Can Fiscal Austerity Work With Tight Money?

[Disclaimer: Bob Wenzel doesn’t like me using the term “fiscal austerity,” since he thinks the public associates it with jacking up taxes and cutting social programs in order to bail out bankers. He has a point, but it will just get too cumbersome in this post if I try to come up with some alternate term. So, when I speak approvingly of “fiscal austerity,” all I mean is the government cutting its spending in order to reduce deficits. Also, I would like to thank the supportive von Pepe for encouraging me to write up this post.]

In my latest EconLib article, I show that the peer-reviewed economic literature is far friendlier towards “expansionary austerity”–the idea that reining in budget deficits through spending cuts can actually boost economic growth, even in the short term–than prominent Keynesians would lead you to believe. (David R. Henderson thinks it’s “one of [my] most important” EconLib articles yet, and recent events have proven that David’s model of the world is spot-on.)

Lars Christensen at the Market Monetarist blog generally likes my article, except he thinks I am ignoring the crucial role that monetary policy plays in all of this:

The Danish and Irish cases are hence often highlighted when the case is made that fiscal policy can be tightened without leading to a recession. I fully share this view. However, where a lot of the literature on expansionary fiscal contractions – including Bob’s mini survey of the literature – fails is that the role of monetary policy is not discussed. In fact I would argue that Denmark was a case of an expansionary monetary contraction – a the introduction of new strict pegged exchange rate regime strongly reduced inflation expectations (I might return to that issue in a later post…).

In all the cases I know of where there has been expansionary fiscal contractions monetary policy has been kept accommodative in the [sense] that nominal GDP – which of course is determined by the central bank – is kept “on track”. This was also the case in the Danish and Irish cases where NGDP grew strong through the fiscal consolidation period.

My view is therefore that that fiscal austerity certainly will not have to lead to a recession IF monetary policy ensures a stable growth rate of nominal GDP. This in my view mean that we will have to be a lot more skeptical about austerity for example in Spain or Greece being successful….

All the cases of expansionary fiscal consolidations I have studied has been accompanied by a period of fairly high and stable NGDP growth and the unsuccessful periods have been accompanied by monetary contractions. My challenge to Bob would therefore be that he should find just one case of a expansionary fiscal contraction where NGDP growth was weak… [Bold added.]

Now right off the bat, look at how loaded the deck is, in favor of the market monetarists. Of course, if they’re right then it doesn’t matter that the deck is loaded; they should still win the argument. But if they’re wrong–which I think they are–it makes it hard for me to prove it.

THEORY

What do I mean? Well, suppose a new president (perhaps a fan of this blog) takes office in a small country and (a) cuts government spending by 30% in one year and income taxes by 15%, in absolute terms, and (b) abolishes the central bank and ties its currency to gold. A large budget deficit is transformed in one year into a modest surplus. Further suppose that my wacky Austrian views happen to be right–and Lars/Scott Sumner are utterly wrong. What happens?

Well, because I’m right (by stipulation), the real economy is just fine. There might be an initial period where the official unemployment rate in the country shoots through the roof, because workers have to move out of government (or government-subsidized) sectors, and into purely private sectors. But the big tax cuts and stability provided by the new gold standard, as well as the drop in government borrowing, lead to a fall in interest rates and a surge in private investment and job creation. Within 6 months, the unemployment rate is below the level at the start of the policy change. For the year, real GDP is up 8% when all is said and done, while consumer prices fall 2%.

Now I would look at this as a stunning refutation of Lars’ views, and a great counterexample. But he would look at the figures and say, “What do you mean Bob? Clearly maintaining aggregate expenditures was crucial for that giant reduction in government spending to work out. Nominal GDP rose 6% during the year, and interest rates fell. It was only the relatively loose monetary policy that offset the fiscal contraction.”

Does everybody see what I’m saying? Lars has defined “accommodative monetary policy” in such a way that I would have to find a government that simultaneously slashed spending while deliberately engineered massive price deflation. If the market monetarists are wrong, then it means a government could enact very tight restrictions on monetary inflation–perhaps going back on gold–and yet their own metric would classify that as “not tight” so long as the economy didn’t collapse. That is not a good way to think about these issues, especially since the very issue under dispute is whether the market monetarists are right.

Furthermore, it’s not even an absolute value of NGDP growth that’s at issue. If I understand Sumner’s worldview, the reason “NGDP matters” is that workers and firms sign contracts that have nominal values. So, suppose I find an example from 1880-82 where a European government slashes spending by 30%, and the economy doesn’t falter. Furthermore, NGDP is flat throughout the period. Did I just win? No, because Sumner can say, “Hang on, this country was on the gold standard. For the prior decade, prices had generally fallen about 2% per year, and real growth was 3% per year, so NGDP growth was only 1% per year. Thus, NGDP being flat from 1880-82 was only 1 point below trend per year. Compared to the fiat money era, flat NGDP would indeed be scandalous, but back then it wasn’t that far below the norm, and so people’s nominal debt burdens wouldn’t have been much harder to service.” (I’m making up the numbers for this hypothetical 1880-82 scenario, but I’m just showing how incredibly difficult it would be to actually find a counterexample to the Sumnerian explanations.)

Finally, as an Austrian economist who endorses Misesian business cycle theory, I admit upfront that it’s going to be hard to find a deliberately contractionary fiscal and monetary policy, leading to economic expansion even in the short term. That’s because I explain recessions as due to a switch from loose to tight money, where I define those terms differently from how a market monetarist would.

HISTORY

I’m not going to give a perfect counterexample–since, as I explained above, that would almost be impossible in principle, even if the market monetarists are totally wrong–but World War II offers something pretty close. Let’s work through two graphs and see why.

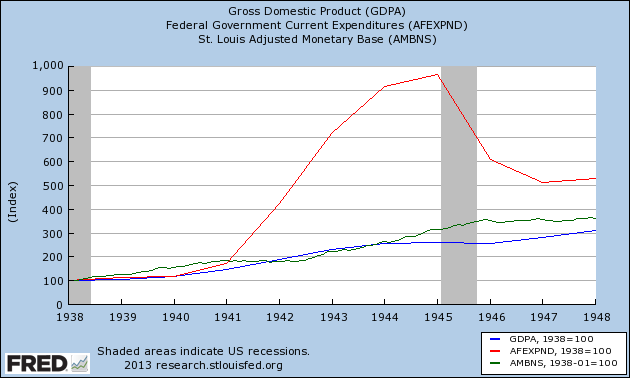

This first graph shows the level of NGDP, current government expenditures (note that this isn’t the same thing as “how much money did the government spend those years?” but it’s close enough), and the monetary base. Notice that I put the monetary base on the right axis, so you could see it better.

In the next graph, I’ll show the same three variables, but this time as an index=100 at 1938 (and now of course they’re all on the same axis):

Now this is really the killer chart. From 1945-46, clearly there was a more severe contraction in fiscal policy, than a corresponding looseness in monetary policy, if we are going to use those terms in a way that is useful in refereeing the claims of the market monetarists. Furthermore, coming off of five years of rapid NGDP growth, now it is flat.

Of course, the obvious MM response is to say, “Right! And notice there was a recession right then, just like we’d predict.”

But the free market camp can’t have it both ways. We’ve been congratulating ourselves for years now on how the Keynesians were wrong for predicting a postwar depression. (Look what our gloating did to poor Daniel Kuehn.)

Now if we move on to the next year, 1946-47, it’s very interesting. Just eyeballing the chart it looks like government current expenditures (again, this term doesn’t mean what you probably think–I ran into this issue on a major paper last year) fell about 15 percent, the monetary base was about flat, and yet nominal GDP growth was quite strong (in percentage terms). So I’m guessing Lars would say, “Right, accommodating monetary policy!” even though the monetary base growth came to a screeching halt after half a decade of rapid growth.

