Potpourri

==> I thought this Lew Rockwell podcast about “guilt, shame, and anxiety” was interesting. Now I understand my life…

==> My recent Mises CA post on bank moral hazard and liability for shareholders.

==> Here’s the agenda for the Texas Bitcoin conference, on March 28-29 in Austin. If you use discount code “robertmurphy” you get $25 off.

==> Speaking of Bitcoin, here’s my interview with John Bush. We talk about Silk Road, hitmen, pacifism, the regression theorem, and all kinds of cool stuff…

==> Here’s a good NR article talking about Krugman (and Mike Konczal) pointing at the stands and then the Market Monetarists struck them out. I like this one in particular because it focuses on David Beckworth.

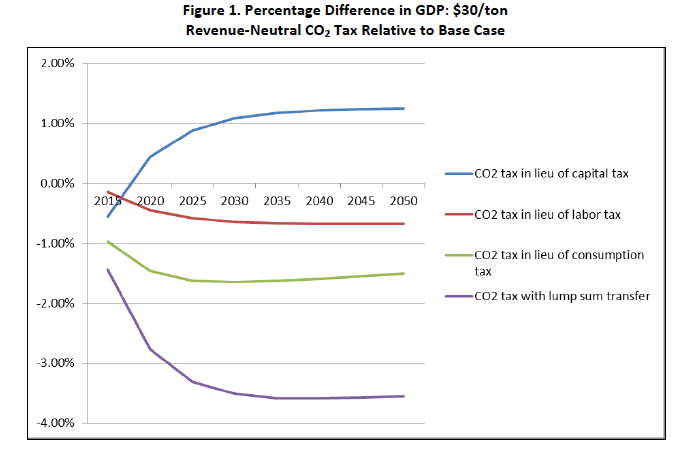

==> My latest at IER shows that even the fans of a carbon tax agree it will hurt the economy, even if 100% of the revenues are recycled back through payroll tax cuts. Look at this chart from a 2013 Resources for the Future (RFF) study:

The next time someone tells you, “Econ 101 says ‘tax bads, not goods,’ duh, a sensibly designed carbon tax swap will help the environment and the economy!” you can show him this chart.

Yay, the topic of bitcoins!

Ok, I’ve had some pent up demand for this topic, so here goes:

As was mentioned by someone in an earlier thread, the real economy is measured in stuff, not dollars.

This is why money has to have use-value. If the money does not correspond to stuff, then it’s not measuring the real economy.

Human action is the employment of means (the stuff) to satisfy subjective preferences. The preferences don’t have to be everyone’s preferences, and the attempt to satisfy them can be illogical, and the Action Axiom would still be true. BUT THERE ARE REAL PHYSICAL MEANS which are employed to attempt to satisfy those preferences, and when the money does not represent those physical means, you have malinvestments.

This is why bitcoins have never, and can never, be money. They don’t correspond to anything that is a means to satisfy subjective preferences.

OR, if that approach doesn’t suit you, I have another one, based on the pro-bitcoin argument that an otherwise useless thing can be legitimate money if the value is based on yesterday’s value (which I consider to be a deviation from the Regression Theorem).

In other words, what this argument is saying is that the money can cease having a 1:1 relationship with a particular good, as long as people voluntarily agree to use it, and this free market “fiat” money will function economically.

The rebuttal actually comes, indirectly, from Joseph Salerno.

In discussing the Soviets’ copying of Western prices, he says this:

Calculation and Socialism | Joseph T. Salerno

http://www.youtube.com/watch?v=KseRuyAjlHY#t=41m23s

“… and the Soviet Union, in fact, did act in that way. Their steel prices, their electricity prices: they used Western prices. Prices for labor maybe even in some cases.

“But those prices didn’t reflect the exact same scarcity conditions in the Soviet Union; They were drawn from other parts of the world. So they weren’t the correct prices. So you still had shortages, and so on. And you had increasing inefficiency.”

Notice the reference to scarcity conditions, and especially to increasing inefficiency.

The reference to scarcity is a reference to the stuff that is the real economy.

The reference to increasing inefficiency is a reference to changing preferences, and therefore changing subjective values for the goods that are the real economy.

