A Post on Debt Burdens for Professional Economists

OK I gather that most people are moving on with their lives, so I’d better make this post now on everyone’s favorite question, “Does the government’s debt impose a burden on our grandchildren?” In this post, I want to explain why, as of Friday October 12, and after Nick Rowe went head-to-head against Brad DeLong, both Dean Baker and Paul Krugman were still saying false things. It was clear that they hadn’t yet fully removed themselves from their erroneous way of thinking about the issue–an erroneous way that I myself used to believe–even though they had now officially read what Nick Rowe had to say about the matter.

Here’s Krugman:

First, however, let me suggest that the phrasing in terms of “future generations” can easily become a trap. It’s quite possible that debt can raise the consumption of one generation and reduce the consumption of the next generation during the period when members of both generations are still alive. Suppose that after the 2016 election President Santorum tries to buy senior support by giving every American over 65 a gift of newly printed government bonds; then the over-65 generation will be made richer, and everyone under 65 will be made poorer (duh).

But that’s not what people mean when they speak about the burden of the debt on future generations; what they mean is that America as a whole will be poorer, just as a family that runs up debt is poorer thereafter. Does this make any sense?

…

[A] debt inherited from the past is, in effect, simply a rule requiring that one group of people — the people who didn’t inherit bonds from their parents — make a transfer to another group, the people who did. It has distributional effects, but it does not in any direct sense make the country poorer. [Emphasis in original.]

And now for Dean Baker:

I saw that Nick Rowe was unhappy that I was saying that the government debt is not a burden to future generations since they will also own the debt as an asset….The burden of the debt only exists if there is reason to believe that debt is somehow displacing investment in private capital, which is certainly not true at present.

As the above quotations clearly indicate, Krugman still thinks this is merely a distributional issue such that (say) some people alive in 2080 can be made poorer, but others must necessarily be made richer, by the level of interest payments that the government makes in 2080; yet clearly (so Krugman still thinks as of the above post on October 12) the country as a whole in 2080 can’t be made poorer by our debt decisions today, so right-wingers are nuts for worrying about us living irresponsibly at the expense of our grandchildren.

Dean Baker, for his part, thinks that debt payments per se can’t be a burden, since some people are being taxed while others (alive at the same time) are pocketing the tax revenues; it’s just a transfer payment at that future date. The only way our deficits today can hurt our grandkids, is if it somehow leads us to bequeath fewer tractors and drill presses to them.

The following simple counterexample shows that each of these points is wrong. It is an elaboration of the text descriptions Nick Rowe has been dreaming up, but it is better pedagogically because (a) you can “see it” in one fell swoop, and (b) it has more than 3 generations, making sure Krugman and Baker can’t get by with thinking this is still just an intra-annual redistribution that can’t make “future generations” poorer collectively.

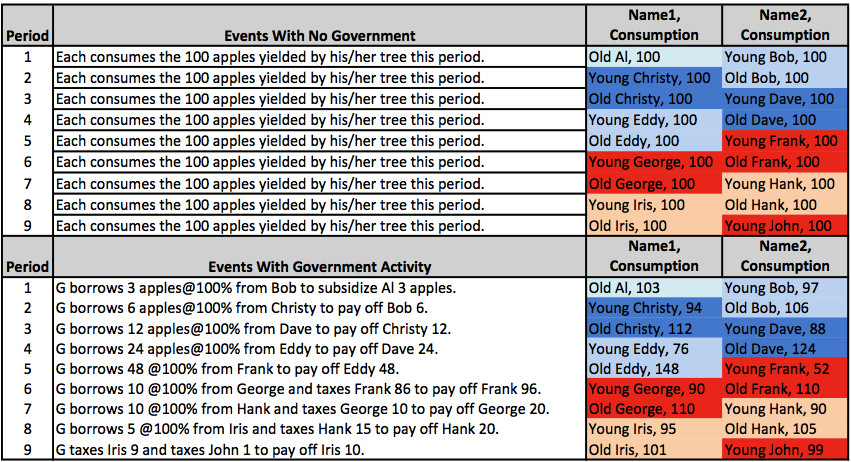

So here’s the picture, and then I’ll explain to professional economists (and others who are comfortable with mathematical economic models) how to parse it:

The above depicts a pure endowment economy. Each period, 200 apples are produced; that is “real output” and it is technologically fixed for all time. There is no carrying forward of apples, since they will rot.

