I Hope Nobody Took Brad DeLong’s Betting Advice

(Note for new readers: If this post seems obscure and petty, you must not have been around when this happened.)

Back in February 2009, the new Obama Administration put out an economic outlook that forecast real GDP in 2013 would be 15.6% above the 2008 level. Greg Mankiw was quite skeptical of this forecast, thinking the Administration’s projections were far too optimistic, and brought up what professional economists describe as the “unit root hypothesis” (an econometrics term).

Paul Krugman responded with a blog post titled “Roots of Evil” (obviously combining “unit root” with “the root of all evil”–ha ha that guy’s such a joker), in which he accused Mankiw of “more than a bit of deliberate obtuseness” in Mankiw’s apparent misunderstanding of the nature of the economic slump facing the nation in 2009. Now Krugman’s accusation was totally bogus, since Mankiw in his original post (let alone if one read his actual academic work on the topic) made quite clear that the issue was that we didn’t know when unemployment would return to normal; nobody doubted that there would be strong economic growth if (and when!) millions of people suddenly returned to work. Yet despite misconstruing Mankiw, Krugman–as often happens–was sly enough to make it look like he was merely objecting to the reasons Mankiw gave for doubting the growth forecast; Krugman didn’t actually go on record as saying he believed the forecast. (Furthermore, Krugman was smart enough to ignore Mankiw’s follow-up offer of a bet.)

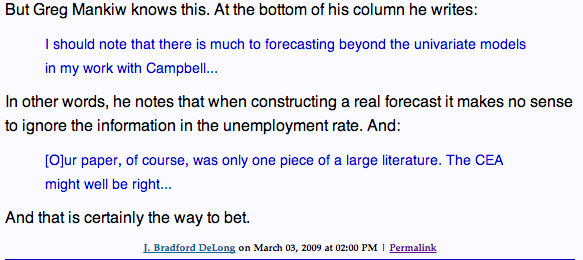

The same escape hatch is not available to Brad DeLong. In response to Mankiw’s criticism of the Administration forecast, DeLong wrote a post that began with “Sigh.” (italics are DeLong’s) to show how frustrating it was to deal with such idiocy. DeLong explains that because the 2009 economy was depressed due to high unemployment, we could expect higher than average economic growth as the unemployment rate quickly fell over the next two years (during which half of the above-natural unemployment should be erased). Then DeLong–like Krugman–acknowledges that Mankiw knows all of this, and ends his post this way:

There’s no wiggle room there; DeLong is saying in March 2009 that the people who understand the nature of the recession should bet with the Obama Council of Economic Advisers that real GDP in 2013 will be 15.6% above the 2008 level, and ignore Mankiw’s warning that sometimes recessions linger on and on and on.

So how did things turn out? Scott Sumner reports that “the actual 5 year RGDP growth just came in at slightly under 6.3%. That’s not even close. Mankiw won by a landslide.”

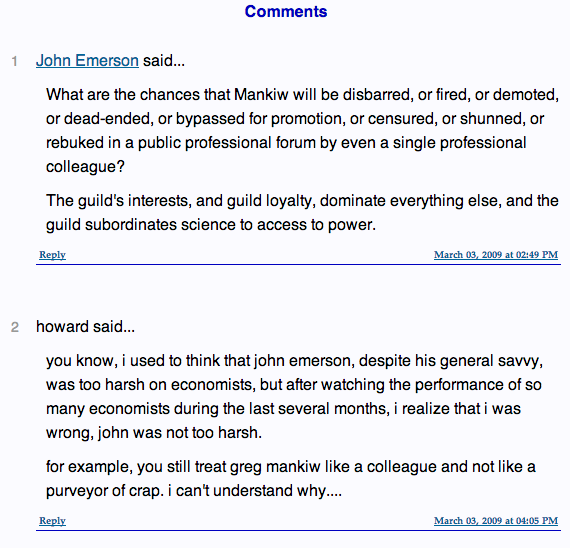

Incidentally, when I went back to re-read DeLong’s commentary on Mankiw, I was greatly amused by the first two comments after his post:

Oh, one last thing: For the defenders of Krugman/DeLong in the comments, please please please don’t say, “They were just saying that once the jobs problem was fixed, economic growth would be above-trend. Of course they knew unemployment might remain high for years; don’t you read their blogs?!” This was Mankiw’s whole point. One might almost say their reaction to him involved…deliberate obtuseness.

