Krugman on Treasury Default: 57% of the Budget “Isn’t That Much”

I realize I’m blogging a lot of my favorite Keynesian lately, but he keeps pushing the envelope. In the debt ceiling saga, the standard line of the Administration and its defenders is that Republican obstinancy will force Treasury Secretary Lew to default on government bonds, thus causing a global financial meltdown. Plenty of people (not just me but David R. Henderson and Steve Landsburg) have pushed back, saying that of course this isn’t true. The government has enough money coming in from taxes to pay off bondholders, if it wanted.

So here’s Krugman’s post today to deal with that argument:

The debt ceiling situation remains extremely foggy….And nobody knows what comes next. The immediate question is whether Treasury can, in fact, “prioritize” — pay interest on the debt while stiffing everyone else, from vendors to Social Security recipients. If they can, they might choose to do this to avoid financial meltdown.

But as I and many others have emphasized, even if this is possible, it would be a catastrophe, because the Federal government would be forced into huge spending cuts (Social Security checks and Medicare payments would surely take a hit, because there isn’t that much else). [Bold added.]

OK now let’s stop and think about what he’s saying here. Can everyone agree that Krugman is arguing that

(a) net interest to Treasury holders

(b) Social Security

and

(c) Medicare

constitute such a large fraction of the budget, that it would be impossible to make payments to all three categories if the Treasury is forbidden from borrowing more money? Krugman isn’t here making a political or a security argument, saying something like, “I predict Lew will stick it to Social Security and Medicare recipients, because that’s the path of least resistance” or “I predict Lew will stick it to Social Security and Medicare recipients, because otherwise we’ll be taken over by terrorists.”

Nope, Krugman is saying that once you add up those three categories, “there isn’t that much else” to cut from the budget.

Let’s see just how wrong this statement is:

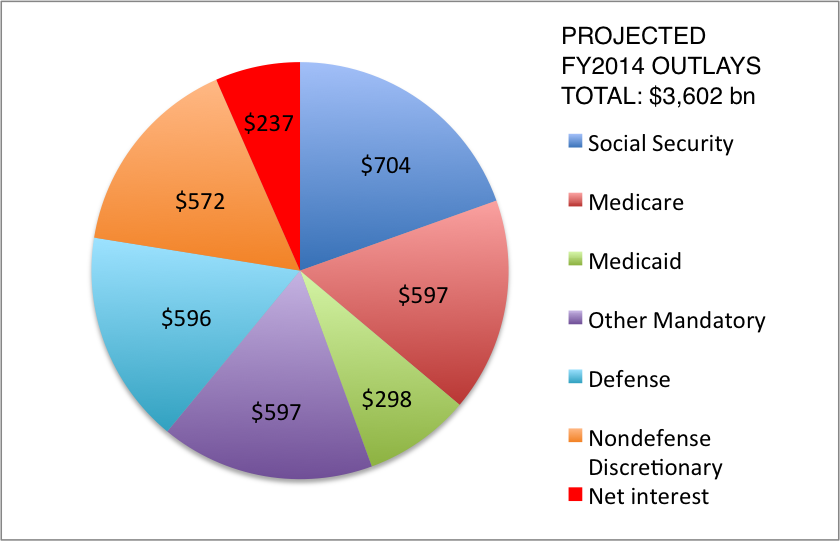

So, those three categories add up to $1.538 trillion, out of total projected outlays of $3.602 trillion. In other words, they constitute only 43% of the total budget. So the other 57% of the federal budget is “isn’t that much else” in Krugman’s mind.

Last way of putting this: The projected cashflow deficit for FY2014 is $560 billion (at least back in May when CBO made its projections). Nondefense discretionary spending alone (at $572 billion) could thus cover it. Everyone got that? According to the government’s own (loaded) classification system, it could still pay all bondholders, meet all “mandatory” spending obligations (which covers Social Security, Medicare, and Medicaid), and it doesn’t need to cut a penny from defense, all within a balanced budget.

Now if Obama, Lew, Krugman, et al. want to argue, “No way should we have to cut spending, we’re wrecking the world economy to teach these Republicans who’s boss,” OK fine. But thus far they have been saying things that are simply not true.

Really: I am curious for a Krugman acolyte to defend his statement quoted above. How can he possibly claim that 57% of the budget “isn’t that much else”? This is ridiculous.

Can’t blame Krugman for staying on message.

This is nothing new. As long as people have been demanding a balanced budget, the progressives in both parties have stayed remarkably consistent. The Democrats maintain it’s impossible without dismantling social security leading to mass starvation int he streets. The Republicans claim it’s impossible without eliminating the military leading to nazis/communists/al queada taking over the country.

Both sides are lying of course, but once again, this is nothing new.

Nice to see we’re nailing Krugman on hyperbole here.

See I would have gone the other way in regards to this, as a proponent of privatizing social security, if Krugman is arguing that social security takes up such a large portion of the budget that “everything else isn’t that much” doesn’t that mean there is a very good reason to promote reform?

responsible cuts in all areas will allow focused debt reduction & decreased government in the future. it’s time to end america’s world police role. defense spending needs to be cut as well. if you think we can just chop away social funding travel to the rural areas of this country and let me know how they’re doing.

Krugman apologists to the rescue in 5…4…3…2…1….

Krugman’s main point is all about stabilizers, multipliers and the daaaaaanger of any cuts in government spending.

Thing is, if they just let the debt keep growing, the result will be exactly the same, as that red slice above gradually squeezes out all the other slices and government really is forced to cut spending.

Currently if the entire government outlay went into paying back debt, they could do it in 6 years. A decade ago that would have only been 3 years. Back in the 1970’s they could have done it in 2 years. This is all ignoring the fact that future Social Security liability isn’t even listed as debt (i.e. if your first payment is due next year, this is accounting-wise NOT a liability to the government). Thus, we all know the SS payments are guaranteed to grow.

There will come a day when (price) inflation forces the Fed to raise nominal interest rates. Maybe it didn’t happen as quickly as some Austrians thought, but you can’t put aside fundamentals forever. It will happen.

I gues the media is operating by a very pure keynesian premise that cutting such a big amount is out of the question. I suppose that isn’t surprising. The surprising point is that they don’t even acknowledge that this is an option and that bond holders are therefore first heads on the chopping block. This is the point Peter Schiff keeps making, namely that by the media, the president, the parties talking in this way they are basically telling the bond holders that they are the lowest priority when push comes to shove. If we assume the Chinese are already calculating on scenarios on what could happen in the future they now know that a preemptive move out of bonds on their part would be the smartest and safest.

“Social Security checks and Medicare payments would surely take a hit, because there isn’t that much else”

Krugman finally admits nearly all government spending takes otherwise good money and send sit down the rat-hole never to be seen again. Sub-consciousness is a bitch when it slips to the surface…

Except my point in this post was that that Krugman line is totally wrong. 🙂

I wonder what would happen if we read only 43% of Krugman’s posts?

Bob is transparently right here. PK engaged in a little misleading hyperbole and Bob caught it.

I believe “little misleading” is being too friendly to PK’s comments.

It is misleading hyperbole, but in this case it’s hyperbole that completely changes the conclusion.

There are good reasons for saying debt proioritization is a bad way to solve this – that we just don’t have the money to do that is not one of them.