Sometimes You Should Look Up the Numbers, Fiscal “Cliff” Edition

I’m working on an op ed on the “fiscal cliff” and just for kicks, I decided to see just how savage these massive cuts in spending would be. Now let me confess, the results shocked even me, so by all means, somebody show me what I’m overlooking…

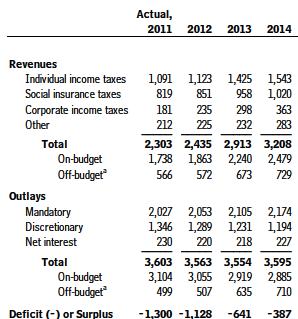

Here’s a snapshot from a table in the CBO’s August 2012 forecast:

We are already in Fiscal Year 2013; it started on October 1. So the column for 2012 is already done; the changes (if no deal is reached) will show up in the 2013 numbers.

So: If nothing is done and we go over the “cliff,” then total spending will drop from $3.563 trillion to $3.554 trillion, a reduction of $9 billion, or 0.3%. Notice everyone, I am saying a drop of three-tenths of one percent. Then, by 2014, total spending will have risen to above where it was this year, in 2012 (because 3,595 > 3,563).

On the revenue side, going over the “cliff” is projected to raise receipts from $2.435 trillion in 2012 to $2.913 trillion in 2013, an increase of $478 billion, or 19.6%.

The deficit in 2013 is projected to be $641 billion, down from the actual $1.128 trillion deficit in 2012, for a drop of $487 billion.

In summary, if we go over the “cliff,” the government plans on sharply reducing the budget deficit compared to its 2012 level. Of this $487 billion reduction in the federal budget deficit, the savings will come through two mechanisms:

==> A cut of $9 billion in government spending (1.8% of the deficit reduction), and

==> An increase of $478 billion in tax receipts (98.2% of the deficit reduction).

Happy holidays!

Yep. It’s even less cuz of the projected $2 billion drop in interest payments. Seven “devastating” billion dollars in real net cuts.

Wait. The more I think about this the more confused I get. Even if the derivative drops, total debt is still going up.. .I guess interest payments are only expected to drop slightly because rates are expected to be even lower? Why does the CBO say net interest was $230 billion in 2011 when the Treasury website says it spent $450 billion in interest? Are we really offsetting a good half of that with interest payments on student loans or whatever?

Why does the CBO say net interest was $230 billion in 2011 when the Treasury website says it spent $450 billion in interest? Are we really offsetting a good half of that with interest payments on student loans or whatever?

I’m not sure, but it might be that the Treasury number is the total outgoing interest payment, but the CBO number nets out how much of that interest flow was remitted by the Fed. (I.e. Treasury paid some of that interest on bonds held by the Fed.)

Dr. Murphy,

What would happen if we went back to exactly the same fiscal structure that existed when Clinton left office? I mean we had a surpluss then so it would be difficult for the right to complain and Clinton was a democrat, so it would be difficult for the left to complain. Spend the same and tax the same now as when Clinton left office. Has the new debt and the number of new retirees between then and now increased so much as to make this an impossibility? Yes, I know this is a libertarian site, my point is simply, When Clinton left office things weren’t a total disaster like they are now and we probably won’t be getting to Libertopia any time soon.

Senyor

Mandatory spending in 2012 was $2.053 trillion, with total revenues of $2.435 trillion, according to the chart above. Based on the 2001 version of the same CBO report, mandatory spending in 2000 was $1.030 trillion, with total revenues of $2.025 trillion.

To return to a Clinton-era fiscal structure, we would need to:

A) Raise taxes by $1.6 trillion per year (Obama’s proposals raise a similar amount over TEN years), or

B) Pass entitlement reform that cuts mandatory spending by 40% (close to what Gary Johnson wanted), or

C) Some combination of the above.

Judge for yourself the (im)possibility of returning to Clinton’s fiscal structure.

It is no longer possible to leverage social security in order to fake a government surplus. Social security is starting to ask for its money back — and there in lies the problem.

Yep, that is certainly a huge part of it, one that many people have entirely missed.

We did not have a surplus. There was a windfall in SS, and the government duly spent it to buy public debt, moving it into intragovernmental debt. The debt grew every year. It’s like paying off your Mastercard with your Visa.

Correct, it was an accounting trick that allowed SS to not be accounted for in the general budget, thus the intergovernmental debt associated with SS was not shown in the White House figures (giving the false impression that there was a surplus in the General Budget). And, of course, Treasury debt increased every period during Clinton’s tenure.

