03

May

2017

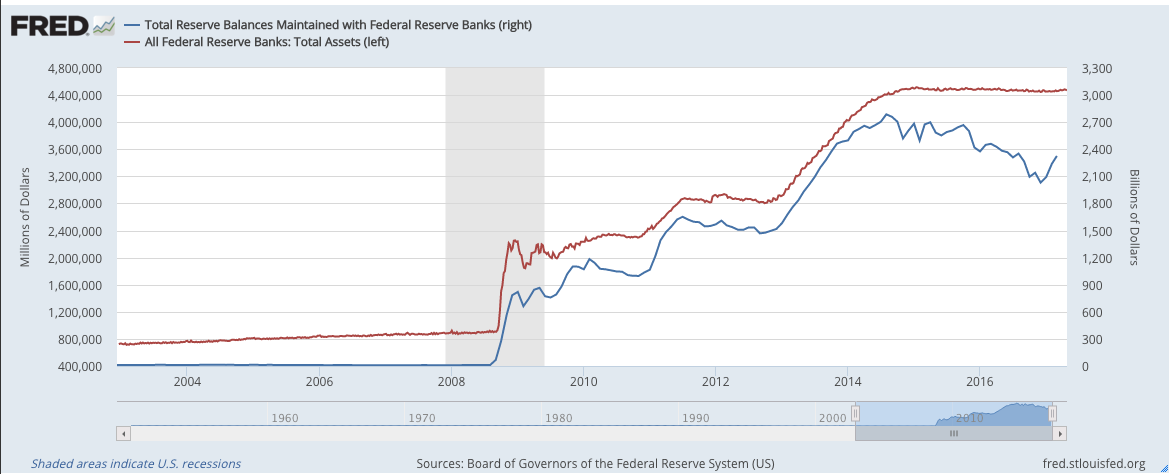

An Interesting Development in the Banking System

For a while I have been meaning to investigate the drop in reserve balances maintained with Federal Reserve banks, but I’ve been swamped with projects and traveling. But at least let me document it for you. Any ideas? (Click on image for full size.)

Its because:

1) More Reverse Repos. This is totally expected since reverse reops are the tool the fed is using to raise rates while they still have all these excess reserves.

2) More Currency. The economy has grown since 2014 while fed asserts have been flat. To first order the Fed balance sheet equation is Assets=Currency+Reserve Deposits so more currency means fewer reserve deposits. Interesting how fast currency has grown in the electronic banking era.

3) More non-reserve deposits at federal reserve bands which is mostly The Treasury General Account. I believe this is because Treasury has decided to keep the proceeds of bond sales in a special account at the Fed and to keep it out of the banking system and this is a means by which the Fed is increasing rates but, I’m not totally clear on this last point.

This very busy FRED graph tells the story:https://fred.stlouisfed.org/graph/?g=dBh4

Fed Assets=Reserves+currency+reverse repos+Treasury General Account

https://fred.stlouisfed.org/series/MDOTHIOH

There’s some signs that the banks have weakly started lending again, starting maybe late 2013 or early 2014.

Compared to the insane growth happening back in 2006 the recent growth has been extremely weak … but that’s probably a very good thing.

https://fred.stlouisfed.org/series/HHMSDODNS

That one might be a better indicator, still with turnaround early 2014 and weak growth since then. But, yeah lending is happening.

But, Tell,

More lending will not reduce reserve balances. If the Bank of Carlos lends you some money and you buy a house, the party selling the house takes the money she gets from you and deposits it in the Bank of Bob. Total reserve balances in the banking system don’t change because the Bank of Carlos made a loan.

I believe your claim that more lending is going on but lending doesn’t affect reserves. Not to first order anyway.

I was guessing what Tell said too — but specifically isn’t the graph reserves *maintained with Federal Reserve Banks*?

This may be dumb (and wrong), but I don’t *think* all reserves count. And if banks are lending, their reserves may be being drawn into other arrangements.

I think the FED now maintains the interest rate by adjusting the rate paid on reserves (as opposed to the old overnight rate). This would have no effect on market rates if lending did not affect your reserves held with the FED.

Anyway, that’s my reasoning…

Scott, you said ” if banks are lending, their reserves may be being drawn into other arrangements.” The. only “other arrangements” of consequence are: a) Lending to the Fed itself. This is usually done by having a bank purchase a security from the Fed with an agreement to sell the security back to the Fed for the original purchase price plus interest. The Fed would call this a reverse repo. b) Lending to or paying taxes to the US Treasury with the Treasury putting the proceeds on deposit at the Fed or c) banks issuing currency to customers where some portion of said currency remains in circulation.

Actually, Tel, I’ve changed my mind. Banks really aren’t lending. Here’s why I think they are not: https://fred.stlouisfed.org/graph/?g=dC8e

By the way Bob, I am still eagerly waiting for the Fed’s balance sheet as a percentage of GDP to return to pre-2008 levels. Because then we can have a test of the statement you made six years ago this month:

http://consultingbyrpm.com/blog/2011/05/even-supercore-inflation-might-not-do-the-trick.html

“To translate that into a falsifiable prediction (which I’ve made before but will here repeat): If the Fed’s balance sheet goes back to where it was pre-crisis (we can make it % of GDP to make it fair), and unemployment (as currently defined) goes under 6%, and we don’t have CPI (as currently defined) inflation higher than 5% over any 12-month period, there’s not some major event that could totally falsify the measures (like a war and Obama drafts everybody and imposes wage and price controls), and (just to cover myself) that situation lasts for at least a year without any hiccups in the economy (i.e. there’s not a stock market crash two months after the above conditions are met), then sure I don’t just need to tweak things a bit, I would have to question Austrian business cycle theory itself.”

I’m also waiting because that’s when I get Murphy to admit Ron Paul’s proposal default on the debt the Fed holds would be inflationary.

http://consultingbyrpm.com/blog/2013/01/daniel-kuehn-like-krugman-has-advice-to-improve-jon-stewarts-show.html#comment-56404

I’ve been patiently waiting 4 long years thinking of nothing else.

A lot of Fed officials have been talking lately about cutting the Fed’s balance sheet in half. That wouldn’t take us to pre-2008 levels, but hopefully GDP will keep growing until the balance sheet as a percentage of GDP falls to pre-2008 levels.

I am waiting too! I have made my bets, and I am ready to be anecdotally proven right or wrong!

Obviously in a way it is not possible to not bet..

So far it isn’t even heading in the right direction.

Point being, recessions tend to come in cycles and we are moving to that phase where it’s time to see things start to dip again (obviously I don’t know exactly when, I was expecting it somewhat sooner, the Trump factor is something of a wildcard). If it gets back into recession, going to be difficult to shrink the balance sheet until some distance out the other side… by which time it might well be significantly bigger.

So then what?

Speculating here, but I think it might have something to do with the gold rally. Currency Crisis ahead?