12

Jul

2012

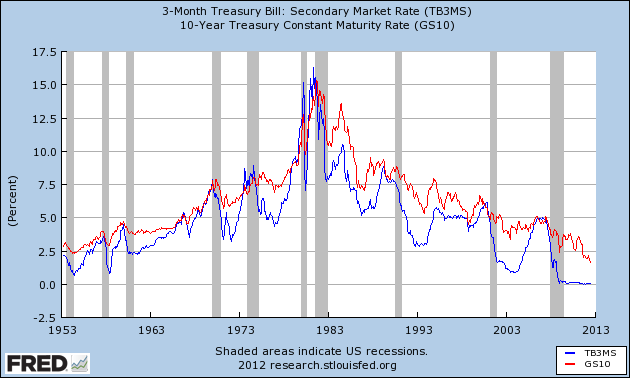

Updated Yield Curve Chart

For my Anatomy of the Fed class, I showed how the Austrian theory of the business cycle actually has a very natural explanation of the yield curve’s ability to “predict” recessions. (Details in my paper here.) Some people asked me to update the charts. Here ya go:

The entire financial summary of modern USA, sits with Ronald Regan as the pivot.

Hmmm, perhaps Paul Volcker’s spell at the FED makes a more central pivot here… 1979 to 1987 neatly brackets that central spike in the graph.

Well of course this makes sense: The way you record a “recession” is lagged. The Fed has access to data quicker than we do. They typically lower short term rates to try and stave off a downturn by way of printing money and other mechanisms. This of course all depends on if the Fed can make the correct call as to where they see the economy heading.

But honestly, I don’t know why Austrians care for how a recession is even measured. All they have to do is manipulate CPI and as the deflator for GDP, can make it look like there is growth.

The Fed has access to data quicker than we do.

It’s actually the exact opposite.

Entrepreneurs and market participants have data before the Fed does, because the Fed depends on them to collect the data they already know.

I agree market participants do have data quicker, but I am talking about those who affect interest rates. I doubt a construction worker is forecasting interest rates. And I also doubt market participants are seeing inflation in their prices and going, hmm I think interest rates should go up, or should go down. I am not defending the fed. I am merely saying the two areas the fed “controls” are inflation and growth. Even if market participants have some of the data, the fed is the only entity able to manipulate rates to affect those two areas.

By “control” I mean, they release the data. See my below reply to Matt Corso for an explanation.

try and stave off a downturn…all depends on if the Fed can make the correct call as to where…economy heading

a downturn in what? shadowbanking liabilities? Surely you do not mean that manipulating the most pervasive price in any economy – interest rates – does something for real economic growth, “staving off a downturn”?

It prolongs the downturn. It rearranges capital into inefficient allocation, lending the temporary perception that all is well, meanwhile, those stolen from in the process are less able to invest in business, have less of an ability to make efficiency maximizing decisions from accurate market prices (as they are demolished). What exactly is being staved off here? They remain at the mercy of economic law, and act in their own self-interest, self-preservation.

I do not advocate that the fed can “stave off a downturn”, notice I said “TRY”. Of course manipulating interest rates doesn’t do anything for “real” economic growth”. “real” economic growth, as I argued isn’t measured in GDP numbers. My whole point being that GDP numbers are calculated with an inflation “deflator” And who measures inflation? The Fed.

Let me give you a numerical example, and please do not spout off austrian economic ideas at me, because I fully agree with them already and understand them. If “real” inflation is 5%, but they measure it at 2%, and use the 2% to “deflate” GDP, and GDP comes in at 3%, it is a lie. GDP should be deflated at 5%, and therefore “Real” GDP is actually 0%.

So in effect it looks like the Fed has staved off a downturn, by manipulating numbers it sees before we do. As we do not see GDP and Inflation numbers before they are released.

I’m sitting in on Bob’s class with just an intro to economics (taught from Samuelson) and a pretty awful history of economics thought (for non-econ majors) under my belt, and this was more than a few years ago.

Anyone care to humor a layman’s curiosity?

Question:

When a typical economist looks at a chart like this one, what’s his automatic, knee-jerk response?

1. Does he say to himself, “Aha, I may have discovered a fact. When long and short term T-Bill yields flip, a recession will follow shortly.” And then if he has the data available he can take a look at long vs short term treasury equivalents both over time in the same country (some defined, distinct economic universe like the US, Europe, Japan, whatever) as well as in different countries to see if he may have in fact discovered something. This is sort of, if you stretch the analogy a bit, like dropping various objects from the Leaning Tower of Pisa to see if they hit the ground at the same time.