I think that it was during Reagan’s administration that the accounting rules changed, but regardless, all Congresses since the SSA passed have spent the entire surplus revenue that went into SS every year (when I say surplus I am talking about the amount of taxes that go into SS vs the outflows, not those of the General Budget), they then issue non-negotiable bonds for that sum and place it into the SS Trust Fund.

People often like to act as if it was only the Clinton administration did this, when in fact it was written into the original SSA that this must be done. So, not only did every administration and Congress do this since SS’s inception, they *must* do this by law.

The problem is one of legal obligation. Government accounting is strictly speaking correct, but not for the reasons people think.

Social security payments have been declared to not be a legal obligation at all and thus government pays these only out of the goodness of its heart. Indeed, all military pensions and government employee retirement packages fall into the same category — they are paid only on a voluntary basis, there is no legal nor contractual obligation to keep paying.

The “trick” here is that people paying into Social Security were convinced that they would also be getting something out of it. People in the military believe they are entitled to their pensions. Maybe a moral entitlement exists, but no legal entitlement.

Thus, government can at any time balance its books by just not paying these (strictly voluntary) pensions. This is why the accounting is strictly correct.

People would be pissed, but that’s another matter.

Well, I thought SS belongs to mandatory spending that has to be spent this or that way required by law?

See:

http://en.wikipedia.org/wiki/Mandatory_spending

You would be wrong there sir. Please note: “Debt held by the public is the largest explicit liability of the federal government and is widely reported. However, GAO first reported in 2003 that other fiscal exposures–responsibilities, programs, and activities that may explicitly or implicitly expose the federal government to future spending–also warrant attention. We use the terms explicit and implicit to provide a framework to consider long-term costs and uncertainties. An example of an explicit exposure is the amounts owed for military and civilian pension and retirement health benefits. This is considered a liabilityA probable future outflow or other sacrifice of resources as a result of past transactions or events. Generally, liabilities are thought of as amounts owed for items or services received, assets acquired, construction performed (regardless of whether invoices have been received), and amount received but not yet earned.. Examples of implicit exposures—the assumption of future spending embedded in current policy or public expectations—are future Social Security and Medicare benefits. See GAO, Fiscal Exposures: Improving the Budgetary Focus on Long-Term Costs and Uncertainties. ” See http://www.gao.gov/special.pubs/longterm/debt/keypolicy.html

http://aging.senate.gov/crs/ss2.pdf

From 1985:

Of course, any existing law holds unless explicitly changed, the point is that Congress could at any time pass a law nullifying those supposed liabilities.

You as an individual cannot declare your liabilities null like Congress can, nor can any corporation do this.

There’s precedent at the Federal level documented in Wikipedia, with the statute references in there:

http://en.wikipedia.org/wiki/Congressional_pension

Thus they created a property right, then extinguished that property right, then created a new one a few years later.

Also precedent in state law:

http://www.bloomberg.com/news/2012-12-05/rhode-island-s-needed-pension-cuts-pass-the-legal-test.html

Thanks Tel, I guess that makes it quite clear.

Yet, as you said, this won’t change much when people who counted on SS in their old age find out they where only promised castles in the air…

They still have their votes.

Their entitlements stay untouched until Congress passes a law, so a deadlock between the houses would be sufficient to block such a law.

I know this is a bit off the thread of thought here, but offhand, joining the military may be one of the quickest way to enter permanent poverty.

I don’t know the statistics of the living standards for veterans, based on their “benefits” that are delivered, but i suspect the picture is only worstening for vets, esp since Gulf War 1.

At Military.com it says that you start getting a pension with benefits the day you retire. It’s roughly 50% of base pay if you retire after 20 years (38 years old?). If you do 40 years and retire at 58 as a colonel, you get $10, 737/mo.

If, OTOH, you were an enlisted man or woman, and you retire at 58 as an E-8, it would be $5,591/mo. Still not bad.

Just thought I’d mention something for perspective; And that is that government pensions are unconstitutional.

It’s not OK that we’re paying for something we’re NOT using. When people end their time in government, they need to stop taking our money.

(Also, Unionized government is a horrendous violation of the principle of a constitutional republic.)

Numbers are funny, because projections are always off. That hilarious projection of raising revenues through taxes is crazy and inaccurate. As is evidenced, regardless of the tax rate, revenues have stayed the same sine the 30s.

