Ben Swann and Josh Tolley Reflect on the Objectification of Women

This was hands down the highlight last night at “Galt’s Gulch” in Chile. It’s not about me, it’s about the karaoke.

Krugman: Failed Apocalyptic Predictions Are Laughable, Unless They Support Bigger Government

Not his exact words, mind you.

Krugman in his November 7 review of William Nordhaus’ new book on climate change economics:

Forty years ago a brilliant young Yale economist named William Nordhaus published a landmark paper, “The Allocation of Energy Resources,” that opened new frontiers in economic analysis….

For if one looks back at “The Allocation of Energy Resources,” one learns two crucial lessons. First, predictions are hard, especially about the distant future. Second, sometimes such predictions must be made nonetheless.Looking back at “Allocation” after four decades, what’s striking is how wrong the technical experts were about future technologies….For what it’s worth, current oil prices, adjusted for overall inflation, are about twice Nordhaus’s prediction, while coal and especially natural gas prices are well below his baseline….

So the future is uncertain, a reality acknowledged in the title of Nordhaus’s new book, The Climate Casino: Risk, Uncertainty, and Economics for a Warming World. Yet decisions must be made taking the future—and sometimes the very long-term future—into account….And as Nordhaus emphasizes, although perhaps not as strongly as some would like, when it comes to climate change uncertainty strengthens, not weakens, the case for action now.

…

But it seems that we have, without knowing it, made an immensely dangerous bet: namely, that we’ll be able to use the power and knowledge we’ve gained in the past couple of centuries to cope with the climate risks we’ve unleashed over the same period. Will we win that bet? Time will tell. Unfortunately, if the bet goes bad, we won’t get another chance to play.

Krugman on October 24 discussing the people warning about big government deficits and central bank asset purchases:

Once upon a time, walking around shouting “The end is nigh” got you labeled a kook, someone not to be taken seriously. These days, however, all the best people go around warning of looming disaster….

As I’ve already suggested, there are two remarkable things about this kind of doomsaying. One is that the doomsayers haven’t rethought their premises despite being wrong again and again — perhaps because the news media continue to treat them with immense respect. The other is that as far as I can tell nobody, and I mean nobody, in the looming-apocalypse camp has tried to explain exactly how the predicted disaster would actually work.

On the Chicken Little aspect: It’s actually awesome, in a way, to realize how long cries of looming disaster have filled our airwaves and op-ed pages.

…

So has the ex-Maestro reconsidered his views after having been so wrong for so long? Not a bit.

…

So the next time you see some serious-looking man in a suit declaring that we’re teetering on the precipice of…doom, don’t be afraid. He and his friends have been wrong about everything so far, and they literally have no idea what they’re talking about.

Just to be clear, I skillfully used ellipses so it wasn’t obvious Krugman was talking about people wanting to cut government spending. And the ex-Maestro who hasn’t reconsidered his views after having been so wrong for so long is Greenspan, not Nordhaus.

Krugman: ObamaCare Rollout the Fault of Private Insurance; Single Payer Would Fix Everything

A lot of us have been warning that ObamaCare is a system that even many of its proponents knew would fail, but in so doing would pave the way for their true objective: the elimination of private health insurance to be replaced by the federal government as a “single payer” for all medical care.

In that context, check out Paul Krugman’s recent efforts to explain the unfolding disaster of the Healthcare.gov rollout:

Obamacare isn’t complicated because government social insurance programs have to be complicated: neither Social Security nor Medicare are complex in structure. It’s complicated because political constraints made a straightforward single-payer system unachievable.

It’s been clear all along that the Affordable Care Act sets up a sort of Rube Goldberg device, a complicated system that in the end is supposed to more or less simulate the results of single-payer, but keeping private insurance companies in the mix and holding down the headline amount of government outlays through means-testing. This doesn’t make it unworkable: state exchanges are working, and healthcare.gov will probably get fixed before the whole thing kicks in. But it did make a botched rollout much more likely.

So Konczal is right to say that the implementation problems aren’t revealing problems with the idea of social insurance; they’re revealing the price we pay for insisting on keeping insurance companies in the mix, when they serve little useful purpose. [Bold added.]

God the Father

What are the attributes of a good father?

==> He loves you unconditionally.

==> He has the power to take care of you.

==> He is fair and just.

==> He makes plans for your future prosperity.

==> He teaches you to help you avoid error.

==> He disciplines you when you are in the wrong, in order to teach you.

==> He pursues you if you run away and welcomes you back even though you betray him countless times.

==> He would die for you.

Explaining the Success of the Keynesian Revolution

A lot of times Austrian economists will say that the Austrians used to be really popular and influential, but that they were eclipsed by the Keynesians in the 1930s. Then they might explain this outcome along the lines of, “The Keynesian economists told government officials exactly what they wanted to hear: spend more money to fix this depression, whereas the Austrians told them they were the problem, not the solution. So naturally, the Keynesians ended up teaching at the top rank schools (funded with tax dollars) and staffed all the important posts.”

