Ms. Yellen, It’s a Trap!

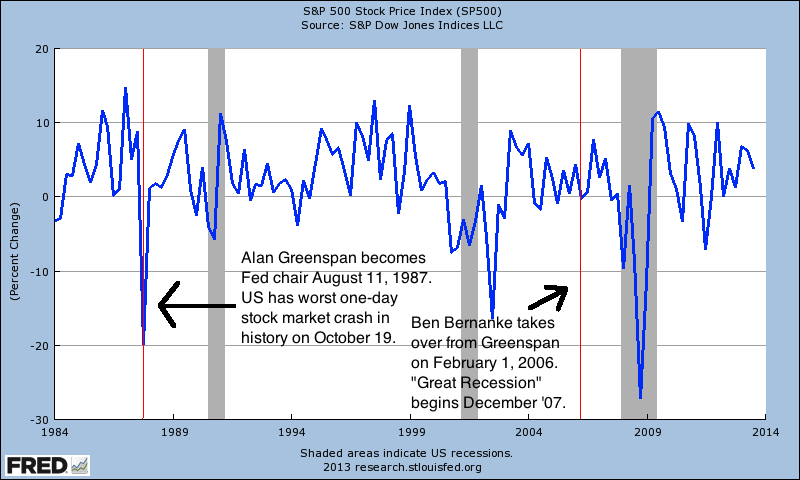

That Larry Summers is one sly dog. With his “surprise” move to continue QE3, Big Ben just bought himself some time to safely exit the scene, following the pattern of the last two Fed handovers:

(It should go without saying that the red lines above are only approximately correct. You can tell I don’t have mad skillz when it comes to the MacBook’s Paintbrush program. Also, the above shows the percentage moves in the quarterly average of the S&P500.)

As I said on Facebook tonight:

If I were a cigar-chomping financial titan, running the world through backroom deals with my fellow Good Ole Boys, we’d think it was pretty funny to have the first black president and first woman Fed chief at the helm when the US economy collapses. Thank goodness We the People run this country.

I never understood Americans. Your economy is about to crash and you think it’s funny?!

In Soviet Amerika, economy laughs at you.

And in Soviet Amerika, the commissars laugh at everybody.

It’s funny because everyone knows the economy is not about to crash. Some people are forced to say that due to their ideology. Just imagine the crazy guy wearing the bright yellow rain coat every day. One day it’s the right outfit and he can pretend he’s a genius who predicted the weather.

LOL. The economy is in a bubble, joe. And it’s one of those that you’ll tell us was “obvious” after the fact, just like the housing bubble….

It’s funny because everyone knows the economy is not about to crash. Some people are forced to say that due to their ideology. Just imagine the crazy guy wearing the bright yellow rain coat every day. One day it’s the right outfit and he can pretend he’s a genius who predicted the weather.

Hang on, Joe. Are you saying the economy is not about to crash, or are you hedging and saying nobody can really know, and that even if it did, I would only be right because of a “stopped clock” effect? (Like Scott Sumner dismissed me when he claimed that the 2007-09 recession was “not predicted by economists.”)

I ask because I am quite sure if the economy crashed next June, you would not own up to your sentence above about, “everyone knows the economy is not about to crash.”

The Austrian School on Business Cycles: 100 Years of Being Right | Mark Thornton

[WWW]http://www.youtube.com/watch?v=HegiGuJlzTQ

Don’t believe the hype — the U.S economy is not recovering, it’s getting sicker.

[WWW]http://www.youtube.com/watch?v=Vcd5IO_LMBs

Stress Tests No Sweat

[WWW]http://www.businessinsider.com/stress-tests-no-sweat-2012-5

Despite endorsing phony economic data that shows the US is in recovery, the Fed knows full well that the American economy cannot move forward without its low interest-rate crutches. Ben Bernanke is trying desperately to pretend that he can keep rates low forever, which is why that variable was deliberately left out of the stress tests.”

Funny Schiff Radio: The Roach Motel

[1:10]

[WWW]http://www.youtube.com/watch?v=jIOfbZX70k0

… there’s no way that the Fed is going to shrink its balance sheet because, in order to do that, it’s got to find buyers for all the assets that it wants to sell.

And where’s it going to get those buyers? I mean, right now, the Fed is the buyer; The Fed is buying Treasuries. If the Fed wants to shrink its balance sheet it actually has to sell Treasuries.

So now it would have to sell Treasuries in competition with the Treasury that was trying to sell Treasuries.

So instead of being a buyer – instead of buying from the Treasury – they would be competing with the Treasury to sell. And what would happen to the price? It would plunge.