I don’t have good NGDP figures, but I imagine you would find the same pattern–perhaps even more so–if you looked at the end of World War I, where the Fed engaged in unprecedentedly tight monetary policy, and the government slashed spending tremendously. (I give the stats here.) Yes, there was a sharp depression, but it was soon over and paved the way for the Roaring Twenties.

CONCLUSION

I admit I have not found the smoking gun Lars wanted, but I hope I’ve shown why that is almost impossible, even in principle, given that I believe in Austrian business cycle theory. In any event, market monetarists shouldn’t ever roll their eyes at Keynesians who refuse to see the difficulties that particular historical eras provide for their theories. This is because from my perspective, both camps have a tough time explaining why the US bounced back so quickly after 1920-21 and 1945-46, if their explanation of 1929-1939 is correct.

” Just eyeballing the chart it looks like government current expenditures (again, this term doesn’t mean what you probably think–I ran into this issue on a major paper last year) fell about 15 percent, the monetary base was about flat, and yet nominal GDP growth was quite strong (in percentage terms).”

I think MMist would respond to this by saying something like “Demand for money fell during that period for reasons related to the end of the war so this allowed NGDP to grow at a reasonable pace with no need for any expansionary monetary policy”, They would also believe that the 1945 depression could have been avoided by more monetary expansion.

There is a graph at Sydenham’s Law of public expenditure and GDP growth that shows clearly how the post war depression was a public sector depression and private sector boom.

The key to managing public spending is to neither continuously increase the rate of spending nor continuously decrease it. If the rate is kept constant at, say 1 or 2% growth per annum all will be well…

The period 1945-1948 has virtually no lessons for today.

It was an extraordinary period. During the war demand was depressed via rationing and high savings rates. Demand in terms of consumption and investment was then strong after the war.

The fall in government spending is merely the end of war production, and always had to happen as a precondition for transition to a peacetime economy.

Yes, there was a sharp depression, but it was soon over and paved the way for the Roaring Twenties.

The recession of 1920-1921 was not short. It was of average length at that time, and long by contrast with the average length of recessions pos-1945.

LK fair enough about the length of it. I guess what I have in mind is that the reasons Keynesians and monetarists give for the awfulness of 1929-1933, were worse for 1920-21, and yet it was over after 18 months. So since on paper it arguably should have been worse than the Great Depression, it was “soon over.”

Now I know you disagree with that analysis, I’m just explaining what the “soon” is in reference to. But yeah, I should try to be clearer in the future since it wasn’t short.

“Demand in terms of consumption and investment was then strong after the war.”

What boosted the post war economy was not “demand” for both capital and consumer goods, as if they are interchangeable, as if both are equally contributing factors to economic growth. It was “demand” for capital goods and labor specifically, relative to demand for consumer goods, that did it. Saving/investment is the only way to grow economies. Increased consumption without corresponding investment may be associated with increased employment and temporarily increased output, but this would be fleeting and impoverishing, since it would contain capital consumption, and capital consumption decreases productivity of labor and decreases prosperity.

Whether one calls 18 months “short” or “long” is obviously a function of the agenda one wants to advance by whoring that experience out.

Monetary savings are not required for production if real goods and resources are available.

If you’re saying that real resources and investment are required to grow real output, and that the postwar-boom was driven by private investment, that does not in any way conflict with Keynesianism.

Monetary savings are not required for production if real goods and resources are available.

Who said anything about cash hoarding? I said saving/investment.

To address that point though, monetary savings are not required to be reduced or eliminated for production. A higher cash preference can come out of reduced consumption and/or reduced investment. As long as the relative ratio remains the same, the relative demand for capital goods as compared to consumer goods will remain, and result in enough resources going to capital that can replace the worn out and used up capital that goes into consumption.

Keynesianism ignores relative spending and prices, and focuses on aggregates. Thus it cannot see a declining economy when more consumer goods are produced and fewer capital goods are produced. It’s all “output”.

If you’re saying that real resources and investment are required to grow real output, and that the postwar-boom was driven by private investment, that does not in any way conflict with Keynesianism.

I am saying that in a division of labor, monetary economy, abstaining from consumption spending and making productive expenditures is the only way to ensure that enough real resources go to capital, so that the resources used up in consumption are able to be replaced and more than replaced by new capital, so that the economy grows.

BTW, what you said does conflict with Keynesianism, if you understand Keynesianism beyond the superficial vulgar version of it, and go the academic, textbook version of it.

Textbook Keynesianism has the general thought process as follows:

In a free market without government deficits and fiat inflation, continuous capital accumulation will allegedly continuously decrease the average rate or rates of return (marginal efficiency of capital) in the economy.

At some point, the average rate of return will decrease to such a low level that investors will begin to hoard and not invest the money that is made available by existing abstentions from 100% consumption out of the increased nominal incomes generated out of increased real output (Yes, Keynes conflated real and nominal incomes).

As a result, savings will allegedly outrun profitable investment, and there will allegedly be a permanent “savings leakage”, i.e. cash hoarding, that will allegedly permanently mire the economy in a depression, with no further economic growth, if not an outright decline.

The ONLY way out of this inevitability, according to Keynes, is for the government to bring about an increase in government spending, so that the marginal efficiency of capital will rise and thus eliminate the cash hoarding and coax investors into investing more, to match the too high savings. This rise in spending, which is supposedly the ultimate foundation for economic growth, is not a rise in private investment. It is a rise in “spending”. War would do it. Pyramid building would do it. ANY spending brought about by government would do it.

Hence, textbook Keynesianism does not hold that saving/investment is the source of economic growth. It holds that saving/investment will eventually, given enough time of allegedly declining returns through continuous capital accumulation, destroy economies.

The only implication from the claim that saving/investment will eventually destroy economies, is that the other form of spending, i.e. not investment, i.e. consumption, ultimately grows economies.

Furthermore, textbook Keynesian theory has no other alternative than to believe that a rise in consumption never shrinks economies, no matter how large the increase, even if it comes at the expense of capital and productivity of labor. Keynes even ignorantly believed that a marginal propensity to consume of unity, or 1, i.e. consuming 100% out of incomes, can ensure full employment and full output…even though such a thing would entail zero nominal demand for capital goods and zero nominal demand for labor!

Investment arises spontaneously out of thin air in textbook Keynesianism. If there is consumer demand, than investment demand is automatic as a deux ex machina, even if consumer demand competes with capital goods demand and actually shrinks it! Apparently it doesn’t matter, because investment spending will always be there to grow economies when there is lots of consumption, even with potentially less capital.

(1) the waffling at the beginning appears to concede that point.

(2) the marginal efficiency of capital (MEC) is not even necessary for a Keynesian theory of a modern economy. Some Keynesians dispense with it.

(3) “Hence, textbook Keynesianism does not hold that saving/investment is the source of economic growth…..

Investment arises spontaneously out of thin air in textbook Keynesianism”

Yes, more absolute proof that you’re the most ignorant of all commentators here.

(1) Thanks for conceding my point.

(2) Since you are having trouble reading, I will repeat: I am explaining the academic, textbook version of Keynesianism, not the superficial vulgar versions. The MEC is central in the GT.

(3) Thanks for conceding my point. Your churlish insults fail to mask your profound ignorance.

Re (3):

The passage beginning with “Only if the marginal propensity to consume is equal to unity”, as found in the GT, has the necessary, logical implication that investment comes out of nowhere.

Just think about it instead of trying to defend it against criticisms. If everyone consumed 100% out of their incomes, then there would be zero demand for capital goods and labor, and yet Keynes proceeds as if employment and output can be maintained, even increased.

