Yes Scott Sumner Is “the NGDP Guy”

I explain why he has been pigeonholed. For example, he has said the Fed is more powerful than God because it controls NGDP.

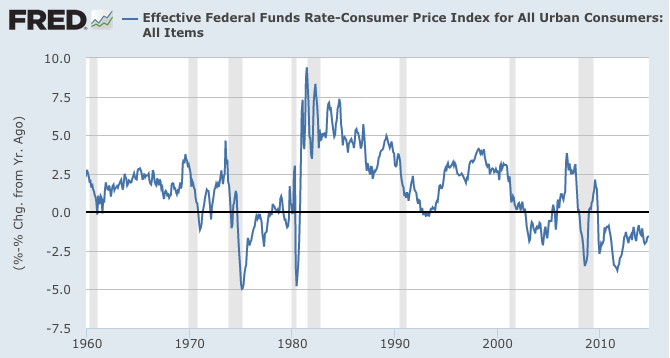

More substantively, I produce the following chart:

So yes, Scott is right that some economists foolishly thought monetary policy was tight in the Weimar Republic because nominal interest rates were high. But if we adjust for Consumer Price inflation, we can see that the “real” fed funds rate lately has been quite low. The only other times (since 1960) it’s been like this, have been in the late 1970s–when Scott agrees Fed policy was too loose–and during the peak of the housing bubble years. Why, it’s almost as if the Austrian narrative makes perfect sense…

Yeah that protest is eye-rolling, given that Sumner has repeatedly emphasized that when someone complains about the Fed being too loose or too tight, that they had better have a particular metric in mind or else they are just blowing hot air. Well, if Sumner says:

“I see myself as the “monetary misdiagnosis guy.” I’m the one that claims almost the entire profession has it wrong, and Milton Friedman had it right….Monetary policy has been tight since 2008. There should be no debate about whether the Fed should end its extraordinarily accommodative policy, as there has been…no such policy. These views distinguish me from almost all other economists on both sides of the spectrum.”

Then taking his own advice he had better have a metric in mind, right? And oh look at that, he believes the right metric is…NGDP. He is saying almost all economists are wrong…that they misdiagnosed monetary…because they aren’t using NGDP as the metric.

Sumner made his own bed.

*monetary policy

I think the distinction you make between real and nominal interest rates is a side-issue for Market Monetarism since I think they actually believe that tight money can go hand-in-hand with low REAL interest rates as well as low nominal rates.

If NGDP is falling , then even if real interest rates are low or negative then money is tight.

I think interest rates (both real and nominal) are irrelevant to the core of Market Monetarist thinking. NGDP can be controlled by varying the size of the monetary base and this can be done without reference to prevailing interest rates. If NGDP can be kept on a steady trend line that everyone knows about and expects then interest rates will actually gravitate to their natural rate (which is where Austrians would want them to be, right)?

Austrians want the interest rates to be determined by what is necessary for the quantity of voluntary savings supplied, to be equal to the quantity of investment fund demanded. Any particular non zero rate which is forced by a Central Bank, for the growth of spending on final goods, cannot achieve that. It could at best approximate that result, which in reality could only be achieved by a free market financial system.

Putting aside what I said in a previous thread about PT making more sense than PQ as a measure of the effective money stream. Although a free market would arguably stabilize PT.

“Austrians want the interest rates to be determined by what is necessary for the quantity of voluntary savings supplied, to be equal to the quantity of investment fund demanded”

This is pretty much how I would define the “natural rate” , and what I think NGDP targeting would allow to emerge better than any other monetary policy that assumes the existence of a CB. I think an NGDP target could best be achieve by abandoning interest rate targeting by he CB even as a short term objective.

Not quite sure I follow the difference between PT v PQ (is that related to final goods v total spending ?) but I agree that in a free market processes and institutions would arise that would tend to optimize NGDP levels.

As we are some ways from such a free-market outcome I am happy so support NGDP targeting a a policy that :-

a) would probably work

and

b) can be supported within a framework that is essentially free-market

“I am happy so support NGDP targeting a a policy that :-”

=

“I am happy to support NGDP targeting as a policy that :-“

Yes, PT is total spending PQ is NGDP, total final goods spending. I’m basing the need to focus on PT on this statement from one of the footnotes of Prices and Production:

“From now onward the term ” amount of money in circulation ” or even shortly ” the quantity of money ” will be used for what should more exactly be described as the effective money stream or the amount of money payments made during a unit period of time. The problems arising out of possible divergences between these two magnitudes will only be taken up in Lecture IV.”

