Questioning the Government’s GDP Numbers

Scott Sumner responded to my post on him vs. Schiff by saying he hoped I was joking.

No, I’m not. I actually think it’s weird that so many right-wingers endorse Scott’s argument. (To remind you, Scott argues that if price inflation were a lot higher than the government’s numbers, that would mean the economy is doing much worse than is plausible.) For what it’s worth, Scott doesn’t just take the BLS’ word over the experience of average Americans; he also trusts the Chinese government’s numbers over the perceptions of the people.

OK, let’s step back for a second and think about this. In recent years, the government run an annual deficit that hit 10% of GDP (the highest since World War II). The Fed took over AIG and engaged in what Jeff Hummel calls “central planning” by intervening in specific asset markets (while tripling its balance sheet). We had a huge move toward government takeover of the health insurance sector. The Treasury literally took ownership (some argue effectively at gunpoint) of major banks. They also bailed out the Detroit automakers. There are currently proposals floating around to institute a several trillion dollar (scored over the first decade) carbon tax, i.e. tax on energy (given current infrastructure).

So: If all of the above just causes some sluggish growth in the economy, such that Peter Schiff doesn’t even pass the “laugh test” for suggesting we’re still in a bad recession, then why the heck are so many of us interested in free-market economics? It clearly doesn’t make that much of a difference, right?

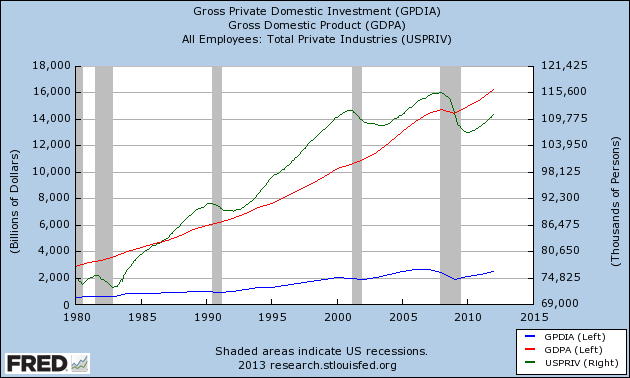

Try this. The chart below looks at the official total GDP number (red), versus the private domestic investment component (blue). Although the former is easily at an all-time high, the latter hasn’t exceeded 2007 levels (just eyeballing it).

The other line (right hand axis, green) shows total nonfarm private employment; this is the total absolute figure, i.e. bodies, not adjusted for population growth or anything like that. Just eyeballing it, it’s currently lower than in the late 1990s.

So you tell me: Is it really that outlandish–such that we just guffaw and don’t even bother responding–when someone says that maybe the government’s official numbers are understating how bad the economy is?

No, not really. It is common sense to assume that all economic statistics done by government are “understated”…

It is well documented across the world. Especially where socialists rule…

Ten years ago while a senior in college studying economics (before I found a real career in software development), one of my profs had some people from the BLS come in to talk to some us about the joys of being economists there. They implicitly stated that they were under enormous pressure to low-ball inflation numbers. Ever since then I have taken government statistics with a grain of salt.

Dr. Murphy,

Why have stock prices done so well?

How was Obama re-elected in the midst of a massively covered-up depression?

Truly elementary replies.

“Why have stock prices done so well?”

Some good reasons, some bad.

To name a couple

-Earnings growth

-Da Fed

The stock market isn’t an indicator of a healthy economy per se.

“How was Obama re-elected in the midst of a massively covered-up depression?”

Clearly the economy is better than it was when he took office. Besides correlation implying causation(Obama was in office, economy got better) and being a better liar……. gee I dunno

” massively covered-up depression?”

They didn’t “cover up” anything. They intervened on a grand scale.

The economy APPEARS good right now. What is that worth? You have a job, you can afford your lifestyle NOW. It says nothing about the future. The economy looked great in 2007 didn’t it?

Come on people, think outside the box a little.

Mitt Romney

^ Yup.

Plus, I could have sworn that FDR got re-elected amidst a fucking Great Depression, so the question is sort of stupid.

Do private sector estimators of inflation face the same pressures?

Bob,

This is an awful argument.

Scott is saying that we know inflation isn’t 8% because if it were, then that would mean X, Y, and Z, which we can see aren’t true.

Your response is that if X, Y, and Z aren’t true, then the whole free market ideology is wrong, so we should assume that they are true.

The direction of fit ought to go from reality to ideology, not the other way around.

?? I’m saying the economy seems like it sucks to me. It seems like it sucks to my former college students, some of whom are living with their parents. Prices seem like they’re rising to me.

Scott says, “No, if prices were rising really fast, then that means the real economy is shrinking, which it obviously isn’t.”

I’m showing a bunch of reasons to think that the real economy is doing awful, versus official GDP stats. And yes, as a kicker I’m reminding people who believe in free-market economics, that it would be sort of weird if the New Deal-lite led to a whopping 7 months of declining GDP.

So what you’re saying is that you believe the government and investment components of GDP, but don’t believe the consumption component? What strange way to disprove GDP.

What? How in the world did you get that from this post? Is it a reading comprehension problem, or are you just trying to be as uncharitable with your interpretation of what Murphy is saying as you possibly can?

Why is Murphy using the GDP investment numbers at all if he doesn’t believe GDP?

Is the argument that the level is of investment is incompatible with that level of consumption? I’m not quite sure what he’s trying to say.

DJ I’m saying a lot of the reported total GDP figure relies on government spending, for one thing.

I though exactly what Blackadder said after the first 3 paragraphs.

Then you graphed a few things and you assumed your point was self evident without any real explanation. I have no idea what your argument is and what you’re setting out to prove or disprove.

