Bob Higgs Was an Optimist: No “Ratchet Effect” When It Comes to Federal Tax Receipts

[UPDATE in text.]

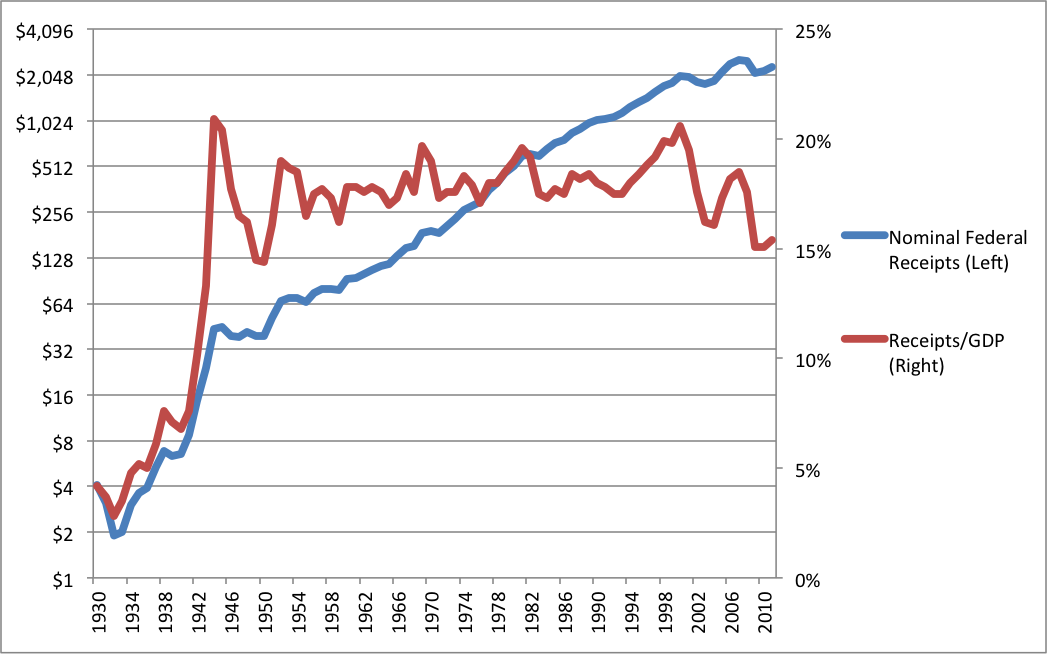

I am working on a project for the Macdonald-Laurier Institute, summarizing the U.S. government’s sorry fiscal situation. I worked up a chart showing the history of federal spending from FY 1930-2011, and it was just what I expected: big surge up through World War II, then a major pullback, and finally a gentle secular increase until a tapering off in the Clinton years, followed by an explosion under Bush then Obama.

I then went in the text to talk about federal tax receipts, and said (without having constructed the chart) something like, “As Figure 2 shows, we see a similar pattern–though not as high, because of budget deficits–for federal tax receipts.” Then I went to Excel and whipped up the chart, and was shocked by what I saw.

I don’t think I have ever seen the below chart, have many of you? Most data sets start in 1947 or later. Look at this thing:

(Note that the blue line [left axis] is on a semi-logarithmic scale, so that its slope represents the rate of increase in nominal receipts.)

I actually had to go double-check the numbers. This illustrates that the federal government incredibly jacked up how much it taxed out of the economy going into World War II…and never pulled back. [UPDATE: Actually that’s not right, there was the ratchet effect. But my point is, this chart looks nothing at all like what happened with federal spending as a % of GDP. Relative to that, there was essentially no pullback in taxation as a share of the economy, after World War II. We hit a permanently higher level.) Indeed, in FY 1944, at the height of the war, the government collected a record 20.9% of GDP in receipts. In FY 2000, the feds collected 20.6% of GDP in receipts.

Last thing: I am referring in the post title to Bob Higgs’ famous “ratchet effect” of crises. I am quite sure Higgs knows about the above chart, so I’m just making a joke of course. If you want to see a compilation of Higgs talking about wartime statistics, see this video (compiled by Niels V.).

It’s pretty consistent with ‘Hauser’s Law’. In fact, Gary North just posted pretty much the same graph last week, only it didn’t have nominal federal receipts.

Surprisingly, North didn’t mention ‘Pareto’s Principle’ (one of his favs).

But JF that’s basically my whole point: Hauser’s Law says, “Since WW2…” Since nobody ever shows you what the graph looks like before WW2,

you don’t realize how much they tightened the vise in such a short time. I was walking around thinking “the gov’t always took about 20% of GDP in taxes” when that’s not true at all.Sorry JF that wasn’t right at all. It’s kind of freaky; I knew I disagreed with you and then my subconscious just filled in something that would explain the disagreement. I’m going to consult Robin Hanson about this disturbing incident.

