DeLong Gives Me Whiplash

[Two UPDATEs below, one embedded and one at the end.]

I have to be brief, so if you’re a newcomer to this blog, you won’t get much from this. But back in early 2009, Brad DeLong was very skeptical about the ability of the Federal Reserve to rescue the world economy from the ravages of the Great Recession. Here’s DeLong from January 2009: “The fact that monetary policy has shot its bolt and has no more room for action is what has driven a lot of people like me who think that monetary policy is a much better stabilization policy tool to endorse the Obama fiscal boost plan.”

[UPDATE: I realized I didn’t give a long enough quote to see why there is no wiggle room here. Earlier from DeLong’s January 2009 post:

The difference between now and 1982 was that back in 1982 the interest rate on Treasury bills was 13.68%–there was a lot of room for the Federal Reserve to cut interest rates and so reduce unemployment via monetary policy. Today the interest rate on Treasury bills is 0.03%–there is no room for the Federal Reserve to cut interest rates, and so monetary policy is reduced to untried “quantitative easing” experiments. [Bold added by RPM.]]

Then later, when Scott Sumner was the toast of the town, DeLong made it sound like he’d been on board with NGDP targeting all along. For example, in January 2011 DeLong put in a seminar paper:

So a bunch of us went nuts at the time, pointing out what a total rewrite of history this was. (E.g. here’s Sumner.) I can’t find the link, but at the time DeLong bit my head off for daring to suggest that he had ever cast aspersions on the power of the Fed in the beginning of the crisis.

And now we’ve come full circle. In a book review DeLong writes:

The dominance of Friedman’s ideas at the beginning of the Great Recession has less to do with the evidence supporting them than with the fact that the science of economics is all too often tainted by politics. In this case, the contamination was so bad that policymakers were unwilling to go beyond Friedman and apply Keynesian and Minskyite policies on a large enough scale to address the problems that the Great Recession presented.

Admitting that the monetarist cure was inadequate would have required mainstream economists to swim against the neoliberal currents of our age. It would have required acknowledging that the causes of the Great Depression ran much deeper than a technocratic failure to manage the money supply properly. And doing that would have been tantamount to admitting the merits of social democracy and recognizing that the failure of markets can sometimes be a greater danger than the inefficiency of governments.

The result was a host of policies based not on evidence, but on inadequately examined ideas. And we are still paying the price for that intellectual failure today.

Fortunately, we don’t need to speculate on how the above three positions all mesh perfectly, as I expect Daniel Kuehn will inform us in the comments.

UPDATE: Daniel Kuehn in the comments tries to defend DeLong by making a distinction between conventional and unconventional policy, and that’s what DeLong did back in 2011 when I noted the apparent inconsistency. But that won’t do. DeLong in 2011 is claiming that pre-crisis, he thought the Fed could and would do whatever it took to keep NGDP growing–including “helicopter drops.” In case it’s not clear, let me make it so: A “helicopter drop” means the Fed literally gives money to the public, without even bothering to buy assets. It is further from conventional monetary policy than QE is. You don’t rely on interest rate adjustments if you’re using helicopter drops to boost aggregate demand.

So, the only way to make sense of DeLong’s 2011 post, in light of what he said in 2009 (and now), is this: “Back before the crisis, I was convinced the Fed would ignore naysayers like me when it implemented unconventional policies. I am frankly astonished they took me seriously.”

As you’ve said, there’s already been lots of talk about how your confusion about Step 1 DeLong and Step 2 DeLong is unwarranted – that they’re not saying different things. Since you don’t seem to have trouble seeing Step 3 DeLong as comparable to Step 1 DeLong, the meshing of all three shouldn’t be that much of a mystery – just go back and see why people thought you were confused in 2011.

In a nutshell, to say things like we needed to go “beyond” Friedman, that the monetarist cure was “inadequate” and that the problem is “deeper”, is not really a disagreement about proper policy at the Fed at a time like this. It seems clear to me that the point is we also need some policy action from Congress.

Two errors confuse people on all this:

1. The error of assuming fiscal policy and monetary policy offer an either/or menu of policy options, and

2. The error of not distinguishing between what people call conventional and unconventional monetary policy. Someone like Sumner has a very unified view of what “monetary policy” means. That’s fine and defensible, but you can get into interpretive trouble if you impute that view to others.