Wrongology has many specialised sub-disciplines: Keynesian Economist, Global Warming Scientist, and this joker:

http://www.slate.com/blogs/moneybox/2013/07/17/obamacare_s_going_to_be_great.html

Laugh or cry… might as well laugh, huh?

Yglesias has a unique sophistication and understanding of almost everything:

And not only have conservatives been sharply critical of Barack Obama’s American Recovery and Reinvestment Act, but conservatives have been increasingly critical of Ben Bernanke who, as best one can tell, is a rock-ribbed right-winger appointed to office by George W. Bush.

Hand-in-hand with this trend is, as Dave Weigel reports, Ron Paul’s success in evangelizing among congressional Republicans for the economic thought of Thomas Woods, a figure who conservative congressmen weren’t prone to listen to when he was arguing against Bush’s wartime policies. Now, however, Woods is pushing a fringe economic doctrine that tells the right what it wants to hear so he’s gaining popularity. The doctrine in question is so-called “Austrian” business cycle theory, memorably lampooned by Tyler Cowen. You can see other brief criticism from a libertarian point of view from Bryan Caplan or read Paul Krugman’s 1998 takedown.

But perhaps the best thing to read is this recent item from John Quiggin which lays out the ways in which Austrian Business Cycle theory was, at the time, a major advance but one that’s long since been superseded.

http://thinkprogress.org/yglesias/2009/05/05/192820/the-right-and-austrian-business-cycle-theory/

John Quiggin is an ideolog and even lazier than Krugman (should such a thing be possible). He can’t be bothered studying anything about the Austrian school, so he comes to the conclusion that Austrian economics has no new ideas.

Quiggin wrote that in mid 2009, with the clear implication that he expected the US crisis to be over in a year or two with sufficient stimulus. Well he got his stimulus and it still ain’t over 4 years later… so much for “generally over in less than a year”. Personally I doubt it will be over before the 2016 presidential elections.

Well duh, free banking is exactly the same as competing currencies, because in a free banking environment, each bank can issue their own notes (or coin, or whatever) on their own terms. Because one of the options amongst those competing currencies is a gold standard, the market itself imposes strict controls over fractional reserve banking. Quiggin doesn’t even understand enough economics to be able to explain what Austrians are on about.

Mises in his book “The Theory of Money and Credit (1912)” wrote about central banking mentioning the Bank of England and the German Reichsbank and their influence on the money market at the time, selling treasury bonds and the discount rate. The US Federal Reserve was completely irrelevant given that Mises was European and living in Vienna when he wrote that. I mean, get a clue, dude!

Besides the obvious historical blunder, there’s a perfectly self-consistent theory that says free banking will have small-scale panics and banking crashes (because inevitably someone will push their luck) but these will not result in contagion to the system as a whole. However central banking (and worse, globally linked central banking) ties everything together without solving the underlying problem. Instead of local small-scale problems happening on a haphazard basis we have global large-scale boom and bust happening with a longer cycle time but far more aggressive amplitude.

If choosing between one or the other, central banking is by far the worse of the two evils.

Reading comprehension fail.

1. The phrase you should have bolded is like the current crisis. Anyone familiar with the history of banking-driven crises new that the recession was likely to be a long one.

2. On central banking you missed “in its modern form”. The 19th century central banks did not attempt to stabilise the business cycle in the manner of the Fed.

So Rothbard, living in the USA, wrote about the US central bank and claimed that the Federal Reserve interfered with the monetary system and thus encouraged malinvestment.

You call his ideas “problematic” based on the evidence that Mises, living in Europe, a whole generation earlier, had offered a slightly different theory when writing about European central banks, which are completely different banks. But the now you claim the deeply important crux of the matter is that the Federal Reserve is more modern than those European banks that Mises wrote about.

Well, I’m sure Rothbard understood this, and just maybe Rothbard’s theory is more modern than Mises as well, so what?

