Krugman Ignores Massive Human Suffering

Really! Watch where I take this post.

In a post titled, “Debasing Lincoln” Krugman writes:

Greg Sargent catches John Boehner invoking none other than Abraham Lincoln to inveigh against the deficit. This is pretty funny — in multiple ways.

One is the whole notion of relying on Lincoln as an authority on economic policy. Why should we believe that a lawyer speaking in 1843…knew what we should be doing about an economic slump…170 years later?

Then there’s Greg’s catch: Boehner truncated the quote, leaving out the part where Lincoln called for balancing the budget by raising taxes. And also the point that Lincoln was actually a big government interventionist for his time, a strong advocate of what we would now call industrial policy.

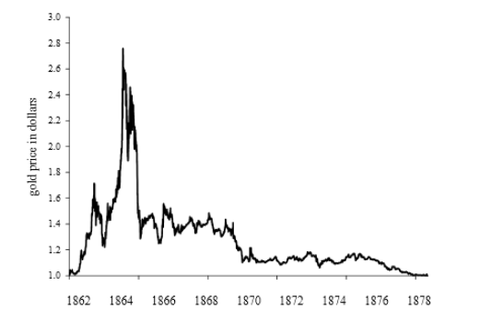

But wait: there’s more. Lincoln’s most dramatic departure from standard economic policy was … drumroll .. debasing the currency (pdf). Here’s the dollar price of gold:

True, he did it to pay for a war; but do you think a 19th-century version of Paul Ryan would have stroked his immense beard and said “Well, under the circumstances, letting the dollar fall to a third of its gold parity is OK?”

Actually, the greenback experience is interesting, mainly for two reasons: nothing terrible happened despite 15 years off the gold standard, and despite this fact all the Very Serious People continued to believe that going off the gold standard was a terrible, terrible thing. It doesn’t much raise your hopes that they’ll learn from recent failures. [Bold added.]

Wow, where to begin?

First, note the irony here. Krugman is chastising John Boehner for not realizing that Lincoln was a tax-raising, big government advocate of industrial policy, who also debased the currency. And yet, when Tom DiLorenzo was a witness for Ron Paul’s monetary committee, Krugman summarized the episode with a blog post titled “Johnny Reb Economics.” His good buddy Matt Yglesias had an even more inflammatory title, “The Strange Case of Pro-Confederate Monetary Policy.” (In fairness, maybe the editors at ThinkProgress pick their blog post titles.) So it seems if you call Lincoln a big government fascist, you get your head bitten off, and if you cast Lincoln as a small government conservative, you get mocked. Tough crowd, these progressive bloggers.

But that’s just incidental. The real jaw-dropper in Krugman’s post above, is his claim that “nothing terrible happened” from 1862 to 1878, and that therefore the Very Serious People who worried about Lincoln going off gold are proven wrong once again.

Naturally, there was the whole Civil War (aka War Between the States aka War of Northern Aggression), with hundreds of thousands of people dying. So obviously the economy was in awful shape during these years.

NOTE: I am not saying, “Krugman thinks hundreds of thousands of people dying is no big deal!” No, what I’m saying is that he isn’t in any way looking at any kind of metric when he says “nothing terrible happened.” That is a throwaway line, anchored to jack squat. For one simple example, the last time I looked up the stats, I ballparked cumulative price inflation in the North at about 75 percent from 1861 to 1864, for an annualized rate of 20 percent for that three-year stretch. (It was far worse in the Confederacy of course, just proving how ridiculous it is to say Tom DiLorenzo was a fan of Confederate monetary policy.) Isn’t that the most obvious “terrible thing” that a gold bug would bring up? Yet Krugman doesn’t even bother to tell us anything about prices; he just assures us “nothing terrible happened.”

Let’s continue, to prove my point. After the Civil War, but when the U.S. was still not back to dollar parity with gold, did we have any kind of economic problems? After all, Krugman’s chart–and his statement “despite 15 years off the gold standard”–show that we need to consider U.S. economic history from 1866 to 1878, if we want to see what the postwar era was like.

Here’s an interesting idea: Before we look it up, let’s first settle something obvious. If there had been, oh I don’t know, the worst depression in U.S. history to that point, then probably that would count as “something terrible” happening, right? Maybe it wouldn’t be the fault of going off gold, but surely Krugman would be either a liar or ignorant if he said “nothing terrible happened,” right?

Well there was this thing called the “long depression,” which the NBER dates from October 1873 to March 1879. Here’s how Wikipedia describes it:

The Long Depression was a worldwide economic recession, beginning in 1873 and running through the spring of 1879. It was the most severe in Europe and the United States, which had been experiencing strong economic growth fueled by the Second Industrial Revolution in the decade following the American Civil War. At the time, the episode was labeled the Great Depression and held that designation until the Great Depression of the 1930s. Though a period of general deflation and low growth, it did not have the severe economic retrogression of the Great Depression.[1]

It was most notable in Western Europe and North America, at least in part because reliable data from the period are most readily available in those parts of the world. The United Kingdom is often considered to have been the hardest hit; during this period it lost some of its large industrial lead over the economies of Continental Europe.[2] While it was occurring, the view was prominent that the economy of the United Kingdom had been in continuous depression from 1873 to as late as 1896 and some texts refer to the period as the Great Depression of 1873–96.[3]

In the United States, economists typically refer to the Long Depression as the Depression of 1873–79, kicked off by the Panic of 1873, and followed by the Panic of 1893, book-ending the entire period of the wider Long Depression.[4] The National Bureau of Economic Research dates the contraction following the panic as lasting from October 1873 to March 1879. At 65 months, it is the longest-lasting contraction identified by the NBER, eclipsing the Great Depression’s 43 months of contraction.[5][6]

In the US, from 1873–1879, 18,000 businesses went bankrupt, including hundreds of banks, and ten states went bankrupt,[7] while unemployment peaked at 14% in 1876,[8] long after the panic ended.

This is simply inexcusable. And as I have taken pains to point out over the years, this is typical Krugman. He simply makes stuff up about the historical “record,” with such carelessness in throwaway lines that when you catch him, his fans won’t even care. To wit: “Oh come on Bob, it’s not like Krugman said, ‘The Long Depression wasn’t terrible.’ All he meant was, Lincoln’s debasement of the currency had no ill effects. The Long Depression wasn’t about gold at all; there was deflation!”

In conclusion, let me make sure my point is clear: Krugman likes to dot his i’s and cross his t’s. Not only does he present what he thinks is an elegant, internally consistent theory, but he prides himself on constantly cross-referencing it objectively with “the data.” But he is so sure that he’s right, and he is often so incredibly sloppy in his work, that he will cite “facts” that, if anything, prove the exact opposite of what he tells his readers.

The reason Krugman refers to the Greenback Era as 15 years is that it is dated as 1865-1879 (as in Irwin Unger’s prize winning history of this era. It is also why counting the Civil War as part of the terrible stuff is just wrong.)

Hmm, so if I read the wiki quote correctly there was “strong economic growth fueled by the Second Industrial Revolution in the decade following the American Civil War.” And this ended in 1873, which was followed by a long depression. What happened in 1873, which led the greenback to turn into an albatross around America’s economy? Oh, I suppose it was the Coinage Act of 1873, which per wiki, had the effect of “putting the United States de facto on the gold standard.” And what features of the greenbacks made this depression so long? For it surely had nothing to do with the (Specie) Resumption Act of 1875 which, “restored the nation to the gold standard through the redemption of previously unbacked United States Notes.”

How odd that these two (among other achievements of hard money advocates) should coincide so well with this depression, while greenbacks themselves coincided with the strong growth. Still, you are right, I am not sure why Krugman would cite this period in history as supporting his view.

Thank you Yosef for perfectly demonstrating my ability to anticipate completely tangential apologies for Krugman’s statement. This isn’t about whether the gold standard is good or bad, it’s about Krugman saying the 15-year period of not having dollar/gold parity showed “nothing terrible” happening.

Bob, I was not saying whether the gold standard is good or bad. I am saying that how does it make sense to blame the “something terrible” which happened on the greenbacks, when this terrible thing happened when the greenbacks ended?