The inefficiency INCREASES as the deviation between money prices (under price controls) and the subjective valuations of goods in terms of the preferences for which they are valued as means of satisfaction continues.

And this is exactly what occurs when using bitcoins: People will try to use bitcoins because they believe it to correspond to subjective values, but since bitcoins do not have an anchor in the real economy (the stuff), attempting to use it is necessarily a gamble (like with FRNs).

Maybe that helped.

“This is why money has to have use-value. If the money does not correspond to stuff, then it’s not measuring the real economy…This is why bitcoins have never, and can never, be money. They don’t correspond to anything that is a means to satisfy subjective preferences.”

If you could explain something here it would help me understand your view on this. Are you saying that because bitcoin does not represent stuff, it is impossible for it to be used by enough people to facilitate exchanges of stuff. Or are you saying that even if lots of people somehow did end up using it to facilitate exchanging stuff, it would still not be money?

The second explanation says the soviets used Western prices. This is surely a very different thing from using a different medium of exchange. It was the price control, not the currency, that was the problem.

“Or are you saying that even if lots of people somehow did end up using it to facilitate exchanging stuff, it would still not be money?”

I say that ‘general use in indirect exchange’ is a necessary, but insufficient, aspect of money.

To see why this is, it helps to go back to basics and describe the function of money.

Money involves indirect exchange. This is, all other things being equal, necessarily less efficient than direct exchange (barter), because indirect exchange involves at least one extra step.

So, there’s no reason to use indirect exchange unless it costs someone less in term of foregone opportunities to do so. By extension, there’d be no reason to use money.

This is only the case if someone else doesn’t want what you’re offering in a direct exchange. In this case, the next (and only) most efficient means of acquiring what you wanted in trade is to procure or make that thing, yourself.

This may or may not increase your opportunity costs above that of your next highest ranked preference. If it does, then you will abandon the attempt to acquire that good in favor of pursuing your next highest ranked preference.

But if the process of indirect exchange – even though it costs you more than direct exchange, all other things being equal – costs you less in terms of foregone opportunities than does your own manufacturing of that good for which you were willing to barter, then it will be worth the extra step to make the same trade, indirectly.

So there’s no reason to engage in indirect exchange unless the opportunity costs are lower than the costs of making the good for which you’re trading.

In all trades, you’re comparing your subjective preference for what you’re giving up to your subjective preference for what you’re getting in return. When your trade results in the satisfaction of your highest ranked preference, this is profit.

But money, since it involves indirect exchange, doesn’t satisfy any of your preferences. It’s not the money you want, but the stuff the money will buy. So you can’t possibly know if you’ve profitted until you buy something with your money.

This is why money has to have a link to use-value. Profit and losses are not, per se, properly calculated on money units, but on the stuff that is the real economy.

“The second explanation says the soviets used Western prices. This is surely a very different thing from using a different medium of exchange. It was the price control, not the currency, that was the problem.””

The price control caused a deviation from subjective values. It is this deviation that resulted in malinvestments.

Such a deviation can also occur when the money does not correspond to the stuff that is subjectively valued as a means for satisfying preferences.

This is the case with FRNs because it’s not backed by anything (i.e., it’s not a 1:1 money-substitute for any one good), and with bitcoins because it is not, nor has ever been, backed by anything but arbitrarily values and gullibility. You can do the same thing with sand, as I keep saying.

And in fact, if arbitrary valuations doesn’t defeat the purpose of money (which is what the bitcoin adherents are actually saying), then the price of bitcoins, in terms of dollars, didn’t have to fall at all.

Since trade in bitcoins got started because someone assigned an arbitrary value of a pizza to a certan number of them, all bitcoin adherents would have to do to raise the price in terms of dollars, is to simply choose to value it that much.

Poof. Magic. Problem solved.

An arbitrary amount of bitcoins were assigned to a pizza, so why not arbitrarily assign the same number of bitcoins to a house? What’s stopping them?

Of course, the reason they’re not doing this is because they really do believe – mistakenly – that bitcoins correspond to real goods and services, and they are, in fact, attempting to use bitcoins to measure goods against goods.

It wouldn’t make any sense, in terms of the stuff that is the real economy, to arbitrarily assign a number of bitcoins to the subjective value of a house. That person would take a loss in terms of stuff.

