Life Insurance, the Forgotten Savings Vehicle

Most Americans today know precious little of their country’s history, besides things like certain U.S. presidents and big wars. For example, most Americans don’t know that because of Constitutional concerns, the Eisenhower Administration had to cite the need to quickly move tanks and troops around to fend off an invasion, as a national security justification for building the interstate highway system. Can you possibly imagine someone challenging the federal government’s authority to fund highways in today’s political climate?

Another example is our nation’s monetary and banking system. Americans are vaguely familiar with the fact that the dollar used to be backed up by gold, though hardly anybody could speak for more than a moment about how this system actually worked, and what its rationale was. Yet if few Americans know about the gold standard, fewer still understand that there were large stretches when the U.S. operated just fine without a central bank. And for those who, somehow, manage to recall from a high school or college class that the Fed was founded in 1913, their teachers almost certainly never pointed to the awkward fact that the stock market crash of 1929, and the ensuing Great Depression, happened deep into the Fed’s watch.

Along with inconvenient facts such as these, another tidbit swept into the dustbin of history is that Americans used to rely on life insurance as a major savings vehicle. This sounds perhaps shocking at first, but remember the scene from It’s a Wonderful Life, when George Bailey (played by Jimmy Stewart) is down on his luck and runs to the greedy Mr. Potter for help. What does Bailey bring to Mr. Potter as an asset? Why, his life insurance policy.

This scene seems odd to many modern viewers; I remember being puzzled when I first saw the movie. This was because I only thought of term life insurance, rather than permanent (or cash-value) life insurance. The modern financial gurus, such as Dave Ramsey and Suze Orman, counsel their listeners unequivocally to avoid permanent life insurance as a terrible investment, if not an outright scam.

Yet it was not always so. Here is the great economist Ludwig von Mises, writing matter-of-factly in his 1949 treatise Human Action:

For those not personally engaged in business and not familiar with the conditions of the stock market, the main vehicle of saving is the accumulation of savings deposits, the purchase of bonds and life insurance. (p. 547)

and later on

[Under capitalism, even] for those with moderate incomes the opportunity is offered, by saving and insurance policies, to provide for accidents, sickness, old age, the education of their children, and the support of widows and orphans. It is highly probable that the funds of the charitable institutions would be sufficient in the capitalist countries if interventionism were not to sabotage the essential institutions of the market economy. Credit expansion and inflationary increase of the quantity of money frustrate the “common man’s” attempts to save and to accumulate reserves for less propitious days. (p. 834)

The notion of life insurance as a savings vehicle was displaced by mutual funds, which had become more accessible to the average household, and looked very attractive by the late 1970s. The high interest rates and inflation of this era—the result of government manipulation in the financial markets—suddenly made conservative life insurance look boring and sluggish. Americans were steered by the “experts” into Wall Street, and federal tax laws—which levy large penalties on all assets except the ones exempted by the IRS—only reinforced the transformation of the conventional wisdom.

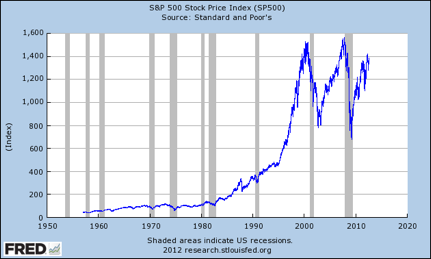

But is the stock market really a safe place to put one’s genuine savings, as opposed to the funds one considers as investments? In terms of economic theory, this distinction fades away, because there is no such thing as a perfectly safe investment. But in everyday practice, there is a definite difference between wealth that is supposed to be bedrock savings, versus more speculative investments that offer the chance for higher return but come with greater risk. With this framework in mind, how should one classify the average American’s 401(k) or other tax-advantaged retirement vehicle based on “the market”?

