Keynesians Wrong on Sequester Just Like Stimulus

My latest post on Mises Canada. The money part:

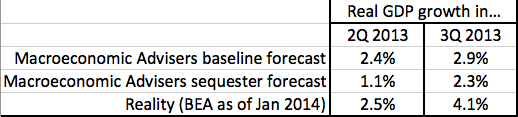

For example, in February 2013 Paul Krugman wrote a piece titled “Sequester of Fools,” in which he referred to the “fiscal doomsday machine” that was being unleashed upon the nation. He claimed that the sequester would cost 700,000 jobs, and justified this number by linking to a Macroeconomic Advisers analysis, which was completely Keynesian in its approach. It said (just as Krugman and the others said, in decrying the sequester) that reduced government spending would reduce economic growth. The Macroeconomic Advisers analysis first made a baseline forecast of U.S. growth without the sequester, then showed what GDP growth would be (broken down by quarter) if the sequester occurred. The bulk of the action occurs in the 2q and 3q of 2013. We are now in a position to compare the Keynesian forecasts to reality (as codified by the Bureau of Economic Analysis):

As the table…shows, we have the mirror image of the stimulus debacle: Actual U.S. GDP growth in both quarters was greater with the sequester than what the Keynesians told us would be the case without the sequester.

But remember, the IS-LM framework has come through this period with flying colors.

Wait wait, I know how you answer this one!

“SEE? The economy’s doing even BETTER than we thought! The growth would have been even higher if we hadn’t had the sequester!”

Of course, that would mean that the economy’s doing even better AND even worse than we thought, at the same time.

Not at the same time. The economy is doing worse than we realized when government increases spending, and better when government cuts spending.

The counterfactual economy is even more volatile than the factual one!

From the Post Keynesian perspective, such forecasts cannot predict future specific GDP quantities with objective probability, and we face degrees of uncertainty about the future.

But this is hardly the big deal you make it out to be: Keynesians accept that the private sector can provide unexpected growth.

However, there are mountains of evidence that:

(1) in many markets demand and sales volume drives production, output and employment.

(2) hence increasing income and spending via stimulus increases investment and employment.

In 2008-2009, many nations, the US included, engaged in stimulus packages that ended their recessions and averted actual depressions.

Those nations that did not provide stimulus — such as Ireland, the Baltic states, and Greece — suffered severe depressions comparable to those of the 1930s.

Your problem, Bob Murphy, is that you never make it clear what your fundamental argument on this subject even is.

Do you seriously think government stimulus programs NEVER increase real output growth and end recessions? Never in any known case?

I dunno, if you take the chart of the USA real GDP per capita and the same chart of Estonia, the overall shape is pretty much identical, despite significantly different monetary policies. Here is the USA:

http://www.tradingeconomics.com/united-states/gdp-per-capita-ppp

Here is Estonia:

http://www.tradingeconomics.com/estonia/gdp-per-capita-ppp

Flip from one to the other… sure the USA is a more wealthy nation but overall the recent years don’t show any significant effect of stimulus.

If we’re allowed to say that we admit that some unexpected factor outside our theory ended recessions whenever it suited us (much like you just did) it would be very very easy to be certain that government stimulus programs NEVER end recessions, because if a statistical case ever really made it appear that a recovery corresponded to a stimulus, we’d simply say what you said: The private sector provided unexpected growth.

You’ve discarded *this* empirical case because you’ve established non-accountability through this acceptance of “uncertainty”, and then you expect Murphy to assert that stimulus programs NEVER increase real output growth, knowing full well that the counterargument will be empirical and based on a similar statistical lining up of dates? You’re trying to hold an Austrian who formally embraces the psychological method over the empirical to a higher standard of empiricism than that to which you hold yourself, and if you’re of any other school (as the signs would suggest, but I’m new here, forgive me) then you likely judge the contributions of your own side on their empirical rigor. You’re asking for him to be better at *your* trade than you are willing to demand of yourself.

you never make it clear what your fundamental argument on this subject even is

Hmmm. For starters, artificial credit expansion causes price distortions which impair economic calculation. Continuing the process which caused the problem as an alleged “cure” for the problem impedes and precludes the necessary price corrections necessary for unimpaired economic calculation.