I didn’t miss anything, point is that “in its modern form” doesn’t change the fact that your so called evidence is a complete non-sequitur. Mises wrote about what he observed around him, and Rothbard wrote about what he observed around him, and their theories were adapted to the time and the place that they lived in, and this surprises no one else other than John Quiggin.

So central banking does an excellent job, all the time, except when it doesn’t. Got it.

And the market goes up every day, except when it goes down, and it’ll be fine if it doesn’t rain.

If I’m being too subtle, perhaps just point out to me where in your devastation of Rothbard, Mises and Austrian economics you took the trouble to explain what makes this particular crisis so special? Did we suddenly return to free banking when no one was looking? Did Bush/Greenspan use too much Keynesian stimulus or not enough? What exactly went wrong?

Returning your charitable reading, I’ll just say thanks for acknowledging that my little post represents a “devastation of Rothbard, Mises and Austrian economics”. I thought it was an effective critique, but not quite as final as you suggest.

Unsurprisingly, the answer to your question is that Bush and Greenspan weren’t Keynesian enough, in fact, not Keynesian at all.

Tel:

“So central banking does an excellent job, all the time, except when it doesn’t”

No, that a bald faced lie from Tel.

The actual quote:

” recessions since 1945 have generally lasted less than a year, and have mostly been produced by real shocks or by contractionary monetary and fiscal policy.”

Effective fiscal policy makes the crucial difference.

I’ve always found this exchange interesting:

http://critiquesofcollectivism.blogspot.com/2011/02/john-quiggin-on-abct.html?showComment=1298001476947#c6188943951814638041

“Quiggin wrote that in mid 2009, with the clear implication that he expected the US crisis to be over in a year or two with sufficient stimulus.”

There is no “clear implication” at all: you’re just reading that into his post.

Note the crucial words: “sufficient stimulus”, which Obama’s stimulus was not.

It was sufficient, because the economy got worse. That is what sufficient stimulus does to economies.

I love that word.

It wasn’t clear to me why Krugman and DeLong were predicating more rapid growth than Mankiw until I read Delong original post:

“Mankiw is here arguing that the Obama administration’s forecast is too high, and so forecasts future deficits that are smaller than the deficits are in fact likely to be.”

In other words: Krugman and DeLong were supporting views that that favored running a larger deficit then (2009) – and saying this wasn’t a big deal because the recession will be followed by a period of rapid growth and allow these large deficits to be countered by smaller deficits in the future.

However I suspect that Delong will simple say (if he says anything) that events haven’t proved his model wrong – just the timing. Eventually there will be a recovery and his arguments will prove to be true. It’s possible he may also say that if the deficit had indeed been even bigger in 2009, then recovery would have been more rapid and his prediction would already have come true by now.

To reply to myself: On second thoughts DeLong can’t use the “my model was right” argument because this discussion was very explicitly about timing not models.

Bob, I have a technical question. Is it a Konradiction for Krugman to say the the rich complain because Obama does nothing more than looking at them funny (Krugman’s “Ma! He’s Looking at Me Funny!”, eg http://krugman.blogs.nytimes.com/2011/10/17/mortified/?_php=true&_type=blogs&_r=0) and Krugman saying Obama has rolled back taxes on the wealthy to pre-Reagan levels? (http://krugman.blogs.nytimes.com/2014/01/26/obama-and-the-one-percent/)

So, what are the chances that Krugman/Delong will be disbarred, or fired, or demoted, or dead ended, or bypassed for promotion, or censured, or shunned, or rebuked in a public professional forum by even a single professional colleague?

I wonder what the chances are of DeKrugman sitting at the feet of Mankiw chanting ‘om mani padme hum’ until he/they/it achieves enlightenment.

Does the recent sympathy with secular stagnation count? Because that’s essentially what Mankiw was proposing from the outset.

I’m guessing you’ll find reason to hate on them either way, despite the fact that they’ve already adjusted their views to the new facts on the ground.

How about they just write a blog post stating that Mankiw was correct, and they were wrong? Do you think they will do that, Daniel?

It’s likely from DeLong, probably less likely from Krugman unless he catches DeLong’s.

Why not send him an e-mail encouraging it?

