Krugman/Sumner Death Match: Let There Be Peace on Earth, and Let It Begin With Me

OK when I see Scott Sumner and Paul Krugman (also Mark Thoma) arguing over the best way to destro fix the economy–should Bernanke crank out more $100 bills to buy long-term government debt so the feds can buy more Predator drones, or should Pelosi borrow more directly from the private sector so the feds can buy more Predator drones? Decisions, decisions–I am tempted to get snarky.

But then I see that Krugman and Sumner really are talking past each other, and my compassion kicks in. It’s like going to a kickboxing fight when the gladiators are blindfolded and can’t even hit each other. Booooring.

I’m not going to bother quoting and parsing. Here is my take on the big-picture worldviews here. I offer this because Scott Sumner actually sometimes publicly acknowledges my existence, and this could actually affect his future posts. (I hold out no such hope for Krugman. Maybe one day he’ll notice me. Then I will be special.)

WHAT KRUGMAN (AND I THINK THOMA) IS SAYING:

The goal is to boost aggregate demand, so that actual output equals potential output and everybody is employed. When the government runs a massive fiscal deficit right now, that necessarily boosts current aggregate demand. The freshwater economists who invoke “Ricardian equivalence” to supposedly disprove this are liars, idiots, or possibly both. What Ricardian equivalence says is that for a given stream of government spending, it doesn’t matter how you finance it. Whether you run a balanced budget or run deficits in the near-term, rational taxpayers will set aside what they need in order to pay future tax liabilities (which will be higher if there is a growing public debt). So for example, you can’t stimulate the economy by giving a massive tax cut today, while not cutting government spending. Whatever the IRS hands back to taxpayers, the Treasury takes right back in the loan market. Real interest rates don’t change either (no crowding out), because the increased government borrowing is perfectly offset by the increased taxpayer savings.

But Ricardian equivalence has NOTHING to do with the case where government decides to increase its current level of spending. Even if current taxpayers see the rising deficit and think, “Uh oh, there goes Obama’s pledge not to raise my taxes,” they are still not going to perfectly offset the government’s new spending. It doesn’t matter whether people believe the feds will keep it up; the point is to boost aggregate demand this year, and that’s exactly what will happen.

I’m surrounded by freaking idiots!! Where’s my bike, I need to burn off some steam.

WHAT SCOTT SUMNER IS SAYING:

People are knocking out a monetary solution to our current problems, by saying that the markets expect future Ben Bernanke will take actions to undo the policies implemented by today’s Ben Bernanke. OK, that’s true as far as it goes, but by the same token future Ben Bernanke could cut the monetary base by 85% in 2011 if he wanted to thwart Pelosi’s fiscal stimulus. So what’s Krugman’s point? That’s like saying monetary policy won’t work because Martians might come, say they hate Friedman and Schwartz, and unleash the invasion. True, but maybe the Martians hate Keynes too.

Man people are thick. I knew I should have moved to China.

An economics blog is a terrible thing to waste.

Are You Scared Yet?

[UPDATE below.]

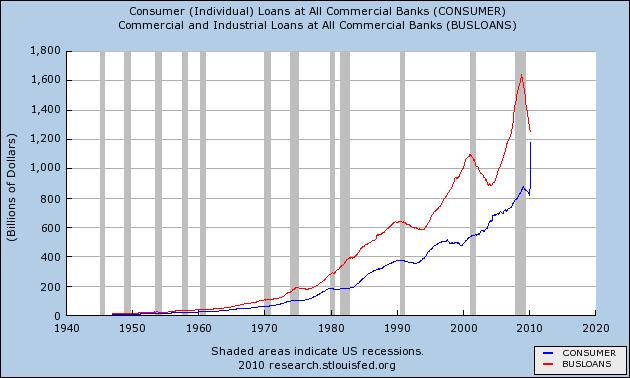

Alasdair Macleod wants to know what I think about this:

Since I’m not a Keynesian, and actually believe in a structure of production, this is what I think.

UPDATE: Mark Wise–whom I used to work with in the financial sector–talked me down from the ledge. He linked me here, and said:

This is the April 9th H.8 release from the Fed. Basically on this date FASB 166 and 167, which were passed at the height of the financial crisis finally came into force, requiring banks to recognize a bunch of off balance sheet A + L on their balance sheet. The main category affected was consumer loans.

“As of the week ending March 31, 2010, domestically chartered banks and foreign-related institutions had consolidated onto their balance sheets the following assets and liabilities of off-balance-sheet vehicles owing to the adoption of FASB’s Financial Accounting Statements No. 166 (FAS 166), Accounting for Transfers of Financial Assets, and No. 167 (FAS 167), Amendments to FASB Interpretation No. 46(R). Domestically chartered commercial banks consolidated $377.8 billion in assets and liabilities. The major asset items affected were: other securities, mortgage-backed securities, -$5.6; other securities, non-MBS, -$15.9; commercial and industrial loans, $32.3; real estate loans, revolving home equity loans, $5.8; real estate loans, closed-end residential loans, $21.5; real estate loans, commercial real estate loans, $1.2; consumer loans, credit cards and other revolving plans, $323.9; consumer loans, other consumer loans”

Basically its an accounting gimmick. If you adjust the data to remove the added loans, you actually see that consumer loans continue to fall rather than spike up. Hope this helps.