Artificial transfers of purchasing power caused by “stimulus” will tend to induce artificially stimulated and thus unsustainable and misleading patterns of transactions at distorted prices.

You know. The stuff we’ve explained a billion times before in a thousand different ways.

Maybe this fancy comparison chart URL will work??

http://www.tradingeconomics.com/charts/united-states-gdp-per-capita-ppp.png?s=usanygdppcapppcd&URL2=/estonia/gdp-per-capita-ppp&type=line

If it does, the similarity of those countries on a GDP per capita PPP basis should be very obvious.

http://www.tradingeconomics.com/charts/greece-gdp-per-capita-ppp.png?s=grcnygdppcapppcd&URL2=/latvia/gdp-per-capita-ppp&type=line

Here’s a comparison between Greece (no recovery whatsoever) and Latvia (very clear recovery visible). Actually, there’s no comparison, they are totally different.

Note that Greece did NOT even show a dramatic collapse right after 2009 like most countries did. Greece took on a lot of bailout loans around then and they pumped their GDP as hard as government was able to, but what we see is that right now Greece is still heading into recession, they have not hit the bottom yet. Greece is showing a smooth and steady CONTINUOUS decline.

“Greece … pumped their GDP as hard as government was able to”

That is utter rubbish, Tel.

Government spending contracted by 8.3% in 2010 and a further 4.1% in 2011. There was no Keynesian stimulus.

http://www.tradingeconomics.com/charts/greece-government-budget.png?s=wcsdgrc&URL2=/latvia/government-budget&type=line

There’s the Greek government budget (percent of GDP) compared to the Latvian government budget (also percent of GDP). Note that in 2010 they both delivered the worst deficits but Greece delivered a much larger deficit at a whopping 16% of GDP. In comparison Latvia peak deficit was 10% of GDP.

Latvia ran smaller deficits every single year and also has very nearly returned the budget back to balance.

Greece and other austerity nations had deficits almost wholly because tax revenues collapsed, not because of some huge Keynesian increase in spending.

You haven’t the foggiest idea what you’re talking about.

Greece got a ridiculously generous bailout package. Sheesh, they ran big deficits and they also got bailout loans all over the place. What is your clever strategy then?

(1) A bailout does not mean that engaged in a Keynesian stimulus.

(2) deficits do not mean a Keynesian stimulus designed to end the recession was used.

As I said, Greece and other austerity nations had deficits almost wholly because tax revenues collapsed, not because of some huge Keynesian increase in spending.

(3) As I said below, your incompetence with GDP stats and utter inability to understand basic concepts of macroeconomics shows how little you know about economics.

What is a Keynesian stimulus then?

Why are the George W Bush tax cuts considered to be a stimulus while when Greece pulls in less tax (because people just don’t bother paying) it somehow has no stimulus effect?

Why is that?

What would YOU have done if you were the Greek government?

A Keynesian stimulus is fiscal policy used to expand aggregate demand and hence real output and employment.

One designed to close an output gap requires:

(1) the calculation of potential GDP and an estimate how severely GDP is likely to collapse by,

(2) estimation of the Keynesian multiplier and

(3) then designing fiscal policy to expand demand by tax cuts and/or appropriate level of discretionary spending increases to hit potential GDP via the multiplier.

——-

Of course, some stimulus packages are not designed to close output gaps, and some underestimate the extent of GDP collapse.

But Greece, Ireland, and the Baltic states rejected stimulus and Keynesian fiscal policy.

They were committed to budget balancing and deficit reduction from the beginning.

Some automatic stabilisers did exist in these nations (that is, welfare and social security policies that increase payments during recessions), increasing the size of government spending somewhat in 2008 or 2009 (e..g, as in Ireland).

But that is far from what a Keynesian stimulus actually is.

Government deficits do necessarily mean a Keynesian stimulus is being carried out.

OK, quit with the waffle.

What exactly can be measured to determine whether a Keynesian stimulus has taken place?

Not designed to this and that, but what can I see with my own eyes to determine whether there was a stimulus?

By the way, you did not answer the question of why the Bush tax cuts count as stimulus but lower taxes in Greece do not count.

(1) There is no waffle. It’s already been explained to you above, If you can’t understand it, you’ve got serious deficiencies in your ability to understand economics.