You have no knowledge about the very crackpot theory you have brainwashed your own mind with. How surprising.

You’re all data and zero understanding.

“The passage beginning with “Only if the marginal propensity to consume is equal to unity”, as found in the GT,”

There is no passage in the General Theory beginning with “Only if the marginal propensity to consume is equal to unity…”.

Congratulations on demonstrating again your ignorance.

In fact, the only sign of “Only if the marginal propensity to consume is equal to unity…” as a quotation anywhere, either via a web search or in Google books is in a quotation here by you in your guise of “Captain_ Freedom”:

http://consultingbyrpm.com/blog/2011/04/landsburg-1-krugman-0.html#comment-14671

It looks like just inventing quotes from the General Theory is now another of your ridiculous tactics.

Oh, I see I made mistake above. You did not invent the quote.

It is an inaccurate garbling of this:

“Perhaps it will help to rebut the crude conclusion that a reduction in money-wages will increase employment “because it reduces the cost of production”, if we follow up the course of events on the hypothesis most favourable to this view, namely that at the outset entrepreneurs expect the reduction in money-wages to have this effect. It is indeed not unlikely that the individual entrepreneur, seeing his own costs reduced, will overlook at the outset the repercussions on the demand for his product and will act on the assumption that he will be able to sell at a profit a larger output than before. If, then, entrepreneurs generally act on this expectation, will they in fact succeed in increasing their profits? Only if the community’s marginal propensity to consume is equal to unity, so that there is no gap between the increment of income and the increment of consumption; or if there is an increase in investment, corresponding to the gap between the increment of income and the increment of consumption, which will only occur if the schedule of marginal efficiencies of capital has increased relatively to the rate of interest. “

—-

Since that quote is talking about propensity to consume an “increment of income” (or additional income) it does NOT show Keynes saying that

” If everyone consumed 100% out of their incomes, then there would be zero demand for capital goods and labor.”

Nor does it imply or require the “logical implication that investment comes out of nowhere. ”

Quite clearly, you have no idea what you’re talking about.

LOL, look at all this waffling.

“There is no such passage! Haha! You can’t read!”

“Oh wait, there is such a passage.”

“But you’re still wrong!”

…………

LK, you’re just not able to think. You read the words only at the most superficial of levels.

I skipped the steps in between “marginal” and totality. Just keep increasing this “margin” until it encompasses the whole. Is this really so difficult for you?

The claim is that IF money wages fall, then full employment and output can be allegedly had if the MPC is unity.

In other words, imagine wages to be falling, which lowers costs of production.

The passage is saying that if THE COMMUNITY’S marginal propensity to consume is equal to unity (meaning the entire increasing difference of the wage income drop is “offset” by more consumption spending), then full employment and output can be had.

But this is wrong. If wages keep falling, tending towards zero (part of my stipulation of increased consumption), and assuming wage earners saved and invested a positive amount out of their wages prior, it follows that if consumption spending rises to offset the entire fall (which included positive investment), then even if consumption spending replaces wages, and even if consumption spending replaces capital goods spending, there is supposedly no drop in employment and output.

The flaw is easy to see.

MF, if we count the days of your life backward eventually you no longer exist and if we count them forward you’re dead.

When people talk about the paradox of savings they don’t say “what if people saved all of their income,” they talk about what happens when everyone saves more of their income at the same time.

They take it or granted that *in the long run* people will start spending again.

And yet you’re like a dog with a bone proposing an equally absurd collapse of all economic activity.

You’re just like the people who say Keynesians only want to increase spending and never decrease it because they don’t understand debt could be rising as debt/gdp is falling.

So you for some reason don’t understand that when the “increment of consumption” rises that it could induce more investment. (Or in the full-employment equilibrium scenario you describe maintain full-employment.)

That seems to be the confusion. I think Keynes is just describing a full-employment equilibrium and using the MEC to show how we might fall out of it. (Similar to how Hayek in “the paradox of savings” was trying to show how we might maintain one.)

And yet you’ve taken an absurdly literal reading of the passage to troll LK with.

xgsmmy:

“MF, if we count the days of your life backward eventually you no longer exist and if we count them forward you’re dead.”

Cool story.

Now talk about during people’s LIVES, you know, where economic science is applied. Economics is not a science about dead people.

“When people talk about the paradox of savings they don’t say “what if people saved all of their income,” they talk about what happens when everyone saves more of their income at the same time.”

Another cool story.

Now learn that the paradox of saving is a farce. If everyone tried to save more, then there is no reason why there would be problems, because everyone can save and invest more, which will not reduce profitability.

“They take it or granted that *in the long run* people will start spending again.”

They never stopped.

“And yet you’re like a dog with a bone proposing an equally absurd collapse of all economic activity.”

It’s called analyzing the logical implications of concepts.

The collapse of economic activity FOLLOWS from certain Keynesian assumptions.

“You’re just like the people who say Keynesians only want to increase spending and never decrease it because they don’t understand debt could be rising as debt/gdp is falling.”

You’re like the people who say others are like the people who say something you don’t agree with.

“So you for some reason don’t understand that when the “increment of consumption” rises that it could induce more investment.”

That investment “inducement” is precisely the “out of thin air” assumptions Keynesian make. You don’t understand that in the aggregate, consumption spending and capital goods spending are in competition with each other. In this context, you cannot say that a 10% rise in one part can make the other rise by 10%, for then you would be going over 100%.

You don’t understand that you can’t just assume that more consumption always induces more investment, because you can only do one thing with a given dollar. If you consume with it, that same dollar cannot be invested.

You don’t understand that the law of identity when applied in economics means you cannot treat consumer spending as associated with more capital spending.

When you consider more consumer spending, you have to consider it in a sort of cycle, repeating over and over again, and not just thinking something like “If I spend more money at McDonalds, then the McDonalds can have more money to buy beef and labor.” You can’t do that because that would be an act of SAVING and investment (the purchase of the beef and the purchase of the labor). Higher consumption that is followed by a reduction in consumption and increase in saving is not an example of what happens with an increase in consumption.

You also can’t do that because when you buy a hamburger, THERE NEEDS TO BE A PRIOR ACT OF SAVING and investment to make that hamburger available to you.

If we consider a rise in consumption, then we have to consider NO rise in saving and investment, and ONLY a rise in consumption. That is what a rise in consumption means. You can’t sloppily include a rise in investment whenever you consider a rise in consumption.

That’s your confusion.

If there is an increase in consumption, then that means there is a rise in demand for consumer goods PERIOD. That’s it. In that context, what happens is that there will be a rise in profitability of consumer goods relative to capital goods. That will pull more resources away from the machines that help produce the beef farms, and so on, and more towards McDonald’s restaurants themselves.

This will reduce overall productivity, and McDonalds will have to make do with less capital, despite the fact that they are making more dollars.

What you need to get through your mind is to stop conflating consumption with investment, and consumption spending with investment spending. You are taking capital goods investment and spending totally for granted, based solely on the presence of increased consumption.

Yet because consumption and investment are in competition with each other, both in real and nominal spending terms, it means that a rise in consumption must be treated as coming at the expense of investment, despite the fact that after you buying a hamburger, McDonalds turns around and buys more capital which “stimulates” those industries.

The “stimulus” is actually the other way around. The capital goods industries “stimulated” McDonalds in being physically able to sell more consumer goods. Without that initial capital “stimulus”, there can be no more consumer goods produced.

Clear as mud?

“I think Keynes is just describing a full-employment equilibrium and using the MEC to show how we might fall out of it.”

Too bad he contradicted the context of falling wage rates and prices when he considered a rise in capital goods prices in his claim that the MEC falls.

