem in Krugman’s analysis. To point it out, I think it’s easiest for me to recapitulate his argument:

(1) The baseline is Harberger, who famously showed that if we have a closed economy with a fixed stock of capital goods, then it is the capitalists who bear 100% of capital taxes.

(2) However, nowadays capital is very mobile internationally. In the limit, if we imagine a small open economy, then the after-tax rate of return to capital in that country must be equal to the world average. If the government of this small economy cuts its corporate income tax, that temporarily means a higher after-tax rate of return in this country, compared to the global average. But then capital from foreign investors flows in, pushing down the PRE-tax return on capital in this small economy, until the after-tax rate of return is once again equal to the world average. So this means the capitalists of this economy don’t benefit from a cut in the corporate income tax. Instead, the *workers* do, because the extra capital flowing in yields more investment, so the higher capital per worker means labor is more productive and hence wage rates are higher.

(3) Krugman says this isn’t the full story. What other people have long known is that you have to worry about monopoly rents, and the fact that the US is a huge economy and so capital flowing into it might raise “the” global rate of return. So even in the new equilibrium, when the after-tax rate of return in the U.S. is the same as for the rest of the world, it might still be that U.S. capitalists (and global investors too) are better off, while U.S. workers have not benefited as much as the analysis in (2) would have supposed.

(4) But, says Krugman, there is another element to all of this, that only Krugman has put his finger on. Specifically, you have to ask what is the mechanism by which a “temporarily” higher after-tax rate of return in the U.S. will be whittled away? Sure, you can say “an inflow of capital from abroad,” but in practice that means the USD appreciates against other currencies, in order to cause a current account deficit (flipside of a capital account surplus). Because only a small portion of GDP is in tradable goods, it means the dollar has to strengthen a LOT to get a really big movement in the trade deficit. Krugman uses some plausible numbers and a Cobb-Douglas production function to estimate “about 6 percent of the deviation from the long run eliminated each year. That’s pretty slow: it will take a dozen years to achieve even half the adjustment to the long run.”

====> OK now that I’ve summarized Krugman’s post, here’s my problem: Krugman is assuming that ALL of the growth in the U.S. capital stock (which is needed to push down U.S. pre-tax “r” such that after-tax U.S. “r” once again equals the global average) must come from an influx of foreign saving. In other words, Krugman assumes that the increased investment in the U.S. must work through a capital account surplus, which is limited (as he says) because of the sluggishness of the international flow of goods.

But that wouldn’t be the only mechanism of adjustment. Apparently Harberger’s baseline result assumed a fixed domestic stock of capital, but of course that’s not true in reality. If the U.S. government cuts the corporate income tax rate, that will increase the return to saving and so American “S” will jump up. So the rate of U.S. capital accumulation will increase, not simply because of an influx of foreign capital, but because Americans will save a higher fraction of their income as well.

Is this empirically relevant? Well I was googling around and found this from the St. Louis Fed:

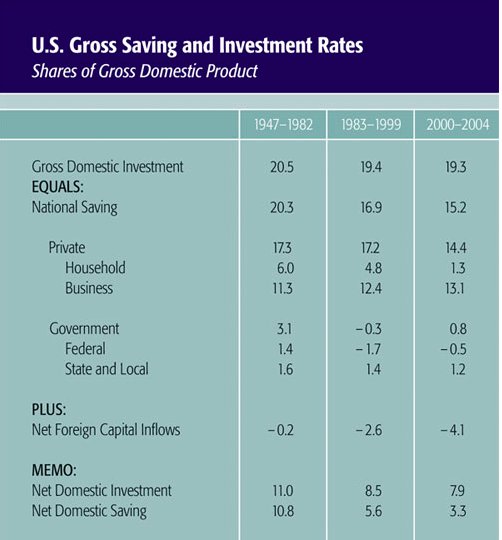

So if I’m interpreting those figures correctly, it used to be the case that U.S. saving accounted for almost all of U.S. investment. But more recently (i.e. from 2000-2004), Americans provided about 78% of the saving to finance American investment, while foreigners provided the other 22%. (Gross domestic investment was 19.3% of GDP during this period, while Americans’ saving was 15.2% of GDP and net foreign capital inflows was 4.1% of GDP.)

I think Krugman is telling us that if we have to boost the U.S. capital stock *solely* through the mechanism of larger net inflows of foreign capital, that it could take decades to fully adjust to a corporate income tax cut. OK fine. But at least for the above period, American saving provided 3x the funds for domestic investment. Those figures might have moved a lot because of government deficits but surely we shouldn’t ignore the role of American saving?

“In the Long Run, I Will Always Quibble With Krugman”

As the cohost of a podcast dedicated to combating Krugman, I took it this was a given?