Klassic Krugman Kontradiction

So there’s a new paper [.pdf], full of regressions, confidence intervals and the like, purporting to show that the Obama stimulus package destroyed jobs on net.

Full disclosure of a busy consultant: I didn’t actually read the paper. From reading this critique by Noah Smith of “Noahpinion” (whom I am going to add to my blogroll, since I like him in the same way that El Guapo was amused by the Three Amigos), it looks like the study may indeed have been fishy.

But my point today is neither to praise nor condemn the paper. Instead, it is to point out a Klassic Krugman Kontradiction. Remember, in a Krugman Kontradiction, he doesn’t actually contradict himself, the way a lesser man might. Instead, Krugman uses true data in order to frame the debate this way or that, always in order to ridicule his opponent, even if he himself is taking the opposite side of an issue from one episode to the next.

So in Krugman’s discussion of this latest stimulus paper, he writes (and I’m reproducing it in full):

STUPID STIMULUS TRICKS

So there’s another the-stimulus-didn’t-work paper (pdf) making the rounds, and as usual being seized on by people who have no idea what the issues are with this kind of estimation.Basically I’m with both Dean Baker and Noah Smith here, but I thought I might add some more general discussion.

What this study claims to do is estimate the effect of the stimulus by looking at cross-state comparisons. So the first thing we should understand is just how difficult it is to do that.

Remember, the stimulus was not big compared with the economic downturn. The original Romer-Bernstein estimate was that it would, at peak, reduce unemployment by about 2 percentage points relative to what it would otherwise have been. And most of that effect was supposed to come through measures that would have been common to all states: tax cuts, transfer payments, etc.. At most, differences between predicted effects among states should have come to no more than a fraction of a percentage point off the unemployment rate.

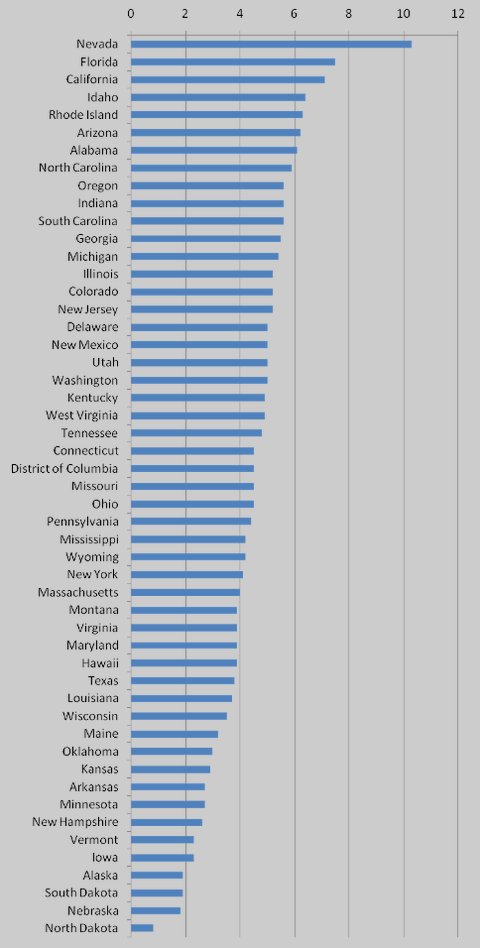

Meanwhile, there were large differences in actual unemployment changes by state. Here’s the change in the unemployment rate from 2007 to 2010:

Obviously there were factors other than the stimulus driving the great bulk of these differences. At the top are the “sand states” that had the biggest housing bubbles; at the bottom, cold places where nobody lives.

To tease any effect of the stimulus out of these interstate differences, if it’s possible at all, would require very careful and scrupulous statistical work — and we’d like to see some elaborate robustness checks before buying into any results thereby found.

The latest anti-stimulus paper shows no sign of that kind of care. It makes no effort to control for the differential effects of bubble and bust. It uses odd variables on both the left and the right side of its equations. The instruments — variables used to correct for possible two-way causation — are weak and dubious. Dean Baker suspects data-mining, with reason; the best interpretation is that the authors tried something that happened to give the results they wanted, then stopped looking.

Really, this isn’t the sort of thing worth wasting time over.

So if you go and re-read Krugman’s post, you’ll note that the one actual argument he spells out–as opposed to mere assertions of dubiousness that may be valid, for all I know–is that these guys didn’t adjust for the housing bubble’s obvious effects on unemployment among the states.

Dean Baker was particularly aghast that these Ohio State researchers could have omitted such an analysis. He went so far as to say:

It also would have been nice to see [in this paper purporting to show that the stimulus destroyed jobs] a variable for the drop in house prices by state. The economics profession as a whole was too thick to notice the $8 trillion housing bubble on the way up, or to realize that its collapse would have any impact on the economy. Now that the collapse of this bubble has led to the worst downturn since the Great Depression, one might think that economists would finally start paying attention to it….At this point, it should be economic malpractice to run state employment regressions without including a housing price variable.

OK, so it’s pretty clear that the pro-stimulus Keynesians can’t believe these moronic researchers didn’t model the obvious fact that unemployment rates across the states were affected by how bad the housing bubble was in each state. I mean, who could possibly have missed that?

In this context, Krugman’s post from December 2008 strikes me as ironic. At the time, he was ridiculing any “hangover theory” of recessions, which blamed out current malaise on the malinvestments of the housing bubble years. Krugman wrote:

So the hangover theory, which I wrote about a decade ago, is still out there.