Your confusion here is that you don’t seem to be able to understand Keynes’ errors.

“And yet you’ve taken an absurdly literal reading of the passage to troll LK with.”

It’s not absurd. It’s called strict analysis. If it cannot stand up to such softball criticisms, then it’s bogus. Sorry.

Now learn that the paradox of saving is a farce. If everyone tried to save more, then there is no reason why there would be problems, because everyone can save and invest more, which will not reduce profitability.

MF, if you want to say that the paradox of saving is about “money hoarding” rather than saving, that’s fine, but know that you’re just playing semantics.

If savings is the exact same thing as investment rather than an accounting identity then I have to wonder why we have two words for the same thing. Note: that was a rhetorical statement.

That investment “inducement” is precisely the “out of thin air” assumptions Keynesian make. You don’t understand that in the aggregate, consumption spending and capital goods spending are in competition with each other.

Yes, and again, you’re ignoring reserve banking where investment creates savings “out of thin air”.

You don’t understand that the law of identity when applied in economics means you cannot treat consumer spending as associated with more capital spending.

Look, MF, in addition to an increase the money supply from private sector borrowing or Fed-accommodated government borrowing, the velocity of money could increase. (However in Keynes example this would only raise prices.)

Higher consumption that is followed by a reduction in consumption and increase in saving is not an example of what happens with an increase in consumption.

MF, Keynes is talking about higher consumption replacing lower investment.

But I see how my comment might have been confusing. (I was talking about situation where growth is not held constant and we’re below full-employment. I think the example you’re using from Keynes is describing a full-employment scenario.)

That will pull more resources away from the machines that help produce the beef farms, and so on, and more towards McDonald’s restaurants themselves.

Wow, this actually does seem right to me.

The thing is I think Keynes is saying when captial-goods prices rise consumer-good producers can either “hoard-money” or consume more.

He’s saying the only way to maintain the current level of production at full-employment is by them choosing to consume rather than “hoard”.

Yes, eventually the capital goods they have will wear out.

Yes, if they don’t invest in improvements their will be no growth.

That’s probably why Keynes used it as an example. He’s saying they will be *forced* to save more eventually so he can talk about falling prices and unemployment.

xgsmmy:

“MF, if you want to say that the paradox of saving is about “money hoarding” rather than saving, that’s fine, but know that you’re just playing semantics.”

If you still beat your wife, then know you’re a wife-beater.

“If savings is the exact same thing as investment rather than an accounting identity then I have to wonder why we have two words for the same thing.”

I define saving as the use of money for something other than consumption.

“That investment “inducement” is precisely the “out of thin air” assumptions Keynesian make. You don’t understand that in the aggregate, consumption spending and capital goods spending are in competition with each other.”

“Yes, and again, you’re ignoring reserve banking where investment creates savings “out of thin air”.”

Again, I am not ignoring reserve banking. I am explaining to you how markets work, not how fractional reserve banking systems work.

Credit expansion out of thin air that leads to more consumption, or more investment, brings about the business cycle.

Even if we include credit expansion, there is still a competition between consumer spending and investment spending. You can’t spend the same credit on both consumer goods and capital goods. You must choose.

“Look, MF, in addition to an increase the money supply from private sector borrowing or Fed-accommodated government borrowing, the velocity of money could increase.”

Velocity is a fudge factor. It has no independent definition other than the other variables in the so-called equation of exchange.

Even if velocity increased, it has a limit without inflation of the money supply. Plus, and very importantly, velocity is correlated with the rate of inflation. The higher the rate of inflation, the higher velocity becomes

“MF, Keynes is talking about higher consumption replacing lower investment.”

No, he is talking about higher consumption replacing cash holding.

Keynes talked about a lot of things. In the quote I cited, he talked about a drop in wages, and a rise in consumption. I took that claim to its logical conclusions.

“(I was talking about situation where growth is not held constant and we’re below full-employment. I think the example you’re using from Keynes is describing a full-employment scenario.)”

Even if there is less than full employment, my argument still applies.

“That will pull more resources away from the machines that help produce the beef farms, and so on, and more towards McDonald’s restaurants themselves.”

“Wow, this actually does seem right to me.”

Examples tend to do that for those who have trouble thinking abstractly and in technical terms.

“The thing is I think Keynes is saying when captial-goods prices rise consumer-good producers can either “hoard-money” or consume more.”

Except the context in which Keynes wanted to refute the claim that falling wage rates and prices can cure unemployment, is a context of falling capital goods prices, not rising capital goods prices.

“He’s saying the only way to maintain the current level of production at full-employment is by them choosing to consume rather than “hoard”.”

And I am saying that the context in which Keynes made that argument was falling wage rates and prices, not constant capital goods prices and costs, which of course will lead to losses and unemployment if there is a rise in cash preference.

“Yes, eventually the capital goods they have will wear out.”

Don’t forget, capital goods includes materials that are used up in production as well. For many materials, they are used up almost immediately (think milk at bakeries), while for others they are used up relatively more slowly (think factories made from steel).

“Yes, if they don’t invest in improvements their will be no growth.”

I am saying that those improvements require capital, and capital has to be available. Available capital today requires saving and investment yesterday, so to speak.

“That’s probably why Keynes used it as an example. He’s saying they will be *forced* to save more eventually so he can talk about falling prices and unemployment.”

Except falling prices cures unemployment.

If you still beat your wife, then know you’re a wife-beater.

MF, I’m saying that it’s fine to call it hoarding money, but it is still wrong to criticize the paradox of thrift.

In a reserve banking system a paradox of thrift may involve a lower demand for “credit money”. Most people would not call this “money hoarding”.

The point is the paradox of thrift works even if you just imagine people stuffing money in the mattress.

Even if we include credit expansion, there is still a competition between consumer spending and investment spending.

Nobody has said that there wasn’t. Keep beating that strawman, though.

No, he is talking about higher consumption replacing cash holding.

No, he’s talking about higher consumption *instead of* “cash holding”.

The higher consumption is necessary to maintain full-production employment (constant GDP) because of lower investment spending. Hence: higher consumption replacing lower investment.

Except the context in which Keynes wanted to refute the claim that falling wage rates and prices can cure unemployment, is a context of falling capital goods prices, not rising capital goods prices.

Nope, capital goods cannot fall if the MEC is zero (or whatever) because of resource (supply) constraints (shortage).

Either GDP has to fall or inflation has to rise. (Or consumption has to rise).

Don’t forget, capital goods includes materials that are used up in production as well. For many materials, they are used up almost immediately (think milk at bakeries), while for others they are used up relatively more slowly (think factories made from steel).

Right, but for simplicity we can imagine that the constraint is that the capital goods makers productivity is the bottleneck. There’s enough resources, they just can’t extract them any faster.

Except falling prices cures unemployment.

And in the long run we’re all dead?

xgsmmy:

“MF, I’m saying that it’s fine to call it hoarding money, but it is still wrong to criticize the paradox of thrift.”

You haven’t shown why it is wrong to criticize it.

“In a reserve banking system a paradox of thrift may involve a lower demand for “credit money”. Most people would not call this “money hoarding”.”

Then the paradox of thrift, in terms of money hoarding, would not apply.

“The point is the paradox of thrift works even if you just imagine people stuffing money in the mattress.”

You can’t stuff more money in your mattress unless someone else SPENDS money on you.

“Even if we include credit expansion, there is still a competition between consumer spending and investment spending.”

“Nobody has said that there wasn’t.”

I didn’t say that you said that there wasn’t.

“Keep beating that strawman, though.”

I wasn’t accusing you of holding that position.

“No, he is talking about higher consumption replacing cash holding.”

“No, he’s talking about higher consumption *instead of* “cash holding”.”

