Why Some of Us Are Really Suspicious of the Banks

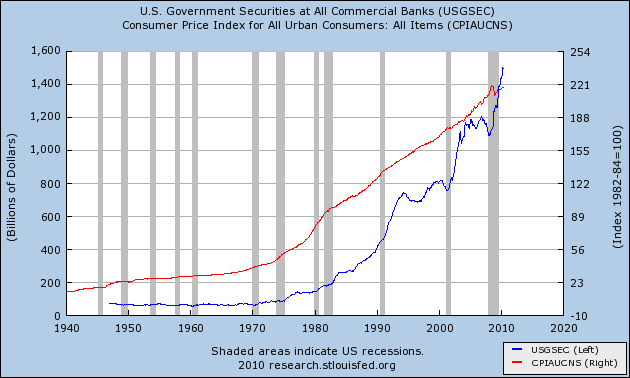

No joke, the elusive von Pepe and I literally sent each other the same FRED chart in crossed emails, because we saw different bloggers mentioning it. The chart shows a huge spike in US government securities held by commercial banks. It looked familiar, so I decided to overlay the CPI:

Now of course, correlation doesn’t prove causality. It’s possible that the commercial banks just want to hold more dollar-denominated bonds when the purchasing power of the dollar drops.

Even so, I think this is strong circumstantial evidence backing up the conspiratorial view many of us hold, that the government and the banks are in league, ripping everybody else off. Once freed from the last vestiges of the gold standard, the government was free to run massive deficits, because the Fed and the commercial banks would be only too happy to provide the “loans.” It’s easy to lend money to the government when the government sets up a system whereby you can create money out of thin air.

Of course, this leads to rising prices, but hey, every system has flaws. Stop being so critical.

Um, you have the chain of causality backwards. The entire reason that states banking in the US was established was so that the states could force banks to buy their debt via the state charter. The nationally chartered banks were the same way wrt federal debt.

How is my story “backwards”? You are saying the same thing I am, except I claim the banks don’t mind being in their position relative to a free market. I am not saying the banks are forcing the government to run deficits.