Sumner’s point was that if we really had the type of inflation Schiff is talking, the economy would still be in contraction. You put up a graph that shows growing figures of investment and employment since the start of the recession. Check mate, Sumners. What?

Okay, investment isn’t the greatest, but it’s still growing. That contradicts a contracting economy.

The impression I’m getting from you is that the reason the headline GDP figure is high while investment is low is because we have extremely high government spending that is taking over the economy. But you left out consumption for some reason, which clearly gives the better explanation for the high gdp figure.

http://research.stlouisfed.org/fredgraph.png?g=l3M

Why is Murphy using the GDP investment numbers at all if he doesn’t believe GDP?

Argh! Because if I dispute the government numbers I’m accused of wearing a tinfoil hat. So I’m pointing out that you can tell the economy is awful just by looking at other types of numbers, instead of just the headline GDP figures.

Well considering Schiff’s original point was about understating inflation then ostensibly he only talking RGDP being off even though base GDP is sound. Even if Murphy is saying raw GDP is overstating growth then it’s still not inconsistent to then say “even using government statistics the economy looks weak.”

The economy being weak is not in dispute though. The dispute is if the economy is shrinking.

DJ – That’s only the dispute because Sumner has phrased it that way. It’s a claim he can defend, but it’s totally different from the question of GDP, which is what Murphy is talking about.

Get it? Sumner basically argued a red herring. I don’t understand why so many people take some of Sumner’s debates so seriously. He always just frames every issue in terms of NGDP and his theory about it, and then keeps delivering the Sumner message. If someone tries to make some other point, Sumner just changes the subject back to NGDP.

I’m not saying this disproves your case but I think it is interesting – If you redo your charts using 2007 as an index :

http://research.stlouisfed.org/fredgraph.png?g=l3n

You see the GDPA and GPDIA tracking each other quite closely. Then in 2007 GPDIA takes a much bigger hit but actually recovers more strongly. It hasn’t caught up yet – but looks like it might do if the trend continues.

You can see this even clearer if you take % annual change since 2007

http://research.stlouisfed.org/fredgraph.png?g=l3r

GDP has been trending at just below 5%, while GDPIA is increasing at double-digits.

Are we basing our evaluation of the economy’s health on GDP? Really? HAHAHAHAHAHA! Oh, my sides!

GDP includes government spending, which suffers from a few flaws. First, the spending does not represent consumer valuations. Second, it includes much waste, fraud, and abuse as legitimate. Thirdly, it doesn’t matter whether the program is building roads or buying pet rocks – it’s all counted as the same, no matter how absurd the program is.

Additionally, malinvestment makes the dollar output included in GDP soar temporarily, but ultimately results in no gain, or even a loss. See, for instance, the housing bubble, the tech bubble, and others.

Thirdly, if the price of computers, for instance, drops by half, and 25% more are sold, the GDP would fall – but many, many more people would be better off. Alternatively, if we put a quota on imports, raising the price significantly, such that more overall dollars are spent on fewer goods, this would create rising GDP. Thus, it is not a useful measure of living standards.

Finally, inflation causes GDP to automatically rise by some amount, and the CPI and other inflation calculations do not and CANNOT accurately account for this change – no matter what the government’s numbers, they will not account for every single price change in the economy that is included in GDP. (To do so, one would have to switch to units sold, which would actually be a better indicator, but result in an comparability issue – how does one add 200 units of eggs with 400 units of milk? Is that better or worse than 300 of each?)

There’s a lot of reasons why gdp is a bad metric, but people have searched hard for better metrics and you end up with “Happiness Index” and other stuff that is equally useless.

Steve Keen pointed out that GDP should be adjusted by the rate change of total debt. The point being that by borrowing and spending, a government (or an individual) can arbitrarily simulate prosperity until the line of credit dries up. This just hides bad decisions and defers consequences, so by including a debt adjustment you correctly attribute the figures.

So if a government runs up large assets as a creditor, should that reflect positively in the RGDP figures? Sounds like mercantilism to me.

We talk about debts as liabilities, and that’s true, but they’re liabilities incurred in return for an asset e.g. if I get a loan from someone, I also get money from them. My loan is a liability, but the money is an asset.

We can try second-guessing whether the assets and liabilities are of equal objective value or distinguish between “good debt” and “bad debt”, but that’s not very subjectivist. Debt is important, but why not just look at GDP AND look at debts, as well as how those debts have been incurred e.g. debts for wars can be more easily repaid when the war is over than debts to pay for never-ending entitlements.

If a government does nothing more than borrow and pump the money into any sort of bogus scheme, then GDP can temporarily be pumped. This does not require any intelligence or know-how, it does not produce a sustainable recovery, therefore it should not be considered any positive attribute for the people doing it.

Think of a guy who lost his job, but can’t deal with facing up to his family and telling them, so he pretends to go to work while he walks around the park all day and then comes home with cash he took out of the credit card. It’s sad when an individual is deluded like this, maybe he even managed to convince himself that this is the right thing to do, for whatever reason, but it can’t work, the credit card debt will win and he will end up losing everything, all the stuff he worked for all those years before he lost the job.

The Australian government did much the same thing in 2009 then hard times hit… they just borrowed money against the public trust, refused to accept there was a problem, pissed away the money on all sorts of jobs-for-the-boys schemes and ran up approx $2000 per capita per year in additional debt… that’s an extra $8000 per year for a family of four. They are exactly like that guy who walked around the park every day telling his wife he was at work, but I can feel sorry for an individual hitting the skids, I can’t feel sorry for a government doing it with other people’s money. Did I tell you they gave themselves massive pay rises at the same time?

Wayne Swan was declared “treasurer of the year” which is a complete joke. The guy is useless.

