06

Jul

2016

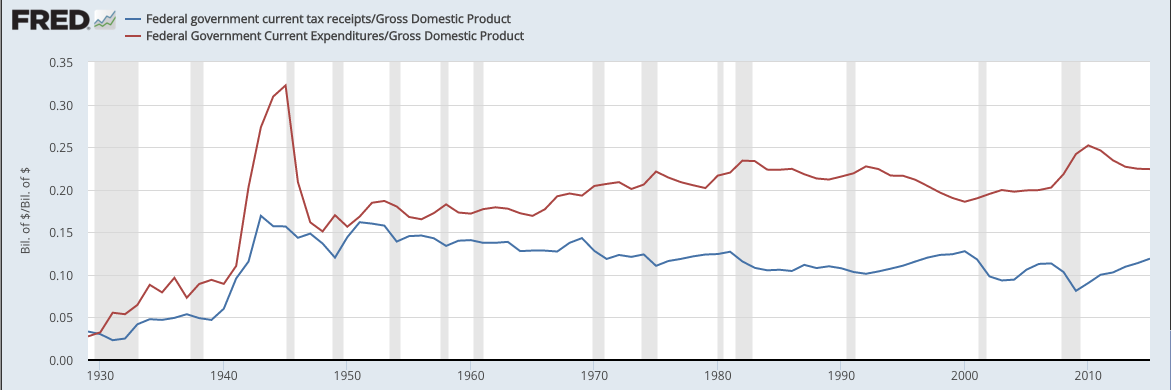

Federal Expenditures and Tax Receipts Over Time

I had to make this chart for a recent presentation, and thought it was interesting. Notice that taxes as a share of GDP tripled during WW2, and stayed up there for a decade. Notice also how high spending is, compared to historical levels.

(Be careful, I think on this chart “current expenditures” is not the same as “total spending,” having to do with transfers etc. But it’s a consistent measure over time.)

I don’t know to interpret this. There were brief periods of surplus in the 40s and 50s, and in the 90s/early 2000s, but there is no sign of it on this chart.

Google “the myth of the Clinton surplus”.

Will, right, that’s why I was saying that “current expenditure” for the BEA is not the same as “current spending.”

It means spending devoted to current things.

So, e.g., if there’s a surplus from Social Security that is helping to offset the rest of the federal fiscal position, I don’t think that would show up here, because payroll tax receipts (I don’t think) are “current tax receipts.”

I would’ve used something that more closely resembles “total spending” and “total tax receipts” but I don’t think FRED had such series.

I think you picked the correct spending series, but there’s definitely some type of revenue not counted as current receipts.

This shows ALL the Federal Government Current Receipts:

https://fred.stlouisfed.org/series/FGRECPT

As I suggested below, FICA and SECA don’t get counted as “Tax Receipts” but are put into a separate group. Search the FRED system for “Contributions for government social insurance”. Of course, it has nothing whatsoever to do with insurance, but nothing is as it seems. 😉

There’s top level accounting breakdown sheets that give all the main categories, such as here:

http://www.bea.gov/scb/pdf/2014/09%20September/0914_government_receipts_and_expenditures.pdf

Compare Bob’s chart with this one. I don’t know that FICA and SECA are what’s missing specifically, but the numbers are higher.

Do those “tax receipts” include Social Security?

Look how low spending and taxes were coming out of the 1920s.

Okay what gives, why are my attempts to comment on this specific post getting eaten?

Not sure what you mean, I don’t see anything on my end.

I keep trying to mention that you should compare the FRED series for shares of GDP for federal government consumption and investment expenditures to your series on current expenditures/gdp, which would indicate pretty clearly that the current expenditures series includes net transfers.

I can only assume posting the ID of the series looks like a weird spam sequence of letters and numbers to your spam filter.

Andrew_FL do you mean because they’re equal? If so, that doesn’t prove it includes transfers, because I think transfers are NOT part of consumption or investment. I.e. they’re transfers, it’s not the government itself that is consuming or investing when it sends out (say) food stamps or Social Security check.

I am not certain of this, but I’m pretty sure that’s how BEA does it. I had to get into this stuff when I was looking at World War 2 several years ago, because in that case the definitions were pretty important due to the huge swings.

“Andrew_FL do you mean because they’re equal?”

The opposite, because they are *not* equal, in fact Current Expenditures is quite a bit more than Consumption and Investment Expenditures (except during WWII)

Here, look at this chart. Do you see what I mean?

Yeah I see what you mean… So I guess Current Expenditures doesn’t include government investment spending, but includes transfer payments?

Nope, that can’t be it, Federal Government Gross Investment Expenditures is much more than the difference between total and current expenditures.

There’s this relatively small residual between Current Expenditures and Total Expenditures, but what it actually constitutes I can’t figure out.

This might be what you’re looking for, from the BEA.

http://www.bea.gov/faq/index.cfm?faq_id=552

Wait, I see what I did wrong, yeah the difference is gross investment. I was looking at gross investment for the whole government.

Mea Culpa, there is a slight difference, but it’s not due to transfer payments, too small.

Look at all that austerity after 2008!

After 2010, actually. That’s the Republican takeover of the House, then the Senate.

But yeah, those guys just roll over for Obama!

Something about this chart feels problematic to me. If government expenditures increase at a “modest” rate, then the same force that causes the red line to trend up is the same force that causes the blue line to trend down. In other words, slowly increasing government expenditures should increase GDP (but only by definition), which will then cause tax receipts divided by GDP to decrease.

This makes it look like tax receipts have been trending down since the mid 20th Century, when the reality is probably much different.

I guess what I’d suggest instead is to use a different denominator here, one that isn’t directly correlated to the numerator of the red series.