Mish vs. Murphy

So somebody sent me this article by Mike “Mish” Shedlock, where he takes me out to the woodshed. Here is the relevant portion:

Flashback November 23, 2010: Austrian economist Robert Murphy predicts “high inflation” and and writes a post Has Mish Deflated the “Inflationistas”?My response which in retrospect has clearly carried the day was Failure to Consider Constraints – My Response to “Has Mish Deflated the Inflationistas?”

I invite you to read my detailed response to someone who was clearly wrong but here is the key snip.

OK, the term “high inflation” (note his quotation marks) isn’t in the November 23, 2010 article. Indeed, I don’t make any predictions at all. Instead, I go through and point out three bad calls Mish made because of his “credit deflation” worldview.

Now in fairness, I think what Mish means is that he is linking to one of my earlier pieces where I am worried about price inflation. If you read his original response to me, you will see the discussion.

Also, I should note that Mish was cool about linking to my Krugman Debate. I didn’t realize he had done that, until just now. (I think because it was buried at the end of his blog post; I must have stopped reading it when I thought he was done with me, when it first came out.) Since that is the case, I can now tell this story:

Back when the Krugman Debate was launched, I of course was trying to get various people to promote it. I wanted the thing to take off and gain currency outside the readership just of Mises.org etc. So when Mish called me up out of the blue, and said he was really interested in the debate and was going to push it on his blog, I was thrilled.

The only problem was, I had a pending article at Mises.org that was critical of Mish. Like, it was going to run within a few days of him calling me. So I was in a quandary. Obviously I wanted Mish to push the Krugman Debate, but I also didn’t want to be a jerk and not mention that I disagreed with his deflationist perspective. I considered telling the Mises guys just to pull the article, but that would have made me feel dirty.

So, my solution was to send Mish an email giving him a heads’ up, just so I wouldn’t feel funny if he pushed the debate and then my “hatchet job” (not really) came up the next day or something. I can’t remember if he answered that email, but as far as I knew, he never mentioned the Krugman Debate, and I filed away another cynical encounter with my fellow human beings.

Thus, I am very pleasantly surprised now to see that Mish in fact did still promote the debate, notwithstanding our tiff. (To be clear, the reason I am telling the story publicly now, is that it has this happy ending. Back when I thought Mish changed his mind out of spite or because he didn’t want to promote somebody who was an idiot on inflation, I didn’t blab the episode because that seemed ungentlemanly.)

Anyway, back to the big argument: inflation or deflation? Mish and I do NOT refer to prices with those terms. I have in mind money broadly conceived (including demand deposits and maybe some other things), whereas Mish includes “credit” though I’m not sure exactly how he defines that specifically. The point is, neither of us mean prices when we use the terms with no qualifier.

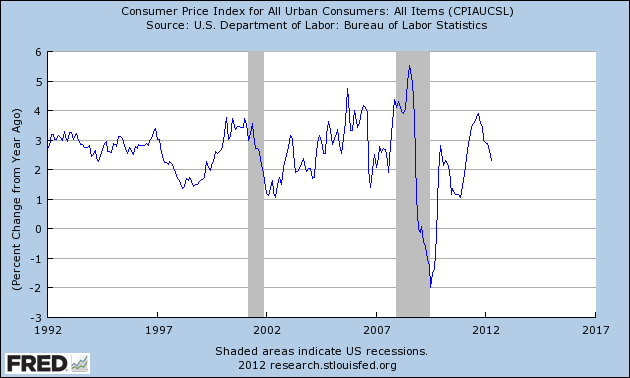

However, in terms of telling the public what we think is going to happen, surely the movement of consumer prices is key. And on that score, I think Mish and I were both wrong. He has been running around telling people that Bernanke is a small player compared to the global credit system, whereas I have been warning people that the excess reserves could leak out and spiral out of control very quickly (calling them a genie in the bottle). Here’s what has actually happened to CPI:

Note the units: It’s percentage change over the previous 12 months. Yes, consumer prices dropped sharply when the crisis first struck, but then with QE1 they turned around. Since then they rose

steadily, started falling and them zoomed up rapidly (because of QE2? I am not going to bother matching it up), peaked at almost 4 percent, a rate rarely achieved in the last 20 years. Then CPI’s increase slowed, so that the yr/yr growth rate has fallen down to a bit above 2 percent.Obviously this is nowhere near where I thought it was going to be. But, someone running around saying “deflation” for 3 years has been wrong too.

As I said to the guy who is a fan of both of us, back when he was feeding me Mish’s response to me, “Well we’ll just have to wait and see. If prices rise very quickly then I’m right. If prices start falling then Mish is right. If we have modest price hikes for a few years then Krugman is right.”

