Paul Krugman’s Eyes Are Smiling

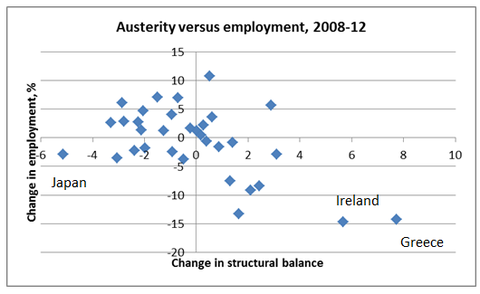

In this post, Krugman takes Marco Rubio to task for claiming that government deficits crowd out private investment. Amongst his points, Krugman produces the following scatter plot:

…and then comments, “Contractionary policy has proved contractionary.”

Wait a second. Look at that chart. Even on its own terms, it’s not nearly as obvious as Krugman makes it seem–if you take out the bottom two data points, there’s no clear pattern at all.

And what are those bottom two data points? Greece and Ireland. As we all know, the Greek government systematically lied for years about its actual deficit, in order to placate EU authorities and continue to violate their rules about fiscal responsibility. Then when the crisis struck, their bonds got hit–you know, by those “invisible” vigilantes in which Krugman doesn’t believe. So yes, the Greek economy has been performing badly the last few years, but it’s not a slam-dunk case that this is an example of why fiscal prudence is a bad thing.

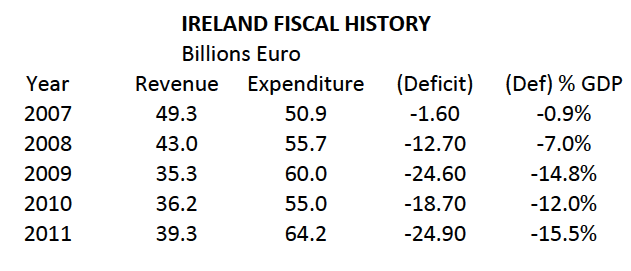

Yet the other example, Ireland, is even more ridiculous for Krugman to be using in this fashion. I have no idea what it means to say that from 2008-2012 Ireland had a “change in the structural budget balance as a percentage of potential GDP” of almost 6%, but here is what Wikipedia has to say about the expenditures, revenues, and deficits for Ireland from 2007 – 2012:

So with those numbers, you can see it’s a bit much to cite Ireland as an example of a country that eschewed Big Government Keynesian demand stimulus when the crisis struck.

In fact, I can cite a Nobel laureate who agrees with me, that the Irish bailout of its banks was a terrible idea, because it racked up too much debt:

Ireland’s bank bailout had a face commitment around 15 percent as large as the TARP — in an economy 1/100th the size of the United States. The TARP was only 5 percent of GDP; even if a large part of the money (mainly used to purchase bank equity) had been lost — which it wasn’t — it would not have been a big factor in federal debt.

There have been other losses, largely at Fannie and Freddie; but in the end the cost of financial bailouts is not an important factor in US debt and deficits. In Ireland, by contrast, it is what has made a potentially manageable debt situation catastrophic.

I’d add that the big risk in October 2008 — that the whole world financial system would freeze up — was never a concern in the Irish case.

But mainly, putting taxpayers on the hook for 5 percent of GDP is one thing; putting them on the hook for 60 or 70 percent of GDP, something quite different.

At this point, I don’t have to actually tell you which economist I’m here quoting, who was worried about the Irish government’s spending in the crisis leading to a “catastrophic” debt situation, do I?

Even without Ireland and Greece the slope coefficient on this scatter would look to be fairly negative. Even so, most of those with large positive changes in the “structural balance” and big drops in employment are probably peripheral European countries with little else to choose. Their austerity is forced by bond markets and heavy on taxes. Not a great gauge of what discretionary fiscal policy in the U.S. would do.

re: “Even without Ireland and Greece the slope coefficient on this scatter would look to be fairly negative.”

Agreed. I honestly think they flatten it out.

Not that we should be encouraging raw scatterplots as causal stories in the first place…

I had about half a post written knocking Krugman for the raw correlation (these are very endogenous), until I realized that the endogeneity bias worked against him.

A couple thoughts:

1. The relationship (whatever its worth) is stronger than you suggest, I think. If anything Japan, Ireland, and Greece make it look flatter than it would with those countries excluded.

2. Ireland had a bad 2012 in terms of the budget deficit as a result of some fiscal deals.

3. I’m not expert on the European situation and I’m just plain confused right now. John McHale (who I assume is up on these sorts of things) suggests there has been a persistent shrinking of deficits throughout the crisis and the numbers are a lot smaller than your Wikipedia numbers suggest: http://www.irisheconomy.ie/index.php/2012/05/08/is-irelands-fiscal-adjustment-failing/

Maybe Krugman’s numbers aren’t counting the European bailouts?

Anyway, I think it’s pretty hollow anyway because the endogeneity bias works against Krugman here, so even if we put Ireland somewhere else because Krugman’s data is wacky I’m still not sure what that tells us.

Maybe Current can clear this up.

One thing I know for sure: we need a cooler name for our president, like “Taoiseach”

Daniel,

See my post below on why this data does not show Keynesian stimulus Ireland.

On the topic of endogeneity, shouldn’t there be more points in that bottom-left third quadrant? I mean how about ’08 – ’09 when structural balances deteriorated into massive deficits as a result of falling employment. Tax revenue drops, automatic stabilizers kick in, etc… were the employment drops at this time really less than “5%”, however that is defined in the chart?

“So with those numbers, you can see it’s a bit much to cite Ireland as an example of a country that eschewed Big Government Keynesian demand stimulus when the crisis struck.”

No, Robert Murphy, I am afraid you have done nothing but demonstrate once again (as in the case of your writings on Hoover) that you do not understand even the basics of Keynesian fiscal policy.

(1) does it not occur to you to look at Ireland tax increases and the bank bailouts?

The tax increases that Ireland adopted as part of its austerity were very sharp and badly hurt the economy.

(2) in 2008 Ireland announced a €5.5bn bank recapitalisation program. The bank bailouts did not add to aggregate demand (AD) because the banks just hoarded the money (probably at the ECB) – just as QE in the US did not really add to AD – and private credit collapsed anyway.

http://www.rte.ie/news/2008/1221/111941-bank/

I am not sure whether that money was actually spent in fiscal 2008, but let us ran through the options:

(a) Assume fiscal 2008 saw the bank bailout and tax increases (though the numbers do not add up, I admit). The result?: government spending increases in 2008 wiped out (since bank bailouts did very little to actually stimulate AD, they just prevented financial sector collapse) and tax increases would have made fiscal policy contractionary anyway, by wiping out the stimulatory effect of any remaining increase.

Assume 2008 saw some discretionary increase in spending (planned from the previous year’s budget), automatic stabilisers, and only part of the banking bailout – probably the most likely scenario

Result? The bank bailout did not stimulate the economy. You must subtract it from total spending. And still the tax increases would have drained enough spending from the economy to wipe out more than the spending increases, meaning contractionary fiscal policy.

(b) 2009: Assume automatic stabilisers, and again more of the banking bailout. Result? The bank bailout did not stimulate the economy. You must subtract it from total spending. And still the tax increases would have drained enough spending from the economy to wipe out more than net spending increases, meaning contractionary fiscal policy.

(3) Since fiscal 2010 shows quite clearly steep absolute cuts in government spending, that should be clear to you as austerity, without additional details about why it may have been even more contractionary than it looks (for reasons listed above).

(4) and most of the deficit was just caused by the collapse of tax revenue, so don’t bother citing the size as a % of GDP, since that stat per se does not tell you whether government fiscal policy was expansionary or contractionary.

(5) yet another factor that would need to taken into account is the effect of the fiscal policy of the 29 county councils and five city councils in Ireland (local government). I doubt whether that was expansionary, since local governments normally are not in recessions. Whatever spending power the local governments drained from the economy would have to subtracted from federal fiscal numbers as well.

