Thoughts on the New Budget Deal

==> Scott Sumner and Steve Landsburg are none too happy.

==> David R. Henderson takes a different perspective.

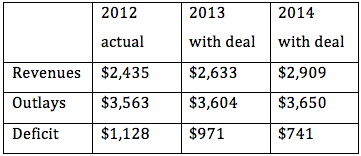

==> I come down on the side of the whiners in this IER post, though I understand what David is saying. (I think we’re mostly just disagreeing about what the relevant baseline should be. Compared to 2012, this deal is bad, and compared to the possibilities of genuine reform, it’s awful. But David is comparing it to the “fiscal cliff” scenario.) Here’s the money table I calculated, because the CBO did everything relative to the fiscal cliff baseline, which turned it all into huge tax cuts. No, compared to 2012, there are tax hikes. To wit:

Those figures are in billions. So, according to the CBO’s own projections, I commented in the following way:

[R]elative to Fiscal Year 2012 (which ended last September), in Fiscal Year 2013 the budget deficit will fall by $157 billion. This will be achieved through (a) a spending increase of $41 billion, and (b) a revenue increase of $198 billion. Some of the projected revenue increases are due to assumptions of economic growth, rather than tax rate hikes per se, but even so, the fact remains that under the new budget deal, the government is still going to fleece the taxpayers of even more money, while ramping up its spending. To top it all off, the projected deficit will still be just about a trillion dollars.

And think back, everybody, to when those fiscally conservative Republicans OH SO RELUCTANTLY gave in on the debt ceiling hike, back in 2011. Remember all that drama, everyone? When the credit rating got reduced? Here’s Boehner back then:

“An increase in the debt limit without major spending cuts will hurt our economy and destroy jobs,” Boehner said in a statement. “A credible agreement means the spending cuts must exceed the debt-limit increase.”

As I pointed out at the time, the Republicans clamoring for a constitutional amendment requiring a balanced budget, etc. are just putting on a show. All they had to do was not raise the debt ceiling and we would have automatically had a balanced budget requirement.

Instead, they went along with raising the ceiling, but put in place a committee–why, a super committee–to give all sorts of expert recommendations, and if those wily Democrats didn’t listen, why, there would be massive, draconian, across-the-board spending cuts…

…which they just avoided, by simply voting not to implement them. (And remember, the cuts would have meant a $9 billion reduction in federal spending in 2013.)

“All government, in its essence, is a conspiracy against the superior man: its one permanent object is to oppress him and cripple him. If it be aristocratic in organization, then it seeks to protect the man who is superior only in law against the man who is superior in fact; if it be democratic, then it seeks to protect the man who is inferior in every way against both. One of its primary functions is to regiment men by force, to make them as much alike as possible and as dependent upon one another as possible, to search out and combat originality among them. All it can see in an original idea is potential change, and hence an invasion of its prerogatives. The most dangerous man to any government is the man who is able to think things out for himself, without regard to the prevailing superstitions and taboos. Almost inevitably he comes to the conclusion that the government he lives under is dishonest, insane and intolerable, and so, if he is romantic, he tries to change it. And even if he is not romantic personally he is very apt to spread discontent among those who are.”

HL Mencken

Candidate for my epitaph:

The most dangerous man to any government is the man who is able to think things out for himself…

Danger is my middle name.

Nice.

Ah, but the show *must* go on!

I approve of the deficit coming down. What we discovered in Australia is that hearty predictions of rising revenue often don’t turn out as good as hoped.

Also, doesn’t fix the Social Security and pensions problem, but step in the right direction.

How does this change our outlook for inflation? Still gonna happen right?

Yep, it’s still happening but you have to know how to measure it to see the full effect.

The big picture is that the productive will continue to get squeezed until they’re damn near non-existent, here and in Australia. 🙁