Looking Behind the Curtain on Oil Prices

In previous posts (such as here, but you need to follow the links to get the whole story) I’ve summarized the main factors behind the crash in oil prices. However, to focus on facts such as “the Saudis are pledging to maintain production despite the price fall, which fueled even further price falls” is to ignore the larger geopolitical context.

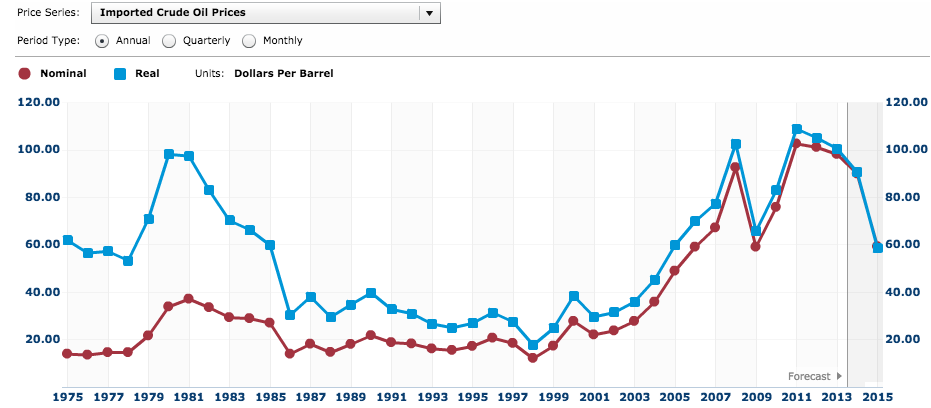

Besides the 2008 financial crisis, there was another time when oil prices collapsed this much and with comparable rapidity, in the mid-1980s:

Now of course we can explain that fall by reference to supply and demand factors–particularly a crucial decision by Saudi Arabian officials–but it is a well-known theory (with varying degrees of endorsement) that U.S. officials pressured the Saudis behind the scenes to do this, in order to bring pressure on the USSR.

In our time, John Kerry visited Saudi Arabia in September, leading some (e.g. here) to suggest that this pattern is playing out once again.

In other words, maybe it’s not a coincidence that the world price of oil collapses “unexpectedly” when tensions between the U.S. and Russia are intensifying.

There’s a lot of factors going into oil prices, certainly demand is part of it… smaller cars, hybrids, more use of natural gas & LPG, and I think people have just been beaten out of the habit of discretionary motoring by high consumer prices at the pump. I’ll point out in Australia we as still paying between $5 and $6 per gallon depending on where you shop and how much ethanol vs octane you want to buy, taxes are higher here and the AUD is a bit weak at the moment, but all things considered pump prices have not fallen for the Australian consumer all that much.

Also, I think diversity of supply makes more difference than absolute available supply. The OPEC cartel was able to artificially increase oil prices for decades, they had a pretty good run all things considered. We now have mutual distrust amongst Iran, Iraq, Saudi Arabia, Syria so it’s going to be more difficult for them to cooperate, and of course America and Russia will never cooperate just on principle. The whole economics of cartel making and breaking is way outside the textbook supply curve meets demand curve sort of stuff.

One question on demand: have any of your IER buddies got the low down on offshore methane ice? Seems there’s a lot if it out there but no one is using it right now as an energy supply. This could radically shift the balance of power between Russia and the EU if there’s an easy alternative to buying Russian gas.

Slightly off topic, but Peter Schiff (I think it was Dec 18 show) was busy blasting Jannett Yellen’s comments on low oil prices as hypocrisy. Maybe I’m the last guy around here to listen to it.

Yellen was basically saying that low oil prices are good for the economy, because it effectively puts a bit of spare money into the pocket of the average consumer who then has a bit more inclination to spend on other things.

Schiff came back at her asking why wouldn’t lower food prices also be good for the economy for exactly the same reason? Cheaper food would give consumers a bit more change out of buying a meal, they can buy something else with that.

What about cheaper electricity? Same thing. Cheaper rent, cheaper clothing, cheaper everything. Hey wait a minute here, maybe deflation might be good for the economy, how about that? Why do we need QE to stop the deflation then? Why does Yellen tell us that deflation would be a terrible thing for the economy?

Anyway, Schiff gets himself quite worked up over it, but he does have a point. Yellen (like Krugman) says whatever suits her this minute.

This is precisely why Sumner says “never reason from a price change”.

No, he says never reason from a price change because he wants everyone to instead reason from a spending change.

Except similar problems arise by reasoning from what is just another non-action, historical statistic premise.

Suppose economy X is buying resources and labor towards the production of inferior products, where they will be better allocated throughout economies A, B and C instead. If spending were to then fall in economy A, and rise in economies A, B and C, thus facilitating a partial transfer of economic control away from X and towards A, B and C, then reasoning from an NGDP change would lead to us concluding that the drop in output in X is a bad thing, because NGDP fell there. Then it would be claimed that spending should not have fallen in X, even though that is a movement towards optimal production.

Never reason from any nominal variable. Reason from individual valuations and actions.

The raw material you have for economic study is transactions, which consist of only these things:

* price

* volume

* annotation (description of what changed hands)

If you don’t want to study prices, you are going to be quite limited in what you can do with volume alone.

Monetary Lessons from America’s Past | Thomas E. Woods, Jr. [@ 08:05]

“… history, in and of itself, is really just a sequence of events. It cannot, on its own, prove correlation: that A caused B. It can prove that B followed A in temporal sequence, but it can’t prove that A causes B. For that, we need economic theory; And that is what Austrian Economics gives us.”

Tel,

Mere serfs like us are too ignorant to know which low prices are good and bad for us. That’s why our benevolent overlords are in positions of power to guide our dim witted minds. Fear not! They are on guard.

Now go consume something

🙂

I’m unsure of what to consume, waiting for Yellen’s next update.

In genéral I do not like conspiracy theories, especially one as clean and neat as this one. In favor of Smith’s theory, he does not insult us by suggesting any degree of competence by the current bureaucracy (they of the reset button).

From a pure economics perspective, i.e. without reference to baseline, pre-fracking barrels of oil, oil prices seem to be largely lacking in explanatory value.

To put it in a different perspective: the drop in the price of oil could be driven as neatly by a drop in the price of commodities due to a slowdown in Fed stimulous or due to a macro cycle clearing unnecessay or over production.

A lower price for energy is good for consumers, lower prices for food would be good for consumers, lower prices for housing also good, etc., etc., but that isn’t the same thing as an increase in the value of a dollar (i.e. deflation) unless wages are indefinitely sticky.

So I haven’t heard Schiff’s explanation or all of Yellen’s response, but there is nothing inconsistent with stating a falling relative price of a resource is a good thing and at the same time not favoring an increase in the value of a dollar.

Perhaps the Saudis believe most of their oil will end up being left underground if the price doesn’t fall.

What a joke. At least get your geopolitical oil history correct. That isn’t how the US manipulated oil prices in the 80’s. The way they did that was by helping the Venezuelans increase production and cheat on their OPEC quota (well the world’s western oil companies did most of the heavy lifting). The Saudi’s were so pissed at Venezuelan cheating that they loosened the spigots to teach them a lesson. World oil prices were low until a certain OPEC friendly would-be Dictator took power in Venezuela — bringing the country back in line. (Chavez became “President” in 1999).

The idea that some US guy just goes to Saudi and really gets compliance on oil output is a fantasy. Why even create OPEC if all that is required to break its back is a visit from a high ranking US diplomat? When wouldn’t an oil importing country want lower prices?