Put another way, Krugman was saying ‘When we had greenbacks, nothing terrible happened.’ You then say that the long depression is something terrible which happened during that time. So I reply that actually the long depression is not technically during the period of not having dollar/gold parity. If this something terrible did not happen during the period that Krugman said nothing terrible happened, how is that tangential?

Yosef, what is the 15-year period you think Krugman is talking about? And then, did the Long Depression occur in that period or not?

The period I think Krugman is talking about is 1865 to 1879 which covers the post Civil War circulation and (importantly!) contraction of greenbacks to the point of fully re-establishing gold parity in 1879 (for the first time since suspension 1861). That is, the greenback era also, be definition, involves a period of time during which greenbacks were being removed from circulation and returned to gold.

The Long Depression occurred in this period, on the count that the greenback era (again by definition) includes those years in which greenbacks were redeemed and specie payments resumed. The Long Depression therefore occurred in the period in which greenbacks were no longer divorced from gold. So, the Long Depression did not occur during the period in which the US was off gold.

The relevant time period that includes Greenbacks includes the civil war, because Greenbacks were issued 1862 to 1971.

Dr. Murphy, I think you’re misreading Yosef’s post and I think Yosef is reinforcing it simply by not emphasizing this sentence:

“Still, you are right, I am not sure why Krugman would cite this period in history as supporting his view.”

So you are right Yosef is completely off-topic, but he is not attempting to use it to apologize for Krugman’s statement. He is pointing out his own view and what he believes Krugman should have said.

You didn’t read Yosef’s last paragraph sarcastically enough.

LOL. That’s a fail on my part. I knew I shouldn’t have tried to call out Murphy for misinterpreting someone.

Life With the Fed: Sunshine and Lollipops? by Tom Woods

http://www.lewrockwell.com/woods/woods169.html

guest, yes, I know there has been some revisionism lately, but I don’t think Krugman is relying on the new scholarship to rule out the Long Depression. I don’t think Krugman even thought for one moment about what actually happened in the 15-year period he cited. Rather, since the U.S. wasn’t taken over by another country, all was well; “nothing terrible happened.” It’s akin to when people mock those who said (when Britain went off gold in the early 1930s) that it was the end of Western civilization. As if the events of the 1930s and 1940s couldn’t plausibly be classified as the end of Western civilization.

Surely the events of the 1930s and 1940s would be classified as an interruption, rather than an end of Western civilization.

Would have been the end had the world Murphy style pacifist advice. Maybe that’s what Bob means …

And as Lew Rockwell argued recently, fiat money enables and prolongs war:

War and the Fed | Lew Rockwell

http://www.youtube.com/watch?v=Tl9lS5k7H5M

Further, if a lot of people, that were promised pay, die in a war, well then the government owes less and there is less demand for consumption goods, and so the economic destruction of inflation is masked.

Bob, I think this can be an example of “the new scholarship” about what in the world *really* happened

http://adamgmartin.com/Homepage/Essay_Contest_files/Newman%20Long%20Depression.pdf

“Following a run up in the credit expansion that occurred in the early 70s, a visible widening in both relative prices and production compared to the late 60s emerged that fostered multiple malinvestments, mostly concentrated in the railroads. While not the product of a central bank, the expansion in the money supply was largely caused by the National Banking and Greenback Acts that allowed for easier credit creation through multiple pyramiding off of reserves, including both specie and government greenbacks. The bust also showed symptoms of an Austrian contraction, with the decline in output concentrated in industries that overexpanded during the boom. Furthermore, without the aid of government intervention the economy recovered and contrary to contemporary opinions the late 1870s was not a period of stagnation and depression.”

“Recent detailed reconstructions of nineteenth-century data by economic historians show that there was no 1870s depression: aside from a short recession in 1873, in fact, the decade saw possibly the fastest sustained growth in American history”

No, that is rubbish.

Recent data shows severe economic problems from 1873-1878:

(1) Davis’s US industrial output index show an industrial recession from 1873 to 1875.

http://socialdemocracy21stcentury.blogspot.com/2013/02/us-unemployment-graph-18691899.html

(2) Unemployment grew significantly from 1873–1878

http://socialdemocracy21stcentury.blogspot.com/2013/02/us-unemployment-graph-18691899.html

(3) Average real per capita growth from 1873-1879 was historically low:

Average Growth Rate 1879 to 1896: 1.36%

Average Growth Rate 1873–1879: 1.64%

Roaring 20s, Average Growth Rate 1920–1929: 2.04%

Recovery from Depression 1934–1940: 5.75%

Average Growth Rate 1948–1973: 2.30%.

From the article Tom Woods is citing:

Freakoutonomics

http://www.nytimes.com/2006/06/02/opinion/02morris.html

So according to this, unemployment went down in sectors where not as much labor was needed, and real wealth was increasing.

And here’s Tom Woods talking about why deflation is a good thing:

Answering the Same Old Arguments Against Sound Money | Thomas E. Woods, Jr.

http://www.youtube.com/watch?v=h-PxMzSyujw#t=18m59s

(at 18:59)

Well, you need not cite Thomas Woods to me. I have already listened to and refuted that video:

http://socialdemocracy21stcentury.blogspot.com/2013/03/woods-on-sound-money-and-deflation.html

And incidentally your quote from Woods does not refute the clear data from Davis’s US industrial output index, which is adjusted for deflation/inflation.

Ok, I will read your article, then.

In the previous point, (4), you link to an article (see below) which I believe you would say supports (5), and the link will be relevant to my response:

Free Banking in Australia

http://socialdemocracy21stcentury.blogspot.com/2012/05/free-banking-in-australia.html

If banks would operate on 100% reserves, then a bank might be tempted, in a scenario where foreign capital is overflowing to the banks, to loan close to all of its gold (or silver), but the loans would be limited to what others in the economy have set aside for that purpose; and if the loans don’t work out, then the malinvestments get liquidated and the banks fail, but the bank customers get their money back.

So there would be no system wide economic destruction, in this case.

Can I ask if you believe, like I do, that the primary reason we as individuals trade with each other is to lower the cost of acquiring what we want? (i.e. as a way of not having to produce that thing, ourselves.)

I’m thinking that somewhere between the basic concept of trade and the concept of credit, you’re losing sight of the point of trading.

If trading doesn’t lower the cost of acquiring what people want, then there’s no point in trading.

The same thing applies to indirect exchanges: The only reason I would need to acquire something I didn’t want is to use it to acquire something I did want – that’s the function of money.

So money has to actually represent, in some real sense, that which I wish to acquire, otherwise there’s no reason for me to hold the money.

This is why fractional reserve lending is fraudulent.

If you disagree with all this, can you show me where your first point of contention would be?

“So money has to actually represent, in some real sense, that which I wish to acquire, otherwise there’s no reason for me to hold the money.

This is why fractional reserve lending is fraudulent.”

Credit money does allow you acquire what you want! You can buy goods and services with it.

And it is monetarised “promise to pay” later. That is whole basis of any advanced capitalist monetary system.

Credit is a promise, money IS the thing that people choose to represent wealth in terms of what they want to acquire, and money substitutes are claims to existing supplies of money.

Credit is not money, so “credit money” doesn’t make any sense.

If you’re saying that credit for actual goods is the future good that is monetized, well that’s just a promise to promise. That is certainly fraud.

If I monetized my promise to pay like the Fed does, I’d be accused of counterfeiting.

But the government wants me to treat the Fed’s paper notes AS the money? No thanks. It defeats the purpose of money, which is to solve the coincidence of actual wants.

If the money doesn’t represent actual wants, then it’s not money. Printed notes can’t do that.

Want proof? How about I just go ahead and monetize MY promises to pay later? I’ll say that one note of my funny money is worth one note.

And, really, if the Fed just came out and told people “we buy stuff by printing money”, people would find something else to use as the money.

(1) First, if Krugman declared that the greenback era was from 1862 to 1878, then he is wrong, and you would have done better to examine whether his statement was true.

