DeLong Sees Nothing In the Investment Data That Would Slow Capacity Growth

[UPDATE below.]

Brad DeLong has this habit where he makes it look as if he’s walked through several different strands of evidence, and they all come down squarely on the position he agreed with at the start of his investigation–even though some of the evidence obviously cuts the other way. It’s like we’re arguing over whether the Beatles ever released goofy songs, and he says, “I have considered John, Paul, George, and Ringo, and see no reason to support your wild accusation.”

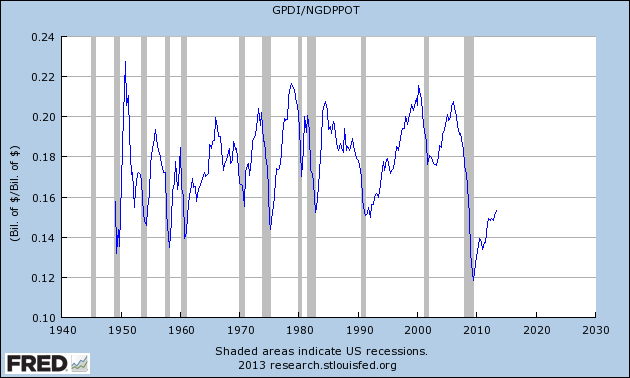

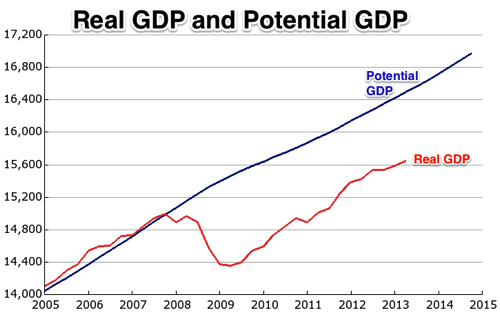

Case in point: In his most recent post, DeLong is baffled that the Fed is still gung-ho about tapering later this year. Here’s DeLong, who first posts this chart and then comments:

There are no signs in the pace of technological progress, in the level of investment, in the pace at which the American labor force educates itself, in measures of capacity utilization, in signs of upward wage pressure due to labor quality bottlenecks, or in surging commodity prices due to supply bottlenecks to suggest that the path of growth of U.S. sustainable potential GDP is materially lower today than was believed back in 2007. [Bold added.]

Now I could quibble with all of those “indicators,” incidentally, because according to DeLong’s own framework, we’re well below potential GDP. So the fact that, say, wages aren’t rising rapidly, doesn’t mean that potential GDP is growing as before; even if potential GDP growth had sharply decelerated in 2008, the “real GDP” line could still be well below it, meaning you would see the weak pressure on wages that we are currently seeing. (Again, I’m doing this whole post within DeLong’s framework, just to show he’s making a non sequitur even on his own terms.)

But the most egregious claim above is that there’s nothing “in the level of investment…to suggest that the path of growth of U.S. sustainable potential GDP is materially lower today than was believed back in 2007.”

Oh really? Here’s the official government statistics showing gross private domestic investment as a percentage of potential GDP. To keep potential GDP chugging along at its previous pace, you’d think GPDI should stay about the same percentage as it was from 2005-2007. But this is what actually happened:

Incidentally, I’m not purposely loading the deck against DeLong by only including private domestic investment; FRED doesn’t seem to have a single series adding government and private investment spending. But, I hardly think DeLong is able to claim that the above chart is more than offset by the huge surge in government investment spending (at federal, state, and local levels) from 2008 – present, what with the Republicans’ vicious austerity and all.

So not only are the Austrians (and Larry Summers in the occasional op ed) the only ones who think the composition of investment spending is important for sustainable growth, but apparently we’re the only ones who think going from 23% down to 15% of total potential devoted to investment, might slow down the growth of potential output.

UPDATE: In light of DeLong’s further commentary on this topic, I now think he didn’t mean that the rate of growth of potential GDP is not materially lower today, than in 2007. (It’s about 25% lower, according to the CBO estimate.) Rather, DeLong was saying that the (slower) growth in potential GDP since 2007, has not rendered its current level materially lower than people would have believed, back in 2007.

This is still very wrong, in my view. According to the CBO’s figures–which I believe are the source of the graph DeLong himself provided in his post above–the 2q2013 level of potential GDP is about 3.6% lower than it would have been, had potential GDP grown at the same rate from 4q2007 onward, as it did from 4q2006 through 4q2007. I imagine if, say, employment today were 3.6% lower than it would be in the absence of the sequester, that DeLong would not dismiss it as an irrelevant difference.

All of the above discussion can be seen in its sarcastic and puerile detail in the comments of this Daniel Kuehn post.

“apparently we’re the only ones who think going from 23% down to 15% of total potential devoted to investment, might slow down the growth of potential output.”

Well, of course Dr. Murphy. Did you not learn in your economics classes that Keynes had proved (PROVED! LOL) that consumption = investment, and both are just as good for GDP growth?

Also, government investment is – as always – a blatant farce.

“In recent years, particularly in the literature on the “under-developed countries,” there has been a great deal of discussion of government “investment.” There can be no such investment, however. “Investment” is defined as expenditures made not for the direct satisfaction of those who make it, but for other, ultimate consumers. Machines are produced not to serve the entrepreneur, but to serve the ultimate consumers, who in turn remunerate the entrepreneurs. But government acquires its funds by seizing them from private individuals; the spending of the funds, therefore, gratifies the desires of government officials.Government officials have forcibly shifted production from satisfying private consumers to satisfying themselves; their spending is therefore pure consumption and can by no stretch of the term be called “investment.” (Of course, to the extent that government officials do not realize this, their “consumption” is really waste-spending.)” – Murray Rothbard

There’s probably a lot of corruption, but I don’t think Rothbard’s argument here applies to most spending in, say, the United States. When a government builds a road it’s an investment (even if you want to argue that there was an alternative investment, with a lower opportunity cost, that the private sector could have allocated inputs toward). When a government bails out a car factory, it’s an investment. And, with relatively advanced political institutions, the probability of corruption falls.

And, no, Keynes did not “prove” that consumption equals investment.

“When a government bails out a car factory, it’s an investment. And, with relatively advanced political institutions, the probability of corruption falls.”

I agree with the corruption statement in general, but I’m pretty suspicious about how many of these things went down with the auto bailout. Ex. One of Obama’s major political contributors had the inside track on purchasing Delco, but a firm Romney was invested in beat him to the punch and then Geithner allegedly helped Romney’s firm get rid of 20,000 pensions.

There may not have been any wrong doing, but the power to modify major contractual obligations certainly challenges the integrity of “advanced political institutions”.

I agree with you, but are things like auto bailouts the exception to the rule? (Although, they are pretty big exceptions.) What I mean to say is, what percentage of total public spending is corrupt? My guess is that while there is probably some corruption in everything (corruption including things like uncompetitive bidding between suppliers), but that the percentage is still relatively small.

Rothbard also seems to be talking about a specific kind of corruption. He seems to think that all public spending goes towards satisfying the preferences of the political class. An example would be if Obama used tax revenue to buy himself a yacht (outside of his income as president). I think Rothbard is mostly wrong, although obviously there are cases of this kind of corruption. Most of our spending is invested, even if the process of allocating tax money towards expenditures is corrupt in the sense of betraying, to one extent or another, a competitive allocation of money.

“Rothbard also seems to be talking about a specific kind of corruption. He seems to think that all public spending goes towards satisfying the preferences of the political class. An example would be if Obama used tax revenue to buy himself a yacht (outside of his income as president).”

If Obama signs a law that bails out GM, that is satisfying the desires of the political class just the same. It is THEIR preference – and not that of the consumers, as shown through the market – that GM continues to exist without running out of money. Whether this be “corrupt” in the sense that they benefit financially is besides the point – they obtain psychic profit (at the very least) from their spending decisions, or they would not make them.

Jonathan,

The government depends on the private market for its sustenance. The government does not produce anything. You cannot call it an investment for someone to rob Peter to pay Paul. That isn’t an investment. That is a coercive transfer of wealth, even if they pay Paul and then charge money for the use of what Paul produces later on.

“And, no, Keynes did not “prove” that consumption equals investment.”

In terms of his aggregate demand framework, he kind of did. He wrote that “only if there is a rise in investment, or the propensity to consume is equal to unity” (paraphrased), will there be no drop in employment/income/etc.

The implication of this is clear. Employment and output would, according to Keynes, NOT collapse if investment fell to 0 and consumption rose to 100% of total spending (in a context of unchanged “aggregate demand”). According to Keynes, this would be just as good for economic growth and employment as would be a rise in investment to 80% say, and fall in consumption to 20%, say. As long as there is a demand for “something”, output and employment are allegedly secured.

A firm depends on the consumer for sustenance. It doesn’t follow that the firm “doesn’t produce anything.”

A complete non-sequitur. An investment has a specific economic definition. It has nothing to do with how the resource owner got those resources in the first place. And, flows of resources change the distribution of wealth, so I’m not sure what your point is.

No, he never argued that “consumption = investment.” He said that the inducement to invest is directly related to the marginal propensity to consume. Those are two very different claims.

And, yes, Keynes did know that if there is no production then there will be no wealth in the next period (other than savings). That’s why Keynes didn’t just advocate greater consumption, but also the “socialization of investment.”

A firm depends on the consumer for sustenance. It doesn’t follow that the firm “doesn’t produce anything.”

A thief a firm.

There is no trade taking place. The only thing the government can give in compensation for its taxation is the goods produced by others – robbing Peter to pay Paul.

So a government owned and run nationalised industry like an oil extraction facility cannot produce profitable oil output?

Thieves can engage in production with that which they have stolen, yes.

hmm.

Correction:

This: “A thief a firm.”

Was supposed to be: “A thief <> a firm.”

I disagree. Government trades on it’s monopoly on the use of violence. The service they offer is refraining from killing you. Mosler waving his hypothetical nine was an honest and accurate description of government operation.

The market value of this service depends very much on how much you value your own life, and whether you feel inclined to try your hand beating them at their own game. Lots of people have decided it is easier to pay protection money.

The real problem is a lack of general understanding of this fact, and a belief that government serves all sorts of other whacky purposes.

The service they offer is refraining from killing you. Mosler waving his hypothetical nine was an honest and accurate description of government operation.

NOW I understand MMT.

I swear I do!!

“A firm depends on the consumer for sustenance. It doesn’t follow that the firm “doesn’t produce anything.”

Woah, have you been brainwashed in the recent past or something?

Consumption depends on production, not the other way around.

Consumers depend on producers for sustenance, not the other way around.

If consumers stopped paying producers, then producers will produce for themselves. They won’t necessarily die. But, on the other side of the coin, if all production stopped, then those who need to consume who used to depend on other producers, would die if they don’t first produce for themselves.

“An investment has a specific economic definition. It has nothing to do with how the resource owner got those resources in the first place. And, flows of resources change the distribution of wealth, so I’m not sure what your point is.”

I wasn’t talking about a single act abstracted away from all other actual or potential acts. Sure, if you want to ignore everything else, then I am a “doctor” because I put a band-aid on my nephew’s skinned knee, and I am a “physicist” because I jiggled the handle on my toilet to test how many times I have to shake it before the water stops running, I am a “civil engineer” because I made a bridge using a wood plank to go from one side of a ravine to the other, etc. etc.

To be an investor means to bring into fruition new wealth that did not exist before by abstaining from consumption. The government is not an investor because it does not produce anything. It is like your grown up child living in the basement, not working, but consuming what their parents produce.

“No, he never argued that “consumption = investment.” He said that the inducement to invest is directly related to the marginal propensity to consume. Those are two very different claims.”

He doesn’t have to explicitly argue “consumption equals investment”. There are two ways of saying something, directly/explicitly, and indirectly/implicitly.

Keynes argued consumption is the same thing as investment in the latter sense, when he argued that employment and output would not fall as long as investment OR consumption spending rises in response to hoarding somewhere else in the economy.

He very much did equivocate the two, just not explicitly. And he certainly did not argue they are equal universally, which is what you seemed to have thought I meant by the way your response is framed.

“And, yes, Keynes did know that if there is no production then there will be no wealth in the next period (other than savings). That’s why Keynes didn’t just advocate greater consumption, but also the “socialization of investment.””

No, Keynes held that if the propensity to consume is equal to “unity”, then no decline in output or employment will ensue. This was one half of an “either or” argument he made. He argued that as long as investment rises OR as long as consumption rises, THEN such and such…

Keynes advocated for a “socialization of investment” to prevent firms from hoarding money that would otherwise be invested, yes, but this was due to his worry over interest rates falling to zero. Investment is only significant in Keynes’ framework because it adds to AD. In Keynes’ system, if the propensity to consume is somehow able to replace any drop in investment due to firms hoarding cash which is itself due to interest rates falling (to 2% or less), then to Keynes, it’s all a wash. Employment need not suffer at all. AD has not fallen. The composition just changed.

Assuming you actually have proper trade happening (admittedly a somewhat imaginary scenario) there is no distinction between “producers” and “consumers”. Every person consuming something must also produce something else of equal value in order to be able to trade.

OK, this idea of mutual benefit has faded from view somewhat with the idea that firms are “producers” and households are “consumers” but that’s just politics.

I minor quibble. You said, “every person consuming something must also produce something else of equal value in order to be able to trade.”

I disagree in that I believe that one must see a greater value in something in order for them to consider such a trade. After all, we can keep trading dollar bills back and forth, but this would be a pointless exercise, one that actually has a greater cost than simply abstaining.