Beyond the wild volatility of allegedly “diverse” stock market holdings, is the fact that government regulations put your assets virtually in prison until official retirement age. With few exceptions, there are severe penalties for early withdrawal, and you can’t even use such “advantaged” funds as collateral for loans.

If the stock market, whipsawed about by Federal Reserve policy, is too risky for one’s genuine savings, the commercial banking sector nowadays is useless as well, with interest rates at historic lows—again because of the Fed. Moreover, what little interest you do earn on CDs or savings accounts, is then taxed at “progressive” rates.

In this bleak environment, many have flocked to the precious metals—the market’s original money, before they were driven underground by government measures—as the last refuge. I myself have urged my readers to acquire stockpiles of gold and silver, and I continue to do so. However, although the precious metals provide an excellent hedge against inflation, they too are subject to price volatility, they don’t generate an income stream, and they are subject to capital gains taxes. (Plus, there was that incident in 1933 when the federal government forcibly seized everybody’s gold under threat of fines and up to ten years of imprisonment.)

After several years of study—reading textbooks, interviewing actuaries, and attending seminars—I have come to believe that the old-timers were on to something: Life insurance, especially with its currently favorable tax treatment, is an excellent savings vehicle. Not only does it allow you to conservatively store your wealth in a relatively safe place, but you can instantly access it through “policy loans” from the insurance company (with your policy’s underlying “surrender cash value” serving as collateral).

I realize there are many knee-jerk reactions to this proposal, including the catchy slogan, “Buy term and invest the difference.” In future posts I will tackle these objections, because I have spent much time on them and believe they are spurious. For now, let me close with these thoughts from one of the world’s current experts on monetary and banking theory, economist Huerta de Soto:

The institution of life insurance has gradually and spontaneously taken shape in the market over the last two hundred years. It is based on a series of technical, actuarial, financial and juridical principles of business behavior which have enabled it to perform its mission perfectly and survive economic crises and recessions which other institutions, especially banking, have been unable to overcome. Therefore the high “financial death rate” of banks, which systematically suspend payments and fail without the support of the central bank, has historically contrasted with the health and technical solvency of life insurance companies. (In the last two hundred years, a negligible number of life insurance companies have disappeared due to financial difficulties.) — Jesús Huerta de Soto, Money, Bank Credit, and Economic Cycles (Auburn, AL: The Ludwig von Mises Institute, 2009), p. 590.

Lies. All lies. The Fed was founded in 1776 and the first chairman was George Washington.

You’re at that point where I can’t tell if you’re joking. Not good.

We seriously need a detente, Silas – because honestly I don’t know if you’re joking about not knowing if I’m joking 🙂

Thanks for using a word I had to Google.

You thought the USSR and USA were engaged in dentistry all these years?

France is Bacon.

Argh, try again:

France is Bacon

He’s been at it for a couple of days. He pulled “truculent” out the other day. It appears that somebody found themselves a thesaurus.

You and I just aren’t good at sarcasm.

Neither of you can hold a candle to me when it comes to being shitty with sarcasm. I’m good with fat jokes, though.

😉

I’m not joking. I’ve seen you stretch definitions like that to claim that this-or-that was “really happening all along” or what the Founders “really meant” or “would obviously favor today”.

And Washington certainly did fill some of the roles that “the Ben Bernank” fills today. Also, I wouldn’t put it past you to claim that “the Fed” was *functionally* in operation as soon as US dollars started existing.

Oh holy cow. I actually thought you had to be joking but that that would be a funny response to you (hence the smiley face).

I do think many (including Washington) of the founders would have found the Fed perfectly constitutional from the beginning. I do not think it was around in 1776. I think Washington had his hands full that year even if he wanted to meander into monetary policy.

Clearly the first chairman would have been Robert Morris (and sorta was, actually).

