Paul Krugman, Inflation Denier

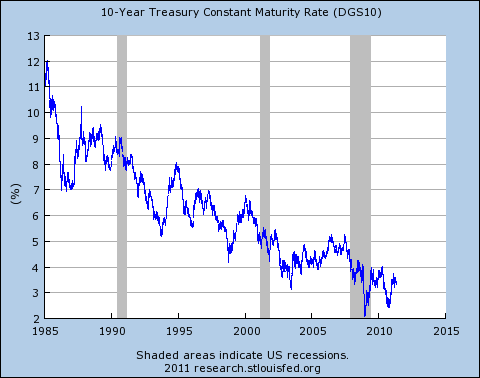

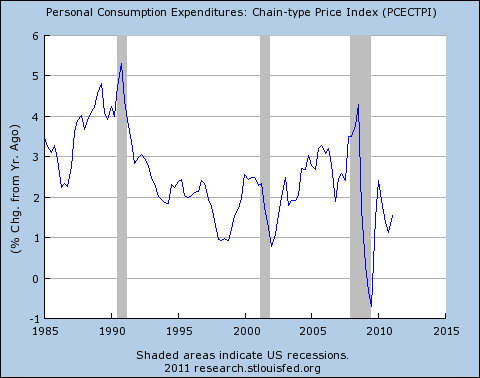

In a recent blog post, Krugman provides some graphs of the things “we’re supposed to be worried about,” which he means sarcastically. Namely, bond market confidence and (price) inflation. Here are the charts:

Then Krugman concludes:

A naive observer might note that interest rates are low by historical standards, making you wonder why we’re obsessing about the bond market; that inflation is also low by historical standards, making you wonder why it’s an issue at all; and that unemployment is immensely high. But Washington has its priorities.

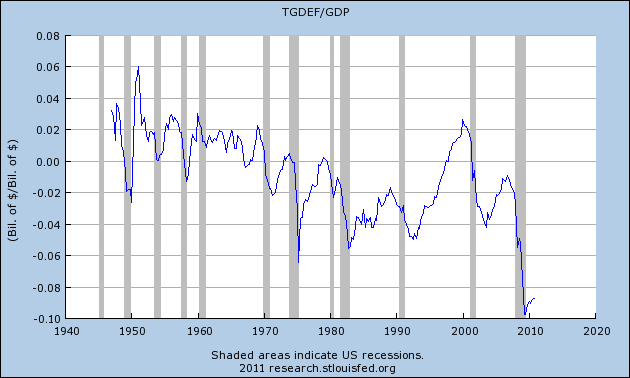

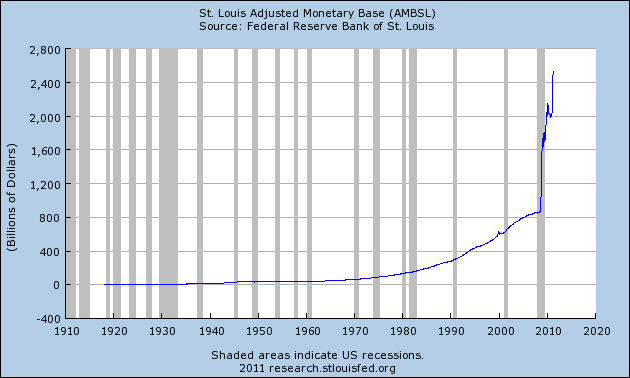

Hold on a second, Professor. It’s not as if those of us wringing our hands over the bond market and (price) inflation don’t have our own empirical reasons for alarm. To wit:

The first chart (i.e. third chart in this blog post) has an obscure title generated by FRED, but it is “Net Government Saving” divided by Real GDP. So it is basically showing how big the deficit is (a negative number) as a share of the economy. The second chart above (i.e. fourth and last in this blog post) shows the monetary base in absolute dollar terms.

So we see that the deficit as a share of the economy is the highest it’s been since World War II, while Bernanke’s monetary activities have literally been unprecedented and in fact have added more to the base in the last 3 years than humans have added since the Model T.

It is a basic tenet of economics that, other things equal, the more money you pump in, the higher price the price level. Indeed, we currently have the highest CPI in recorded history, and five of the years with the highest CPI were in the last five years.

Now Krugman can come up with all sorts of sophisticated models explaining why these basic theoretical and empirical trends aren’t really there. And I’m sure he and the other inflation deniers will pounce on that awkward email I sent to Bob Wenzel, saying that, “I used John Williams’ ShadowStats’ trick to hide the decline in core CPI.” That email line has been taken out of context and I assure all of you, Wenzel and I are committed scientists. A special commission set up by the Mises Institute has cleared us of any wrongdoing.