Of course, my example above leaves entirely out of the picture the case of time, interest, and inflation. But I think that this problem is easily solved when one understands that prices and values are not synonyms.

I was oversimplifying a bit, for the sake of trying to stick to the question of producers and consumers. It’s an artificial distinction however you want to quibble over subjective valuation and all that.

“Assuming you actually have proper trade happening (admittedly a somewhat imaginary scenario) there is no distinction between “producers” and “consumers”. Every person consuming something must also produce something else of equal value in order to be able to trade.”

This is not true Tel. Those who steal from others are consuming but not producing the equivalent of what they consume.

You’re talking about a laissez-faire market where property rights are respected and enforced. In that context I will agree with you.

I kind of figured that, because I’m familiar with you enough to know that you already know that. I just thought it was strange that you said it, is all.

I did mention that this applies to “trade” and not many people classify stealing as trade (yes I know there are a few).

You don’t require a completely unregulated environment in order to have trade. Although regulations can obstruct trade, there are cases where they can facilitate it as well (such as prohibition on fraud).

(such as prohibition on fraud)

Ahh, but this is not a regulation; It’s an enforcement of private property rights.

It only comes into play when fraud has actually been committed and the victim seeks justice.

No victim, no crime.

“If consumers stopped paying producers, then producers will produce for themselves”

Most consumers are producers. And producers are consumers.

The only people who could produce only for themselves are those who have the means and the ability to produce absolutely everything they consume or use, such as the food they eat, the tools and resources they use to to grow that food, etc.

A producer who produces only for themselves would be a totally self-sufficient person with their own land who never uses money or trades with others and simply makes everything themselves somehow.

… if there is no production then there will be no wealth in the next period (other than savings).

This is false. All that would have to happen for wealth to be created, absent production, is for voluntary trades to take place.

Boom: New wealth.

Wealth is not output, per se. Wealth is the substitution of a more preferable situation (as subjectively defined by the individual) for a less preferable one.

“No, he never argued that “consumption = investment.” ”

C+I+G = Y, according to Keynes. This equates consumption, investment, and government spending (however classified) as all the same. In other terms, we are just as wealthy if all our money is spent on food as if it was spent in part on capital equipment. And this remains true if government is spending the money on researching the reproductive habits of sperm whales or something. It’s all the same according to Keynes. This aggregate tells us NOTHING about standard of living or actual wealth accumulation, but hey – it’s the standard now, thanks to Keynes and his EQUALIZATION of all kinds of spending.

I try to clarify my argument here.

The government depends on the private market for its sustenance. The government does not produce anything.

So a government owned and run nationalised industry like an oil extraction facility cannot produce profitable oil output?

Better tell that to Norway and numerous other countries.

“So a government owned and run nationalised industry like an oil extraction facility cannot produce profitable oil output?”

No matter how complex or sophisticated the physical object is, it doesn’t make the government an investor.

The “oil extraction facility” you refer to is a consumption activity, not an investment activity.

Both you and Jonathan are confused because you are abstracting away a particular activity from all the other activities that relate to it and are necessary in establishing what is going on.

A coercive transfer of wealth prevents the latter activity from being an investment, even if on day 2 you see activity that resembles actual investment activity. Contrary to Jonathan’s claim, it very much does matter how a person acquires wealth, in order to know whether a person is a producer or a parasite.

Sure, the latter activity when abstracted away from all other activity will lead one to view it as an investment, and hence the person an “investor.”

“When a government builds a road it’s an investment”

Generally, not in modern America. The amount of corruption involved in building roads is immense. And even if there isn’t corruption, the road is being built because Politician X desires a road in Location A, not to satisfy some desire of consumers. If I were to build a road to facilitate getting my product to market, that would be an investment. But building roads in the current method is not investment – and that’s temporarily ignoring the vast majority of driving is really a form of consumption, anyway.

“When a government bails out a car factory, it’s an investment.”

No, that one is not even really debatable – that’s consumption spending. It’s done to satisfy the desire of the government officials that GM/Ford/etc. continues to exist. That’s the only reason for it. And whether the reasoning be some erroneous “Made in America” nonsense or an affinity for classic car companies or something else entirely, it’s still consumption on the part of politicians.

Maybe he is talking about business investment.

Nonresidential investment was 13.86% of GDP in Oct 2007 and now it’s 11.8% of GDP.

Private Nonresidential Fixed Investment (PNFI)/Nominal Potential Gross Domestic Product (NGDPPOT)

http://research.stlouisfed.org/fred2/graph/?g=lJD

I wonder what DeLong has in mind there. He’s talking about potential GDP, so that private investment is currently depressed doesn’t necessarily speak to what potential GDP is — maybe the decline in private investment is mostly cyclical in the sense that it can recover (Austrians might predict that the capital stock has declined in value, implying a lower potential GDP path). But when he writes “level of investment” it’s somewhat ambiguous. How can he infer potential GDP from the level of investment? How does he know whether the current level of investment is entirely a question of depressed trade (e.g. a money shortage), instead of including the possibility of capital consumption?

“How does he know whether the current level of investment is entirely a question of depressed trade (e.g. a money shortage), instead of including the possibility of capital consumption?”

He cannot measure that so this that cannot be the answer…

Jonathan,

Make sure you understand what my point is, though. I’m not saying, “Because observed investment is down, that means the economy was operating above capacity in 2007 and now we’re at the new normal.”

Rather, I am saying that to keep potential GDP growing at the previous trend, you would need actual investment to stay in the same percentage of potential output. After all, part of the reason that potential GDP grows is that (in addition to workers getting more educated, population growing, etc.) the absolute level of the capital stock grows.

So if–even if for “Keynesian” reasons–the level of investment relative to potential GDP for some reason falls way below trend for 5 years running, that surely will mean that potential GDP can’t be growing at the same rate the whole time. At the very least, you surely can’t say, “There’s nothing in the level of investment that would make me doubt potential GDP has been growing at the 2005-07 trend.”

“Now I could quibble with all of those “indicators,””

It looks like a nice little list of things that *have* changed.

I think economists make too much of Potential GDP trend. A lot of the past GDP growth was fueled by increases in private debt. It’s based on steady increases of future obligations. We added 20 trillion dollars in credit market debt between 2000 and 2008. We’ve only added 5 trillion dollars since 2008. If you plot GDP minus the prior year’s increase in debt, we appear to be pretty close to the trend we’ve been on for the past 30 years (all the years I had data for).

I’m not saying that the economy is healthy. I’m saying that GDP was much more above trend during the boom than it is below trend now. The main problems as I see them are composition of investment (as you said) and barriers to entry of entrepreneurs into the marketplace.

That chart needs to die. There is no such thing as an unsustainable boom? GDP is an indicator that indicates accurately the underlying fundamentals of the economy?

Some MMT’ers responded to my above criticism and said “look, the blue line is below the red line before ’08”

No reply needed there…….

But as RPM wisely noted in a lecture on the “ending’ of the great depression, we saw an enormous growth in government consumption and a huge decrease in private sector consumption due to the war that “ended” the great depression. Surely something is wrong with their analyses that are only seemingly valid if they are not dissected.

Good post, Murphy.

Potentially, the potentially GDP should be much higher than that… in potential I mean.

Much, much higher.

haha… exactly!

Murphy’s point is actually a good one, but I’ve got to the stage where I just can’t take this stuff seriously. I don’t have the calmness of mind any more to attempt to unpick Keynesian fruit loopery.

Oh yeah, I agree with Murphy’s point and it was DeLong’s graph although Russ Roberts and John Taylor did a video discussing the same graph.

I think that the “potential” GDP trend leans heavily on past enormous levels of increases in future obligations. Sure the economy can potentially produce that much, but only if everyone is being promised the sky. Interest rates and money availability were not telling people the truth about the economic environment people were living in.

That is funny Tel. I was thinking of posting that the trendline for potential GDP could easily be lower.

It is indeed simultaneously both potentialy higher and potentially lower, than what it actually is.

Brad DeLong replies (http://delong.typepad.com/sdj/2013/08/any-explanation-for-this-other-than-that-robert-murphy-simply-doesnt-do-his-homework.html#more)

Krugman replies as well:

http://krugman.blogs.nytimes.com/2013/08/26/news-flash-the-cbo-isnt-stupid/

I used to think the CBO provided projections regarding what they thought was going to happen. Then I would go away thinking they were a bunch of goons when they constantly got it wrong. I’m glad Krugman set me straight on that one… those were only projections of potential GDP, not GDP itself.

I wonder if this would work at the horse races?

“I’m sorry sir, your horse did not win, so you don’t get paid.”

“You fool! I was betting on the potential winner, not the actual horse that won the race.”

Lets try a better analogy “I think I can sell 700 crates of screws but I could make 1000 if I wanted to. After that I will need to add more productive capacity.

http://www.cbo.gov/sites/default/files/cbofiles/ftpdocs/99xx/doc9957/01-07-outlook.pdf

Back in 2009 they predicted a growth rate in Real GDP of 4% for 2011, 2012 & 2013 but the officially recorded real GDP showed growth a little over 2% (about half of what was expected).

The CBO also predicted that 3-month Treasury bills would be at 4.7% and holding steady. In other words, they were stabbing in the dark and had no idea of what would happen.