For the same reason, though, it didn’t make any sense for someone to arbitrarily assign bitcoins to pizza to begin with.

“I say that ‘general use in indirect exchange’ is a necessary, but insufficient, aspect of money.” Isn’t this just defining your interpretation as correct? It isn’t money unless it what I say is money. I could say it isn’t money unless it has the Queen’s head on it. Those US dollar things are a general indirect exchange, but they ain’t money.

“So you can’t possibly know if you’ve profitted until you buy something with your money” Whilst this might be technically true, this is not how people live their lives. We cannot know the sun will rise tomorrow, nor that gravity will continue to attract. The evidence that the money will be exchangeable is strong enough that we consider it a certainty.

“Isn’t this just defining your interpretation as correct?”

No; This is why I explained the *function* of money.

Since the function of money is to profit from the trade of that which you value less for that which you value more, under the condition that you are not able to do so, directly, this definition logically obtains.

You’re doing the same thing you’re trying to do under barter conditions, except that you have to do so, indirectly. You’re still comparing the value of that which you value less to that which you value more (which can’t happen until you buy something, because it’s not the money you want, but the stuff).

“Whilst this might be technically true, this is not how people live their lives.”

People may not consciously think about it this way (kind of like how nobody thinks about the definition of “humor”), but all deliberate action is an attempt to alieviate some felt unease (the Action Axiom).

People do treat FRNs and bitcoins as if they mean something, in their day to day lives, otherwise they could just decide that eating paper or shocking themselves with bitcoin signals had the same utility as food.

This is also why LK’s mutuum system hasn’t really been tested: People treat the money in banks as a set amount of stored value, not as unbacked promises. Look at how the people of Cyprus reacted to their “haircut”.

“As was mentioned by someone in an earlier thread, the real economy is measured in stuff, not dollars.”

Well it’s nice to be a someone I guess. I like to think I offer a good, quotable aphorism now and then.

Try being a nobody with whom others will still bother arguing.

😛

It’s difficult to search the comments on this blog, so that’s why I didn’t link to you.

It could have been worse, though: I actually thought it was skylien who said that.

From the Bitcoin interview:

“… and so that, to me, seemed like not a valid argument since people were using Bitcoin already …”

That people will voluntarily try something based on others’ willingness to do so, does not necessarily validate Bitcoin any more than it does a Ponzi scheme.

Voluntary adoption is a necessary, but not sufficient, test.

For example, gold would make a good money, but for those places where the government penalizes its use, it is not money because it is not widely traded.

Further, even though gold is not money in these places, it can still be a medium of exchange.

By the way, a commodity’s “higher value as a money” as compared to its value in barter does not mean that there is a separate aspect in it’s “money-ness” that people “value more”.

All trades involve a divergence from the good’s use-value because each party values what they are getting in return more than that which they trade away.

So the higher value of the “money-ness” of a commodity is inherent in trade, itself – including under barter.

There’s no separate aspect of money as compared to barter, except that money is more widely traded. It’s not that money is “more valuable” – it’s more like “the more valuable thing” is the money, if that helps.

Murphy, do you believe that Market Monetarism is a “better theory” than Keynesianism?

I do. An NGDP target would have bouts of extremely loose and tight credit, but there should be no risk of too tight or loose money. So the Great Recession and aftermath would simply be a period of rising inflation and some bank closings followed by layoffs and a period of stagflation and deleveraging with unemployment rising more gradually and reaching a maximum of something like 8% instead of 10%. Long-term unemployment would slowly rise to its highest level ever (but still lower than under Bernanke’s monetary regime). On the other hand, inflation hawkery would have become more popular and a more legitimate-sounding position. The recovery would very much have felt like the one we actually had. The recession would not have been nearly as damaging. Instead of feeling like Japan, 1990-2013, America would have felt like Italy, 1994-2007, or Portugal, 2000-2007, where 2% inflation was the rule.

Ah but “monetary offset” isn’t really a uniquely Market Monetarist theory. It’s just crowding out working in reverse.

It’s actually a very insidious name for it, though, because it sounds like a proposal to replace one kind of stimulus with another, rather than a theory about why fiscal policy shouldn’t really impact NGDP under certain monetary regimes.