I don’t have the time to do any more research on this, but Mark seems to have solved the mystery. I would believe that total debt shot up like that, thanks to Obama & Friends, but I couldn’t believe consumers and banks would be that crazy (hence my horror).

Incidentally, to explain my original reaction: The drop in business loans is good, that’s what should happen after an unsustainable boom. But I thought it was being mostly offset by an increase in debt-fueled consumption. So that would have meant the last year showed “artificial prosperity” (!!). Hence the scream.

Obama vs. Ron Paul

The Austrian economics stuff is just bonus. Look at the difference between these two. *swoon* (HT2 LRC)

“The World Is Ending! The Market Value of Money Market Accounts Is Dropping! Aaaaaaaa!”

[UPDATE below.]

I need to do some more research before I open fire on David, Robert, Ambrose, and all my friends, but I think these guys are all missing some really basic stuff here.

Fortunately for their self-esteem, I am really busy and don’t know when I can deal with this in a careful (and more respectful) fashion.

For now, let me give you an idea of where I’m coming from. Take this quote from the article that has everyone in a tizzy:

Mr Ashworth warned against a mechanical interpretation of money supply figures. “You could argue that M3 has been going down because people have been taking their money out of accounts to buy stocks, property and other assets,” he said.

To me, that sounds analogous to someone saying:

“You could argue that the number of oxygen atoms in the universe has been going down because the growing population has been taking oxygen out of the air in order to engage in respiration.”

UPDATE: Actually in retrospect Mr. Ashworth might be making my point, so I shouldn’t be accusing him of saying something dumb. What I’m saying is that I think it’s possibly very wrong to talk about “the money supply” changing when people take “money” out of MMMFs and put it into stocks. If I sold my TV and bought bottled water instead, nobody would worry about the change in the money supply. I think a similar thing is going on here, though it’s obviously more defensible to put MMMFs into a monetary aggregate (namely M3) than bottled water or stocks.

Housekeeping Note for PIG-ish Readers

Sorry for the gauche announcement but this is a lot easier than sending a bunch of emails: If you ordered the PIG books a few weeks ago, I shipped them out on Saturday. So you should be getting them soon. However the postage differed based on your location and whether I shipped one or two. That means I need to make up individualized invoices for everybody.

So just sit tight until I email you an invoice. Read a book or something.

Glenn Greenwald vs. Eliot Spitzer

Arguing about the Israelis boarding the flotilla etc. What’s amazing about this controversy is how people on both sides are acting like it’s self-evident that they’re right and the other side are evil monsters. E.g. GG on his blog is mad that Obama is hemming and hawing rather than condemning the actions like most other world leaders, whereas on the radio today Sean Hannity was going nuts that Obama wasn’t endorsing wholeheartedly Israel’s right to defend itself from terrorists. (BTW I can only listen to Sean Hannity in 2-minute bursts. I was flipping and was curious to hear how he would discuss this situation.)

I think someone like Gene Callahan would say, “See? That’s why empty slogans like ‘non-aggression’ are useless; both sides claim self-defense in this episode.”

Of course, someone like Stephan Kinsella could say, “See? That’s why it’s important to have a logical theory of where property rights come from, so we can identify the actual aggressors in a conflict.”

Nice Article on ShadowStats’ John Williams

Here. (HT2 Jeff Hummel) An excerpt:

Is Williams a crank? Is he cynically selling flawed economic models to panicky investors? Some of the country’s most prominent economists certainly think so. But perhaps a better question is: after a catastrophe brought on by people who get paid to be the stewards of our economy, how can you tell who to trust? After all, Williams isn’t the only Cassandra out there. Over the last ten years, a small collection of economists, investment analysts, and hedge fund managers were warning that something was dangerously wrong with the economy, only to be openly mocked from the pulpits of CNBC. On subjects from derivatives and subprime loans to Bernie Madoff, experts in suspenders assured us that nothing was wrong.

Murphy on Krugman on Hoover…Again

The one new thing in this piece is that I put a bunch of my arguments into chart form. Maybe this time they will sink in.

If you are bored feel free to email the article to Krugman. I would really love to hear what he has to say about my points. I suppose he could go like this, “According to Murphy’s logic, since we had bigger deficits and looser Fed policy this time around, the economy should be worse off than it was in 1931. But obviously that didn’t happen. What an idiot.”

Recent Comments