As Yosef points out, 1873-1879 is hardly to be considered a “greenback” era. It was a deflationary era:

(1) by 1868 the Treasury had already withdrawn $100 million in greenbacks;

(2) the Coinage Act of 1873 was deflationary:

The Fourth Coinage Act was enacted by the United States Congress in 1873; it embraced the gold standard, and demonetized silver. Western mining interests and others who wanted silver in circulation years later labeled this measure the “Crime of ’73″[1]. Gold became the only metallic standard in the United States, hence putting the United States de facto on the gold standard.

http://en.wikipedia.org/wiki/Coinage_Act_of_1873

(3) in 1874, “hard money” supporters persuaded Grant to veto a bill to print more money;

(4) in 1875, the “hard money” victory was nearly complete: they got the Resumption Act passed and the

Treasury began to acquire gold reserves by federal surpluses and borrowing to back the greenbacks in circulation, further inflicting a deflationary bias.

———-

(2) Secondly, your narrative conflicts with the standard Austrian narrative on this period by Murray Rothbard:

It should be clear, then, that the ‘great depression’ of the 1870s is merely a myth—a myth brought about by misinterpretation of the fact that prices in general fell sharply during the entire period. Indeed they fell from the end of the Civil War until 1879. Friedman and Schwartz estimated that prices in general fell from 1869 to 1879 by 3.8 percent per annum. Unfortunately, most historians and economists are conditioned to believe that steadily and sharply falling prices must result in depression: hence their amazement at the obvious prosperity and economic growth during this era. For they have overlooked the fact that in the natural course of events, when government and the banking system do not increase the money supply very rapidly, free-market capitalism will result in an increase of production and economic growth so great as to swamp the increase of money supply. Prices will fall, and the consequences will be not depression or stagnation, but prosperity (since costs are falling, too) economic growth, and the spread of the increased living standard to all the consumers.” (Rothbard 2002: 154–155).

So you’re saying you disagree with Rothbard?

Well, that is all very well, and you would be right that 1873-1878 was a period of economic malaise:

http://socialdemocracy21stcentury.blogspot.com/2012/09/rothbard-on-us-economy-in-1870s.html

http://socialdemocracy21stcentury.blogspot.com/2013/02/us-unemployment-graph-18691899.html

But you have still failed to see that the monetary measures in this era pretty much much rule out calling it a greenback era: it was an era of deflationary choking off of necessary money supply growth.

Why do you like activity so much? What’s the point of doing business if it doesn’t create wealth in terms of fulfilling individual preferences?

If everyone is trying to fulfill their preferences through voluntary trades, then, on net, costs have to go down because labor and resources are being freed up for new projects.

As individuals, everyone is better off in a free market due to increased production and falling prices, and the crashes you think require government assistance were the result of prior government interventions, so there’s no need to trick people into chasing artificial purchasing power.

If he were to admit that point, he would have to abandon Keynesian Theory. I guess he is aware of that… The only problem is that he at the same time needs to pay lip service to subjective value theory, which doesn’t allow for an objective measure of ‘real output’, ‘economic activity’, hence ‘wealth’ and ‘wealth creation’.

I think to conceal that this contradicts subjective value theory he does not like to use terms like ‘wealth’ but rather like to obscure it by using terms like ‘real output’ etc..

re: “So it seems if you call Lincoln a big government fascist, you get your head bitten off, and if you cast Lincoln as a small government conservative, you get mocked.”

Gee! It’s almost as if there’s some kind of illusive middle ground between “big government fascist” and “small government conservative”!!!

What a weird concept!

Exactly. For example, DK is at least an inch closer to small government conservative than a big government fascist. Zing!

Exactly. For example, DK has moved at least an inch away from being a big government fascist towards being a small government conservative. Zing!

Watch it buddy… I might use my contacts to get you on a certain list… 🙂

On the key point of the post I think you’re right. Krugman’s argument is certainly right, but it pretty hard to defend with so much else going on.

It’s a pretty weird tactic to say someone was right and then claim the opposite of what he said in the next sentence.

It’s like me saying: Daniel I think you’re right. Obama is killing innocent people around the world.

Hmmm…

I think you’re having a little trouble distinguishing between a claim and the evidence for that claim. The evidence presented in his post was quite weak. The claim was not so weak.

Surely you’re not suggesting that whenever a claim is poorly defended the claim itself is automatically a poor claim, are you?

Because if you are saying that then I’ve got a lot of crude internet Austrians that I thought weren’t worth citing in my arguments with more sophisticated Austrians, but now I’m wondering if they are. After all – they poorly defend their claims. That must be a knock-down argument against the claim!

Sorry, I don’t even know what you are talking about now.

You just said you agreed with Robert Murphy’s key point which you certainly do not. His key point was that Krugman is either a liar or ignorant, not that he made a good claim as you suggest.

What you did here is a rhetorical strategy frequently employed by politicians. You embrace criticism of your position by saying that you agree with it only to then change the interpretation of the criticism in a way favorable to you.

Look, you seem really confused. I agree with the idea that Krugman did not defend his assertion, without qualification or reservation.

I’m not changing that claim by also disagreeing with Bob on the question of whether the assertion about whether or not going off the gold standard is a terrible thing.

I don’t see how it makes me like a politician to have some things I agree with Bob on and some things I disagree with Bob on, and to be the sort of person that regularly holds conversations about out thoughts.

*our

“I find the way you answer (regularly – not just here) funny/frustrating. Some people will just agree and add another point to the conversation, and then I’ll agree (or not) with that and add more points. You always seem to really like disagreeing with people, even when you agree.”

FWIW, I think Daniel is right here.

I know you’d like this to be a case where a bunch of ogre statists disagree with the valiant Bob Murphy on everything, but that’s not how the world works.

Few people are real ogres. Few are particularly valiant. Most of us agree with some things we say to each other and disagree with others, and ideally we’re able to talk about that together.

Not a big deal, man.

You’re new here I take it.

You’re new here I take it.

What do you mean?

DK wrote:

On the key point of the post I think you’re right. Krugman’s argument is certainly right, but it pretty hard to defend with so much else going on.

Daniel, you know how you get so frustrated when people can’t understand the clear meaning of your prose? Look at what you just wrote here.

I humbly suggest next time:

“On the key point of the post I think you’re right Bob: Krugman’s argument is terrible. But his conclusion, in my opinion, is certainly right; he just didn’t do a good job trying to reach it, in this one post.”

Ah, yes. Definitely better.

Although in fairness to me, Bob, it’s kinda noteworthy that in this case nobody seemed confused in the slightest about what I meant.

The people who misread what I write always seem to be a few usual suspects… oddly EXACTLY the same people that think I’m a statist guilty of believing all sorts of obscene things… and NOBODY else ever seems to have problems with it. Weird coincidence, don’t you think?

😉

Daniel, the people I’ve seen you get exasperated with on your blog, for misunderstanding your “obvious” meaning, include: Steve Horwitz, Don Boudreaux, David Friedman, … These aren’t just 16 year old Rothbardians.

Didn’t mention age or Rothbard, Bob. Sorry.

Each of them is a discussion in and of themselves.

I don’t know David’s blogging habits well, but I’m obviously not alone in getting blasted by the other two. They obviously have a temper with anyone that crosses them. You’re more a Rothbardian than either of them – why do our discussions always go so smoothly? Why have I never had that sort of problem with Russ?

It’s not exactly a mystery and I’m not sure these examples are helping your case.

The people who misread what I write always seem to be a few usual suspects… oddly EXACTLY the same people that think I’m a statist guilty of believing all sorts of obscene things

I am pretty sure I do not have a record of accusing you of being a “statist guilty of believing all sorts of obscene things”. And since this is the first time I really challenged something you said, I don’t think I qualify as usual suspect either.

But, hey who cares, maybe I am just misreading what you wrote again?

Bob I think I see what you’re trying to do now. Every title has to be an escalation in terms of libeling Krugman .

“Naturally, there was the whole Civil War (aka War Between the States aka War of Northern Aggression), with hundreds of thousands of people dying. So obviously the economy was in awful shape during these years.”

Did the greenback cause the Civil War? If not this is kind of a reach.

Not really, Mike.