\The lead author of the rff report is Jared C. Carbone. Nomintative determinism?

“if 100% of the revenues from a carbon tax are devoted exclusively to reducing taxes on capital gains, profits, interest, and dividends, that it will still hurt the economy.” This is not strictly true, because it explicitly ignores the benefits of the carbon reductions. If we only count costs, it is not surprising that we find there is a cost. The win-win is looking not so good, but we get pretty close to a win-draw with several of the scenarios. That is, we could get a 15% reduction in CO2 with very little cost to the economy. There is no need after all to return to the stone-age.

“Tax bads, not goods” is usually derived from what we think about welfare, right?

This is in terms of GDP. Does that matter? At the very least they’re not equivalent. But a lot of the costs of climate change are not strictly costs associated with reduced production capacity, right? So it seems like in the total welfare picture you are steeply discounting the benefits of a carbon tax and counting all of its costs.

I don’t really trust much welfare economics so I’m not saying I have a good alternative.

Harold and Daniel, the people I am arguing with (often) say that if you “tax bads not goods” then you will help even the conventional economy, disregarding environmental benefits. I have seen conservatives literally say that even if you think climate change is largely an exaggeration, we right-wingers should still strike a deal with the environmental Left if they will refund the carbon tax receipts to payroll tax cuts. Because then we’re not penalizing work etc.

That’s why I called it win-draw rather than win win. If there were a win-win, then as you say, it would be sensible to tax carbon if there were no environmental cost. Where would that end? Why stop at carbon? Should we tax milk and off-set income tax? Cars, cheese, elephants?

I get the point that the second win may be illusory, but off-setting other taxes reduces the cost, so the overall cost/benefit comes out better.

It is difficult to asses the size of the cost without a wider context. I would be interested to see similar analysis for switching other taxes around. How much benefit would we see for GDP over the same time period if we switched all of capital tax to consumption tax? I suspect it would completely swamp the small loss from taxing carbon and off-setting it with income tax. How much bigger would the economy be if we did away with savings tax?

I can see that there is no reason to adopt a policy that reduces GDP by even a small amount, so taxing carbon in the absence of an environmental or other gain would be senseless. But if the costs of doing so are very small compared with other tax issues then it is not worth spending too much time on this one when so much more could be gained by reducing capital taxes.

Note: this is where I disagree with Bob (and the literature that comes to this conclusion) per my blog post.

Ultimately, it comes down to failing to capture an important dynamic — that carbon taxes make people *specifically* economize on carbon, where general taxes don’t do this, even if they’re both incident on the same factors of production.

Failing to account for that dynamic would make you likewise conclude that the government should just raise taxes and give out free cell phones to anyone who asks, since then you don’t have to deal with the deadweight loss of people having to pay money for them, and the costs of preventing theft, etc.

What? How the hell do you reach this conclusion? Those two are nothing alike.

Was it not clear from the link that you did read before responding, given that it was a ready-to-go clarification of the point that sounded unsupported?

Well, yeah, I did. But, I still don’t see how anti-CO2 laws can be considered in line with laissez faire (which is not to say that there is anything wrong with that).

The absence of property rights, and regulations filling the void, is blurring the real scarcity that has to be addressed somehow.

Assume for the moment there’s a legitimately scarce good, like fish, with some sustainable extraction rate. If the fish had private owners, they would sell at a sustainable extraction rate (modulo time discounts). People would economize on fish use, and stocks wouldn’t collapse from a tragedy of the commons. Everyone’s happy. (This is known as tradeable fishing quotas.)

Assume instead of that system, the government had ridiculous, roundabout regulations that attempted to cut back on fishing, but didn’t get at the root cause: say, you can only fish one day of the year, or you can only do it from an unpowered boat (not far from actual government programs they’ve tried for this). That would be stupid. If the government won’t privatize it, it should at least manage it like a private owner would, act as the long-term owner.

What would you say to someone that insisted the government *not* assign rights in fish, and sabotage any private attempt to define them, preferring that “hey, everyone has the right to fish”? Hopefully, you’d see that as the worst of both worlds: no one economizes on fish, and the fish still die out.

This is what the cell phone analogy is getting at.