In any period, there are only two agents alive. Each agent lives for two periods. This is an overlapping generations (OLG) model, such that in each period, one agent is Old and the other is Young. The colors are chosen to make it easy for you to see each person’s two-period lifespan.

Preferences are described by the utility function U=sqrt(A1)+sqrt(A2), meaning we take the square root of apples consumed as a young person and add it to the square root of the apples consumed as an old person. So there is no altruism or envy, and there’s no time preference per se (just to keep the math easier). However, there is a desire for consumption smoothing, because of diminishing marginal utility within each period.

In the top half of the chart, we see the laissez-faire outcome. Each person owns half of the apples trees, and ends up consuming (of course) 100 apples each period. There are no loans made in terms of apples, because there would be no point to them: everybody maximizes utility by consuming his personal endowment each period.

In the bottom half of the chart, the government interferes with the laissez-faire outcome. The government runs a “primary deficit” of 3 apples in the first period, in order to make a gift of 3 apples to Old Al. Then it just keeps borrowing more and more in order to roll over the debt (at 100% interest) until period 6, when it (for the first time) imposes taxes to start paying down the debt. The debt is finally extinguished in period 9.

By comparing their lifetime stream of consumption in the top half with the bottom half, we can see who gains and loses from this whole operation. Specifically, the first five generations (Al, Bob, Christy, Dave, and Eddy) benefit, while the last five generations (Frank, George, Hank, Iris, and John) all lose. I have chosen blue colors to denote winners, and red colors to denote losers.

Here are some additional points about this example, to drive home why Dean Baker and Paul Krugman’s commentary has been so misleading–and why they still didn’t “get it” even as late as Friday October 12, in the quotes I provided at the beginning of this post:

==> There is no crowding out of private investment in this example. Real GDP is fixed at 200 apples per period.

==> This isn’t an issue of intra-time-period redistribution. The first five generations all benefit, the last five generations all lose. If this example doesn’t depict “the present voters using deficit finance to benefit at the expense of unborn future generations,” what would?

==> There are no foreign owners of government bonds. Each period, the government debt is “owed to ourselves.” But look at poor Frank in period 6. He is being taxed 86 apples and is then handed 96 apples by the government. The way Baker and Krugman have been guiding their readers through this, they would describe this by saying, “In period 6, that lucky ducky Frank actually gains 10 apples on net from the government’s operation, since he inherited all the bonds from people holding them in period 5.” Yet this is completely misleading. Frank is getting screwed more than any other person in the history of this economy.

Final point: It seems that by the next day, Saturday October 13, Dean Baker was finally starting to understand the gap in his arguments. But instead he played it off like this was some little technical quibble. If he had any honor, he would have said, “Holy cow! I have been writing complete nonsense on this matter for at least 11 months! Sorry everyone!” Yet, that’s not exactly how he phrased it…

Just on observation on the table for everybody to digest, with absolutely no effort to read the whole post (I said I’m exiting this discussion and damn it I’m a man of my word!):

Future GDP is completely unaffected by the debt in Bob’s model.

Future GDP is completely unaffected by the debt in Bob’s model.

Right, and so if Krugman cares about GDP more than our great-grandchildren, then he’s right. But he was leading people to believe our great-grandchildren can’t possibly be affected.

(Why are we doing this again? I have to walk away.)

I thought he was saying the effect could be replicated by the appropriate transfer scheme.