Distinction without a difference.

“The higher consumption is necessary to maintain full-production employment (constant GDP) because of lower investment spending.”

This is assuming prices of wage rates cannot fall.

“Hence: higher consumption replacing lower investment.”

Non sequitur based on faulty premise.

“Except the context in which Keynes wanted to refute the claim that falling wage rates and prices can cure unemployment, is a context of falling capital goods prices, not rising capital goods prices.”

“Nope, capital goods cannot fall if the MEC is zero (or whatever) because of resource (supply) constraints (shortage).”

False. Capital goods prices can fall and that will increase MEC. You can’t keep MEC constant when there is no reason for it to stay constant.

“Either GDP has to fall or inflation has to rise.”

Nominal GDP can fall. Real GDP does not.

“(Or consumption has to rise).”

Non sequitur.

“Right, but for simplicity we can imagine that the constraint is that the capital goods makers productivity is the bottleneck.”

There is no reason to assume such a simplistic thing. Bottlenecks are a consequence of partial relative overproduction and partial relative underproduction. In competition, such partial over and underproductions tend to be reversed due to the desire for profit and avoidance of losses.

“There’s enough resources, they just can’t extract them any faster.”

The desire for more resources always outstrips the ability to extract them.

“Except falling prices cures unemployment.”

“And in the long run we’re all dead?”

Falling prices do not take more than a person’s lifetime. Most people will not choose starvation over a lower wage rate.

You can’t stuff more money in your mattress unless someone else SPENDS money on you.

Yes, I know, that’s the paradox of thrift. My spending is your income and your spending is my income. So if we both increase our savings then both our incomes must fall.

I wasn’t accusing you of holding that position.

Nobody holds that position. (Well, I’m sure we can find someone who does.)

This is assuming prices of wage rates cannot fall.

For wage rates to fall either more people have to be unemployed or people have to work more for the same amount. But there are no more people to be employed! It’s full-employment with falling MEC.

You can’t keep MEC constant when there is no reason for it to stay constant.

I gave you a reason: supply constraints. Why aren’t you getting this?

Bottlenecks are a consequence of partial relative overproduction and partial relative underproduction. In competition, such partial over and underproductions tend to be reversed due to the desire for profit and avoidance of losses.

What’s with the jibber jabber?

In this case there is an “unproduction” of human beings and an overproduction of demand.

Yes, it will be reversed in this case by the inevitable increased “hoarding” because consumer goods producers don’t want to take losses since the MEC is falling too low for profitable investment.

Falling prices do not take more than a person’s lifetime. Most people will not choose starvation over a lower wage rate.

Absurdly literal readings of famous statement for one hundred!

(There has to be a job to accept a wage.)

xgsmmy:

“Yes, I know, that’s the paradox of thrift. My spending is your income and your spending is my income. So if we both increase our savings then both our incomes must fall.”

But then you would require someone ELSE to SPEND their money on both of us.

See, the error you are making is called the fallacy of composition. You isolate yourself and myself, and consider ourselves to hold more money, and then you make an inference on that, and then, you make the error of inferring the same thing to the economy as a whole. But you can’t do that. Everyone in the economy cannot hold more cash, unless there is a rise in the quantity of money.

In the aggregate, any attempt by people to hold more cash will not result in more cash being held, but the same cash being held.

You and I cannot hold more money unless someone else holds less money. If EVERYONE tried to hold more money, they couldn’t do it. They would be accomplishing the goal of higher purchasing power on the side of falling prices and the same quantity of money.

You don’t seem to understand that when people desire to hold more money, they really aren’t just wanting to hold more money qua money. They want more purchasing power. More money is the way an individual can accomplish that. But everyone together cannot do that at the same time. Purchasing power is increased for everyone on the side of falling prices.

Once prices fall, then the desire for more purchasing power will be accomplished, and no further desire to hold more money would exist, because prices are such that the desired purchasing power has been reached.

The paradox of thrift, both in terms of investment and in cash preference, is BOGUS.

“This is assuming prices of wage rates cannot fall.”

“For wage rates to fall either more people have to be unemployed or people have to work more for the same amount.”

False. Falling wage rates does not mean unemployment. Falling prices and wage rates means less money being spent on the same supply of goods and labor.

“But there are no more people to be employed! It’s full-employment with falling MEC.”

There is no falling MEC with capital accumulation. That’s your error.

“You can’t keep MEC constant when there is no reason for it to stay constant.”

“I gave you a reason: supply constraints. Why aren’t you getting this?”

BECAUSE IT IS FALSE and because I have already explained to you why it is false. Why aren’t you getting that? It’s like talking to a wall.

Resource constraints, again, for the third time, are UBIQUITOUS. Resources are ALWAYS scarce. That’s why resources have prices in the first place. It cannot possibly be an explanation for rising prices.

The assumption of rising capital goods prices, in a context of falling wage rates and prices, is, again, for the third time, a fallacy. You can’t argue against what falling wage rates and prices can accomplish by literally denying that context and assuming a rise in capital goods prices!

Again, in a context of FALLING wage rates and prices, this can cure unemployment, and capital goods prices will FALL, not rise.

“Bottlenecks are a consequence of partial relative overproduction and partial relative underproduction. In competition, such partial over and underproductions tend to be reversed due to the desire for profit and avoidance of losses.”

“What’s with the jibber jabber?”

What’s with your lack of critical thinking skills and economic illiteracy?

“In this case there is an “unproduction” of human beings and an overproduction of demand.”

Ridiculous. No, there is no such thing as too much demand. Demand for goods is practically infinite.

In the case I described, there is a relative underproduction of some goods, and relative overproduction of other goods. In a division of labor, where each industry depends on the others, when industries are out of whack relative to each other, it LOOKS like bottlenecks in general.

“Yes, it will be reversed in this case by the inevitable increased “hoarding” because consumer goods producers don’t want to take losses since the MEC is falling too low for profitable investment.”

The MEC is not falling with fallign wage rates. it is INCREASING with lower wage rates.

“Falling prices do not take more than a person’s lifetime. Most people will not choose starvation over a lower wage rate.”

“Absurdly literal readings of famous statement for one hundred!”

Then don’t make stupid statements that you don’t intend to be taken seriously.

“(There has to be a job to accept a wage.)”

Your wage would be negative.

Yikes, MF.

I just meant if both us tries to increase our savings both our incomes must fall in proportion to our increase in savings.

I did not mean that our total savings would rise.

You are by far the least charitable commenter on the internet.

You are so bad that I can’t trust that you will even recognize the hyperbole in that last statement.

I’m astounded by your lack of decorum and rampant psychological projections.

It’s simply stunning that someone who insults their interlocutor at every turn can cry foul at even llegitimate phrases like “moving the goalposts”.

I’ll try to wade through the rest of your bile if I have the time.

You must be physically incapable of admitting even the slightest mistake.

Whatever made you this way I curse it and the day I was born.

Good day.

Resource constraints, again, for the third time, are UBIQUITOUS. Resources are ALWAYS scarce.

Yes, “resources are always scarce”, but imagine all available resources are already being employed at their highest productivity so that any attempt to employ more resources will only bid resources up in price.

Falling prices and wage rates means less money being spent on the same supply of goods and labor.

Yes, MF, if all wages and prices fell simultaneously it’s just like nothing happened. Unfortunately we still face the lower bound of the MEC.

The assumption of rising capital goods prices, in a context of falling wage rates and prices, is, again, for the third time, a fallacy.

All resources are being used to their productive limit. Any attempt to employ more resources will either make the MEC unprofitable or result in rising inflation.

So producers have a choice: “hoard” or consume.

There are no other choices.

Again, in a context of FALLING wage rates and prices, this can cure unemployment, and capital goods prices will FALL, not rise.