Daniel,

In 2009 Delong says that monetary policy has shot its bolt.

In 2011 he says that 3 years before (which would have been 2008) he had thought fed policy using helicopter drops could have been effective.

The only way to reconcile these views (discounting the idea that he changed his mind between 2008 and 2009) is to believe that he doesn’t think that the fed using helicopter drops counts as monetary policy. Is there any evidence that he has that view ?

See #2 above.

Or see the DeLong post for context (beyond what Bob quoted) of what bolt has been shot.

Or see the enormous discussion we had about this in 2011 or whenever it was.

Or don’t. I’m starting to wonder whether this will ever be put to rest.

Daniel, is a “helicopter drop” of money considered conventional or unconventional Fed policy? Has it been tried yet in U.S. history?

I don’t know if QE would be considered helicopter drop or not. What a lot of people like about the idea is that you’re just throwing money at everyone. Obviously with QE you’re not really doing that so I’m sure a lot of people would not consider it that.

Anyway, when people have used the term over the last couple years “conventional” has meant either interest rate changes or (going back to the brief monetarist stint) money supply adjustments. People generally seem to be taking QE as “unconventional”. I imagine helicopter drop would be too.

I’m probably not the best person to provide a taxonomy of monetary policy options.

I don’t know if QE would be considered helicopter drop or not.

That’s not important for my point though, Daniel. Let me clarify:

(1) Is a “helicopter drop” considered conventional or unconventional monetary policy?

(2) Before the 2008 crisis, had the Fed engaged in a “helicopter drop,” or at that point, would it have been considered an untried policy?

So I thought I had said (1.) unconventional, and (2.) it hasn’t so far as I know. I was only cautioning that “helicopter drop” originated as an off-handed remark sort of thing. Some people might consider QE a helicopter drop some might not.

DK wrote:

I’m probably not the best person to provide a taxonomy of monetary policy options.

Then why are you so confident that Sumner and I are wrong when we say DeLong flipped from 2009 to 2011?

Ummm… for all the reasons I’ve given, none of which depend on an expert taxonomist I don’t think. I’m just saying I don’t know all the ins and outs of how they thought about policy instruments before IT and interest rates, or all the details on the money supply targeting stuff, or what came before that. A monetary historian is probably better at walking you through those things. But unless I’m missing something I don’t think I need to be some kind of expert taxonomist to point out that when DeLong says “conventional” he (and everybody else that uses it) is using it to refer to interest rate adjustments. There’s no deep intellectual mystery here. There was a post where he literally numbered the different kinds of monetary policy.

Brad DeLong has personally confirmed my read of him in these past conversations. All I’m saying above is “I am not Allan Meltzer. Please consult Allan Meltzer if you want to talk to Allan Meltzer.”

??? And in our interview for the Lara-Murphy Report, Peter Schiff said he hadn’t been wrong on inflation predictions. So I guess you’ll expect Krugman to drop that allegation?

The moral of the story is not “trust what anyone claims”. The moral of the story is at the very least to trust DeLong and Schiff to know and explain their own minds. Dispute them on the arguments or the facts if you want but they have a distinct advantage in knowing what their claim is.

“Your distinction between conventional and unconventional monetary policy is a bad one” is admissible.

“You make no distinction between conventional and unconventional monetary policy despite repeatedly telling me that you do” is inadmissible unless you’ve got some damn good evidence to convince people otherwise. And considering he lays out the distinction in plain English, I don’t think you do.

My victory is complete.

+2

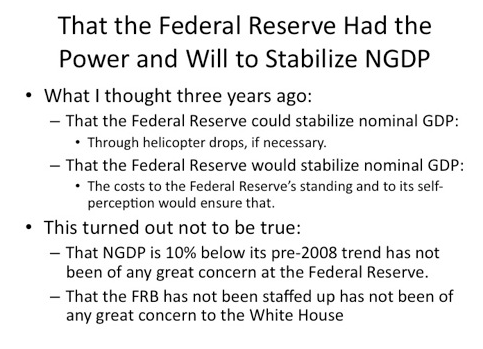

I notice neither you, nor even Murphy, are considering the bullet point from DeLong that makes “the three” arguments incompatible.