Increases in government spending and tax cuts done to increase aggregate demand can be measured.

(2) if you are referring to the Bush tax cuts of 2001, yes it was a type of stimulus.

(3) Greece has been **increasing** taxes in its austerity packages, not cutting them

http://en.wikipedia.org/wiki/Greek_government-debt_crisis_countermeasures#Austerity_packages_and_reforms

Read you own comment above “tax revenues collapsed” so therefore by definition the government of Greece is pulling less tax money out of the hands of the citizens.

You are now telling me this is not stimulus? Basic Keynesian theory says that with less tax rake Greek people should have more money to spend. That’s Aggregate Demand right?

What do you mean “cuts done to increase aggregate demand” as compared with tax cuts done for some other reason? How can I measure the difference between one tax cut and another tax cut? Either tax gets collected or it doesn’t I would have thought.

Even ignoring the tax situation, there was a steady increase in absolute Greek government spending right up to a big surge at the end of 2009 and start of 2010. However the GDP situation peaked in 2008 (two years before the government spending started to drop) and has been falling ever since.

That big surge of government spending on 2010 didn’t do Jack to turn things around, not even a whimper of a recovery. They tried stimulus, they ran themselves broke with spending and they ran many of their creditors broke. No result.

http://www.tradingeconomics.com/charts/greece-government-spending.png?s=greecegovspe&d1=20040101&d2=20141231&URL2=/greece/gdp-per-capita-ppp&type=line

“A Keynesian stimulus is fiscal policy used to expand aggregate demand and hence real output and employment.”

See that Tel?

A Keynesian stimulus is defined by government activity that succeeds in increasing output and employment.

Hilarious.

http://www.greekdefaultwatch.com/2012/11/austerityagain.html

There’s more details on Greek government revenues and spending, pointing out that government revenue as a share of GDP stayed at about 40% but came up to 42% in 2011.

Spending on social services went up as a percentage of GDP including a further increase in 2011, and in absolute terms (see in the comments) we can see that 2009 was the big increase and 2010 and 2011 were still higher than 2008 and before.

Nikos also points out that both social spending and old-age spending in Greece are higher than OECD average (or were at the time of writing).

(1) Greek GDP collapsed by 3.3% in 2009. For anyone not a libertarian ideologue, that is a serious collapse. In 2008 the contraction was mild at 0.2%, but this is just due to differences in the time at which the recession stuck and its immediate effects. None of this contradicts what I said.

(2) As as said above the notion that Greece “pumped their GDP as hard as government was able to” is just utter rubbish.

Greece is showing absolutely no signs of recovery, while the Baltic nations that spent a lot less are showing strong recovery. How do you explain that?

All those IMF loans to Greece were pissing money out the window. Germany should have put hands in pockets and walked away from Greece. I said as much at the time.

It’s not a bad thing for malinvestments to be liquidated.

It’s not a bad thing for home construction to “collapse” if the existing housing construction cannot be completed, and investors discover their errors and stop wasting resources, take time to reassess and replan, which of course leads to a statistical fall in output

For statist ideologues, a 3.3% reduction in output is a serious collapse because the world has to be hysterically described in order to justify initiating violence against innocent people.

As always, LK is taking his a priori theory that demand drives output, and uses that theory to interpret history, even though other, more internally reasonable theories, explain history as well.

“However, there are mountains of evidence that:

“(1) in many markets demand and sales volume drives production, output and employment.”

History does not show that this is the only plausible theory. Indeed, once we subject competing theories (those of which are consistent with history), we find that it’s not demand that drives output or employment at all, but rather saving and investment drives output and employment.

Once again, you are taking the theoretical consideration that an individual firm’s output and employment depends on demand for that firm’s output, and committing the fallacy of composition by asserting that demand also drives aggregate output and aggregate employment.

However, by utilizing superior economic theory than yours, we can establish that in the aggregate, demand for output is actually in competition with demand for labor and demand for capital goods. In the aggregate, individual firm demands are offsetting. More demand for output actually means less demand for input.

When you observe more demand for output correlated with more demand for input, what you are actually observing is more demand for output taking place BECAUSE of more demand for input. Wages and capital goods are paid for BEFORE demand for the output of those inputs are paid. So when you observe more demand for output, you are actually observing the effect of more demand for inputs that took place prior.