Increased investment cures unemployment not falling prices.

(I can already see now how you’re going to say you were talking in the “context” of the other Keynes. John Boehner Keynes.)

Ridiculous. No, there is no such thing as too much demand. Demand for goods is practically infinite.

I said there was an overproduction of demand and not enough productive capacity to fulfill that demand.

Since this is not inconsistent with demand being “practically infinite”, it must be your first sentence that’s key.

Yet that sentence appears to deny the possibility of an inflationary spiral.

Stagflation cannot occur, thank the lords.

In the case I described, there is a relative underproduction of some goods, and relative overproduction of other goods. In a division of labor, where each industry depends on the others, when industries are out of whack relative to each other, it LOOKS like bottlenecks in general.

Are you trying to describe Say’s Law? That’s where it looks like you’re heading.

(Just case you raise this objection to something I posted before. Yes if people all work less at the same rate (work sharing) then you could eliminate “unemployment” that way. So call it underemployed if you want.)

Your wage would be negative.

Even then there would need to be a job.

(I’m accepting a wage by paying you to let me work?)

xgsmmy:

In other words, the context of rising capital goods prices that Keynes THOUGHT would take place in a context of falling wage rates and prices, is wrong.

Keynes was trying to refute the argument that falling wage rates and prices cures depressions. He tried to refute that argument by literally denying the context of falling wage rates and prices.

Can you not see how it is absurd to argue against the ability of falling wage rates and prices (and thus falling capital goods prices) to cure unemployment, by setting up his reply by assuming a rise in prices? It makes no sense to do that.

You can’t argue against the ability of a fall in wage rates and prices to cure unemployment, by assuming no fall in wage rates and prices in your argument!

The context of falling wage rates and prices leads to RISING MECs, not falling MECs. The context of increased savings and investment leads to RISING MECs, not falling MECs.

MF, just for the sake of argument, to take this in another direction, and accept your premise. (And keep in mind non-economist here.)

In a deflationary environment at the zero-lower bound of interest. If wages and prices are falling isn’t the MEC falling at an equal rate?

So that you have to assume a secondary assumption to claim that the MEC is rising?

(My brain is fried, now. I’m topsy-turvy.)

xgsmmy:

“and capital can only be produced through saving and investment, NOT consumption”

“Who said capital can be “produced” by “consumption”.”

“You did.”

“[Citation Needed]”

When you said there has to be an increase in consumption in order to prevent unemployment and fall in GDP. Preventing unemployment and fall in GDP would imply that an economy grows (i.e. capital accumulates) more than what it otherwise would have grown without such consumption. This is equivalent to saying consumption produces capital.

“During a depression, the brunt of the hurt is felt by capital goods companies, not consumer goods companies”

“Do you have a link for this?”

Yes, my posts. Link to them.

“I still want that 70% link too.”

You can link to my posts for that too.

“(Although, I haven’t had time to read through skylien’s link I don’t think it has empirical numbers.)”

You don’t need constantly updated empirical numbers. It is logically deduced from the fact that profits are less than 50%. A mathematical series of the form I showed above, with profits averaging 25% on capital invested, would have a sum equal to $5.00 total spending for every $1.00 consumption spending.

“You can’t help the capital goods stages by increasing the nominal profitability of consumer goods companies.”

“The consumer goods companies can be induced to buy more capital goods.”

They can’t purchase more capital goods unless there are capital goods available. Available capital goods requires prior saving and investment.

“You’re just reverting back to reverting back to the idea that consumer goods producers will consume all of their income.”

No, I am not. You keep insinuating that my hypothetical example of 100% consumption is a sort of prediction, when in reality it is used to test Keynesian theory. Keynesian theory holds that 100% consumption can maintain employment and output. That is false.

“More consumption spending during depressions can only reduce productivity of labor and standards of living. The increased nominal incomes are illusory growth.”

“Yikes.”

I’ll take that as yet another concession.

“That was not the context of the argument Keynes made to “rebut” the claim that falling wage rates and prices can eliminate unemployment and depressions.”

“[Citation Needed]”

Keynes’ “General Theory.”

“The context of the rising capital goods prices Keynes claimed took place, was when there is less than full employment, and falling wage rates and prices.”

“Falling or rising GDP?”

During periods of unemployment.

“Falling capital goods prices on the basis of the context of falling wage rates and prices, which was the context Keynes responded to.”

“Falling or rising GDP?”

During periods of unemployment. The argument Keynes responses to is that falling wage rates an prices can cure unemployment. He held that falling wage rates and prices cannot do it, because he fallaciously claimed capital goods prices will rise, even though they would fall in the context given.

“Yes, that obviousness is exactly what Keynes made the mistake of contradicting.”

“[Citation Needed]”

Keynes’s “General Theory”.

“Then you agree that Keynes was wrong when he presumed the opposite. Not explicitly of course, but implicitly in the course of his arguments.”

“Yikes.”

I’ll take that response to be another concession.

“At full capacity, any further NOMINAL investment will make the MEC fall, yes, but this is not problematic, for if any cash hoarding arises on the basis of a too low” MEC, then that would only increase profitability through falling asset prices, as explained, which will thus remove the impetus for cash hoarding, as explained, and restore a higher MEC, as explained.”

“After GDP stops falling it, will start rising”.–MF

False. That is not what I argued. I argued that the decline in profits will eventually be reversed. The aggregate spending can stabilize at a lower level.

If you propose a hypothetical scenario of an increased cash preference, then that is the same thing as proposing a hypothetical example of an aggregate money spending deflation, which is roughly the same as a decreased NGDP, or what you call it, just “GDP”.

My response was not to just claim that a fall in GDP will be followed by a rise in GDP, but rather, that a rise in cash preference, which manifests as a falling in aggregate spending, will at first be a scenario of declined net investment, which when combined with producer consumption, will result in a declined MEC. But because a rise in cash preference will be accompanied by a decline in productive expenditures, asset prices will fall to a new lower level. Once that occurs, accumulated capital in dollar terms will decline, and producer’s consumption and the same relative rate of net investment (since rising cash preference cannot be assumed to come from ONLY investment or ONLY consumption, but both, that is, time preferences don’t change), these will become a larger fraction relative to accumulated capital in dollar terms. That means a higher MEC after all is said and done. NGDP would be lower, but rates of profit will be higher, because assets (costs) are lower relative to producer consumption and net investment.

“Are you finally conceding here then, that what you claimed was impossible is possible?”

I cannot possibly “concede” an utter falsehood. Whether or not aggregate spending (NGDP) is higher or lower, is a transition period that the market process does not get stuck at, but adapts to by virtue of what happens to the resulting differences in nominal demands between investment, capital accumulation, and consumption.

“How much unemployment there is will I suppose decide whether you call it a recession or depression, but the point is that you are not keeping the context in question in mind.”

“No, falling GDP or constant GDP or rising GDP?”

What do you mean “No” here? You are evading the context of falling wage rates and prices in an environment of unemployment.

Whether NGDP is rising or falling depends on the assumed change in cash preference you postulate.

If cash preference rises, this is the same thing as saying NGDP falls, provided of course that money is not destroyed (e.g. credit default/payback).

“Leave aside the issue of the number of unemployed. The only issue there is whether it is below full employment, full employment, or above full employment.”

You’re telling me to leave aside the number of unemployed, AFTER you brought up the “complaint” that we have to make clear whether we are talking about “recession” or “depression”? You’re not making any sense. If you want to make clear whether we’re talking about “recession” or “depression”, then you are asking me to consider the number of people unemployed, because that’s how those terms are typically defined. 7% unemployment might be called a recession, whereas 25% unemployment might be called a depression.