Because I don’t converse with him regularly. Those that I do converse with regularly, I’m happy to point out things I think they get right and wrong. If I’m only conversing with him once every couple months it seems tacky/pestering to drop a line just to tell him I think he got something wrong.

You could. I want to maintain a good relationship with him and not come across as tacky.

Let me know if you need his email although I’m sure it’s easy to find.

Krugman’s recent sympathy with secular stagnation was promptly disciplined and gag ordered by Christina Romer. You see, if the secular stagnation gains traction, then further Keynesian activity would be effectively muted.

My comment was directed more at DeLong. I pretty much just quoted him verbatim, because DeLong is in the same position that Murphy was in when DeLong made that comment.

You’re right, I probably would find a reason to hate on them either way (since they are haters of my and other people’s freedom) but that doesn’t undercut the point I am making.

“I’m guessing you’ll find reason to hate on them either way,”

Now now Daniel, mustn’t be churlish and petty. Just because you hate people you have disagreements with doesn’t mean everyone else does too. Stop projecting your character failings on to others.

“they’ve already adjusted their views to the new facts on the ground.”

Isn’t that the same as saying that their prognostications were wrong to begin with and so they’ve had to “adjust” them to agree with an economic reality they didn’t foresee?

They manifest their desire to impose what they believe using the state.

They might admit to being wrong intellectually, but practically speaking, they’re always right. States, guns, obedience.

private real GDP grew 8.7% so they can’t blame cuts in govt spending, unless they assume a big multiplier. The public real GDP shrank 3.5% from 2008 to 2013. So much for austerity boosting GDP. Krugman and Delong weren’t the only ones getting it wrong. Of course if we had completely abolished govt in 2008, we’d have 10% a year growth and real GDP would by 61% larger in 2013 than in 2008.

I believe “joe” and “Jerry Wolfgang” are actually the same person:

http://www.economicpolicyjournal.com/2014/01/scary.html?showComment=1391198765290#c3162439007573040531

What austerity?

“public GDP”, good one…

Can anyone point to an acknowledgement by our opponents that back in 2009, most every Austrian predicted that super low rates would lead to a very long period of bad times and/or that such a result would be predicted by Austrian theory?

Don’t Austrians usually predict low rates would cause artificial booms, not slow growth?

Long term lower growth, because resources are wasted during the boom.

Short term higher growth, akin to eating the seed corn.

But where’s the high short term higher growth now? You’d think the supposed loosest monetarily policy in American history would do more than what it has now? Low interest rates cause booms except when it doesn’t it seems.

In fact, wide read Austrian Robert Wenzel was betting for a big recovery right along with Krugman.

http://www.economicpolicyjournal.com/2009/01/extraordinary-money-supply-growth.html

Where was the boom? Emerging markets. Leaders of several of those countries complained about our QE causing inflation and unsustainable growth in their countries at the time. Now we are seeing the effects.

“But where’s the high short term higher growth now?”

You are looking at it.

When I say higher growth, I mean higher than it otherwise would have been. I don’t mean temporally rising growth per se.

One can eat one’s seed corn, sacrifice long term to the short term, and yet still stagnate in the short term.

“You’d think the supposed loosest monetarily policy in American history would do more than what it has now?”

No, because the theory that printing money makes us wealthier, is ridiculous.

“Low interest rates cause booms except when it doesn’t it seems.”

Booms do not always entail a minimum percentage growth. A boom can be brought about by the Fed, which turns what would have been significant negative growth, into only mild negative growth, or modest positive growth.

You’re thinking from only a single set of history, when you have to be taking into account counter-factuals using economic reasoning.

“In fact, wide read Austrian Robert Wenzel was betting for a big recovery right along with Krugman.”

Haha, “wideread”, as if that means anything regarding his point. Big recovery? Defined as what? More short term unsustainable boom?

So what what you’re trying to say is, “They didn’t print enough money”? What are you? Some type of Keynesian apologist?

“Haha, “wideread”, as if that means anything regarding his point. Big recovery? Defined as what? More short term unsustainable boom?”

I mentioned Wenzel because he’s one of the more popular Austrians who did not predict slow growth in 2009 despite Roddis’ insistence that Austrians got it right. Also, defined by “eyeball numbers such as GDP and unemployment.” Those are his words.