——————

One question: are you going to spend your life ignorant of these basic methods for understanding whether fiscal policies are contractionary or stimulative?

Why should a Keynesian like Krugman debate you when you are apparently incapable of doing the simple analysis I have just done above?

Haven’t Bob and other Austrians repeatedly made the point that austerity as a blanket term is highly misleading and that not all fiscal consolidation is created equal? Which we of course, all realize. Since Rubio and other GOP ignoramuses are certainly not basing their “contractionary” rhetoric on the premise of large tax increases, shouldn’t Krugman et al. be looking for comparable cases of austerity? Shouldn’t his graph compare employment growth to countries whose structural balance shifts are mainly a result of spending-based adjustments, and not revenue?

Shouldn’t his graph compare employment growth to countries whose structural balance shifts are mainly a result of spending-based adjustments, and not revenue?

Historically there are several examples of countries that did this, and their economies quickly recovered. Krugman explains them all away with various excuses, to show why they aren’t relevant for us today. (E.g. they cut interest rates, they boosted trade, etc.)

That list of “excuses” sound more to me like “critical elements of any sensible understanding of the macroeconomy”.

They are not excuses. They are clear explanations of what happened, unless you think they recovered by magic.

Many of the few examples of “expansionary austerity” happened when the rest of the world was booming and not subject to the Great Recession, and export-led growth usually provided some driving force for a recovery.

Anyway, Keynesianism says not that the private sector can never create a recovery in the absence of stimulus, just that there is necessary reason why it should, since market economies do not converge towards full employment GE.

Correction:

“just that there is NO necessary reason why it should, since market economies do not converge towards full employment GE.”

“unless you think they recovered by magic.”

This is precisely what your bankrupt theory forces you to believe, if there isn’t the kind of stimulus you believe is needed, and there is a recovery you didn’t expect. If there isn’t the kind of stimulus you believe is needed, then the only other alternative is “magic” isn’t it?

This is just more evdience that your theory is a priori and not a posteriori.

You might as well say

“It couldn’t have been due to what the anti-Keynesians are saying. It just couldn’t! There MUST be some government activity that we can focus on to fill the gaps and prevent the other story from having real world evidence. I can’t understand the economy any other way!”

“This is precisely what your bankrupt theory forces you to believe, if there isn’t the kind of stimulus you believe is needed,”

No M_F.

An economy *might* recover real output growth without stimulus by private sector investment and consumption and/or export led growth.

There is no necessary reason why it should, since market economies do not converge towards full employment GE, nor any strong empirical evidence that economies reliably do so in the real world.

No LK, you’re still presupposing your bankrupt theory as a priori true, that “spending” has to increase before economies can recover, and if spending does not increase, but economies grow or recover, then you believe it has to be “magic”, and anyone who “peddles such nonsense” must also be peddling the validity of “magic”.

Your other a priori claim that “markets do not converge towards full employment” is fallacious on its face, since the fact that humans act necessarily implies that they act to benefit themselves in a context of market transactions, and that is sufficient and necessary for there to be a “convergence towards full employment.”

Now, this necessarily true convergence is of course a tendency towards full convergence, not an actual attainment of full convergence (perfect satisfaction), but what you always overlook and/or ignore is that this necessarily true convergence tendency takes place over time.

While every market actor (obviously) acts to attain their ends in a context of market exchange, not every individual does this at the same “speed”. For some individuals, they can find the relevant information and potential exchangers relatively quickly, while other individuals find information at a relatively slower “speed”. Thus, as time passes, you will observe less than full employment and less than full resource utilization from the arbitrary standard of whatever time limit you subjectively believe is “justified.”

As owner of my labor and my productive assets, you may believe they are “idle” when in reality I am just biding my time waiting for a better offer, as I am moving in my particular tendency towards full satisfaction, without ever reaching it.

This whole “non-ergodic stochastic” mathematical description of markets that you repeatedly opine is nothing more than a mental crutch that you believe serves as some sort of sufficient evidence that individuals will somehow not act in their own interests over time and allegedly fail to make the exchanges that benefit BOTH parties when it benefits BOTH parties.

You want everyone to believe that the mere existence of time is in itself an intolerable fact of life, that ipso facto proves humans do not fix their lives for the better. After all, if they aren’t fixed now, or after whatever arbitrary amount of time you personally subjectively believe is justified, then your opinion on the matter is somehow sufficient evidence that introducing non-market activity is justified to attain YOUR personal ends that of course include other people and therefore imposing ends on others that do not match their own ends for themselves.

The “empirical evidence” you point to that allegedly shows there is “no strong evidence that economies reliably do so in the real world” is laughable on its face, since we don’t have market economies, but economies with massive and widespread non-market activity from states, which you refuse to grasp hampers real recovery, since to you all that matters is bodies moving and money flowing, even if such movements do not reflect the true desires of individual market actors, but the desires of statesmen and their thug enforcers.

You can’t possibly claim that the historical observations you make that are full of government activity, are somehow evidence of what markets look like. That is intellectual dishonesty to the nth degree.

(1) existence of time and uncertainty do not stop people from acting to achieve goals.

You idea that I think that uncertainty means “individuals will somehow not act in their own interests over time and allegedly fail to make the exchanges that benefit BOTH parties when it benefits BOTH parties” is just a stupid straw man.

(2) ” since the fact that humans act necessarily implies that they act to benefit themselves in a context of market transactions, and that is sufficient and necessary for there to be a “convergence towards full employment.”

No, it isn’t. That anyone could believe such nonsense shows that you do not understand even Austrian economics.

And of course you give the game away at the end when you say that, if only we had real market economies (read: lunatic Rotbardian fantasy worlds that have never existed in the real world) then everything would be fine.

What you would need even for convergence towards full employment GE (though the state is never attained) is:

(1) not just a universal law of demand, but a real world economy where prices are actually set by demand and supply dynamics which do tend towards their equilibrium values (even supposing they exist in ever market, which is an act of faith).

But real word price setting/administration is enough to demonstrate this is nonsense.

(2) a labour market that tends towards market clearing wage. Yet again so obviously not true in the real world, where people object to having their real wages cut. And that assumes that equilibrium wages wages even exist universally, which is again nothing but an act of faith.

(3) the abolition of business subjective expectations, which essentially means an abolition of uncertainty.

Yet Austrians accept both subjective expectations and uncertainty.

(4) a market clearing interest rate: but (3) is already sufficient to destroy that.

(5) and finally the mad Austrian world, even if it were introduced, with its desire to create perpetual deflation would be subject to debt deflationary forces thwarting imagined equilibrium forces.

Keep up the good work, M_F.

“where people object to having their real wages cut. ”

This statement is false and shows how sheltered your life is. Over the past several years I’ve witnessed many people taking, and offering to take, wage cuts in order to have some income rather than no income. But this, I believe, is definitely tied to available job opportunities. It might be different, if the jobs were more plentiful.

LK:

“(1) existence of time and uncertainty do not stop people from acting to achieve goals.”

“You idea that I think that uncertainty means “individuals will somehow not act in their own interests over time and allegedly fail to make the exchanges that benefit BOTH parties when it benefits BOTH parties” is just a stupid straw man.”

No it isn’t a “stupid straw man” because that is exactly what is implied in your pathetic insistence that the market process does not tend towards a convergence of full employment.

It is a necessary implication of your denial of this, and of your garbage understanding of how markets work in general. By claiming that the market is a “non-ergodic stochastic system” that does not tend towards such convergence, you are at the same time, whether you realize it or not, denying that individual market actors seek to attain their ends and to seek mutually beneficial exchanges with others whose value scales are offsetting in terms of ranked order of preferred goods.

(2) ” since the fact that humans act necessarily implies that they act to benefit themselves in a context of market transactions, and that is sufficient and necessary for there to be a “convergence towards full employment.””