In other words, does he see the correlation between T-Bill yield inversion and recessions (pick ANY set of relationships among numerical variables and some real economic occurrence) as pretty much an irreducible fact?

Or 2., does he say to himself, “This is interesting. I wonder why it is that a T-Bill yield inversion would occur just prior to a recession.”

Do you economists attempt to explain what you observe sort of like a geologist conceives plate tectonics to explain what he sees in the earth?

Or is your science pretty much trial and error, more comparable to what a physicist or chemist might do?

Does this question even make sense to an economist?

Dan,

I’m a financial economist, so I can answer your query from that perspective.

The answer is: it depends on the character of the researcher.

The finest research, meaning that which advances our understanding of the world, seeks answers to puzzles. Puzzles are features of the data that do not fit with our current understanding of the world.

For example, the value premium (that firms with low market-to-book equity ratios outperform firms with high market-to-book equity ratios) is a persistent puzzle. Firms that will perform well should not be systematically underpriced, so the puzzle is: why are they? Lots of attempted explanations, and it’s an ongoing area of active research.

To put it bluntly, researchers for investment firms care about finding good forecasting tools, while academic researchers seek answers to puzzles. Both types have a role, in my view.

I’ve been intrigued by that question myself as I’ve been dealing with my investments. The two explanations I’ve heard for “value” investments outperforming are the cost of capital theory and the idea that you are compensated for the extra risk of buying a troubled company. The cost of capital theory just says that money you invest in a companies stock will earn a higher return if that company would also have to pay a higher interest rate on a loan from a bank. I’m not convinced by either explanation.

The third, and most likely explanation for that come from John Bogle the founder of Vanguard. He points out that for long time periods (10 years of more) growth stocks have outperformed value stocks and vice versa. He thinks that in a long enough time period the relationship will revert to even.

John,

I think the cost of capital theory is simply stating that riskier companies have higher expected returns. While that is theoretically true (I mean that’s what the theory tells us), I don’t think it applies to the value premium. So I agree it is not convincing.

The distress factor theory is also not personally convincing since many of the ‘value’ companies show no other signs of distress, like high leverage or low profitability.

Bogle may be on to something. I’m not able to recall seeing any ‘very long’ studies, where the value stocks and growth stocks were held for ten years. Most studies use annual, or even monthly, rebalancing.

The explanation I find the least incorrect is the mispricing explanation. Essentially, value stocks are those that are currently out of favor with analysts and institutions, and therefore are not priced correctly in the market. So the value premium is more properly understood as a liquidity premium.

Small cap and value stocks have generally outperformed from 1926-2011 by a couple percentage points. Bogle’s point was actually that that isn’t long enough. There were periods of 10+ years of trend reversal. His theory is that every strategy reverts to the mean and that over time there will be a trend reversal in large cap or growth stocks that will bring them back in line with long-term returns.

I find it hard to believe that the market would consistently misprice stocks with feature X over the course of nearly 100 years.

You are quite right in your final paragraph: the same stocks are not repeatedly mispriced. Rather, the stocks that are underpriced tend to have low liquidity.

The value premium studies never follow the same firms over time, because they are rebalancing the portfolios periodically. I think that is a major flaw and there is probably a lot of insight in observing the ebbs and flows of the valuation levels (M-to-B) of the same firms.

It sounds as though, for Bogle, the whole history of the stock market wouldn’t be enough! It certainly shouldn’t be the case the all classes of firms should have the same returns over time. Unless you mean risk-adjusted returns, then yes, that’s true. In expectation, all stocks should have the same risk-adjusted returns.

I’m just throwing out the reversion to the mean idea to play devil’s advocate. I’m not sure if I 100% believe it.

Check out Chapter 10 of his book “Common Sense on Mutual Funds.” For what it’s worth, he gives a graph of returns by mutual funds based on growth vs. value principles from the late 30s to the present day (in the revised edition) and they are almost exactly the same.

The biggest difference is between large-cap and small-cap funds. The dominance in small-cap stocks from 1926-2008 is only because of the decade from 1973-1983. If you take out those 10 years, large-cap stocks performed better.