“So what what you’re trying to say is, “They didn’t print enough money”?”

No, that is not what am trying to say, nor is it what I am saying. What I am trying to say, and what I am saying, is what I did say.

You are imputing your own reactions to the statements I made, onto me as if that would be my reaction as well. You should know me better by now. Word of advice: If you believe I am supporting statism or violence in general in any way, it is certain that you are wrong, and you should think about what you are reading a little more before responding.

“What are you? Some type of Keynesian apologist?”

You got me. I am (was) a secret “Keynesian apologist”

“Economics is not a predictive science.”

Only in prospect. In retrospect if there is no boom they recite “economics is not a predictive science.”

Ken B, the structure of Austrian economics isn’t established on some heads I win and tails you lose, deceitful and reactionary apologia for a certain ideology.

There is a difference between the proposition “If A occurs, then B will follow at some indefinite point in the future” and the proposition “A will occur next year January, and B will follow 4 years later”.

ABCT is a theory of booms. It is not a prediction of when or where booms will occur, nor when the booms will be revealed as such.

You say “recite” as if there is no intellectual foundation for the statement you quoted. You’re only revealing your own ignorance of that foundation when you say that.

Hah!

Only artifically low rates, caused by creation of money, no?

Add credit expansion to the list

I should clarify. Low low low rates but no loans. I expected much fewer loans but I didn’t think the American people would have put up with it for as long as they have. And you reach a point where new funny money is no replacement for a serious permanent price correction back to reality.

Yes, the low rates are there for government to borrow money from the Fed, not for ordinary business to borrow on their overdraft. Credit card interest rates are not low in the least, and home loan interest rates are low but overall mortgage debt has been falling not growing so presumably there’s some adjustment happening there. The honeymoon rate resets only recently finished increasing the rate many people had to pay.

The funny money gets handed out quite selectively.

When either the president is caught lying to cover up spying or when your mainstream economics loses badly to heterodox in the super bowl of recessions that is not the time to attack. That is the time to just bend over and take it. Maybe even try to learn something.

That’s a rhetorical question right?

My question is why do we even have to do this? Why can’t we just say some combination of abct and debt deflation (and arnold kling’s psst) best account for this set of observations.

I’m not even an economist so I’m not fully aware of post keynesianism but no allegiances turns out to be an advantage when our “best” economists are proud of how little they know of other schools of thought..

Meant as reply to Bob.

Andrew, I think we are on the same page. I’m advocating a broad general overview of booms and busts that generally contain ABCT or asset bubble type phenomena followed by debt deflation all caused by prior interventions and credit expansions that distorted the pricing process.

From that overview, one then needs to look at empirical evidence to determine exactly what happened factually.

The “post-Keynesians” are Minsky-ites who note the inflationary booms while meticulously ignoring the nature and existence of prior interventions (and ignore the difference between intervention and non-intervention) and they ignore the price information distortions of prior funny money emissions which itself is a form of intervention.

http://consultingbyrpm.com/blog/2014/01/potpourri-183.html#comment-217357

With this lazy and deceptive analysis, the problem must be “capitalism” which then requires a wise omniscient and benevolent third party regulator with guns (them) to fix.

A bad enough hangover can cause someone to turn down even a free Bloody Mary. People’s appetite for debt and restrictions from Dodd Frank kept much of QE out of the economy.

One way to look at it is if the Fed pulls back where would we expect to see problems completing projects. One answer in my opinion is emerging markets.

It would be fair to point out that a great deal of non-monetary interventions have been popping up. I mean Obamacare is clearly an economic intervention, but it doesn’t link to either high or low interest rates. Demonstrating to people that they have no privacy will have economic effects. Using the IRS as a political enforcer will have economic effects.

ABCT is not a ubiquitous theory of everything. It was never intended to cover all the things humans might ever dream up of doing to one another.

I think the recent discussion of secular stagnation is more or less the about face on this, although it would be nice to mention Mankiw (this would make a perfect “DeLong Smackdown Watch”.