“No, it isn’t.”

Yes it is. That anyone would deny this shows that you do not understand not only Austrian economics, but of how markets work in the absence of “strong centralized” initiators of aggression.

“And of course you give the game away at the end when you say that, if only we had real market economies (read: lunatic Rotbardian fantasy worlds that have never existed in the real world) then everything would be fine.”

Another dishonest and contemptible straw man.

I never claimed that “everything would be fine” in my last post, and I challenge you to show where I did.

What I did claim, which you seem utterly incapable of showing even the most rudimentary understanding, is that you cannot claim there is “little evidence” or “no strong evidence” that market economies can or cannot have particular outcomes by observing non-market economy data, but rather, data that is severely affected and influenced by state activity.

In your lunatic statist ideal, peaceful people are exploited and victimized by force. Only in your bats&*t insane world can free market activity be viewed as “lunatic”. Sanity tends to appear as insane to you and your ilk who believe it is insane for people to act peaceful towards one another.

“What you would need even for convergence towards full employment GE (though the state is never attained) is:”

All of your rubbish below is false. There is no such thing as “equilibrium” values, nor “equilibrium” prices, not anything on the side of “equilibrium”. The values set by individuals, through their cooperation, and exchange, are constantly in flux, contingent upon the knowledge and preferences of people AT THE TIME.

You again deceitfully claim that there is “real world evidence” that the labor market does not tend towards clearing wages. No, we don’t have such “evidence” because we don’t have a free market to observe. Only if we had a real world laissez faire market can you even begin to claim you are observing free market data and historical free market evidence.

By your insane logic, we should be able to observe activity in a slave worker camp and claim that there is evidence of private markets, private labor market activity, and other free market evidence.

Futhermore, and contrary to your silly claim that “tendency towards full employment and output” requires an “abolition of subjective business expectations”, it is precisely the fact that all expectations are subjective that grounds the very tendency towards full employment and output in the first place.

For the values that allow for exchanges to be had in the first place are subjective to the individual. One individual can only trade with another individual if there are DIFFERENT, NON-OBJECTIVE valuations of goods and services and labor and everything else that can possibly be traded. Trade implies a different, offsetting valuation of goods among subjective preference individuals.

If value were objective, if expectations of future value were objective, then exchanges would not even take place.

It is hilarious how you can actually believe the myth that subjective expectations is somehow a degradation in any way, when it is precisely what allows the very free market activity (which we don’t have in full because of thugs who impose what you are too chicks&*t to do yourself) to take place that CONSISTS in individuals seeking to attain their ends which is, as mentioned above, both necessary and sufficient to ensuring that there is indeed a tendency towards full employment and output.

It may take longer than what your worthless opinion on this matter would have anyone believe, but it is always present by the very nature of acting towards attaining more desirable ends over less desirable ends.

There is absolutely no requirement for any single “market clearing” interest rate. There is no such thing as a clearing interest rate. There is only a tendency towards a complex of interest rates in the plural that would, if actually attained, fully clear all borrowers and lenders. But because preferences, technology, and knowledge, among other things, constantly change, the clearing complex is never actually attained.

The very fact that market actors continue to act is sufficient proof to refute your nonsense that there somehow has to be an actual market clearing rate before the market “works” the way your bankrupt view says it should work.

As long as individual borrowers and lenders seek to engage in mutually beneficial trades, then it is sufficient to conclude that whatever the quantifiable rates that do take place, are a part of a tendency towards clearing in full (but never actually attain).

Finally, only in your mad, insane, crazy Keynesian world are falling prices INHERENTLY an evil, as if human plans and goals and ends sought after are completely irrelevant, and the only thing that matters is that humans become slaves to numerical statistics that they themselves are the creators of.

Falling prices caused by rising productivity are not deflationary in the sense of declining profits, widespread debt defaults and unemployment. They are a healthy aspect of an economy whereby all goods and services are voluntarily produced and sold at voluntary prices in the market. This of course includes the production of money itself.

There has not been a single good reason ever given by any Keynesian, or any other economist, why falling prices is necessarily bad/evil/destructive.

Selling twice the goods and half the prices does not reduce profitability. It does not make debts harder to pay back. It does not cause unemployment.

“What I did claim, which you seem utterly incapable of showing even the most rudimentary understanding, is that you cannot claim there is “little evidence” or “no strong evidence” that market economies can or cannot have particular outcomes by observing non-market economy data, but rather, data that is severely affected and influenced by state activity.”

Yes, it is perfectly clear what is going on here.

When I said “market economies” I mean what everyone else in the world understands by that term: market economies that do in fact exist in the real world (and where we have some proper or at least half-decent economic data), i.e., real world market economies from the 19th century up to now.

Of course you want it to mean the fantasy Rothbardian anarcho-capitalist world, which has never existed anywhere.

Of course, by definition, we have no empirical evidence for how it would work, but unless uncertainty, subjective expectations, price setting and opposition to

wage cuts, etc., just disappeared in such a world, there is no theoretical reason to think it would converge to full employment GE either.

LK:

“Yes, it is perfectly clear what is going on here.

When I said “market economies” I mean what everyone else in the world understands by that term: market economies that do in fact exist in the real world (and where we have some proper or at least half-decent economic data), i.e., real world market economies from the 19th century up to now.

Of course you want it to mean the fantasy Rothbardian anarcho-capitalist world, which has never existed anywhere.”

Worst. Logic. Ever.

By this garbage method, which I suppose should be given a name, considering how often you foolishly use it: “Observationism”, if there has never been a murder free country in the history of the world, such that we have never observed murder free countries, then humans are allegedly wrong to use the phrase “no murder” to describe an absence of murder, since, after all, there has never been a murder free country in the history of mankind.

So if silly “Rothbardians” (PS Why you keep using that term, given that anarcho-capitalism PRE-DATES Rothbard by over 100 years, can only mean you’re just using it as a mantra) dare assert that “no murder” means absence of murder, then they must be wrong, because there is no such thing as a murder free world.

A billion other actions can be used in place of murder with the same force of argument: We have never had an absence of racism, so “Rothbardians” are allegedly wrong to assert that “no racism” means an absence of racism. Sexism, gun violence, theft, you name it. Since they “exist”, it somehow means anyone who defines “No X” as not including X in some way, that they are somehow spoiling the well, or redefining terms, etc.

What you are doing is insisting that we use the term “market” to describe the prevailing empirical world so that you can take a dump on it, and in so doing, hoping that you can drag “Rothbardianism”, and all other variants of “market” (justified or not), into the mud with the current severely hampered market that we now live under.

It’s not an arbitrary or misleading definition to define and interpret the market process as being the totality of legitimate private property exchanges and dispositions of private property.

What you are obviously trying to do is deny and deflect responsibility of your own rotten policy advocacies as part of the reason why there are significant economic problems. You want to blame the market, which is really a government hampered society, and then you want to present the government as solution, when it is in fact responsible for why the “Rothbardian” market went sour.

“Of course, by definition, we have no empirical evidence for how it would work, but unless uncertainty, subjective expectations, price setting and opposition to

wage cuts, etc., just disappeared in such a world, there is no theoretical reason to think it would converge to full employment GE either.”

There is of course a very good reason to think it would TEND to converge. This is the fact, as mentioned, that goal seeking individuals by their very nature tend to avoid less valuable outcomes, and seek and achieve more valuable outcomes.

If their goals and outcomes are not what you expected, or not what you believe is “good for them”, that doesn’t entitle you to claim that “the market does not tend to converge to full employment.” It only entitles you to saying “Individuals in a market context behave differently than how my fallacious and crude model says they “should” behave.”

If individuals want to work, and if individuals want to hire workers, then, provided individual property rights are respected, there is in fact a very real world tendency of the labor market tending towards converging to full employment. It may take weeks, months, years, for overall employment numbers to rise to what you a priori expected, but the tendency is real.