And what about the mortgages that they’re going to try to sell? Who the hell’s going to buy those? Those were the toxic assets that they had to buy off the banks so the banks didn’t fail; Why would anybody want to buy them back?

That’s why I said their monetary policy is the equivalent of the “Roach Motel”. Those toxic assets check in, but they ain’t checkin’ out.

Bill Gross Tweets: “Without Central Bank Check Writing, We Only Have Ourselves To Sell To” Sends Yields Soaring

[WWW]http://www.zerohedge.com/news/2013-08-16/bill-gross-tweets-without-central-bank-check-writing-we-only-have-ourselves-sell-sen

I forgot to add:

Ask an Austrian Economist

[WWW]http://www.tomwoods.com/blog/ask-an-austrian-economist/

We have a kind of “Ask an Austrian Economist” section at LibertyClassroom.com, and someone recently asked:

“Peter Schiff has been very outspoken on his show on the idea that a large increase in the interest rates will lead to massive bank failures. He was critical of the stress tests the Fed ran earlier in the year on the banks because they did not assume interest rate hikes, which he felt would collapse the banks and prove that they were not sound. I never understood, however, why interest rate increases in our situation should lead to bank failures. Why would this be so?”

The answer:

“Rising interest rates will collapse the capital value (i.e., the market price) of assets banks hold. If they have existing T-bonds at 3% and interest rates on newly issued T-bonds rise to 6%, the price that investors will be willing to pay for the 3% bonds collapses. When that happens, banks become insolvent.”

Vodka rations still is good, da!

Armando, We are very easy to figure out.When something is completely out of our control, we joke and make fun of it.Simple. Bob, when are you just going to corner that little weasel Krugman…I’ve got alot of money on this.

Seing the thing a bit like Menger, (as I read somewhere else) I sometimes think it would be really the best to have Krugman as Fed Chairman and President at the same time, which means control of monetary and fiscal side and therefore no excuses possible, let him just end the depression NOW! I guess this would really set a quite compelling data point, whatever direction this would finally go.

It wouldn’t matter. When Krugman failed, he would be penning a blog post explaining how he was even more right than he had initially thought, but had only underestimated how bad the economy was, and how big the stimulus had to be. And he would blame it on Friedman.

Certainly he can try it, but there is only so much room for this kind of excuse that the plausibility of it is so bad already that even for the mass of the people it will finally mean to try something else..

What do you think of Raghuram Rajan appointment as RBI chairman and his paper “a 100 small steps”. If you give me good advice, You will find me sitting at your feet, chanting ‘om mani padme hum’ until I achieve enlightenment.”

Didn’t know that the former chief economist at the BIS even was a sane (from my perspective) person (now at the OECD): Mr William White’s his view:

”

“Mr White said the five years since Lehman have largely been wasted, leaving a global system that is even more unbalanced, and may be running out of lifelines.

“The ultimate driver for the whole world is the US interest rate and as this goes up there will be fall-out for everybody. The trigger could be Fed tapering but there are a lot of things that can go wrong. I very am worried that Abenomics could go awry in Japan, and Europe remains exceedingly vulnerable to outside shocks.”

Mr White said the world has become addicted to easy money, with rates falling ever lower with each cycle and each crisis. There is little ammunition left if the system buckles again. “I don’t know what they will do: Abenomics for the world I suppose, but this is the last refuge of the scoundrel,” he said.”

http://www.acting-man.com/?p=26007

Just a little dose of confirmation bias again, good to know that I am not alone in wearing a tinfoil hat.

http://planningcommission.nic.in/reports/genrep/rep_fr/cfsr_all.pdf A hundred little Steps, by Raghuram Rajan

I’ll give you one tiny step. Remove the capital gains tax on Gold and Silver.

Do you really think this…

“Proposal 29: Expedite the process of creating a unique national ID number with biometric identification.”

is not a one-way street to tyranny?

I agree and have not registered for my UIDAI card yet….but I do keep a pan card..

The PAN Card is not an option. They don’t let you live a life without it. So no one would blame you for holding one. Kudos on refusing to register for the UIDAI card. Do keep the spirit up…

Please give us a critique of Indian monetary policy and some of the steps that should be introduced. We will be greatly indebted pretty please, with sugar on top.

Austrian economists are global citizens, because there theories are meant to be valueless as they can be applied to any society, yet you might have written 100 post on America with 350 million people, you havent even referred to 5 with regards to India. Even Milton Friedman wrote working papers on India. I have some very good friends in Nobel prize committee. If you write 10 proper papers on India, I will guarantee you a nobel in the next 20 years ( most probably sooner). I am a man of my word.