The “potential GDP” is just an intermediate value the CBO uses as part of the calculation, but since they are getting it wrong at any rate, why attach such importance to their working?

It’s helpful for us to understand DeLong’s high standards when it comes to deletion of comments.

Murphy is a tool and his fans are mainly deranged ideologues and small-minded a$$h01e$

http://tinyurl.com/n2szqpe

He obviously wants to minimize troll like comments. You know, from “them” only.

And DK calls us belligerents.

I guess free advice is worth what one pays for it….

Since Lord “Fixprice” Keynes has taught us that “capitalism” is “Non-Ergodic”, how can there be a “trend line”?

And, of course, Krugman taught us: “After all, the Fed’s ability to manage the economy mainly comes from its ability to create booms and busts in the housing market. If housing enters a post-bubble slump, what’s left?”

http://www.nytimes.com/2005/05/27/opinion/27krugman.html?_r=1&

How can an artificial bubble induced by the central bank’s creation of funny money loans create a “trend line”? Indeed, Krugman’s “what’s left” question suggests that even he knows that there is no “trend” at all other than further artificial and unsustainable government “stimulus”.

If LK responds, he will likely contradict himself for the millionth time and claim that by “non-ergodic systems” he was only talking about individual stocks, individual commodities, and individual securities. Not economies.

“Certain types of phenomena in our universe are what mathematicians call non-ergodic stochastic systems. The concept of radical uncertainty applies to such systems, like medium term weather events, financial markets, and economies, and other natural systems studied in physics.”

Oops.

“Certain types of phenomena in our universe are what mathematicians call non-ergodic stochastic systems. The concept of radical uncertainty applies to such systems, like medium term weather events, financial markets, and economies, and other natural systems studied in physics.””

That sentence does not deny the existence of trends or cycles in economies or even in non-ergodic processes, e.g., trends like bear or bull markets in stock markets, even though future prediction of the value of any one share with objective probability scores still cannot be given.

Even long term climate, which Edward Norton Lorenz argued was virtually non-ergodic, nevertheless displays trends and cycles.

“That sentence does not deny the existence of trends or cycles in economies or even in non-ergodic processes, e.g., trends like bear or bull markets in stock markets, even though future prediction of the value of any one share with objective probability scores still cannot be given.”

See Roddis? Contradiction as expected.

No LK, we’ve fone over this already. One can’t simultaneously hold that the economy is non-ergodic, that the past is not a reliable guide to the future, and at the same time hold that one can “construct trends.” For such “constructions” will invariably be utilizing information, and information is…past data.

See, what likely happened in your creation of your contradictory position, is that you wanted to attack the free market by introducing a mathematical concept that actually doesn’t apply to a system of human actors, in order to justify in your mind coercion from the state, but in the process you inadvertantly set up an argument that makes central planning, or what you call “regulating”, based on such trends, an impossible venture.

So now you’ve been repeatedly trying to dodge this by claiming that what you meant all along were just individual stocks and bonds. But this isn’t a rescue, because the crucial comments you made were that “the past is not a reliable guide to the future”, and that “the problem of induction is particularily acute”.

These are the comments that prevent any “trends” from being based on real world information. They invariably make them figments of your imagination, which is fitting, since that is where you get your vocalized, but not self-practised, claim that coercion is justified against innocent people, in the name of “certainty.”

To you, it’s better to be “certain” that we’re all slaves, than to be “uncertain” of what will happen tomorrow in freedom.

But I’ve already pointed out that all your talk is just that: all talk. You say what you say for the sake of appearances. In terms of practise however, in terms of how you live your life, you’re an anarcho-capitalist, just like me, and just like Krugman, DeLong, and every other statist, with the exception of those who actually practise violence, or what you call “regulation” and “managing the economy”. Those are the only practising Keynesians and Monetarists. The rest of you are hypocritical pretenders who just want to be told by those vicious animals that you’re loyal and honorable.

(1) Any economy is a complex mix of both ergodic and non ergodic factors, and (2) as stated even non-ergodic processes can still have trends — general directions in which some variable is developing or changing. — which you are incapable of refuting.

“So now you’ve been repeatedly trying to dodge this by claiming that what you meant all along were just individual stocks and bonds”

If you think stock markets are non-ergodic, you’re already destroyed your position and conceded my argument.

Typically, you haven’t even the basic understanding of the issues you’re discussion.

We understand everything about you. But it is beyond the scope of your tiny brain to understand that the future is made many times more unpredictable and past data is made many times more misleading as the result of the perverse distortions and incentives of your beloved Keynesian policy. All your yapping about alleged future probabilities is just a lot of smoke to distract from your inability or unwillingness to understand the obvious.