People say government budgets are nothing like a household budget, and that’s true — a household budget involves some elements of common sense, while government budgets do not.

We should just track real privately produced goods over time as a metric.

Look at how many cars, houses, clothing, food, appliances, electronics, etc are produced over time.

Yes, except for the part about imports. More spending on imports would reduce GDP.

Read it again. I was saying that we would artificially limit imports via quotas, forcing people to spend more on domestically produced substitute goods. Standard protectionism – the same bad policy that’s been floating around since the Middle Ages.

Bob Murphy,

If your case for the free market is that some intrusions of the government will immediately lower RGDP, then I don’t think much of your case for the free market. However, both you and I know that that’s not YOUR case for the free market, let alone that of other reputable free-market economists. It’s certainly not the line of argument in “The Politically Correct Guide to Capitalism”, a fine book that has your name on it.

“Prices seem like they’re rising to me.”

– The plural of ‘anecdote’ is not ‘evidence’. If I told you, “minimum wage hikes don’t seem to have any effect on employment to me”, would you believe that minimum wages have no effect on employment? Or, if I said that I saw some folks getting hired after a minimum wage hike, would you believe that minimum wages increase the number of employed people?

Also, there’s a world of difference between (a) saying that “maybe the government’s official numbers are understating how bad the economy is” and (b) saying that the US has been a recession since most of the time after the US abandoned Keynesianism, price controls and since the Carter/Reagan deregulations, which is what’s implied by the Schiff/shadowstats conspiracy theory.

Anyway, what’s more free-market: (i) believing that Obamanomics didn’t instantly crash the US economy or (ii) believing that entrepeneurs and businessmen generally are so hopelessly stupid that the private sector has totally missed this giant distortion for decades and actually produces independent numbers similar to the CPI index and GDP deflator? And if you believe (ii), then you also have to explain why the private sector caught on so quickly with Argentina’s manipulation of the inflation figures.

Finally, as an Austrian economist who understands the subjectivity of value you shouldn’t have anything to do with the CPI index, however it’s calculated. Some price indexes can have their place, but “hedonic calculus” is a fancy word for “anti-marginalist sheenanigans.”

“If your case for the free market is that some intrusions of the government will immediately lower RGDP, then I don’t think much of your case for the free market. However, both you and I know that that’s not YOUR case for the free market, let alone that of other reputable free-market economists. It’s certainly not the line of argument in “The Politically Correct Guide to Capitalism”, a fine book that has your name on it.”

LOL! Let me try one. Dr. Murphy, if your case for the free market is that some intrusions of the government will immediately cause everyone to be homeless, then I don’t think much of your case for the free market. However, both you and I know that that’s not YOUR case for the free market, let alone that of other reputable free-market economists. It’s certainly not the line of argument in “The Politically Correct Guide to Capitalism”, a fine book that has your name on it.

Great example: basing your arguments against rent controls on the claim that they’ll immediately destroy the entire housing stock and make everyone homeless is a terrible argument for a free market in house prices, because it’s obviously not true, just like it’s obviously not true that a depression results the moment the US government introduces some dumb economic policies (otherwise the US would have been in a depression since 1776).

Instead, we know that rent controls divert investment away from rental housing in equilibrium, and so damage the tendency of rental supply to meet rental demand.

Similarly, the policies Bob Murphy lists (Obamacare, nationalising banks, bailing out auto-companies, running deficits and talking about revenue-positive carbon taxes) haven’t caused a continual contraction of US output over the last 5 years, but they have harmed the potential for US growth over time. If the bad effects of bad policies weren’t so insidious, then there wouldn’t be so many bad policies persisting.

I was actually just poking fun at your first paragraph. I found it funny that you basically said, “If Murphy believes X then I don’t think much about his opinion, but he and I both know that he, I, and everybody else don’t believe X.”

Don’t you see why that is a weird paragraph?

My point is that Bob overstates the case against the GDP figures when he says, “why the heck are so many of us interested in free-market economics? It clearly doesn’t make that much of a difference, right?”.

Free-market economics is not at threat here, so we can logically separate the case for free-markets from the case for Peter Schiff/John Williams conspiracy theory-libertarianism.

Sorry, that should be “The Politically INCORRECT Guide to Capitalism”. I just think of it as “that Bob Murphy book”.

Also, there’s a difference between what the chart that you (and Geoff’s charts on TheMoneyIllusion) can imply (that the US economy is in bad shape and hasn’t recovered to 2007 levels yet) and what you have to believe if you believe that the US HAS has very high inflation in recent years, which is that the US economy has been contracting for the past few years.

Defend the first claim all you want; it’s kind of a waste of time, since no-one disputes it. However, to claim that the US economy is contracting, you still have to deal with the evidence in the very chart you put up, which shows a slow but indisputable recovery in employment and private investment in recent years. Why would private investment and employment be recovering if RGDP was falling?

Bob,

Do you think that the ShadowStats numbers are accurate?

I don’t know Blackadder. I think it’s very accurate when Schiff says, “The reason it feels like a recession to most people is because it is.” (perhaps not exact quote)

When talking recession, we’re not talking a crappy slow growing or stalling economy. We’re talking contraction. So when you you agree with Schiff that there’s still a recession, you’re saying that at no point during the past few years has the private sector ever stopped producing less and less?

You guys take the cake for putting words in someone’s mouth.

Murphy didn’t say it, but it’s the implication of a recession

No, the words you put in RPM”s mouth are not the “implication of a recession”.

Why not just take his statement literally?

” think it’s very accurate when Schiff says, “The reason it feels like a recession to most people is because it is”~RPM

What exactly am I getting wrong?

This is statement that started the whole thing from his previous blog post.