I’m paraphrasing, but that’s basically what I said to the guy. On that score, then, I think of the three of us, Krugman has the most justification for running victory laps (though even he too threw the deflation threat around a bit much, just not as much as Mish).

If any of you are regular Mish readers, I would love some clarity here. What is his position? Is he merely saying, “I bet we won’t have hyperinflation in the next two years?” Well no kidding, most people don’t think that. It seems to me he has been saying a lot of more.

23 Responses to “Mish vs. Murphy”

Leave a Reply

When you say “consumer prices dropped sharply after the crisis first struck” you may be conceding too much. Yes, there is a relatively short period where change is less than 0%, but a 1% or 2% fall in the consumer price level is not really all that “sharp” (although, surely, the prices of some goods did sharply drop, just like the prices of some goods are sharply rising today). In any case, the real movement in price is in that of intermediate goods. These did crash sharply as the crisis unfolded and have risen sharply since — the rate of change is much more dramatic than the average price of consumer goods.

Something else I should mention is that two items included in the above graphed index are “food and energy.” Both, perhaps (but especially the latter), can be considered both capital and consumer goods, depending on who’s buying them. It, therefore, makes sense that these make up a large part of the most volatile prices included in the above-graphed index.

Yes, I thought the same exact thing when I looked at this chart. The drop was actually quite small. To be honest, I never paid much attention to CPI, my eyes have been on PPI for most of the past 2 years, and that showed quite a bit more movement.

So neither one of you are talking about prices when you talk about inflation, but now you’re looking at the CPI? I think everyone should forget this episode ever happened.

CP we weren’t making predictions about which way money or money+credit were going to move. I was saying (effectively), “Because there is so much inflation by my definition, I think the general public should be prepared for rapidly rising prices in the stuff they have to buy regularly.” I took Mish to be saying (effectively), “Because there is so much credit shrinkage, Bernanke’s efforts can’t stop the overall deflation. The people warning of rising prices are nuts. That’s why the dollar will strengthen, oil won’t pop, and the stock market will fall in half during 2009.”

I think Mish correctly takes into account credit, the desire for credit and timing. The main thing QE seems to have done so far is distort investment preferences which fed into a commodities bubble and hence prices.

According to this and this, calculations of inflation using 1990 and 1980 methodologies respectively, we have had high price inflation since 2010, so you win.

Remember Murphy, you are at a distinct disadvantage because of government underreporting inflation and thus overreporting deflation.

You made a prediction that very powerful people have all the incentive in the world to go against, and Mish made a prediction that those same very powerful people have all the incentive in the world to agree with.

It would be like you predicting higher civilian casualties as a result of the Iraq and Afghanistan wars, and Mish is predicting fewer. You might end up being right, but I wouldn’t put my money on you if the bet is settled by looking at the numbers reported by those who caused the casualties.

From an opposite point of view, the government (especially the Fed) has an equally strong reason to not report outright deflation and therefore, in those instances, attempt to report mild inflation.

If one assumes both sides to be true, than the current level of core-PCE around 2% is a perfect compromise. One could also use this as a support for inflation targeting by the Fed versus a different target that permitted higher inflation.

From an opposite point of view, the government (especially the Fed) has an equally strong reason to not report outright deflation and therefore, in those instances, attempt to report mild inflation.

I disagree. With a lower reported inflation, the Fed has more justification to print more money. So one could argue they too have an incentive to underreport inflation.

For the love of, god, can you please stop citing Shadowstats? And can you stop saying that they use the same methodologies of 1990s and 1980s? Because they don’t. They don’t recalculate anything. The just use an “ad factor “. As far as I can tell, all they do is grab the official number and more or less tack on 10% to it. How exactly is that anything like “using the same methodologies” ? The other day I mentioned to you that if anything, the old version of CPI would be lower than today’s version of CPI because it now uses owner’s equivalent rent instead of house prices like it used to. While rents have been slowly increasing through the recession, home prices have been mostly falling. Also, the implication of such a high inflation number is that we’ve been in ridiculous contraction since the year 2000, which is contrary to all the evidence. Finally, the only independent alternative to the government statistics is more in less in line with CPI.

I’m pretty sure I’ve mentioned these things plenty of times here (to you even), but I have yet to hear any plausible counter arguments.