I actually lean towards that way. It sounds more compatible with laissez-faire to me. I don’t see privatization as a solution to the tragedy of the commons, but as a way of sweeping it under the rug. It misses the point of people who wish to preserve the commons.

S.C.,

If you want a laissez faire solution I can provide one: under the current system people can have their property destroyed by human caused global warming and there’s nothing they can do about it legally. So one proposal would be for the state to simply stop enforcing the property rights of anyone who emits more than a set amount of CO2. The government will do nothing directly to limit emissions, but if someone tries to burn their factory down the police and fire departments won’t respond, if someone renigs on a contract they can’t take them to court, etc.

It’s an idea crazy enough that I’m surprised Bob Roddis hasn’t come up with it, but it’s perfectly laissez faire.

Burning the factory down would release a lot of CO2.

Property rights and contracts aren’t part of my definition of laissez-faire, which is simply “unregulated business”, so I’m not sure I understand how your proposal can be expressed in terms of being laissez-faire or not being laissez-faire. Tradeable emissions credits are a market-based departure from laissez-faire for me. It seems like you’re trying to turn the concept on its head.

http://cnsnews.com/news/article/barbara-hollingsworth/hurricane-activity-remains-historic-low

With so few hurricanes out there you can see why property owners have such a strong claim on CO2 production.

Tel: The IPCC predicted not more tropical storms, but that the intensity of the greatest would likely increase. Typhoon Haiyan last year was the strongest landfall, and this year Cyclone Pam “had the highest 10-minute sustained wind speed of any South Pacific tropical cyclone; it is tied with Cyclone Orson and Cyclone Monica for having the strongest winds of any cyclone in the Southern Hemisphere.” Seems consistent with predictions to me.

Property rights and contracts aren’t part of my definition of laissez-faire

There would still be property rights and contracts. They just wouldn’t be enforceable by the government.

Right now if someone’s property rights or contracts are impaired due to carbon emissions, they have no recourse from the government. If that’s not contrary to laissez faire, then why not do the same to the emitters?

The sustained wind speeds around the region are listed here:

https://notalotofpeopleknowthat.wordpress.com/2015/03/16/cyclone-pam/

Orson (1989) 180mph

Ron (1998) 165mph

Zoe (2002) 180mph

Monica (2006) 180mph

Pam (2015) 165mph

Pam was big but not the biggest. Of course, that’s not helpful if all you have is a rickety hut in Vanuatu… but there’s no observable trend towards worse cyclones.

Some more cyclone comparisons

Pressure (lower is stronger):

Tip (1979) 870 millibars

Gilbert (1988) 888 millibars

Wilma (2005) 882 millibars

Rita (2005) 895 millibars

Pam (2015) 899 millibars

Haiyan (2014) 895 millibars

More here…

http://www.weather.com/storms/typhoon/news/cyclone-pam-super-typhoon-haiyan-comparison

Also a disclaimer in there, many of the measurements are estimates.

Tel.” there’s no observable trend towards worse cyclones.”

Not so. Emanuel noted this for the Atlantic in 2005: “Whatever the cause, the near doubling of power dissipation over the period of record should be a matter of some concern, as it is a measure of the destructive potential of tropical cyclones.”

http://www.schafferer.de/chameleon/outbox/public/4/NATURE03906.pdf

For other basins the data is not so reliable or comprehensive, so tends are harder to spot. However, Elsner et al report in Nature: “We find significant upward trends for wind speed quantiles above the 70th percentile, with trends as high as 0.3 plusminus 0.09 m s-1 yr-1 (s.e.) for the strongest cyclones. We note separate upward trends in the estimated lifetime-maximum wind speeds of the very strongest tropical cyclones (99th percentile) over each ocean basin”

http://www.nature.com/nature/journal/v455/n7209/abs/nature07234.html

Others have correlated these rise to increase in SST.

Definitely not conclusive, but there clearly are observable trends to worse cyclones.

If you want to look at accumulated energy the graph is here:

http://models.weatherbell.com/global_running_ace.png

Both globally, and in the Northern Hemisphere, we see a ramping up into two peaks 1993 and 1998, then it ramps down after that. Again, no upwards long term trend.

Dr. Ryan N. Maue has lists of all the storms if you want to go through them, the data is available to download.