Furthermore, in regards to Senyoreconomists remark, Clinton created another bubble by monetizing the debt. He basically kept borrowing and used the bond market to make it look like he created a balanced budget. In these times balanced budgets are not what should be aimed for, we should aim to cut and remove all that we can, even if that means removing ourselves from government participation altogether.

Lessons from the past—borrowing is what the government does to make it look like we have reduced the debt. It’s called artificially low rates. Unless of course people are ready to take a hit in the economy so it can properly correct itself, we’ll stay in the doldrums for a while, or get more booms and busts….hyperinflation soon to be exact. I personally don’t think people are ready to take a hit, so hyperinflation will be coming.

Egats! You think the Laffer Curve is real?

Tel, Laffer is a silly statist, but he did have one basic logical concept correct, that rich people will look for less loopholes if there is lower taxes. Rothbard wrote about these things long before Laffer. Like any statist economist, they write down a basic phenomenon and take all credit for it’s basic logical exposition. Ronald Reagan was just as bad as Clinton insofar as he mass amounts of military expenditures. Also, Volcker was not that good of a central banker…there are no good central bankers if they do not quit and remove their job altogether. Volcker is targeting the rate that Bernanke is targeting now. Inflation is a tax, no matter its small amount. And taxes create the business cycle as well, by deceiving entrepreneurs and hindering capital accumulation. Murphy here shows what I’m talking about in regards to Reagan:

http://www.youtube.com/watch?v=mXm4j2ORYcg

Loopholes is part of the problem, or outright evasion like in Greece, or people just don’t bother working as hard because they know they can’t keep what they earn.

I guess this is a good opportunity to do the test.

Inflation is also a tax, but difficult to figure out exactly who is paying that tax.

“Inflation is also a tax, but difficult to figure out exactly who is paying that tax”

That is actually Mises’s reasoning for stating that inflation is *not* a tax. Basically, with a tax the government is in entire control of who that burden rests on, but with inflation it is the price system that determines this (i.e. it is entirely outside of government control after the money has been created and spent). Therefor, inflation is an alternative to taxation.

Hmmm, surely the government is never fully in control of who pays a tax, because in an economic system each entity adjusts their prices with costs in mind. Income tax merely gives the appearance of being paid by the individual, but actually the decision on the margin of whether that individual works more or less is a matter of the nett advantage of working vs not working (including tax and everything else). Similarly the decision to make more or less effort to avoid tax depends on the relative risk/incentive balance.

Inflation encourages people to put their wealth into solid assets, but then Capital Gains Tax is in effect just a back-door way to tax people who try to sidestep the inflation tax. Once you have both Inflation and CGT in place, it discourages people from investing at all. Destruction of property rights also discourages investment, so as a society we have sacrificed future prosperity for present day consumption.

Well, certainly there are value imputation considerations to take into account, so one could say that all taxes ultimately fall onto the original factors, land and labor. However, I am talking about the incidence of the tax, not how the market necessarily adjusts to that after the fact.

With a tax, the burden is immediately apparent to whomever must pay the tax at the incidence of taxation. However, with inflation, there is no net burden at the incidence of money creation (there only exists a net benefit to a party or parties), the burden of inflation is only arrived at through the price system, which is entirely out of the government’s powers.

So, if we are to call inflation a tax, then we must take into consideration that the tax is not from the government, but rather from the numerous other actors in the market.

The banks act as agents to the government for tax collection purposes in a whole number of ways. Inflation is just part of that.

For example, the mortgage industry pumped by low interest rate inexhaustible credit provided by the government, is what increases the price of houses. The banks just add a premium onto the interest and profit from the mortgage, but they give government a share of that profit. Just a tax like any other, but you have to live somewhere.

Indeed, but inflation is a form of taxation, in which the government and other early receivers of new money are able to expropriate the members of the public whose income rises later in the process of inflation. But, at least with inflation, people are still reaping some of the benefits of exchange. If bread rises to $10 a loaf, this is unfortunate, but at least you can still eat the bread. But if taxes go up, your money is expropriated for the benefit of politicians and bureaucrats, and you are left with no service or benefit. The only result is that the producers’ money is confiscated for the benefit of a bureaucracy that adds insult to injury by using part of that confiscated money to push the public around. Both result in capital consumption, and this is where the expropriation resides. One is expropriated visibly, the other latent by certain.

