Yet More Sumner Sleight-of-Hand

Here’s a good one. Recently John Quiggin updated a post in response to objections from Market Monetarists, because he had said (initially) that nominal interest rates were a good indicator of the looseness or tightness of monetary policy. The Market Monetarists said that the standard view was that real interest rates were a better indicator, and Quiggin agreed.

Then Scott Sumner wrote a post entitled, “Real interest rates are not much better.” He made some decent points about the theoretical difficulties in equating “low real interest rates” with “easy money,” and “high real interest rates” with “tight money.” OK fine.

But then look how Scott delivered his finishing move:

Quiggin seems to think that MMs [Market Monetarists] are sort of oddballs. OK, but what does he make of the Volcker disinflation?

1980:3 to 1981:3: NGDP growth = 14.0%

1981:3 to 1982:3: NGDP growth = 3.2%

Meanwhile nominal interest rates on 3 month T-bills fell from 16.3% in May 1981 to 7.71% in October 1982. These data are quite similar to the Australian episode considered by Quiggin. If we use his criterion for easy money then America’s most famous tight money policy since the Great Depression was actually an expansionary monetary policy.

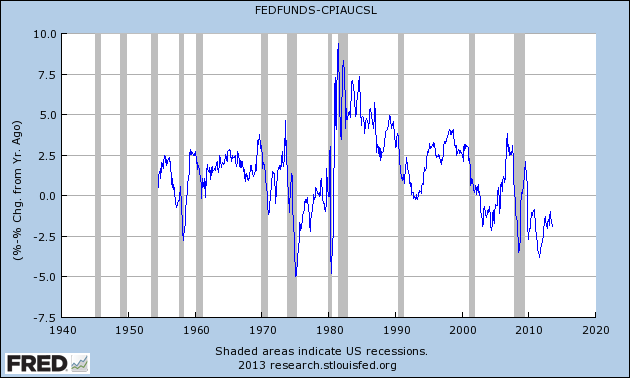

Hang on though: Are we talking about Quiggin’s updated criterion? Because if you use real interest rates–which for our purposes I generate in FRED by taking the effective funds rate minus the year/year percentage change in CPI–you get this:

So yep, the “most famous tight money policy since the Great Depression” was associated with at least an 8-percentage-point spike in the real effective fed funds rate, which also happened to be the highest real rate (using the proxy I whipped up here for this blog post) during the 60 or so years that FRED can display for us.

Obviously, I haven’t here blown up Scott’s world, but it’s odd that he points to the best example of tight money==>high real interest rates on record, as evidence that real interest rates are a poor guide to the stance of monetary policy.

Thanks for pointing this out. I was annoyed by this too, but decided I didn’t want to argue on too many points at once.

Oh don’t worry Dr. Quiggin, I can wage a war with multiple fronts against Scott Sumner.

I have a more fundamental problem with all of this and that is the word “REAL”. How do you determine the “REAL” interest rate or any other price? The interest rate real or otherwise is a price. The only way to determine a price is to let participants in a completely free marketplace do their business AND then it is only valid for the last trade and offers no prediction of the future. I find it even more amusing that their definition of real is the current force modified market price or last price minus the inflation rate. But the inflation rate is a complete fabrication as well so we are back to the issue that real is not real at all, it is just some number based loosely on market participant interactions in a distorted marketplace.

I think they mean “real” in terms of “what really happened” rather than in terms of “what ideally should happen”. I agree that prices are distorted by a great many things, some of them quite deliberate, some arbitrary and haphazard.

It does also imply an accurate value for (price) inflation adjustment, and that’s another whole can of worms. Agreed on that point.