Causality doesn’t really matter – the question is can Krugman pull the signal out of the noise to defend his claim. He really can’t because things were so crazy during this period, and he certainly doesn’t try to.

It’s just an odd thing to say in defense of your idea given the empirical uphill battle he faces.

I thought the first half of the post was interesting and good. It’s fascinating that they apparently clipped the quote.

But it probably would have been better not to claim hjstory as an obvious example and instead just make your assertion. Or at least say something like “look, the 60s were just nuts but if you look afterwards at the late 60s and early 70s going off the gold standard didn’t make for some kind of tragedy”

I do find Bob’s concerns with the period after ’73 a little weird even aside from the question of how bad the depression actually was (although I agree with his general criticism of Krugman for making these statements).

Yes, there were still greenbacks around after 1873… but something else happened in 1873… people thought it was so important they called it a “crime”.. can’t quite recall what it was…

I guess we can disagree. I think Bob is just reaching because he wants so bad to have a “gotcha” moment with Krugman.

Regarding the “crime” I think Milton Friedman called it that but ti wasn’t the greenback if memory serves. It was actually forcing us back in the gold standard-Friedman thought we should have done bimetallism.

Totally agree that he thinks he’s got a “gotcha” when the smart money on any given instance is that he doesn’t.

And there’s a very easy explanation for this Krugman post besides Krugman being ignorant or a liar: http://www.factsandotherstubbornthings.blogspot.com/2013/03/lax-defense-of-ideas-judge-to-be-good.html

But those blindspots of Bob’s don’t change the fact that he’s right here.

See that’s a point right there Daniel. When Krugman haters take aim at him they are so quick to play the “AHA! He’s either ignorant or a liar!” card.

There’s always the third less exciting possibility that he-or anyone else-can be wrong in any partiuclar instance.

In real science, people are wrong sometimes and have no trouble admitting it. There’s no gotcha

re: “Regarding the “crime” I think Milton Friedman called it that but ti wasn’t the greenback if memory serves. It was actually forcing us back in the gold standard-Friedman thought we should have done bimetallism.”

Yep, precisely (and I think they called it a crime at the time… I’m not sure Friedman’s article coined it [yuk yuk]).

Whether there was a huge depression or or a more modest one, the period after 1873 was instigated by a monetary tightening which loomed so large that it set a lot of the political agenda and divisions that would shape American history for the next half century.

So, not exactly what I would whip out against Krugman if I were in Bob’s position!!!

I guess we can disagree. I think Bob is just reaching because he wants so bad to have a “gotcha” moment with Krugman.

How is Murphy reaching? Krugman said nothing bad happened. Certainly, bad stuff did happen.

I mean, I can understand you saying Murphy is reaching on other posts (though I might disagree with you, depending on what you point out). But you certainly picked the most illegitimate example to make your argument.

It’s just false causality. Krugman never said there was no Civil War. His point was what terrible things can be ascribed to the devaluation. Neither Bob, you, or anyone else has named me one thing.

It’s like Bob saying the gold bugs are in some sense validated by WWII. Guess England should have stayed on the gold standard! Tsk tsk. He then tries to do concern trolling by saying “I’m not saying the gold bugs were necessarily proven right by WWII but at least it showed their concerns weren’t nuts. It was wrong to have laughed at them.”

It’s falsely assuming causation just because of correlation. It’s not what economics is supposed to be about.

Mike Sax, you can’t think of any plausible causal mechanism, whereby World War II would not have been as big, if the major powers all stayed on gold?

I

Do I think it would not have been as big if the major powers had stayed on gold? No.

Of course, that’s different from the question of whether I can think up a casual mechanism. I can think the gold standard had nothing to do with it yet think up a causual mechanism where it plausibly could.

However, I can’t come up with one myself. If you have one I’d be happy to hear it.

The Market Monetarists suggest-Hawtrey et. al-suggest we may not even of had a Depression if they had gotten off gold sooner.

This post has very little to do with causality and you are reaching to try to make it about that. Krugman said nothing bad happened in those 15 years to the economy. This is clearly false. The economy was bad during the civil war, it was bad during the massive price inflation, and it was bad during the depression of 1873-1879 (at least Krugman would likely agree with this last part).

Obviously, Krugman’s intent in saying that nothing was bad is to show that nothing bad happened due to the greenback. But his absolutely horrid argument was “There was the greenback. Nothing bad happened. Therefore nothing bad happened due to the greenback.” This is a terrible argument precisely because bad stuff did occur and Murphy is right in pointing it out.

It is all about causality. If you say bad things happened but they had nothing to do with devaluation then in what way was Krugman wrong

Did you skip reading my comment and reply to it anyway?

Krugman essentially said “There was the greenback. Nothing bad happened. Therefore, nothing bad happened due to the greenback.”

This is a bad argument because bad stuff did happen!

He did not say “There was the greenback. Nothing bad happened due to the greenback.”

It’s like you can’t see past your belief that Krugman is right to realize that he is making a bad argument.

Causality is irrelevant, unless you can point out where Bob made a statement of causality.

This is nothing more than a question of who can take the trouble to check the historic record.

IWell Lord Keynes looked at the historic record. Why don’t you? It showed that the 1870s depression that Rotbhard actually denied-so why not blast him instead of just Krugman-was caused by deflation.

Ie, austerity. It’s no accident that Austrians and Auesterians are virtually the same word.

Mike Sax wrote:

It’s no accident that Austrians and Auesterians are virtually the same word.

If you had said “It’s ironic…” that would be one thing. But you’re saying it’s by design? Like, when they formed the Austro-Hungarian Empire, they did so knowing one day in the distant future, people would embrace fiscal policies that bore a similar linguistic root?

Mike, you seem to believe that the historic record (i.e. what actually happened on the day) can intrinsically document what it was caused by. Can you explain how this process works?

Bob:

Bob, you got it backwards, when Keynesians decided to kidnap the word “austerity” and use it to mean something related to government having unlimited powers, they also felt the need to invent the word “Austerian” which has never been a real word but seemed like a nice idea back in 2010 as something to sound important about.

http://www.ritholtz.com/blog/2010/06/word-origins-austerians/

I guess this is what gives you kicks Bob. The obvious point is there were no earth shatttering effects from going off the gold standard. Certainly you can’t blame the civil war on it as it started before that happened. I wonder what you’re going to accuse Krugman of next: Maybe something to do with the Nazis?

Let’s just suppose Krugman made a statement like: “I smoked a cigar the other day, and it didn’t start pouring with rain or anything.”

The Bob comes back and says, “Well I just checked the weather records and it was raining all that week.”

So then you come back with, “We all know cigar smoking can’t cause it to rain, so actually Krugman was right in saying that there was no rain.”

See how silly this is? The observed facts are what they are, you are entitled to draw whatever conclusions you like, but not entitled to rewrite the observations.

Try as I Might Bob, I don’t see how this is the smoking gun on Krugman. You keep trying to find one but none of these word games and attempts to parse everything he says ever matters.

This depression lasted 20 years so it was still around after years of being back on the gold standard as well.

Usually Austrians claim that there were no depressions during the pre-Fed age. You’re now admiting there was one because you think this somehow nails Krugman.

re: “This depression lasted 20 years so it was still around after years of being back on the gold standard as well.”

Dude – he’s not making a case for the gold standard here. He is criticizing the quality of the case made by Krugman against it.

I agree Bob’s smoking guns are often quite flimsy – and I don’t think this is a smoking gun either for any kind of deeper problem that is unique to Krugman. But I think you’re barking up the wrong tree here.

Usually Austrians claim that there were no depressions during the pre-Fed age. You’re now admiting there was one because you think this somehow nails Krugman.

Bob’s next post will be about why Rothbard mis-titled his book The Panic of 1819

LOL

I always like how people who aren’t familiar with the Austrian criticisms of the Fed automatically assume that we have no idea that booms and busts have occurred before it’s creation. Rothbard not only wrote about that particular case of 1819, but has also written about various other periods. Doug French even wrote a paper about the Tulip Mania. Others have written about different periods going back to the Roman Empire.