If both taxation and inflation cause capital consumption, with inflation causing a false boom for its latent omnipresence, they are both one in the same. The difference is that taxation seizes investment projects sooner than inflation does. For this reason taxation never causes false booms, but results in long busts. This is due to taxation being the tool governments use to either 1) continue their wasteful and coercive spending projects–which makes inflation more illucid, or 2) to attempt to get themselves out of the bust phase which they created in the first place.

Adrian – your syntax is a little garbled; are you calling both Laffer and Rothbard statists, or just Laffer ?

just laffer. his idea is to cut rates, not taxes. have you not read the analogy i pose. while inflation is an illucid tax over time, and thus creates bubbles which are not seen by anybody (most importantly the entrepreneurs), taxation seizes income lucidly and at the beginning of the production process. Taxes can be passed on to the consumer when they are aimed at business men through higher prices, but these rise in prices are not due to the rise in the money base, it is due to the attempts to upkeep capital. This results in job cuts. Inflation is a rapid cut in jobs and business losses. Taxation does not allow businesses to be created, because it chokes profits which force businesses to make quick cuts or go out of business quickly. There is a very thin line, but both do result in capital consumption, which means one can suggest they both cause the business cycle and are one in the same. Rothbard criticized Laffer for his desire to keep taxation existing, and thus kept the statist matrix in tact. Listen here:

http://www.youtube.com/watch?v=bZ9nHLKKGRY

The Laffer Curve doesn’t predict a stable ratio of government revenues to GDP. Just the opposite. If you’re on the wrong side of the Laffer Curve, you can raise more revenue by lowering tax rates, but revenue/GDP will still go down, as the way you get the extra revenue is by growing the economy.

Tax revenue has tended to stay between 15-20% of GDP since WWII, but I suspect there are political rather than economic reasons for this.

No one really knows the shape of the Laffer Curve, but it could in principle be fairly flat near the peak (many optimization curves in physical systems are flattish around the peak).

Before any math nerd has a go at me, yes I know that an optimized peak is by implication a stationary point, and therefore flat, but regardless of that it can be flat over a very small section of curve, or flat over a large section of curve.

I’m always amazed by “progressives” howling for Obama to “soak the rich” when Obama is pretty well off himself, and hangs around with a lot of rich people, and gets a lot of donations from rich people. Yes, the Laffer Curve presumes that tax can be boiled down to a simple rate and nothing else — obviously a major simplification. The tax laws get more complex every year so you can be sure we will never get an optimal answer, and probably that’s the whole idea.

Tel,

It doesn’t matter where on the Laffer Curve you are, cutting taxes should reduce tax revenue as a percentage of GDP.

it’s flat only if the function and its derivative are continuous

I don’t know if the Fed is going to be doing the net $45 monthly billion purchase of Treasuries on a fiscal year basis or regular calender, but at the risk of assuming fiscal that amounts to a planned $540 billion of the possible $641 billion deficit. Or, a little over 84%. Perhaps there is a chance the Fed will indeed be monetizing nearly all of the 2013 deficit?

I think the basic observation that all the reporting on this has been making – that the bulk comes through the tax increases – is exactly right. But I think the way you crunch the numbers here makes the imbalance look bigger than it really is. Here’s my crack at it: http://factsandotherstubbornthings.blogspot.com/2012/12/the-impact-of-fiscal-cliff.html

I think a 70/30 to 85/15 (depending on the year you’re looking at) makes more sense.

I’d also be curious how this works out taking the doc fix and the AMT out of the picture, since those are always an impending increase that never happens. They’re not really a part of this fiscal cliff per se. But I’m not going to do that leg work.

Print, Forrest, print!

Has been a while. I thought you had given up on us…

😉

Bob,

If you seriously think the $478 billion in additional revenue is going to deficit reduction rather than $478+ billion in new spending then I have a bridge for sale that you might be interested in.

I love these “more libertarian than thou” comments. Tom, you don’t think it’s noteworthy that according to the government’s own figures, they are only going to cut spending 0.3 percent? That’s not at all how it’s being portrayed.

I will only buy it if it leads to nowhere.

Here is my question for the professor:

I’m opposed to any tax increases, particularly if they are income taxes.

However, as someone pointed out we are a long way from a Libertarian Utopia, and getting there in one fell swoop is highly improbable and unlikely.

So – to “solve” the political issue at hand, I would propose this:

and equal amount of cuts in spending to match revenue increases. However NONE of the increases can be from income tax.