In any case, it’s much tougher than people think to make the case that any one asset class will outperform another over a long period of time. Risk adjusted or not.

One of the interesting things about risk-adjsuted returns is that when you take a risk by investing in something like small-caps, or the broader stock market in general, you aren’t taking the risk of short-term volatility but greater returns over the long-run. You’re taking the risk that you’re investments will suck for the duration of the time you can hold them. Sort of like we’ve seen with the stock market over the last 15 years or so.

@John Becker

Yes, the small-firm effect did disappear. The question is, was the small-firm effect ephemeral for its own reasons, or did people start trying to arbitrage the small-firm effect and thus it disappeared?

I don’t like to use mutual funds to study general market trends, since mutual funds have many trading restrictions on them. The academic method, if you will, is to create zero-net-investment portfolios (one long portfolio balanced dollar-for-dollar against a short portfolio) and check the performance between the two over time. That said, I know why Bogle talks about mutual funds, and that makes good sense for individual investors.

Btw, my own work indicates the small firm effect is partially explained by lack of liquidity for the small firms.

Finally, you are quite right: asset allocation, in general, is very difficult even for seasoned professionals.

I just discovered economist Antal Fekete. Check out this sublime (and quite relevant) article:

http://www.financialsense.com/contributors/antal-fekete/2011/12/30/mainstream-economists-monetary-insanity

FTA:

“According to Krugman, in spite of the ‘false alarm’ sounded by the Austrian economists over the debasement of the dollar, inflation is still only 1.5 percent. ‘Who could have predicted that so much money printing would cause so little inflation?’ he asks rethorically. ‘Well, I could, and I did’, he boasts, ‘because I understand Keynesian economics that Mr. Paul reviles.’”

“In the event, unknown to Krugman, I also predicted the same thing. Unlike Krugman I did more than simply predicting that inflation was not the danger. I warned that Keynesianism would lead to deflation and depression. Money-printing has become counterproductive. Krugman doesn’t understand that it will boomerang. I stated that, unwittingly, Bernanke is the Quartermaster General of the Great Depression II (see: Front-Running the Fed, http://www.professorfekete.com, February 9, 2010). He doesn’t understand the monstrous mistakes prophet Keynes made concerning the role of speculation in the money-creation magic. The fact is that central bank buying makes speculation risk free in the bond market. In comparison, speculative risks in the commodity market appear forbidding. All the speculator has to do in order to reap risk-free profits is to preempt the Fed. He buys the bonds before the Fed has a chance. Then he turns around and dumps them into the lap of the Fed at a profit. The Fed is helpless: it must buy at the higher price. Keynes completely misrepresented the ability of the central bank to stay in charge, given its compulsive drive to suppress interest rates when confronted with a profit-hungry pack of bond speculators.”

“Friedman’s analysis of the Great Depression couldn’t be more wrong. In 1933 deflation was brought about not by the gold standard but, au contraire, by abolishing it. Here is what actually happened. Roosevelt has removed the only competition government bonds have, gold. The most conservative investors saw their gold confiscated and, willy-nilly, they were forced into the next most conservative instrument, Treasury bonds. Speculators became emboldened and bid bond prices sky high for risk free profits. Had gold been still available, bondholders would have severely punished the speculators for their daredevilry. They would have sold the overpriced bond and stayed invested in gold until bond prices came back to earth from outer space. Then they would have bought their bonds back at a profit.”

“In the absence of gold, speculators made interest rates go into a tailspin. That caused dominoes in the commodity market fall. Prices collapsed one after another. Pieces on the chessboard started falling as well, symbolizing serial bankruptcies of productive enterprises. Breadwinners of families lost their jobs in droves as money flowed from the commodity market to the bond market in the wake of speculators selling commodities short while buying bonds hand over fist. All the while Keynes was rubbing his hands together behind the scenes exactly like Mephistopheles had in the famous paper money scene of Göthe’s Faust (Part Two).”

“The same thing is happening all over again. When a central bank increases the monetary base three-fold in three years, this is a clear invitation for bond speculators to move in and make a killing. But what the central bank utterly fails to understand is that, contrary to its hopes, new money is not going to the commodity market. Speculative risks there are far too great. Instead, new money is going to the bond market where the fun is. Bond speculation is risk-free. Speculators know which side the bread is buttered. Krugman doesn’t.”

————–

Wow!

That is some amazing nonsense.

That is an amazingly empty claim.