“Sumner said that if the official (price) inflation numbers were bogus, then that would mean the real economy was shrinking”

Murphy believes that this Sumner is wrong is believing it’s outrages that the economy is shrinking. A shrinking economy means a recession. A recession means the private sector never stopped producing less an less than the previous quarter.

Murphy believes that Sumner is wrong in*

Eh, accidentally hit entered too soon.

You said

“past few years ”

and now say

“previous quarter.”

and then offered your own definition of recession.

I think this definition is better for this convo.

. The technical indicator of a recession is two consecutive quarters of negative economic growth as measured by a country’s gross domestic product (GDP); although the National Bureau of Economic Research (NBER) does not necessarily need to see this occur to call a recession.

We can call something “technically” a recession by using higher inflation #’s (real gdp). The CPI is just a measure of NET inflation. The inflationary effect of the Fed, govt etc isn’t 1-2% a year. They are combating powerful deflationary forces. If a car was supposed to decrease in price by 5k in 1 year but actually increased by 1k, you’d wisely conclude a 6 k difference, no?

Or we can look at the real economy. Sustainability should be factored in. I can go out and hire dozens of workers, but this says nothing about tomorrow unless we look at a much more complete picture. Is the girl at the bar REALly prettier because you’re drunk?

Our economy looked just fine in the Summer of 2008. Production: high, unemployment: low etc etc etc, yet the factors and conditions were already well in place for the downturn.

The present and the past don’t matter as much as the future. I.E. you don’t care about what a stock is trading at now or yesterday, you care what you will get when you sell it….. in the future. If you can understand this, then you can understand why Austrians see recessions as healthy.

“I don’t know Blackadder.”

Really? You don’t know if the US ever recovered from the Reagan recession?

Take these unemployment charts, which would be more probable if the shadowstats RGDP numbers were accurate-

http://www.shadowstats.com/alternate_data/unemployment-charts

– and if you believe that, then that means that, for all the relative flexibility of the US labour market, the US has a structural unemployment rate well above that of France? Now THAT would be a problematic statistic for free-market economists.

I agree if you define a recession like Nick Rowe does:

http://worthwhile.typepad.com/worthwhile_canadian_initi/2011/08/recessions-are-always-and-everywhere-a-monetary-phenomena.html

Dr. Murphy,

Why in the world have stock prices done so well?

How in the world was Obama re-elected in the midst of a massively covered-up depression?

TravisV FDR was re-elected in 1936. Do you agree with me that the US economy was still in the Great Depression in 1936?

And yes, official GDP stats were expanding then. Sumner is giddy about how great the US economy was doing because they got rid of that rascally gold standard a few years earlier.

But can we all agree that the US economy still was awful in 1936?

This debate is funny/crazy.

“Do you agree with me that the US economy was still in the Great Depression in 1936?”

Except your idea is based on the classic Austrjan tactic of refusing to define “depression ” and using that definition consistently.

And in this case it’s also a fallacy of equivocation.

Schiff and his supporters are saying that the US has been in recession since in 2008 in the sense of

(1) having negative real GDP growth.

But now you want to redefine recession/depression to mean

(2) the *aftermath* of a real output contraction in which there is positive real growth but high unemployment and insufficient private investment.

All the evidence shows that the US came out of recession in sense (1) in 2009. Redefining recession to sense (2) does not refute that fact.

As long as the FED is in crisis mode (Signs of crisis mode are: ZIRP, Huge Excess Reserves, and programs like QE etc) any talk of real growth seems to be quite questionable to me. If you really believe in the free market and that economic growth at least to the overwhelming degree comes from the private sector then you should only speak of an end of the recession and real growth when the FED isn’t in crisis mode anymore and private investment and the stock market are still rising. Even Sumner doesn’t believe that would happen if the FED exited now…

It’s like arguing that a junky has overcome his drug addiction while he still is on opioid substitution therapy…

I want to change that to: *…while he still is on heavy opioid substitution therapy…*

Surely the fact that the free market doesn’t collapse in the face of minor disturbances is a point in its favor, rather than a reason to abandon it?

sorry, that wasn’t meant as a reply to skylien but as a response to “…why the heck are so many of us interested in free-market economics? It clearly doesn’t make that much of a difference, right?”

Exactly. As Adam Smith said, “There is a lot of ruin in a nation”, and there’s a lot more ruin in a capitalist nation, which is why markets today are able to function (sub-par, but still without collapsing) even when the government swallows up 40%+ of national output.

The drug analogy doesn’t really work, unless you’re going to argue that the US has been on drugs since 1913 (which is a whole different position).

As long as there is a monopolist in a market (in this case, a monopolist in the market for new base money) then that monopolist is intervening. The only issue is whether or not it’s meeting the demand for its product.

Speculating about what would happen to the US economy in the short-run if there was a sudden switch to free banking would be a fine example of the fatal conceit, so let’s not do it.

Anyway, this is all a side-argument, because Fed-dependent growth would still be sufficient for disproving Peter Schiff’s position, which was what Sumner was doing.

Finally, ‘Fed’ is not an acronym or initialism, so it shouldn’t be capitalised.

“The drug analogy doesn’t really work, unless you’re going to argue that the US has been on drugs since 1913 (which is a whole different position).”

No, I am not going that way. For the sake of the argument I assumed the pre 2008 Fed to be obviously not in crisis mode. That is why I added some qualifiers to make that clear. So I took the conventional understanding of the mode the Fed is in, and in this respect the analogy works perfectly fine.

“Speculating about what would happen to the US economy in the short-run if there was a sudden switch to free banking would be a fine example of the fatal conceit, so let’s not do it.”

I have not argued to do that, have I?

“Anyway, this is all a side-argument, because Fed-dependent growth would still be sufficient for disproving Peter Schiff’s position, which was what Sumner was doing.”

