31

Jul

2014

Thank Goodness the Government Insures Our Checking Accounts

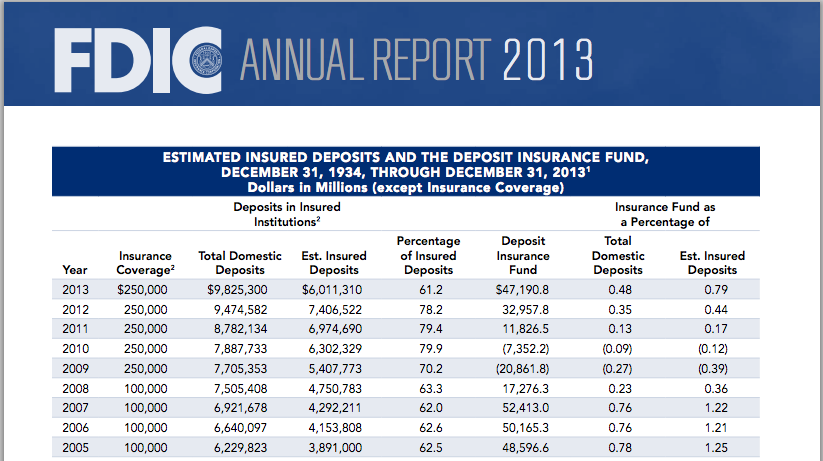

I’m going to write up a longer discussion later, but for right now take a look at this snapshot from page 116 the 2013 FDIC Annual Report:

Notice that in 2009 and 2010, the FDIC fund was negative, meaning it had to borrow money from the Treasury just to make whole the depositors of failed banks. As of 2013, FDIC has a fund of about $47 billion, with which it insures commercial deposits of more than $6 trillion–a coverage ratio of 0.79%.

So remind me why our money is safe in the commercial banks?

It’s all just smoke and mirrors…

However it is interesting that while total deposits increased by about 0.4 trillion from 2012 to 2013, the insured deposits decreased by 1.4 trillion. Does anyone what happened there?

Does anyone *know* what happened there?

I’m guessing M&A could have turned some formerly uninsured deposits into insured ones.

Aah! Or visa versa.

Yup, smoke and mirrors. This is how every level of guberment is. They just slop some stuff on paper and call it a day. No real threat of default, out of business. loss of customer, etc…

Study your town/city budget with a microscope, you will be horrified.

That state required audit is a joke. It is not a scope audit nor forensic audit. The private audit firm simply verifies all the columns add up, never knowing if the money was/is really in the bank. SO long as your town treasure can add/subtract while she/he is lying, it is all copasetic.

Good question skylien, I personally don’t know. Presumably people didn’t lump more than a trillion dollars of separate checking account deposits into single accounts (where total exceeded $250,000).

Schizophrenics have it so easy.

Interesting. Although the FED will pick up the tab if needed. If money printing is all you do, everything is a hammer 🙂

If money printing is all you do you are probably a printing press.

No, the promise is exactly true: If your bank fails, no matter how many other banks fail at the same time, you will receive one or more pieces of paper representing the full and exact number of pieces of paper you have on deposit.

DF Linton how do you know that? Worst case scenario, are you saying the government would just print up $5 trillion in extra cash to hand out to people? They might not say, “Oh wait a second, that could lead to trouble once the banking system settles down.” ?

Bob, do you really think when the bank deposits of vast herds of voters are at stake that politicians will think about consequences? No the FED will be in full liquidity provisioning mode in seconds.

You all are worried about those deposits that are currently insured. My eyes went to the columns about uninsured deposits. The FDIC, FED and Congress have a bad habit of sprinkling the fairy dust of deposit insurance on formerly uninsured deposits. For example in most of my lifetime the deposit insurance limit was 100K then it was 250K but I thought I heard things about all deposits being insured by the FED/FDIC/Government? These uninsured deposits are normally wealthy individuals who have lots of pull with the Feds. Also they know that if the Feds bulk at insuring their stuff that they will take their money someplace else the next time.

And I still do not see things like guarantees for student loans, mortgages and corrupt foreign governments on any of these balance sheets.

“So remind me why our money is safe in the commercial banks?”

Because the Federal Reserve has the power to buy assets off the banks and lend them money through the discount window, and thereby meet their demand for high-powered money — just as in every other nation with a central bank with its own fiat money and the commitment to stabilise the private banks.

Jez, you’d think QE1, QE2 and QE3 would have taught you these basic facts about how the modern monetary system functions, but apparently not.

Your ability to mindlessly troll day-in and day-out is amazing in some ways but incredibly depressing in others.

