New NERA Study on Two Carbon Tax Scenarios

NERA Economic Consulting is out with a very nice study on two carbon tax scenarios. I know this modeling team (well, at least the lead author) and I think they are very nuanced in their analysis; if you scroll through the paper you can see they explain exactly what their charts are saying, etc. This is an above-average study in this genre, just in terms of its attention to detail and transparency.

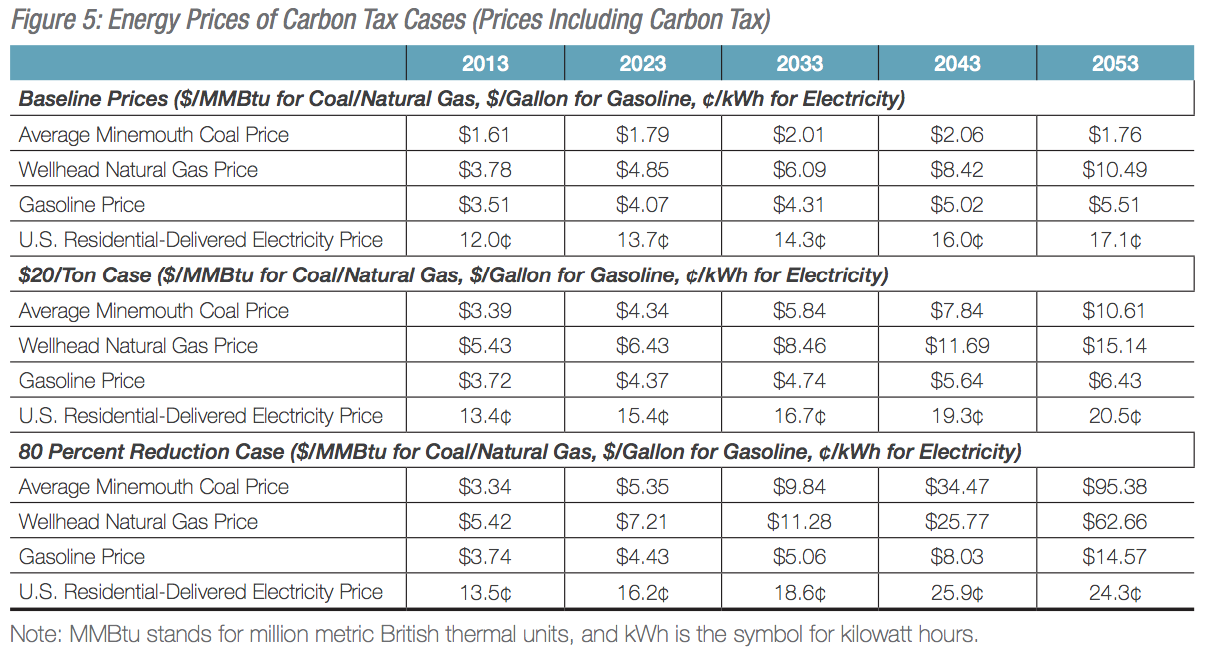

Here’s a money chart:

As I explain in an IER blog post discussing the study:

[T]he 80% [emissions] reduction case shows drastic increases in electricity and gasoline prices in the coming decades, should the US government seriously try to meet the emission reduction targets that many groups are proposing as “sensible climate policy.” By 2053, the NERA study anticipates residential electricity prices having risen 42 percent relative to the baseline, and gasoline pries at a whopping $14.57 per gallon (compared with $5.51 in the no-tax baseline, because of rising crude market prices).

And of course, if someone is interested in the coal industry—forget about it. The price of coal in the high-tax scenario eventually ends up being 54 times higher than it would be without the carbon tax. Such a punitive tax rate will obviously destroy the coal industry, which after all is one of the stated objectives for those who want to drastically reduce US emissions.

Ironically, I conclude by pointing out that the NERA study understates the economic damages from their hypothetical carbon tax scenarios:

The most obvious reason is that the NERA study assumes the carbon tax receipts will be used to either (a) reduce the federal deficit from what it otherwise would have been, holding spending constant and/or (b) reduce other taxes. In terms of supply-side economic analysis, given that there is going to be a new carbon tax, then the very best things one could do with the revenues is use them to cut other tax rates and/or to make the deficit smaller, so that the government doesn’t siphon off as much from the capital markets away from private investment.

In other words, NERA’s projections of economic outcomes under the two carbon tax scenarios has the government behaving very responsibly, doing just what a free-market economist would want, given that it was imposing a carbon tax.

In reality, of course, the government won’t keep its spending trajectory the same, (for reasons I explain here) in the presence of hundreds of billions of new annual revenue in the modest scenario, and even trillions of dollars in new revenue in the aggressive case. Specifically, the NERA projections show that the 80% Emission Reduction scenario has the federal government taking in $1.8 trillion in inflation-adjusted revenues by the year 2053 from its carbon tax.

Does anybody seriously believe this flood of new revenue won’t lead to higher federal spending than would otherwise be the case? Note that such spending would include any “transition payments” to help poorer households or certain industries adjust to the new carbon tax, which will surely be part of any politically feasible deal.

Is the much lower rate for the rise in electricity prices conditioned on expanding nuclear power? I mean, if the other prices rise, many will find a way to switch to electricity.

I’m not sure Ken. For sure, it must be because of alternatives for electricity production, but I don’t know if they’re assuming an expansion of nuclear. I have to read that section more carefully; I focused on a different part yesterday. (It just came out.)

I’m thinking it must, if you cut back on coal.

I was thinking exactly the same thing, though it is possible some of the muted rise in electricity could come from assuming wind and solar taking on more of the base load from coal and natural gas.