Schiff would certainly not disagree that the “growth” (like in the stock market) we actually have is Fed induced. What they discussed was genuine growth from the private sector. That is why Schiff brought up some actual facts (Energy, labor participation) to witch Sumner didn’t respond, as well as he didn’t respond to me when I reminded him of these points in the first blog post of Bob about this.

“Finally, ‘Fed’ is not an acronym or initialism, so it shouldn’t be capitalised.” You are surely right on this one though.

*which* not *witch*..

And of course the analogy would also work in the extended version like described by you. However as you state that is a different position, albeit it is related.

The main point is that as long as any kind of exogenous “support” is given to something/someone you just cannot distinguish if the aggregated results from this stem from the subject itself or the support. This is not a criticism of the yardstick (like GDP in this case), this criticism sets in earlier, it is a criticism of the fundamental logic behind this reasoning.

As long as someone is on life-supporting machines you cannot be sure he can live on without them.

As long as a father financially supports his kids, you cannot determine if without this support they can maintain their living standard alone.

As long as I drive with training wheels on my bike I cannot be sure that I can drive without them…

I guess you get the point…

Gosh another person that refuses analogies to be used in economic discussion.

lol

“The drug analogy doesn’t really work, unless you’re going to argue that the US has been on drugs since 1913 (which is a whole different position”

mmm, no Peden, an analogy shows similarities in otherwise dissimilar things……. which quite literally means Skylien wasn’t implying that the USA was literally on drugs.

I am aware of that. I was operating within the metaphor i.e. if all growth when the Fed intervenes is fake, then all US growth since 1913 is fake.

If just some growth when the Fed intervenes is fake, then what’s the basis for the distinction?

If some data points suggest that the US is in a recession and the overwhelming majority of them suggest that it’s not, then why would that be an argument that the US is in a deep depression?

Peter Schiff picked some cute data points and Sumner pointed out that the overwhelming majority suggest the opposite.

My point re: the Fed is that the Fed is always intervening, so we can’t straightforwardly dismiss growth that results from Fed interventions as being not “real growth”.

Finally, if inflation isn’t high because of “fake growth”, then Peter Schiff is still wrong.

“My point re: the Fed is that the Fed is always intervening, so we can’t straightforwardly dismiss growth that results from Fed interventions as being not “real growth”.”

There are infinite paths that economic policy can take us.

The difference between non-fed and fed would provide a growth figure that the Fed alone is responsible for + or -. But let’s look at long term, not short term. It isn’t all or nothing. But the Fed may do enough to change the symbol + or – on net growth.

I think the Fed policy is like wearing a gas mask while trying to run. MMT’ers would disagree.

“Finally, if inflation isn’t high because of “fake growth”, then Peter Schiff is still wrong.”

I think Peter is wrong because he sources shadowstats. I do agree that inflation is higher than is shown in the CPI, albeit less than Schiff claims. I just believe that simply looking at NET price increases allows people to make incorrect assumptions about policy. I think we should talk about “inflation” as Mises defined it and then talk about prices.

This elaborates my point quite well.

http://mises.org/journals/qjae/pdf/qjae8_1_2.pdf

Here are some facts provided by ZH why this recovery doesn’t feel like a recovery at all:

http://www.zerohedge.com/news/2013-07-31/44-facts-about-death-middle-class-obama-should-know-about

One of which shows the great results of pushing homeonwership under GW Bush. It is at an 18 year low…

Of course I am sure without pushing homeownership it would be even lower today..

Because I’m a stickler for detail, the article is from Michael Snyder at the Economic Collapse Blog, just reposted on ZH.

I’ve been reading Michael Snyder’s stuff for years, and he has been predicting collapse for years. He is twice the mega-bear that Peter Schiff is and Snyder’s blog has archives going right back to 2009, always saying exactly the same thing.

That’s not to say we have had a great run since 2009 or anything, agreed that things aren’t looking good, but you know how it is with collapse: it might happen or it might not. For example, socialism in North Korea has been very stable. Not very productive, but nor has it collapsed.

More interesting is to read a random sample of the comments on Snyder’s blog. After a while you can skip the articles (which are essentially all pretty similar) and just scan the opinions and a few of the hard luck stories. No doubt there are significant numbers of people hurting out there, dunno if that makes a recession to a macroeconomist, but for the people who get hit by it, sure feels like a recession.

I fully agree. I am also quite disappointed about the fear mongering that the collapse or whatever must be just around the corner. This really is not necessary and is even counterproductive because it undermines your actual points and instead of waking people up will finally lull them into sleep..

Unsustainable debt cycles can last very very very long. I really like Kyle Bass in this respect. Every time I hear him talk how hopelessly the situation seems to be by showing various facts and arguments, yet he always emphasizes that there is no one who can predict when such decade long developments finally will hit the wall. The only thing you can do is to insure yourself for that event properly, keep an eye on it but otherwise keep on going with your normal life.

Bob,

As has been pointed out above, the very numbers you provide in this post are in conflict with the economy contracting consistently for years. To accept the ShadowStats numbers (which, again, are derived by just taking the CPI number and adding around 8% to it) you have to believe not only that gov figures are made up, but that private sector estimates like BPP and Gallup are just as flawed. And you have to believe all sorts of absurd things about economic life over the last few decades (e.g. we’ve been in a recession for more than a decade, the median American income in the 1970s was six figures in today’s dollars, etc.)

Honestly, I don’t understand why you want to die on this hill.

Not to mention that you’d have to believe that banks have basically been charities (charging astonishingly negative real rates of interest), that the US job market is worse right now than in the 1930s, and that people who talk about real income stagnation since the demise of Keynesianism are wrong: real incomes have been declining since Keynesianism was abandoned!