Right, I’ve read the Giavazzi & Pagano paper on Ireland and Denmark’s experiences. And I’ve seen Krugman place importance on those factors you mentioned in explaining various recoveries. But what of Alesina’s work, which is wide-ranging among developed countries? He draws clear conclusions that consolidations on the spending side are more effective and can even be expansionary. I’ve seen people raise issues with his methodology, it’s obviously hard to avoid endogenous / exogenous mixups. Is that the Keynesian rebuttal?

Are you thinking of this?:

Alberto Alesina “Fiscal adjustments: lessons from recent history”, April 2010

http://www.economics.harvard.edu/faculty/alesina/files/Fiscal%2BAdjustments_lessons.pdf

Read these:

http://bilbo.economicoutlook.net/blog/?p=19050

http://bilbo.economicoutlook.net/blog/?p=10920

The specific article I was referencing was this one: http://www.nber.org/papers/w15438,

But Alesina has built a backlog of similar work on fiscal adjustments so I’m sure they channel each other.

Will take a look at the rebuttals you’ve linked.

It’s worse than we thought.

No Keynesian will give a concrete definition of what exactly they mean by “austerity”, so they arbitrarily can say that a government with rising expenditure and falling revenues continues to practice “austerity”. Next week it will be something else.

“No Keynesian will give a concrete definition of what exactly they mean by “austerity””

That’s rubbish.

Austerity is government fiscal policy (at all levels: tax policy, how it spends (e.g., bank bailouts and QE do not stimulate AD) and total fiscal effect of state, local, and federal government) that contracts demand in an economy.

E.g., when Roosevelt all but eliminated the stimulative levels of deficit spending in his budget balancing 1937-38, he severely contracted demand in the US economy. The result was recession again in 1938.

At all levels? Why is it then that Keynesians like Krugman pick and choose which particular component within “all levels” is to be focused on and then insinuating that is or is not austerity?

How many times have we seen “By this measure, austerity is blah blah blah…”?

Why not stick to ONE meaning for austerity?

“E.g., when Roosevelt all but eliminated the stimulative levels of deficit spending in his budget balancing 1937-38, he severely contracted demand in the US economy. The result was recession again in 1938.”

You mean that after people who used to receive government directed incomes no longer received such government directed incomes, had to find new income streams from others in a market context, which TAKES TIME, and so we observed a temporary drop in “activity”?

Oh my God, the world is so cruel. If only everyone knew exactly who they will trade with and when they will trade with them, after the government changes its activity!

It’s almost like you are saying that when a non-market institution suddenly changes its activity, which sends out information that also takes time to be communicated via new spending and price formations, that because everyone in the market doesn’t instantly adapt and set up new exchanges as if they know exactly how the government’s activity affects their particular incomes through all the complex chain of expenditures and re-expenditures, that this somehow means the government should not have changed its activity. Damn people took time re-adjusting their plans given the new circumstances.

LK, it’s not proof that government stimulus is good for “society” if after a reduction in “stimulus”, unemployment and output fall.

The same damn thing would happen if a country with universal slave worker camps everywhere suddenly experienced universal slave emancipation and the slaves had to learn how to seek out how to produce and work for themselves in a new context of market activity. In this context, “employment” and “output” would PLUMMET in the short run. After all, before everyone was “moving” and all kinds of output like cages, whiplashes, and cabbage soup were being “produced” under the direction of the state’s intervention.

According to the garbage Keynesian theory, because the reduction in government “stimulus” was followed by a reduction in “employment” and “output”, that this is somehow sufficient evidence that the government should immediately round up every worker again and put them right back into the slave camps, so that “employment” and “output” never have to fall for any length of time ever again.

Of course, in our society, the same principles are present, only to a smaller degree, and it is also true that when the state reduces its activity, everyone else finds themselves in a new context of having to find income, work and produce in a new context where the previous coercive based income flows no longer exist. This also will take time, and it is not surprising that “employment” and “output” will fall, as people form new relationships, relationships based more on peaceful cooperation and less on coercion and exploitation.

What the crude “employment” and “output” statistics do not take into account are whether or not that “employment” and “output” are directed towards sovereign consumer’s preferences. In Keynesian corrupted societies, “employment” and “output” are NOT as directed towards sovereign consumer preferences as laissez faire societies. Rather, they are more directed to the preferences of coercive individuals, who you label as statesmen and policymakers.

The core of Keynesianism is NOT “predominantly private ownership of the means of production.” It is full fledged totalitarianism. That is precisely why Keynes himself admitted that his theory is more readily catered to totalitarian societies, and it is also why he envisioned “euthanasia of the rentier.” it’s because the LOGIC of Keynesianism is to completely overturn the market IF people do not “move” and “spend” in a way that Keynesianism does not “approve.”

If every market actor reduces their spending and become self-sufficient farmers voluntarily, then because employment and output would fall to such a high degree, Keynesianism would call for such high levels of government printing and spending on “social works programs” that virtually everyone would become employees of the state. This is what the logical end point of Keynesianism really is. The only reason why you and the rest of your ilk tolerate “private ownership of the means of production” is because you need to communicate that to everyone else lest they catch on to your ultimate theoretical conclusions that does not care one iota about private ownership. It is rather a necessary evil that is only tolerated because everyone doesn’t willingly become wards of the state. But if everyone does, then Keynesianism would come into full flower, just as Keynes himself knew and admitted.

If the percentage of private ownership falls, then there is nothing in Keynesian theory that can show why output and standards of living would fall. Private ownership can fall to virtually nothing, and no Keynesian can explain why output or private sector employment falls IF “AD” was always maintained by government printing and spending.

Even if the entirety of all “spending” was 100% consumption spending for whatever reason, then if AD isn’t lower that what prevailed in a full employment scenario, Keynesianism cannot explain why output is low and why wages are zero.

(1) “LK, it’s not proof that government stimulus is good for “society” if after a reduction in “stimulus”, unemployment and output fall.

I see: you admit austerity causes real output collapse. So the reverse must also be true: stimulus causes real output expansion.

(2) “According to the garbage Keynesian theory, because the reduction in government “stimulus” was followed by a reduction in “employment” and “output”, that this is somehow sufficient evidence that the government should immediately round up every worker again and put them right back into the slave camps, so that “employment” and “output” never have to fall for any length of time ever again”

lol… yes, M_F no doubt!

Most people would, however, conclude after reading these lies that you sound like a full-blown lunatic.

You posts have now got to the point where you have lost all reason and even the pretense of fallacy-free argument has vanished.

LK:

“(1) “LK, it’s not proof that government stimulus is good for “society” if after a reduction in “stimulus”, unemployment and output fall.”

“I see: you admit austerity auses real output collapse.”

If it’s not controversial to assert that output would fall if a society turns from a state controlled slave worker camp society to a free society, why would it be controversial to assert the same thing for a state controlled spending society?

All human action takes time. If a society has government intervention, and then the intervention changes, then it will take time for people to realize how the government is actually affecting their incomes and their personal plans.

Government spending doesn’t just affect the particular individuals it gives the money to. It affects others. Sellers of food can sell to people who receive government checks, for example. If those checks are changed, then so could those food sellers. Since the economy is so complex in the sense of money spending and re-spending, it is impossible for individuals to know exactly how their particular business will be affected if there is a change to government activity.

Hence, it is EXPECTED that the previous activity (that you misleadingly call “real output” as if anti-consumer directed directed output is interchangeable with consumer directed output), would be reduced, so that individuals can replan, reform their goals given the new conditions, and seek out new exchange partnerships given that the old ones are no longer tenable.

Of COURSE if you lump all the “output” and “employment” into single crude globs, then you will see such globs increasing or decreasing. It’s not an evil that these statistics would decrease if the transition is to a more peaceful voluntary exchange society and away from the previous more coercive, exploitative society.

“So the reverse must also be true: stimulus causes real output expansion.”

You’re not even in the same league as economics when you make these stupid comments.

