Why “Potential GDP” Loads the Keynesian Deck

Krugman is back to his oh-so-objective presentation of the facts, which smuggle in the Keynesian policy prescriptions:

There is some tendency among economic commentators to think that austerity policies in a deeply depressed economy are mainly a European thing; you even find a fair number of people imagining that the United States is still engaged in fiscal stimulus. But the truth is that federal stimulus is years behind us, while state and local governments have cut back, so the overall story is one of fiscal contraction that’s smaller than in Europe, but not by that much.

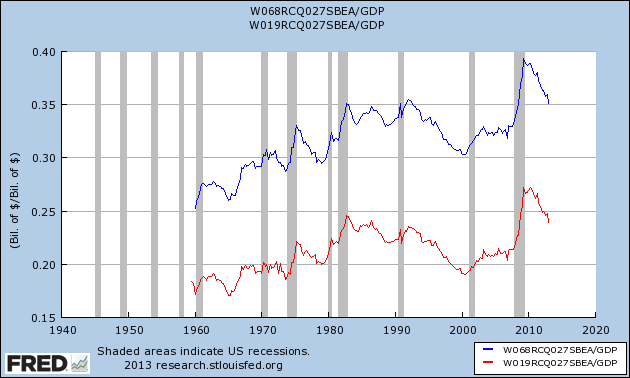

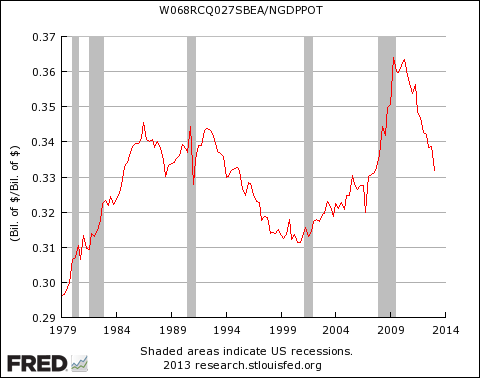

To see what’s going on, you need to do two things. First, you should include state and local; second, you shouldn’t divide by GDP, because a depressed GDP can cause the spending/GDP ratio to rise even if spending falls. So it’s useful to look at the ratio of overall government expenditure to potential GDP — what the economy would be producing if it were at full employment; CBO provides standard estimates of this number. And here’s what we see:

Spending is down to what it was before the recession, and also significantly lower than it was under Reagan….So this is actually a picture of very bad policy.

Yes, this is a decent way to analyze the world, assuming that the economy is fundamentally suffering from a lack of demand and that government spending would fill the gap. But if the Austrian story were correct–that the economy had years of unsustainable, phony prosperity that actually ate away the underlying capital structure–then the above analysis is totally misleading.

Let’s see what happens if we take (a) total government and (b) federal government expenditures, and divide by actual GDP, not “potential” GDP. We find this:

Huh, how ’bout that? According to this metric, government spending (whether total or just federal) is still higher than at just about any point in the last 50 years, save for the crisis period itself and a few little blips. Couple that with the fact that the economy right now is arguably worse than it was during the Great Depression–both DeLong and Krugman tell us this is so–and it’s a good prima facie case that massive government spending hurts the economy. That should make sense, because it lines up perfectly with commonsense “micro” thinking.

Yet even on Keynesian grounds, it’s not obvious to me that “government spending as a share of potential GDP” is the right metric. Suppose we have an economy where government spending is initially $0, private spending is $100 billion, unemployment is 90%, and potential GDP is $1 trillion. Then in the next period, the government runs a deficit of $100 billion.

According to a Krugman/DeLong analysis, I would expect this to have a humongous multiplier. So not only would there be no crowding out, but in fact total private spending would increase, let’s say to $120 billion. Thus GDP in the next period would be $120 billion + $100 billion = $220 billion, a 120% increase. Unemployment would probably fall by more than 10 percentage points. It would seem a good Keynesian would explain the smashing success of this pump-priming by saying, “Ah, the deficit went from 0% of GDP to 100% of GDP (or 45.5% if you use the 2nd-period GDP figure). So no kidding the economy more than doubled.”

And yet, judging from Krugman’s preferred metric, you would have to explain the record-shattering growth in GDP by saying that the deficit went from 0% of potential GDP to 10% of potential GDP.

Don’t get me wrong, you can flip things to the other extreme and come up with cases where relying on deficits as a share of actual GDP would be misleading (within the Keynesian paradigm). For example, suppose we have an economy that initially is all government spending. It’s $1 trillion government spending (all deficit), with $0 private spending, with full employment. Then the government cuts its budget in half, and the private economy doesn’t pick up any of the slack. So total GDP falls from $1 trillion down to $500 billion, and unemployment shoots up to 50% or so. Yet the government deficit as a share of GDP would be the same, at 100% of GDP.

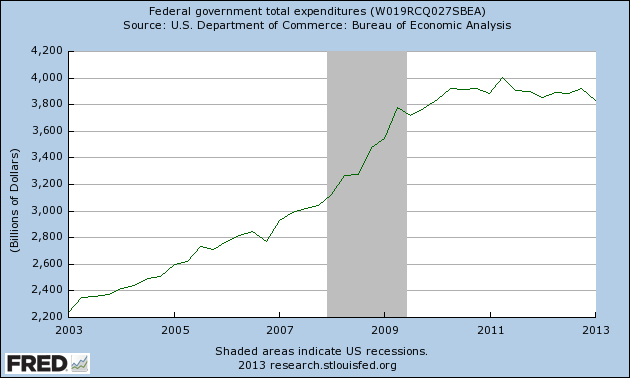

UPDATE: Oh, by the way, Krugman’s line about “the truth is that federal stimulus is years behind us” makes you think there have been crazy spending cuts at the federal level. In fact:

So yes, the stimulus is “years behind us” and federal spending is still about where it was, during the height of the “emergency stimulus spending.”

What about adjusting federal spending for the “true” rate of inflation?

Peter Schiff said yesterday that the true rate of inflation is about 6%/year since 2003.

http://www.economicpolicyjournal.com/2013/04/peter-schiff-on-new-gdp-number.html

“But from April 2003 to January 2013 the CPI Index is up just 25% percent (from 183.8 to 230.28 or about 2.5% per year) while the BMI is up 61% (from $2.71 to $4.37 or about 6.1% per year), or more than twice the rate of inflation.”

Federal Spending:

FY 2009:3,520,082,000

FY 2012: 3,538,446,000

FY 2009 spending in FY 2012 dollars with a 6% annual rate of inflation becomes 4.192 trillion.

So once you take inflation into account, federal spending was cut 15.6% across the board between FY 2009 and FY 2012.

Federal spending in FY 2004 was 2,292,352

Once you adjust that number for 8 years of 6% inflation, you get 3.653 trillion.

So after adjusting for inflation, the federal govt is spending 3.5% less in FY 2012 than in FY 2004.

If we really have had 6% yoy inflation since 2003, do you think a Keynesian should be advocating more government spending?

re: your use of “total expenditure” figures, it turns out that if you look closely at the BEA site, that the “total expenditure” figures aren’t truly total expenditures (even if they are the closest that exist, though their SNA figures are a little closer than the NIPA totals that the Federal Reserve graph site has). Links to where BEA explains that on this page:

http://www.politicsdebunked.com/article-list/goverment-hides-spending

They strangely offset some expenses by receipts (instead of breaking them out separately) as you will see on that page. Federal t budget documents do that as well, there is 1 place in the official white house budget where this is mentioned and true “gross outlaws” give, everywhere else is “net oulays” which leave off 15-20% or so of spending. Links on that page noting the GAO has complained about before. In a parallel to that, they also label some government “business-like” functions as businesses and put them in the business sector instead of government.

re: the “keynesian pump”.It turns out there is some simple data that shows most of the time the faster government spending grows, the slower the private economy grows (and vice versa) in the US and around the world:

http://www.politicsdebunked.com/article-list/spendingpattern

The data is easy to see, and trivial to replicate, no advanced statistics and using public data sets.

The page doesn’t establish what is cause and what is effect, but it seems worst case until there is compelling evidence that doesn’t exist to day against it, to assume that government spending could be bad for the economy.

Obviously it makes sense at times to look at spending as a % of GDP. I’ll note however that in some ways that is like “baseline budgeting”, it builds in an automatic assumed spending increase without justification for it. The rest of the economy becomes more productive over time, agriculture’s share of GDP has dramatically over time, not stayed constant. This page points out that:

http://www.politicsdebunked.com/article-list/federal-spending

” The Federal government spent 3.7 times as much per person in 2011 as it did 50 years ago in 1961 when Democratic hero JFK was in office (adjusted for inflation). If Kennedy were around to propose his level of spending today he’d be denounced by the mainstream media as a radical extremist. State and local governments combined spent 4 times as much per capita. “

RealityEngineer, yeah, I know there are some non-intuitive uses of “expenditure” etc. in these figures. I ran into that problem when I was doing work on World War II spending. But, since my main point was to show how much it changes if you use actual vs. potential GDP, I didn’t bother getting hip deep into the details.

Yup, I know in economics there is a need to just work with whatever the best data available is (or to make a quick point, the most convenient, the Fed graph site is useful). I figured there was a good chance you might be aware of this, but I was surprised to discover it and figured much of the public doesn’t realize the way they hide spending, perhaps even the likely more informed readers of your blog.

A big government nut (not me) would just point out that counter-cyclic spending is working (and necessary). The findings are interesting, but the argument to dismiss the possibility that government comes to the rescue and fills in what the private sector can’t do is weak. That is very much the main argument that Keynesians use all the time.

The problem is that government can always find a way to declare an emergency here, there, or somewhere, and then decide to rescue us from whatever. Then regardless of outcome, just claim we would have been much worse off otherwise.

re: claiming they would have been worse afterwards, Yup, as a poster on the politicsdebunked.com site notes, it is like a quack doctor who gives someone snake oil for a cold and when you still have it a week later claims “wow, you were sicker than I thought, you would have been dead without it”.

The page does address the counter-cyclic argument a bit, noting it is weak and that most of the time countries aren’t in recessions, etc. It notes the site will address it more in the future.

It is interesting how easily they get away with dismissing the problem of the unseen “crowding out” that “government rescue” necessarily does. An investor can only do one of a limited set of things with each $: lend it to the government, invest it privately in this country, invest it outside this country, or stuff it in a mattress. If they don’t lend it to the government, the odds are they will invest it privately instead.

Somehow economists get away with trying to obfuscate that simple reality, trying to claim “oh, interest rates aren’t rising so it can’t exist”.. ignoring other possible explanations for that. For instance “flight to safety” where there is demand for safer investments, bank lending standards being raised after the crisis (leading to a drop off in demand given people won’t apply for loans they can’t get, etc, e.g. see graphs of lending standards and demand on this page:

http://www.politicsdebunked.com/article-list/obama-lied-about-paying-down-the-debt half or two thirds of the way down (the page starts out on a related topic then gets into why the debt is a concern).

Oops, a Freudian typo re: “and true “gross outlaws”

That should have been “gross outlays” of course, unfortunately spending the money is legal, even if its morality is questionable to many.

The whole problem with applying rigid empirical thinking to macro-economics is you don’t have a second world economy to run alongside as a control experiment. Sure you can take empirical measurements from the world economy but you can’t compare them to anything.

Richard Feynman explained this in his famous “Cargo Cult Science” speech, sometimes it is very difficult to be sure you really do control the variables in your control experiment, thus you need not only one control experiment but you need to be able to demonstrate reliable repetition of results. This may sound boring, and wasteful of resources, but if you don’t do that you are not really using scientific empiricism.

Getting back to economics, given that the ideal experimental setup is just not possible, you have to accept there will always be things you can’t measure. Krugman’s “Potential GDP” value is a measurement taken from some control economy where the financial crash never happened. The control economy is in Krugman’s head and nowhere else… he is making stuff up. It might sound like empiricism, but it is classic “Cargo Cult” foolery.

The control economy is in Krugman’s head and nowhere else… he is making stuff up. It might sound like empiricism, but it is classic “Cargo Cult” foolery.

As opposed to the “control economy” assumed by all your and Murphy’s underlying Austrian theory!!? Where things would supposedly be better than now?

You have destroyed yourself with these words.

And, no, proposing hypothetical values for real world phenomena, under a good model of how the phenomena works but with different hypothetical causal factors, does not constitute “making stuff up”.

You can’t use a presumption of a “good model” then say, “ta da!” and hold it up as proof that your model must be good.

http://www.lhup.edu/~DSIMANEK/cargocul.htm

“As opposed to the “control economy” assumed by all your and Murphy’s underlying Austrian theory!!? Where things would supposedly be better than now?”

What Austrian theory holds true for a control economy, does not mean it doesn’t say anything about a less than 100% control economy. Mises and other Austrians used the example of a control economy because it is the clearest example of what can be shown as true in Austrian theory.

Having less than a 100% control economy does not mean that economic calculation is as unimpeded and as true a reflection of individual preferences as a pure anarcho-capitalist economy would have. The same problems exist, only they are less pronounced. And those problems that remain are sufficient to causing business cycles and lower standards of living.

“You have destroyed yourself with these words.”

Keep dreaming.

“And, no, proposing hypothetical values for real world phenomena, under a good model of how the phenomena works but with different hypothetical causal factors, does not constitute “making stuff up”.

It’s not the hypothetical values that constitutes you making stuff up. It’s your core principles that you made up.

Austrian economics doesn’t make the pretence to be 100% based on empiricism either.

Since it is patently impossible for any macro-scale flavour of economics to be properly empirical, at least the Austrians get points for honest self assessment.

It’s reasonable to expect policy decisions to be made on the basis of theoretical analysis that reflects and/or is grounded in empirical research.

“Potential GDP” is a well-defined term, widely used, and not something “in Krugman’s head and nowhere else.”

Empirically, we can observe contracting economies under “austerity” in Europe and an expanding economy under “deficit spending” in the US. Therefore, the hypothesis that an expansion of the deficit spending (your line goes up instead of leveling off) would lead to a higher level of economic expansion, seems reasonable.

Above all, we need economists whose first concern is the impact of policy on ordinary citizens, not the convenient way the features of the currently fashionable model “line up.”

The Europeans are engaged in “deficit spending”, too. I don’t get your point.

(1) ” According to this metric, government spending (whether total or just federal) is still higher than at just about any point in the last 50 years, … “

And GDP and tax revenues were also smaller over the past 50 years. Your statement is irrelevant to the argument.

(2) The stimulus of 2009 brought America out of recession and restored positive real output growth, as aggregate demand drove employment and output — precisely as predicted. You have not explained why America came out of the worst post WWII recession after a stimulus was implemented? Was it magic?

The stimulus shows up in the graph and then trails off, exactly as people like Krugman have been saying.

Your data do nothing but confirm the Keynesian story.

And as I have pointed, what your are now denying, is not denied by other Austrians:

“Although theory suggests that any policy which consists of an artificial increase in consumption, in public spending and in credit expansion is counterproductive, no one denies that, in the short run, it is possible to absorb any volume of unemployment by simply raising public spending or credit expansion …”

Huerta de Soto, J. 2012. Money, Bank Credit and Economic Cycles (3rd edn.; trans. M. A. Stroup), Ludwig von Mises Institute, Auburn, Ala. p. 454.

That would explain the nosedive in this graph here:

http://data.bls.gov/timeseries/LNS11300000

Turns down sharply midway through 2008 and falling ever since. Pretty clear trend in that one. I predict the trend will continue at least until the next US election. After that… hard to say.

Labor Force Participation Rate is a different stat from unemployment data.

Unemployment has been falling since 2009 — actually as you would expect.

https://www.google.com/publicdata/explore?ds=z1ebjpgk2654c1_&met_y=unemployment_rate&idim=country:US&fdim_y=seasonality:S&dl=en&hl=en&q=us%20unemployment

Unemployment has been falling since 2009 — actually as you would expect.

Krugman posts a graph showing government spending falling as a percentage of potential GDP since 2009 to prove fiscal austerity is the reigning policy – and a very bad one. But, during this time, unemployment is falling, which is just what we should expect in a “depressed economy”*- one suffering from a deficiency in aggregate demand?

* Krugman was referring to Europe, but I would argue he strongly suggested the same is still true in the U.S.

The private sector took up the slack after the stimulus petered out.

There is no contradiction here.

If the private sector is now picking up the slack should Krugman be calling fiscal ‘austerity’ a very bad policy? Would that not be the correct policy?

I just inferred a trend from past data that suggests a higher output gap. Thus there is now a larger amount of slack. Now there is justification for government intervention.

See? This Keynesian stuff is easy. You just have to contradict yourself by claiming that the past is not a reliable guide for whole economy predictions, and that the problem of induction is particularly acute for whole economies, but then claim that you just discovered an underlying trend anyway, you know, based on past data, and then hope that this will finally justify violence according to rational principles.

Anyone? Anyone? Beuller?

“Slack” presupposes there is a trend that can be induced from past data. However you claimed that because the economy is “non-ergodic”, no such trend can be induced from past data. You said the “problem of induction is particularly acute”. You said that “past data is not a reliable indicator.”

Now you’re claiming to be able to discern a trend such that you can identify gaps, and hence identify “slack.”

Just more of your contradictory gobbledygook

“And GDP and tax revenues were also smaller over the past 50 years. Your statement is irrelevant to the argument.”

That is irrelevant to the argument Murphy is making.

“The stimulus of 2009 brought America out of recession and restored positive real output growth, as aggregate demand drove employment and output — precisely as predicted.”

The stimulus of 2009 brought down American growth to be lower now than it otherwise would have been, had the stimulus and prior government”stimulus” not taken place. PRECISELY AS PREDICTED.

“You have not explained why America came out of the worst post WWII recession after a stimulus was implemented? Was it magic?”

It was the extent of laissez-faire activity. Growth occurred in this context DESPITE the government spending and taxation. Is growth without government spending “magic” to you? Apparently!

“The stimulus shows up in the graph and then trails off, exactly as people like Krugman have been saying.”

Trails off? Or stays constant? No connection to continued slump, right? The stimulus has to keep increasing, right?

“Your data do nothing but confirm the Keynesian story.”

The data confirms the laissez-faire story 100%.

“And as I have pointed, what your are now denying, is not denied by other Austrians:”

“Although theory suggests that any policy which consists of an artificial increase in consumption, in public spending and in credit expansion is counterproductive, no one denies that, in the short run, it is possible to absorb any volume of unemployment by simply raising public spending or credit expansion …”

Laissez-faire theory does not preclude the possibility of some people getting other people drunk and give immediately apparent reasons to hire people to clean up the puke.

Laissez-faire theory does not preclude the possibility of some people imposing a totalitarian dictatorship, printing up whatever quantity of money is necessary to pay everyone else a salary of $100k a year, to dig holes the ground, build bridges to nowhere, construct weapons of mass destruction, and do whatever else at the behest of the dictators’ spending. This will clearly eliminate unemployment, it may cause aggregate “output of stuff” to grow over time, and so on. Does this mean the laissez-faire theory is wrong? No.

I once again feel compelled to point out that we are now experiencing the first nominal decrease in federal spending-per-capita since Eisenhower withdrew from Korea:

http://squarelyrooted.wordpress.com/2013/02/12/krugman-is-underselling-austerity/

So if that’s not austerity what is?

Not taking prior increases in spending per capita as some sort of sacred status quo baseline?

If I scaled Mount Everest, then walked down a mile in altitude, would it make any sense to compare that to coal miners traveling down into the Earth by half a mile, and say that I traveled down more than miners?

OK, sure, I traveled down a mile in altitude, but consider where I started.

The fact that government spending per capita has flatlined since 2009, after an initial significant increase per capita, suggests that “austerity” is a misleading term.

Since you are defining a period of austerity as “the moment government spending per capita falls”, then we’d have to define going from 100% government spending per capita, to 90% government spending per capita, as “a period of austerity.” OK, sure, if that’s how you want to define “austerity”, then so be it. You wouldn’t be saying much though.

Maybe I’m not spending enough. I spend a lot as a percentage of my income, but I could have potentially been a doctor or even a CEO. In that case, I’m clearly not spendIng much as a percentage of my potential income.

Well, obviously since your brain is potentially capable of doing the intellectual work necessary to perform the role of doctor or CEO, it means your brain is an idle resource. Clearly, that output-gap-slack-recession-austerity-choked-off-potential can be unleashed if only there was some counterfeiter out there who devalued existing money such that you, at some point, earn more money doing what you’re currently doing.

Then you’ll be able to perform brain surgery.

It appears you are trying to be sarcastic with this comment, but it actually highlights the obviousness of Keynsian investment and the problem of austerity.

If you find your skills outdated, income down, and work hard to find, do you cut back on all spending across the board, get a smaller apartment, take the bus, and hope some day things will improve? Or, do you just cut back on luxuries (restaurants, movies, entertainment), borrow a lot of money to pay for tuition, and upgrade your skills and education to something in higher demand, then pay it down when your earnings go up.

This is essentially the reason why countries, in times of economic crisis, should cut back on inefficient spending that doesn’t pay back well, but to significantly increase spending in areas that improve earning potential (productivity, opportunity, efficiency) such as infrastructure and R&D.

Bob,

If Keynesians want more stimulus, then why not offer it to them in the form of a permanent payroll tax cut?

1. It would provide up to $100-200 billion per year in stimulus (depending on how it was structured).

http://en.wikipedia.org/wiki/2009_stimulus#Tax_incentives_for_individuals

2. It would raise the income of the poor and middle classes relative to the top 20% (since the bottom 3 quintiles pay around 7-9% of their income in FICA while the top quintile pays on 5.8%). Payroll tax credits could also be limited up to certain income level (say, $75,000). http://www.taxpolicycenter.org/taxtopics/currentdistribution.cfm

3. If we also reduce employer contributions, it would lower the costs of hiring new workers and spur employment.

The GOP had the right idea in tax cuts, but they showed a tin ear to public sentiment by focusing on cap. gains and the top bracket. In theory, payroll tax cuts should be something both parties can agree on (in practice obv. they didn’t since they let the cuts expire, but some Democrats were in favor of extension).

Incidentally, Europe also seems to have even more room to cut payroll taxes, esp. of the employer contribution side: http://johnhcochrane.blogspot.kr/2012/09/europes-payroll-taxes.html

It occurs to me that if we start with the idea that “World War II ended the depression”, and then we introduce the Krugman concept of “Potential GDP” we must necessarily calculate a model where all those people did not die during the war, but went on to live productive potential lives instead. Then they had potential children who also had potential children all of whom were potentially productive and invented the potential Internet some time around 1960, and the potential iPad around 1970.

In other words, we still haven’t caught up with the damage caused by Keynes himself, let alone his acolytes.

Potentially speaking that is.

So a 33%-odd increase in three years to spending is NOT stimulus? I cringe at the growth path of spending that Krugman would recommend.

“it’s a good prima facie case that massive government spending hurts the economy. That should make sense, because it lines up perfectly with commonsense “micro” thinking.”

Sorry, I wholeheartedly disagree this makes sense. When times are tough you invest in improving your income. Yes, you cut back in luxuries and waste, but you increase spending (and borrow if needed) in areas that pay back more in the long run than they cost. This is why people with low earning potential get student loans to improve their skills and education in areas where the potential jobs and income are good. That is common sense, so common that most people do it and with clear benefit.

In fact, this is the very basis of how capitalism works. You borrow up front to make investments that pay themselves off over time. It does matter what you invest in, of course, which is why investments are risk-adjusted. As long as the increase in productivity from the investment is greater than the interest on the loan, both averaged over time, then increasing such spending is a good investment.

I don’t see how you suggest that austerity in tough times is common sense. That just leads us to living in a box on the street hoping for things to turn around some day.