You keep claiming Murphy is “confused” but his conclusion is in fact correct.

Before I show that, I want to emphasize that it is unwise to blindly trust what either DeLong or Schiff based solely on the fact that they said it. Many people, especially in political economy, are not completely honest with others, because in many instances they are not able to be honest with themselves.

So when you insist that Murphy has to go by DeLong’s current assessment of what past DeLong wrote, as if, and I am not saying you are doing this intentionally, that the choice is between pure assumption by Murphy on the one side and blind faith in what DeLong says on the other, well that misses the elephant in the room which is what we can understand through reading and understanding the author’s own words.

With that out of the way…

Look at the second bullet point in DeLong’s “What I thought three years ago”. He wrote in Jan 2011 that he thought that the Fed WOULD in fact stabilize NGDP. This of course means that 2011 DeLong is claiming that 2008 DeLong believed that the Fed did NOT “shoot its bolt”. This is not about whether or not 2011 DeLong is claiming that 2008 DeLong meant that the Fed could only stabilize NGDP through ” unconventional” methods. 2008 DeLong wrote that monetary policy shot its bolt and so “people like” DeLong went to conclude fiscal stimulus, I.e. more government spending, had to be included. Included why? So as to stabilize NGDP, which 2011 DeLong claimed 2008 DeLong believed the Fed could do all on its own. Hence the statement “I believed the Fed WOULD stabilize NGDP”.

DeLong is being logically inconsistent, and your claim that he “personally” told you “Yeah! You get ’em with that interpretation!”, which is DeLong’s way of using you for his own kooky economics agenda and stroking his own ego watching you gush at being mentioned by him, has absolutely no credibility whatsoever. There is no reason to take seriously the anecdotes made by starry eyed wool over the eyes acolytes who are trying to use them back by mentioning that they corresponded with you. It makes me I’ll watching that silly game of thrones quite frankly.

DeLong quite clearly contradicted himself, which is what tends to happen to political hacks masquerading as economists.

http://research.stlouisfed.org/fred2/graph/fredgraph.png?g=165g

Pretty clear that around 2010 the Bernanke Fed chose to stabilize PPI which essentially links the US dollar to commodity prices, thus rediscovering the age-old concept of commodity money.

Yellen is a bit more hands off but she seems to be keeping it in the ballpark. Peter Schiff says QE-4 is coming, I tend to agree with him, just a matter of when (and there’s always the chance QE-4 might have secretly started already, because as the saying goes, “When it becomes serious, you have to lie.”

“It would have required acknowledging that the causes of the Great Depression ran much deeper than a technocratic failure to manage the money supply properly. And doing that would have been tantamount to admitting the merits of social democracy and recognizing that the failure of markets can sometimes be a greater danger than the inefficiency of governments.”

-So wait…Brad DeLong is a quasi-Austrian? Or at least some kind of RBCer? But a social-democrat one who thinks that the market, not state interference, is the main cause of most financial crises?

There is no way QE can be considered a helicopter drop. One thing that is abundantly clear from the stock market outperforming the economy, after 2009, is that the helicopter hovered over banks and other investors, not the general populace (who, by some accounts, are the ones who boost aggregate demand).

Yup. QE is a helicopter drop, but primarily over those desiring to sell their copious stores of treasury bonds and mortgage-backed securities.

Khodge,

I agree QE was a helicopter drop for the banking and financial sector. Latter QEs provided back door sovereign debt support.

When “official” Fed QE ended (assuming they aren’t lying) it shifted largely to Japan. Now to the EU. I suspect it will boomerang back here in as QE4 although they may need a fancy new name to keep the gullible distracted

It does appear that the Fed doesn’t know what it is doing, which means that the “global economy” is rudderless. I don’t think that Japan and the EU have the where with all to perform a QE.

Murphy, I asked you this in a previous post:

Do you think Market Monetarism is a superior theory than Keynesianism?

Also, and this is a new question:

Do you think that Market Monetarist ideas are better suited against Keynesianism than Austrian theory?