The basic idea is that a recession, even a depression, is somehow a necessary thing, part of the process of “adapting the structure of production.” We have to get those people who were pounding nails in Nevada into other places and occupation, which is why unemployment has to be high in the housing bubble states for a while….

One striking fact, which I’ve already written about, is that the current slump is affecting some non-housing-bubble states as or more severely as the epicenters of the bubble. Here’s a convenient table from the BLS, ranking states by the rise in unemployment over the past year. Unemployment is up everywhere. And while the centers of the bubble, Florida and California, are high in the rankings, so are Georgia, Alabama, and the Carolinas.

Incidentally, Brad DeLong liked Krugman’s empirical evidence so much, that he incorporated it into one of his speeches around that time.

Now the problem with the above (note that that BLS link is dated at this point) is that Krugman was looking at the year-over-year change in unemployment across states as of December 2008, whereas the housing bust had been well underway by then. As I pointed out in my reply, if you started your comparison from when the housing bubble burst, then there was a very tight fit in the rankings of states with housing declines and unemployment increases. So the “hangover theory” made a lot of sense, if you did the timing properly.

I guess I should be grateful that Krugman apparently got the lesson. When he wanted to use the obvious connection between the housing bust and unemployment to suit his purposes–as when he ripped the Ohio guys who were attacking the stimulus–Krugman looked at the change in unemployment from 2007-2010, as you can see when Krugman introduces his chart above.

By all means, Daniel Kuehn and others, point out in the comments that strictly speaking, Krugman hasn’t contradicted himself in these two posts. But if you don’t see why he’s being slippery with his opponents, I guess we’ll have to agree to disagree.

good catch. Krugman Kontradiction a keynesian equivalent of Murphy’s laws?

Picking on Krugman is too easy. Maybe you should pick on Stiglitz for a while. He has had pull with two presidents and seems to disdain the thought of a transaction going untouched by government intervention. A guy who really scares me is James K. Galbraith. Stiglitz and Krugman both defy logic. However, Galbraith is smooth and makes socialism sound so painless and so righteous.

I agree, Galbraith is a socialist and cannot be trusted with power. However, one of the points Galbraith regularly makes is that in the 2008 crash (particularly regarding real estate deals) there almost certainly was fraudulent activity that has hardly even been investigated and the perpetrators have simply walked away.

For capitalism to function, there must be a base in the rule of law. Galbraith is calling for law and order, while Obama is busy looking the other way and Krugman just supports Obama without question. As things get worse (which they will do) this question will become more pressing but by then the forensic trail will be cold and washed away. Rebuilding a nation of laws at that point will be difficult, socialism probably will look like an increasingly attractive path when it offers the only way to put a disordered system back together again. Needless to say, the socialists also will be corrupt, but probably it will take some decades for that to be apparent and at least they are efficient at accomplishing simple tasks, like keeping the masses under control.

If you are using circular non-logic it is not a non-sequitur, the mirror cant see himself in a mirror, krugman kontradikting himself is reading an empty book upside-down.

His “hangover theory” is an overinvestment theory of the downturn, which I don’t think he’s abandoning here (is he?). He doesn’t seem to present any business cycle theory here, in fact.

He is saying what was obvious and what he should have said back in the 2008 post: just because the downturn isn’t caused by malinvestments being worked out doesn’t mean that states where particularly inflated housing bubbles have crashed aren’t going to have comparatively worse situations.

The point is this, though – the Conley-Dupor paper relies on interestate variations to estimate multipliers. Housing market conditions can make a difference for interstate variation without being the direct cause of the recession as a whole (everyone agrees they are least they indirect cause through their impact on financial markets).

So “strictly speaking” I’d say this – it seems to me he was wrong to interpret the data the way he did in 2008. But “strictly speaking” you can recognize that housing conditions can impact interstate variations without thinking that working off malinvestments in the housing industry is the ultimate explanation of the crisis.

Strictly speaking, you don’t have to defend the indefensible – PK. There are plenty of other Keynesians with no ax to grind (your term).

Oh, BTW, My comment on your blog, in response to Gene Callahan hit the memory hole.

Are you sure? Sometimes things are held in moderation and I get them a few hours later, or even day(s) if I’m traveling. There was nothing in the spam folder from you.

No, I was responding to Daniel, and his blog post about Papola.

BTW, I have never had any problem with my comments here, Cafe Hayek, mises blog, MR, Money Illusion etc. Can’t say the same thing about DK’s blog. However, DK’s blog is many magnitudes better than J Bradford deLong’s

sandre –

1. I’m not sure Bob’s comment section is the best place to talk about comments on my blog.

2. Blogger is finicky. I don’t think I’ve ever deleted one of your comments.

The bigger point isn’t that he contradicted himself – it’s the he was simply wrong in this 2011 post. He writes: “It makes no effort to control for the differential effects of bubble and bust.”, but of course it does! That’s the whole point of using the IV models. Now, Krugman and Baker both are suspicious of the instruments used. It’s a good stance to take in any situation (suspicion of instruments), but one thing they neglected to do was explain why they thought it was suspicious. I thought the highway funding instrument was pretty good… I was a little unsure about the sales tax intensity instrument.

I have a post essentially saying “meh” to all the responses to the Conley-Dupor paper (including Noahpinion’s) here: http://factsandotherstubbornthings.blogspot.com/2011/05/more-on-conley-dupor-arra-paper.html

If I’m understanding you DK, you are saying Krugman was both wrong in 2008 and in 2011. Your critique is stronger than mine. I defer to you.