I don’t know of a single Austrian that has ever claimed that depressions, panics, recessions, or whatever other word you want to use, never occurred before the Fed. This guy is clearly just making stuff up.

So now I have my supposed “Keynesian brother”-LOL-knocking me too. I’m being tongue in cheek. I see all this as just hair splitting. You’re saying that he isn’t trying to defend the gold standard just knocking Krugman’s knocking the gold standard.

I don’t know about this-most people who try to knock gold standard knocking support the gold standard or something like it. I think Bob Murphy is a fan of the gold standard. If he supports fiat “funny money” why be so sensitive about knocking the gold standard?

However, Daniel, assuming you’re right this whole discussion is still pretty small beer.

I definetly think Bob often commits the offense of assuming causation out of correlation. So WWII proves that the gold bugs were right or at least that their concerns “weren’t nuts”

Do you agree with him there too Daniel? That people in 1931 were wrong to laugh at the gold bugs because in 1940 there was WWII? It’s the same logic being used here with Krugman.

What about you Lord Keynes? Am I the voice in the wilderness or are you with me?

http://diaryofarepublicanhater.blogspot.com/2013/03/what-will-bob-murphy-accuse-krugman-of.html

I’m with Mike. Daniel, if you don’t have something bad to say about Bob, then shut up!

After all that’s the attitude you guys have about Krugman right?

I have two comments that haven’t appeared yet on the blog.

At most, all Murphy has demonstrated is some poorly researched comments by Krugman.

In 1868, $100 million worth of greenbacks had already been withdrawn, and in 1875 the Specie Payment Resumption Act imposed a deflationary basis in the US.

1873-1879 isn’t really a greenback era, and although it had a bad economy (see links below), in fact the NBER data Murphy cites so quickly is out of date.

http://socialdemocracy21stcentury.blogspot.com/2012/09/rothbard-on-us-economy-in-1870s.html

http://socialdemocracy21stcentury.blogspot.com/2013/02/us-unemployment-graph-18691899.html

I guess the most plausible criticism is Daniel’s-that there is too much noise in Krugman’s example. I disagree as I think that part of doing good economics-a big part-is being able to ignore the noise of not being mislead by it.

He admits that when he first read Krugman’s post he didn’t notice this problem-ie, he shifted through the noise. I feel like even after reading Murphy I’m still able to do this.

His point was not: ‘Nothing bad happened during the 15 years after devaluation and being off the greenback.”

It was the greenback devaluation couldn’t be ascribed to terrible things itself. Again, to me this is obvious and I don’t find the noise distracting.

The terrible carnage of the Civil War and it’s terrible effects and toll obviously should not in any way distract us as it begun before the greenback; to the contrary the greenback didn’t cause the Civil War but was rather an effect of the Civil War-not the most important one either.

You guys (by which I mean Mike Sax and Lord Keynes) are awesome. You are actually saying:

“Sure Krugman’s argument makes no sense at all. But why you think that is somehow a smoking gun that Krugman writes bad blog posts, is beyond me. The earth didn’t cave in when Lincoln went off gold, so clearly the gold standard is stupid.”

All I said was that if Krugman declared that the greenback era included the 1862 to 1878 period, then he is wrong.

Not that “Krugman’s argument makes no sense at all”.

See that’s your trouble Bob. You keep looking for that smoking gun.You think you can write the anti Krugman blog post that will make the whole world decide never to read his blog posts again. That won’t happen.

He’s actually an excellent blogger-even Sumner admits that. I never said Krugman’s argument made no sense. Show me where I did.

Is anyone else seeing a bizarre parallelism between the Krugfans’ defenses of “The Conscience of a Liberal” and Bob’s defenses of “The Bible?”

Didn’t something currency related happen in 1873? It would be a crime to not notice it …

Ken if you had read above you would see that I and Daniel Kuehn discussed the “Crime of 1873” which was not about the greenbacks but rather the imposition of gold again. Friedman called it that because he thinks they would have been better off with bimetallism.

Frankly, I’m sick to death of saying over and over and over that funny money and/or Keynesianism funds and enables war. I posted this cartoon of Nixon and Kissinger on a pile of skulls in May 2009.

http://www.flickr.com/photos/bob_roddis/3520131008/in/set-72157600951970959

The Keynesians will ignore the argument. Then later, they will show up and in one of their pathetic attacks us, announce to the unwashed masses something those crazy Austrians never even thought about. If it weren’t for funny money issued by Lincoln, we wouldn’t have been able to fight the Civil War! The Austrians won’t tell you this because they hate the Civil War because they want to bring back slavery.

Wow. There was no war under the gold standard? No war under hundreds of years of other commodity standards? lol

What “gold standard”, Einstein?

http://socialdemocracy21stcentury.blogspot.com/2013/03/the-classical-gold-standard-era-was-myth.html

+1

The fact that gold fell to a small % of broad money does not change the fact that the gold standard era was not in general a period of Keynesianism. Yet there were plenty of wars. Previous eras – for hundred of years – had silver standards, yet war was ubiquitous.

And haven’t you already said that you do not object to FR banking? Therefore FR banking “funny money” can’t be a problem for you.

You can’t go for 2 minutes without lying, can you? I’ve been very clear that I think FRB is problematic. Further, I’ve been very clear that if the dangers of FRB are spelled out on the face off banknotes, few people would take them. You know all about this because you called me an idiot for stating it.

http://factsandotherstubbornthings.blogspot.com/2012/07/bob-roddis-makes-bad-argument.html?showComment=1342710030818#c2618524232434861358

Yes, you are.

Let me repeat my good sense as written in that comment:

You think people are so stupid that they can’t recognise a debt instrument when they see one? E.g., they can’t distinguish a cheque from a gold coin?

This is typical blathering from someone ignorant of capitalism’s history: time and again the market invents debt instruments like cheques, promissory notes, bills of exchange, and so on, because the benefits and advantages of such instruments.

In fact, most people who normally deal with such debt instruments are perfectly well aware of the risks. Why do we see “no cheques accepted” signs in many businesses?

We are at an impasse then.

For the 4,000th time,

1. If FRB notes do not mislead, they will not cause an ABCT.

2. I still say that IF THE NOTES EXPLAIN ON THEIR FACE WHAT THEY ARE ACTUALLY ARE, people will tend to either not accept them or they will discount them.

That should have been:

I still say that IF THE NOTES EXPLAIN ON THEIR FACE WHAT THEY ACTUALLY ARE, people will tend to either not accept them or they will discount them.

Bob I hardly think you’re picture was much of an argument.As for war, I think you’re fooling yourself that without fiat money there’d be no war. How did they fight the 100 year war?

As for all this talk about “funny money” why with all your libertarianism do you approve of the government crushing a market that clearly is voluntary-fractional reserve banking?

You seem to think that a totally unfettered unegulated market would work without a hitch-rprvided you first had the mother of all government control in snuffing out the fractional reserve banking market

My source for how the Fed funded and facilitated US entry into WWI is always Daniel Kuehn’s paper on the 1920 depression.

http://factsandotherstubbornthings.blogspot.com/2013/01/poor-kid-was-just-couple-years-too.html?showComment=1358997790184#c8276682720113909623

And another thing. Keynesians do not have to explain to us that ending a funny money credit binge will be painful. Even a slowdown in funny money and government spending is likely to be painful in the short term.

Remember what happened when they tried to stop Dark Helmet’s ship flying at Ludicrous Speed?

Dark Helmet: “What have I done?!”

The slowdown is only painful for those whose wealth was dependent in some way on malinvestments.

So, if it was possible for someone to ignore all of the activity created by artificial credit, then he’s not going to suffer during the bust.

I think it’s helpful to think in this way, rather than to think that people are losing wealth during the bust. Wealth was destroyed during the boom, to the benefit of few (cronyism) at the expense of many; Wealth is being created during the bust, and the previously politically connected businesses are losing their ability to socialize their costs.

Many people lost their jobs who in no way made “malivnestments”

If artificial stimulus pays workers to build houses, and those workers give more patronage to certain businesses, and those businesses expand because they believe they are more profitable,

then when the crash comes and those workers no longer frequent the businesses their stimulus-enabled paychecks enabled them to, and those businesses lose patronage as a result,

those businesses will have to lay off workers and sell buildings because the new patronage which justified the expansion of their business was indirectly induced by malinvestments caused by artificial credit expansion to the housing industry.

