Krugman’s Botched Inflation Call and Scary Other-Country Reference

Ideally someone else would make this post, since it will seem petty and defensive coming from me, but sometimes you look inside yourself and realize that you are the only one who can get the job done.

Anyway, I think it’s fair to say that Paul Krugman has been running around for a good two years with variants of the following (which are my words, but very much in the spirit of what he’s been saying):

[FAKE PAUL KRUGMAN QUOTE]: I can’t believe the shameless dogmatism of these right-wingers. Ever since the crisis unfolded, they’ve been trotting out scary-looking charts of the monetary base, predicting huge surges in [price] inflation, and even saying the US was headed the way of Zimbabwe. Well, history has shown them to be totally wrong. And yet, even though their model spit out erroneous predictions about inflation, they continue with the same policy recommendations that they were giving in the beginning. It’s really astounding to behold.

I’m not even going to bother citing the above; Krugman has obviously been making that type of case repeatedly for years now.

In this context, let’s review a Krugman post from February 2010 when he wrote:

Now, the measurement issue: we’d like to keep track of this sort of inflation inertia, both on the upside and on the downside — because just as embedded inflation is hard to get rid of, so is embedded deflation (ask the Japanese)…

The standard measure tries to do this by excluding the obviously non-inertial prices: food and energy. But are they the whole story? Of course not…Hence the growing preference among many economists for measures like medians and trimmed means, which exclude prices that move by a lot in any given month, presumably therefore isolating the prices that move sluggishly, which is what we want.

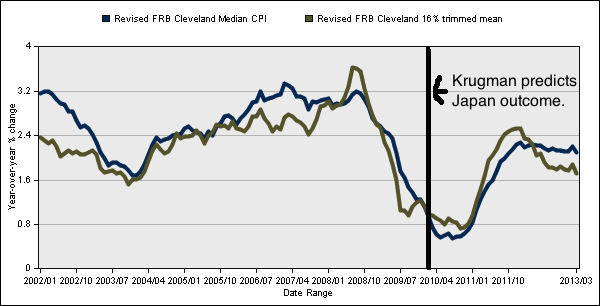

And what these measures show is an ongoing process of disinflation that could, in not too long, turn into outright deflation:

Japan, here we come.

So in conjunction with that chart, Krugman is clearly predicting that the line will keep falling, perhaps even crossing into negative territory, and then will stay down there indefinitely. That’s what happened in Japan, after all: According to this website, over the last 20 years Japan’s CPI has been virtually flat. (This more official-looking site shows Japan’s annual CPI increases have been slightly negative, typically, for the last decade.)

So, how did Krugman’s prediction pan out? Is it true that the Cleveland Fed’s measures of yr/yr median and trimmed CPI kept falling, perhaps even going into negative territory, and then stayed there for years on end? Here’s the chart from the Cleveland Fed (Krugman’s source):

Oops. Krugman’s prediction totally blew up in his face about 7 months later. Rather than falling into negative territory, and not even just staying at its current level, both of the “core” inflation measures roughly tripled more than doubled, jumping back up to almost their pre-recession levels.

In light of his model’s bad inflation predictions, what did Krugman do? Well just recently, when linking to this old post, Krugman explained, “(In that post, I worried about deflation, which hasn’t happened; I’ve written a lot since about why).”

Now if memory serves, Krugman back in early 2010 favored massive government and Fed stimulus to prop up aggregate demand, because we were headed into Japanese-style deflation. When it turned out he was totally wrong about that prediction, he then began calling for— Oh.

Look, I’m not being coy here. If we only cared about the one specific measure of, “Which economist gave his readers a more accurate guess as to what the government’s official CPI numbers would be, over the next five years?” then Krugman was less wrong than me. But he was wrong, and he didn’t even get the direction right.

Yet that’s fine, in Krugman’s book. He’s a scientist, after all. He can still offer the exact same policy recommendations, because he’s “written a lot since” his erroneous worries, tweaking his story about downward wage rigidity blah blah blah.

In contrast, the people warning of large price inflation are supposed to hang up their keyboards and go fishing. They aren’t allowed to say, “Hmm, maybe paying interest on excess reserves, or the situation in Europe, or the effects of ObamaCare, might be contributing to the surprisingly large demand to hold cash…” Nope, that would just be grasping at straws on their part, a ridiculous inability to admit they were wrong about how prices would behave.

Thanks Bob, I feel vindicated. I posted on his blog that IOER, the Europe situation and reserve requirements played a role in keeping inflation numbers down. I didnt bring up Obamacare because I didnt thinkabout how Iit resukts in cash holding. I didn’t bother bringing up the distortions to the caoital structure caused by fed mortgage buying. One of my biggest pet peeves is the myth of “the wealth effect”.

Bob, you write “Now if memory serves, Krugman back in early 2010 favored massive government and Fed stimulus to prop up aggregate demand, because we were headed into Japanese-style deflation. When it turned out he was totally wrong about that prediction, he then began calling for— Oh.”

Umm, didn’t Krugman call for massive government and Fed stimulus because a drop in aggregate demand would lead to massive unemployment and a drop in production? Sure, he thought we might also have disinflation possibly leading into deflation. But those were not the reasons he called for massive stimulus. As in, wasn’t the order or Krugman’s arguments “Hey, without massive government stimulus we will have a huge recession, mass unemployment and suffering. Also, a drop in aggregate demand will lead to disinflation, and possibly deflation, which is bad because the burden of debt increases.” So yeah, he was wrong about the deflation bit, but it wasn’t why he called for stimulus.

(Also, in contrast to some of the price inflation people Krugman has mocked, Krugman has never said “Oh we really have deflation, the statsitics are just being manipulated! Just wait, they can’t hide it forever”)

The most terrifying thing of all is that being completely, comprehensively, unmistakably, fundamentally, fatally, totally wrong has not led [Paul Krugman] to rethink or modify any of his analytical positions or ideological beliefs by even one iota. I mean, one would expect an announcement on his weblog like: “I have been totally wrong, about everything. I am closing down this weblog for five years to avoid misleading readers while I intellectually retool. You will find me sitting at the feet of [Robert Murphy], chanting ‘om mani padme hum’ until I achieve enlightenment.” Not gonna happen…

I started smiling as soon as I saw your fist link, betting that it would be a classic cheesy clip, and you didn’t disappoint. The Last Dragon, awesome!

I think we have to be a bit fair to Krugman in that he called for massive government and Fed stimulus, in order to avoid deflation, and he got massive stimulus, and it does look like the deflation was successfully avoided. We got some inflation, but not spectacular inflation. Krugman got what he asked for, he should be happy.

In an environment where the Fed can make large and seemingly arbitrary interventions, precise predictions are pretty much impossible. I kind of agree with Krugman on the point that if there had not been government intervention, we would have seem more deflation. I don’t think there’s anyone disputing the basic concept that printing money encourages inflation… not even Krugman. The question mark hangs over which way the general tendency of the economy is drifting at the moment.

I might point out that there have been plenty of other massive government interventions above and beyond simple money printing. Many more people are on food stamps now. Fannie and Freddie needed to be nationalized when they crashed so badly that they needed to call on the guarantees that government had (strangely) offered them. The Fed is directly propping up the mortgage market. Government continues to find industries to prop up and places to spend more money. The entire student loan market has been pumped up the whazoo. New wars have started in the Middle East. Americans are spooked over gun control and are purchasing guns like there’s no tomorrow.

Why even bother applying standard economic rules in a system that is screwed up from multiple directions simultaneously?

Yeah, and Obama Care too, and all sorts of “green” initiatives.

Tel wrote:

I think we have to be a bit fair to Krugman in that he called for massive government and Fed stimulus, in order to avoid deflation, and he got massive stimulus, and it does look like the deflation was successfully avoided. We got some inflation, but not spectacular inflation. Krugman got what he asked for, he should be happy.