“Amount of money payments made during a unit period of time” includes all payments, not just purchases of final goods.

The problem with a positive growth rate is that, while it might be helpful for stabilizing contracts that assume a certain level of nominal income growth implicitly, first, the growth rate is not a law of nature, it’s a product of past interference in the economy by the Federal Reserve/the financial regulatory apparatus. And in particular, the positive growth rate implies that money is being effectively injected into the economy and driving a wedge between savings and investment-the bank rate systematically tends to be too low relative to the natural rate. This is why Hayek’s preferred policy was a zero percent growth rate. This poses wicked transition problems, though. Not least because as it stands, people expect inflation and price that into their contracts for debt and labor agreements.

I will say, as schemes for centrally planning the monetary system goes, there are definitely worse methods than NGDP targeting.

I’ll stick to where I think my comparative advantage is: arguing for what’s right, over what’s pragmatic or practical. You’re welcome to stick to yours, as well.

Transformer,

Are you really sure it works both ways? First your assumption that NGDP levels are “optimized” they way you think needs to be true, and secondly even more importantly does it work both ways? Or don’t you have the cart before the horse then?

In a free market uncountable micro transaction finally get you a simple NGDP figure. Why should keeping a predetermined NGDP growth path with broad sweeping CB policies translate back to the same beneficial micro transactions? There just is no reason to think that.

Imagine following picture. There are a lot of little creeks that flow into one big river. Now people like Sumner and you obviously think you could fill the little creeks by filling the big river….

Nice river analogy, dam it,

I concur on the analogy but that pun was painful.

“Why should keeping a predetermined NGDP growth path with broad sweeping CB policies translate back to the same beneficial micro transactions?”

Because keeping a predetermined NGDP growth path helps eliminate the effects of fluctuation in demand for money on the economy.

In a non-CB world free banks and free currency issuers would be allowed to operate to match the supply of money to demand.

In a CB world ,the CB controls the supply of base money. As Austrians (and others) believe this can lead to it setting interest rates too low and causing bad unsustainable booms, and (as monetarists) believe setting them too high and causing avoidable slumps.

By tying the CB to a simple rule like “target a predetermined NGDP growth path” it reduces the possibility of discretionary errors and forces the CB to adjust the supply of money to meet the demand.

Transformer, your answer does not, I think, get to the essence of skylien’s question.

The Central Bank does not supply money to the same people free banks would. This alone eliminates even the possibility that the micro transactions in one case will the be same as those in the other.

I think the problem is that we don’t exactly know how a free market with no CB would solve the issue of matching supply of money to demand.

Austrian of the Rothbardian tradition think that money would be of the commodity variety , and price adjustment would do all the heavy lifting.

Free Banking Austrians generally think that fractional-reserve lending , based on commodity money will deliver a flexible money supply.

While sympathetic to this second view I also think that Hayek was on to something in “The Denationalization of Money”, where he sees private currency issuers as varying the quantity of base money upon which the banking system operates.

I think this option would operate somewhat along the lines of free market quantitative easing – with current issuers buying and selling assets for money, much like MMist call for the CB to do, but driven purely by the profit motive.

Is that an example of liquidity preference , Tel ?

Transformer:

“I think the problem is that we don’t exactly know how a free market with no CB would solve the issue of matching supply of money to demand.”

It is impossible for supply to match demand in any human world, regardless of the laws.

Supply not equalling demand is not an “issue” if one realizes that it is impossible for us to equalize them.

Having said that, the free process does tend to reverse any known “mismatching”, while leading to new “mismatchings” which the continued free market process will again tend to reverse those, and again lead to new “mismatchings.”

No sound economic or ethical theory has to promise an answer for how demand for money will equal supply of money. This can never occur anyway. Even the concept of that equality is absurd. If the supply of money did equal the demand for money, then the implication would be a cessation of spending. For each individual would own an amount of money in their bank account, i.e. supply, that exactly matches the money they want to hold, i.e. demand. If a commodity is to even be a money, there MUST be a difference between the amount of money a person owns, and the demand for how much they want to own.