Compare against a chart of CO2 emissions over the same time period where there really is an upward trend and the obvious conclusion is there is no correlation at all between CO2 emissions and ACE.

Tel. Some times teasing a signal from noisy and sparse data takes more than a look at the headline numbers. Some people have cited careful detailed economic analysis to show that increasing minimum wage perhaps does increase unemployment after all. I could not refute that by looking at the unemployment figures and pointing out that there was no observable correlation to minimum wage. Similarly here – just pointing out that the headline figures do not obviously correlate does not refute the trend identified by Emanuel, Elsner and others. It is observable, but it requires a detailed look to see.

Bob says:

Not if the fuel isn’t carbon-based (i.e., hydrogen, sulfur, iron) or if the oxidant is not oxygen (i.e., chlorine, fluorine).

And, see you at Texas bitcoin.

Regarding the carbon tax piece piece. The chart reproduced above clearly shows that the blue-line (C02 tax in lieu of capital tax), leads to an increase in GDP after a small initial dip.

I suspect that this is because the GDP benefits of a capital tax reduction outweigh the costs of a carbon tax (and the benefits of a reduction in capital tax with no carbon tax at all would be greater still).

However: If you believe that there are some external costs associated with carbon use then the blue line provides a compelling reason why a carbon tax funded by a capital tax cut is a great idea !

A lot of scenarios where you abolish/greatly reduce taxes on capital are attractive. However, as Bob Murphy points out in his article, this is politically very unrealistic.

W. Peden,

How does the politically viability of something affect its economic logic ? His article isn’t entitled: “Fans Agree: Any Politically Viable Carbon Tax Swap Will Hurt Economy” , is it ?

And on: ‘The next time someone tells you, “Econ 101 says ‘tax bads, not goods,’ duh, a sensibly designed carbon tax swap will help the environment and the economy!” you can show him this chart.’

What if he points to the blue line ?

Only politically feasible with severe bribery, and probably not for long due to the threat of 1%-eaters.

Oh, no, because that will just make the capital-holders richer, so sayeth Mar–I mean Picketty.

Believe it or not, Bob, not everyone’s priority is a strong economy. Not saying that carbon taxes are either good or bad, it’s just that there are people who are willing to go along with slightly higher prices if it means that the environment is protected.

On a related note, I think you guys ought to take some tips from Smith when it comes to arguing for your version of free commerce.

You are always welcome to pay higher prices for whatever you want.

What you are interested in doing, is forcing other people to pay higher prices so they buy the things you want them to buy… which is quite a different matter.

And this is quite a dumb response since it misses the point of carbon taxes. Imagine if I said: “You are welcome to honor contracts and not ‘steal’, but don’t force others to do so as well.”.

You changed your argument, you started with, “there are people who are willing to go along with slightly higher prices if it means that the environment is protected” making it sound voluntary. Now you go ahead and say this is about force and not voluntary action.

As for the force required to keep people from breaking their promises, I personally believe we would be better off not using violence to enforce people keeping promises… after all politicians break promises when they are running for office on a regular basis, no violence is ever directed at them. Violence in some situations is unavoidable, but the right thing to do is seek ways to minimise it. At any rate, I wouldn’t go pretending that being subject to force was actually a voluntary action on the part of the victim.

I am forced to accept the consequences of carbon emissions. I can’t opt out. There is force in this whatever happens unless there is a mechanism for everyone to come to mutually agreeable position. This is not possible, so we must accept some force.

“Voluntary” versus “involuntary” does fit into it. I frankly don’t see how taxes are “involuntary”, since you are not forced to do anything. Government just collects them and goes on its way. Some people want the environment protected, even if it means higher taxes. They don’t care what you think and they shouldn’t care what you think because that is not their prerogative.

should read

You can choose to not pay your taxes, or to not file a return.

You can choose to be audited by the IRS.

You can choose to be indicted in federal court for tax evasion.

You can choose to pay fines and/or go to prison.

By this standard, military draft is voluntary. Mugging? Call it a charitable donation. Victims of rape could have chosen suicide instead.

When someone breaks into your house and steal your television, they have not “forced” you to do anything. The draft is nothing like taxation because you actually are forced to do something.

If someone shoots you, it makes no sense to say you have been shot “involuntarily”. Similarly, it is bizarre to me to say that you have “no choice in road providers because the government has a monopoly on it”.