OK, but:

(a) By Feb 2010 Krugman already had a good idea of what the Fed had and would be doing. He still said we were headed to Japan.

(b) Krugman said he wouldn’t want anybody other than Ben Bernanke at the helm, so he can’t complain about the Fed’s policies.

(c) Krugman just recently reaffirmed his view that monetary policy has no traction at the zero lower bound, because gosh it’s so hard to alter future expectations.

(d) If you give Krugman that out, then I can just say, “Well, thank goodness we had unprecedented austerity the last few years! That’s why we avoided the Zimbabwe outcome.” Right?

Isn’t it obvious then? If Krugman erred anywhere it was his underestimation of the Fed’s capabilities at the zero bound. This is even more obvious by the example we are living right now. Sequester cuts? Europe in shambles? Obama tax hikes kicking in? This is a Keynesian nightmare, and, yet, employment is improving. The stock market is going up. Sentiment is mildly improving. This shouldn’t happen in a Krugman universe where the Fed is powerless.

Fine. But now we’ve got Sumner’s head swelling up like a balloon.

Do I even need to mention Japan?

Now wait a minute Bob – if you say “I was wrong because the demand for money is really important right now” I think that’s exactly what people are expecting of you. They may still mock references to Obamacare. That one is a little gratuitous. We can fight about that. But yes, that’s exactly what people are saying: admit money demand is the principle story in a depression.

What else do you think they want you to admit?

Krugman made revisions to his worldview to account for the fact that we have low inflation rather than deflation. He spent a lot of time over the last couple years rethinking that.

Isn’t that exactly what a scientific approach would do?

“money demand is the principle story in a depression.”

Which (high money demand) is caused by a huge overhang of bad debt in the system, and people try to avoid to be the greater fool and suffering the write off, which is why they hide in cash in the first place… So I would argue bad debt is the principle story in a depression.

Krugman made revisions to his worldview to account for the fact that we have low inflation rather than deflation. He spent a lot of time over the last couple years rethinking that.

The traditional Rothbardian view, reflected empirically in the Great Depression, is that “Inflation” often will flow into a bubble and/or specific lines of investment and not the CPI. In 2009, I assumed that there were not be significant late 70s-like CPI inflation because most of the new funny money would be going into propping collapsing asset prices which should have been allowed to collapse. I also assumed that the super-low interest rates would cause years and years of bad times (didn’t Bob Murphy predict that too?). I certainly did not predict that the Fed would pay the banks not to lend. Further, I did not predict that the American people (generation E) would react as the Eloi and allow the funneling of so much wealth to the financial elite without the Fed/Feds making an attempt inducing more loans to the non-elite. I assumed that the American people would have complained more. Or at least complained the slightest bit without taking it all like cowards. The complaining would have prompted more lending and more CPI inflation.

Both predictions in 2009 of significant CPI inflation and/or propped up asset prices is completely consistent with Austrian analysis. There is NOTHING to revisit or rethink other than using the episode as an example of the level of outrages the authorities might perform and that “the masses” will tolerate.

This is pretty close to the dominant model in my mind, especially the distortion of the capital structure by force feeding housing. (I’m guessing that’s the bubble you are referring to). Housing prices are pretty high by historical income/housing ratios, despite the fact that building costs have dropped. To me, economics is largely about efficiency and I dont see it as progress in efficiency for people to pay a larger percentage of their income on housing.

DK wrote:

Now wait a minute Bob – if you say “I was wrong because the demand for money is really important right now” I think that’s exactly what people are expecting of you. They may still mock references to Obamacare. That one is a little gratuitous. We can fight about that. But yes, that’s exactly what people are saying: admit money demand is the principle story in a depression.

What else do you think they want you to admit?

Are you kidding me Daniel? They want me to say, “Running big deficits and expansionary monetary policy are good policies right now.”

It sounds like everyone agrees that there is high money demand and that it is keeping inflation from occurring in the face of fed printing.

If you wanted a policy approach to ease money, wouldn’t it make more sense to lift policies that are restricting it rather than creating opposing policies?

I see current policy like having people push on opposing sides of a car and saying “Don’t worry it’s not going anywhere!” At some point something will let go.

“Krugman made revisions to his worldview to account for the fact that we have low inflation rather than deflation. He spent a lot of time over the last couple years rethinking that.”

Daniel,

Genuine question as I am not a regular reader of Krugman’s blog: What were the reasons he gave why we didn’t get deflation ? He clearly thinks we are in a liquidity trap where no amount of money creation will increase inflation which is why he thinks that monetary policy is effective. I assume that this would also prevent monetary policy preventing deflation ? If so then does he see the lack of deflation as down to fiscal policy or just luck that the demand for money stopped increasing ?

“Krugman made revisions to his worldview to account for the fact that we have low inflation rather than deflation. He spent a lot of time over the last couple years rethinking that.”

Why hasn’t DeKrugman completely abandoned their entire worldviews, the way they wanted Murphy to do so, on the basis of incorrect predictions, that all three individuals have made?

DeKrugman hasn’t made any revisions to their beliefs concerning government spending, or inflation, or the drivers of economic progress. Those are all the same. What they have changed are what I like to call humblebrags. Seemingly admitting one was wrong, but implicitly at the same time complimenting oneself. E.g. “I underestimated just how right my theory is.” “I made the mistake of believing politicians are just as intelligent as me.”

DeKrugman believes that incorrect predictions are not sufficient to abandon Keynesianism, but are sufficient to abandon Austrianism. The irony is that Austrianism doesn’t even make empirical predictions.

What DeKrugman are doing, I think, are psychologically projecting. They take all the self discomfort and self resentment that comes with making incorrect predictions, and dumping it all on Austrian economists. Sort of like how a gay Republican can be the loudest critic of other people’s “alternative” lifestyles. Their own clinging to Keynesianism despite making prediction errors, are communicated to others as “Austrians are dogmatists who won’t change their theories.”, i.e. won’t change them into Keynesian theories like mine.

“admit money demand is the principle story in a depression.”

Uh.. the only “admission” here is the fact that money demand was higher than those expecting high price inflation expected. It’s always been known that unusually high demand for money can temporarily slow price inflation, as the price rise occurs when the money is starting to cycle through the economy.

That doesn’t make it the “principal story in a depression”. In fact, it would have been an entirely unrelated factor if the “powers that be” had not acted so ridiculously with the money printing and the bailouts and everything. Including the uncertainty created by Obamacare. (Wherein my poorer friends are now all “how the hell am I going to get insurance? this is stupid!”)

Krugman wrote “Fine Austrian Whines” 2/20/13:

Substance aside — not that substance isn’t important — Austrian economics very much has the psychology of a cult. Its devotees believe that they have access to a truth that generations of mainstream economists have somehow failed to discern; they go wild at any suggestion that maybe they’re the ones who have an intellectual blind spot. And as with all cults, the failure of prophecy — in this case, the prophecy of soaring inflation from deficits and monetary expansion — only strengthens the determination of the faithful to uphold the faith.

It would be sort of funny if it weren’t for the fact that this cult has large influence within the GOP.

http://krugman.blogs.nytimes.com/2013/02/20/fine-austrian-whines/

Krugman wrote “On Not Learning Continued” 12/31/12:

Robert Murphy replies to Brad DeLong, and DeLong is not happy — for good reason. But I think there’s also a broader point.

Brad’s ire reflects Murphy’s apparent belief that his failed inflation forecast is OK because we just so happen to have faced a huge deflationary downdraft that offset the inflationary impact of Fed expansion. As Brad says, if that’s right, we should be hailing Ben Bernanke for preventing a catastrophic deflation, not attacking him for doing too much. Indeed, if you believe that there are lots of shocks of this magnitude, you should be a big supporter of activist monetary policy.

My broader point, however, involves Murphy’s main argument, which is “Well, some Keynesians got their unemployment predictions wrong, so there.”