The reason I’ve clogged up this discussion on a blog that I like to read but rarely comment on is that I’m amazed that someone as smart as Bob Murphy would want to put himself on Peter Schiff’s side in this argument.

Not to mention that you’d have to believe that banks have basically been charities (charging astonishingly negative real rates of interest)

Exactly. If inflation were really 8% then you wouldn’t be able to get a car loan for 2%, a mortgage at 4%, etc.

“Exactly. If inflation were really 8% then you wouldn’t be able to get a car loan for 2%, a mortgage at 4%, etc.”

Faulty logic.

Bob’s right. This debate is crazy/funny.

Have to agree with Cosmo here. Yeah, banks never ever make mistakes. It’s not like there are any banks who made loans at too low rates in 2006 & 2007 who were subsequently in a position to go bankrupt.

Of course RGDP must be shrinking; otherwise it would not feel like a recession. If RGDP was only growing slower, nobody would be saying we are in a recession. Isn’t this obvious?

So we’re not out of recession until everybody agrees we are out of a recession? Hope for your sake you’re trying to be funny.

What do you mean? Can you find a single person who says we are NOT currently in a recession? Maybe in the US. In Europe you wouldn’t find anyone who says that.

What do I mean? You said

“If RGDP was only growing slower, nobody would be saying we are in a recession.”

So according to you, we are not out of a recession until everyone in the economy says we are out of a recession.

Can I find a single person who says we are NOT currently in a recession? Yes.

I say the US is not in a recession. The business cycle dating committee says we are not in a recession.

Schiff was not talking about Europe. He was talking about the US.

ok, what if I rephrase as “most people in the US believe we are currently in a recession” ?

“So according to you, we are not out of a recession until everyone in the economy says we are out of a recession. ”

>>Perhaps not everyone, but according to a recent AP study, it seems like most people do feel like we’re in a recession:

http://www.usatoday.com/story/money/business/2013/07/28/americans-poverty-no-work/2594203/

Of course RGDP must be shrinking; otherwise it would not feel like a recession.

I can only assume this is satire.

“If RGDP was only growing slower, nobody would be saying we are in a recession. Isn’t this obvious?”

No, it’s crap. You can find people who say all kinds of things: it doesn’t mean that what they say is true.

Can’t believe anyone is defending Schiff in this video.

Here’s labor force, private payrolls, industrial production, real GDP and gross private domestic investment all measured against Jan 2010.

http://research.stlouisfed.org/fred2/graph/?g=l4f

private payrolls up 6.5%.

Industrial production up 12.6%

labor force up 1.5%

real GDP up 7.25%

private investment up 31.7%

Obviously the economy has not been stuck in recession since 2009.

Hey, I know you didn’t use or even bring up shadow stats in either of these two posts, but shadow stats, shadow stats, shadow stats.

According to shadowstats, govt spending has not come close to keeping pace with inflation. State, local and federal spending is up 8% since Jan 2010, or 2.2%/year since Jan 2010. Annual rates of inflation higher than 2.2% mean govt has cut spending.

state, local, federal expenditures.

http://research.stlouisfed.org/fred2/graph/?g=l4h

Awesome. You use an argument against shadow stats in response to my mocking of people bringing them up to counter this post.

Dan,

The anti-ShadowStats arguments people have been making are equally applicable to someone who says inflation is high without citing ShadowStats.

How does saying shadow stats is wrong damage the argument made by Dr. Murphy? He could agree with you completely and it doesn’t hurt his case at all. It seems weird to harp on something that he never even mentioned, or used in any way, to make his case.

Dan,

The claim ShadowStats is making (inflation is 8%!) has certain absurd implications. If someone else (e.g. Schiff or Bob) makes the same claim, it will have the same absurd implications.

On a somewhat related note, in 2010 I got into an argument here about whether hyperinflation was right around the corner, the conclusion of which was that we should wait a few months and see what happened. I think the argument was with you but I’m not completely sure. Was it you I had this discussion with?

No, I’ve never thought hyperinflation is right around the corner. I did, however, believe that inflation would start to heat up back around the time M2 started to grow at 10+%, but then the growth fell significantly which caused me to reevaluate. My view is that eventually all the money that has been printed will enter the economy and prices will rise significantly. How significantly? I don’t know. Depends on what the Fed does in response. If they continue to print in order to try to drive interest rates back down then inflation could get out of hand. If they say screw it and stop printing like mad men then it is unlikely inflation gets out of control but there will be a major collapse. I have no idea when this will happen, I’d have guessed that the money would have started leaking out by now.

My view is that ABCT is correct, and all the interventions by the Fed are causing another boom/bust cycle. I also am on the same page with Murphy on what it would take to cause me to rethink my opinion on ABCT (he did a post on that a few years ago).

“The claim ShadowStats is making (inflation is 8%!) has certain absurd implications. If someone else (e.g. Schiff or Bob) makes the same claim, it will have the same absurd implications.”

Ahh, I must be missing something. I can’t seem to find where Schiff or Murphy have been going on about inflation being 8% like shadow stats claims. I guess once you point me to the article, or whatever, you’re using that shows they are making the same claim as shadow stats then I might be able to see why you keeping using that site against them.

Here’s a recent endorsement of shadowstats in Peters Schiff’s blog.

“Williams compares his truthful , adjusted economic data with the nominal data that the US government points to as signs of recovery.”

http://blog.europacmetals.com/2013/07/phony-government-statistics-and-golds-role-in-the-coming-crisis/

Shadowstats has two different inflations numbers though. One version is at 5% and the other one is at 8%. I’m not clear on which one Schiff believes, but whatever is, Schiff states in the Sumner debate that it’s high enough for it to mean a negative real GDP number.

