The Form of Saving Matters

This one is for serious econ geeks. It is another chapter in the never-ending saga of fighting over fractional reserve banking. The best part:

To repeat, [Bill] Woolsey thinks he has answered this objection by telling a story in which the banks do lend money to precisely those firms who would have sold more corporate bonds to the public, in the first scenario. And then Woolsey admits that this is a “heroic assumption.” Does everyone see the problem here? The Rothbardians level an objection, saying the free bankers are ignoring an important real-world consideration, then Woolsey assumes away the problem and declares that he has met the Rothbardian objection.

He’s Got the Music In Him

This guy really enjoys his job. (HT2 AJM) Note that he takes the glasses off during a performance.

Hey Rich Guy, You Weren’t Going to Use That Money, Right?

I realize this is nothing new, but man I just can’t get over how little the pundits care about property rights. Did they miss a lesson on the schoolyard growing up? Here’s Krugman:

…[I]t would be a terrible idea to make the high-end tax cuts permanent; that would be a huge drain on the public finances, serving no good purpose.

Manuel Ayau, RIP

An obituary from Richard Ebeling:

One of the outstanding leaders of individual liberty and economic freedom in Latin America, Dr. Manuel Ayau, passed away on August 4, 2010 at the age of 85.

Many Americans may not be familiar with his name or his contributions to the cause of liberty, but he was most assuredly one of the “movers and shakers” in defense of capitalism in the Spanish-speaking world.

His greatest and most lasting achievement was the founding in 1972 of Francisco Marroquin University (FMU) in Guatemala. He also served as its first president until 1988. Under his stewardship, FMU has developed into one of the most academically respected institutions of higher learning in Central and South America, not only offering undergraduate degrees but graduate programs in medicine and dentistry, as well…

“The Sunset of the State”

This is pretty sweet (HT2 Jason Osborne)…

On a related note, how much would you folks chip in to see Stefan Molyneux debate me on Intelligent Design theory? If the pot breaks $20,000, I bet we could arrange it. Book-signings and karaoke to follow the main event.

Krugman’s “Call” Back in Early 2009

One of the great things about this piece (which I linked earlier) is that the guy, relying on comments at Krugman’s own blog, refreshes our memory on exactly what the Nobel laureate said back when the stimulus was being discussed.

You see, if you had just been reading Krugman lately, you would have thought that he perfectly predicted how bad the economy would get with the small stimulus, and that the administration economists screwed up because they inexplicably used the wrong calculations in their own Keynesian model. (Try this self-congratulatory Krugman post, for example.)

But as commenters at Krugman’s blog apparently pointed out, here’s what he said on January 6, 2009:

Now, what we’re hearing about the Obama plan is that it calls for $775 billion over two years, with $300 billion in tax cuts and the rest in spending. Call that $150 billion per year in tax cuts, $240 billion each year in spending.

…

Let’s be generous and assume that the overall multiplier on tax cuts is 1. Then the per-year effect of the plan on GDP is 150 x 1 + 240 x 1.5 = $510 billion. Since it takes $300 billion to reduce the unemployment rate by 1 percentage point, this is shaving 1.7 points off what unemployment would otherwise have been.Finally, compare this with the economic outlook. “Full employment” clearly means an unemployment rate near 5 — the CBO says 5.2 for the NAIRU, which seems high to me. Unemployment is currently about 7 percent, and heading much higher; Obama himself says that absent stimulus it could go into double digits. Suppose that we’re looking at an economy that, absent stimulus, would have an average unemployment rate of 9 percent over the next two years; this plan would cut that to 7.3 percent, which would be a help but could easily be spun by critics as a failure.

And that gets us to politics. This really does look like a plan that falls well short of what advocates of strong stimulus were hoping for — and it seems as if that was done in order to win Republican votes. Yet even if the plan gets the hoped-for 80 votes in the Senate, which seems doubtful, responsibility for the plan’s perceived failure, if it’s spun that way, will be placed on Democrats.

I see the following scenario: a weak stimulus plan, perhaps even weaker than what we’re talking about now, is crafted to win those extra GOP votes. The plan limits the rise in unemployment, but things are still pretty bad, with the rate peaking at something like 9 percent and coming down only slowly. And then Mitch McConnell says “See, government spending doesn’t work.”

It’s true, Krugman didn’t say, “I bet my life that unemployment won’t break 9.2% with stimulus spending,” but the point is that he has done the same category of error as the official Obama Administration economists.