And now a word from this post’s sponsor: Northwestern Mutual…

j/k I started using life insurance in exactly this way about 3 years ago. (I’m 30, so it wasn’t very expensive for me.) I was really impressed with the way it appears to work, but I’ve had niggling doubts about it. For instance, how do life insurance companies make money? I’m assuming they invest it. If so, they’re probably investing in government bonds . . . and if that is true, aren’t they exposed to all the downside risk of government implosion?

Thanks for this post. I think this could very well be a good strategy for someone like me who has a very hard time being disciplined enough to set aside savings on a monthly basis.

Lukus check out the link to the left, about How Privatized Banking Really Works.

Jesus Huerta de Soto likes to talk a lot about life insurance as “real savings.” Of course, his company specializes in life insurance…

Catalan I don’t want to horrify you, but a lot of people in the libertarian community earn income selling gold. Another fraud exposed.

Who said anything about fraud?

The 100% reservists!

Ba dum ching!

Guffaw!

Hey, I think I like this sarcasm thing.

One thing to keep in mind is that, when you die, your beneficiary can only collect the death benefit OR the accumulated cash value on your life insurance policy, but not both. The insurance company usually keeps any accumulated cash value.

Kevin, yes that’s true, but by the same token, when you pay off your home mortgage, all you get is the deed to your house. The bank then keeps the “equity” you’ve been building up for 30 years.

If that sounds normal–that the bank wouldn’t also give you a check for the “equity” as well as the deed–then people shouldn’t be surprised that the insurance company just sends a death benefit check. The accumulating surrender cash value is the present discounted value of the future death benefit, minus remaining future premium payments (due account being made for risk of death and time-value of money).

Actually, there are some policies that pay both the death benefit and the accumulated cash value.In other words, if the insured dies, the beneficiaries get the death benefit & the premiums paid to date. Not a bad deal.

I like this post because it talks about some of the less discussed and less understood effects of inflation. 95% of the economists out there treat inflation far too mechanically, as rising prices and so on. Very few delve into the more pernicious effects of inflation, such as goading otherwise low risk savers into more complex and risky investment vehicles that results in an alteration of the real side of the economy.

I agree, life insurance would, in a free(r) market, be a good investment vehicle for many people of a certain risk tolerance profile, but unfortunately with all the distortions due to taxation, regulation, and inflation, all bets are off.

I imagine that once central banking self detonates, which could happen soon or it could happen after my life, life insurance forms of savings for retirement would once again be dominant for most people.

One of the problems with life insurance these days is that if you want to keep up with inflation, you have to invest in variable rather than whole life insurance and that’s subject to the same volatility as the stock market.

I’m no expert, but as I understand it, whole life policies have two components: a fixed interest rate and dividends, which vary over time. Historically, dividends have been correlated with interest rates, i.e., they were higher in the 80s than they are now.

Of course, there’s no guarantee that they would keep up with hyperinflation, but the same can be said of stocks, real estate or even gold.

The stock market has always been, and continues to be the best place to put savings for long term future appreciation. Unfortunately, many novices rely on flawed “price-only” mountain charts or unrealistic 100% equity allocations. Most serious investors diversify broadly across the entire market and use a balanced portfolio of stocks and bonds to moderate short term volatility. Under this more realistic scenario, lets look at the facts:

We’ve had 77 rolling 10 year calander periods since 1926. A 60% US Stock Index (CRSP 1-10), 40% 5YR T-Note Index (rebalanced annually) has had an average 10 year return of 8.8%, and an average REAL 10 year return of 5.3%. Stock skeptics also won’t tell you that the 60/40 mix has never seen a negative 10 year period on a calendar basis (Jan to Dec). On a real basis, the 60/40 has only had negative returns 10% of the time. Clearly a balanced portfolio of low cost index funds (the expenses associated with the above portfolio today is less than 0.1% per year through Vanguard) is the best vehicle to produce future real wealth with very modest short term risk, which all but disappears assuming a reasonable holding period.