I don’t think he is trolling or mindless. His post really does illustrate how convinced he is the fiat system is 100% legit, controllable and without downside. There are many like him. Heck, Fed Chairwoman is an ardent Keynesian.

I am telling you all, modern digital global fiat reserveless fractional banking does work. This is socialism. The only real loss is freedom and the only thing that will break the system is when enough people decide not to chase carrots that keep getting smaller or should I say carrots that perpetually lose nutrition.

I agree with you for the most part, but just because beliefs are authentic doesn’t mean a person can’t be “trolling” per se. One of the main aspects of trolling is that the person acts more as a provocateur than someone willing to engage in honest debate. Arguably, LK seems more interested in stirring the pot than exchanging ideas in a healthy way.

Dissent = trolling, the FA mantra.

Ken B,

This has got to be the most blatant trolling on recent posts:

“So you would rather let the politically-connected, stimulus-propped banks crash than for people to kill government regulators for violating their liberty to liquidate as they see fit (cutthroat competition, wage reductions, lay-offs, mergers, etc.)?”

http://consultingbyrpm.com/blog/2014/08/argentina-another-in-a-long-line-of-keynesian-blogger-success-stories.html#comment-771839

What?!

Government uses force to prevent people from liquidating as they see fit.

Say what?!

I count 6 comments just on this thread so far either directly accusing or strongly implying that the dissenters are just trolling. 6 out of 50. That’s quite a lot isn’t it? I think it is clear that that is almost a reflexive reaction to dissent on this blog.

Ken B wrote:

Dissent = trolling, the FA mantra.

Ken B., let me make myself perfectly clear: I was really hoping you wouldn’t come back. I find you do nothing to advance the discussions, and serve only to high-five other trolls.

I don’t simply ban you, LK, Philippe, and others, even though all of you have repeatedly made it clear that not only do you think I have wacky views, but you also think I have a flawed value system. I’m not sure why the three of you stick around, day in and out, since you think this of me and my fans.

So why don’t I just ban all of you? Because I actually feel funny doing that, without some specific rule that you have violated. (Which is odd, since you guys accuse me of constantly responding negatively to criticism.)

I don’t see the three of you hanging out at other blogs. Maybe I just don’t notice it, but it seems like you guys stick around here (maybe because MF is a glass jaw in your opinion and that lets you have target practice).

If you want to disagree with some factual position, fine I can’t in good conscience just ban you for disagreeing. But if you make snide remarks about my character etc. I’m deleting those comments.

Bob, while you are implying I don’t make substantive arguments I will remind you of John 8, and our difference on Landsburg, much less OLGs and debt.

I cannot speak for LK or Phillippe. I object to bad logic, especially when it brings discredit on small l libertarian attempts to reform policy. I object to the creeping irrationality of public debate, which is advanced by conspiracism, and religious special pleading.

Your long comment bolsters my pithy one. It is SOP here to accuse dissenters of trolling, as you just did, or question why they don’t hang around other blogs. (Email me and I will send you the address of a blog where I have been very active.)

“I don’t see the three of you hanging out at other blogs. Maybe I just don’t notice it, but it seems like you guys stick around here”

lol.. Perhaps because you do not look? I have my own blog. What “blogging time” is usually spent there and on MMT/Post Keynesian blogs like Philip Pilkington’s. Philippe also comments regularly on my blog too.

I tried to stabilize my bank account by printing money in my basement, but I’m told by the cops that stabilization is no excuse.

What’s yours? Lol

I think by safety he did not exclude safety of purchasing power.

Geez, you would think that with QE infinity and the rising prices and devaluation of people’s more slow to rise incomes would have taught you these basic facts.

Guess wealthy bankers are more important than poor people to you.

The money will be incredibly high-powered once the Fed is done “insuring deposits”.

So remind me why our money is safe in the commercial banks?

Because it’s insured by the federal government.

Haha.

Just to clarify, I’m “haha”-ing the phonyness of deposits being “insured.”

Just to clarify, I’m “haha”-ing the phonyness of deposits being “insured.”

If the insurance is phony, why did bank runs go from being a common occurance pre-FDIC to virtually unheard of after it was started?

Oh, so you would trust, say, Blue Cross Blue Shield if it was able to cover only 0.79 percent of all potential claims? Would you call that “insurance”?

Oh, so you would trust, say, Blue Cross Blue Shield if it was able to cover only 0.79 percent of all potential claims?

Blue Cross Blue Shield can’t tap unlimited amounts of federal funds if it runs out of money.

And I’m the one accused of being myopic!

Things that are unlimited (not scarce) do not need to be insured.