The tax increases should be via a Tobin Tax on stock, bond, currency, commodity and all other financial transactions. A Tobin Tax of .01% (by my estimation) should raise in excess of $1.1T dollars – and would impact the very wealthy who engage in most of this trading, as well as corporations who are currently engaging in HFT – the long term results of which we are still unclear on. It’s quite possible HFT, based on its success rate, is nothing more than “frontrunning” by Wall Street firms based on client purchases.

Thus, a Tobin Tax would hit the very pockets the Democrats propose to hit with their income tax increases, BUT would be much less punitive on the margins AND raise far more revenue.

In addition, you could then cut income tax rates on the middle classes by 1% point – something neither party would object to.

At that point, it’s a matter of working out the cuts. Clearly, the cuts are the problem since the Democrats do not want to cut spending and have made only tepid offers on this point.

A bit tangential to the topic, but I would expect that the exchange itself would have the incentive to prevent HFT.

Here is my logic: the purpose of the exchange is not really to facilitate the same stocks changing hands back and forth because shuffling stocks is a zero sum game. The real purpose of the exchange is to facilitate IPO’s and thus encourage new business investment… stocks changing hands is merely a necessary side-effect of that.

So HFT would discourage a lot of investors who are small-time investors and who know that they can’t be checking prices more than once every few days. These are exactly the kind of investors who an exchange should like to attract, so they want to make the rules as user-friendly to small investors as possible.Let’s face it, if a typical stock traded on maybe four auctions a day, that would be plenty. You can always trade again the next day.

HFT may be doing exactly that – but this doesn’t matter. Given the nature of how the Fed is pumping money into the system, the small investor is no longer needed to keep the market moving.

It’s a long-run arrangement bound to fail, but the long-run can be very, very long (Keynes was right about that). In the meantime, there are ways to alter the arrangement so we somehow benefit.

In my estimation, the best way is to tax the structure (Tobin Tax) which is benefitting from government (The Fed) largesse.

It’s my essential belief that we need to actually cut spending. Not in the way the politicians talk (“we’ve cut spending 10%” means that 10% of the expected increase over 10 years was removed – the growth rate is no longer 10% a year, but 9%).

Since that’s a political impossibility, honestly it’s never going to happen, we should seek to find ways to force it. There are factions which are seeking to cut spending, but they have no leverage because they won’t discuss tax increases.

So I’ve proposed one here which impacts the very wealthy (both individuals and corporations) and can help mute the impact of HFT on markets, as well as redirect Fed nonsense back to where it needs to go. Is it a form of Chartalism? Perhaps. But if you can use it as leverage to get the Democrats to talk about real spending cuts – why not do it? If you can use it to cut income tax rates and force Democrats into a corner, why not do it?

Political economy is all about trade-offs. Let’s figure out which ones are likely to be somewhat beneficial. I figure this is one.

Kaizer fan? I don’t respect him to say the least and I saw through him a year before he revealed himself via that event with T. Woods. I’m sure someone more able will answer, but at first glance: it’s a bit naive to think that you will “tax the rich” this way or another. You can’t. They will shift the burden to those who can’t defend themselves. The only way to take away their jolly income sources is to get back to sound money. Get money out of government hands – no more institutionalized fraud. I would also disagree to the assertion that it’s not possible in the near future. We have never been where we are now.

ps. Show it to your friends that talk RBE http://www.youtube.com/watch?v=rZ2uncqukn4

uhhh yeah – just realized there was no question there, but there was supposed to be. The question is how logical does this proposal sound? I checked out all the numbers and they add up. The Tobin Tax and a cut in middle class income taxes would raise about 800bb.

So the real issue, as I mentioned, remains the cuts in spending. I’d like to see the Democrats make a realistic proposal on cutting spending. They keep saying the problem is revenues, but they haven’t proven this yet.

Woa!!

Without even considering the surprising absolute values of the numbers at hand, it is the lopsidedness of the ratio of this mix that says a lot about the path our society has *chosen* since the Fall of the Wall. Who would ever have forseen this just 20 years ago?!

Interesting. However, someone concerned about the looming cuts could argue that *discretionary* spending will be cut by 4.7% from 2012 to 2013 and 8.0% from 2012 to 2014.

Yes, and spending on the Normandy invasion was cut 100%.

Frickin’ France lobby

One of my canuck friends said “frickin” all the time. You Canadian?

Yes, he is.

I thought Canadians were nice.

Live ‘n learn.

You can be an honorary American, because we’re crass and non-humble.