If “he” means Daniel, then yes (eventually that was Daniel’s position). Krugman all along–as of last Friday–has been wrong. He is still thinking the government can only do one-off transactions to make someone poorer today, while thereby making someone else richer today. He’s not seeing how you can piggyback these things sequentially so that everybody alive today can be made richer at the expense of everybody who will be alive in the year 2100.

If Krugman were thinking the (correct) things that Landsburg, Callahan, et al. are (now) saying, he wouldn’t have written the blog that he did on Friday.

Just another observation, the fixed PER PERIOD GDP was deliberately assumed in the OLG model in order to isolate the fact that EVERY PERSON THROUGHOUT THEIR LIFE (beyond 5 generations) is worse off.

No, future GDP isn’t affected, but here is the point that Krugman and others simply never quite get through their heads: if it really were a matter of redistribution in the future, then it would be possible to rectify the distribution to people in the future so that no one in the future is worse off than they would have been had the borrowing never taken place. However, these OLG models demonstrate beyond a shadow of a doubt that such fixing simply is not possible- the people in the past, who consumed more than their endowment can’t be taxed any longer. Since it isn’t possible to make people in the future whole, then it really is a passing of a burden forward.

It is a distributional effect – its just a distributional effect that leaves everyone alive at some points in the future worse off than if the distributional effect had not occurred.

If the govt stopped its distributional activities then from that point it would no longer be true that everyone alive was worse off. The young in that generation and all future generations would again have maximum utility.

Having exited this debate, I can only muse that it would be interesting to see how this would work out if we did discount utility and maximize it at period 1.

Should we care about that?

Its really easy to build an OLG model with different assumptions (including different utility functions) that shows that debt benefits future generations.

But the point is that you only need one model that shows that debt can create a burden for Bob to be prove his point.

Well, lots of people seem to have lots of different points in this discussion, so Bob proving his point isn’t necessarily the same thing as disproving others’ points.

Well, lots of people seem to have lots of different points in this discussion, so Bob proving his point isn’t necessarily the same thing as disproving others’ points.

Daniel, do you not see that the three points I quoted from Krugman and Baker–taken from this past Friday, after they claimed to have digested Nick Rowe’s position–are all wrong? This is really astonishing. I don’t know what it would take for anybody to say, “Yes, Person X was clearly wrong and Person Y demonstrated it.” It’s like we’re all musicians or something.

He’s caught you Bob, because DK didn’t specify which others. You certainly haven’t disproven Cauchy’s proof of the Analytic Function Theorem for instance.

Give me a generation and I will…

It seems to me that Krugman et al. would simply be better off attacking the key assumption of Rowe’s model, namely that GDP growth will not be sufficient to cover the interest payments on the growing debt. It’s only fair to Rowe to mention that he himself has always been clear that this assumption is the key point of the model. One need not even hold GDP constant to get the same result, provided the growth rate doesn’t cover the interest. Of course it’s simpler to see that way.

Anyway, my point is that Krugman and friends can still tell a very Keynesian story about the word in contesting that assumption. That is, that fiscal policy leads to long run GDP growth by correcting for AD deficiency, optimizing MEC, yada yada. They can concede Rowe’s point that there exists a hypothetical world with no crowding out of private investment in which the debt nevertheless represents a burden for our great*8-grandchildren, but justify their plan for a 1.7 trillion apple stimulus on the grounds that it will sufficiently stimulate GDP growth such that the assumption in Rowe’s model will be violated.

There might be a small problem with the fact that government expenditure on debt servicing has been growing relative to revenues, but hey, the government can simply default instead of raising taxes and that will just be a redistribution effect. Right?

Anyway, my point is that Krugman and friends can still tell a very Keynesian story about the word in contesting that assumption.

Right! This isn’t an issue of “debt is good or bad.” It’s an issue of Dean Baker and Paul Krugman repeatedly, since December 2011, using a bogus argument to “show” their readers why the debt burden can’t make our grandchildren collectively poorer.

