CPI Officially Fell At 1.2% Annualized Rate in March (!)

Well hmm. If today’s CPI numbers had shown a positive (seasonally adjusted) growth rate, I was all set to trumpet from the mountaintops: “WAKE UP PEOPLE!! Bernanke et al. keep warning us of ‘deflationary’ pressures when there were three straight months of price hikes higher than the Fed’s alleged ‘comfort zone’ throughout the whole first quarter of 2009!!”

But alas, my case is now rendered dubious by the announcement that the (seasonally adjusted) CPI fell 0.1% from February to March.

OK look kids, yesterday I tried to do the honest thing by admitting that the falling PPI number was disconcerting, for those of you who share my estimate of my own economic acumen. So I hope you will not now roll your eyes when I question these BLS numbers.

First off, if you look at the actual BLS release (top row), you’ll see that the unadjusted CPI rose by 0.2%–an annualized rate of 2.4%–from February to March. OK? So the BLS’s “seasonal adjustment” took a 0.2% increase and transformed it into a 0.1% decrease. Notice that that’s a change of 150% downward from the raw number.

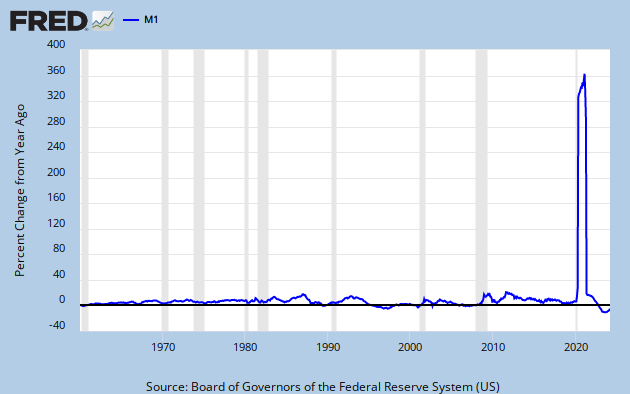

So you say, “Well, is that an unusual swing for the adjustments?” I don’t know, since I didn’t spend my childhood analyzing BLS releases. But for what it’s worth, if we go into the BLS archives for last month, we see that the unadjusted Jan-Feb increase in CPI was +0.5%, which the seasonal adjustment revised down to +0.4%–a downward revision of 20%. (Note that 20% << 150%.) Last point, and I realize this is anecdotal: Have you folks been grocery shopping lately? I am quite sure that the prices of just about everything are a lot higher now than they were a year ago. I had dabbled with the idea of looking into our Excel budgets for past months to compare grocery bills, but that would be useless since we used to shop more at Whole Foods (“Whole Paycheck”) and now we’ve worked Kroger more into the mix. =============== WHY I THINK LARGE PRICE INFLATION IS COMING Let me very briefly explain why all the people talking about “credit unwinding” etc.–and making comparisons to the Great Depression–are missing a big point. From 1929-1933, the quantity of money (let’s say M1) declined by about one-third. During 2008, M1 increased by 17%. OK, everyone got that? Not only did Bernanke prevent the quantity of money held by the public from falling, he boosted it at one of the highest annual rates in history. I’m not talking about bank reserves or the Fed’s balance sheet–which Bernanke of course has exploded–I’m talking about cash in circulation and checking account balances.