MF I think Market Monetarism is a variant of Keynesianism. I definitely find the market monetarists to be a lot harder to critique than the typical Keynesians pushing fiscal stimulus.

Thanks Murphy.

Soooo….yes with reservations?

Bob, OT, but just wondering: would the crises that occurred in Mongolia, Cuba, and North Korea in the 1990s count as demand or supply shocks?

Either you need to explain your updates to me like I am five years old or I need to restate my (our?) position.

So here it goes on my restatement:

Pre-crisis: Monetary policy good.

2009: This is not 1982. All that we have is unconventional. Fiscal policy good. Fiscal policy good ≠ unconventional monetary policy bad. Fiscal policy good = conventional monetary policy moot.

2011: Pre-crisis I thought monetary policy good, both conventional and unconventional. Post-crisis I learned Fed is not really into unconventional monetary policy. This makes fiscal policy even more of an imperative.

2015: Monetarism was inadequate and Keynesianism is important.

So where you might criticize DeLong here is that in 2009 he seemed somewhat confident the Fed could make a real contribution along with fiscal policy and by 2015 he was considering that more politically naive. That just seems like older and wiser Brad DeLong reflecting on younger and less wise Brad DeLong to me.

And considering that I am even younger and less wise than the young and less wise Brad DeLong of 2009, I can’t be that hard on him on that count.

“That just seems like older and wiser Brad DeLong reflecting on younger and less wise Brad DeLong to me.”

There you have it folks.

When passages are inconsistent, go through a zillion hoops to convince the acolytes, then when they finally admit the inconsistency, shrug and say “They just improved and got even better, leave ’em alone.”

Notice I said “might” criticize, because it’s not even clear 2009 and 2015 are all that different. But even if they are I don’t think you’re using the word “inconsistent” very accurately here. Let’s say he was more politically naive in 2009 and less in 2015. That would only really be “inconsistent” if in 2015 if he was denying he ever said what he said in 2009. Quite the contrary, DeLong has been exemplary at pointing out where he had things wrong in the past.

If being wrong in the past and having a different view today is “inconsistent” then the only way to be consistent is to be omniscient and none of us fit the bill.

@everybody – DeLong is a bit of a loose cannon–he shows this all the time–but so what? He’s flexible in mind, even contradictory, which is a sign of intelligence. Keynes was the same way. “Brittle” economists like say Scott Sumner and Milt Friedman are more dogmatic but less interesting, with their monothematic themes (Friedman with his thesis the Fed caused the Great Depression, which is a stretch given that Great Depressions occurred even before the Fed was invented; Sumner with his NGDPLT hypothesis as a cure-all). As for monetarism, the jury is indeed out, as DeLong states, whether it even works. Money is neutral or super-neutral nearly always, and prices/wages are not that sticky the data shows. See here for more: http://raylopez99.blogspot.com/

“Friedman with his thesis the Fed caused the Great Depression, which is a stretch given that Great Depressions occurred even before the Fed was invented …”

Economic Cycles Before the Fed | Thomas E Woods, Jr.

http://www.youtube.com/watch?v=TxcjT8T3EGU

Monetary Lessons from America’s Past | Thomas E. Woods, Jr.

[www]http://www.youtube.com/watch?v=91OIBnrjzLU

Let me quickly add that, contra Milton Friedman, the Austrians have a significantly different take on how the Fed caused the 1929 crash* (The Great Depression was caused by government interventions after the crash, in the Austrian view):

Neoconservative David Frum Hearts the Fed

http://www.youtube.com/watch?v=1d1rcaX-lzU

* Technically, in the Austrian view, a crash is a necessary correction of the distorted prices caused by prior artificial credit expansion, and this correction is carried out by the market. Economic crashes are good things.

Depressions are bad and unnecessary, though.

Oh, god. Ray Lopez, ranter extraordinaire, has arrived to CRPM

“which is a stretch given that Great Depressions occurred even before the Fed was invented”

-No, they didn’t. The Long Depression was just a longer version of the Great Recession. The only economic crises comparable to the Great Depression are those in the Communist and Former Communist states and Belgian Congo in the early 1990s and countries undergoing wars.