As a result of these considerations, which you have not refuted or even challenged, this comment:

“(2) hence increasing income and spending via stimulus increases investment and employment.”

is a non sequitur.

As always, LK is taking his a priori theory that demand drives output, and uses that theory to interpret history, even though other, more internally reasonable theories, explain history as well.

“However, there are mountains of evidence that:

“(1) in many markets demand and sales volume drives production, output and employment.”

History does not show that this is the only plausible theory. Indeed, once we subject competing theories (those of which are consistent with history), we find that it’s not demand that drives output or employment at all, but rather saving and investment drives output and employment.

Once again, you are taking the theoretical consideration that an individual firm’s output and employment depends on demand for that firm’s output, and committing the fallacy of composition by asserting that demand also drives aggregate output and aggregate employment.

However, by utilizing superior economic theory than yours, we can establish that in the aggregate, demand for output is actually in competition with demand for labor and demand for capital goods. In the aggregate, individual firm demands are offsetting. More demand for output actually means less demand for input.

When you observe more demand for output correlated with more demand for input, what you are actually observing is more demand for output taking place BECAUSE of more demand for input. Wages and capital goods are paid for BEFORE demand for the output of those inputs are paid. So when you observe more demand for output, you are actually observing the effect of more demand for inputs that took place prior.

As a result of these considerations, which you have not refuted or even challenged, this comment:

“(2) hence increasing income and spending via stimulus increases investment and employment.”

is a non sequitur.

It’s somewhat more damning than the flawed Romer-Bernstein forecast insofar as things aren’t nearly as up in the air these days as they were back then.

But I’m kind of with LK here – private sector growth isn’t something Keynesians don’t expect to see or think can’t happen, so I’m not sure what the victory lap is about. The claim is a conditional one, and to evaluate a conditional claim you need a counter-factual and you just don’t have that here.

In the work that actually does produce counterfactuals we see good reason to think there’s a fiscal multiplier.

In the years ahead we’ll see good rigorous studies that include data from this period.

Patience.

So when unemployment goes up – more than expected anyway – with stimulus, then the economy is doing worse than expected, but when unemployment goes down or growth goes up – more than expected anyway – with what is essentially negative stimulus, then the economy is doing better than expected.

Don’t you think this is a bit dishonest? Just a bit? Shouldn’t this prompt you to reconsider your views on fiscal stimulus just a bit? Update that prior just a bit?

The joke is that the followers of the Mathematician have such an absolute get out of jail free card for turning off empirical analysis when it doesn’t turn out the way they want it to (or two cards if you throw in hidden multipliers). Essentially they claim to know enough to guide policy, yet a meaningful portion of the outcomes are admitted to be essentially a non-deterministic lottery of effects with invisible causes. It’s perfectly reasonable to admit we don’t have the information to make predictions…BEFORE going around and making them. The Keynesians want to speak with the authority of physicists yet retain the unaccountability of sociologists.

As for rigorous studies down the road, yes maybe they’ll figure out how to produce useful predictive data that you can use to calculate the actual effects of policy, but isn’t ostensibly having that kind of useful model the basis on which they advise policy now? If Keynesians will know in ten years how to model today’s conditions, then they need to wait ten years before providing the kind of policy prescriptions they’ve already provided.

Wrong forecasts still reflect theoretical failure even when the theory has a footnote of “Oh yeah and the effect can also occur out of the blue due to unseen forces!” because such a built in loophole IS a theoretical failure. Neither are they excused by the expectation that the theoretical framework will be mended in the future to be reconciled to the current facts. The effect of the stimulus in the US, and the effect of the sequester in the US, are two huge misses for the Keynesians. Does it demolish the whole framework? No, but only because the framework has this admitted quality of fallability, a fallability that you detect no hint of in the way Keynesian policy proposals are put forth.