Schiff: “The economy is shrinking. Is just that we can’t see it’s shrinking because we’re measuring it with a bad ruler because the GDP deflator is too low.”

I don’t think RGDP matters so much at the rates of growth the government is alleging. The unemployment rate sucks. The labor participation rate sucks. Many who are employed are underemployed. Record numbers on disability and food stamps. Cities are going bankrupt. State credit ratings continue to be lowered. Uncle Sam’s bank buys most of its debt. Pretty much every measure that isn’t directly subject to manipulation by inflation is in the toilet.

The idea that the government is buying back most of its debt is a huge myth. See here:

http://macromarketmusings.blogspot.com/2012/11/the-biggest-myth-about-fed.html

Why are you making stuff up?

That was a TERRIBLE article. You used THAT to debunk debt monetization? lmao

How about something that wasn’t written by an economist with elementary understanding of Fed policy?

“What is usually meant by “monetizing the debt,” however, is the use of money creation as a permanent source of financing for government spending. Thus, to ascertain whether the Fed has in fact monetized its purchases of $1.2 trillion in government bonds since 2008, we have to know what the Fed intends to do with its portfolio of assets over time.

If the recent rapid accumulation of Treasury debt on the Fed’s balance sheet constitutes a permanent acquisition, then the corresponding supply of new money would be expected to remain in the economy (as either cash in circulation or bank reserves) permanently as well. As the interest earned on securities held by the Fed is remitted to the Treasury, the government essentially can borrow and spend this money for free. If, on the other hand, the recent increase in Fed Treasury debt holdings is only temporary (an unusually large acquisition in response to an unusually large recession), then the public must expect that the monetary base at some point will return to a more normal level (through sales of securities or by letting the securities mature without replacing them). Under this latter scenario, the Fed is not monetizing government debt—it is simply managing the supply of the monetary base in accordance with the goals set by its dual mandate. Some means other than money creation will be needed to finance the Treasury debt returned to the public through open market sales.”

http://research.stlouisfed.org/publications/es/article/9644

Yep. That’ll do.

Cosmo,

The St. Louis Fed article came to same conclusion as the one you said was terrible–the Fed is not monetizing debt. And the PDF version of it used the same figure too. So I am not sure I understand you point. All I can tell is that you are supporting TravisV’s assertion.

Thanks.

The outcome is not certain. His article comes to the conclusion that debt isn’t being monetized in a completely silly way. If the Fed doesn’t make this permanent, then I would agree with the conclusion but disagree on how the conclusion was reached.

Oh Good Lord. The supposed intentions of the Fed for what they will or will not do with the Treasuriee they are presently buying in bulk has no bearing on the fact they are the present owners. And they bought them by “not literally” creating money.

Okay, so lets look at GDP per year.

Mar 31, 2013 13.75 trillion

Dec 31, 2012 13.67 trillion

Dec 31, 2011 13.44 trillion

Dec 31, 2010 13.18 trillion

Dec 31, 2009 12.87 trillion

Dec 31, 2008 12.88 trillion

Dec 31, 2007 13.33 trillion

Dec 31, 2006 13.04 trillion

Dec 31, 2005 12.74 trillion

Dec 31, 2004 12.39 trillion

Dec 31, 2003 12.04 trillion

Dec 31, 2002 11.59 trillion

Dec 31, 2001 11.37 trillion

Dec 31, 2000 11.33 trillion

Dec 31, 1999 11.00 trillion

Dec 31, 1998 10.50 trillion

Dec 31, 1997 10.00 trillion

Dec 31, 1996 9.58 trillion

Dec 31, 1995 9.18 trillion

Dec 31, 1994 9.00 trillion

Dec 31, 1993 8.64 trillion

Bob and others… I think this is what is really going on here I think everyone is pretty much correct but not knowing how they are…

Ooops hit the wrong tabs and posted… So this is Real GDP Growth over 20 years. What I think is the most important aspect of this is that between Dec 2007 and December 2012 we have only had a 2.5% growth in GDP. The population in the meantime has grown from about 303 Million in 2007 to 315 Million in 2013. Or about 4%. Put another way REAL GDP per capita in 2007 was about $44,000 per person. Now it is 43,650 per person.

So everyone is technically correct. First we have a higher GDP heck we have a positive REAL GDP over the last 6 years. However the actual growth in wealth has been negative over that same time period or at a minimum stagnant. So what is really happening this has been the real issue over the last half decade and why in my own opinion the policies of this president have been misguided, and the way the Fed has intervened underwhelming.

Lastly it feels like we are creating another bubble in the equities market, which is driving GDP growth. It does this by creating leverage. This leverage has not been fully realized yet but it is beginning to accelerate this year. It feels wrong. Production has not met the increase in stock prices, profits are up because in many ways stocks are up. Revenue to the Government will be up as well as taxes are derived from the revenue created. Anyway. Something feels wrong in the economic world and I think everyone can feel it in one sense but I think irrational exuberance will cause them to forget their worries. After all everything looks fine right now.

Store your grain for we will have another few years of pain coming up. Feast or Famine seems the word de jour.

I know I’m kinda extremely late to this party, but If you do see this in the next day or two. Is there any chance you could tell me where you found these figures and where I might find the updated figures? Thanks a million

I’m sorry Blackadder, where did Peter Schiff in this interview say, “I put in all my chips on the Shadowstats numbers?” I didn’t even know we were talking about Shadowstats, until you guys “informed” me of that.

Sumner said if we have had high price inflation the last few years, then that would mean the economy had been shrinking. Schiff came back and said yes, that’s a point in his favor, because we are still in a recession, just like most people think.

*That* is the exchange I’m pointing to, and saying I think Schiff had the upper hand. I’m not endorsing a specific data series from Shadowstats.