“Citizen” implies being a member of a group, and “global citizen” is so encompassing as to be meaningless.

I don’t belong to anyone even though I reject the legitimacy of a collectivist territorial monopoly (Individuals act; not collectives). This is not to say I reject the legitimacy of voluntary contracts between multiple individuals.

No one is a global citizen.

But you are still a human being right. You think i dont feel what you feel. We are caught in a system none of our making, paying for empty promises and finally dying in pain and dark.

You are saying then that corporations should not be allowed to own or rent land?

It is only legitimate for a single person to own something; After that, many individuals can contract with each other to do certain things on the land.

How would you adjudicate between two people who have supposedly “equal right” over the use of the land, if it’s not specified in the contract? The concept doesn’t make any sense (and not just legally).

One person is claiming the right to order someone else to do something on the land, or prevent another person from doing something on the land. But on what authority may he do so?

What has happened, in this scenario, is that no one has actually claimed the land. It remains a commons.

Are you counting a corporation as a “single person” then?

Legally, at the moment they are, and they can own land.

I mean only to appeal to logic.

Legalese is a matter of contract, to which only individuals can legitimately be party.

No, corporations are not individuals.

Individuals contract with each other into a business structure which is called a corporation.

This is helpful:

Power and Market

Chapter 3—Triangular Intervention

R. Policy Toward Monopoly

[WWW]http://mises.org/rothbard/mes/chap15d.asp#3R._Policy_Toward_Monopoly

Finally, the question may be raised: Are corporations themselves mere grants of monopoly privilege? Some advocates of the free market were persuaded to accept this view by Walter Lippmann’s The Good Society.[77] It should be clear from previous discussion, however, that corporations are not at all monopolistic privileges; they are free associations of individuals pooling their capital. On the purely free market, such men would simply announce to their creditors that their liability is limited to the capital specifically invested in the corporation, and that beyond this their personal funds are not liable for debts, as they would be under a partnership arrangement. It then rests with the sellers and lenders to this corporation to decide whether or not they will transact business with it. If they do, then they proceed at their own risk. Thus, the government does not grant corporations a privilege of limited liability; anything announced and freely contracted for in advance is a right of a free individual, not a special privilege. It is not necessary that governments grant charters to corporations.[78]

If a corporation is not an individual, then when a corporation own land (as many do) and excludes outsiders from this land, then the result is “a collectivist territorial monopoly” which you have stated already is illegitimate.

It is value-free not “valueless”, and this should count for economics in general not only AE.

Why are you so offensive? If you are the same Prateek I know from the Mises Forums, then I have you much nicer in memory.

Not being offensive, India has 1.2 Billion people…why cant Bob write a few posts about it..

Why are you trolling?

Did you call me a troll…Indians like B.R shenoy and Sudha Shenoy have helped the Austrian movement everywehere in the world..they are both dead now….We need help…and I am not a troll

Germany has 82M and Bob doesn’t write about them much either. Your logic is incoherent.

I would very much like to hear Bob write about Germany. For example they recently decided to make Bitcoin legitimate currency in Germany, probably in order to give an outlet to people who want to keep savings without holding Euros (thats my theory).

Prateek,

Things like:

“We will be greatly indebted pretty please, with sugar on top.”

“I have some very good friends in Nobel prize committee. If you write 10 proper papers on India, I will guarantee you a nobel in the next 20 years ( most probably sooner). I am a man of my word.”

“If you give me good advice, You will find me sitting at your feet, chanting ‘om mani padme hum’ until I achieve enlightenment.”

Sounds rather like you want to kid Bob, or as Richie calls it “trolling”. However since I have to do with people all over the world due to my job, I know that I need to be careful especially of only written stuff, because not everything is what it seems at first especially from people with different culture.

Rereading what you wrote and since I know that you are normally a nice guy I give you the benefit of the doubt, though I still can’t believe that you can provide a Nobel to Bob.

Of course I can if under the Permanant income Hypothesis, I come across a large sum of money and direct it to lobbying(within 20 years…have you seen Shawshank Redemption)..

and what are you 5..I have to read articles by so called Nobel prize winner for the last 10 years..as my job. Bob is better than most of them. i mean that sincerely. If he pushes himself to a bigger world view and become a policy advocate as strong as Friedman did for china, Chile. I dont think Bob works for a nobel, people who are creating excellence know that the rest will always follow and it’s not usually the other way round.

Have you considered offering to help by contributing some material? How about a paper explaining what you think has gone wrong with the Rupee? Of course many people are blaming the Indians themselves for buying gold, but Indians have boight gold for generations, so what has changed recently?