I always find it intriguing that you constantly assume Krugman is being “sly” or “sneaky” rather than the far more obvious conclusion that he did not endorse the CEA forecast because despite being unsure about Mankiw’s claims about unit roots he wasn’t 100% sure of the CEA forecast either.

Isn’t that the more obvious answer?

Doesn’t it make sense that for the most part he writes what the thinks?

Why do you always have to be so conspiratorial about it?

He writes plausibly equivocally.

He’s a “good” forecaster.

Daniel, would you ever argue that Krugman was 100% sure of anything?

Given that it is arguably (statistically speaking) unwise to ever be so, should a world reflected by your argument that Krugman does not (and. implicitly should not) endorse a position he is not 100% sure of, contain a Krugman endorsement of any position whatsoever?

If, rather, you intended to imply that Krugman was not inside the bounds of, say, an 85% confidence level on his position, my question is this: At what level of confidence is Krugman comfortable labeling an opposing position “EVILLLL”, and why is that interval larger than one under which he would be willing to actually “endorse” his own position?

“aniel, would you ever argue that Krugman was 100% sure of anything?”

The beauty is that the government and their guns can be “100% sure” on behalf of Krugman. Krugman can make hedged claims all over the place, and the government imposes it by force.

I’m not sure I understand the question. He definitely endorses some things and sometimes he says things in a more qualified way.

Bob regularly interprets qualified statements as sly plots, rather than the more obvious interpretation that he doesn’t actually think the thing that Bob really really wanted him to think.

I’m not sure what you’re trying to say with EVILLL and confidence bounds, etc.

That Krugman is so devious, sometimes it seems like he didn’t say anything remotely like what Bob has him saying! How devious is that?

Only a total jerk would make Bob look ridiculous like that!

The EVILLL thing was a reference to Krugman’s post title, “Roots of Evil (Wonkish)”.

It connects to the confidence bound concept and your point about Krugman above:

“the far more obvious conclusion that he did not endorse the CEA forecast because despite being unsure about Mankiw’s claims about unit roots he wasn’t 100% sure of the CEA forecast either.

Isn’t that the more obvious answer?”

It certainly makes sense that he doesn’t endorse the forecast because he is iffy on it.

However, the title of his post makes a reference to Mankiw’s analysis or method in this case being (wonkishly) “evil”. So, he has a level of confidence that allows him to make an implicit charge that Mankiw’s argument (that the forecast is over-optimistic) is wonkishly evil (to paraphrase, involves more than a little deliberate obtuseness; the (wonkishly) evil thing is in the title).

To quickly retread, Krugman is charging that wonkish evil is why Mankiw doubts the forecast.

But, as you imply, he is not confident enough in the forecast itself to just say, “The forecast is right.”

My point is that Krugman’s post implies that Mankiw is wonkishly evil and more than deliberately obtuse for doubting a forecast which, as you point out, the obvious evidence points to Krugman doubting.

So, irony, mixed with a suspicion that Krugman does not know what “wonkish” means.

My implication above was that the confidence level Krugman uses to conclude wonkish evil as the cause of an argument is smaller than that used to determine if an Administration economic forecast is complete rubbish:

Mankiw, wonkishly evil for doubting this forecast?

Confidence: 4%

Conclusion: YES.

Administration Economic Forecast, accurate?

Confidence: 15%

Conclusion: NO COMMENT.

It’s one thing to say they were wrong about the current crisis – in that sense their views should clearly change. But as far as betting next time, that’s a tougher question. Do you think their betting should change in the future Bob? Is that what you’re claiming too?

Econbrowser has an interesting post here: http://econbrowser.com/archives/2009/03/interesting_eco

The academic debate on unit roots is older. Econbrowser takes a look at more current data and finds that Krugman and DeLong’s view still rules the roost (well… VAR and SVAR rule the roost, but between unit root and trend-stationary I mean).

Are you saying that Krug/Delong should not be claiming that an internal libertarian debate about monetary offset shouldn’t be used as a proxy for dismissing austrianism in the future?

If you are asking about Bob’s bet, as I said at the time his disagreement with other Austrians on money demand (I’m not sure this was really a monetary offset debate, but I suppose I see what you mean by that) was not a reason to dismiss Austrian economic writ large.