As Nick Rowe asks, “What part of counterexample don’t you understand?”

Look, suppose I go around saying, “Cutting government spending is a good idea, because Gov’t Spending + IQ is always constant.” When Krugman et al. go nuts, showing me countless examples where my alleged “constant” isn’t true, I don’t get to simply give *other* reasons why cutting government spending is good. No, if I have a modicum of decency, I will say, “Oops right, bad argument on my part.”

I don’t know why this should surprise you. Political hacks never admit they are wrong, even when it is obvious. But who cares? If they want to look like idiots, I say let them.

Hang in there Bob!

Yep. The argument from the other side is that deficits harm future generations *only if* deficits reduce future GDP (or, more strictly, NNP, if we make interest payments to foreigners). And they think anyone who doesn’t get that point is *logically/conceptually* confused. Bob and I get that point, and it’s wrong. We prove it’s wrong with a counterexample, in which future GDP is not affected by deficits, and yet future cohorts (including those not yet born) are worse off.

COUNTEREXAMPLE!!!

This seems just wrong. Neither Krugburg nor Landsman deny that there are incentive effects. Your counterexamples all seem to be Krugburg’s example: a transfer scheme between descendants. That is replicable with tax as you go or borrow and tax later.

The point is that Frank’s utility function was such that he agreed to lend the government 48 apples as a young man because of the government’s promise to give him 96 apples in the next time cohort. In fact, the government only gave him 10 apples, which is not an arrangement he would have agreed to. He is armed by the government’s default. Default can take many forms; here’s it’s depicted with tax increases, but it could also be illustrated with a simple refusal to pay. If the model had money in it, it could be done via inflation, but the model doesn’t have money, presumably for simplicity.

Looking at it a different way, you could say that the government’s promise to pay 100% interest on Bob’s loan of 3 apples is an implicit promise that 203 apples will exist in global economy during the 2nd time cohort. If productivity grows is in line with the promised rate of interest, then there is no problem, but models do exist in which that doesn’t happen. The government can keep up the charade for awhile in the hopes that productivity will spike eventually, but if it does not, then at some point they’ll find that their lender’s utility function doesn’t allow them to lend 96 apples to the government at 100% interest, even if they did believe it would be repaid. At that point, the jig is up, and Frank is harmed by some form of government default.

Frank is harmed, someone else is helped. This is exactly the same as would happen in the corresponding transfer regime. Perhaps the net effect of the transfers is negative — I’m not sure how Bob as an Austrian can prove it though — but the question is about ill effects *other* than this. And there don’t seem to be any.

Let me put it this way. The future generation could, via a transfer scheme, exactly undo all the effects of the intervention. Thus the suite of possible futures has not been constrained in any way. The future generation has in toto suffered no loss.

No Ken B. you are totally wrong on this sub-thread. When Krugman and Baker were talking about “incentive effects,” they meant taxes causing people to work less and thus lowering GDP below its potential. That’s not happening here. These are lump sum taxes; real GDP is constant in both scenarios.

And you are wrong saying future generations could offset what the earlier ones did. They can concentrate the losses onto some people rather than others, but after Al and Bob are dead, and have gained more than 20 utils lifetime, *somebody* is taking the hit. “Future generations” are collectively poorer. Krugman et al. were explicitly denying this.

When I look at your example Bob it looks to me like a transfer scheme can undo things. Let’s look at row 8 for instance. The govt of that cycle implements a new tax moving 5 from Old Hank to Young Iris in the with intervention table. Now it matches your no intervention table. Is there a line in this table, or if you extend it a future line, where I cannot get both parties to 100? Because if I can then the govt can undo.

I agree incentive effects can lower GDP but I think SL and PK stipulate that.

I can’t do this anymore Ken. If you don’t see how this example blows up what Krugman and Dean Baker have been saying, then there’s no reason to continue. After all, they were saying wrong things. No need to uneducate you, if you never “took” their misleading guidance in the first place.