So Bob let me see if I have your argument right. You aren’t claiming that the gold standard caused the Civil War or the depression of the late 1870s just that Krugman said “nothing bad happened” and they happened? Even though Yosef actually gave the best answer in pointing out that much of the trouble was actually the forced return to the gold standard in the 1870s?

You feel that somehow gold bugs are validated by this and Krugman is invalidated because you think he was honestly unaware of these events?

LK actually hit it out of the park. It was actually a deflationary disaster. If anything getting more into the history strengthens Krugman’s point against deflation.

Just like LK, you don’t understand the concept of economic calculation and mis-calculation. A “deflationary disaster” is what always happens at the end of a funny money induced boom. That is what Mises has said for almost 100 years and it’s our central theme. Every day. All of the time. 24/7.

You and Krugman are purposefully ignoring the essence of our position and you and Krugman are defaming us by pretending we never said it. As with all Keynesians, you are compelled towards deception and misrepresentation.

Bob Roddis with all this talk of “funny money” how do you justify outlawing fractional reserve banking as an extreme libertarian? Why if the free market alwyas right except in this one huge case?

The 1870s didn’t have to end in a deflationary disaster. It hapened because of the Crime of 1973 and related austerity measures-demonetizing silver, enshrining gold. the Coinage and Redemption Acts.

That wasn’t inevitable. It was by following Rothbardianism Circa 1873

In essence, your position only works if:

(1) the ABCT is true (it’s not)

(2) credit money in all forms and FR banking is inherently fraudulent and immoral (it’s not) and its negative aspects cannot be controlled by regulation (false, they can), and

(3) economic coordination in real world markets is achieved by flexible market-clearing prices (false, it is not primarily achieved this way).

In short, nobody is ignoring your concepts or arguments, just disputing their truth.

(1) You haven’t shown how it isn’t true (it is)

(2) Non sequitur. FRB has historically been fraudulent and deceptive in some instances, not fraudulent but the people unaware of it in other instances, and where people are aware of it, it doesn’t cause ABCT.

(3) Flexible according to what standard? If you’re not constraining it to praxeology, you’re talking gibberish, because humans don’t think or act and hence price goods instantaneously.

Now, now, Bob you can always have inflation without corresponding deflation — just requires someone to print enough new money to fill in the gaping hole.

Trying to do this without people seeing the obvious scam requires a bit more effort, that’s where Keynes and Krugman earn their living.

In other words, there are always ways to promise more people more stuff. You just keep writing IOU notes. Getting people to believe that those promises are worth something gets increasingly difficult until you are forced to come up with aggregate demand and other mind bending concepts.

Let me give a shoutout to Lord Keynes to bringing a reality check to the madness.

http://diaryofarepublicanhater.blogspot.com/2013/03/lord-keynes-brings-clarity-to-bob.html

Since you’ve exposed yourself as just another dishonest Keynesian hack, get this straight.

1. Funny money distorts the price, investment and capital structure. People then invest in things and lines of production based upon those false price and other distorted signals.

2. Greenbacks were problematic as they were predicted to be. It was Krugman who said they were not. It will always be painful when prices and plans must readjust after a funny money boom. Greenbacks were also unconstitutional by the way.

3. The Fourth Coinage Act was enacted by the United States Congress in 1873; it embraced the gold standard, and demonetized silver. Western mining interests and others who wanted silver in circulation years later labeled this measure the “Crime of ’73”].

What business is it of the government to “embrace a gold standard and demonetize silver”? This was the fault of Austrians?

Further, LK claims that the “classical gold standard era was a myth.”

http://socialdemocracy21stcentury.blogspot.com/2013/03/the-classical-gold-standard-era-was-myth.html

4. The subsequent long period of continuously lower prices was still not a problem as Rothbard explained.

None of this typically stupid and dishonest Keynesian analysis addresses the central concept of economic calculation and how it is distorted by funny money, FRB and Keynesianism in general.

(1) Then capitalism is doomed to perpetual failure and cycles, for FR banking and credit money over and above any pure commodity base of money will always be developed in real world capitalism — and this process is not inherently immoral.

Congratulations, you proven that capitalism can’t work.

(3) It wasn’t a myth that the measures described above inflicted a deflationary bias on the US economy in the 1870s.

(4) Debt deflation. Pure and simple. You and Rothbard are ignorant of it.

The market does not fail.

You never try to prove that it does.

Your beloved interventions cause the problems. People take on too much debt generally because they think they can outrun funny money inflation. We know about “debt deflation”. It’s caused by you.

There is nothing in your fractured-fairy-tales-historical anecdote method of “analysis” that in anyway refutes the Austrian analysis.

By your own logic, you have already proven it fails: real world capitalism develops FR banking and credit money over and over again. Yet according to you it causes capitalism to fail.

QED.

Human beings create FR banking and credit money. I propose a very strict enforcement against fraud and the initiation of force. That regime has not failed.

The usual state of mankind is war, poverty, slaughter, slavery, rape and pillage. I propose strict rules to preclude those bad things. The strict rules are not the CAUSE of their violation.

Typical desperate and dishonest LK.

FR banking is neither fraud nor immoral, and you are ignorant for saying so.

http://socialdemocracy21stcentury.blogspot.com/2012/08/chapter-1-of-huerta-de-sotos-money-bank.html

http://socialdemocracy21stcentury.blogspot.com/2012/08/a-simple-question-for-opponents-of.html

http://socialdemocracy21stcentury.blogspot.com/2012/08/huerta-de-soto-on-mutuum-contract.html

http://socialdemocracy21stcentury.blogspot.com/2011/10/if-fractional-reserve-banking-is.html

(1) Not true. You are making the false assumption that FRB is some sort of law of the universe, and inherent in free trade even if it is deceptive (as exists today).

(2) It is a lie to blame the gold standard when you yourself denied it was a gold standard.

(3) Debt deflation occurs after debt inflation, which is not always free market.

Thanks, Mike Sax.

Just out of interest, I give the solid data with proper scholarly citations here:

http://socialdemocracy21stcentury.blogspot.com/2012/09/rothbard-on-us-economy-in-1870s.html

http://socialdemocracy21stcentury.blogspot.com/2013/02/us-unemployment-graph-18691899.html

Wow, an avowed bigot who admires the work of dishonest hack who admires a eugenicist. Why is there no surprise there? Birds of a feather.

Bob Roddis this post wasn’t about the Ausrian obsession with “economic caclucation” and the price system-it was about the latest attempt at a gotcha on Krugman.. However, I again will give the last word to LK who just wrote about this Austrian idea. So you’re claim that Keynesians are unaware of these Austrian preoccupations is quite wrong.”

“Murphy and other Austrians do not properly understand the price system in real world capitalism. They do not understand and (often) do not even acknowledge the reality of extensive fixprice markets and price administration. Many businesses do not adjust prices in reaction to demand changes, but supply: that is, they adjust output and employment. That is a strong confirmation of Keynesian theory.”

“The Austrian idea that economic coordination in market economies fundamentally requires universally flexible prices determined by the dynamics of supply and demand curves is wrong: economic coordination – to the extent that it does exist – can be created by “quantity signals,” as Nicholas Kaldor long ago understood.”

http://socialdemocracy21stcentury.blogspot.com/2013/03/warren-mosler-to-debate-robert-murphy.html

It’s Easter and I have other things I must attend to. But that is so stupid as to be beyond belief. LK, after eons of incomprehension, has finally almost discovered the nature of economic calculation and is now hair splitting the differences in that analysis between Hayek, Rothbard and Mises. I think Hayek’s version is supplementary to the Mises version regardless of what Rothbard said about Hayek.