What’s wrong with this line of attack? Two things, actually.

First, it’s really important to distinguish between fundamental predictions of a model and predictions that an economist happens to make that don’t really come from the model.

http://krugman.blogs.nytimes.com/2012/12/31/on-not-learning-continued/

2009 Austrian predictions about what the Fed would do in the ensuing years didn’t really come from a model, just guesstimates about what actions authorities would be taking. So, according to Krugman, they are excusable, right? Further, it is clear that Krugman has no familiarity with the Austrian notion of funny money propping up asset prices. Or anything else Austrian other than alleged failed inflation predictions from 2009. This all sounds just like another episode of Krugman’s dishonest and dishonorable behavior entitled “On Not Learning, Continued”.

Notice the bait and switch from Krugman. Even if Murphy can be excused for making a personal prediction that doesn’t pop out of any Austrian model, the “main point” remains that prices did not fall, so praise Bernanke and poo poo Murphy.

Krugman is constantly switching contexts, never staying on one topic enough to expose his own ineptitude.

In “On Not Learning, Continued”, Krugman continues:

In short, some predictions matter more than others.

Beyond that is the question of how you react if your prediction goes badly wrong.

The fact is that while Keynesians predicting a fast recovery weren’t really relying on their models, the failure of that fast recovery has nonetheless prompted quite a lot of soul-searching and rethinking. It is now standard, in a way that it wasn’t before, to argue that recessions that follow financial crises have a very different time path of recovery from other recessions, and that debt overhang, in particular, poses special problems.

So Keynesian thinking has evolved in important ways; we’ve learned from our mistakes (where by “our”, as it happens, I don’t exactly mean “my” — I expected a slow recovery all along; but the actual event has nonetheless led me to substantial rethinking). The fundamental concepts of demand-side slumps and the importance of the zero lower bound remain, but there’s a lot of further refinement that changes the way we think.

Has there been anything comparable on the Austrian/Austerian side? Not that I can see. All I see are excuses — hey, we would have had inflation except for the Europeans, or something. And to return to Brad’s point, there doesn’t even seem to be any consideration of the implications for policy if in fact things like a debt crisis on the other side of the Atlantic can suddenly triple the apparent demand for high-powered money.

Being willing to learn matters. Unfortunately, that willingness seems absent from many people who consider themselves economic experts.

Krugman doesn’t seem to be making that strong of a prediction.

…because it turned out wrong.

Wonks Anon wrote:

Krugman doesn’t seem to be making that strong of a prediction.

Yes, I suppose maybe he and Robin were just taking a trip to Japan the following day, and I misread him.

If the prediction is meant to be :

“And what these measures show is an ongoing process of disinflation that could, in not too long, turn into outright deflation:”

Then the use of the word “could” means that its not really a prediction at all.

I quoted Krugman supra:

Brad’s ire reflects Murphy’s apparent belief that his failed inflation forecast is OK because we just so happen to have faced a huge deflationary downdraft that offset the inflationary impact of Fed expansion. As Brad says, if that’s right, we should be hailing Ben Bernanke for preventing a catastrophic deflation, not attacking him for doing too much. Indeed, if you believe that there are lots of shocks of this magnitude, you should be a big supporter of activist monetary policy.

Why why why? Keynesians: Please explain why it is so important for the authorities to distort prices from what real people will actually and voluntarily pay to some other artificial price?

Bob,

I am not a Keynesian but I can see the logic in the view that increasing the supply of money to match an increase in demand is an optimization over expecting all other prices to change every time money demand changes. I think that in a world of free banking an “elastic” money supply would develop spontaneously. In a world of central banking we rely on the authorities to adjust the money supply and they do a horrible job.

However effectively calling on the fed to freeze the money supply even when this is likely to lead to ugly outcomes seems a weird policy to me.

“I am not a Keynesian but I can see the logic in the view that increasing the supply of money to match an increase in demand is an optimization over expecting all other prices to change every time money demand changes. ”

Inflation of the money supply increases prices from what they otherwise would have been. Prices would have to change if inflation of the money supply is going to be considered to “work”.

Moreover, the desire for scarce resources always outstrips the ability to produce them. There is no such thing as a single, society wide “demand for money” (holding), that manifests an optimal “offset” inflation of the money supply to “accommodate”, such that “prices don’t have to change”.

For one thing, money is not the desired ends, but what money can eventually buy (consumer goods). If you understand the desire for holding money to be a desire for purchasing power, not just money for the sake of money, then you will realize that people want a particular sum of money relative to prevailing (and expected) prices. They want (what can be generally described as) a ratio.

Also, every time an individual desires to hold more money, it is required that someone else desires to hold less money, and vice versa. That means there can’t be an increase in money holding without inflation of the money supply. Thus, the desires among individuals to hold money are actually insufficient justifications for increasing the quantity of money. The actual way people communicate their desire for more money, is on the side of relative profit and loss between money production, and goods production, in a competitive market. It is not communicated through falling aggregate spending and rising cash holding times.

If everyone wants to hold more money than they own, then what is happening is that everyone is communicating a desire for increased purchasing power. More real goods and services increases purchasing power of money, not more money. If everyone wants more money, what they are actually wanting is a greater ability to purchase goods and services. Inflation of the money supply can’t accomplish this, because inflation will increase prices from what they otherwise would have been, which of course decreases the individual’s ability to purchase goods and services.

Thus, seemingly paradoxically (to those who view more money as an in itself, i.e. those who have desires in line with central bankers), if aggregate spending suddenly falls, and cash holding times suddenly rise, then people may very well be communicating to you and each other that there are insufficient real resources, not insufficient money.

This makes sense in relation to ABCT. Austrians argue that recessions are caused by malinvestment, i.e. too much invested in certain lines and not enough invested in other lines. This latter insufficiency is why cash holding times increase (and why aggregate spending falls). Individuals are communicating to investors to produce more goods that are currently insufficient, and they will continue to hold onto their money until those goods are ready. And guess what? The very market forces that are brought about by increased cash holding times, send the very signals investors need to learn to produce more of the insufficiently produced goods.

Aggregated thinking minds completely misunderstand this whole process, because they look at aggregate output and employment, and go into hysteria whenever those aggregates decline, completely overlooking the dynamic, micro level coordinating forces within.

The only reason Keynesianism has “some logical sense” to you, is because you are already predisposed to the same aggregated thinking and so you find some affinity with other aggregate doctrines. You believe that free banking will do a better job “managing” the various aggregates. Where are the micro considerations?

I would add the problem of debt, which makes deflation problematic. Otherwise, money is just a yardstick. It’s like trying to improve your gas mileage by switching to the metric system. I dont buy the “price expectations lead to lower demand” concept. I still buy computers. Keynsians seem to ignore the natural time preference people have.

Keynesians are making a mountain out of a molehill. They’ll focus on the temporary, fleeting time period of a DELIMITED adjustment in cash preference that arises from a new price inflation trend (from positive to negative), and present that fleeting moment in time as some sort of universal, all encompassing, perpetual, UNLIMITED tendency of holding more and more cash for long and longer periods of time until spending falls to zero.

Of course, in the real world, even if there is a rise in cash preference that comes from living in a world of 2% price deflation, as opposed to 2% price inflation, it would be delimited. Instead of people holding 5% of their assets in cash, they may hold 10% in cash, or whatever. There isn’t any reason for a continued, perpetual, constantly growing rise in the demand for money holding that arises from 2% annual price deflation, any more then there is a constant, perpetual constantly declining demand for money holding that arises from 2% annual price inflation.

“For one thing, money is not the desired ends, but what money can eventually buy (consumer goods). If you understand the desire for holding money to be a desire for purchasing power, not just money for the sake of money, “

False. Money can provide direct utility in and of itself by reducing anxiety, fear or uncertainty about the future.

Even Hoppe agrees:

“Because money can be employed for the instant satisfaction of the widest range of possible needs, it provides its owner with the best humanly possible protection against uncertainty. In holding money, its owner gains in the satisfaction of being able to meet instantly, as they unpredictably arise, the widest range of future contingencies. The investment in cash balances is an investment contra the (subjectively felt) aversion to uncertainty. A larger cash balance brings more relief from uncertainty aversion. ”

Hans-Hermann Hoppe, “‘The Yield from Money Held’ Reconsidered,” Mises Daily, 14 May, 2009, http://mises.org/daily/3449

“False. Money can provide direct utility in and of itself by reducing anxiety, fear or uncertainty about the future.”

False. Money that provides “direct” utility by reducing anxiety, fear, or uncertainty, is in fact indirect utility relating to one’s future purchasing power.

It is the same category of indirect utility that one experiences by holding an “income earning” capital asset. The present utility that one experiences knowing that one has an asset that can provide future consumption benefits, is an indirect utility, not a direct one.

Nobody would hold money as an end if they knew that the money itself would have zero purchasing power beyond their subjective time horizon. It’s why people tend not to seek to hold more Deutchmarks to reduce their anxiety, fear, and uncertainty. It’s because they know Deutchmarks have little to no future purchasing power relating to consumption. The absence of indirect utility relating to future consumption is why they are not sought after (other than the rare instances of people collecting them as a means to sell them later on).

Hoppe is not describing holding money as an end in itself. He is relating it to future consumption (ends).

The anxiety, fear, and uncertainty, are anxieties, fears, and uncertainties relating one’s own future ability to procure consumer goods.

For suppose that an individual who is anxious, fearful, and uncertain about the future, who lived on a deserted island, were given an inheritance of real wealth, such as (portable) mansions, luxury cars, roads, all the (non-perishable) food they could ever eat, clothing, and on and on, then there would be far less need to hold more money. It might be zero need to hold money.

On the other hand, if someone were given a huge sum of paper currency, in a world with such little purchasing power (say they lived on the same deserted island) that the paper currency itself is worth virtually nothing in real terms, then their anxiety and fears and uncertainty would not be any less.

In short, the reason why holding money can reduce anxiety, fear, and uncertainty, has to do with the prevailing and expected future purchasing power of money in terms of ends, i.e. consumption.

Having mansions, cars, food, clothing, and so on, give direct utility in themselves. The fears and anxiety all relate to these ends. Having money does not give direct utility. It’s indirect utility akin to owning income earning assets.

You’re misreading Hoppe.

The fact that money has purchasing power or the power to extinguish debt or taxes does not in any way refute the observation that it has direct utility.

One can compare the direct utility that money delivers with the utility provided by a fire alarm: imagine you buy a fire alarm and install it correctly in your home. You may never have a fire in your whole life, and the fire alarm may never in fact go off. Yet the ownership of a working fire alarm nevertheless provides direct utility: it gives you satisfaction or pleasure in diminishing your fears that a fire may occur at night in your house without your knowing or waking up in time.

Money’s direct utility works in the same way: it diminishes our fear about the future. You can hold $1000 in your home or wallet your whole life without spending it and it will provide direct utility.

“The fact that money has purchasing power or the power to extinguish debt or taxes does not in any way refute the observation that it has direct utility.”

The fact that money is earned so as to procure future consumption ends, DOES refute the false observation that money has direct utility.

“One can compare the direct utility that money delivers with the utility provided by a fire alarm: imagine you buy a fire alarm and install it correctly in your home. You may never have a fire in your whole life, and the fire alarm may never in fact go off. Yet the ownership of a working fire alarm nevertheless provides direct utility: it gives you satisfaction or pleasure in diminishing your fears that a fire may occur at night in your house without your knowing or waking up in time.”

You just made an argument that proves my point. Fire alarms have present utility because it is indirect utility. The direct utility is being able to consume in the future without burning to death.

The satisfaction experienced from having a fire alarm relates to the direct future consumption utility of the home (if the fire alarm is installed in the home), or it relates the indirect utility of owning a capital asset (office, etc) which is itself indirect utility relating to future consumption as well.

“Money’s direct utility works in the same way: it diminishes our fear about the future.”

Money does not have direct utility when it is earned to diminish fears relating to FUTURE consumption.

“You can hold $1000 in your home or wallet your whole life without spending it and it will provide direct utility”

Not if you knew it has, or expect to have, zero purchasing power relating to consumption.

“Fire alarms have present utility because it is indirect utility. The direct utility is being able to consume in the future without burning to death.”I

It is not indirect, but direct, by reducing your fear or anxiety about the future.

“Money does not have direct utility when it is earned to diminish fears relating to FUTURE consumption.”

It does direct utility .

And your emphasis just on consumption is also misplaced.

It could be used to repay debt or taxes or fines.

“It does direct utility .”

That doesn’t even make sense.

If what you meant to say is “It does have direct utility”, then you’re still wrong and repeating it over and over again won’t make it true.

If there was no house as a consumer end, or place of business as an indirect means to acquiring a future consumer end, then the fire alarm would not derive any (indirect) utility. It is because of the direct utility experienced consuming the home (or indirect utility experienced using a place of business) that the fire alarm has indirect utility.

“And your emphasis just on consumption is also misplaced.”

No it isn’t. Consumption is the ends to which means are directed.

You are fallaciously asserting some direct, i.e. final, utility can be experienced through a means that only has value because of its dependency on the subjective end.

“It could be used to repay debt or taxes or fines.”

Repayment of debt…so that one has an opportunity to consume more in the future, as opposed to have the lender take the claim for that future consumption, through either collateral delivery, which is itself either consumption or capital (means to future consumption).

It’s very easy to see that the utility experienced holding money is indirect, not direct. Suppose someone had $10000 in cash. If for whatever reason the supply of money expanded, then purchasing power of that money will fall, and the allegedly direct utility of reducing fear and uncertainty, would also decline.

There is a difference between you having $10000 in cash while everyone receives an additional sum of money, and you having a house or food or other consumer good for your own consumption, while everyone else receives an additional supply of consumer goods as well for their own consumption. Your fear and uncertainty here will not be any less, because the real consumer goods you own are providing you with direct utility.

Not so with money. If a person holds $10000 in cash to reduce their fear or uncertainty, then their fear and uncertainty will be increased if everyone else came into ownership of more money. Why? Because money provides indirect, not direct, utility.

“Money can provide direct utility in and of itself by reducing anxiety, fear or uncertainty about the future.”

This is indirect utility. It can only reduce anxiety, fear or uncertainty because it can provide utility as a medium of exchange.

“I dont buy the “price expectations lead to lower demand” concept.”

Debt deflation does.

Debt deflation is just another phrase for liquidating bad debt, which has to be done anyway. A loss is loss and cannot be turned into a profit.

The only thing you can do is to try to spread the losses as far as possible or/and delay its write off. Yet this has its own consequences. Like even more bad debt, false price signals, increasing moral hazard etc..

Just like an individual criminal is immoral, but a criminal gang writ large is moral (government), so too is it the case with LK that individual debt default is moral, but “widescale” debt defaults is immoral.

The grey area in between the individual and the community is where LK flips logic and reason upside down. All statists do this.

M_F has no understanding of what debt deflation even is.

In his ridiculous world view, cutting wages and prices is the solution to economic recession/depression to restore the tendency towards market clearing prices/wages.

Except cutting wages when nominal debt remains fixed is just a recipe for inducing mass bankruptcy, since the real burden of debt servicing will soar as wages are cut.

LK has no understanding of what debt deflation is.

In his ridiculous world view, cutting wages and prices is not the solution to economic recession/depression to restore the tendency towards market clearing prices/wages.

Yes, cutting wages when nominal debt remains fixed is a recipe for inducing mass bankruptcy, but that liquidation IS the cure, since the nominal claims (interest and principal) are relating to projects that are not physically sustainable.

LK wants everyone to believe that a healthy capitalist economist contains zero bankruptcies.

LK wants everyone to believe that the market process of exchanging private property subject to profit and loss, doesn’t contain losses.

LK wants everyone to fear bankruptcies as inherently evil, when in reality they are a healthy cure to malinvestment.

LK takes a refusal to cower in fear and refusal to seek monopolists to delude us with funny money, as some sort of evidence that one does not understand the economics of debt deflation.

LK is smuggling in an implicit value judgment of “We ought to prevent bankruptcies using coercive monopoly funny money regimes.”

LK’s base morality is exposed once again after his economics are revealed as fallacious.

I posted my response anonymously by mistake, so when Murphy accepts my response, you’ll see it.

In short, you’re smuggling in an implicit ethical claim that bankruptcies ought to be prevented by coercion from monopoly funny money activity, after your economics have been revealed as fallacious.

No, I am not even assuming any ethical judgement at all.

I am correcting demonstrating why your economic argument in favour of downwardly flexible wages and prices as an actual solution to depression does not yield the recovery you think does in economic terms.

To the credit of other Austrians, they are well aware of the reality of debt deflation.

E.g., even the GMU Ausrians recognise its the reality

http://www.coordinationproblem.org/2009/11/is-the-debtdeflation-theory-of-depressions-as-insightful-as-has-been-suggested.html

Of course, no doubt we will hear the no true Scotsman fallacy again as you complain that GMU Austrians are not really Austrian at all, but evil statist thugs, or some such garbage.

“cutting wages when nominal debt remains fixed is a recipe for inducing mass bankruptcy, but that liquidation IS the cure, since the nominal claims (interest and principal) are relating to projects that are not physically sustainable.”

In a depression when there are vast idle resources, idle capital stock and many unemployed workers, all capital projects base don debt are “physically sustainable, are they”!

We are witness to pure genius here.

“No, I am not even assuming any ethical judgement at all.”

Yes, you are. You are advocating for the ethical rule that states, “If there are bankruptcies, then people OUGHT to engage in non-market activity to prevent it.”

“I am correcting demonstrating why your economic argument in favour of downwardly flexible wages and prices as an actual solution to depression does not yield the recovery you think does in economic terms.”

But it does. The bankruptcies are not divorced from the laissez-faire argument. You’re pretending that bankruptcies, because they occur in the laissez-faire solution, are somehow a surprise.

Not so.

Falling wages rates and prices, AND liquidation of bad debt, are all components of the laissez-faire solution which sees a tendency towards full employment and output.

Falling prices and wage rates, coupled with liquidation of bad debt, are all, but not exclusively, components of economic recovery.

You’re not pointing out any incorrect economic thinking on my part. Depressions are cured by, among other things, liquidation of bad debt, i.e. bankruptcies.

“To the credit of other Austrians, they are well aware of the reality of debt deflation.”

To refuse to cry that the sky is falling when debt is defaulted on, to refuse to advocate for inflation to stop healthy bankruptcies, to refuse to hamper recovery by claiming that bankruptcies are somehow not a part of recovery, does NOT imply that I “do not understand debt deflation.”

I just do not adhere to the same immoral framework as you, which is that if bankruptcies occur, then people OUGHT to engage in coercive activity to stop them.

You’re not merely pointing out the imaginary notion that you’re correcting my arguments on what constitutes getting out of depression.

“E.g., even the GMU Ausrians recognise its the reality”

Even them? Even X believes this. Even Y believes that. This is appeal to authority.

“Of course, no doubt we will hear the no true Scotsman fallacy again as you complain that GMU Austrians are not really Austrian at all, but evil statist thugs, or some such garbage.”

I am not here trying to define what constitutes an Austrian or non-Austrian response to bankruptcies. Austrian economics is value free. I am talking purely of the economics of it. During depressions, falling prices and wage rates, AND bankruptcies, subject to private property rights are, among other phenomena, components to economic recovery.

It does not follow that because bankruptcies may lead to temporary increases in unemployment, that bankruptcies are therefore not a component of economic recovery and getting out of depression, any more than claiming that because the realization that one has only 40k bricks as opposed to 50k that one thought one had, and the corrections that occur during the reaction to this, which may include layoffs and rise in unemployment, somehow implies that changing course and reallocating capital and labor to new uses is also not a part of economic recovery and getting out of bad projects.

“cutting wages when nominal debt remains fixed is a recipe for inducing mass bankruptcy, but that liquidation IS the cure, since the nominal claims (interest and principal) are relating to projects that are not physically sustainable.”

“In a depression when there are vast idle resources, idle capital stock and many unemployed workers, all capital projects base don debt are “physically sustainable, are they”!”

You said idle resources twice. Resources includes capital.

The idle resources, and unemployment, are a reflection of the fact that their prior employments were not in line with actual individual consumer preferences. The increase in idleness and unemployment, after being malinvested by previous inflation, are very much a part of the cure process.

“We are witness to pure genius here.”

You dodged the point, and asked rhetorical questions to replace the emptiness in your economics.

“Also, every time an individual desires to hold more money, it is required that someone else desires to hold less money”

Why ?

Because money is scarce, not unlimited.

We are all aware of the problem of “debt deflation”. It is always the result of the Keynesian bust. Without the Keynesian boom and bust, there is no such problem. The (one time) solution would be modification of debts in bankruptcy on a case-by-case basis so that the amount owed is changed to approximately the equivalent in repriced goods and services as was intended by the parties. This is now prohibited for a claim secured only by a security interest in real property that is the debtor’s principal residence because “the masses” are spineless and oblivious. The bank created the loan out of air with funny money and the banks have been made whole 5x by the government. But it’s illegal to force a mortgage note modification on them and the debtor must pay back the bank in money actually earned by them and because us peons do not have access to a “printing press”.

11 USC 1322(b)(2) states:

(b) Subject to subsections (a) and (c) of this section, the plan may—

(2) modify the rights of holders of secured claims, other than a claim secured only by a security interest in real property that is the debtor’s principal residence, or of holders of unsecured claims, or leave unaffected the rights of holders of any class of claims;

http://www.law.cornell.edu/uscode/text/11/1322

“It is always the result of the Keynesian bust. Without the Keynesian boom and bust, there is no such problem. “

Debt deflation existed long before central banks or Keynesian fiscal policy.

E.g., Australia in the 1890s.

Of course, being ignorant of history is the stock in trade of Rothbardianism.

“Australia in the 1890s”

John Maynard Keynes 5 June 1883 – 21 April 1946

Thus are you refuted! All economic ills flow from one source LK …

Yah, that nutjob Keynes was spreading evil even as a 10 year old. 🙂

We’ve been over Australia in the 1890s 27x before, LK. They had a 40% reserve requirement right?

And a little birdie told me The Classical Gold Standard Era was a Myth.

http://socialdemocracy21stcentury.blogspot.com/2013/03/the-classical-gold-standard-era-was-myth.html

zzzzzzzzzzzzzzzzzzzzzzz

I think he meant “Keynesian” in a broader manner – government meddling in general – and not necessarily a particular Keyenesian policy.

Here’s a quote from a paper with a relatively positive view of the free banking era, which nonetheless notes the systemic collapse of 1893

Australia provides a textbook example of free banking in practice. One writer on the subject commented that in Australia “the legal framework with which banks operated was perhaps the least restrictive of any on

record” (Dowd 1992).Butlin (1953),commented that “there was no

tender law, no central bank, no legal control over the total volume of bank loans, and only a very primitive control by the banks themselves through a loosely applied rule of thumb (cash reserves should be to one-third the sum of deposits and notes) concerning reserves against all liabilities”.

the 1840 Colonial Bank Regulations issued by British Treasury governed colonial banking. The requirements included that: capital should be a determinant amount and must be fully subscribed; total debts must not exceed three times the paid up capital and that all notes were to be payable on demand in specie at the place of issue. Failure to pay on demand for a total of 60 days in any year entailed forfeiture of incorporation. Personal liability for bank shareholders was capped at an amount equal to twice capital and loans against real estate, shops or merchandise were to be prohibited. Amendments to the regulations in 1846 limited the note issue to the amount of paid up capital.

Banking was not substantially affected by the regulations, however. For example, the restrictions on total debt and note issue were largely ignored (Butlin 1986). Likewise, banks found loopholes around the prohibition on lending for land (Pope 1989). In practice, Australian colonial banks were allowed to raise the limits on note issue by including coin and bullion in paid-up capital. Over time, even this stricture was relaxed; by 1856 the Bank of Australasia secured a licence to print private notes up to the value of three times its specie and bullion holdings. Reserve requirements were easily met as “double counting” was permitted: reserves used to back the note issue were simultaneously used to provide liquidity in the event of a deposit withdrawal. Rules limiting total indebtedness were also no threat because deposits were excluded.

This freedom of note issue was, however, accompanied by strong liability provisions. In most colonies by the late 1860s, shareholders had unlimited liability for their note issue (Pope 1989).

Source is OPTIMAL REGULATION OF ELECTRONIC MONEV: LESSONS FROM THE “FREE BANKING” ERA IN AUSTRALIA

by

THOMAS A. ROHLING AND MARK W. TAPLEY*

Economic Papers: A journal of applied economics and policy

Volume 17, Issue 4, pages 7–29, December 1998

http://critiquesofcollectivism.blogspot.com/2011/02/john-quiggin-on-abct.html?showComment=1298001476947#c6188943951814638041

LK is again citing the very confused and/or dishonest Steve Keen. LK writes:

At the rotten heart of neoclassical economics (even the New Keynesian models) is the notion that, if only prices and wages were flexible enough, the economy would converge back to full employment equilibrium.

http://socialdemocracy21stcentury.blogspot.com/2013/04/steve-keen-on-instability-at-heart-of.html

Keen writes:

A defining feature of mainstream economic modelling is the belief that the economy is stable: given any disturbance, it will ultimately return to a state of tranquil growth. Mainstreamers argue over how fast this will happen: Chicago/Freshwater /New Classicals argue it adjusts instantly, while Saltwalter/New Keynesians say it will take time because of ‘frictions’ in the economy’s adjustment processes. But they both take the innate stability of the economy for granted, and this belief is hard-coded into their mathematical models.

Note that both LK and Keen are oblivious (purposefully or not) to the impairment of economic calculation induced by the Keynesian/monetarist “solutions”. Further, neither prices nor wages are or can be “flexible”. People who negotiate prices and wages can be either flexible or inflexible, reasonable or not, intelligent or not. The “economy” is not mechanical nor does it lack or require “traction” or “momentum” especially from an external source. It does not require an omniscient third party to instill “flexibility” into inanimate concepts such as wages and prices. Absent some government bailout or subsidy, necessity will be the mother of invention and people will become amazingly flexible and reasonable in their negotiations, even though 99% of the “shocks” they must endure and resolve are caused by Keynesian policies in the first place.

“Note that both LK and Keen are oblivious (purposefully or not) to the impairment of economic calculation induced by the Keynesian/monetarist “solutions”.”

No, it is you who are unaware that supply and demand are equated by quantity signals in most markets, not flexible prices. The prices are not distorted way from some universal imaginary set of market clearing prices (even if such prices even exist in all markets) because most businesses do not even set them that way.

The whole Austrian “economic calculation” fantasy is founded on plain and pure ignorance of actual real world economies.

If a quantity changes, then its price per unit changes, right? Prices are set to maximize as much profit as possible. It does not matter if most businesses set prices by bobbing for apples or throwing darts if that maximizes profits.

What the hell are you even talking about?

Not necessarily. Costs drop or demand rises and more are sold at the same price is the claim LK is making. I am not sure in terms of looking for the Langrange multipliers that that make a difference but it might if the new production involves “idle” resources. If you deny that any resource is “idle” but give only non falsifiable tests for that then LK might have a point here.

I am not taking sides on this btw.

Quantity changes = changes in employment and quantity of output, not prices.

Not very good at understanding basic Keynesian concepts, are you roddis!

I repeat, if quantity changes without an overt corresponding price change, then the underlying unit price has in fact changed, right?

“underlying unit price “?

If this is supposed to mean the sales price of one good, then no.

One still does not know what to make or how much to charge unless and until someone buys whatever amount from you at whatever price they actually pay. You cannot know that for sure unless and until it happens, regardless of how many times it has happened before. LK’s hairsplitting is his M.O., but still pathetic.

lol… So :

(1) year 1: a business sells 100,000 units;

(2) year 2: only 60,000 are sold, with monthly sales failing in last months, though prices are not cut;

(3) year 3: in first quarter production is cut to 20,000 units (instead of 33,000 as in year 1), with a number of workers fired, though prices are not cut, and excess capacity is available to meet any extra demand.

They sell 21,000 in Q1, with an extra 1,000 made by quickly using excess capacity.

———-

This sort of thing happens in the real world all the time: quantity of produced goods is changed to match demand, prices are not changed.

So freakin’ what? It’s a message from God. Sell your stupid business, learn to sing and dance and become a cabaret entertainer.

Impeccably argued!

We have a new nobel prize winner here.

And there would be no need to sell the business. The business would still be profitable.

The “economic coordination” that goes on in the real world is not

the fantasy world Austrian economic calculation you require with universally flexible prices adjusted to market clearing levels.

I HAVE NEVER SAID “PRICES ARE FLEXIBLE”. Or that Austrian theory is based upon “PRICES ARE FLEXIBLE”. See above.

Reducing the amount made and sold without changing its price is simply an example of economic calculation. You nitwit (Bob Murphy, I just couldn’t help it).

Obviously, you cannot sell stuff that people won’t buy and you sure can’t sell stuff for long that costs more to make than you can get for it. So what? Funny money and unpayable debt sure don’t solve those normal problems of existence in this universe.

“I HAVE NEVER SAID “PRICES ARE FLEXIBLE”. Or that Austrian theory is based upon “PRICES ARE FLEXIBLE”.

So … you are saying you are utterly ignorant of basic Austrian concepts?:

“The characteristic feature of the market price is that it equalizes supply and demand. The size of the demand coincides with the size of supply not only in the imaginary construction of the evenly rotating economy. The notion of the plain state of rest as developed by the elementary theory of prices is a faithful description of what comes to pass in the market at every instant. Any deviation of a market price from the height at which supply and demand are equal is – in the unhampered market – self-liquidating.”

(Mises, L. von. 2008. Human Action: A Treatise on Economics. The Scholar’s Edition. Mises Institute, Auburn, Ala. 756–757).

———-

Perhaps you should read more Mises, bob?

Self-liquidating. Do you know what that means? It means that supply and demand are not exactly an ERE.

Mises held it to be a faithful description of what comes to pass in the market, but not identical to the market itself.

In other words, if a price is not optimal from the perspective of the seller and/or buyer, the prices that prevail appear as self-liquidating, because if they’re “wrong”, meaning if they are incurring avoidable losses, then there is an incentive for sellers and buyers to change them.

It doesn’t mean ERE is always present.

LK, they simply refuse to admit that any company could rationally act this way despite the fact that many do all the time.

Bob R would be on stronger ground if he argued that said production changes ALSO involved price discrimination via various sales channels — which also DOES happen all the time. And that reall does mean a price cahnge.

Ken B:

“LK, they simply refuse to admit that any company could rationally act this way despite the fact that many do all the time.”

There is nothing any company could ever do that would refute what I said. It is a fact that whatever prices a seller sets, the same market forces due to actual, real world consumer activity, would present themselves.

LK just doesn’t understand pricing theory. He is using fallacious, arbitrary models of pure and perfect competition, MR=MC, instantaneous price changes, and other anti-real world, i.e. irrational, standards.

The laissez-faire argument is not that the ERE is achievable. It is not that prices will instantaneously adjust to eliminate (temporary) local surpluses and shortages. It is not that depressions can never occur, that unemployment can never occur, that reduced output can never occur.

It is only that introducing violence makes whatever bad situation worse, because violence prevents/hampers/eliminates reason.

LK, they simply refuse to admit that any company could rationally act this way despite the fact that many do all the time.

I’ve never “admitted” nor “denied” that companies might act this way. It’s totally dishonest to suggest or imply that either MF or I have implied that companies could not act this way in a voluntary setting. It’s also a dumb argument.

Bob R would be on stronger ground if he argued that said production changes ALSO involved price discrimination via various sales channels — which also DOES happen all the time. And that reall does mean a price cahnge.

I’ve never “admitted” nor “denied” that companies might act this way.

What I have said is that people will tend to make whatever changes are necessary to make sales, whether that be changing the price, the volume, the quality or going out of business and becoming a cabaret singer. These “problems” can be solved by free people engaging in voluntary activities free of thuggish bureaucrats backed by SWAT teams diluting the funny money supply or engaging in government spending and debt and the can be best accomplished when the Keynesian horde is not distorting the pricing process.

“Why why why? Keynesians: Please explain why it is so important for the authorities to distort prices from what real people will actually and voluntarily pay to some other artificial price?”

WHO SAYS IT’s a “DISTORTION?” Maybe its what real people want. Maybe the “artificial” thing to do is to let prices fall, to let demand deflation continue, let unemployment soar to 40%, millions of people get thrown from their homes, and put America at risk because people are so desperate they’ll listen to any charismatic would be dictator that comes along. Even if the Austrian story WERE true, don’t you think having a fed and a relatively free liberal democracy with “distortions” (Again, if you can’t hold up a non distortion baseline, if you cant predict, than your theory is insignificant ) is better than living under a totalitarian terror?

Its like when I read certain things about Rothbard, and why neo-confederates supported the confederacy. Tariffs. I kid you not! Tariffs! As if tariffs and mercantilism were a bigger evil than the evil of slavery!. No sense of practical perspective at all! (And then there is that letter that Rothbard wrote to the dixie partt in the 1950’s. Disgusting) That was when I started to recover from Austrianism. Or at least the Mises-Rothbard kind

That last part seems to be out of the blue.

It sounds like a cri de coeur from a man who followed a false god until the scales fell from his eyes.

Yep, similar to when I left Keynesianism and discovered the Austrians.

Really?

As I read it as someone who just wanted to smear the Austrian School regardless of substance or relevance.

The cry of “racist” or even “neo-confederate” is usually a good way to do that.

You don’t think the bit “I started to recover from Austrianism” means he stopped finding Austrian ideas so entrancing?

Richie has it right. This is how people react when they get disenchanted with ideas.

Doesn’t matter as the Confederacy ( and Neo-Confederates) has nothing to do with Austrian ideas.

Of course it matters. I described it as a cri de coeur not as a fair characterization. The guy who made the statement agrees it’s a cri de coeur. You denied it was.

So of course the actual wording of what he said, which makes plain that my readfing of it is correct matters. When discussing what people said, what they said matters.

My point had nothing to do with his passion, just pertinence. Of which, I think we agree, there wasn’t any.

We agree Austrianism need not involve accepting neo-confederate twaddle you mean? Yes we agree on that. There is some overlap in the people in those groups but there is no logical connection between the two. There is no logical connection between being a Keynesian and likng Lawrence Welk either.

If people want something, they will buy it. Why doesn’t Occam’s razor apply here? The simple irrefutable truth is that you can’t read people’s minds but you can know what they paid for something. It’s like the Copernican system and it explains everything. Keynesianism ignores the obvious simple explanation, then is 50x more complicated but the elipses in their ptolemaic model are like what happens when you let the air out of balloons.

A “non-distortion” baseline is merely enforcement of the NAP and general English common property, personal and contract rights. It’s not that complicated to examine historical transactions on a case by case basis to determine if they were impacted by violent interventions. You’ve made the traditional garbage LK argument which is just another Keynesian attempt to destroy well known and well understood concepts.

Even though Detroit has an annual murder rate of 40 per 100,000 and murder will probably never be eliminated, it is still possible to define murder and determine on a case by case basis if a murder or other violent intervention has occurred. You garbage obfuscationism will not change that.

Tariffs, huh?

“Edward” not only has no understanding of the concept of economic calculation, he has no knowledge of Lincoln, who said in his famous (actually, not so famous) first inaugural address (and which was somehow missing from the Spielberg movie):

I understand a proposed amendment to the Constitution—which amendment, however, I have not seen—has passed Congress, to the effect that the Federal Government shall never interfere with the domestic institutions of the States, including that of persons held to service. To avoid misconstruction of what I have said, I depart from my purpose not to speak of particular amendments so far as to say that, holding such a provision to now be implied constitutional law, I have no objection to its being made express and irrevocable.

Further, Lincoln made it clear that he really didn’t care what the southern states did so long as long as they did not interfere with the Feds collecting tariffs in the south:

In doing this there needs to be no bloodshed or violence, and there shall be none unless it be forced upon the national authority. The power confided to me will be used to hold, occupy, and possess the property and places belonging to the Government and to collect the duties and imposts; but beyond what may be necessary for these objects, there will be no invasion, no using of force against or among the people anywhere.

http://www.bartleby.com/124/pres31.html

The south may very well have seceded because of slavery, but Lincoln invaded the south to collect tariffs. This was the mainstream view of the Civil War course I took in college in 1971 back when we had the much more realistic New Left analysis of the US government and not the throne-sniffing stuff we endure today.

“WHO SAYS IT’s a “DISTORTION?”

It’s not who, it’s what. The what is the fact that individual preferences in the market are not able to be fully manifested in prices, because of the non-market inflation component. The distortions are called distortions because they don’t reflect voluntary, uncoerced preferences, subject to private property rights.

“Maybe its what real people want.”

What a stupid comment. It implies there are real people and fake people in the world. Real doesn’t mean “I want violence from monopoly institutions.”

People do not want to be deceived. They want to believe things that are sometimes not true, but they don’t want to be purposefully lied to.

Imagine we find a secret letter written by Keynes saying that he lied the entire time, that he was laissez-faire, and that he didn’t believe anything he wrote, and knew it was garbage. His followers, do you think they would appreciate that?

“Maybe the “artificial” thing to do is to let prices fall, to let demand deflation continue, let unemployment soar to 40%, millions of people get thrown from their homes, and put America at risk because people are so desperate they’ll listen to any charismatic would be dictator that comes along.”

Ah yes, the old tried tested, and falsified dogma that Nazis came to power because of deflation.

“Even if the Austrian story WERE true, don’t you think having a fed and a relatively free liberal democracy with “distortions” (Again, if you can’t hold up a non distortion baseline, if you cant predict, than your theory is insignificant ) is better than living under a totalitarian terror?”

Can you say FALSE DICHOTOMY?

You’re fear mongering.

“Its like when I read certain things about Rothbard, and why neo-confederates supported the confederacy. Tariffs. I kid you not! Tariffs! As if tariffs and mercantilism were a bigger evil than the evil of slavery!”

100 years from now your ilk are likely going to be ridiculed as believing that free banking (peace) is a worse evil than central banking (violence).

“No sense of practical perspective at all!”

Violence isn’t practical! It destroys people’s practical solution making.

“(And then there is that letter that Rothbard wrote to the dixie partt in the 1950′s. Disgusting)”

Worse or better than Keynes’ advocacy of eugenics, his enti-semitism, and his advocating a communist takeover of all investment in the economy? Did that turn you off of Keynesianism? Of course not! Why? Because you’re only using ad hominem tu quoque as an excuse to deny Austrian economics principles!

Look up ad hominem tu quoque. It’s your entire rant in a nutshell.

The original distortion was all the housing subsidies put in place by the government to begin with that pushed the average home to income ratio to unsustainable levels. Now the fed is trying to reestablish those distorted home prices on the backs of savers who would be receiving higher interest, pension plans for the same reason and future home buyers who will be stuck with overpriced homes. The crazy thing is the same policy makers restrict loans, while asset prices are at a low and dole out easy money to the banks and other highly qualified who gobble up the real estate and sell it off when the bubble is reinflated.

Dismissing the complexity of the Civil War and treating it as a good v. evil affair may make the whole thing easier to explain, but is a fundamentally flawed approach that can lead intelligent folks astray.

Slavery is, and was, an evil. The North did not fight the South to end slavery.

There was no evil monolith ‘the South’. I’ll recommend Freehling’s Road to Disunion for a review of the many South’s that existed. The Union went on to commit genocide against Natives, locked up Japanese and treated Filipinos quite poorly so there is no reason to attribute righteousness to the North or the Union.

The common denominator for these atrocities is an authoritarian central Govt. The South did not invade the North and try to coerce free states into becoming slave states. Nor did the North invade the South for the purpose of ending slavery. The North invaded to keep the Union whole and try to eliminate the right to secede. Had the South won there would not be slavery today.

That’s not to say the CSA would have been any better in terms of human rights, but a smaller Govt, with the ability to withdraw the consent to be governed, is desirable.

While cheering on the South isn’t much more than Lost Cause sentimentality, at this point, understanding the nature of the conflict in a non-cartoonish way is always worthwhile.

It was the power of the State that systematized slavery in America. Without the 3/5ths clause there is no Union. When the State expanded the scope of its power, as was the case with the LA purchase, the nature and balance of the original compact was altered.

Slave Power was needed to protect the South against an abusive and more populous North, this is seen in the Tariff of Abominations that you dismiss above.

When the State decides it can expand at will and threatens to overwhelm a minority population by watering down their voice you can expect the minority people will recognize that they have lost their self-determination and will react accordingly.

If the Civil War were about ending slavery, why did US Grant own slaves up until the 13th amendment? Why did the Emancipation not apply to loyal slave States? Why did the Ebenezer Creek tragedy unfold the way it did? Why did Lincoln, a man who would suspend habeas corpus and who believed in re-colonization up until his death, utter so many atrocious things like:

“We think slavery a great moral wrong, and while we do not claim the right to touch it where it exists we wish to treat it as a wrong in the territories, where our votes will reach it.”

“I have no purpose, directly or indirectly, to interfere with the institution of slavery in the States where it exists. I believe I have no lawful right to do so, and I have no inclination to do so.”

“If I could save the Union without freeing any slave I would do it, and if I could save it by freeing all the slaves I would do it; and if I could save it by freeing some and leaving others alone I would also do that.”

“I will say then that I am not, nor ever have been in favor of bringing about in anyway the social and political equality of the white and black races – that I am not nor ever have been in favor of making voters or jurors of negroes, nor of qualifying them to hold office, nor to intermarry with white people; and I will say in addition to this that there is a physical difference between the white and black races which I believe will forever forbid the two races living together on terms of social and political equality.”

“If as the friends of colonization hope, the present and coming generations of our countrymen shall by any means, succeed in freeing our land from the dangerous presence of slavery; and, at the same time, in restoring a captive people to their long-lost father-land, with bright prospects for the future; and this too, so gradually, that neither races nor individuals shall have suffered by the change, it will indeed be a glorious consummation.”

Only ideologues try to boil down the Civil War into good v. evil.

What’s scary is Edward is no less ignorant than the average statist/Keynesian on the street. He sounds like an ignorant crank but he’s not much different from even the ‘learned’ Keynesians.

Also notice the telling use of words like ‘let’ where his desire for control come through crystal clear and his inability to imagine that the people he wants to control might not desire it. Put him back 150 years and he’d be pining on how the slave was lucky to be a slave since he had a roof over his head and three squares a day and full time employment. What else could the slave really want?

“What else could the slave really want?”

To be freed by government intervention?

Oh wait, for the cultist Rothbardian that might be violating the “rights” and “property” of slave owners, wouldn’t it!

” Absent some government bailout or subsidy, necessity will be the mother of invention and people will become amazingly flexible and reasonable in their negotiations, even though 99% of the “shocks” they must endure and resolve are caused by Keynesian policies in the first place.”

Unless you MANDATE that debt be downward flexible, and the government passes a law that says all prices must fall equally be the same amount by which NGDP falls (If nominal spending falls by 10% all prices must fall by that amount also.)

THe other option is you need to create mass bankruptcy and see unemployment rise to 40%-50% before workers are so DEMORALIZED they’ll accept wage cuts, Then, you’ll start to see recovery. When people go into new hoovervilles and star to live in tents around formerly wealthy cities because they can’t afford anywhere else.

The second option is economic hell on earth. The first option, ironically is the only way demand deflation can proceed without pain. Ive never seen any austrian endorse it and with good reason. It requires more intervention, much more than if you simply conduct expansionary monetary policy. The champions of “freedom’ are calling for a solution that is more draconian, more authoritarian, than what the monetarists and the Keynesians are proposing

Well said.

So it’s OK to ground one’s arguments on morality, when the morality happens to be consistent with LK’s.

The entire “problem” is caused by some form of funny money creation/FRB and today via fiat funny money dilution. The problem is caused by you interventionist/inflationists you should feel great shame. “Debt deflation” is horrible and is why inflationism and Keynesianism must be elimintated. I’ve proposed a one time CASE BY CASE solution which would never again be needed once we have competitive currencies.

lol.. The attempt to create an inflexible money supply would itself induce deflation and debt deflation, as well as limit investment credit and strangle economic growth.

Roddis would create the exact same problems with his “deftationism”.

No reason in the world to believe that people are so stupid and pig-headed that they could not resolve that “problem” without artificial distortions of prices caused by Keynesians.

They resolve the problem of creating a workable monetary and banking system by producing credit money and an endogenous, elastic money supply, just as in fact happened under the gold standard and through history in all develop capitalist economies.

Of course, roddis has a vivid imagination or perhaps by some special power (magic?) just *knows* people would never so stupid as to use credit money, even though that is actually what they have done again and again, and for 1000s of years, probably since ancient Mesopotamia.

We’ve been over that 15x before too.

http://factsandotherstubbornthings.blogspot.com/2012/07/bob-roddis-makes-bad-argument.html?showComment=1342649925304#c790455305419085448

zzzzzzzz

Since we have, in fact, been over this before, I submit that LK’s comments about my views on the topic are purposefully misleading.

http://factsandotherstubbornthings.blogspot.com/2012/07/bob-roddis-makes-bad-argument.html?showComment=1342710030818#c2618524232434861358

“They resolve the problem of creating a workable monetary and banking system by producing credit money and an endogenous, elastic money supply”

This is not a solution to the problem. This is externalizing the costs of the problem onto third parties. The “they” you have in mind is not 100% of the population of individuals. It is the people in the state, and those who support the state for not only themselves, but wanting it to be imposed on everyone else against their will.

And central banks were not even designed as a solution to that problem. It was designed by bankers, for bankers, to allow banks to expand credit without limit, and to externalize the costs of this onto everyone else who is forced, by taxation laws, to accept dollars.

“just as in fact happened under the gold standard and through history in all develop capitalist economies.”

False. Central banks are not free market institutions.

“The attempt to create an inflexible money supply would itself induce deflation and debt deflation, as well as limit investment credit and strangle economic growth.”

No, it would prevent debt inflation in the first place.

Limiting credit in nominal terms is not synonymous with limiting credit in real terms.