The peer-reviewed literature is on our side. Inflation is always and everywhere a monetary phenomenon. We have case studies of what happens when societies become saturated with too much money. Already we can see food riots around the world, and even in the United States people are hurting because of high gas prices and heating bills. How long will the inflation deniers bury their heads in the sand, and ignore the suffering their policies have wrought?

The truth will out, and we need to stop injecting so much fiat pollution into our banking system. Don’t let the Soros-funded deniers convince you that our reckless fiscal and monetary behavior is sustainable.

lol This is better than the 3 Stooges.

“It is a basic tenet of economics that, other things equal, the more money you pump in, the higher price the price level. Indeed, we currently have the highest CPI in recorded history, and five of the years with the highest CPI were in the last five years.”

Nowhere is that a basic tenet of any empirically-based theory. That’s completely made up. You judge the effectiveness of a change in monetary policy first and foremost by the immediate market reactions to news of the change, and then follow market reactions over time. Otherwise, you’re mired in arguing with the market and, at least given your history of opinion, you don’t win. Keep telling the market it’s wrong, but how it’s way too complicated for attempts at government intervention. lol

Never trust the opinions of strong EMH deniers who aren’t highly successful investors. They literally have failed to demonstrate any understanding of economics, or even capitalism generally.

And is this taken out of context Bob: http://mises.org/daily/3933? Where exactly is your record of success as a prognosticator, especially where you specifically disagreed with the free market? Even if I didn’t associate a financial crisis in an economy with low baseline inflation in ’07 and ’08 with the obvious, that is, deflation, and act accordingly, I could just sit back and watch you embarrass yourself with one failed prediction after another.

Is it really so hard to understand that when aggregate demand is down, that demand for loanable funds for investment will be down as well, ultimately leading to low rates, yet not low enough to clear the market? lol It’s like people lose their minds during financial crises, actually viewing the temporary extreme rate spikes as revealing some long underlying hidden inflation, when it only reveals the desperation of lending institutions and some others to save their asses. lol

You can’t even define inflation in any meaningful way. You literally misuse the word, as if choosing some perceived antecedent of inflation could ever justify simply bastardizing the term, even if you were correct. It’s confusing to those trying to learn something about economics AND shameful. The word has been long established to refer to rising prices, not some precursors, especially imaginary ones.

Sorry Bob, and I’m not trying to be insulting here, but you don’t even know what science is. No scientist would give a moment of serious attention to Austrian “theory”, which even prides itself on an anti-scientific praxeological foundation.

So, let’s really get down to all that matters here. What is your explicit theory and where is evidence of its predictive validity? If you don’t have that, you have nothing.

David,

Bob wrote: It is a basic tenet of economics that, other things equal, the more money you pump in, the higher price the price level.

You responded: Nowhere is that a basic tenet of any empirically-based theory. That’s completely made up.

You are incorrect.

MV=PY. If you increase M, then “other things equal” (i.e. if V or P don’t change) then you will get an increase in P.

Of course, pretty clearly other things were not equal during the last half of 2008, which is why we didn’t see the massive inflation Bob and others were predicting in 2009.

MV=PY is totally useless if you can’t even tell when are other things equal or not. Which things actually?

Bob was wrong, and the MMT people were right, that’s it.

MV=PY is totally useless if you can’t even tell when are other things equal or not. Which things actually?

The other things in this case would be V and Y.

You are quickly becoming my favorite commenter, Blackadder. Your style is very much like your namesake. In fact I think I am going to see if Blackadder is available on Netflix.

Come on Bob. Where’s your evidence? Where’s the high inflation? Why aren’t people carrying their bills to the bank in wheel barrels? lmao

David S wrote:

Come on Bob. Where’s your evidence? Where’s the high inflation? Why aren’t people carrying their bills to the bank in wheel barrels? lmao

Right, just like the “climate change deniers” laugh their butts off everytime it snows during a global warming conference. Ha ha where’s the evidence?! Sure people can point to massive increases in CO2, but so what?

(To repeat everyone, I’m just ironically noting how similar the rhetorical strategies are when it comes to liberals and conservatives in the debates over monetary policy and carbon emissions.)