Oh, so the Fed can just create six trillion dollars out of thin air to cover all deposits. Yay for purchasing power!

Oh, so the Fed can just create six trillion dollars out of thin air to cover all deposits.</i?

In other words, you concede my point.

If the FED can just print all this money to cover these deposits, then why doesn’t the FDIC simply say in their report that all deposits are 100% insured?

Josiah, if you were in the front row of a lecture by Thomas Sowell and he said, “Just because the government provides universal health coverage for everybody, don’t think it’s ‘free,'” I’m guessing you wouldn’t be such a wiseguy. I can’t tell if you’re trolling me or you really can only 6 inches in front of your face at my blog.

It’s a code 18 issue.

The problem is 18 inches away from the computer screen.

Can’t be me then, I just measured and I am 22.5 inches away.

Your eyesight is better than mine.

I can’t tell if you’re trolling me or you really can only 6 inches in front of your face at my blog.

I tend to have that effect on people.

Okay, as a practical matter…how many Americans lost money on their insured deposits 2008-9, the worst postwar recession?

Seems to work.

Excellent blogging Benjamin.

These fools have to be trolling right? The USD would be so screwed.

LK, DF, and Josiah aren’t really trolling IMO. They’re possibly being somewhat terse, likely due to explaining the same concepts over and over again (not just here, most likely in all walks of life). The government could “just print up $5 trillion in extra cash to hand out to people” in the case of a banking collapse. They aren’t operationally constrained. Could there be inflationary consequences? Of course, but I don’t think LK and company ever stated that couldn’t be an issue. In the case of a banking collapse, that $5 trillion in newly printed dollar units would probably be trying to fill a deflationary vacuum in which trillions of dollar units had already been destroyed.

In the 2008 crisis, there were trillions of dollar units created in order to bail out the banks. 9 trillion is probably a VERY conservative estimate. That kind of dollar creation isn’t unheard of.

Like I said, LK and company are probably weary from arguing against many popular financial myths such as “markets, (not the Fed) set interest rates”.

Look, I’m a punk rock classical liberal at heart. I don’t ideologically agree with how the current US monetary system works, but I haven’t seen LK (in this post and many others) ever misrepresent how the monetary system functions operationally.

LK, DF, and Josiah aren’t really trolling IMO. They’re possibly being somewhat terse, likely due to explaining the same concepts over and over again…The government could “just print up $5 trillion in extra cash to hand out to people” in the case of a banking collapse. They aren’t operationally constrained. Could there be inflationary consequences? Of course, but I don’t think LK and company ever stated that couldn’t be an issue.

OK, but when Josiah “explained” to me that FDIC insures bank depositors against losses, you think this was advancing the discussion? That I was going to slap my head and say, “Oh, *that’s* what all those column headers were referring to?”

It’s weird that we’re supposed to give a wider degree of latitude to the people posting hostile comments (often under pseudonyms) rather than the guy who’s running this blog.

Bob,

Agreed, that particular post by Josiah was snarky and didn’t advance the argument. Apologies if it came across that I was defending that particular instance.

Thank you for running this blog and for sharing your insights and ideas.

How was he not? Unless you are implying that the extent of the backing provided by thre FDIC is limited to and constrained by the amounts you list in your spreadsheet you post seems to have no point. Aren’t you saying in effect ” see, the fund went negative, so the backing is illusory”? And to that claim Josiah’s riposte is relevant. That is is also tart is just a bonus.

Yes, the government (Fed) could print up trillions of dollars; however, they aren’t contractually obligated to do so like the FDIC is. Since the Fed isn’t obligated to bail out the banking sector (although it may be likely that they would), and since the FDIC would cover only 0.67 % even though they are contractually obligated to cover more, then I think its relevant for Bob to point out that these deposits aren’t exactly safe from a depositor’s point of view who only considers contract law as relevant when analyzing the security of his deposits.

It should be noted that the creation of FDIC was one of the provisions of the Glass Steagall Act which was not repealed under Gramm Leach Billey. This effectively left the Steagall compromise bits (FDIC) of the act in place while repealing the Glass stuff. An unbalanced mess in other words.

One can argue that the original Glass Steagall was a “balanced” compromise, i.e. Restricting affiliations between commercial and investments banks in exchange for government deposit insurance.

The Gramm bill left the FDIC in place, which was IMO a huge mistake and gave us “TBTF”. Without FDIC, i would seriously doubt if anyone would deposit their hard earned cash in one the Wallstreet casinos.

The Glass-Steagall Myth Revisited

http://tomwoods.com/blog/the-glass-steagall-myth-revisited/