I am in the process of responding to LK’s desperate posts including this one.

http://socialdemocracy21stcentury.blogspot.com/2013/03/hayek-on-use-of-knowledge-in-society.html

This is another of LK’s desperado hair splitting exercises I will be addressing soon.

http://socialdemocracy21stcentury.blogspot.com/2013/03/mises-and-hayek-dehomogenized-note-on.html

Bob I look forward to reading it. If we motivated you to begin blogging on a more regular basis perhaps we degenerate Keynesians deserve some gratitude after all-not that I imagine you acknowledging it.

1. From LK:

“Uncertainty for Hayek means that each individual decision maker only has a small piece of the puzzle. However, as a whole, the aggregated set of all decision makers have a complete set of all relevant knowledge. There are no pieces missing, lacking or unavailable from the puzzle. Market prices organize and synthesize the aggregate amount of knowledge so that market price signals, understood only by savvy, knowledgeable entrepreneurs, [eliminate] … any uncertainty.” (Brady 2011: 14).

“Keynes, Knight and Schumpeter deny Hayek’s claim that the market generates price vectors which concentrate the knowledge so that savvy, knowledgeable entrepreneurs can act on this information and solve the problem of uncertainty. Uncertainty means vital important information is missing. Pieces from the puzzle are missing and will not turn up in the future” (Brady 2011: 14).

“Hayek could not accept the standard concept of uncertainty as defined by Keynes, Knight and Schumpeter because it would then be impossible for market prices to concentrate knowledge that did not exist. In conclusion, nowhere in any of Hayek’s three articles on Knowledge in Economics in 1937, 1945 and 1947 does Hayek deal with the standard view that uncertainty means knowledge that is not there.” (Brady 2011: 15).

To the extent Hayek claims that prices provide perfect knowledge in the existing universe, he’s wrong. This planet, this universe and the knuckleheads that inhabit it are the only source of our knowledge. The fact that humans cannot discern perfect knowledge does not mean that the market does not disseminate the best possible knowledge or that it is not the primary and essential source of such knowledge. There is not the slightest bit of argument that the Keynesian bureaucrats with their SWAT teams have superior knowledge or that funny money and government spending/debt alleviates whatever lack of knowledge that might exist.

2. It never occurs to Hayek that, in the advanced capitalist economies of his day, prices had already grown rigid in many markets because of administered prices.

Prices do not have volition. Further, it does not matter how prices are determined if they turn out to be profitable. If these “fixprice” prices were not profitable, they wouldn’t be employed. The point is that whether or not these prices are determined by the economic actors themselves or are the result of government diktat. Another garbage changing of the subject.

http://socialdemocracy21stcentury.blogspot.com/2013/03/hayek-on-use-of-knowledge-in-society.html

3. I omitted this previously. As we have informed LK so many times before, the ABCT and a housing boom/bust are examples of “debt-deflation”. Most “speculation” is trying to outrun funny money dilution in the first place and is inherently dangerous because it is always difficult to determine in advance when the boom will end and the bust will begin. It is caused by FRB and funny money dilution in the first place. The market does not fail.

This sentence:

The point is that whether or not these prices are determined by the economic actors themselves or are the result of government diktat.

should have said this:

The point is discerning whether or not these prices are established by the economic actors themselves or are the result of government diktat.

(1) ” The fact that humans cannot discern perfect knowledge does not mean that the market does not disseminate the best possible knowledge or that it is not the primary and essential source of such knowlede”

No, prices do not communicate the “best possible knowledge ” either. You have addressed none of the points I made. Prices cannot communicate knowledge that does not yet exist.

Investment decisions require information about medium to long-term future variables, information that is not communicated by current prices.

(2) So Roddis is saying that it does not matter if prices do communicate information by being flexible, yet asserts that fixprices (by magic!!) nevertheless do communicate the necessary information. He is logically incoherent.

(3) The ABCT says nothing about debt deflation. Roddis has no idea what he is talking about.

Investment decisions require information about medium to long-term future variables, information that is not communicated by current prices.

I understand that. In 1980, last year’s prices for men’s bell bottom pants wouldn’t help one know what style of straight leg men’s pants to make in 1980. So what? How does funny money and government debt solve that problem? That’s what entrepreneurs are for. Still, the prices of pants from last year provide essential information about the general cost of making pants and the machines and workers required to be profitable in the industry. Prices are essential but not the entire story. Again, so what? Who doesn’t know that, other than a Keynesian?

Fixprices provide information about whether such prices and lines of production are profitable or not. Again, so what?

The ABCT says nothing about debt deflation.

The entire theory is about debt deflation. Funny money loans distort prices, especially interest rates, making the loans and the lines of production (or speculative assets or houses) the loans go into seem profitable. When the loans and lines of production (or assets or houses) are exposed as ill-advised, the borrower is saddled with debt plus capital goods, consumer goods, assets and/or houses that are worth less than what was originally believed. Their price falls. You know this because you constantly attack us for proposing that the prices be allowed to fall and the borrowers allowed to go bankrupt. I’m saying in the nicest, sweetest, warm and fuzzyest way posible that you are being a teensie weensie bit dishonest here LK.

Further, I like Hayek’s emphasis upon knowledge for an introduction to the Austrian analysis. Hayek was writing around the time of “The Road to Serfdom” and his analysis was aimed at people who believed firmly in the Mary Poppins Theory of Government. It is essential to explain that only the economic actors have the essential knowledge necessary for economic prosperity and that such knowledge is generated by the process of free exchange itself and only by such a process. The bureaucracy does not and cannot have such knowledge. The fact that Hayek’s additional analysis of the nature of entrepreneurship is supposedly lacking or weak does not help the Keynesians or interventionists in the slightest.

Whether you prefer the Hayekian or Misesian version of economic calcuation or the knowledge problem, that does not change the fact that interventionists, Keynesians and funny money dilution distort and impair the process and are the cause, not the solution of such problems.

(1) decentralised market agents do not have the necessary information to avoid market failure in a world of Knightian uncertainty.

(2) since no Keynesian advocates complete central planning communism, government does not need the knowledge required by decentralised market agents.

(3) Roddis refutes nothing. He never explains:

(a) why Hayek’s theory does not require “proximal equilibrium.”

(b) how Hayek’s decentralised market agents overcome Knightian uncertainty. By magic perhaps?

(c) how prices that remain essentially rigid in response to demand changes (quite frequent in the real world) have the knowledge-communicating role of Hayek’s theory.

(1) decentralised market agents do not have the necessary information to avoid market failure in a world of Knightian uncertainty.

Market agents have all of the information that there is, and there is no market failure absent the impairment of such necessary information by you Keynesians. Your policies make life significantly more “uncertain” than it would otherwise be. There is no problem to cure but for your phony “cures”. You are the cause of the serious uncertainty that afflicts markets.

(2) since no Keynesian advocates complete central planning communism, government does not need the knowledge required by decentralised market agents.

It does not need what knowledge to do what? I guess that means that the government hacks can just sit around and whistle the Seinfeld theme through their nose.

http://www.flickr.com/photos/bob_roddis/4774791015/in/set-72157600951970959

Explain why Hayek’s theory does not require “proximal equilibrium.”

I don’t even know what that is supposed to mean. And I don’t care if Salerno thought it up. I don’t like the term “equilibrium” applied to human exchange.

Further, I prefer Rothbard’s more thorough explanation of economic calculation to that of Hayek:

Salerno points out that for Mises, knowledge and appraisal on the market are complementary, and have very different natures and functions. Knowledge is an individual process, by which each individual entrepreneur learns as much as he can about the largely qualitative nature of the market he faces, the values, products, techniques, demands, configurations of the market, and so on. This process necessarily goes on only in the minds of each individual. On the other hand, the prices provided by the market, especially the prices of means of production, are a social process, available to all participants, by which the entrepreneur is able to appraise and estimate future costs and prices. In the market economy, qualitative knowledge can be transmuted, by the free price system, into rational economic calculation of quantitative prices and costs, thus enabling entrepreneurial action on the market.

That being said, the knowledge function is still essential and important. When dealing with Keynesians, all of whom deny how Keynesianism distorts prices, Hayek’s explanation of prices as knowledge is an important first step in trying to explain the obvious to the terminally obtuse.

how Hayek’s decentralised market agents overcome Knightian uncertainty.