If the government were to tax everyone’s incomes 100%, and printed off a few trillion more, and then paid a contractor $20 trillion to construct a giant pyramid of poo, then according to your garbage understanding of “real output”, we should conclude that “real output expanded tremendously”.

In reality of course, real output directed to sovereign consumer preferences would have collapsed.

The same principle is present when the government prints and spends money. Yes, the crude, singular “GDP” statistic may go up quantitatively, but that does not entitle you to claiming that individual lives are in fact better off.

“(2) “According to the garbage Keynesian theory, because the reduction in government “stimulus” was followed by a reduction in “employment” and “output”, that this is somehow sufficient evidence that the government should immediately round up every worker again and put them right back into the slave camps, so that “employment” and “output” never have to fall for any length of time ever again””

“lol… yes, M_F no doubt!

Most people would, however, conclude after reading these lies that you sound like a full-blown lunatic.”

HAHAHAHAHAHAHA, you totally evaded the point that exposes your worldview as rubbish, and you of course have to relegate yourself to ad hominem, obfuscation, and silly rhetoric and sarcasm.

You don’t have an answer to what I said, because you know it’s exactly what your evil worldview implies, and so you just hope that by spewing enough ad hominem, that people will be convinced on the basis of pure demagoguery that you are peddling a doctrine that has a logical implication of something other than what I explained above.

It is absolutely true that a Keynesian would be forced to conclude that should “output” and “employment” fall in the transition from slave worker society to a free society, that this constitutes grounds for the government to immediately reverse course and “employ” the workers once again, so that we never ever have to ever ever ever observe any hint of falling “output” and “employment”, as if these MEANS to people’s ends take precedence over their ENDS.

That’s another thing about your backwards and primitive worldview. Employment and output are, in economic science, means the attainment of human ends. Yet Keynesians want to put those means as above human ends. This is not surprising, since Keynesianism is just a manifestation of a long tide of irrationalism that denies individuals having goals. The only real goals to Keynesians are collective goals, meaning of course goals of states (whether that is intended or not).

Individuals in society are really nothing more than stewards and empty vassals from which the state is to achieve particular ends of its own, namely “output” and “employment”, so that it can, of course, increase its rate of parasitism. The more “output” occurs, the more the state can take. The more people who are employed, the more the state can tax.

There is zero consideration of individuals’ goals in Keynesianism.

I know that you have no response to any of this, because what I am saying is true and you can’t stand it.

Try to respond to what I actually argued, and you’ll look even more the fool, if that is even possible at this point.

“It is absolutely true that a Keynesian would be forced to conclude that should “output” and “employment” fall in the transition from slave worker society to a free society, that this constitutes grounds for the government to immediately reverse course and “employ” the workers once again,”

You mean re-enslave them again as slaves? Just because because unemployment rose?

This is biggest joke I ever read.

No, M_F.

Ever Keynesian would start from the basic moral idea: slavery is wrong.

A Keynesian policy in such a transitional state – if indeed it was suffering from recession with idle resources and idle capital goods – would be to boost AD through fiscal policy and to employ unemployed who wish to do so as free men on

public works programs.

If, for example, as in the case of US history, vicious racism stands in the way of former slaves getting a job, legislate and stop racist discrimination.

LK:

“You mean re-enslave them again as slaves?”

Yes. I mean Keynesian theory leads to the conclusion that the government made a policy error in freeing the slaves, because “employment” and “output” collapsed.

“Just because because unemployment rose?

This is biggest joke I ever read.”

I agree. Keynesian “theory” is the biggest joke I’ve ever read.

“No, M_F.”

Yes, LK.

“Ever Keynesian would start from the basic moral idea: slavery is wrong.”

False. Keynesian theory does not discriminate against slavery. Neither does Austrian theory to be honest, because Austrian theory is a theory of the categories of human action, not a prescriptive ethical doctrine.

Keynesianism however DOES contain a prescriptive component, namely, it requires the existence of government, and that necessarily presupposes that there ought to be a government.

With Austrianism by contrast, there is no “humans ought to act” or “humans ought not act”.

Every Keynesian would, in the presence of a reduction in government activity that was soon followed by an “employment” and “output” collapse, would necessarily conclude that the government made a policy error and should immediately reverse course.

“A Keynesian policy in such a transitional state – if indeed it was suffering from recession with idle resources and idle capital goods – would be to boost AD through fiscal policy and to employ unemployed who wish to do so as free men on

public works programs.”

Assuming the former slaves would agree to work for their former masters as “public employees”, it’s likely that every individual would have to work for the former slave masters to prevent an immediate “employment” and “output” collapse. If the state does not get everyone back, then the “proper” Keynesian response cannot be had. The only way that the “proper” Keynesian response, of increasing government activity to prevent any fall in “employment” or “output”, can be brought about, is through reversing the slave emancipation.

“If, for example, as in the case of US history, vicious racism stands in the way of former slaves getting a job, legislate and stop racist discrimination.”

Yes, minimum wage laws, which are based in large part on racism, stand in the way of blacks, especially teenage and low-skilled blacks, from competing for jobs.

And that’s just how the racist progressives want it. The outcast can then come hat in hand to the welfare offices, and the progressives can then experience their existing feeling of racial and ethnic superiority in real life.

The biggest supporters of minimum wage laws are (racist) unions, who hate having to compete with blacks for jobs.

Keynes was director of the British Eugenics Society so he very much had the conciet to think he could improve humans through incentives and coercion.

How does prove M_F’s mad idea that Keynesians think “the government should immediately round up every worker again and put them right back into the slave camps, so that “employment” and “output” never have to fall for any length of time ever again”?

That is what follows from Keynesian theory.

The government allegedly made a mistake by reducing its activity, because it “plunged the (worker slave camp) economy into a recession”, where recession is falling output and/or employment.

Further data on tax hikes in Ireland:

(1) “Ireland clearly stands out here as:

One of only three OECD countries (Italy and Mexico being in our company) that is raising taxes (and here we are facing tax increases that are 12 times more severe than Italy and over 4 times more severe than Mexico, before the April 7 Mini-Budget hammers us even more);

One of only two countries (Iceland being another country, but it is constrained by the IMF conditions) to raise individual taxes (our tax increases are twice those of Iceland). What is even more insulting is that our individual tax increases are by far the biggest source of fiscal burden of all other fiscal policies Messr Cowen and Lenihan are willing to adopt;

One of only 3 countries (the IMF-constrained Hungary, and Italy being the other two) that is raising consumption taxes, with increased consumption tax burden being 5 times greater in Ireland than in Italy;

A country with the heaviest burden of fiscal policies on households – with combined effect of individual, social security and consumption tax increases of +3.7% – 12 times the rate of tax burden increases in Italy and almost 4 times the rate of total household tax burden increases in Iceland and Hungary;”

OECD report blasts Irish policies, Tuesday, March 31, 2009

http://trueeconomics.blogspot.com.au/2009/03/oecd-report-blasts-irish-policies.html

Also note how tax increases were frontloaded into 2008 and 2009 budgets and public sector pay cuts were implemented.

(3) The austerity is still ongoing as of December 2012:

“Spending cuts and tax hikes worth €3.5bn will be announced today, which Government leaders insist will bring the country a step closer to economic independence and growth.

Finance Minister Michael Noonan and Public Expenditure Minister Brendan Howlin will announce €1.25bn in tax hikes and €2.25bn in spending cuts.”

http://www.irishexaminer.com/budget/breaking/country-braced-for-austerity-budget-576683.html

Taxing people more isn’t austerity for the government, which is the thing that needs to be more austere.

Spending less is austerity. Spend less than is taken in (without raising taxes), and the government will run a surplus.

The government’s purpose is to serve the constituents, not the other way around. When government becomes a burden to the constituents, the government needs to shrink.

“Spending less is austerity. Spend less than is taken in (without raising taxes), and the government will run a surplus>.”

