IMF Plans for a Global Currency?

Michael McKay showed me a rather alarming paper from the IMF [.pdf]. (Thanks to Floy Lilley for finding the online version; McKay said it had been yanked from the place he originally got it.)

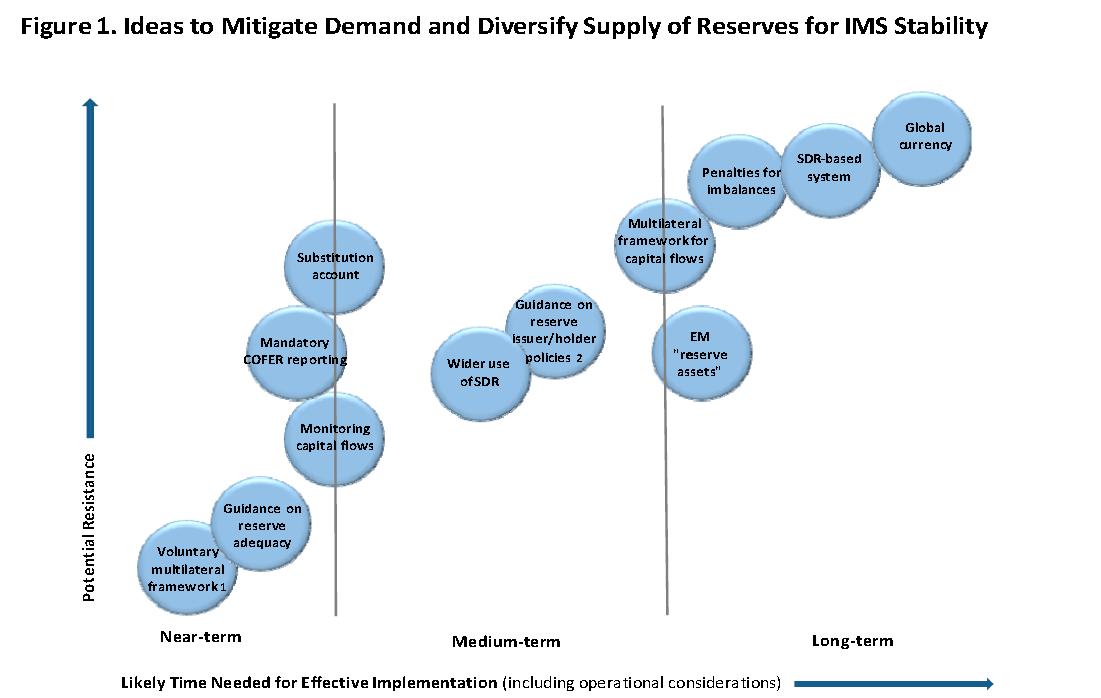

I don’t have time to do a full analysis anytime soon, so I wanted to at least get this out into the paranoid geeconosphere circles. The paper concerns the “problem” of excess demand for dollars reserves, and what central bankers can do about it. Look at this diagram taken from the top of page 4 (note that “EM” means “emerging markets”):

I apologize for the poor quality, but it was tough to scan it and retain readability. (Thanks to Briggs Armstrong.) [UPDATE: Two separate people emailed me cleaned-up versions taken from the PDF file, rather than a manual scan.] But make sure you see that the horizontal axis is “Likely Time Needed for Effective Implementation,” the vertical axis is “Potential Resistance” (!), and the three top-right options are “Penalties for imbalances,” “SDR [special drawing rights]-based system,” and “Global currency.”

The IMF has wanted a single world currency since its foundation. SDR’s were an attempt at just that. Didn’t work out as they planned. I doubt any of their plans will work out.

It will work if people don’t speak out against it.

I can’t speak on the economics of a world currency, however I know for certain that the masses will eat it up, like they do everything else. So they will absolutely try for this.

We know that *they* have wanted a world authority in every sphere of social life since at least the 1930s. CFR Fabian world socialists, all of em.