You can’t be serious. MV=PY is totally useless, it’s just economics charlatans trying to sound scientific with a physics-looking formula that is not backed by any empirical evidence because:

– nobody knows what M should be despite loads of people trying to come up with different definition of monetary aggregates and trying to find correlations with what is only true in their imagination

– V cannot be measured

– P is only approximated by some arbitrary index

If this is a basic tenet of economics, then economics should be abandoned straight away.

It’s laughable, isn’t it?

That formula is not a basic tenet of economics. lol It has nothing to do with modern monetary theory. I’m not disappointed though. How could my expectations get any lower?

David S wrote: That formula is not a basic tenet of economics. lol It has nothing to do with modern monetary theory.

Congratulations David, you’ve now said that supply and demand analysis aren’t involved in basic economics. You can claim the proposition is unhelpful, particularly in the present environment, but you don’t know what you are talking about when you continue to deny what really is a basic tenet of economics.

lol That’s not what I said at all. That equation does not represent the supply and demand for money in the real world. Show me some empirical evidence supporting that formula. lol

You totally lack critical thinking skills.

I am talking about the proposition I made, namely that as the the supply of a good goes up, while other things are equal (i.e. demand stays the same), then the price goes down. If news comes out saying Saudi Arabia is increasing output by 100,000 bpd, then that by itself is a reason for investors to think the price will go down. Now you can say other things might not be equal blah blah blah, but don’t keep denying that supply and demand analysis is a basic tenet of current economic theory. Gee whiz.

Nobody denied supply and demand. lmao Show me where I did. Is this your defense? lmao

In fact, I’m still waiting for empirical evidence to support any claim you make about inflation. Come on Bob. Where are your metrics? Show me how to make money with your model. lmao

David, the major piece of investment advice I gave on this blog was to tell people to stock up on gold and silver in the fall of 2008. Anybody who did that sure as heck is glad he did.

I have admitted several times that my predictions about CPI didn’t pan out. I’m not saying I am a better investor than you are; maybe you are as good as you claim. I am saying that your confident assertions show that you often don’t even take the time to understand what some of us are saying. Like on this thread. You are pointing to obviously correct statements that I made, and comparing them to the 3 Stooges. I never laughed when Moe walked around uttering true statements, it was more like him poking people in the eyes or getting smacked by a wooden plank that made me lol.

Bob, you celebrating being right for the wrong reasons on gold and silver should seal it even in your eyes. How much of that advice was based on your exactly wrong inflation prediction? Did you know the gold supply’d been falling since around 2000, going on 11 years now? lol

There’s nothing special about silver or gold. Had you traded the stock indexes, forex, commodities, or even inferior versus normal goods manufacturers/suppliers/retailers with the eye toward tight monetary policy, you could have done far better with the use of derivatives, which I’ve demonstrated. It’s harder to trade gold and silver on this basis, at least for me, because the response to inflationary or disinflationary events is more complex.

So, enjoy the small whole multiples in gold and silver you may have gained over the past decade or so, but realize that there’s far more money to be made in the actual inflation/disinflation trade just by looking at signals that money maybe relatively loose or tight going forward.

You can’t get rich on small whole multiples over a decade. lol

http://www.goldsheetlinks.com/production.htm

Shows that world gold production has been pretty much steady since 1998. The small fluctuations in supply volume don’t go anywhere remotely close to explaining price of gold.

David S., I got this punk. Allow me:

you are a joke. lol. let me know when you trade based on something put out from “goldsheetlinks” and make money. lmao

To Tel:

lol So, you miss the entire point about gold and offer your little link below. Given the explosion of demand from China and India, flat gold production still tells much of the story of the rise in price. lmao

http://www.gold.org/about_gold/market_intelligence/gold_demand/gold_demand_trends/

But, we can trade some links. Here are some showing world gold production falling over the last decade:

http://whiskeyandgunpowder.com/looking-at-gold-price-trends/

http://www.themoneyillusion.com/wp-content/uploads/2010/12/Gold2.jpg

David, your chart is much better than mine… more colourful, better presented, easier to read. Please forgive me for grabbing the first link off a 10 second google search.

However, both charts seem to show the same thing, which is that relatively tiny recent decreases in gold production are trivial compared to the production increases in the 70’s 80’s and 90’s. BTW I believe that 2009 was up on 2008 by a little bit, your chart only goes up to 2008 (minor detail).

What I hear you saying is that in a market exhibiting soaring demand and relatively static supply, prices are primarily controlled by supply. I find the demand side more interesting and significant.

Very few of the people who buy gold actually need it, they want it for personal vanity or for hoarding and trade. Why are Chinese and Indians not satisfied with paper money and bank accounts? Why are they searching for tangible wealth in a physical form?

Do you think perhaps that recent instability in the financial system has had an effect on how much people are willing to trust that system?

Tel,

Apparently, you completely ignored the pdfs on gold demand I linked to. Well, I don’t expect anyone here to actually look at data.

That formula is not a basic tenet of economics.

What is it then, an advanced tenet of economics?

It isn’t a tenet of anything real. Define those variables rigorously and then show me it predicting empirical data.

You’re gonna have to read and understand Popper if you’re going to have a conversation with me. Actually learn to understand the scientific method, or I’ll ignore you.

You’re gonna have to read and understand Popper if you’re going to have a conversation with me. Actually learn to understand the scientific method, or I’ll ignore you.

You seem to have a poor understanding of how incentives work. If not reading Popper means that you will ignore me, then I most certainly am not going to read Popper.

In fact, if your behavior on this thread is typical, I would suggest you make a similar deal with Bob. Tell him that you absolutely refuse to comment on his blog anymore until he establishes to your satisfaction that he understands the scientific method.

only four LOLs in your post, I’m disappointed.

Bob, the third chart in your post shows the deficit as a percentage of GDP showing a decrease at the tail end. My guess is the publicly-held debt to GDP would continue to show an alarming rise, and that’s more important than the deficit itself.

What makes it alarming? Be specific. And, under what specific conditions does the US start seeing serious problems manifest?

Under the specific condition that in future under an interest rate that is not artificially forced down by QE, the interest payments on Federal Government debt will force the government to levee high tax while returning minimal spending back to the community.

Of course, we don’t know what those interest rates will do, but rates are rising everywhere else in the world, and the DGS10 graph at the top of this page is absolutely not a free market indicator of anything. It has been blatantly manipulated by QE money injections.

The Fed is facing the basic decision:

More QE ==> USD devaluation and price inflation

Less QE ==> Higher interest payments on Federal Govt debt

Both sides are ugly, and that’s because the US economy is ugly right now. The only question is where that ugliness goes to.

Tel, you nailed it on the head by pointing out the rock and a hard place Bernanke has gotten himself into. The Fed is buying 85% on Treasuries, although there is some evidence there is money flowing from commodities into Treasuries. Not sure where things will go when Bernanke starts “unwinding” QE by putting more onto the market.

To answer David’s question, there are no “specific” conditions. I won’t fall into that trap. I think Reinhart and Rogoff’s work make that clear. Publicly-held debt at 90% of GDP is a danger zone, which is a tough thing to gauge in the U.S. given that state and local debt need to be taken into account, as well as very low rates of savings.

Reinhart and Rogoff are jokes. We’re well beyond their threshold, but no solvency problems to be seen anywhere. lol We were also well beyond it at the end of WW2 and Japan’s been so for years and years.

I hope you trade on your “model”. That’d mean less money for Ron Paul to run on.

David S, and punishing everyone with his cat-of-9-lols, Whip! Whip! Oh, no! Did he just LOL someone again? Ouch! ( 9 lols in the same reply ? Soooo brutal. How can anyone tolerate it!?!!?)

As if.

On top of being a completely impolite and arrogant ASS, your over-confidence in your own dimwitted observations is stupefying.

Let’s start with the logical fallacy in this observation above that “nothing has happened (yet)” therefore it must be wrong / “they are jokes”. It’s the same brilliance in logic exhibited by mine workers in a clearly deteriorating mine: The longer time went on without a collapse, the more confident they would become in the safety of the mine when all evidence otherwise suggested it was the exact opposite.

Genius, DaveS.. . You must be a card varying Super Genius. ( Mensa, perhaps? Do you order from ACME?)

(Oh, no!!! Now I’ve done it!! He’s going to lay out some more LOL’s on you all.. Everyone, run for cover. God help you if the biting genius wit of DaveS exposes your (lol) inadequacy to communicate with him!)

PS — I recommended gold in 2002 at $318 oz and silver at $7 or whatever it was at the time, as well, based on many of the fundamental theories that float around here. No doubt, exact predictions are a very difficult game for anyone, let along folks working in an environment where the authorities change the rules as the game is being played, and have access to a printing press to flood this asset or that with artificial demand… But Let’s see how humble you crawl back here to show some humility when this hits the fan. I don’t expect it one bit. Moreover, someone as big-headed as you will be certain to concoct a hundred other reasons why the idiot policies didn’t work, why the dollar really isn’t collapsing and why a collapsing currency really isn’t the opposite side of the coin re inflation, money expansion, etc., and more intervention is needed.)