Remember also we are only halfway though the period when Macroeconomic Advisors said the 700,000 job loss would occur.

http://www.nytimes.com/2010/04/02/business/global/02austerity.html?pagewanted=all&_r=0

Oh no, get out the violins, if only the Lithuanians had Klever Krugman to tell them what to do.

http://www.tradingeconomics.com/charts/united-states-gdp-per-capita-ppp.png?s=usanygdppcapppcd&URL2=/lithuania/gdp-per-capita-ppp&type=line

Probably also fair to point out that the Lithuanian economy had a shallower dip, faster recovery and better overall growth than the North American economy. I bet you never read about that in the NYT.

Shallower dip? lol.

According to this, Lithuanian GDP contracted by 23.16% between 2009 and 2011:

http://www.tradingeconomics.com/lithuania/gdp

Adjusted for inflation? How do you recommend comparing nominal GDP between two different currencies?

(1) Real Lithuanian GDP contracted by 14.8 in 2009% — a deep depression

http://www.quandl.com/IMF-International-Monetary-Fund/MAP_WEO_GDPG_LTU-World-Economic-Outlook-Real-GDP-Growth-Lithuania

(2) Contrast that with the US, where the peak to trough decline in GDP was 4.3% Today GDP is above its 2007 peak.

http://en.wikipedia.org/wiki/List_of_recessions_in_the_United_States

Also, Lithuania has been losing population into Europe ever since the Iron Curtain came down, because the country was ravaged by Communism. You have to use per-capita figures to get a fair indication, I mean you can’t seriously expect any government to rapidly reverse those long years of neglect.

Real per capita GDP (PPP) in Lithuania collapsed by 13.71% in 2009.

http://www.quandl.com/IMF-International-Monetary-Fund/MAP_WEO_GDPPPPPC_LTU-World-Economic-Outlook-GDP-Based-on-PPP-Per-Capita-Lithuania

Almost the same as the real GDP collapse.

Your utterly incompetent use of the GDP data is contemptible.

Taking the bottom of the dip in the USA (2010 at $41506.31 using IMF data if that’s what you want to use) is equivalent for USA the USA economy of going back to 2005 (at $41703.02) which effectively was a setback to the economy of 5 years growth.

Do the same with Lithuania, the bottom of the dip (in 2010 at $16470.08) is only equivalent to 2007 at $15968.93, so that was only a setback of 3 years growth (actually slightly less than 3 but ignore the tiny bit).

By the way, Your utterly incompetent use of the GDP data is contemptible… but you already knew that.

And the economy imploded, and real GDP is STILL 10.59% below its 2009 peak:

http://www.tradingeconomics.com/lithuania/gdp

Contrast that with the US, where the peak to trough decline in GDP was 4.3% Today GDP is above its 2007 peak.

http://en.wikipedia.org/wiki/List_of_recessions_in_the_United_States

GDP includes government spending. Not an accurate measure of economic health.

From EPJ, Walter Block links to a paper he wrote criticizing Salerno, Rothbard and Mises on whether cost of production impacts final prices. However, under either view, “demand” for final stage goods does impact whether or not those goods are made and the sale price for those goods. Yes, Keynesians, economics is almost always about “demand” for final goods. So what? We already know that. It does not call for or justify an immoral and illegal transfer of stolen purchasing power to induce the masses to buy more junk than they would have on their own with their own savings.

When I said I agreed 100% with Joe Salerno’s criticism of you, it concerned only your views on why Austrianism is not accepted by the mainstream economics profession. These were my exact words: “I am a BIG FAN of both Bob Wenzel and Joe Salerno. Here, the former cites the latter’s excellent critique of Pete Boettke on why Austrianism is not accepted by the mainstream economics profession. Needless to say, I think Salerno 100% correct on this, and Boettke 100% wrong.” How you can interpret this statement of mine as support for anything other than what I actually said, is beyond me. Certainly, I don’t agree with him [Salerno] on everything; see this blast of mine at him, where Bill and I ‘indict” him and two people he supports:

Barnett, William II, and Walter E. Block. 2005-2006. “Mises, Rothbard and Salerno on Costs.” Corporate Ownership & Control, Winter, Vol. 3, No. 2, pp. 203-205;

http://www.virtusinterpress.org/additional_files/journ_coc/issues/COC_(Volume_3_Issue_2_Winter_2005-2006_Continued).pdf

The Walter Block link came from this post, FYI:

http://www.economicpolicyjournal.com/2014/01/walter-block-replies-to-peter-boettke.html