Particularly when the fed is doing bizarre untested policies that noone, even the fed know what they will do. What is the “Multiplier” on interest on reserves? Do we even know it was demand versus supply of credit?

Oh, and thanks for being evenhanded.

I was being loose with my use of “monetary offset”. There may be some offset where debt is played down but just enough money is created to create just a tad of inflation- mainly to avoid deflation and bank bankruptcies.

“If this post seems obscure and petty, you must not have been around when this happened”

For once I can agree with you Bob. It does seem obscure and pottery and it doesn’t seem better with the context.

The way you Krugman bashers act-especially you-I think back to the episode of Cheers where Sam Malone finally broke down and agreed to pay his new neighbor rent for the upstairs room he always used free of charge before but he’d show him by writing on every check ‘You are not God.’

That’s what about the kind of moral victory you seem to want from Krugman. “Aha! On this particular day, in this particular post, years ago, Krugman was wrong or maybe even looked a little silly. I don’t look silly by how much sweat and tears I’m putting into culling all this. No clearly I don’t look silly, he does! Ha ha!’

Pottery

Pottery indeed. In Mike’s case, cracked.

If someone titled their blog, “Diary of a Republican Hater”, could that make them petty?

Mike, I think you just don’t understand. Its not about Krugman, its about his hacky shtick. There are at least two if not three Krugman personae.

“We need a housing bubble.” “Haha I was just kidding” “now…in my publication persona I have adopted debt deflation…but don’t expect the full implications in my public addresses” “oh, Larry Summers says macro really is now just a series of bubbles- sounds good to me” “Austrian ideas aren’t worth even dismissing because I’m super confident nyt economist all the answers so the other side is ignorant and evil guy!” “But its not just about political demagoguery…trust my confidence everyone else is wrong!”

Love how Mike seems to be pretending that Krugman was wrong or makes mistakes roughly as often blue moons in leap years….takes quite a level of blindedness to not see the daily spewage of deceit, sophistry, and downright horse***t from the Liberal Without a Conscience.

Ken B., Daniel, and Mike Sax: Do you guys really mean to tell me you think Krugman below is saying, “Mankiw may very well be right about the economic forecast; I think DeLong went out on a limb in endorsing the CEA prediction.” ? Krugman’s readers wouldn’t have thought he was siding with CEA and DeLong against Mankiw?

============

As Brad DeLong says, sigh. Greg Mankiw challenges the administration’s prediction of relatively fast growth a few years from now on the basis that real GDP may have a unit root — that is, there’s no tendency for bad years to be offset by good years later.

I always thought the unit root thing involved a bit of deliberate obtuseness — it involved pretending that you didn’t know the difference between, say, low GDP growth due to a productivity slowdown like the one that happened from 1973 to 1995, on one side, and low GDP growth due to a severe recession. For one thing is very clear: variables that measure the use of resources, like unemployment or capacity utilization, do NOT have unit roots: when unemployment is high, it tends to fall. And together with Okun’s law, this says that yes, it is right to expect high growth in future if the economy is depressed now.

But to invoke the unit root thing to disparage growth forecasts now involves more than a bit of deliberate obtuseness. How can you fail to acknowledge that there’s huge slack capacity in the economy right now? And yes, we can expect fast growth if and when that capacity comes back into use.

I’ve always found it odd the extent to which people will make excuses for Paul Krugman and Brad DeLong, but to my knowledge no one will make similar excuses for someone like Greg Mankiw, or say John Cochrane. Doesn’t that strike anyone else as really strange? We’re talking about four economists that are all pretty standard New Keynesians – okay, PK is a bit more of an “old Keynesian,” but not exceptionally so.

All I can really conclude is that people make excuses for PK/BD because of their politics. If I’m wrong, I challenge any of the usual PK defenders to cite just one example of when Krugman and Mankiw significantly disagreed, and Mankiw unequivocally had the better position.

Anyone?

Mankiw did not support Obama.

Haha, wait I said unequivocally!

Oh. Well, feel free to substitute any stronger adjective.

re: “I challenge any of the usual PK defenders to cite just one example of when Krugman and Mankiw significantly disagreed, and Mankiw unequivocally had the better position.”