What’s even more strange to me is that Sumner is the only one who mentions any numbers at all, which were 4-6%, but BA keeps going on and on about shadow stats 8% inflation numbers are wrong, therefore you and Schiff are wrong. It makes no sense.

This is what Peter Schiff said in the very same interview. “The economy is shrinking. Is just that we can’t see it’s shrinking because we’re measuring it with a bad ruler because the GDP deflator is too low.”

Then you said it astounded you that that Sumner could think it’s crazy to think the economy was shrinking.

Then you posted some evidence that the economy is weak. Is this supposed to be some breaking news? I don’t think anyone ever disagreed that the economy was weak.

I have no problem with you calling what we still have a recession. When it ends is kind of an arbitrary distinction. The NBER tends to mark the end of a recession when it reaches its trough and stops contracting. Calling it over when the unemployment rate is closer to normal is also fine though. But Schiff clearly meant recession as in still contracting economy.

The problem here is that you’re defending Schiffs ridiculous comment by being far too generous towards him. You changed his argument from “shrinking economy” to “sluggish growth.”

And you’re shocked at us for being shocked at you when you come to his defense.

I’m sorry Blackadder, where did Peter Schiff in this interview say, “I put in all my chips on the Shadowstats numbers?”

This is why I explicitly asked you what you thought about the ShadowStats numbers. If you want to say “I think the CPI understates inflation but not by as much as ShadowStats claims” or “I think that inflation could be around 8-10% now but, contrary to ShadowStats I think this is a new development” etc. then you are free to do so.

The one advantage of ShadowStats is that it gives you a precise number, whereas just talking about the CPI “overstating” inflation or inflation being “high” is vague and in the context a little weaselly. If you want to defend Schiff here (and even claim that the truth of free market economics is at stake) then you should at least put your cards on the table and say what you really think is going on.

Sumner said if we have had high price inflation the last few years, then that would mean the economy had been shrinking. Schiff came back and said yes, that’s a point in his favor, because we are still in a recession, just like most people think.

But the very evidence you cite suggests that Schiff is wrong!

“So: If all of the above just causes some sluggish growth in the economy, such that Peter Schiff doesn’t even pass the “laugh test” for suggesting we’re still in a bad recession,”

It doesn’t, Bob. Constructions projects are restarting, the Dow is hitting all-time highs, new construction is going forward again, rents are soaring…

“then why the heck are so many of us interested in free-market economics? It clearly doesn’t make that much of a difference, right?”

The economy can do fine with a fair amount of intervention, yes.

Look at the disturbing corner you’ve painted yourself into: despite the massive evidence to the contrary, your position is, “I HAVE to believe there is a bad recession, otherwise I’d have to give up my ideology!”

“It doesn’t, Bob. Constructions projects are restarting, the Dow is hitting all-time highs, new construction is going forward again, rents are soaring…”

>> Homeownership rate at 18 year lows, labor participation rate at 30 year lows, surging part-time workers, 1 in 7 Americans living under the poverty line. And a significant portion of housing demand is coming from institutional money through private equity firms.

“The economy can do fine with a fair amount of intervention, yes.”

>> What’s your definition of “fair amount?” Does “fair amount” include the things Bob mentioned such as government bailouts / takeovers of some of the biggest companies in the banking, insurance, and auto sectors?

“Look at the disturbing corner you’ve painted yourself into: despite the massive evidence to the contrary, your position is, “I HAVE to believe there is a bad recession, otherwise I’d have to give up my ideology!””

>> Look at the disturbing corner you’ve painted yourself into. Despite there also being massive evidence that the economy is sluggish, your position is, “I HAVE to believe the economy is doing fine, otherwise I’d have to start making better arguments rather than resorting to beating down a strawman.”

“Constructions projects are restarting, the Dow is hitting all-time highs, new construction is going forward again, rents are soaring…”

Sounds like a Fed-induced bubble to me. Thanks, Gene.

Sounds like a Fed-induced bubble to me.

It’s a bubble *and* a recession at the same time! Genius.

BA. No so fast genius. Please explain why this shouldn’t be possible?

A bubble (fake wealth that isn’t there) means that the economy or a part of it looks better than it really is, that more wealth is created or existing than there really is. Yet this doesn’t say anything that net real wealth is increasing, stable or decreasing. A bubble is just fake wealth on top of real wealth, completely independent of where real wealth is going…

If half of the economy (due to government action) switched tomorrow to producing anti alien defense lasers then this would clearly classify as a bubble industry that is induced by the government and would break down in the moment the stimulus ends (except of course really very bad tempered aliens show up, that actually can be held off with this weapons).

At the same time a lot of other industries need to shut down to support this new industry.

That would obviously be a clear case of a bubble occurring within an economy with decreasing real wealth, hence a recession.

Of course GDP and even employment would still look great or might even improve… Living standards though would undoubtedly go down!

Of course only NGDP would look great in my example, RGDP however necessarily needs to be lower. Except your hedonistic intuition would tell you that when bread becomes more expensive people will switch to buy such great anti alien defense lasers and maybe just shoot themselves…

skylien,

The question is whether the things Glenn mentioned are indicative of an economy that is contracting. Saying “oh, that’s just a bubble” while cute and glib, isn’t really responsive.

Right that is the whole point. Yet try to see it from both angles. Saying “oh see that is QE induced real growth” while cute and glib, isn’t really responsive as well.

And now we are back to square 1..

Who is Glenn?

Economic data is like a Rorschach test. Everyone has pretty much a preconceived idea of how it’s supposed to work and then sees economic data in exactly the shapes needed to fit the story and thinks others must be utterly blind (if not to say stupid) not to see the same pattern…