Norm MacDonald Tells the Moth Joke

I heard Bill Burr mention this–in the context of saying that many comedians act like they don’t care if people like them, but NM is the real deal–and I had to look it up.

Further Thoughts on Fractional Reserve Banking and Simple Theft

Again, it looks like I’m loading the deck by saying “FRB is like a mugger,” but that’s not the motivation for this analogy…

If you haven’t already read it, you should check out my previous post, where I set up a thought experiment to work through the mechanics of FRB, and how it might (or might not) cause the boom-bust cycle as described in the Austrian tradition.

Ironically, I created the analogy in that post in order to box Enrico into a corner, thinking he would have to admit that if a simple thief surreptitiously lent gold coins out into the community (without the owner realizing it), then surely this would distort interest rates, and so therefore FRB would do the same, if the depositors acted as if they still had their cash balances available.

However, my attempt didn’t work, because Enrico (understandably) clung to an important difference in the analogy, namely that the rich man in my story didn’t know what the thief was doing, whereas people in the modern world are (at least vaguely) aware of what’s going on with FRB.

To add insult to injury, one of the people on “my side”–namely, Dan–also didn’t find my analogy compelling, since in his mind the important thing about FRB and the boom-bust cycle is that FRB creates new money (which hits the loan market relatively early in its life). Since the thief in my original tale wasn’t creating money, but merely stealing it out of a vault, Dan didn’t see how this could be causing a boom-bust cycle in the Misesian framework.

So, in this post let me try to motivate my original idea. But I’ll have to take a detour first, in order to highlight what I think is so special about FRB.

First, imagine a rich guy is walking down the street with 10 gold coins in his pocket. A mugger comes up, sticks a gun in his belly, and takes 8 of the coins. This is certainly immoral and illegal, but it won’t cause a business cycle. The rich man realizes his cash balances have fallen, and so he changes his behavior accordingly. Resources in the economy get reallocated; they now cater more to the mugger and less to the rich man, compared to the original scenario, but there is no reason for the economy to enter upon an unsustainable boom. If, say, the rich man was about to spend those 8 coins on a stagecoach, while the thief instead spends them on a vacation in Barbados, that will simply change relative prices in the economy.

Even if the thief loans the money out, whereas the rich man would have spent it on consumption, that won’t cause a boom. It lowers the interest rate, but that is “correct” in light of the new distribution of wealth. The thief has a lower time preference than the rich man. The rich man has to reduce his consumption (because he just had a bunch of money stolen from him) and that frees up real resources, so the thief’s lending (and pushing down of interest rates) doesn’t cause the capital structure to get out of whack.

* * *

OK, so far so good, I’m imagining. I think Dan, Enrico, and I are all on the same page. Now let’s change things to a standard story of fractional reserve banking. Starting originally from a position of 100% reserve banking on demand deposits, the commercial banks look at all of their customers’ deposits of gold in their vaults, and take 80% of them, and lend them out into the community. This pushes down interest rates. But the original rich depositors don’t alter their behavior. Somebody who had planned on spending 8 of his 10 gold coins still does that. So aggregate consumption in the community doesn’t drop. Therefore, to the extent that the sudden drop in interest rates induces new investment projects that wouldn’t have occurred otherwise, there is an unsustainable boom that must eventually end in a bust.

* * *

At this point, Dan is still with me, but I believe I’ve lost Enrico. Now let me tweak it yet again. Instead of the commercial banks lending out 80% of the gold coins, instead what happens is that a thief slips into the bank vault, and takes out 80% of the coins. But he’s quiet about it, so nobody realizes what happened. The depositors don’t alter their behavior. So long as they don’t all try to withdraw their coins at the same time, the remaining pile of 20% of the coins is enough to satisfy the vagaries of spending/income imbalances.

If the thief lends the money out, won’t that cause a boom-bust cycle?

* * *

I think the thing that’s tripping us all up, is that it’s hard to see what economic function “sterile” money balances serve. In a stable equilibrium of perfect certainty, it’s “wasteful” for a rich guy to hold 10 ounces of gold in his cash balances; he should lend out that money (or use the gold for industrial/consumption purposes) and “put it to work.”

But in the real world, people hold cash balances (partly) in order to keep their options open for future purchases that they can’t know precisely, ahead of time.

So this is why, in my opinion, something is screwy if 100,000 people pool their savings into a common pile, and then they act collectively as if they all still have all of their money available, even though 90% (say) of the pile has been lent out.

Notice how common analogies break down here. For example, the owner of a parking garage can safely sell 1,000 (say) stickers that entitle the buyer to park his or her car in a lot that only has 100 parking spots, if the owner has studied the past and thinks there is only a very small probability that more than 100 people will want to park at the same time. That economizes on society’s scarce resources; it would be foolish to insist on “100% reserves” in such a setting. Let the market do what it will, perhaps with clauses in the contract for what happens if a buyer can’t find a spot. (This is like what happens when airlines overbook, and they have to use an auction to get people to give up their seat.)

