And the Winner of the Most Implausible Blog Statement of 2010 Is…

…Scott Sumner!

Just to clarify, “Implausible Blog Statement” means “statement someone made on a blog, that is not likely to be true.” After all, it would be very implausible that someone would post on a blog, “I just took a bath with my toaster.” But that’s not what I mean with this category.

After praising Don Luskin’s thoroughly obnoxious appearance on the Kudlow show, Scott Sumner proceeded to school me in the comments of his post with this answer to my question:

Bob, The Fed’s policies of the last three years have made things really hard for the federal government, as the Fed has caused inflation to fall to the lowest level in my lifetime, which is bad news for the world’s biggest borrower (Uncle Sam.) That’s why the US fiscal position is getting much worse–because of the Fed.

That strikes me as absurd. For one thing, everybody knows that it’s not price inflation, but NGDP growth, that debtors care about. (A little joke there for ya.)

But more seriously, the federal government has added a ton of debt in the last three years, and it plans on adding a lot more in the next few years. So it’s not like we’re looking at a guy who bought a house three years ago and then (price) inflation expectations collapsed.

Furthermore, because of the Fed (I claim) nominal interest rates on newly issued Treasury debt have been much lower than they otherwise would have been.

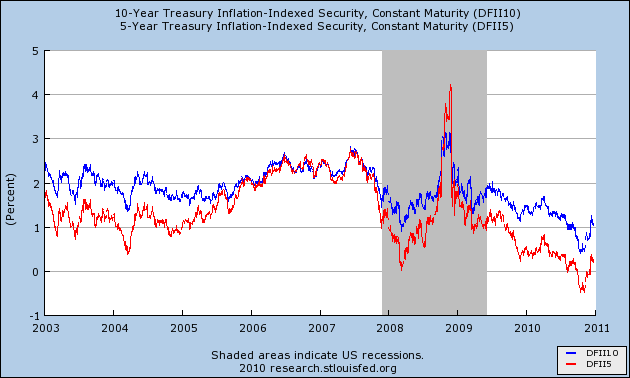

I think Scott is a big fan of TIPS yields. Roughly speaking, that should take into account the nominal/price inflation effects, and show the real cost of government borrowing. And except for that spike (which is Scott’s smoking gun for his thesis that Bernanke was too tight in the fall of 2008), it sure looks to me like the government has been able to borrow more cheaply during the crisis than was the norm before: