More Moves Against the Dollar

The problem with the USD being the world’s reserve currency is that it’s a situation where things could unravel very suddenly. So long as most investors think that the dollar will be OK next week, then it will be a self-fulfilling prophecy. But if people start to worry, then there could be a sudden crash as people head for the exits. Thus the USD system is like a giant commercial bank subject to a run, whenever the public loses confidence.

In that context, it’s interesting to relate three recent news items:

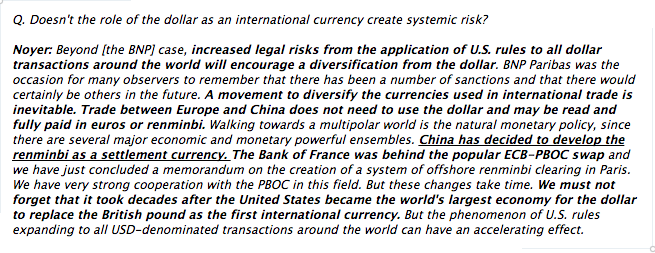

==> ZeroHedge reported on this exchange (in an interview in a French magazine) with Christian Noyer, governor of the French National Bank and member of the ECB’s governing board:

==> The German government recently decided to keep its gold stored in the US after all, but Gary North explains the irony of that decision.

==> Russia and China made a major energy deal that didn’t involve the US dollar. Here’s how a Telegraph article analyzes the significance:

With the dollar as the world’s petrocurrency, it also remains the reserve currency of choice for central banks globally. As such, the US is currently able to borrow with “exorbitant privilege”, as it has for decades, simply printing money to pay off foreign creditors.

With China now the world’s biggest oil importer and the US increasingly stressing domestic production, the days of dollar-priced energy, and therefore dollar-dominance, look numbered. Beijing has recently struck numerous agreements with major trading partners such as Brazil that bypass the dollar. Moscow and Beijing have also set up rouble-yuan swap facilities that push the greenback out of the picture.

If Russia and China now decide to drop dollar energy pricing totally, America’s reserve currency status could unravel fast, seriously undermining the US Treasury market and causing a world of pain for the West. This won’t happen tomorrow or next year. It’s unlikely even by 2020. But by announcing this deal, Russia and China turned the screw half a twist more.

Two David Stockman Hits

Here he is on the Scott Horton show talking about foreign policy, and here’s the transcript of his recent appearance on the Tom Woods show talking about his (Stockman’s) conversion from the Left.

If only there were somewhere you could go to see David Stockman live… Oh wait!

Downtown Nashville

Apparently it was featured in Forbes recently with this shot:

Hey hey hey kids, if you want an excuse to check out “NashVegas”–and you want to hear hard-hitting commentary on our financial system–come to the Night of Clarity August 15!

Tom Woods’ Opening Talk at Mises University

Tom got us all fired up last night:

Hmm you’re probably wishing that you could catch Tom live. And you’re free on August 15. Plus you’ve been meaning to visit Nashville because you hear it’s as fun as Vegas but classier. Oh I know! You can come to our Night of Clarity!