Now, is the cash value plan of whole life insurance superior? Not even close. First, ask yourself what insurance companies invest in? These same stocks and bonds that individuals can access themselves for 0.1%. Worse yet, insurance companies will try to actively manage this money, and we know how badly that works out. And insurance companies don’t provide this service for free. Managing cash values are a major source of revenues for them, which simply means there is a large croupier between you and the public stock and bond markets used to grow your cash value. Skip the Wall Street marketing machine and own capital markets directly, you’ll be much better off.

As to the “tax-free” nature of cash-value withdrawals? Well, that’s of course a loan against your policy. Traditional savings vehicles are superior in almost all cases. If you like tax-free withdrawals, put your savings in a ROTH IRA. If you want a tax-deduction instead (and of course you can’t get this with an insurance contract), opt for a traditional IRA. For first time home purchases, some health care emergencies, and other issues, you can pull money out of IRAs without the early withdrawal penalties. If you think you will need money sooner for retirement, then you need to commit savings to a taxable account. A Total Stock Index is extremely tax efficient (losing 0.3% per year to taxes in the last 15 years), and an Intermediate Muni fund is tax free.

Finally, can we please stop pretending Gold is an “inflation hedge”. Those who make this claim either don’t know the history of gold prices or don’t know what a “hedge” is. $1 invested in Gold in 1980 was worth $0.26 in real wealth by 1999 (the 60/40 I mentioned above had a 10% per year real return over this period with only one calendar year decline). Even including the tremendous run since 2000, that $1 is only worth $1.04 on a real basis through 2011. Clearly, an asset that can decline by 75% on a real basis over two decades isn’t a hedge against inflation, nor is one that takes almost 30 years to produce a real return. Where did people actually get this nonsense? Gold may perform well (although it might not) during a period of unexpectedly high inflation, but thats a roll of the dice. Anyone remember the early 80s? 1981 saw 9% inflation but a -30% return on Gold Ouch.

The only way to deal with inflation is to hold an investment portfolio whose total returns are expected to exceed inflation sufficiently over time. That is of course the job of balanced “total market” stock and bond portfolios that I mentioned above. If you believe in markets, then buy markets. If you believe that central planners are better positioned to manage our economy, then by all means “actively manage” your assets the same way through speculative positions in gold or farm it out to the Wall Street croupiers such as insurance companies who would love to take a huge slice of your savings to pad their bottom lines.

To analyze the stock market, you used 77 rolling 10 year calander periods since 1926.

To analyze gold, you used a very long-term cyclical peak in 1980. That’s like analyzing the S&P 500 based on its March 2000 high, “proving” that it’s a lousy investment for over 12 years.

If you start in 1929, it took the stock market almost 25 years to match its previous peak. Or look at the Nikkei. It hit 40,000 in 1990 and is less than 9,000 today. I know the typical response: “That’s Japan…it couldn’t happen here in the good ol’ USA.” But there’s no way to know that.

ICG another thing that chad did, was compare raw gold performance with stock/bond mix. So to be consistent, he should have compared his ideal portfolio with a 60/40 gold/bond mixture. (Not to be confused with Gold Bond powder.)

True. And if you’re going to use any single date to calculate gold’s return, it should be 1971 when we came off the gold standard. That marked the beginning of our current monetary policy. I believe gold was around $35/ounce just before that…

BTW “chad” if you are still reading, I’m not saying you lied in your stats. I’m just saying you stacked the deck against gold in your demonstration.

First, the snake oil comment is humorous. What am I selling? The 40 Trillion dollar world stock market that we can all buy a share of through Vanguard for about 0.2% per year?Sounds like we have a Merrit Financial rep on these boards…or is it Gold Line? What’s the mark up on those Silver Eagles by the way?