I agree that by nationalizing gold, FDR funnelled private investment into Treasury bonds (and thus made that investment available for government projects).

However, I disagree that government bonds are risk free. As the Chinese discovered, when you are only getting low interest to begin with and then the currency devalues a bit, you can end up worse off than you started. On the internal side of things, rising prices and inflation can eat away your returns just as easily, and then there’s Capital Gains Tax as well.

Sure, I know, we don’t have any rising prices… errr except for food and fuel and electricity and bus tickets and all the stuff people need.

In the extreme case of course, we must understand that when you buy government bonds you are actually buying the government’s ability to confiscate wealth from future generations. Your first problem is that those future generations might not have as much wealth to confiscate, and your second problem is that in a Democratic system, those generations might quite reasonably vote to default.

I would argue that the real reason we haven’t seen as much inflation as expected is that a lot of debt is still continuing to unwind, even after four years there are still mortgages going under. We haven’t hit the bottom of it yet, so bad debt is still being flushed out of the system, and the powers that be are still searching around for ways to push against the tide.

I don’t anything changes in Fekete’s arguments if you start calling treasuries risky.

Less risky is sufficient.

Fekete founded the “new Austrian school of economics” by the way, mainly because he promotes the Real Bills Doctrine, which is not really well received at LvMI. As far as I know he was associated with Lew Rockwell once. But it seems they broke with each other…

Here is a link to Feketes critique of Mises about the Fullarton Effect:

http://mises.org/Community/blogs/martinf/archive/2008/12/24/where-mises-went-wrong-by-fekete.aspx

http://www.professorfekete.com/

I don’t know what to think of all this….yet.

What is fascinating about Fekete is that he hails a German writer who wrote about the real bills in 1930, then goes on to state that real bills ended in 1914 and was never restarted or retried.

That is very odd considering that in 1933 Hjalmar Schacht became the head of the Reichsbank and then went on to implement real bills in Germany, ending it in 1938 when full employment had been reached.

That shows to me that Fekete doesn’t know history very well, even in a subject which he is fully engaged and promoting.

I think he means on an international basis and on a market basis.

The Reichsbank scheme from Schacht was national only and not meant to last…

For those who can read German. A quite interesting letter from Schacht to Hitler from 1939 is now online:

http://www.seasonalcharts.com/schacht01.png (the goes from 01 to 07).

This letter did cost Schacht his position at the Reichsbank..

I’m using Adam Tooze “The Wages of Destruction” as a reference. Schacht implemented currency controls, import/export quotas for various industries, and largely wrangled with the imposed foreign repayments.

Even in 1934 & 1935 they were well on the path to central planned economics. Schacht’s confrontation with Hitler was over what was possible under the circumstances — Schacht was a central planner, but also a realist; Hitler was anything but realistic, leading to inevitable disastrous results. Getting rid of Schacht was probably the first of Hitler’s really stupid moves.

Also, if you are referring to the MEFO Bills, they were IMHO nothing more than a confidence trick, with the power of government propaganda and black budgets, to hide from both the Treaty of Versailles and make it difficult for the German people to understand how they were being ripped off. In other words, Keynesian trickery at it’s worst. Similar tactics were seen with the Volkswagen bonds and other promises that just were not kept.

I don’t for a moment believe that this principle has been missed by modern governments.

An excellent book, but one I found difficult in places. Also dull in places. But well worth reading.

HHGS is an interesting guy.

I like shady characters on the edges of major events, like him, or Molotov. He was acquitted at Nuremburg in 46 in the big trial.

Hang on a second Tel. You’re saying because the ratio of cubes to spheres flips in a certain way, going from 8 to 9 dimensions, that you doubt economists can model an economy with 9 factors of production that behaves “properly”?

“Hang on a second Tel …”

I think in geologic terms this comment would be called an ‘erratic’

Bob,

It’s really great to see the aprioristic-deductive approach honed by Menger, Mises, and Rothbard applied to the present day. What a refreshing change from the mathematical garbage the profession generally spews out!

By applied to the present day I meant that the approach is used to continue to help the evolve economic thinking. That approach is the only way to rationally attack economic analysis and if people stop using it we’ll really be back into the pre-economic era.

What a brilliant passage by Hayek about the wheat dealers selling short more wheat than they could supply. That’s a much better metaphor for the ABCT than Mises’ master builder analogy.