For most people, the demand for money exceeding the supply of money is a normal, everyday, commonplace reality. It is why most people earn money (which is an occurence of demand exceeding supply), and spend money (which is an occurence of supply exceeding demand). And that’s all economic reality actually consists of. Occurrences of demand exceeding supply, and supply exceeding demand, in a ceaseless flux.

Transformer-difficult as it may be to believe, Hayek’s Denationalization of Money represented a theoretical retrogression from Prices and Production. The idea of private banks issuing competing fiat currencies, doing so in such a way as to maintain price level stability, is anathema to the Austrian theory Hayek had earlier articulated, when he explicitly rejected the desirability of stable, rather than gradually falling prices.

Transfomer,

„Because keeping a predetermined NGDP growth path helps eliminate the effects of fluctuation in demand for money on the economy.“

This just confirms what I said. To stay with the river analogy. The reason the big river dried out was because the little creeks reduced their flow for some other reason, not the other way around! Decreasing NGDP was not the reason that people started to spend less. Hence making NGDP artificially go back up cannot by definition address the actual problem.

It is symptom fighting nothing else.

The way you describe it now seems as if demand for money were the problem. And yes by pushing NGDP you can replace spending that stopped with other spending (in the river analogy you are just flooding the wrong area) However the demand for money is just a different name for the same cart! What is the horse I ask you?

Well thanks Tel and Andrew.

However I didn’t get the pun until Andrew made it clear. I only saw that something was wrong with it, but thought it was a type… haha.

omg getting a typo in ‘typo’ is embarrassing…

“The way you describe it now seems as if demand for money were the problem. And yes by pushing NGDP you can replace spending that stopped with other spending (in the river analogy you are just flooding the wrong area)”

Bingo. If *some* people have an increased demand to accumulate cash balances, you don’t solve the problem by supplying cash to completely different people. And that’s why a Central Bank doesn’t really solve the problem.

Is that an example of liquidity preference , Tel ?

CPI-adjusted interest rates matter only for creditors; nominal income-adjusted interest rates matter more for debtors.

http://research.stlouisfed.org/fred2/graph/?g=Sjr

By this metric, however, real interest policy is still pretty loose and is the most consistent over a four-year period in all U.S. history. This is, indeed, remarkable.

I wish I had said the Fed is more powerful than God. About those low “real” interest rates—would you agree that when real interest rates on 5 year TIPS soared from 0.57% to 4.2% in late 2008 that money was suddenly getting super tight, at exactly the wrong time? If so, did you complain at that time that the Fed was driving us into a depression? And if not, why not?

And why doesn’t the argument that nominal interest rates are not a reliable indicator of the stance of monetary policy also apply to real rates? Aren’t real rates affected by real economic growth, which is affected by monetary policy?

Regarding your longer piece, I’m not sure “complaint” is the right term. In a sense I was saying that I’m not deserving of being called the NGDP guy, lots of other more famous economists have advocated the policy, before and since. The rest of the post seems to miss the point. My misdiagnosis argument doesn’t require a NGDP benchmark; the Fed’s dual mandate would do just as well, indeed money was too tight even using a simple forward-looking inflation target. The radical part of my argument is misdiagnosis, which is only tangentially related to NGDP targeting.

Yeah but even if the Fed was hitting the 2% price inflation target, and the economy slumped, then you’d still say most other economists were misdiagnosing because they weren’t using NGDP as a benchmark.

That in principle one could have used any other benchmark other than 2% price inflation to make the argument the Fed was too tight does not mean those are the benchmarks are the actual reasons you believe most economists were misdiagnosing. It is really just a convenience. It is a rhetorical tactic that only grants validity their benchmarks only to get them to make the same conclusion you are making for different reasons.

If I said to a Keynesian something like “Even by your own premises, your argument is false”, that does not imply those premises are a somehow a part of my own set. One makes these types of arguments to convince a person to agree with one’s conclusion made an entirely different way, because one’s own premises don’t seem to be working.