You could save yourself a lot of keystrokes by typing “I have no idea.”

The base is locked up in reserves, isn’t it? At least, as long as short term rates can be suppressed down to zero, it is. I wonder if the Fed can ever allow short term rates to rise even a quarter point without removing the QEs first.

The base is pretty irrelevant. What’s important is non-financial credit demand and inflation expectations, not so much short rates.

It’s not a question of the fed allowing short rates to rise. It’s the inter-bank market that will keep that rate low unless the fed starts doing massive reverse REPOs, sell-side POMOs, time deposits or raises the rate it pays on reserves held at the fed. All of which would be contrary to what they’re trying to do.

Yes, but if the banking system had any better (non-risky) short term thing to do with reserves other than collecting 0.25% from the Fed, they would do that, wouldn’t they?

I understand that this against what they are trying to do today, but what about when they do let the short end rise? Can they do that without without withdrawing the QEs and not get massive inflation?

The fact that long term interest rates are higher than short term interest rates pretty much spells it out that most of the punters think rates have to go up in the next few years. Those people could be wrong, but if they are right and rates do go up, we can only conclude that the Federal Government interest payments will also go up.

I was playing around a little bit with Fred and I figured I’d share this: http://research.stlouisfed.org/fredgraph.png?g=q8

Few interesting bits:

1) M2 and GDP correlate up to the crisis.

2) M2 and GDP and AA bonds correlate

3) AA Bonds and stock market, absent the bubbles correlate.

4) The stock market follows the housing market up to the crisis

5) The rise in the stock market is due to the rise in the monetary base – excess reserves.

The conclusion I draw is that inflating the monetary base has stopped the decline and restored the stock market/asset prices to where it/they should have been absent the bubbles and the crisis. The risk of inflation is difficult: m2 is higher, gdp is lower.

In short: I think both sides do have a point with regards to inflation and the stock market.

What puzzles me though, is what happened in 1995 to the correlation between M1 and M2/GDP

http://research.stlouisfed.org/fredgraph.png?g=qb

“and five of the years with the highest CPI were in the last five years.”

Actually, 2009 cpi did not beat 2008 cpi, so not technically correct.

http://research.stlouisfed.org/fredgraph.png?g=qe

The quoted statement is correct. I didn’t add, “And each of the last five years was higher than the previous year.”

I interpreted it as five out of the last five years had new record price level. My mistake then.

Just to clarify what I’m doing in this post, everyone: I saw Krugman’s charts, and I was annoyed that he was acting as if there were absolutely no reasons for the handwringing except, “I’m mad that there’s a black guy in the White House.” So I was going to do a modest post just pointing out that there were pretty scary projections of federal debt/GDP, and of course the monetary base is through the roof.

But then I realized that Krugman I were arguing vis-a-vis inflation in the reverse way that he and I would argue about climate change. So I tried to write a post with the same style and truthiness as those who castigate the climate change “deniers.” They do things like point out the simple physical law of increased radiative forcing from higher CO2 concentration, they say things like, “The hottest x years on record have occurred in the last y years,” and so forth. And in the inflation debate, “my side” has to explain away awkward things like the core CPI, so I made the joke reference to the “Mike’s Nature trick to hide the decline” thing from Climategate.

So actually, this post is as much a criticism of “my side” in the climate debates as it is of Krugman and Yglesias when it comes to inflation. I’m observing that the things we rush to depend on what we think the answer should be. Just as Lindzen can say, “No there are feedback effects, and that’s why the simple prediction of temperature increase from higher CO2 hasn’t been borne out empirically,” so too can you guys say, “Other things aren’t equal. The demand for base money has gone way up since 2008, so we’re not getting the increase in CPI that your naive relationship would predict.”

Figured you would let things play out a bit before you had to explain the whole point of the post.

btw, Krugman likes to look at nominal rates which don’t have much predective power when the fed is targeting long rates and making it quite profitable to arb the rate strucutre. Maybe if he looked at 10yr TIP breakevens (which are now higher than the pre-crisis level), or inflation swaps, or the 2-10 spread, or about a dozen other things, he might be a little more understaning of why people are worried.

Jon can you elaborate on this? It’s very interesting.