But when it comes to cash balances, it seems to me at least that something weird happens if you don’t actually have the cash available. It’s not “wasting” the gold coins for them to be in your pocket even if you’re not spending them in the next 10 minutes, the way it is arguably “wasteful” if there is an empty parking slot with your name on it, even though you have no intention of leaving the house that day.

No, it seems to me that money sitting in your pocket (or in your wallet, your purse, your home safe, your bank vault, etc.) is “providing a flow of services” just by sitting there. It’s not that the money is being wasted until the moment you spend it.

And so in that light, if 1,000 people pool their savings hoping that only 100 of them will want to use them at any moment, that seems economically much different from 1,000 people chipping in to fund a parking garage with 100 spots. The former seems to me that it would cause a mismatch between investment and saving, whereas the latter seems like a clever and efficient leveraging of real estate.

Potpourri

==> This is an old but very interesting post from Mark Bahner on atmospheric CO2 and how quickly it could be removed if need be.

==> A very interesting post from David Beckworth on the yield curve (HT2 Scott Sumner). But most important–look at this analysis from Ben Bernanke back in 2006!! Not only was the Bernank totally wrong, but his wrongness is relevant to right now.

==> An interview with Stan Bush, who was instrumental in one of the greatest scenes in American movie history.

==> On the latest Contra Krugman: How to Unwind the Welfare State.

==> A petition to free Ross Ulbricht.

==> Venezuela’s annual price inflation rate is apparently more than 1 million percent…

==> I raise concerns about the Curbelo carbon tax bill, and Veronique de Rugy criticizes carbon taxes too.

==> I was amazed to see this letter to Nature (keep in mind that “climate mitigation” means “government policy actions taken to slow climate change”):

Our analysis shows that by 2050, the potential for a sizeableincrease in the risk of hunger is higher in the RCP2.6 scenariosunder climate mitigation than in the RCP6.0 scenarios withoutmitigation in all socio-economic futures and economic mod–els, despite the fact that RCP6.0 scenarios have more severe cli–mate change and greater reductions in crop yields (Fig. 1a–c;Supplementary Fig. 11). With the SSP2 socio-economic backdrop,the population at risk of hunger in 2050 increases by 24 million(2–56 million: the range represents variation across models here–after) with the climate impacts of the RCP6.0 scenario, comparedwith the baseline scenario. This number increases by around78 million (0–170 million) people with the combined climateimpacts and emissions mitigation policies of the RCP2.6 scenario(Fig. 1a and Supplementary Fig. 14 for the global and regionalbaseline scenario). Most of the increase in hunger in the RCP2.6scenarios is caused by the implementation of climate mitigationpolicies, not the climate change impacts.

No, Brett Kavanaugh Doesn’t Think Killer Whale Shows Are a Professional Sport

People I respect like Judge Napolitano have raised serious concerns about Brett Kavanaugh because of his rulings on privacy issues related to the Patriot Act etc.; see Judge Nap’s appearance on the Tom Woods Show for more details.

But what is a completely bogus criticism is that in his (in)famous dissent in the SeaWorld case, Kavanaugh had to stoop to the argument that putting on a killer whale show was the same thing as a professional sport, and since OSHA doesn’t interfere with safety in sports, therefore it shouldn’t mess with SeaWorld. (“Ha ha, what a right-wing tool, Kavanaugh can’t tell the difference between LeBron and Shamu.”)

For example, here’s a ThinkProgress piece repeating the claim, accompanied by an apparently smoking-gun quote from Kavanaugh’s opinion:

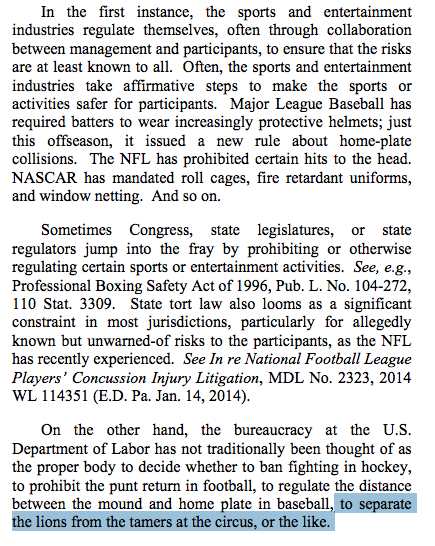

Now to be clear, this is totally wrong. Kavanaugh did NOT say that putting on a killer whale show was a sport. He repeatedly talked about the “sports and entertainment industries” in his decision, and was making arguments pertaining to both of them.