Taxes aren’t based on contracts; They’re based on the logically impossible proposition that something can be owned by more than one person, and that therefore any one individual’s rights can be ignored.

Ownership means the exclusive right to use, and two people cannot both have the same exlusive right.

Did you eat an extra bowl of gobbledygook this morning? Because that’s all that’s coming out of your mouth.

That’s irrelevant to my point.

They’re not based on that and that is not logically impossible.

No one who believes in taxation thinks they are a rights violation.

First of all, that’s not necessarily the definition of ownership. Second of all, two people can have “the exclusive right to use” if it is exclusive to them together.

“Second of all, two people can have “the exclusive right to use” if it is exclusive to them together.”

I believe in you, S.C. …:

Where did two people, out of the rest of the more than two people in the world, get an exclusive right to something?

Where did one person? (What’s up with the “I believe in you” thing, BTW?)

No, in your worlldview, two people can have an exclusive right.

I’m asking, in your worldview, how did two people get an exclusive right that the rest of existing people don’t have?

The significance of my question is this:

The answer you give to justify exclusive property rights for a subset of two can be used to justify those rights for a subset of one.

Or, if you go the other way, saying that everyone must agree, then the rights are not exclusive, and we’re back to square one, having made zero progress with regard to property rights.

The problem with the idea that everyone must agree is that it presupposes authority from which permissions must be granted!

The next logical question: From where, in the collectivist’s worldview, did this authority originate.

Your definition of what property is is idiosyncratic.

What the hell are you talking about? Isn’t this the exact same complaint libs have about taxes? That you never “agreed” to them?

There is nothing “collectivist” about this “worldview”.

“Your definition of what property is is idiosyncratic.”

Thanks for asking.

Having the fruit of your labor used by someone else without your permission is functionally equivalent to you being forced to labor on their behalf – i.e. you’re their slave.

This is why an unowned object becomes your property when you transform it.

“Isn’t this the exact same complaint libs have about taxes? That you never “agreed” to them?”

(When you said “libs”, that threw me. I thought you were talking about liberals, but I realize now that you’re talking about libertarians.)

You missed two points.

The first one is that when I accuse you of saying that “everyone must agree”, in the context of my rebuttal I mean to say that in your worldview everyone on the planet must agree to each other person’s (on the planet) property rights.

The second is that this is an internally inconsistent position since it requires that each person must have the individual right to agree. You’re trying to deny individual property rights by assuming them.

No it’s not. Another thing is that people disagree about what rightfully belongs to you. It’s like pro-copyright people saying that people opposed to it favor stealing their work, when they simply think that there shouldn’t be copyright. This is truly a sub-retarded thing to believe.

Non sequitur.

It does no such thing. Two totally different things that you equivocating on. Why are rights even coming into this argument? They’re nowhere near fundamental arguing points.

That is not my worldview. However, that complaint is equivalent to your complaints about laws you don’t like.

I am willing to pay a high price for what I want. Are you wiling to pay a high price for what I want?

What’s that blue line at the top of the chart? We should do that.

+1. But the progressives will kick and scream and shout until the capital taxes are made double their pre-carbon tax strength.

Josiah, even the authors of the study–I quoted it from their Executive Summary–say that the capital tax swap hurts the conventional economy. I confess I couldn’t figure out from their paper what the “technical” approach was that yielded that outcome, given the GDP chart. I thought maybe it had to do with discounting (since the capital tax swap hurts GDP initially, and only later boosts it), but eyeballing those numbers, it would involve a pretty high discount rate to make that work.

The paper does not seem to say what the approach was that yielded a slight reduction. The take-away message is that either the slight increase in GDP or the slight reduction from the unspecified approach is insignificant, “either way the net costs are close to zero.”

To put this in perspective the cost to nearly everyone of this policy are less than $30 / yr. About half pay less than $10 / yr, and and a few pay about $40 /yr.

So even if there is no benefit to cutting carbon emissions, the costs would be pretty small. We must bear this in mind when people say that climate alarmists want us to go back to the stone age. The costs for a 15% reduction in CO2 are about the same as one beer a month – not quite the stone age.

We must bear this in mind when people say that climate alarmists want us to go back to the stone age.