(1) That is new coming from you. Before you said the economy is non-ergodic, period.

(2) I am not refuting that particular argument. I just exposed your contradictory argument that holds future trends are possible based on past data, and that past data is not a reliable guide to the future because the problem of induction is particularly acute. You can’t have it both ways. If you think trends are capable of being calculated, then that means the past is a reliable guide. But if you claim that the past is not a reliable guide, then you can’t construct trends based on that data.

You can dance and tiptoe around this all you want LK, but you just can’t square a circle. You have to reject one of your claims if you want to have a consistent position on this.

” If you think trends are capable of being calculated, then that means the past is a reliable guide. “

You’re simply using a fallacy of equivocation by defining “calculated ” as calculated as an objectively probability score.

If you admit that bull or bear markets do exist, then you have already conceded the argument.

“Since Lord “Fixprice” Keynes has taught us that “capitalism” is “Non-Ergodic”, how can there be a “trend line”?”

You’re still utterly ignorant of basic concepts, roddis:

http://socialdemocracy21stcentury.blogspot.com/2013/08/non-ergodicity-and-trends-and-cycles.html

Why should anyone think there is a “trend line” at all when the “trend line” consists of distorted artificially stimulated and unsustainable prices? Then, why should we believe that such a “trend line” can or should be replicated into the future by generic government spending?

trend /trend/ Noun

A general direction in which something is developing or changing.

———

If you are now saying that trends do not exist, then it is obvious “funny money” cannot cause price inflation — defined as an average upward movement in prices over a time period — because there can be no such trend line!

Roddis refutes himself and then disappears up his posterior.

I never said that “trends” do not exist. At the same time, there is no guarantee that what happened in the past will or should be replicated. This is just another of your sad attempts to obfuscate the issue.

The purpose of your “non-ergodic” nonsense is “heads I win, tails you lose”. It is only the world of voluntary non-governmental economic actors that is “non-ergodic”. Government thugs and Keynesian know-it-alls can see the future perfectly and know how to act on it with their funny money, spending and war schemes.

Why didn’t the tech boom create enough “traction” so that we could take the off the stimulus training wheels?

Why didn’t the housing boom create enough “traction” so that we could take the off the stimulus training wheels?

Where is the empirical testing that proves there is such a thing as a “trend line”?

Trends presuppose determinism.

Determinism presupposes constancies in human action.

Since there are no constancies in the field of human action, there are no trends in the economy.

Sure, after the fact you might be able to “see” a trend, but this is history, not economics.

Lord “Fixprice” Keynes found it necessary to devote an entire new post on the deep and complex meanings of “non-ergodic” which only government thugs and Keynesians can discern.

http://socialdemocracy21stcentury.blogspot.com/2013/08/non-ergodicity-and-trends-and-cycles.html

I’m sticking with Yogi Berra.

It’s tough to make predictions, especially about the future.

Too bad his claim that “the past is not a reliable indicator of the future”, and “the problem of induction is particularly acute” contradicts his belief that the all wise overlords can “manage the economy” based on…constructing trends, which of course presupposes the past being a reliable indicator of the the future.

For how does LK know that next year’s output will be closer to $15 trillion, as opposed to say $10,000 trillion? He uses past data of course! You know, the very data that he also claimed is not a reliable indicator of the future.

Since I do not claim Keynesians know *objectively* with mathematical probability scores the precise value of GDP next year, any potential GDP for a next year is only an approximate estimate.

There isn’t any contradiction here and you’re just inventing straw man positions and ascribing them to your opponents,

“Since I do not claim Keynesians know *objectively* with mathematical probability scores the precise value of GDP next year, any potential GDP for a next year is only an approximate estimate.”

You don’t have to not claim that particular argument. It’s the fact that you believe that trends are capable of being calculated, and that the past is not a reliable guide to the future.

It is a contradiction, and nothing you can say can change it. The only thing left for you to do at this point is to abandon one of those positions above

” It’s the fact that you believe that trends are capable of being calculated, “

To give a mere non-objective estjmate of GDP next year is different from saying you can give an objective probability score that it will have be x value next year, and you’re doing nothing here but showing your continuing ignorance of these concepts.

Also, even non-ergodic processes have trends. If they did not, there would be no such thing as bull or bear markets.

This totally refutes your position.

Delong is of course right, and Krugman shows he’s even more right than he thought he was.