Hey, don’t you call me a “Ken B”. Seriously, it’ll drain my confidence.

Ok. You’re a “Gene Callahan” Joe.

🙂

No, Canadians aren’t nice, apparently.

“and 8.0% from 2012 to 2014.”

It’s ~7.4%, and if you shut the government down for a week and didn’t fund it you’d get roughly the same result.

I know I’ve probably dumped too many quotes about Social Security, but it’s an increasingly important thing to deal with in terms of deficit, etc. Here’s yet another:

http://www.journalofaccountancy.com/Web/20102792.htm

NOTE: current practice is that the liability is considered real (from a government accounting point of view) when it becomes “due and payable”. That is to say, when it is too late for Congress to change their mind about that particular payment. There is considerable controversy over whether this is the correct way to account for social security, and significant numbers of people are pushing in the opposite direction (account for the liability much earlier).

It is not jaw-drop obvious who is right here, both sides make sense from a certain perspective.

Point is that under the current system, as each worker retires and takes his/her SS money, suddenly their little contribution turns from a surplus to a deficit on the national accounts. This is going to put massive pressure on any president. Even Ron Paul could not have fixed this.

Ron Paul ‘would’ have solved this problem. Allowing the younger generations to opt-out would place the burden of liability and expense upon the users of the good. Since government accounting places a monopoly on the free-market allocation of scarce resources, and thus a more efficient understanding of how to account for these costs is crowded out by this government intervention, government attempts at distributing monies expropriated, and later accounting for it, become impossible. Tel, you just gave one of the best examples of what the Austrian School called the impossibility of economic socialist calculation. Thanks for this. Privatizing social security would also make more clear the accounting practices of such expenses. FASAB is a monopoly on business accounting and thus business practices, it is a bureaucracy that dictates the rules of expropriation and socializing of sectors of the economy intervened by the government. I suggest you take a look at how your example here is an affirmation of Mises’ greatest argument against government in general:

http://wiki.mises.org/wiki/Economic_calculation_problem

you have to break spending cuts into discretionary and nondis

if the spending cuts are coming only from non soc sec medicare etc, then the impact could be pretty big.

for instance, the major source of dollars for biomedical research (“the war on cancer”, “human genome project” etc) is the NIH (National institutes of health)

The NIH budget has been constant for about 10 years, so with ~~3% inflation a year, the NIH budget has suffered sig cuts in real terms.

If you are running a lab, and have mice that represent years of work, and trained people, and $ reagents, and you get a fiscal cliff cut of 5%, thats a lot….

All those of you who think otherwise, excepting under 40s who don’t ahve real responsibility for running things, how would you deal witha sudden 5% cut ??

would you easily absorb it into your group ?

after 10 years of cuts taht amt to 30%

give me a break

PS: you know a dog by its fleas; any blog that would attract someone who thinks that Rothbard is a statist is wierd

back in the real world of reality…

Effects of sequestration

Main articles: Budget Control Act of 2011 and United States Congress Joint Select Committee on Deficit Reduction

U.S. Federal budget deficit as % of GDP assuming continuation of certain policies for 2012-2022. The baseline deficit assumes current law takes effect, meaning tax cuts expire and spending cuts are applied. Avoiding the “fiscal cliff” increases the projected deficit.

The spending reduction elements of the fiscal cliff are primarily contained within the Budget Control Act of 2011, which directed that both defense and non-defense discretionary spending[note 4] be reduced by “sequestration” if Congress was unable to agree on other spending cuts of similar size. Congress was unable to reach agreement and therefore the sequestrations are expected to take effect on January 2, 2013 if Congress and President Obama do not agree to a budget deficit reduction plan. The scope of the law excludes major mandatory programs such as Social Security and Medicare.

The effect on both defense and non-defense discretionary spending will be significant if the cliff is not avoided. Cuts totaling $110 billion per year will be applied from 2013 to 2022, split evenly ($55 billion each) between defense and non-defense discretionary spending. For scale, discretionary funding for 2011 totaled $1,277 billion: budget authority of $712 billion for defense and funding totaling $566 billion for non-defense activities.[18]

During 2013, defense and non-defense discretionary spending would be maintained around 2012 levels due to the sequester. However, the spending begins to rise thereafter, but not at the pace projected prior to the sequester. In other words, the trajectory of spending increases is reduced, but spending is not frozen at 2012 levels. Defense and non-defense discretionary spending increases from 2013–2021 would be about 1.5% annually, significantly below the prior decade.[18]