Bob,

In all seriousness, there are many parallells in these two debates, and many of the same issues of complexity are involved. At its core, climate is an initial values vs boundary values problem. In economics, we might say this is a microeconomics vs macroeconomics debate. Climate is the statistical aggregate of all the weather that goes on in the system, much like the aggregates in economics might be called the “climate of the market”. For expample, if we look at NGDP, that is an aggregate metric which is “forced’ in certain directions by changes in boundary values (ie the money supply), but over the short term is highly sensitive to initial conditions such as the demand to hold money.

These are fundamental debates that are occuring across science disciplines, and the commonality points to some very deep epistemological issues.

K Sralla, nice to hear from you… I of course wanted this post to be amusing, but I am serious about the similarities too. I think people on both sides of each issue should ask themselves why they favor one set of rhetorical strategies on one issue, but the opposite on the other. I’m trying to do the same myself, to see if I’m just biased or if there really is a reason I’m very concerned about price inflation while I reject the doomsayer projections of the climate alarmists.

If there is such a strong correlation between the monetary base and inflation, then how come when inflation was trending down from the late 80’s to today, the base kept rising? And how come the base did not rise during the 70’s and 80’s more rapidly? And how come, despite the massive rise in the monetary base over the last few years, credit continues to be destroyed on a monthly basis:

http://pragcap.com/wp-content/uploads/2011/04/cc1.png.png

Sorry Mr. Murphy, there is exactly zero support for the idea that by creating a bunch of reserves, banks will start expanding credit and pushing inflation higher. Remember, the banking system is never constrained by reserves, so the entire concept of excess reserves is meaningless.

Maybe this is a graph that really needs a log scale.

In order to understand anything AP Lerner says, one must read original source material. Silly GOVERNMENTS CAN AND DO IMPOSE CONTRAINTS ON THEMSELVES. Like reserve requirements:

http://www.federalreserve.gov/monetarypolicy/reservereq.htm

As MMT guru Scott Fullwiler explains:

Of course, governments—particularly when they are operating on an outdated understanding of the monetary system—can and do impose constraints upon themselves. In the US case, laws previously written by Congress forbid the Fed from providing direct overdrafts to the Treasury. As such, if the Treasury wants to spend and its balances are dwindling, it must either tax or issue bonds to do so. Unfortunately, this self-imposed political constraint is the starting and ending point for Krugman and most others, even as it has little to no economic significance according to MMT.

http://tinyurl.com/4yuptgh

Of course, under MMT, states ultimately have no constraints whatsoever, so you and your children can be used as fertilizer or food. The only reason that you and your family aren’t already in someone’s stew right now is because silly governmental officials fail to realize that they are, in fact, not constrained by anything.

I hope you get a good night’s sleep, Bob, because tomorrow my MMT critique runs at Mises.org. The dogs of war will be howling.

I’m gonna be too busy figuring out the chords to Rick Astley songs to worry about something silly like MMT tomorrow.

Actually states like Canada don’t have reserve requirements and did not see their banks collapse during the crisis.

I do agree people involved in the financial sector should be used as fertilizer or food though. That’s the only way they could become useful.

Did you lower your real wage already or is it still stubbornly sticky?

MamMoTh, are you salivating? Just a few more hours and my critique of MMT goes up on Mises.org. Since James Galbraith posted on the other thread, I’m hoping he will join the fun. The internet renders us all equals.

Salivating? Not really after what I’ve read on your previous blog entry. Hopefully it will be fun though. Most articles at Mises.org are!

You mean, “funny” right? As in, so ludicrous you can’t believe your eyes and can read no further because the tears of laughter cloud your vision? lmao

Now that we’ve spent all this time learning a screwball “theory” (no theory, just facts!!!) like MMT, I think it’s time for all of the MMTers and Keynesians of whatever clique to finally learn some basic Austrian School concepts.

Austrian Economics:

1. MV=PY

2. ??????

3. Inflation!!!!

PS: you lowered your sticky real wage yet Roddis?

Actually, a lot of ‘Austrians’ have problems with MV=Py as well…

http://mises.org/daily/2916

Bob M’s point was that if you increase the supply of money, and the demand for it remains the same, then prices rise. What is so controversial about that?

Here is an interesting redefinition of the equation of exchange, from a fund manager’s perspective:

Briefly, M / Q = I, where I = F(V)

http://www.scribd.com/doc/54663217/April-2011-Special-Report

It’s nice to see that there are some others on this thread who understand just what a joke this all is. Austrians will be forgotten when we, if ever the way things are going, get back to full-capacity.