I don’t know any “climate alarmists” who recommend a $30/ton CO2 tax, 100% of the revenues to be refunded through a reduction in the corporate income tax.

“Most recently Dr Hansen has stated his support for a revenue-neutral fee on carbon that returns the money collected from the fossil fuel industry equally to all legal residents.” He says “A tax should be called a tax. The public can understand this and will accept a tax if it is clearly explained and if 100 percent of the money is returned to the public. Not one dime

should go to Washington for politicians to pick winners.” Not quite reducing capital taxes, but still clearly promoting a revenue neutral carbon tax. He doesn’t specify the level of the tax.

It is also fair to say that this is not the only policy Hansen thinks we should have.

Generally I think we should listen to experts about their field of expertise. Climate scientists should be listened to about the climate, but their opinions about how to implement reductions should not be given any more weight than anyone else.

Just seen elsewhere that Hansen suggested a tax of $115/tonne

Harold, so imagine how badly that would depress GDP relative to the baseline, if the revenues were refunded as lump sum checks as Hansen wants. Remember that the deadweight loss (disregarding climate benefits) of a carbon tax increase with the square of its magnitude.

Yes, my second comment was to acknowledge that Hansen was not the example of climate alarmists I thought he might be. However, he does agree with a revenue neutral tax, the rest is detail.

Does anyone really think a C02 tax will be “in lieu of” and not “on top of”?

Does anyone really think a C02 tax will be “in lieu of” and not “on top of”?

That seems to be the way it works in British Columbia.

Did B.C. remove any capital taxes when it imposed its carbon tax?

Did B.C. remove any capital taxes when it imposed its carbon tax?

Yes.

Josiah is right that the experience in BC is surprisingly close to actual revenue neutrality, but I know guys in Fraser who are working on a piece showing that it’s increasingly *not* revenue neutral. (For example, they raised the corporate income tax rate back up a percentage point.) And even originally, there were all kinds of offsets, not just a straight dollar for dollar reduction in the CIT. There were tax credits for individuals for example, which aren’t even as supply-side as payroll tax rate reduction.

Don’t get me wrong, it’s better than spending money on gov’t research for car batteries, but I think even on paper, even when BC’s deal first went through, it wouldn’t help the conventional economy according to the chart in this blog post.

http://mises.org/library/natural-interest-rate-always-positive-and-cannot-be-negative

Is that really correct?

Suppose you have apples, and right now you have many more apples than you could possibly eat, but somehow you know a bad season is coming up and you expect that you will not be getting any more apples for a long time.

But apples don’t last too well, if you just put them on the shelf you will surely die when all the apples rot. You can exchange half your apples for a fridge which will extend the life of the remaining apples but not indefinitely. You could make applejack which will last a long time but some apples are wasted in the process. All options available involve having less apples in future than the apples you have now, but you are not hungry right now, you will be hungry in the future.

Human action “axiom” doesn’t overrule the natural world that humans live in. If you are in a less than ideal position, all the options might be bad. The human action would be to take what they personally see as the best available option, which still might be negative interest rates (i.e. your savings effectively decay over time).

“The human action would be to take what they personally see as the best available option, which still might be negative interest rates (i.e. your savings effectively decay over time).”

Yes, this is correct, as far as it goes; But you’re both right, in a sense.

The options you propose results in less loss, so the interest is still positive as compared to having zero apples.

Or, you might pay to store gold in a bank to protect your savings from theft as best as possible. Same thing.

Sure, if you are paying for gold storage (good example) then you must have subjectively decided that, when the risk of theft is factored in, the negative interest rate making those protection payments is the best option available. Thus, in a completely free market environment people might well choose negative interest rates in some situations.

Not to say our currently imposed negative real interest rates are the result of a free market by any means… I’m just pointing out that it could conceivably happen.

Bob, is there something screwy going on with your blog’s coding? The reply box used to appear beneath whatever comment I clicked “Reply” on and it used to remember my name and email address.

No it’s not. Another thing is that people disagree about what rightfully belongs to you. It’s like pro-copyright people saying that people opposed to it favor stealing their work, when they simply think that there shouldn’t be copyright.

Non sequitur.

It does no such thing. Two totally different things that you equivocating on.