And the author of the ThinkProgress piece knew that, because he clipped the above quotation. Here is the context taken from Kavanaugh’s decision (starts on page 24 in this PDF), where I have continued the quote to the end of the sentence:

David, Goliath, and Gladwell

Say what you will about him, Malcolm Gladwell is a great storyteller. In conjunction with his 2013 book, here he gives a 15-minute TED talk on a new perspective regarding the famous underdog story:

As some of the outraged people in the comments brought up, the one glaring omission here is David’s faith. (Even if purely from a secular perspective, I wish Gladwell had mentioned it.) Surely it is relevant that David was absolutely certain of his victory, again, even in purely secular terms. Here’s the actual story:

32 And David said to Saul, “Let no man’s heart fail because of him. Your servant will go and fight with this Philistine.” 33 And Saul said to David, “You are not able to go against this Philistine to fight with him, for you are but a youth, and he has been a man of war from his youth.” 34 But David said to Saul, “Your servant used to keep sheep for his father. And when there came a lion, or a bear, and took a lamb from the flock, 35 I went after him and struck him and delivered it out of his mouth. And if he arose against me, I caught him by his beard and struck him and killed him. 36 Your servant has struck down both lions and bears, and this uncircumcised Philistine shall be like one of them, for he has defied the armies of the living God.” 37 And David said, “The Lord who delivered me from the paw of the lion and from the paw of the bear will deliver me from the hand of this Philistine.” And Saul said to David, “Go, and the Lord be with you!”

…

41 And the Philistine moved forward and came near to David, with his shield-bearer in front of him. 42 And when the Philistine looked and saw David, he disdained him, for he was but a youth, ruddy and handsome in appearance. 43 And the Philistine said to David, “Am I a dog, that you come to me with sticks?” And the Philistine cursed David by his gods. 44 The Philistine said to David, “Come to me, and I will give your flesh to the birds of the air and to the beasts of the field.” 45 Then David said to the Philistine, “You come to me with a sword and with a spear and with a javelin, but I come to you in the name of the Lord of hosts, the God of the armies of Israel, whom you have defied. 46 This day the Lord will deliver you into my hand, and I will strike you down and cut off your head. And I will give the dead bodies of the host of the Philistines this day to the birds of the air and to the wild beasts of the earth, that all the earth may know that there is a God in Israel, 47 and that all this assembly may know that the Lord saves not with sword and spear. For the battle is the Lord‘s, and he will give you into our hand.”

Contra Cruise 2018 Contest Winners

I can’t remember if I posted these already? Anyway, here is the runner-up video, and then the two winners for this year’s contest:

A Thought Experiment on Fractional Reserve Banking

Enrico in the comments of my FRB lecture writes:

“if someone lends 100$ to a bank for a fixed time period, and then the bank makes a loan of 90$, no boom&bust cycle will happen. The reason is that the 90$ loan granted by the bank is “backed” by (at least) 90$ real savings from the initial lender. But the same conclusion is true in fractional reserve banking. If someone deposits 100$ into a bank, he is saving (= not consuming) that money until the moment when he’ll withdraw it. Thus, if bank reserves are sufficient for satisfying depositors’ withdrawing, it means that bank loans are backed by real savings. If banks reserves happen to be insufficient, the bank goes bankrupt and the depositors will have to wait for getting their money back (= not consuming in the meantime); therefore, they will be “forced” to save such amount of money. In conclusion, in a free banking system, bank credit is always backed by real savings, and thus cannot generate boom&bust cycles.”

Before we ponder this, let’s think about a different scenario.

Suppose there is a rich man in a small community. He has (say) 1,000 ounces of gold stored in his personal vault at his house. Depending on the vagaries of his income and expenses, the man dips into his personal stockpile, but typically he can go for months at a time without the stockpile ever falling below (say) 500 ounces.

Some workmen come to the rich man’s house to add another bedroom. One of them realizes that he can surreptitiously carve out a small opening into the vault from the outside, which is invisible to a casual passerby.

From that point on, this workman makes regular trips to the vault. He sneaks out anywhere from 100 to 200 ounces of gold at a time, taking them from the back end so that the rich man wouldn’t notice it when he enters his vault from the inside. The workman isn’t a fool; he doesn’t blow the money on consumption, but instead makes loans in the community that he thinks will pay off. When someone pays back a loan, the workman puts the principal back in the vault (at night of course), and keeps the interest for himself. Obviously, if someone defaults on a loan, then the workman has to eat the loss out of his gross earnings on the other loans.

My question: ECONOMICALLY (I’m not talking about ethics, morality, or legality), is there any problem with this? Will some investment projects be funded that otherwise would not? If so, is that a problem?

Is It Intellectually Honest to Chortle About This?

Major Freedom tipped me off to this Bloomberg interview with Krugman, which aired in March 2017:

So in the interview, Krugman says 3% growth is not possible, even if they made him dictator. (Really.) Krugman goes on to say that 2% growth is the reality we now face, for various reasons (like demography), unless there is a productivity “miracle” which no one knows how to engineer through policy.

The reason people on reddit are mocking this, of course, is that the latest GDP numbers show 4.1% quarterly growth, but even year/year it’s 2.8%.

So my question: Is this yet another example of Krugman being wildly wrong in his prognostications? Or in context, did he mean in the interview that 3% sustained growth over the next decade (say) was impossible?

More specifically: At what point would even Krugman’s defenders admit he was wrong? (Note well, I too am worried about a crash as the Fed hikes rates, so I’m not saying I am optimistic about the future. But I *do* think Krugman doesn’t understand how much marginal tax rate reductions can boost growth.)

Recent Comments