Exactly wrong, Ken. Let’s say you do take 5 from Old Hank, then all you have done is make Hank worse off over all since he loaned 10 apples when young, and his net consumption is now down to 190.

There is no way to make everyone whole once a single generation has died who enjoyed more than the 200 apples of consumption in this hypothetical. Someone has to pay the bill.

Ken,

See my post below.

After the first lender has been repaid with interest and the debt is rolled over, the successive agents combined will have less than their original share.

We agree that Frank is harmed, now we just need to agree on who the “someone else” is that was helped. If you are correct that future generations could undo the harm via some transfer scheme, then it would have to be the case the person helped is alive during the cohort in which Frank is harmed. That person would be George, but George clearly was not helped. He only consumed 90 apples during cohort 6, and his lifetime average consumption per cohort was 100.

Whose lifetime average apple consumption was higher than the 100 that they were entitled to? Al averaged 103, Bob 101.5, Christy 103, Dave 106, and Eddy 107. Those are the people that were helped, and they’re all dead. They can’t be taxed or take part in any transfer scheme to help Frank.

It’s true that the situation could be fixed if people would agree to lend to the government at 0% interest. For example, Old Frank could say “Fine, just give me 148 apples”. In that sense, you can get all future generations back to a lifetime average consumption per cohort of 100 apples. Maybe that’s where your intuition comes from that the problem can be fixed with transfer payments. The problem is, people don’t tend to like lending to the government at 0% interest and tend not to do it voluntarily. Thus, they are still being harmed even if they consume 200 apples in their lifetime.

This isn’t about Krugborg denying incentives. This is about Krugborg’s UNIVERSAL claim that government debt cannot burden future generations, full stop.

One counter-example is a sufficiently relevant response.

It is clear that you have provided a counter example and, thus, that the arguments you are refuting are technically incorrect. I wonder, however, how significant the interest rate that you chose is. For instance, in your example, Bob would have accepted an interest rate as low as 1.523%. Would assuming more realistic interest rate (something closer to 1.523% rather than 100%) give more credence to the arguments made by Krugman et al.?

Can someone please explain in layman’s terms why govt borrowing doesn’t cause crowding out. Seems that’s the one point everyone can agree on but I can’t get my head around it.

Whatever the govt borrows, somebody else can’t use to build a factory or open a hair salon. If the govt is borrowing to buy lots of emporer’s-new-clothes-style outfits with this money, how is crowding out not taking place?

Instead of factories and salons we are getting nothing, which means the debt + interest can only be paid off with more borrowed money because the govt’s purchases aren’t generating any money of their own.

I know, I’m probably being simple but I’d love someone to point out what I’m missing!

That’s a good question, and why it’s simpler to compare it the way Krugman and Landsburg did: you have a determined set of spending decisions, and then the question is to tax now (reducing what is available for private use) or borrow (reducing — crowding out — what is available for private use). In each case it is the governemtn SPENDING — allocation of what is available — the crowds out what can be invested.

No Ken, Krugman has been totally misleading on this. He still thinks that you can’t have an outcome such that every single American living after 2050 is poorer because of the deficit financing we set in motion up through 2049. He is simply wrong.

For sure Landsburg is thinking about this the right way, but it’s not how Krugman has been thinking about it. Krugman keeps bringing up foreign ownership of the debt. Landsburg has to keep making excuses for this. Landsburg (and you) apparently don’t see the wrong way Krugman and Baker have been framing the issue.

The reason I am so confident, is I was doing this wrong framing myself until reading Nick on it. So I can see exactly why they are writing what they have been writing, and I’m telling you, they are wrong.

Here’s what I don’t see then Bob.

1. Landsburg says he agrees with Krugman. So where do they differ?

2. With exactly the same spending in each generation your own charts show a situation where tax vs borrow makes no difference. So how is PK wrong in your 2050 hypothetical here?