What’s really funny is that I am pretty sure Krugman has quoted from this very blog post before, to show his readers, “Hey, I told you guys this would happen.” But I’m also pretty sure he just quoted the Mitch McConnell stuff, and not the part where Krugman talks (conditionally) of a 7.3% average unemployment rate in 2009-2010, or of an unemployment rate that peaks at 9%. (If someone can actually find where Krugman quotes from this January 6 blog post, that would be great.)

Bottom line: You can’t trust Krugman’s version of history, whether he’s discussing Herbert Hoover’s fiscal record or Paul Krugman’s prediction record.

(And yes I have made some bad predictions myself, but I hope I didn’t make lemons into lemonade with them a la Krugman.)

Tom Woods Touts the Mises Academy

Man, if I weren’t busy with my own course, I’d love to take Tom’s. I am almost afraid to show this, because it might steal some of my customers. Oh well, bring it, Woods.

IMF Plans for a Global Currency?

Michael McKay showed me a rather alarming paper from the IMF [.pdf]. (Thanks to Floy Lilley for finding the online version; McKay said it had been yanked from the place he originally got it.)

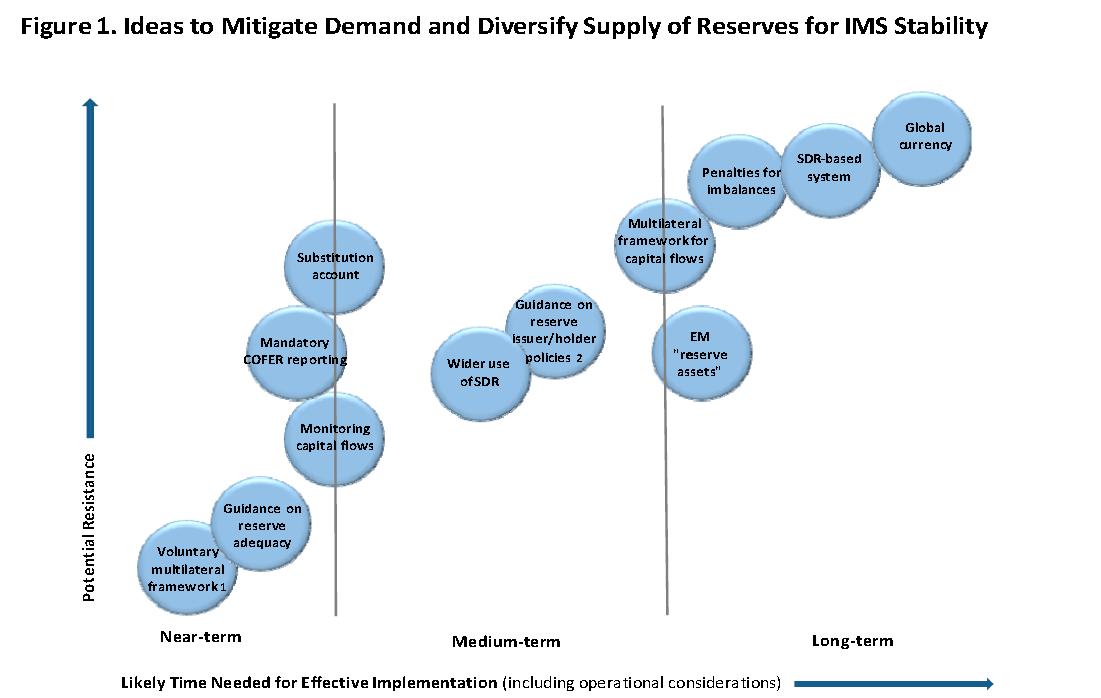

I don’t have time to do a full analysis anytime soon, so I wanted to at least get this out into the paranoid geeconosphere circles. The paper concerns the “problem” of excess demand for dollars reserves, and what central bankers can do about it. Look at this diagram taken from the top of page 4 (note that “EM” means “emerging markets”):

I apologize for the poor quality, but it was tough to scan it and retain readability. (Thanks to Briggs Armstrong.) [UPDATE: Two separate people emailed me cleaned-up versions taken from the PDF file, rather than a manual scan.] But make sure you see that the horizontal axis is “Likely Time Needed for Effective Implementation,” the vertical axis is “Potential Resistance” (!), and the three top-right options are “Penalties for imbalances,” “SDR [special drawing rights]-based system,” and “Global currency.”

Recent Comments