If you read closely, you will see I was comparing 60/40 stock and bond portfolios TO LIFE INSURANCE, not Gold. These are, by the way, the same stocks and bonds that insurance companies buy when you give them money so they can make a profit off your premiums. You get that, right? Its not like you’re investing in one stock/bond market, and insurance companies invest in another one. Everyone gets the same returns minus costs. So if your stock/bond returns suck, the return on your life insurance cash value will suffer as well (but more, because you pay the middle man — Met Life — to try to make money off your money). By the way, beware of those cash value “projections” based on simulations from the 80s and 90s when we had double digit interest rates! You can’t get there from here.

And, yes, I used 77 rolling 10 year periods for stocks and bonds because you can. That’s half the point. Stocks and bonds were heavily traded and in net supply over this period so the returns are highly credible. Gold, on the other hand, was illegal to own for about 1/2 this period (33-74), and the early 70s gold returns were mostly a byproduct of coming off the gold standard, US gov’t decoupled the dollar’s value from gold, etc. which are one time events and are highly questionable as to how they should be used for any long term measurement as it applies to the future. Are we going to come off the gold standard again? No, you can basically throw out everything prior to 1975. If you look at real gold returns from 1975-2011, you see a return above inflation of 1.8% per year! To put this in perspective, rolling over 6 month t-bills twice a year earned you 2% above inflation over this period. Incidentally, if the stock and bond markets were closed for 50 years, I wouldn’t use those returns to illustrate stock results either.

And the starting point of my gold returns should be completely arbitrary if it is your point that gold is an inflation hedge. If it is, it shouldn’t be a “time dependent” hedge (are you saying “gold is an inflation hedge so long as you don’t buy it close to a cyclical peak and assuming you can identify that peak in advance”?). This should be obvious to anyone who actually understands what a hedge is. You cannot hedge something if there is the potential you may underperform it by 75% over 20 years. Any 20 years, regardless of the period in question.

Finally, lets make sure we are using accurate data on stocks and bonds before we condemn them. First, no one should be 100% S&P 500 (or even 100% stock) unless you are really young and can dollar cost average — taking advantage of positive expected returns but periods of negative outcomes. The 60/40 I mentioned above has earned about 4.5% per year since January of 2000, or about a 2% real return. Not great, but not forcing you to eat dog food either. What if you had the good sense to include non-US stocks and REITs (real estate) as well to come closer to the “market portfolio”? 5.7% per year, or over 3.2% real returns.

As for Japan, those are PRICE ONLY results, but when you buy stocks, you get the dividends as well (unless you buy an equity indexed annuity from a life insurance company, and then they shaft you out of the dividends like they shaft you on your whole life cash value returns compared to what you could earn on your own). A 60% MSCI Japan Index, 40% Japan Gov’t Bond Index since 1990 has earned 2.2% per year — and of course Japan has had massive DEFLATION over this period, so your REAL RETURNS are in the 4%+ range. We could also add non-Japanese stocks and Real Estate to this mix as Japanese investors should diversify globally across markets just like US investors should, leading to a 5.7% return since 1990 and close to 8% real.

And finally we come to Old Hellen Yeller, that belief that it took US stocks 25 years to recover from the Great Depression. This is so often misstated it reminds me of “the New Deal saved us from the Great Depression”. Here are the facts: we had massive DEFLATION during the early 30s, so on an inflation adjusted basis, which is all that matters, $1 invested in 100% stocks in 1929 (worst timing imaginable) was worth $1.20 by 1936, for a real return of 2.4% per year–thats 4 years to recover. The 60/40 mix had a real return of 5.8% per year from 1929-1936, far from “25 years to break even”. As a matter of fact, the 60/40 had a positive real return BY YEAR END 1933–or just 1 year.

Just don’t ask me to find a 20 year period where a 60/40 stock and bond portfolio had a real loss of 75%. That I can’t answer for you.

— On Thu, 8/9/12, Chad Nelson wrote:

From: Chad Nelson

Subject: your post on life insurance

To: “Eric”

Date: Thursday, August 9, 2012, 12:47 PM

Reply

ICGat

To analyze the stock market, you used 77 rolling 10 year calander periods since 1926.