Oh Tel,

The answer is rather simple. The Government of India, The Reserve Bank of India and the banking system have flooded the market with so much money, they make the Fed look like an amateur (on the flooding bit).

You should see the pace at which food prices are galloping. Trust me, it’s not funny living through it.

What kind of Job is that?

I am sure if Bob ever gets the Nobel, he will certainly mention you in his thankings speech.

Wasn’t Friedman already much more famous when he gave (free?) advice to other countries? In politics it helps to be famous.

Bala, how about a comparison on USA and QE (which is still money printing) with the Indian experience?

Are you saying then that Bernanke has been showing well measured constraint and only printed money to the extent he can get away with it, without (price) inflation? How to judge this?

It is still highly unlikely, isn’t it?

😉

However I commend you for your efforts. And BTW I forgot to apologize for misinterpreting your intent. (no I have not seen it yet…)

So embarrassing.. How can one write that he actually forgot to apologize only to not apologize again…haha (Loughing at myself).

I apologize!

😉

And yes I meant value free…thanks for correcting

http://m.youtube.com/watch?v=4F4qzPbcFiA&desktop_uri=%2Fwatch%3Fv%3D4F4qzPbcFiA

So what you are suggesting Bob is my prediction that it will take 3 – 5 years before the economy crashes again may be too optimistic? I do not see that there is enough leveraged money ( everyone is getting it for free from the Fed ) to actually cause the kind of melt down that is necessary for it to crash. Oh I think that it is bad because the assets like stocks are WAY too high for where we are as an economy, over valued I think is the right term, but that is about all I can say about that.

I just don’t think there is enough debt out there yet to cause a ‘crash’ crash. I also can see the Fed increasing its purchase rate before it would decrease it.

All in all I am SHOCKED that they did not decrease the rate of purchasing. It feels like they have decided that unbridled optimism is a good thing to have. I am worried, very worried, but hey on the bright side I have a pretty large amount of food storage.

Oh and what are the odds this gets blamed on capitalism and the rich rather than on policy and the Fed? oh well…

Well margin debt at the stock market is at an all time high. I guess the potential for a crash is definitely there. Also there currently is the BTFATH (By the fucking all time high) mentality working at the stock market because the Bernanke Put who keeps the pumps going…

*Buy*

Guys, Prateek is not being offensive or trolling. However, Prateek, it’s not that I’m ignoring India, it’s that I’m concentrating on the United States, since that’s what I understand the best. I don’t know the first thing about India’s political system or central bank.

I barely write about China or South America. There are lots of people living in those areas too.

Hey Bob ,

Thanks for your reply , it just that the austrian policies in India can raise more than 300 million people out of poverty in 3 years. I just want you you to see the sense of propertion. China has almost 5 times our GDP with the same population.

Yours Sincerely

Prateek Mishra

Prateek,

You keep prattling on about India. Did you know that outside of India there are millions of people? Why aren’t you commenting on [insert pet issue]?

Um, probably because he’s Indian.

You didn’t even mention that Australia’s climate change commission has been disbanded and the carbon tax repeal is getting put together asap.

http://swaminomics.org/If you can just read his in a serious manner. it will only take a week. I have been a Consultant to centre in college and we had been writing trade monitoring reports to our ambassador.i genuinely believe that if you wrote articles with him, you have potential to take out almost a billion people out of poverty. You achieve somthing Friedman achieved from 1980 to 2000, (before he ran out of ideas). here for the last few years you have been playing a duel of sort with an Noble Prize eco. Either sir you can keep to your comfort zone or you can actually help create out of something out of an America when it was an untapped continent 170 years back. I am asking this because I and you both know that you have the mental faculties of a Mises or a Hayek.

http://swaminomics.org/If you can just read his works in a serious manner. It will only take a week. I have been a Consultant to centre in college and we had been writing trade monitoring reports to our ambassador. I genuinely believe that if you wrote papers with him, you have potential to take out almost a billion people out of poverty. You achieve somthing Friedman achieved from 1980 to 2000, (before he ran out of ideas). Here for the last few years you have been playing a duel of sort with an Noble Prize eco. Either sir you can keep to your comfort zone or you can actually help create out of something out of an USA when it still largely an untapped continent 150 years back.Everybody is Everybody the details hardly matter. I am asking this because I know you that you have the mental faculties of a Mises or a Hayek.

Prateek, maybe asking G.P. Manesh would be better. I believe he currently lives in the United States, but he is more likely to know more about India’s political institutions and economy than Murphy is.

http://www.gpmanish.com/index.html

Thanks