While NGDP growth was falling well below zero, it is really a convenience that prices were also falling below 2%. That way, you can say “The Fed is too tight” while thinking, and also repeatedly stating, that you are saying that because of what was happening to NGDP, while hoping that the mere fact you are sounding off the alarm and calling attention to too tight of money will be picked up by economists who use a price inflation benchmark instead because oh look, the Fed is too tight because of that too.

I doubt that the skeleton argument of “You agree with me the Fed is too tight!”, without saying why or by how much, which allows people to agree with you for all sorts of reasons, including ones you vehemently reject, somehow makes you “not just the NGDP guy”.

I advocate for individuals achieving happiness. One of the premises I use to come to how individuals can achieve happiness is private property rights. Now would the fact that there might be communists or fascists out there who also want individuals to achieve happiness, who would agree with me on that, would that somehow make me something other than the anarcho-capitalist guy? That because I share the same conclusion, that I am really a guy with a healthy dose of anarcho-capitalism, a dash of communism and a sprinkle of fascism? That I would not think and possibly say to communists and fascists why they are wrong, and that the why they are wrong is private property rights?

That I want individuals to achieve happiness, if I spin it the right way so that like you I can mislead others into agreeing with me, might appear to make me a utilitarian. But if were honest with myself, I would not reject the labelling of ” the ancap guy”.

It is our premises that distinguish us from others, not our conclusions. Most of our dreaded enemies would agree with us about conclusions, e.g. freedom, happiness, prosperity, etc. Is there even such a thing as an ethic that explicitly advocates for slavery, sadness, and poverty?

If Rorty were in my corner, he might tell me this:

“Don’t present your ancapism as extreme and radical. There is little chance you would be able to get away with convincing people that anything you say is true. Instead, pretend you are a compromiser. People like compromisers! Say that you are not an extremist in anti-violence. That you thought long and hard about it and after plenty of open dialogue and listening to criticisms, you have since decided to compromise with the extreme anti-violence pacifists. That you now reluctantly admit that the extremist view is not practical, and so you will meet halfway and say that you would only support violence if it were used in defense against initiations of it. I believe if you phrase it that way, you’ll get even the statists to agree with you and think “hey that guy’s alright.”. Then when the time is right, gradually wean them towards anarcho-capitalism and hope that they don’t notice that everything you have told them so far, was grounded in your mind on ancap principles.

My current thinking is that the Fed Funds rate minus the growth rate of gross transactions (PT) would be a good indicator of the direction policy is moving in. Unfortunately because everyone seems more interested on the aggregate “real value” of consumption goods, than the total money stream (Again, I am referring to what Hayek was talking about in Prices and Production) there are not measures of PT going back very far at all. The closest thing is Skousen’s Gross Domestic Expenditures (although he doesn’t seem to fully grasp why one wants to measure PT, rather than either Q or PQ). And no measure of any part of the total money stream is in the same time resolution as the interest rate data is. Best I’ve been able to do is approximate what this would look like: I’ve thought Fed Funds rate minus the growth rate of Nominal GDP or alternately, Final Sales to Domestic Purchasers (nominal) is probably close. Some observations about this:

First, during almost every boom period, this measure decreases to below zero and stays low until near the end; loose monetary policy fuels unsustainable booms. Second, at the end of boom periods, this measure increases-the interest rate is moving back in the direction of the Wicksellian Natural Rate, precipitating a bust-and possibly, that the Fed moves the rate too far in the other direction, past the Natural Rate, precipitating the Secondary Depression (although to me, it looks like this really hasn’t happened in most recessions there are *possible* minor cases in the 50’s, the only unambiguous case since World War II is the Great Recession). Third, the looseness of policy during the House Bubble is much more apparent than in your graph above.

My point being that I think this measure would in fact better illustrate the Austrian theory, than Fed Funds – CPI.

http://research.stlouisfed.org/fred2/series/MDOAH

Note the peak in 2008 where mortgage bubble was the epicentre of the crash. Deleveraging a lot of mortgages does have an effect on the money supply. About 1.5 trillion dollars were wiped out there.

This needs to be emphasized more.

Credit expansion and contraction is the main mechanism of monetary inflation and deflation. Not a lot of respect is being paid to the truth that gigantic quantities of money can be literally erased from existence.

Whenever I hear of market monetarism, I have nausea. Its proponents are just new “Inflationists in Wolves’ Clothing” http://mises.org/library/inflationists-wolves-clothing