To analyze gold, you used a very long-term cyclical peak in 1980. That’s like analyzing the S&P 500 based on its March 2000 high, “proving” that it’s a lousy investment for over 12 years.

If you start in 1929, it took the stock market almost 25 years to match its previous peak. Or look at the Nikkei. It hit 40,000 in 1990 and is less than 9,000 today. I know the typical response: “That’s Japan…it couldn’t happen here in the good ol’ USA.” But there’s no way to know that.

Reply

Bob Murphyat

ICG another thing that chad did, was compare raw gold performance with stock/bond mix. So to be consistent, he should have compared his ideal portfolio with a 60/40 gold/bond mixture. (Not to be confused with Gold Bond powder.)

Reply

ICGat

True. And if you’re going to use any single date to calculate gold’s return, it should be 1971 when we came off the gold standard. That marked the beginning of our current monetary policy. I believe gold was around $35/ounce just before that…

Reply

Bob Murphyat

BTW “chad” if you are still reading, I’m not saying you lied in your stats. I’m just saying you stacked the deck against gold in your demonstration.

Remind me NEVER to give you any of my money to invest. You’re a snake oil salesman.

Major_Freedom,

Are you referring to me, Bob or Chad? If me, don’t worry – I don’t manage anyone’s money (at least directly) nor do I sell gold or insurance.

You have to look at where the blue “Reply” lines up.

Since mine is directly under yours, and slightly to the right of chad’s, it means I am replying to chad.

I know it’s not exactly easy to immediately discern.

Chad, what you wrote is clearly complex and confusing to most people. I have yet to find a savings account that would pay me a death benefit. Whole life is a savings vehicle with a death benefit component; it’s that simple. The stock market is not were savings are “parked” or should be parked. As you well know, the stock market and all it’s bells and whistles are highly speculative. Whole life is boring in this respect, but most of us are willing to jump on this bandwagon. Furthermore, insurance companies are limited by statue on what they can “invest” in and most invest in highly-rated bonds. Nevertheless, whole life should be looked at as a “savings”, not “investment” vehicle.

Didn’t FDR and his Social Security scam take over the life insurance business?

Also, wasn’t the US dollar originally backed by sliver, not gold? The meaning of “dollar” being a silver coin.

Well, the colonies mostly used Spanish silver coins for trade, which is where I think the word, in its US usage, came from.

Sorry, hit submit before realizing I didn’t answer your question.

The U.S. was on a bimetallic standard from 1793, but the ratios were set such that silver was overpriced & gold underpriced, so gold was taken out of circulation. I can’t remember when it was ended (I want to say 1890s some time, but must look it up). Throughout the period of bimetallism, the ratio was adjusted several times to try to bring gold back into circulation.

I found Bob’s <a href="http://consultingbyrpm.com/how-privatized-banking-really-works"exposition of whole life insurance very insightful (especially since I will need to get some life insurance to fund cryonics anyway).

However, what turns me off is that it is not robust against the real danger: hyperinflationary scenarios, since WLI policies invest in fixed-income dollar-denominated securities of the government and government-entangled entities (as they have to if they are to invest “conservatively”), the very ones that will be worthless in such scenarios. (Speaking of which, how did WLI policies fare in Weimar or other hyperinflationary countries?)

In fairness, the hyperinflation scenario applies just the same to using a term policy to fund cryonics (or other mundane things), so I’d have to hedge against it some other way in any case.

In any case, we could at least ditch this whole “You can get easy loans from WLI!” meme, since it’s no more interesting than the fact that you can spend your savings but then “promise yourself to ‘pay it back'”.

Argh, sorry about the link formatting.

I do that all the time. One missed character, and it’s all she wrote.

For example, this one.

There are pluses and minuses to each of the three types of life insurance policies.

Whole Life Policies have the benefit of safety but with the interest rate environment what it is, you have a very good chance of earning negative real returns over the life of your policy.