I think the best index that shows what people are “really” experiencing on a day to day basis is the Federal Reserve Bank of Atlanta’s flexible CPI. There’ also the sticky cpi in there. They basically take all the fast moving prices and remove the slow ones and put them in separate indexes. The flexible CPI happens to be mainly composed of things like food, gas, and clothing. It got has high as 10% last year, which should be just high enough to satisfy the conspiracy theorists. But the problem with using this number is that the flexible items only makes up 30% of CPI while the sticky items make up 70%. Combine the tame sticky prices with the flexible CPI and you should unsurprisingly get the headline CPI.

For the love of, god, can you please stop citing Shadowstats?

No.

And can you stop saying that they use the same methodologies of 1990s and 1980s?

No.

Because they don’t.

They do.

They don’t recalculate anything.

He does.

The just use an “ad factor “.

No, it’s not. If it were, then each readjusted data point would be equidistant from the unadjusted data.

As far as I can tell, all they do is grab the official number and more or less tack on 10% to it. How exactly is that anything like “using the same methodologies” ?

The same reason the change in 1980 and 1990 resulted in a reduction of reported inflation.

The other day I mentioned to you that if anything, the old version of CPI would be lower than today’s version of CPI because it now uses owner’s equivalent rent instead of house prices like it used to.

Housing only encompasses a portion of the CPI, and changing to owner’s equivalent rent doesn’t increase the CPI, especially when home prices increase faster than other goods.

I’m pretty sure I’ve mentioned these things plenty of times here (to you even), but I have yet to hear any plausible counter arguments.

I’ve yet to see initial convincing arguments. I’ve already critiqued everything you’ve said. It’s like they don’t even exist or something.

I think the best index that shows what people are “really” experiencing on a day to day basis is the Federal Reserve Bank of Atlanta’s flexible CPI.

I disagree.

As a reader of Mish (and yours), I tend to agree with his view of accounting for credit, but believe this clarification of terminology is necessary to reconcile any disagreement. That being said, I tend to think Mish’s deflationist claims are more about disinflation than outright deflation, but that may be a personal bias.

For some reason, the fact that all money is a loan is counter intuitive. But it is: every last penny of the aggregate money supply is a loan from someone.

So when debts are being defaulted or paid down, that is deflation. That is no more a matter of debate than gravity.

I don’t know of any dispute among physicists as to why objects on earth fall to the ground.

But, plenty of economists dispute the notion that money is an IOU. It might not just be counter-intuitive, but more importantly, wrong.

For some reason, the fact that all money is a loan is counter intuitive. But it is: every last penny of the aggregate money supply is a loan from someone.

That isn’t correct. A substantial portion of the aggregate money supply was created by credit expansion for sure, but not the entire aggregate supply. The hard currency component of M3 for example is “debt-free”. If you have $100 cash in your wallet, then that money is debt-free. If debtors default on their loans, then your cash won’t disappear. It will remain. It’s when you have money claims at a fractional reserve bank. That’s when debt defaults can result in monetary deflation.

I think he’s making the point that money is a claim on future consumption, and in that sense a loan. I don’t have all my widgets now, I have $1 and plan to use it to claim a widget tomorrow. This may not be right but it’s different from the claim you are rebutting.

I think he’s making the point that money is a claim on future consumption, and in that sense a loan

I don’t think so.

Money is a claim on present goods and services. A loan is a claim on a future cash flow.

MF,

You wrote “Money is a claim on present goods and services”

Mises (and other Austrians) say no. Money is the most marketable commodity. It is not an IOU, not a claim. You do not ‘claim’ goods with money. You exchange money for goods.

I agree.

I was only remaining consistent with Ken B’s terminology so that he understands that the money commodity is not debt, it is not a claim on future consumption. Sticking with the “claim” terminology, money is a “claim” on present goods.

You’re right, it’s not an IOU, it’s not debt, it’s not a claim that one MUST oblige.

Shouldn’t mild price inflation in the face of a very serious deflation count as major price inflation?

Of course not.

Back when it was published and I read Mish’s endorsement of the Krugman debate challenge I was a regular reader of Mish but had never heard of Murphy. I can’t remember if that’s when I started reading Murphy, but it wasn’t too long after that. I read both blogs regularly now. I really don’t think that his views are so different from Murphy’s. He is obviously an Austrian Economist in my opinion with some technical and macro stuff mixed in. His attacking inflationists often seems like an argument over semantics. I wouldn’t make too much of his “deflationist” self-labeling. I just take it to meen that he believes in a fractional-lending world the natural forces of the market is to deleverage while at the same time governments will fight that with more inflation. He believes that the deleveraging will inevitably occur or else the governments will lead their economies to bankruptcy and/or hyperinflation. None of this seems incompatible with what Austrian economists are saying.

Speaking of price inflation measures, the Atlanta Fed offers this measure: http://www.frbatlanta.org/research/inflationproject/stickyprice/