Ummmm… the unit root debate????

Cochrane’s not really a NK.

Speaking of Cochrane, he had the better of DeLong in their argument about the Nakamura and Steinsson multipliers, and I said as much at the time.

Perhaps you are overstating how unfair typical defenders of PK are being because you don’t like their politics?

Or perhaps it comes down to the fact that this is the first time I have ever seen anyone mention this on a blog.

But perhaps it’s your reading that’s the problem, and not everybody else?

In my experience you’re one of the least charitable blog readers out there when you disagree with someone. So perhaps you have an innate tendency to see things this way?

You’ve gone from thinking you had no examples (which I find a little hard to believe, but perhaps that’s honestly you couldn’t recall a single one) to having two that I just thought of off the top of my head.

Does that move your priors at all, Ryan?

I’m glad you gave me a couple of examples, that’s for sure. My priors twitched. They’d move if you supplied me with supporting links so that I could verify what you’re telling me, rather than simply taking your word for it.

You did not at all have to resort to calling me uncharitable in order to make that point.

And you didn’t need to pose the initial question with your view that people were making assessments based on their politics.

Look, when you come out swinging like that, you should expect the reply equivalent of eye-rolling.

I don’t mind that you rolled your eyes, Daniel, or that you would prefer that my initial comment looked more like something you would write, and less like something I would write.

I’m also glad you mentioned a couple of cases – which I have still yet to see in print – where Krugman’s defenders sided with and vehemently his critics. I would be ever-more-greatful if you could point me in the direction of some of these examples.

But I have no reason to sully this thread by sparring with you. I’m very sorry you find my comments upsetting. You can alleviate some of the resulting frustration by resisting the urge to reply.

That said, in this case, I’m glad you did – especially if you manage to cite some of those examples you mentioned.

I don’t understand – look at the comments above. I am siding with Mankiw in the first comment and I am siding with Cochrane in the second comment. There it is in print. I’ve been talking about Mankiw in this comment thread. If you want to see my prior thoughts on Cochrane in addition to my statement of support here, just google it.

Okay, thanks, Daniel. Good point.

Originally, I was thinking of people beyond just, you know, Daniel Kuehn. There are a lot of Krugman supporters out there. He’s a popular guy who writes a lot, and so do his supporters.

But I appreciate that you gave me two good examples from one Krugman supporter – yourself – and I’ll take that into consideration in the future.

Cool?

What amazes me is that you don’t even have to read between the lines.

PK: paraphrasing – I’m not debating Bob Murphy because just being in my presence would elevate austrian theory and put it before people that I would protect from being misinformed to through censorship.

No, even if that is true (which of course it isn’t – as we have pointed out and Steve Keen also reports http://www.debtdeflation.com/blogs/2009/07/15/no-one-saw-this-coming-balderdash/ the two tags for people who predicted the crisis were primarily post-keynesian money realists and/or Austrian and a housing index analyst- What is Robert Shiller?) if you are a real intellectual you don’t base who you debate first and only on whose status is raised or lowered.

Did Milton Friedman do that?

Indeed. Krugman is free to say it wouldn’t be productive, or you need to pay me more. Those are perfectly sensible responses. But his “I won’t dignify it lest we harm innocent minds” line is bogus.

You don’t think there are any beliefs that are so crazy that they shouldn’t be dignified with a debate, lest they be given too much credibility?

Oh I do. I just don’t believe it in this case. As Bob noted once, when PK did get paid, a book tour, he did debate (and destroyed) an Austrian in Europe. (Bob agreed PK won the debate). So I don’t believe that is Krugman’s real reason. Besides, Austrianism is not Rothbardism. There are indubitably serious Austrians: Buchanan was one, or Hayek. So the school as a whole is not bat-sh*t crazy. Just one of the classrooms …

Where is this destruction of the Austrian economist? And why are you even commenting on the Austrian school? You’ve never even demonstrated understanding the basics. Same goes for Libertarianism. The NAP throws you. Learn the basics before offering your opinion. You won’t be laughed at so much.

Excellent point re: Friedman.

DeLong is a bigger tool than Krugman, imo. More aggressive and less slick.