Now you’re saying leave the numbers aside, and focus on whether the economy is “below full employment, at full employment, or above full employment.”

That was MY original focus before you derailed it with quibbling over the semantics of whether to call the economy in a recession or depression!

To repeat for the millionth time, the context in which Keynes made the argument that capital goods prices rise, was in an economy with unemployment. That is what I have ALWAYS argued, and so now it should hopefully be clear to you.

“The “secondary deflation” is just an arbitrary focus on one step in the process of falling wage rates and prices.”

“I thought secondary deflation was gratuitous part of deflation.”

Deflation is deflation is deflation.

“The unnecessary pain.”

If I choose to reduce my spending, and that all else equal this will reduce other people’s nominal incomes, this is NOT “unnecessary.” This is NECESSARY to accomplish my ends. The market is a process where individuals can achieve their ends. It isn’t a prison, whereby everyone has to spend, or else they’re punished by law. That punishment is unnecessary pain.

“Wouldn’t secondary deflation further distort prices in a possibly endless series of miscalculations?”

No. Voluntary deflation is a CORRECTION to previous distortions that undue inflation has wrought.

Voluntary deflation is a manifestation of individual valuations given the new conditions of knowledge and preferences. It is beyond judgments of “right” and “wrong”. It is what individuals now prefer. The market process is a mechanism by which individuals can accomplish their new desired ends. Criticizing this is just criticizing voluntary peaceful activity of others. Who are you judge other people in this way?

“But the economy doesn’t work that way. Prices fall sequentially, as each individual makes choices at different times, given the events that are transpiring around them.”

“So the government takes all the responsibility for the unsustainable boom (even though we can now see is possible without the government), and every individual is left to fend for himself in the collapse (with no necessary bottom)?”

Yes, because the government CANNOT fix the problems it itself created. The only solution to distortions to the market process, is to let individuals in the market process fix their problems and coordinate their actions with each other.

Yes, individuals in the market process have to bear the costs of what those in the government did. That’s one of the main reasons why Austrians are so adamant that booms do not occur in the first place. It’s because they know that the costs will be burdened on those who had nothing to do with bringing about the boom.

“(Thinking about diagnoses and prescriptions for past and current real crises.)

which is what economists claim can cure unemployment, but Keynes rebuted this by presuming a rise in capital prices.”

“Rising or falling or constant GDP?”

Stop evading the context. It’s falling capital goods prices.

“You seem to want to concede that point, but not totally, and hopefully quickly go to some other argument, which is the alleged evil of price deflation,”

“No, it’s just that when you talked about it before I was thinking about the present day where GDP is rising.”

If by GDP you mean total spending, total spending (continually) rises when there is inflation of the money supply. The reason NGDP fell 2008-2010 is because the total supply of money actually fell due to credit collapse.

The Federal Reserve System brought that credit expansion about, to a very high ratio relative to base money. This made the financial system like a house of cards.

“But now I’m thinking about the case where GDP is falling or hits a flat bottom and wondering if the MEC will start falling there too.”

As I recommended before, you ought to first understand what you have put on your plate first, because you ADHD over to another topic.

To answer your question, yes, when total spending falls, it will almost always be associated with a declining MEC, because while revenues decline instantly, costs fall with a time lag, since current costs are a function of past (productive) spending, when total money spending (and productive spending) were probably higher.

But this fall in MEC is temporary, because when total spending falls, so does productive spending tend to fall, and when productive spending falls, so too do costs eventually fall. Once costs do fall to a new lower level, then given the new (lower) total spending, MEC will rise once again (since net investment and producer consumption will put a constant and relentless pressure on MEC to rise).

“I’d forgotten about the initial crash.”

You were insistent that I address your claims in a context of full employment and full capacity. Now you’re saying you want to go to a scenario of a crash, which of course means unemployment and less than full capacity?

“No, because the MEC does not fall when capital goods prices fall.”

“This is just a tautology.”

[Facepalm]

“No, it is not a tautology. Falling capital goods prices and the MEC are different, but related beasts.”

“Could you expand on this? If you’re talking about all capital goods it seems true (discounted by the rate of interest). (Ignoring the spot price or whatever.)”

If you know what I said is true, why the heck did you claim it was nothing but a tautology?

“No, I argued that the MEC does not fall when capital goods prices fall.”

“What’s the difference? Is it the cost of money? Or the rate of profit? (Okay, I need to think about this I guess. And read about it.)”

The MEC can be understood in a few different ways, but the way I was using it, and the way I think you were using it, was aggregate profitability, i.e. rates of profit prevailing throughout the economy on capital invested, in nominal terms.

High inflation can drastically increase MECs by virtue of widening the difference between revenues and costs (since costs are a function of past spending, which was lower). This is not, by the way, inherently a good thing, because MECs just reflect, or in a free market would reflect, the time preferences of individuals. A high MEC is not objectively “better” than a lower MEC.

“MEC does not fall when capital goods prices fall, is not a tautology.”

“I’m confused.”

Maybe you think capital goods prices are the costs of capital in interest rate or borrowing terms.

I am defining capital goods prices as the dollar prices for capital goods, i.e. a machine is priced for sale at $100,000.

“False. You can’t hold the MEC as constant and then consider a change to investment, when the MEC is a FUNCTION of investment!!!!”

“MF, in the case you responded to raising consumption to offset falling investment restores the MEC to equilibrium at constant GDP.”

I recommend to stop evading the issue, and address it head on. The MEC does not constrain investment in any sense. The MEC is a PRODUCT of investment (and consumption), relative to each other. If the MEC is ANYTHING, 5% or 1%, or any other rate, a rise in investment will just keep making the nominal MEC fall, and by less and less of a fall as more and more investment is made. Real MEC would keep growing, making the smaller nominal MEC more and more worthwhile to invest!

The claim you made, that falling investment is accompanied by a rising consumption “to offset it”, is a confusion, because falling investment does not need rising consumption to “restore” GDP or unemployment. Indeed, CONSUMPTION SPENDING DOES NOT PAY WAGES. Not even NGDP pays wages. What pays wages is saving and investment in labor. This spending is in competition with consumption spending.

An employer that has savings available can financed his own consumption, or he can pay wages. He can’t do both with the same money.

Yes, falling NGDP may tend to be associated with falling employment, but this is only to the extent that wage rates do not fall. It’s not that falling NGDP did it, it’s the failure of wage rates to balance with the new (lower) nominal demand for labor.

More consumption spending cannot prevent the fall in wages, because more consumption spending just results in higher profits for consumer goods companies.

And no, you can’t argue that more consumption spending will be used by consumer goods company owners to pay subsequent wages, because that would be saving and investment, NOT consumption spending. So you would be contradicting the context of CONSUMPTION spending raises wage rates.

And even if the economy ends up with more employment in the consumer goods industries for whatever reason, this would end up harming workers’ standard of living, because with fewer workers in capital goods industries, and more workers in consumer goods industries, the rate of capital accumulation will be otherwise lower.

THIS is why I brought up the hypothetical of 100% consumption. For imagine that investment for some reason collapses 90%. If the “solution” to this is for there to be an equivalent rise in consumption spending, thus attracting almost all workers to consumption, then the capital base would eventually rust and wear out, be disintegrated, the productivity of labor would collapse, and real standards of living would plummet.

The more optimal solution therefore, is to make saving and investment as attractive as possible, to maximize it, so that the fall in investment is reversed, and workers can be attracted back into the capital goods stages from whence they came, so that the rate of capital accumulation does not plummet.