Anyway, what I should have said is that I always thought the Hauser’s Law thing was post-war, just like a bunch of other trends are documented that way. E.g. people often say, “This is the highest blah blah blah since WW2.”

So, I would have guessed that tax receipts as a share of GDP shot way the heck up during WW2, then came way down right after. But as you can see, they didn’t fall that much at all.

Here’s a good one:

Government spending 1944-2010 got us out of the Great Depression. If we decrease government spending now, we’ll plunge back into another Depression.

Wait, you didn’t know that all of this, the whole 20% of GDP thing, didn’t begin until WWII? Ok, this post makes more sense now. I remember looking into the matter when I first heard about Hauser’s Law and I immediately saw the large increase in taxation as a share of GDP. I am sure that you notice many things economic begin at WWII and the depression. It is as if history didn’t exist before this point sometimes.

Here’s North’s graph from last week if you’re interested: http://www.garynorth.com/public/9539.cfm

JF please see my corrected comment (I left the old stuff with a strikethrough). Sorry about the miscommunication.

Ah Bob, if only on the gay marriage threads you could do the same with Leviticus ….

Don’t let it happen again. LOL

Yeah, I noticed that, too. But, I think that 20% also kind of represents a general maximum for the American economy, that the Congress will have a real hard time getting it much higher if they wanted (and, only in special circumstances like war). They do try. Also, most of the tax changes on the books are nothing more than political theater, but they make certain constituencies feel as if they’ve won their battles.

Once they did get it to 20% for a few years the people were accustomed to it, so there is no need for them to lower it much at that point (why retreat?). Remember, this is at a period in American history where anti-government sentiment was almost non-existant. If you look at spending and borrowing you will see a huge drop off in 1947, and then a steady increasing trendline thereafter (if memory serves, anyway).

If you look at it through the revenue enhancing lens, then this all kind of makes sense. Basically, you max out taxes to the most that you know people will tolerate (using war as the justification), then you just print and borrow the rest slowly (well, at a rate to allow inflation to aid in repayment, but not kill the economy). It may be a coincidence (I wouldn’t know), but the Fed’s target inflation rate seems to match the 12 month treasury yield average over the past 20 years.

Sorry, that should be the period of the end of the war to 1947, not just the single year 1947 (regarding the drop in spending.

You should have included the average temperature in Alabama in the chart as well.

Normally I “get” your jokes MamMoTh (laughing at them is a different matter). Here I can’t even go that far.

Those jokes are not his.

Ya – I think the 20% average is associated with the regime change in the 30s and 40s. There’s not all that much more they could have spent it on before that!

This point intrigued me more:

“But my point is, this chart looks nothing at all like what happened with federal spending as a % of GDP. Relative to that, there was essentially no pullback in taxation as a share of the economy, after World War II. “

One of the issues may be that you are charting nominal receipts and spending. By dividing by GDP for the red line, you’re essentially pulling out inflation. Do you have a line comparable to the red line for spending? Presumably part of the difference between the flat line and the secular growth is the increased reliance on the civilizing policy that is deficit spending, but a chunk of that is going to just be inflation too.

Interesting stuff.

Here’s a good long term perspective on the deficit:

http://www.usgovernmentspending.com/downchart_gs.php?year=1900_2010&view=1&expand=&units=p&fy=fy11&chart=G0-fed&bar=0&stack=1&size=l&title=US%20Federal%20Deficit%20As%20Percent%20Of%20GDP&state=US&color=c&local=s

I’d be interested in seeing this chart as a deviation from the debt-stabilizing deficit level rather than as the raw deficit.

I just realized that what I quoted you on implies you do have a graph with the comparable red line for spending. Could you post that? Actually what would be really interesting is the two “as a percent of GDP” lines on the same graph.

Doesn’t this clash with the Austrian line that the government made HUGE spending cuts post WWII that allowed us to recover?

World War II spending did fall dramatically following the war. But, Higgs’ explanation of recovery (the “Austrian” one) is that the war forced Roosevelt to liberalize many of his production policies, and when Roosevelt died Truman didn’t push to restore the New Deal industrial programs and regulations. The result was an industry with the space to absorb the increasing labor supply (although, how many women were let go to make room for returning soldiers?).

Tax receipts fell substantially after 1945, but then sprang back when the Korean War began. That’s one of the reasons Acheson wrote, “Korea saved us” — meaning, of course, saved the military-industrial complex and the newly expanded U.S. empire. Federal spending fell proportionately much more than revenue after 1945, but it also leaped up after 1950, and headed north, never to turn back.