More Krugman Re-Writing of His Stimulus Views

I really had decided I was going to lay off Krugman for a while, but this one was too much. In light of the 5th anniversary of the Obama stimulus package, Krugman is claiming that he never understood the Christy Romer’s team’s rosy forecast of a quick recovery back in early 2009. Greg Mankiw winces with pain…

Details here.

David R. Henderson on CBO and ObamaCare

The opening paragraphs from my new Mises Canada post:

The good thing about the Internet is that there is a Hayekian safety net: When a bunch of free-market economists are idiots and overlook an obvious point, eventually somebody comes along to rescue them. For today’s example, we have the arguments over the CBO’s estimate that the Affordable Care Act (ACA aka “ObamaCare”) will cause a reduction of the equivalent of 2.5 million full-time jobs in the U.S. labor market.

In previous posts (here, here, and here), I walked through the attempts of Paul Krugman and other ACA apologists to spin this finding as a good thing. Yet there was something incredibly obvious that I (and everybody else I have been reading) missed, until David R. Henderson pointed it outin a piece for the Hoover Institution. David writes:

Can’t stand the suspense? You’ll have to click the link.

Scott Sumner Statistics: Trust, But Verify

I am being sincere when I say that I’m not accusing him of skullduggery, but I’ve noticed that sometimes Scott Sumner’s descriptions of the data lead the reader to imagine something far different from the reality. A good recent example of this is Scott’s discussion of his theory that it was (purposelessly) tight monetary policy that brought on the Great Recession:

Inevitably when I make this argument there are a few tiresome “people of the concrete steppes” who insist the Fed did not cause the recession, they merely failed to offset the fall in velocity. Unfortunately they haven’t bothered to look at the data. After rising at roughly a 5% rate for many years, the Fed brought growth in the monetary base to a complete halt between August 2007 and May 2008. That triggered the onset of recession in December 2007. Velocity actually rose during that 9 month period, but not enough to offset the Fed’s tight money policy. [Bold added.]

So from the sentence I put in bold–and especially to understand why the second greatest financial crisis struck the world in the fall of 2008–Scott’s innocent reader would assume that annual growth in the monetary base had bounced around in a fairly narrow band centered on 5% for at least 10 (?) years, with this steady 5%-ish growth chugging along until July 2007. Then, this pattern was completely disrupted starting in August 2007, when growth in the monetary base fell off a cliff.

Yet if we go look at the actual data, they don’t remotely resemble Scott’s story:

Don’t get me wrong, the above chart makes it a little awkward for other Austrians and me to tell our preferred story, namely that it was massive Fed inflation that fueled the housing bubble. (I have tried to do so e.g. here and here. But my point is, it would be easier to convince skeptics if the surge in the monetary base had been higher in the early 2000s than in practice it was.) But for sure, the above chart doesn’t seem to line up at all with the narrative Scott is spinning in the block quotation.

Financial Sector “Suicides” Mounting

Yet another JP Morgan employee has apparently committed suicide:

A third JP Morgan employee has died under mysterious circumstances in a matter of few weeks. A still unidentified “Chinese male in is thirties” jumped from the roof of Charter House, the 30 floor Hong Kong headquarters of JPM.

An eyewitness told the South China Morning Post he saw a man climb onto the roof of the skyscraper shortly after lunchtime on Tuesday.

…

The unidentified man, aged about 33, was a junior employee who served a supporting function at the bank and wasn’t involved in investment activity, according to Bloomberg. Rumors circulating in the media say that his last name was Li.A colleague of the man said that before the suicide he had complained about heavy work-related stress, though police say no suicide note has been found.

“Out of respect for those involved, we cannot yet comment further. Our thoughts and sympathy are with the family that’s involved at this difficult time,” JP Morgan said in an e-mailed statement.

The latest apparent suicide marks the 3rd sudden death at JP Morgan and the 6th in the global financial world in just a few weeks.

In my earlier comments on this trend, I wished for someone to tell us the context; after all, there are a lot of people in the financial sector around the globe, so how many would you expect to commit suicide in a given month?

No matter what, I think we can all agree that this particular case is extremely suspicious:

The founder and CEO of American Title Services in Centennial was found dead in his home this week, the result of self-inflicted wounds from a nail gun, according to the Arapahoe County coroner.

Richard Talley, 56, and the company he founded in 2001 were under investigation by state insurance regulators at the time of his death late Tuesday, an agency spokesman confirmed Thursday.

It was unclear how long the investigation had been ongoing or its primary focus.

A coroner’s spokeswoman Thursday said Talley was found in his garage by a family member who called authorities. They said Talley died from seven or eight self-inflicted wounds from a nail gun fired into his torso and head. [Bold added.]

Really? I could conceivably believe that a guy who had wrecked his company would punish himself by firing a nail gun into his torso once, before turning it onto his head. But wouldn’t he have to be James Bond to shoot himself “seven or eight” times? (I tried finding out how many of the shots were to the head, but couldn’t come up with a breakdown.)

If you want to see a more explicitly conspiratorial explanation of these events, try this piece (HT2 Frank C.).

Follow-Up On India’s Ban on Child Labor

In a recent post I asked people to draw me a picture, illustrating the claim floating around the free-market blogosphere that India’s ban on child labor perversely led to more children being employed. (If you don’t know/remember the context, you need to go read that first post for this one to make any sense.)