Whatever uncertainty exists in the world is exacerbated by Keynesian policies.

how prices that remain essentially rigid in response to demand changes (quite frequent in the real world) have the knowledge-communicating role of Hayek’s theory.

Prices don’t have volition. You and your anthropomorphism. Are these profitable prices? If they are profitable, that’s important information. If they aren’t profitable, that’s important information. I don’t even know what you are asking. Are there people somewhere who are too dumb to know how to set their own prices? Do they stay in business for long? If they don’t know how to set their prices, why don’t you call them up and tell them that you know how to set their prices for them?

Bob Roddis you say that Hayek was wrong if he assumed the prices produce perfect knowledge as if you and other Austrians don’t believe this.

Yet you have also said more than once that markets don’t fail. This proves that in fact you do believe they have perfect knowledge.

Human beings are quite fallible. And prone to murder, rape, pillage and war. That’s why you need to strictly enforce the prohibition on fraud and the initiation of force.

Markets do not fail in the sense of resulting in mass unemployment and mass poverty. Those problems are caused by interventions. Keynesian policy by definition gives unwarranted and abusive power to human beings prone to criminality and greatly reduces the protections against fraud and the initiation of force all to solve problems that do not exist but for the exercise of the aforestated unwarranted and abusive power. The Keynesian “cure” is the problem.

However, markets are just the cumulative of human decisions but you think they can’t fail.

What you’re saying is that humans are fallible individually but not collectively.

Basically you are saying that markets without government intervention-accept in the fractional reserve market-are infallible.

The difference you are avoiding is the difference between the initiation of force and a prohibition on the initiation of force. And that the people wanting to exercise force do not have the necessary knowledge to accomplish what they claim to acknowledge which can result only from unforced voluntary exchanges.

Don’t start using the term “collectively” when referring to bureaucracies and statist thugs initiating force. True “collective” action is voluntary collective action. If it must be forced, it’s because the vast “collective” would not do it. If it must be forced, how can it be “collective”?

The word “acknowledge” above should be “accomplish”.

It’s late.

The last sentence of the first paragraph above should read:

And that the people wanting to exercise force do not have the knowledge necessary to accomplish what they claim they wish to accomplish which can be accomplished only via unforced voluntary exchanges.

I think you’re missing my point. I was using the word “collective” in reference to the market.

I was suggesting that you seem to be assuming that while individuals are fallible the market as a collective of individuals isn’t.

No.

The point of trading is to fulfill individual preferences, so while an individual may be fallible in being able to fulfill his own preferences, he’s actually in the best position – being the one who suffers the consequences of his failures – to do a post-mortem.

Regulations, because they hinder the fulfillment of individual preferences, cause distortions in market prices – prices which others are attempting to use as a gauge to see how successful they are at fulfilling their preferences.

As long as people aren’t violating each other’s rights, the market, as a collective of individuals, tends toward the satisfaction of individual preferences.

“Markets do not fail in the sense of resulting in mass unemployment and mass poverty. Those problems are caused by interventions. “

In other words, you have a quasi-religious, Rothbardian belief that capitalism tends to a vector of market clearing prices and wages.

Yet you have previously denied that is what Austrian economics actually preaches!

Bob Roddis: ignorant of Austrian economics.

I know you are, but what am I?

We have fundamental rights to our bodies and property under the common law. You have no basis for your brutal and vicious attack on those rights to cure your non-existent imaginary “macro” problems with government spending, debt and funny money. It’s not just that you cannot show that the market fails, but you so know that it doesn’t fail that you dare not even try to show that it does fail.

Your real and authentic religion is that of the Mary Poppins Theory of Government. Your imaginary bureaucrat just wiggles her nose and the toys magically jump back into their toy box and line up on their shelves. That’s why you can’t comprehend the concept of economic calculation. Your baby brain cannot fathom how the world might operate without the omniscient Mary Poppins in charge. FRB would work if only we’d appoint Mary Poppins to examine and rule upon the wisdom of every single loan in advance with her omniscience and benevolence. FRB causes bubbles because we just won’t let Mary Poppins rule over the loan process. How pathetic and infantile.

Completely off topic especially with Major_Freedom away all day at his religious services, but Russ Roberts interviewed Scott Sumner without challenging any of his assertions. I still don’t think there’s any there there. Only after listening to the whole thing did I realize that I could have quickly read the transcript.

http://www.econtalk.org/archives/2013/03/sumner_on_money_1.html

As an antidote to all of LK’s distortions, there is the excellent “A REFORMULATION OF AUSTRIAN BUSINESS CYCLE THEORY IN LIGHT OF THE FINANCIAL CRISIS” by Joseph T. Salerno:

http://mises.org/journals/qjae/pdf/qjae15_1_1.pdf

Mises (1998, pp. 546–547) vividly described the nature and implications of overconsumption:

“It would be a serious blunder to neglect the fact that inflation also generates forces which tend toward capital consumption. One of its consequences is that it falsifies economic calculation and accounting. It produces the phenomenon of imaginary or apparent profits…. If the rise in the prices of stocks and real estate is considered as a gain, the illusion is no less manifest. What make people believe that inflation results in general prosperity are precisely such illusory gains. They feel lucky and become open-handed in spending and enjoying life. They embellish their homes, they build new mansions and patronize the entertainment business. In spending apparent gains, the fanciful result of false reckoning, they are consuming capital. It does not matter who these spenders are. They may be businessmen or stock jobbers. They may be wage earners….”

Rothbard (2000, p. 30) also emphatically rejected the overinvestment explanation of ABCT on essentially the same grounds as Mises, referring to it as a “misconception… given currency by Haberler’s famous Prosperity and Depression.” According to Rothbard (2004, p. 993):

“Superficially, it seems that credit expansion greatly increases capital, for the new money enters the market as equivalent to new savings for lending. Since the new “bank money” is apparently added to the supply of savings on the credit market, businesses can now borrow at a lower rate of interest; hence inflationary credit expansion seems to offer the ideal escape from time preference, as well as an inexhaustible fount of added capital. Actually, this effect is illusory. On the contrary, inflation reduces saving and investment…. It may even cause large-scale capital consumption.”

After discussing the falsification of capital accounting and resulting overstatement of profits caused by inflation, Rothbard (2004, pp. 993–994) concluded:

“Inflation, therefore, tricks the businessman: it destroys one of his main signposts and leads him to believe that he has gained extra profits when he is just able to replace capital. Hence, he will undoubtedly be tempted to consume out of these profits and thereby unwittingly consume capital as well. Thus, inflation tends at once to repress saving-investment and to cause consumption of capital.”

Pages 16-17

Salerno’s version of ABCT is just as flawed as any other:

(1) it’s dependent on a non-existent, imaginary natural rate of interest (p. 21, 30).

(2) the false assumption of a full employment starting point. Inability to explain why factor inputs cannot be imported.

(3) From p. 26, where he finally talks of the asset bubble in housing, the phenomenon and its effects are obviously not explained by ABCT. Nor are debt deflationary effects. Nor is the financial crisis.

(4) The whole paper collapses by the time we get to this passage:

“This enormous increase in net worth was based almost solely on paper profits and phantom capital gains on households’ real estate and financial assets. Misled by their inflation-bloated balance sheets, households were induced to “cash out” some of their home equity and increase expenditures on consumer goods and services. In the expression of the day, people began “using their homes as ATM machines.” Households financed their increased spending on boats, luxury autos, upscale restaurant meals, pricey vacations etc., through fixed-dollar debt.” p. 27.

Bingo – this constitutes credit flows to finance consumption.

Rothbard:

“What happens, however, when the increase in investment is not due to a change in time preference and saving, but to credit expansion by the commercial banks? …. What are the consequences? The new money is loaned to businesses. ….

[footnote]

110 To the extent that the new money is loaned to consumers rather than businesses, the cycle effects discussed in this section do not occur.” (Man, Economy, and State, 2004 [1962]: 995–996).

(5) Salerno is even worse than Hayek, and holds that secondary deflation is a good thing, totally ignoring the role of excessive private debt and deleveraging.

I realize that you are a dishonest and desperate person. This one may be your most dishonest and desperate post yet.