Now usually, mainstream economists reject this type of explanation as a self-serving conspiracy theory. They will say the Austrians failed the “market test” in the academic arena. “If you Austrians had better ideas, they would have risen to the top in the peer-reviewed journals. Stop whining.”

In that context, I was very surprised to read Paul Krugman’s account of the Keynesian triumph:

If you go back to the state of American economics in the 1930s and even into the 1940s, it was not at all the model-oriented, mathematical field it later became. Institutional economics was still a powerful force, and many senior economists disliked mathematical modeling. When Paul Samuelson published Foundations of Economic Analysis in 1947, the chairman of Harvard’s economics department tried to limit the print run to 500, grudgingly accepted a run of 750, and ordered the mathematical type broken up immediately.

So why did model-oriented, math-heavy economics triumph? It wasn’t because general-equilibrium models of perfect competition had overwhelming empirical success. What happened, I’d argue, was Keynesian macroeconomics.

Think about it: In the 1930s you had a catastrophe, and if you were a public official or even just a layman looking for guidance and understanding, what did you get from institutionalists? Caricaturing, but only slightly, you got long, elliptical explanations that it all had deep historical roots and clearly there was no quick fix. Meanwhile, along came the Keynesians, who were model-oriented, and who basically said “Push this button”– increase G, and all will be well. And the experience of the wartime boom seemed to demonstrate that demand-side expansion did indeed work the way the Keynesians said it did.

Except for that last sentence–the part about Keynesianism “work”ing–Krugman’s narrative fits almost exactly the (allegedly) self-serving Austrian version.

Murphy vs. Yglesias On Chinese Bond Purchases

In this Daily Caller article I dispute Matt Yglesias’ recent argument that the Chinese government exercises no leverage over the American government because it buys so much of its debt. An excerpt:

The only way to completely offset both [rising U.S. Treasury yields] and [rising U.S. consumer prices], is if foreign investors are willing to step into the breach and smoothly offset the Chinese unloading of Treasuries, without asking for a higher yield on the assets to induce them to expand their holdings. Only in this case would Americans be relatively unaffected; the immense holdings of Treasuries would simply have switched from China to, say, Japan.

But the President Said I Could Keep My Health Insurance…?

Remember how President Obama defused all the paranoid whining from people who didn’t want the government to help poor people get insurance? For example:

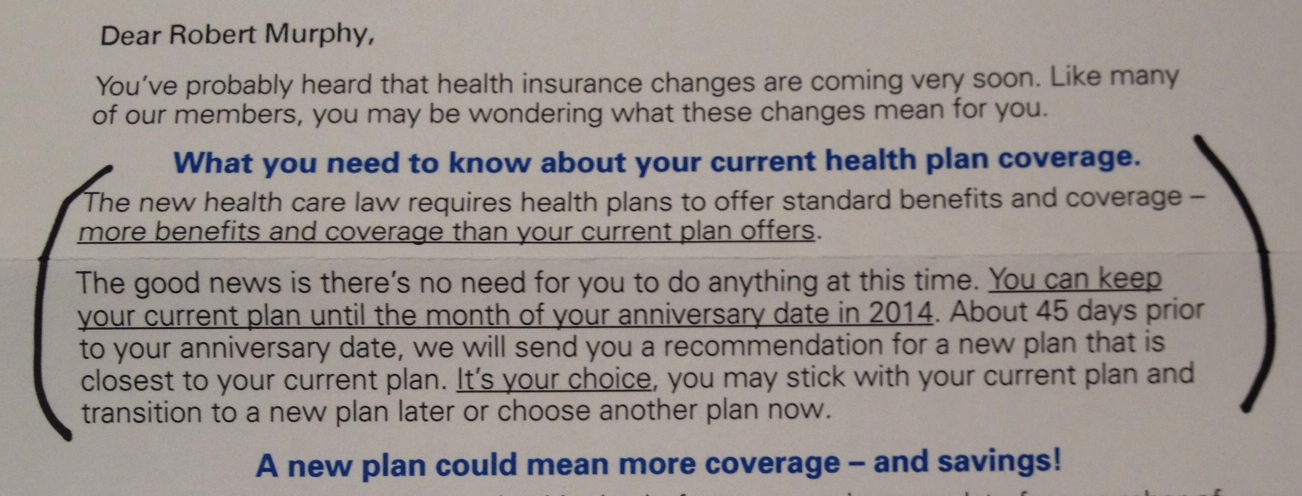

Yesterday I got this letter from my insurance company:

I thought I was happy with my health insurance plan, but I must have been mistaken. That’s the only explanation.

In any event, I can’t wait to see all the savings I’m going to get from my new plan with more benefits!

Recent Comments