This would occur “naturally” in a free market with protections of property rights, but unfortunately, the state is guided by the exact Keynesian thinking as you, and they do everything they can to make investing as unattractive as possible, and as least capable as possible. Lots of government borrowing from the market’s savings, which redirects saving from investment to government spending, decreasing interest rates below what the market process would have put them at, which makes investment less attractive, and punishing cash holders – who would have made profits rise (as explained above) – with inflation.

“At that point raising or lowering investment pushes the MEC out of equilbrium as capital depreciates.”

There is no such thing as an equilibrium MEC apart from where voluntary investment and consumption would have put it. Capital depreciation does not lower the MEC.

“At full employment and full capacity, if there is a rise in investment, then the MEC will fall. It won’t hit a lower positive bound that will not fall no matter how much additional investment and fall in consumption is made. The MEC is a function of investment. If investment rises, then the MEC will fall, even if it has to fall from 2% to 1.8%.”

“If what you claim is true (that MEC can’t ever fall to zero or below) then the interest rate will eventually rise in response to inflation making the real MEC negative, even if nominal MEC is positive.”

The argument that the MEC can’t ever fall to zero, and below zero, is only true in the context of non-declining aggregate spending.

If you assume inflation is taking place, which will turn the existing nominal MEC negative in real terms, then this is the fault of those who are inflating. It’s not the fault of the market. I was explaining to you how MARKETS work, and yet you seem to want to haphazardly go back and forth between markets and hampered markets, as if there is no fundamental difference between the two.

At any rate, if there is inflation, then that will tend to raise the nominal MEC. The MEC won’t remain constant. The MEC is a function of investment, capital costs, and consumption. Inflation will tend to widen the spread between spending and costs, and thus raise MEC.

So the hypothetical negative real MEC you have assumed, is highly innaccurate.

In a context of zero inflation, then the nominal MEC will be positive and the real MEC will be positive.

“The MEC can not hit zero at full employment, because consumption of producers is always positive.”

“Unless this is a tautology then it’s not true because consumption can fall to zero. People can jump from tall buildings in a recession.”

What a ridiculous assertion. Economics as a science presumes people are alive, not dead. If everyone is dead, then there won’t be any investment or consumption.

Obviously, not everyone kills themselves. Consumption in the aggregate can never hit zero as long as humans LIVE.

And what I said is NOT a tautology. You keep throwing that term around when it is clear you haven’t the foggiest clue what it even means. Tautologies do not mean “obvious truths”, as if the only “real” truths are those that are complicated and hard to understand. Maybe that’s how truth appears to you, where the only time you think you’re close to a truth is when you are confused, but many truths are trivial.

What I said is not a tautology because the MEC and producer consumption are separate, but related concepts. Just like my discussion of the relationship between capital goods and the MEC was claimed by you as a tautology, now you’re saying my discussion of the relationship between producer consumption and the MEC is a tautology.

To reiterate, the MEC is one thing. Capital goods prices and spending is one thing. Producer consumption is one thing. They are related to each other, where producer consumption and capital goods investment determine the MEC, but this does not mean that saying “the MEC does not hit zero because producer consumption is always positive”, is a tautology. There are two different concepts there. It’s not like saying A is A.

“You’re insane. I did not once mention ABCT, not did I once mention economic calculation, nor did I even HINT at referring to those things. You’re totally out to lunch. I challenge you to show me where I mentioned ABCT or economic calculation in this thread with you.”

“My mistake. I went back and looked and it appears you were making a crowding out argument.”

[Facepalm]

“False, xgsmmy. The rate of interest is a function of profits, not the reverse”

“You’re just quibbling over semantics now. This is evasion. This is why the length of comments is rising and rising.

Saying you’re being evasive is not the same as saying you “have something to hide”.”

No, saying that profits determine interest, rather than vice versa, is not “semantics.” I am not arguing something by insisting that you are using the wrong word to describe what we are both agreeing to. I am not agreeing with you as to the determinants of interest or profits.

You claimed that interest rates affect profits. I responded to that by saying no, it’s the reverse.

The only reason these comments are getting longer and longer is because you choose to write such comments, and because I choose to write my comments. You are blaming me for choices you made. I recommend you maybe take responsibility for your own actions. Yes, I know, crazy thought.

I am not being evasive either. I have taken the time to respond to every claim you have made, and I have answered every question you have asked.

You have not done that in return. You have repeatedly changed topics, not finished an unfinished line of thinking, refused to seriously address the context of falling wage rates and prices, and repeatedly tried to derail this into discussions of GDP, whether to call recession a depression, and on and on.

I recommend that you do a little soul searching instead of accusing me of doing something that you have no proof of me doing, and considering the fact that you have such poor reading comprehension, that you even accused me (since recanted) of introducing highly complex topics such as ABCT and economic caculation, even though I did not once mention those things. That should be strong evidence for you to be more critical of your own ability to read and understand comments, before you start judging my comments. You can’t possibly understand that which you read, unless you yourself are first mentally capable of it. Improvement starts with you, not others.

“But imagine a central bank who can hit any interest rate target it wants to.”

Imagine the truth that interest rates mean something, and that if the central bank changes interest rates by fiat, it doesn’t mean it is helping people coordinate their actions because such coordination requires unhampered interest rates.

How about you stop trying to think like a central planner, and start trying to understand how peaceful, voluntary market activity works, and how it is coordinated, before you begin to understand how central banking affects it.

You can’t know how A affects B, unless you know B without being affected by A.

“You keep holding things constant and then imagining what happens when there is a change to certain variables, despite the fact that those variables you are changing GENERATE the very variables you are holding constant!”

“No, you won’t find your escape hatch here.”

It’ not an “escape hatch”. I am not “trying” to “find an escape hatch.” I am not looking to escape. I am not feeling pressured in any sense here. I am not on the defensive. I am helping you understand that which you as of yet don’t understand.

My argument that you are holding some variables constant, and then you are imagining the effect of changing other variables, I am telling you is an incorrect approach, because the variables you are holding constant are not in fact constant when you change those other variables!

How can you possibly not grasp that? How can you possibly respond to that argument of mine by claiming I am trying to find an “escape hatch”? You’re not making any sense.

“Interest rates, and MEC are not deux ex machina variables, dictated by investors by fiat, after which any change to other variables are to be analyzed by holding interest rates and MEC constant.”

“Nope.”

Nope? NOPE? You’re obviously highly confused.

The MEC and interest rates are a product. They are effects. They are effects of prior causes.

For the MEC, the prior causes are investment spending and consumption spending, as well as accounting for past productive spending. If investment spending changes, if consumption spending changes, or if accounting for past productive spending changes, then the MEC will change. The MEC is not a rigid value which somehow investment and consumption must adapt and mold and “fit” into.

“Try again.”

I don’t have to try again. You need to try to understand it again, because your last attempt was a disaster.

“The interest rate is the variable we have control over.”

This is not a rebuttal to what I said. I said that interest rates are an effect of prior causes. You can’t refute that by making the very vague and fuzzy claim that humans control it in some sense.

I wasn’t arguing that interest rates arise out of thin air. Are you not reading what I am writing? I am saying interest rates are not deux ex machina variables that are fixed by decree. They are a product of individual time preferences in coordination in the division of labor.

“MEC is constant in equilibrium at max capacity.”

False. The MEC IS NOT DETERMINED BY PHYSICAL PRODUCTIVITY.

You keep making the same error, over and over and over again, that the MEC somehow is fixed when the economy is at a GIVEN capacity.

You are fallaciously holding capacity fixed, when capacity is ALSO an effect, determined by the extent of prior saving and investment.

The more saving and investment there is, the more capacity an economy will have. There is no objective upper limit to capacity that is reached, beyond which it cannot ever go, no matter how much additional investment is made.

Capacity, again, for the sixth time, is a PRODUCT of investment. The higher the investment, which is a choice we have, then the higher the capacity.