Variable Life Policies have the best chance of keeping you ahead of inflation but the same downsides as investing in the stock market.

Universal Life Policies are the trickiest. They give you flexibility about how much you want to pay in and build your cash value but tend to “blow up” on people. They blow up because expected returns and interest rates where much higher ten, twenty, or thirty years ago. The shortfall from expected returns eats into the policies cash value and one day the policy holder may wake up to find that their premiums have literally risen over 100% from the last month. Most people can’t afford to keep the policy in effect when this happens and end up losing everything they put into it. Be very careful about Universal policies and understand that you don’t just want to pay the monthly minimum.

At the moment pension funds and insurers are not very happy with this never ending ZIRP:

http://online.wsj.com/article/BT-CO-20120720-700748.html

And like in this case the dutch CB even forced a dutch pension fund which wanted to diversify in gold, to sell it’s gold…

http://www.zerohedge.com/article/here-comes-executive-order-6102-qe-generation-dutch-central-bank-orders-pension-fund-sell-it

*its*…

“Can you possibly imagine someone challenging the federal government’s authority to fund highways in today’s political climate?”

Sadly I can.

I question your choice of emotional adjective.

Bob,

I wonder if you don’t mind addressing some questions about some of your claims about precious metals.

1. What do you mean when you say precious metals were the market’s original money? How can they be money when they have other markets for purposes other than money? Wouldn’t the money supply be arbitrarily determined in that case?

2. Why do you claim that they “provide an excellent hedge against inflation”, when the correlation between precious metal prices and inflation is nearly zero? Without even needing to pull up charts, it’s quite obvious the most recent run up in precious metal prices far outstripped that of inflation, especially since the financial crisis during which we sometimes had disinflation. Why not recommend TIPS, since they were designed for exactly this purpose, in addition to actually paying income in real terms?

Because that would mean (1) funding the US government, and (2) earning your interest return by means of stolen tax dollars.

“How can they be money when they have other markets for purposes other than money? Wouldn’t the money supply be arbitrarily determined in that case?”

One of the reasons precious metals can be money is precisely because it has value as something other than money.

Austrians say that goods *become* money when they trade as a medium of exchange among enough people (the term “enough” is arbitrariily determined, though).

So, for a good to be a medium of exchange, it just has to be acquired for its ability to make you enough of a profit as you intended to make for trading away your initial good.

If I want a certain kind and/or amount of stuff for the initial good I sell, and I’m able to get close to that, or more, for the amount of stuff I get in return for selling the medium of exchange, then we say that the medium of exchange has “held it’s value” (even though the good has zero intrinsic value, since all value is subjective).

That medium of exchange becomes “money” when enough people use it as a medium of exchange.

But it’s trade value is derived from its use-value – that’s why commodity money is not arbitrarily valued. It is *subjectively* valued, but not arbitrarily valued.

The difference is that subjective value is based on the alleviation of some felt unease. The unease is *really* being felt by the individual.

The unease is subjective, but not arbitrary.

I can’t alleviate the subjective unease of hunger by arbitrarily assigning the value of “food” to glass, and then eating it. And I can’t alleviate the unease of hunger by throwing the glass at people.

Same thing with money. If money doesn’t measure the objective quantity of some actual good, then it can’t be used to measure how much of a good is needed to alleviate some subjective end which requires objective means to attain.

The only reason FRNs are used, today, is because people are being robbed in order to prop up a fraudulently overvalued currency.

Note: Bob Murphy vehemently disagrees with this view, so you’ll want to weigh what he has to say, as well.

Tom Woods put together this helpful resource page on the Austrian view of money:

An Introduction to Sound Money

http://www.libertyclassroom.com/soundmoney

Are you getting paid to write that stuff?

Gary North is totally against whole life policies and calls them a scam.

Good blog post , I was fascinated by the information ! Does someone know where I would be able to find a fillable TN DoR SLS 450 version to fill out ?