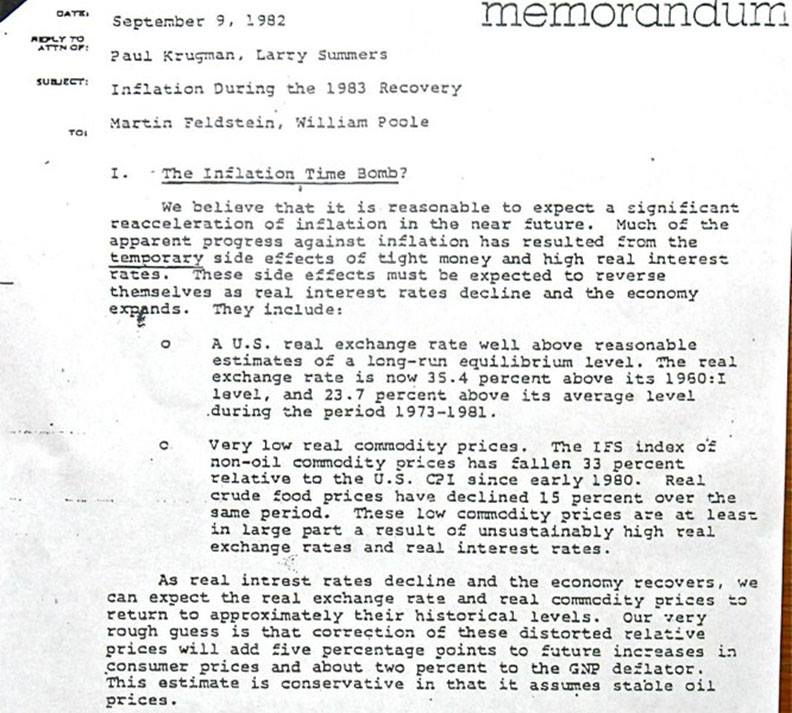

A Freudian Explanation of Paul Krugman

Phil Magness posted this in the comments of my Facebook link to Krugman’s banana post. I of course knew about this memo, but I’m not sure if I ever saw the section header.

You may recall that this was the period in Krugman’s life when he flirted with Austrian economics.

Potpourri

==> My latest Mises CA post catches Krugman being misleading, at best, regarding the latest CBO long-term budget outlook.

==> Tom Woods has a great, ecumenical interview with Ralph Nader.

==> If there is something creepier than Scott Sumner endorsing Cass Sunstein trying to get people to second-guess their intuition against killing innocent fat guys, I’d like to hear it.

==> Steve Horwitz responds to Yglesias on gold standard.

==> Rand Paul can’t handle the truth! He scrubs my book from his website.

==> Krugman gives a fruity response to my exchange with Noah Smith, which contains this great admission: “[T]he main point is that nobody else cares about the monetary base, or at any rate they care about it only to the extent that it was presumed to say something about future rises in the CPI.”

I would have been reluctant to attribute such a naked stance to him before, but hey, he volunteered that.

Last point on this: In fairness, I have heard Peter Schiff at least once make the rhetorical move that Noah and Krugman are complaining about here. Specifically, one time I did catch Schiff on a CNBC show or something like that where the anchor said, “You’ve been wrong or premature in your inflation warnings, haven’t you Peter?” and he tried to say, “We have had inflation, inflation is what Bernanke’s been doing…” But I hope any fair reader will agree that that is NOT something I have been doing, and Noah is wrong to act as if this definitional point was invented by Austrians after the fact to cover up failed CPI predictions.

Hello! McFly!

I realize I am hardly unique in this observation, but it astonishes me when I think back to how naive and clueless I was, growing up. The things I feared, the people I tried to impress, the reckless decisions I made, the people I foolishly trusted, the times I shied away from doing what I knew was right…

When I go down this path, I often wonder whether “Future Bob” could have changed things. If only Present Bob could go back in time and have a talk with High School Bob or College Bob, wow the things I could tell him. Think about it: With the possible exception of my son, there is nobody to whom I would have given more careful, loving, and excellent advice, than my (say) 20-year-old self, from my current vantage point.

Yet here’s the kicker: What if right now, I got a knock on my door, and there was Future Bob? Even if he spent 30 minutes convincing me beyond a shadow of a doubt that he was legitimate, and even if I could agree with him that he had my best interest at heart, and that he had an unbelievable advantage over me in knowing the effects of various courses of action I am currently considering…would I still unconditionally obey him?

No, I don’t think I would. And by the same token, I think High School Bob would say, “Thanks for the advice, but I think I’m still doing it this way. And, uh, holy cow what happened to your hair and weight?”

If any of this made you chuckle, I have one last observation: Even Bible-believing Christians often willfully disobey what they know God wants them to do. As Goldmember would ask, “Ishn’t zhat veird?”

Continuing My Chats With Noah Smith

Since some of you asked, I deliver. An excerpt:

Now in all seriousness, Noah is actually a really sharp guy. The problem is that he’s JUST SO SURE the Austrian contribution to recent debates is so absurd, that he doesn’t even try to understand where we’re coming from. He’s like the patronizing police psychologistSilberman interviewing Kyle Reese in the first Terminator movie: “This is great stuff. I could make a career out of this guy! You see how clever his part is? How it doesn’t require a shred of proof? Most paranoid delusions are intricate, but this is brilliant!” Needless to say, with an attitude like that, Noah is just as oblivious to the dangers facing us, even though he (just like Dr. Silberman) no doubt thinks he’s being very scientific in his handling of my unorthodox claims.

Recent Comments