Well, Tel in the comments gave a nudge in the right direction, but as usual, if you want something done…

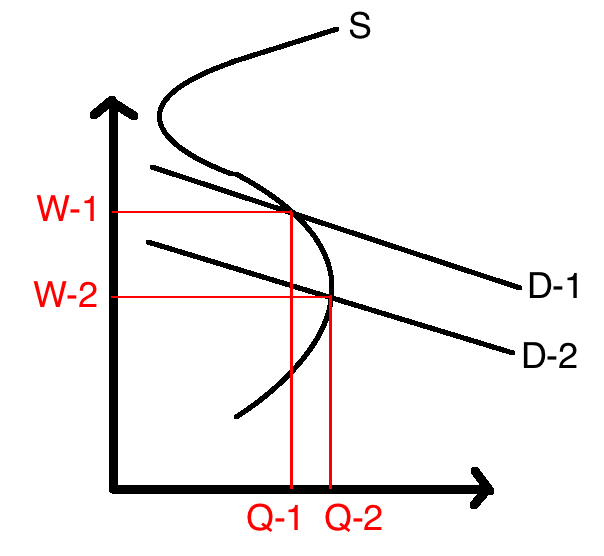

So in the above diagram, we see that even though the Demand for child labor drops (from D-1 to D-2) after the government announces it will fine any employer caught with kids on the payroll, nonetheless the total quantity of child labor increases in equilibrium.

The reason, of course, is that the Supply curve has a region that is “backward bending,” presumably because the income effect dominates the substitution effect.

OK, I suppose that’s possible, but what really made me suspicious was that the academic paper that started this whole discussion says–unless I misunderstood it–that not only did the number of children employed go up, but that the total wages paid to children increased as well (and by a lot).

Does that really make sense? I guess you could do it for an individual household. They needed the 14-year-old to bring in $5/week, then the child labor ban cut his earnings to $4/week, so the family sends his younger sister (who only makes $2/week) so the two combined end up bringing home $6/week, a 20% increase from the original outcome. And given that you’re going to send his sister to the factory, you might as well make her go full-time, rather than just enough to make up the shortfall in “mandatory” income.

But does this make sense for the country as a whole, and over many years?

To repeat, I’m not saying this story is impossible, I just think free-market fans are too quick to trumpet this explanation since it fits in so nicely with their hostility to the ban on child labor. (Also note, whether or not the explanation holds, it’s obviously not doing child laborers any favor by making it illegal for employers to hire them.)

Administration Celebrates the ARRA (“Obama Stimulus Package”)–And Cites Bastiat!

I am pretty sure this qualifies as heresy. At least Paul Krugman has the decency to call French classical liberals cockroaches when discussing their relevance to fiscal multipliers. But Scott Sumner alerts us to page 33 of the Obama Administration’s 5-year report on the American Recovery and Reinvestment Act (ARRA), aka the Obama Stimulus Package passed in early 2009:

The Recovery Act and subsequent jobs measures also contained a large number of

provisions that were aimed at strengthening long-term growth. In designing the Act, the

Administration believed that it was not just the quantity of the fiscal support that mattered, but

the quality of it as well. In this sense, the Administration took to heart a lesson that has been

pointed out by many but can be traced back as early as the 19th century to a French writer and

politician named Frederic Bastiat. Bastiat (1848) wrote of a shopkeeper’s careless son who broke

a window in the storefront. When a crowd of onlookers gathered to inspect the damage, Bastiat

took objection to the discussion that ensued: “But if, on the other hand, you come to the

conclusion, as is too often the case, that it is a good thing to break windows, that it causes money

to circulate, and that the encouragement of industry in general will be the result of it, you will

oblige me to call out, ‘Stop there!’”For this reason, the Recovery Act was designed not just to provide an immediate, short-

term boost to the economy, but also to make investments that would enhance the economy’s

productivity and overall capacity even after the direct spending authorized by the Act had phased

out. The Act’s investments in expanding broadband infrastructure and laying the groundwork for

high-speed rail, to take two examples, are a far cry from the broken window in Bastiat’s parable

because they do so much more than simply restore things to how they once were. Rather, these

types of investments will raise the economy’s potential output for years to come, from a rural

school that can now offer its students and teachers high-speed Internet access, to a business that

has a new option to transport its goods more quickly.

Note that the formatting is from the original, including the omission of “锑s from his name. They were trying to save taxpayers money, I’m sure.

Last thing: In the Executive Summary, they claim that the ARRA directly provided $674 billion in “fiscal support through 2012,” and that it saved or created “about 6 million job-years” of full-time employment through 2012. That works out to $112,000+ per job. Did all those beneficiaries get (or keep) jobs that paid an average of $112,000 in annual salary? If not, what would the numbers need to look like for the Administration to report, “Man we wasted a lot of money.” ?

(And of course I dispute the figures from the outset; I think the ARRA reduced employment. I’m just pointing out that even on their own terms, this was a very inefficient use of money.)

Has QE EVER Worked?

I ask at my latest Mises Canada post.

On Twitter, Josiah Neeley wanted me to defined “worked.” I responded: “Economy was awful, central bank doubled (at least) balance sheet in short time, economy seemed fine, balance sheet back to normal.”

Tom Woods and I Discuss a Rolling Stone Article

Sounds low brow, right? But not in our hands.

Recent Comments