MF and others have responded to DeLong and Krugman in comments to the “Percy Jackson” post.

http://consultingbyrpm.com/blog/2013/08/so-this-is-what-it-feels-like-to-be-a-square.html#comment-72553

What is up with the GDP? by Frank Shostak

[WWW]http://mises.org/daily/770

The GDP framework gives the impression that it is not the activities of individuals that produce goods and services, but something else outside these activities called the “economy.” However, at no stage does the so-called “economy” have a life of its own independent of individuals. The so-called economy is a metaphor—it doesn’t exist.

By lumping the values of final goods and services together, government statisticians concretize the fiction of an economy by means of the GDP statistic. By regarding the economy as something that exists in the real world, mainstream economists reach a bizarre conclusion that what is good for individuals might not be good for the economy, and vice versa. Since the economy cannot have a life of its own without individuals, obviously what is good for individuals cannot be bad for the economy.

The GDP framework cannot tell us whether final goods and services that were produced during a particular period of time are a reflection of real wealth expansion, or a reflection of capital consumption.

…

The whole idea of GDP gives the impression that there is such a thing as the national output. In the real world, however, wealth is produced by someone and belongs to somebody. In other words, goods and services are not produced in totality and supervised by one supreme leader. This in turn means that the entire concept of GDP is devoid of any basis in reality. It is an empty concept.

The GDP framework gives the impression that it is not the activities of individuals that produce goods and services, but something else outside these activities called the “economy.”

I don’t think the GDP framework gives that impression at all. Perhaps others might, but to dismiss the framework entirely just because others may misinterpret it (and I strongly believe that most economists understand the limitations of GDP) seems like a case of throwing the baby out with the bathwater.

However, at no stage does the so-called “economy” have a life of its own independent of individuals. The so-called economy is a metaphor—it doesn’t exist.

I would go with “concept” as opposed to metaphor. And while the economy is not a material object, that doesn’t mean that the concept is useless.

Since the economy cannot have a life of its own without individuals, obviously what is good for individuals cannot be bad for the economy.

What is good for some individuals can be bad for other individuals in the economy. It is plausible that particular policies or regulations can cause greater harm than good on net.

The GDP framework cannot tell us whether final goods and services that were produced during a particular period of time are a reflection of real wealth expansion, or a reflection of capital consumption.

Not with omniscience, and not by itself, but that doesn’t mean it can’t be at all helpful. For instance, if you looked at the growth of construction and housing-related activities’ contribution to GDP in the early 2000s combined with a knowledge of central bank and GSE actions during that time, that might give you an indication that housing was in a bubble, and reason to suspect capital consumption.

The whole idea of GDP gives the impression that there is such a thing as the national output.

Sure. National output is the summation of all the individuals’ outputs in the economy.

In the real world, however, wealth is produced by someone and belongs to somebody

This is not inconsistent with a national output metric.

In other words, goods and services are not produced in totality and supervised by one supreme leader. This in turn means that the entire concept of GDP is devoid of any basis in reality. It is an empty concept.

His conclusion here – that GDP is “devoid of any basis in reality” and an “empty concept” – does not at all follow from the premise that goods and services are not produced in totality and supervised by one supreme leader. GDP absolutely gives us a decent, albeit crude, measure of how countries fare relative to one another. Specifically, PPP-adjusted GDP/capita, while far from perfect, is a reasonable measure for comparing different countries in terms of relative wealth.

DeLong has long had trouble with his math. In 2009, he wrote:

We have $2 trillion of losses in mortgages: we have to write down the value of the housing stock we have built over the past seven years by $2 trillion, and presumably we will be building $200 billion less of housing per year over each of the next ten years relative to what we would have done otherwise, which means that we have to reduce construction employment below trend by 2 million workers for a long time to come. If it takes us six months of job search and recombination of enterprises to find new job-firm matches for each of these workers, the consequences of this act of overinvestment should be to raise the unemployment rate by 0.6% for a year.

But it now looks as though this recession is going to raise unemployment by an average of 4% for 3 years–20 times as great as the overinvestment-and-sectoral-shift Hayekian story says.

Garrison and other Austrains have a very basic problem with their math. The story they point to of overinvestment in construction and sectoral shifts is part of the story, but only 5% of the story.

“Hamlet without the Prince of Denmark” comes to mind.

http://delong.typepad.com/sdj/2009/05/one-last-time-the-austrian-theory-of-the-recession-just-does-not-work.html

The fact that the value of everyone’s house collapsed reducing the value of debt instruments and most everything else doesn’t count, I guess. The fact that most everyone suddenly discovered that what they owned was worth a whole lot less than they and everyone else previously believed must be ignored.

Again I ask: Why is a “trend line” consisting of artificially induced and unsustainable transactions and prices something that must again be artificially replicated once its unsustainability has been recognized?