So you think running a surplus during a recession – taking people’s income and not spending it, causing more demand contraction – will cause recovery?

That is fascinating. I suspect not even academic Austrians are silly enough to think this.

I’m sure that if you were charitable enough you could imagine that if it turns out there’s surplus revenue an Austrian would see the next step as reducing taxes even further. Although, Hayek did advocate at one point for the government to use surpluses during healthy periods to pay for social insurance programs that kick in during fluctuations. But, other Austrians don’t have the same “social justice” concerns.

Use the surplus to pay off the debt.

In a recession, people have a demand for savings. It’s individuals who are trying to recover – the governent is in the way.

Again, the point of government is to serve the interests of the constituents – and by “interests”, I mean the individuals’ desires, not what the government thinks is best.

The government is not a manager, but an arbiter between members of the private sector. The private sector is the creator and sustainer of government, not the other way around.

I’d say repudiate the debt instead of paying it off.

If we’re not going to make a seamless transition from fiat money back to commodity money, then sure – we actually deserve to have the world (and us) abandon our fiat money.

If the government stopped borrowing money on the backs of constituents, and if companies actually paid for imports with exports, then American buyers could regain the trust we’ve lost after defaulting.

You don’t think Austrians would favor a reduction of taxes and spending? I thought you claimed to read a lot of Austrian economics literature?

But that’s precisely NOT what happened in Ireland, based on the figures above. Government spending went up and revenue went down, yet LK and others still bark about “austerity”.

If you look above, he defines “austerity” in terms of any result, “that contracts demand”. By defining something in terms of a result, he can say, “Did demand contract? Ahh! Must have been austerity then.”

“If you look above, he defines “austerity” in terms of any result, “that contracts demand”.”

No ,Tel, that you can predict beforehand will contract demand.

Tell me, was any Keynesian predicting Ireland would see a robust and quick return to growth when the recession struck and the government implemented its fiscal policy? Well??

Do you know they did predict?

As for Keynesian predictions, of course I pretty much have to go on Krugman here and cite his comparison of three economies that he has revisited a number of times. Those being Spain, Ireland and Iceland. Here is the link to Krugman on Spain vs Ireland

http://krugman.blogs.nytimes.com/2010/08/26/ireland-and-spain-revisited/

In other places Kruman compares Ireland vs Iceland at length, you can find the links easily enough.

Well let’s just look at those numbers now shall we? I’m going by Trading Economics where you can get a graph of government 10Y bond rates for Ireland, Iceland and Spain. What you see is that both Ireland and Spain started out together around 4.5% and flat during 2008, 2009 as the rest of the Euro countries were doing.

Ireland showed linear rise up to crisis point at 12% mid 2011 but then it turned around and they are now back to 4%. OK, they took a beating but they turned it around and have indeed regained the confidence of the market. I personally don’t believe for a minute that they “embraced savage austerity” to do it, but anyhow we are already arguing over the definition of “austerity” so I’ll run with Krugman for the time being.

In comparison, Iceland started out much worse in 2008 with 10Y bond rate hitting 12% and they have also got that under control, levelling it out around 7% and looking reasonably steady. Not a great result, but not appallingly bad. At any rate, Ireland has come out of it better.

Spain has seen sporadic jumps with the general trend upwards and hitting 7% (but showing a brief recovery in recent months). Since the trend is upwards I would say they are not out of the worst of it yet and it will continue (especially considering their unemployment situation). Spain is worst IMHO.

So let’s move on to comparing unemployment between these countries.

Iceland is best. Their unemployment shot up early in the crisis but only hit 9% and since then has worked it’s way gently down to around 6% with a clear downward trend. They actually weren’t that badly hit unemployment wise.

Ireland’s unemployment also shot up early in the crisis to 14%, then pretty much levelled out, peaking at 15%, and has just started to get over the worst of it with a small downward trend during 2012.

Spain in comparison shows their unemployment trending upwards linearly, with no sign of recovery reaching a staggering 26% and no turnaround in sight! This is really bad. Very bad. Spain is clearly worse than Ireland here.

There’s a big proviso on unemployment, because it’s a skanky metric at the best of times and governments are prone to cheat where they can. Anyhow in terms of both trend and absolutes, the rank of best to worst is obviously Iceland, Ireland, Spain. So Spain loses again.

Now consider GDP comparison. I’m going to ignore 2008 and 2009 because those years were overheated and the GDP was high as a kite on debt. I think it’s perfectly reasonable for an Austrian economist to do that. What I’m doing here is using an average of 2004, 2005, 2006 as the baseline and then looking at percentage change to the three-year average of 2010, 2011, 2012.

Spain is best with a gain of 42.6% growth so their GDP never got badly hit by the crisis. That’s weird when you consider their rising unemployment… that’s another reason why I don’t think they have seen the worst of it yet.

Ireland is OK, with a gain of just 18.2% growth. Not spectacular but

Iceland is worst with a fall of 4.6%. They actually delivered lower GDP in the past three years than they did back around 2005. The reason is because Trading Economics works in US dollars and Iceland devalued… so its GDP devalued as well. That’s a real step backwards.

So out of Krugman’s two darlings, Iceland come in worst on one metric and Spain came in worst on the other two metrics. Regarding that country that Krugman thinks is crap (no not Estonia, the other one), Ireland didn’t come worst on any metrics, and actually came out best on the one metric that Krugman predicted the exact opposite — which is government bond rates and their implications for investor confidence.

Ha Ha, Major Freedom. Beat that dude!

(1) “Ireland’s unemployment also shot up early in the crisis to 14%, then pretty much levelled out, peaking at 15%, and has just started to get over the worst of it with a small downward trend during 2012.”

lol… Which vindicates Krugman.

As for GDP in Ireland, it has been a disaster:

http://www.tradingeconomics.com/ireland/gdp-growth

(2) and what Keynesian predicted anything but a severe recession for Ireland? Then sluggish and poor recovery? (which is what has happened).

Except that unemployment in Spain is worse, and by Krugman’s measure Spain should be better.

As I go through in some detail above, Iceland is worse, when you baseline it from the 2004, 2005, 2006 period and when you factor in their devaluation (which in effect also reduces GDP).

Iceland being the Krugman darling is worse than the so called “disaster” GDP of Ireland, so go figure.

“Except that unemployment in Spain is worse, and by Krugman’s measure Spain should be better.”

Wrong. You have selectively quoted Krugman.

Krugman has been warning of the folly of Spanish austerity (which began in earnest in 2010) in many posts:

“According to news reports, Rajoy has announced 65 billion euros of tax increases and spending cuts; this will clearly deepen Spain’s depression. So what purpose will this serve?”

http://krugman.blogs.nytimes.com/2012/07/11/pointless-pain-in-spain/

http://krugman.blogs.nytimes.com/2012/04/15/insane-in-spain/

http://krugman.blogs.nytimes.com/2012/03/07/finally-spain/

This is either ignorance or just downright dishonesty, Tel.

(1) And unemployment in Iceland is far better than Ireland.

(2) You have clearly missed Krugman’s point about Iceland:

“Iceland did not engage in fiscal stimulus; it didn’t have to, given the kick from a huge depreciation of the currency. It did, however, have a quite effective program of mortgage debt relief that is a role model for countries like the United States.”

http://krugman.blogs.nytimes.com/2012/07/08/the-times-does-iceland/

(3) as for the GDP numbers they are not great but better than Ireland’s.

Hang on a moment, I quoted Krugman from 2010, and you quote Krugman from 2012 (two years later). So what does Krugman say about Spanish austerity in 2012, I’ll quote from your reference:

See that bit about new austerity measures as spoken by Krugman in 2012. So clearly he does not agree with you that Spanish austerity started in 2010. You are rewriting history here.