3. I agree that borrowing makes spending easier as it hides the pain and allows more scope for public choice stuff, but ceteris paribus it doesn’t seem to destroy wealth more than direct taxation. So how does it do so?

1. Not relevant to the core issue.

2. Everyone past generation 5 is worse off.

3. Not relevant to the core issue.

Bob: Is Landsburg’s point that, if your model allowed ‘inheritance’, any individual could choose not to consume the benefit ‘taken’ from future generations and bequeath it back to one’s own descendants, thus making the choice individually dependent but not deficit dependent? That seems pretty different from Krugman et al and I’m surprised he thinks they’re mostly in agreement.

Well, I think Landsburg (and everybody) has been making several points on this. Landsburg (and Gene Callahan and Daniel Kuehn and…) point out, among other things, that it’s not the debt per se causing the problem. And yes, that’s true in a sense, but by the same token even for a private household, debt per se isn’t harmful. That’s why I think Landsburg et al. are wrong to claim that Krugman is essentially right on this; they are reaching the same conclusion but through a totally different chain of reasoning (theirs is right, his is wrong). Krugman agrees that there is a sense in which private household debt can burden in the future, and he’s saying this micro logic breaks down when you aggregate to the economy as a whole. That’s totally different from what Landsburg et al. are saying.

You’re right, in my framework, one of the ways Landsburg might illustrate his perspective is to say that if Old Al feels so terrible about harming future generations, he can make a gift of 3 apples to Young Bob with the understanding that Bob next period will blah blah blah…so that everybody is made whole, to offset the taxation that will eventually occur in periods 6 through 9.

Yep. Steve Landsburg thinks Ricardian Equivalence is normal, so he assumes that Paul Krugman believes Ricardian equivalence too. Steve doesn’t understand that Paul is a Keynesian who doesn’t believe Ricardian equivalence.

If Ricardian Equivalence is true, then there is no burden. (Or rather, individuals foresee the burden on their heirs and take steps to offset it so there is no burden)..

Just on the face of it – they do not foresee it. They close their eyes and ears and hope for the best. Is Ricardian Equivalence some sort of nirvana fallacy like perfect competition, all knowing actors etc.?

Ah but Nick, even WITH Ricardian Equivalence, people are worse off.

Foreseeing future wealth confiscation and adapting one’s actions in the present accordingly (e.g. bequeathing rather than selling t-bonds) does not mean no losses are had even in the OLG model.

Just one single counter-example is needed to refute THAT claim. The counter-example is this: There is one single individual who is morally against taxing people to pay back t-bonds.

Even if everyone else is OK with taxation to pay back t-bonds, that one person, even if they were bequeathed a t-bond from their grand-parents, and would “gain” in terms of dollars but lose in terms of personal utility, is enough to blow up the theory that assuming Ricardian Equivalence means no burden ON NET.

This is the problem Krugman and other Keynesians run into when they see the world in aggregates. I don’t need to see a chart or model to understand that Krugman et al are wrong. How is the gov’t going to repay those earlier debts? Does Krugman think that the debt will get rolled over indefinitely? The debts must get paid by somebody, either in higher taxes or through fiat money inflation. Either way, purchasing power is lost. Wages never rise fast enough to keep pace with inflation. His whole gov’t bond reference is really ridiculous.

It’s really very simple:

– there’s a fixed total

– therefore once anyone gets more than his original share, there will be less for the rest

– anyone who lends money and gets repaid with interest, will get more than his original share

– so there will be less for the group consisting of his contemporary and future agents

– if this loss is not born by his contemporary agent(s) it will inevitably be born by future agents (since the total is fixed)

– therefore if the debt is rolled over once it’s a burden on future generations

Note this doesn’t depend on:

– the specific numbers of apples

– all shares being equal

– a specific interest rate (as long as it’s more then zero)

– there being only two agents at a time

“born” should be “borne” 🙂

Borne to be wilde.