Krugman also shows a graph of government debt as % of GDP and Span was bringing down their debt before 2008 but after that their debt has just gone up and up, there’s not the slightest sign of any attempt to keep the debt under control. In three years they have gone from 40% debt to GDP up to 70% debt to GDP and that’s absolutely not sustainable. There’s no hint of “austerity” in that chart.

Seriously, you seem to just invent “austerity” retrospectively to explain any crisis that comes along. Go and find a Krugman quote from 2010 when your supposed “austerity” started and tell me exactly which government policy can be blamed. Something that happened right then at the time.

http://rt.com/news/spain-union-protest-mass-228/

There’s the news story about people protesting against what they call “austerity” which is happening in 2012, not a late protest over 2010.

http://www.bbc.co.uk/news/business-19733995

There’s an article (also 2012) that actually gives a few points:

OK, so they intend to cut ministerial spending, but that’s hardly an across the board spending cut, it is microscopic.

Public sector workers won’t get a pay rise (just like most of the private sector workers also haven’t got a pay rise for years).

Some monitoring authority? Big deal, no doubt they all draw fat paychecks.

An increase in pensions? Hmmm “austerity” for sure, must be terrible to have your pension increased like that.

Some car scrappage scheme? Cash for clunkers? Cost even more money no doubt. That’s their “austerity” spending even more money. No wonder the unions are freaking out.

Just following up myself here and trying to put Estonia into the picture. Using the same formula for GDP, Estonia ends up with 69.5% growth (best of the lot).

There is no data for Estonian government bonds but their central government interest rate has been around 1% so looks like they must have minted some platinum coins or something. Their inflation rate is also on the high side, but so far looks to be under control. Bad, but no disaster.

Their unemployment ramped up to 20% at the worst of it (still not as bad as Spain) but they got that under control too, and as explained elsewhere, not because of some huge burst of emigration either.

Krugman seems to be getting his Estonian predictions wrong too. We will see how their inflation goes, possibly there’s some argument for a type of monetary stimulation happening in Estonia with mild inflation and low central bank interest rates. At any rate they are staying on top of it, and seems to be working for them.

On Estonia:

(1) If you had bothered to read your own Mises.org article:

“since Q2 2011 the government has reversed its stance and embarked on massive spending. “

Frank Shostak, “Why Estonia Is Beating the Eurozone,” Mises Daily, October 18, 2012.

http://mises.org/daily/6232/Why-Estonia-Is-Beating-the-Eurozone

So those high growth rates from Q2 2011 (in 8% range) were not caused by austerity.

(2) Unemployment in 2011 before the turn to different fiscal policy was at 13% and even the fall in 2010 (from 20%) had more to do with emigration than real output growth.

(3) real GDP is still well below its 2007-2008 level:

http://krugman.blogs.nytimes.com/2012/06/06/estonian-rhapsdoy/

(4) and your statement that “Krugman seems to be getting his Estonian predictions wrong too” is just bullocks.

(5) Keynesians predicted a terrible depression in Estonia: Estonia had a terrible depression, from which it has still not recovered properly.

“since Q2 2011 the government has reversed its stance and embarked on massive spending.”

After three years of government spending cutbacks. They did not attempt to prop-up malinvestments, they liquidated.

Thus the Estonian government are only spending what they can afford to spend, and their debt to GDP percentage is actually going down at a time when most countries are going up.

Their recent government spending has created inflation, but only about 4% which they seem to be keeping under control, and the government debt is tiny. So long as the GDP and productivity grow faster, they aren’t getting into trouble, because growth fixes it.

Countries like the USA simply cannot depend on growth to get them out of trouble, which is made worse because they stubbornly refuse to liquidate.

Here is Krugman on Estonia in June 2011 (written after the turnaround in fiscal policy that you describe):

http://krugman.blogs.nytimes.com/2011/06/05/no-bell-prize/

It isn’t exactly a prediction, but “they have made a desert” clearly implies that he expects nothing will grow there. He got that one wrong, Estonia’s GDP is almost back to where it was at peak, and they have achieved good growth with falling unemployment.

Krugman was trying to convince his audience that the determination to stay with the euro was a waste of time, but actually it did them a lot of good.

If Krugman advocated walking on two legs, I’d buy a pogo stick the same afternoon.

Starting from a point where govt borrowing is used to fund some employment then if this funding is removed employment will be reduced as a direct result. Even at full employment there would be a lag between the end of these govt funded programs and the redeployment of these resources elsewhere – so it is not surprising that the data (taken during a recession) proves Krugman’s point that “Contractionary policy has proved contractionary.”

Krugman thinks that deficit spending can be used to achieve full employment The govt can just borrow (or print) sufficient money to fund projects that will directly or indirectly lead to the hiring of all unemployed workers. He feels so strongly that this is self-evidently the correct policy that he thinks that anyone who disagrees is a knave or a fool.

I think Krugman is right – such a policy would “work” – but in my opinion that is the beginning not the end of the argument.

When Rubio says:

“Every dollar our government borrows is money that isn’t being invested to create jobs. And the uncertainty created by the debt is one reason why many businesses aren’t hiring.”

He identifies two good reasons why deficit funded employment may be bad for the private sector.

1. The more the govt spends on resources the more they will crowd out the private sectors ability to employ them. This would be true if the govt projects only hired unemployed resources, doubly true if (as would be inevitable) the govt projects bid away currently employed resources.

2. The more that the private sector thinks that they will have to compete with the govt for resources in the future the worse their expectations will be about future profit-levels and the lower their levels of hiring will be.

In a recession that is marked by a reduced demand for labor then a market-based solution would require lower real wages to increase employment levels (until demand returns to normal levels). If the govt steps in and uses fiscal policy to increase employment levels this will both increase the wage level when what is needed is a wage fall , and decrease optimism about profit levels among businesses and further decrease demand for labor. Both will further reduce private employment levels and require yet more fiscal policy to maintain employment at the desired levels.

So if you want full employment and don’t care about the implications of a enlarged and long-term government sector then support Krugman. If you think the market can find a better solution then think again.

In terms of “Contractionary policy has proved contractionary,” it would be easy enough for the US government to think up some nominal export service to offer the Japanese government, and then the Japanese government could export some different service back to the US (for the same price).

In the GDP formula, the government spending would go up by the price of this service, and also government revenue would go up by the same amount (thus no effect on the deficit). Also, the “X” and “M” would both go up by the same amount. This means that GDP as a whole also goes up by this amount, so higher GDP for both countries can easily be achieved.

With higher GDP, the policy is no longer “contractionary”. job’s done!

Market Monetarist hold the view that if the CB responds to a reduction in the deficit by increasing the money supply until the point where GDP is stabilized then the contractionary effects of contractionary fiscal policy would be minimized.

II tried to reproduce the graph using the IMF data set which is freely available, the World Economic Outlook.

1) data for 2012 is almost entirely estimates, mostly is too for 2011

2) I can roughly reproduce K-man’s graph, which makes me think I’m using the same methodology as him. Though Greece is even more of an outlier.

3) If I strip Greece and Ireland out of the dataset, the regression line has R^2 of 0.05

4) The significant movement in potential output between 2008 and 2012 for some of the outliers makes a mockery of the idea of using “deficit/potential GDP” an indication of “austerity”. Greece is 9% above potential output in 2008, 6% below in 2012.

Humongous deficits that are somewhat less that previous humongous deficits accompanied by tax increases amount to horrible policy. The use of the word “austerity” (which is derived from “austere”) to describe such a policy is typical Keynesian dishonesty.

aus·tere

/ôˈsti(ə)r/

Adjective

Severe or strict in manner, attitude, or appearance: “an austere man with a puritanical outlook”.

(of living conditions or a way of life) Having no comforts or luxuries; harsh or ascetic.

Synonyms: severe – stern – strict – rigorous – stringent – rigid

I love it when you play around with definitions and try to undermine and straw man the hell out of the arguments of your opponents.

I love it that we’re at humungous levels of government activity and there is still talk of austerity.

It’s a bit like a man in bed with 3 hookers and asking them to dress like Doris Day isn’t it?

So reducing a deficit from one trillion to 500 billion by a combination of spending cuts and tax hikes is not austerity?

Don’t think so. The deficit in 2008 was 1.4 trillion dollars. If the govt cut spending by 1 trillion, slashed spending by 30%, that would certainly be austerity. The deficit would still be 400 billion.

But there would still be a deficit, so there’s be zero austerity.

It’s similar to how Ron Paul nails the Republicans for wanting to cut merely proposed increases in spending, and then calling those actual cuts; They’re not.

So if I’m drunk, but was considering getting messed up even worse, then actually that’s austerity too.

Hmmm….

Rubio said that cutting govt spending will kill jobs and innovation. So Rubio disagrees with Rubio.

“Thousands of jobs in defense-related enterprises have been lost already, with many more projected to go if the sequester crisis is not averted. These defense cuts hurt innovation, medical research and thousands of small businesses who subcontract for defense-related work.”

Rubio’s a Keynesian, too. It’s a one party system.

We need to get out of the habit of calling government positions “jobs”. These positions are not intended to increase wealth (if we’re following the Constitution, that is; and if not, then they shouldn’t exist), but to protect individual rights as individuals in the private sector increase wealth for themselves..

I recently blogged about Krugman’s argument that Ireland shows that “austerity” is bad for the economy:

http://www.jeremyrhammond.com/2013/02/14/on-krugman-kicking-the-can-down-the-road-and-irelands-austerity/

No, the level of Irish government debt is not proof of stimulus in Ireland. This is naivete.

As for the deficits they were mostly the result of tax revenue collapse and the bank bailouts, not a stimulative spending program to create more private investment/consumption.

As noted above the steep tax hikes also imposed severe fiscal contraction. I have not seen good data on what Irish local government did to contribute to the austerity either.

“No, the level of Irish government debt is not proof of stimulus in Ireland. This is naivete.”

It’s a very close proxy, since debts grow when deficits grow.

“As for the deficits they were mostly the result of tax revenue collapse and the bank bailouts, not a stimulative spending program to create more private investment/consumption.”

How is government spending, which redirects real resources and labor away from where the sovereign consumer wants them, and towards where the government wants them, helpful to private investment?

If you printed money and redirected the allocations of private resources towards where your non-private activity influenced them, then it won’t do private investment any good, even if private investors have more pieces of paper. You can’t produce consumer goods with green pieces of paper. You need machines and other real resources, but with government “stimulus”, those machines and other real resources are misallocated, meaning they are allocated NOT in accordance with sovereign consumer desires. That just makes private investment less directed towards sovereign consumers, meaning it DECREASES private investment and consumption, even if the dollar amounts exchanged increase.

Where did I write that the level of Irish government debt is proof of “stimulus” in Ireland? This is a strawman argument.

As for the case of Greece…

http://www.jeremyrhammond.com/2012/10/29/new-york-times-calls-for-austerity-in-the-u-s/

Every Keynesian should take time off their normal activities of ignorance and try understanding the Austrian business cycle. Most of these “intellectuals” in economics haven’t even heard of Austrian economics and disclude it as something hysterical. In my opinion (I may be wrong) austerity has seemed to “fail” in certain countries like Greece and succeeded in countries like estonia because for one, Greece had a much higher debt to pay off in percent of GDP while estonia’s debt was relatively low in percent of GDP. We see a contraction of the Estonian economy when government never imposed the Keynesian depression remedies after the economy had a bust but after going through the short term pain, they prosper in the long run. Compared to Greece, he debt was substantially greater so its obvious that they would need to cut back more on spending creating that “contraction”, while they need to suffer a longer short term period of contraction it is solely due to the irresponsible government that had created an economy built on sand. Also many people would say “estonia has a population of 100, that doesn’t count for austerity”. Well why wouldn’t it count? Just because their short term pain is substantially lower than that of if the U.S went into major spending cuts doesn’t mean it’s not a valid example of austerity working.

Do you have good data for Estonia? The last article I read on Mises.com that was pro-Estonian policy post-2008 had unemployment figures that were much lower than the official Eurostat ones I could find. The Mises article was uncited and didn’t link to any decent data.

No, Estonian unemployment was in the double digits at 11% even in late 2011.

Unemployment fell significantly fell from 2010 to early 2011 because of mass emigration, not to strong domestic employment growth:

“… all three [sc. Baltic states] have seen mass emigration over the last four years, particularly amongst the young. All three have the highest emigration rates in the EU, with 24 people out of every 1,000 leaving Lithuania in the last year. This, in turn, has restrained domestic unemployment; and while people should be free to go and find work where they can, their exit hardly counts as a ringing endorsement for the government.”

James Meadway, “The Myth of Successful Baltic Austerity,” New Economics Foundation, 18 July 2012.

http://socialdemocracy21stcentury.blogspot.com/2012/10/the-success-of-austerity-in-estonia.html

Furthermore, according to Shostak:

“since Q2 2011 the government has reversed its stance and embarked on massive spending. “

Frank Shostak, “Why Estonia Is Beating the Eurozone,” Mises Daily, October 18, 2012.

http://mises.org/daily/6232/Why-Estonia-Is-Beating-the-Eurozone

So what happened after Q2 2011 is not related to austerity.

What a load of cobblers.

Take a look at the graph of the population of Estonia. The “mass emigration” started twenty years ago when the Iron Curtain came down, and it has largely stabilized in recent years. The emigration had no significant effect in 2010, 2011.

http://en.wikipedia.org/wiki/File:Population_of_Estonia_(1970-2010).png

If you don’t like the Wikipedia data then you can use Index Mundi (which uses CIA data) and has more recent years. Here is the population growth rate data (as percentage):

2000 -0.59

2001 -0.55

2002 -0.52

2003 -0.49

2004 -0.66

2005 -0.65

2006 -0.64

2007 -0.64

2008 -0.63

2009 -0.63

2010 -0.64

2011 -0.64

2012 -0.65

There’s really no stand-out year in that lot, the whole myth of this “mass emigration” from Estonia due to “austerity” is just to scam people who can’t be bothered researching the data.

(1) no one denies that emigration begun in the early 1990s with the imposition of neoliberalism on Estonia!

(2) it is not population growth per se, but net migration rate that matters here:

http://www.indexmundi.com/g/g.aspx?c=en&v=27

And, yes, the trend began in 2004 but continued and increased from 2008. That does not contradict what I said.

(3) These rates were amongst the highest in the EU. Even today the migration rate is amongst the highest in the EU:

http://www.indexmundi.com/map/?v=27&r=eu&l=en

(4) A lot of unemployed people left – which means that falls in unemployment are also a strong product of migration.

(5) Apart from which, even with the migration and some weak recovery, unemployment is still very high:

http://www.tradingeconomics.com/estonia/unemployment-rate

What is your point here LK, Shostak goes to explain that the central bank is embarking in monetary stimulus by increasing the money supply and has been doing so since late 2011. These sorts of practices can either create a fall in uemployment by creating a new bubble, or would result in prepetuatiing unemployment by not allowing the liquidation of bad debt or a recalculation of the economy. You’re missing some key points here in Austrian analysis buddy.

Most importantly, you keep using that reduction of unemployment card that suggests emigration is reducing the rate. Then you are basically allowing Austrians the right to use that fact that child labor laws distorted the unemployment rates during the Great Depression. See here: http://mises.org/daily/2858

It totally contradicts what you said, because Estonian unemployment only started rising in late 2008, peaking in mid 2011 and then falling after that. No correlation whatsoever with the nett migration rate you just cited.

“It totally contradicts what you said, because Estonian unemployment only started rising in late 2008, “

No, it does not. The robust employment growth before the recession kept unemployment low, and, yes, emigration contributed to keeping those stats low.

But once the recession struck emigration (and not primarily real output growth) was a major cause of falling unemployment stats.