Krugman Gloating on Gold

This really makes no sense. As everybody knows, gold just had the biggest one-day drop in three decades. Here’s Krugman’s reaction:

So, the slide in gold has turned into a rout. As Joe Weisenthal says, this should be seen as really good news, because it offers strong evidence that the goldbug/inflationista view of the world — which says that we need to stop all efforts at monetary and fiscal stimulus lest we turn into Weimar — is, in fact, all wrong.

…

Maybe, just maybe, the gold crash will finally bring intellectual capitulation. But I wouldn’t bet on it.

OK how would an inflationista explain the movements in the price of gold? He’d say it was connected with Bernanke’s wild money printing, right? So what would you expect the price of gold to do, if that theory were right?

Well, when the Fed announced a major new initiative, like QE3, you’d expect gold to shoot up. And then when the minutes came out from a Fed meeting saying they had discussed stopping asset purchases this year, you’d expect the price of gold to tumble.

And that’s exactly what happened, as even Bloomberg framed it: “On April 12, gold slumped into a bear market on concern that Cyprus may sell bullion holdings to cover a bailout, and the Federal Reserve signaled that that U.S. monetary stimulus may be scaled back this year.”

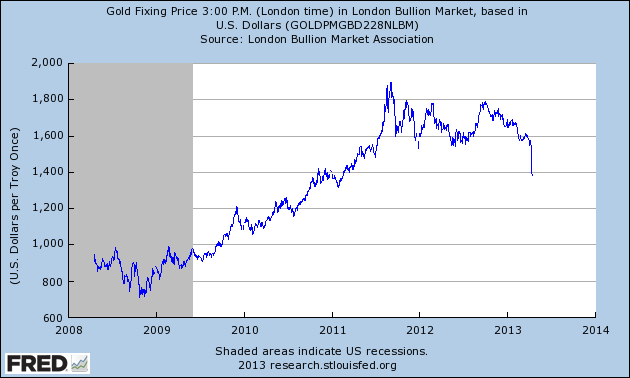

Here’s the price of gold over the last 5 years:

So even with the recent drop, it’s still up about 75% from when the Fed really kicked in with quantitative easing. You can see it zoomed up around September 2012, which was when QE3 was announced. I’m getting ready for a trip, but you guys can check and see if the timing of QE2 works also.

In contrast, what was Krugman’s theory about gold prices? Well for the first few years of the crisis, he just said ‘volatility, who the heck knows.’ (That’s a paraphrase, not an exact quote, but that’s really what he said.) Then, he blamed it on Glenn Beck (really). Finally, he was relieved when somebody suggested it was due to very low real interest rates, because then Krugman could finally give a wise, elegant model to explain why the goldbugs were confused (focusing on the Fed’s asset purchases as the trigger, instead of the falling real interest rates).

Now since Krugman congratulates himself for his willingness to admit when his model is wrong, somebody should let him know that rates across the entire yield curve slightly fell over the recent drop in gold. (Same for real yields.) This goes in the wrong direction, according to Krugman’s model. In other words, falling interest rates should mean gold prices go up. (NOTE: That link to the Treasury yield curve data isn’t time-stamped, so it will be obsolete soon after this post runs.)

So there you have it: The qualitative movements in the gold price generally fit the “goldbug, crazy Bernanke” story, including the fact that gold is still way up from its level pre-crisis. In contrast, Krugman’s own model of gold prices doesn’t even go in the right direction for the recent crash.

Look, no simple model is going to explain every zig and zag of the price of gold, and obviously I don’t endorse a long-term rational expectations approach to commodity prices; of course there are bubbles and busts possible in any asset class. (I’m also aware of speculation about rigging the market, but I just don’t know enough to comment on these claims.)

My simple point is, once again, Krugman is running a victory lap for data that generally match his opponents’ worldview, but are completely at odds with his own. Isn’t that weird?

I haven’t read a convincing case linking the rise in the price of gold stock and quantitative easing. The correlation is there, but what’s the causation? I can see an indirect link, which is that people became interested in gold as an inflation hedge. But, I feel that most of the volatility in gold prices is speculation, pure and simple. As demand for gold stock rose, others began to invest in it as well, leading to greater changes in gold prices than what would have otherwise occurred. The thing is, even here the connection between inflation and gold prices is an expectational one, and there’s nothing which makes these expectations necessarily accurate. This still runs contrary to Krugman’s model, but it’s not quite what Austrians have in mind, either.

Just to put the idea out there, my problem with Krugman’s model is that it doesn’t explain why gold is a more profitable investment than other assets. It doesn’t explain why, in a world of depressed yields, people opt for gold over other alternative assets. It must be that people see something in gold that they don’t elsewhere, and I think this original “stimulus” was a change in inflation expectations amongst a sufficient number of investors to move the price of gold. Once it became profitable, then other investors began speculating, as well.

“I feel that most of the volatility in gold prices is speculation, pure and simple.”

I’ve never understood the idea that speculation is mindless tracking of trends. Especially since, if that were the case, gold would continue to rise in demand basically forever, because what would create volatility. Why would it go down if the equation is simple as “rising demand = more rising demand by speculators”. Caught in a never ending loop, there.

“The correlation is there, but what’s the causation? I can see an indirect link, which is that people became interested in gold as an inflation hedge.”

Why is that an indirect link? I, personally, bought silver (not gold, as I’m not very wealthy) precisely because I thought (still do, in fact) that QE would eventually result in high levels of inflation. (My opinion is that this is being temporarily staved off by the incredibly high levels of excess reserves the banks are holding now.) Yeah, it is expectational, but the fact remains that the theory exists that supports those expectations – and the world is run on expectations in many ways, especially in investment.

Why do you assume the Fed would not take action to tighten credit as soon as they see excess reserves fall rapidly? Why do you assume our trading partners will not start to buy dollars to devalue their currency if the dollar starts to fall rapidly?

People buy gold because they think gold is going up. There is no other reason to buy it.

1. When the return to other assets rises, someone may rearrange their portfolio by selling gold. If someone else’s position is based solely on the notion that the price of gold will continue to rise, then expectations will have to be revised and there may be a steep drop in gold as people sell their position. The “bubble” elements are still there;

2. Expectations are an indirect channel of monetary policy. A direct relationship would be where new money is printed, loaned to investors, and then invested in gold. If the new investment is only expectations drive, though, then the rise in the price of gold is not necessarily caused by an actual increase in the money supply (or a rise in velocity).

“If the new investment is only expectations drive, though, then the rise in the price of gold is not necessarily caused by an actual increase in the money supply (or a rise in velocity).”

Good point Jonathan. Maybe that’s why Mises, Rothbard and the rest of the Austrian Schools don’t believe in the the velocity of money.

It is certain that the subjective theory of value does certainly have a lot to do with the price of gold, as does the most important element of the regression theorem. Professor Murphy pointed to key factors in the fall in price which are Cyprus’ desire to sell its holdings, as well as Goldman Sachs listing it as a sell. Bubbles are in every asset, and in many commodities (best example is oil), but in the long run gold still maintains all the important features as a safe investment. If one is to expect gold to rise in tandem with Fed intervention, one would be too eager in purchasing the commodity. I would fully agree with Neil below, as speculators and investors of bullion understand, one should see this as a signal that inflation is about to set in. The future is not something fully predictable, and due to the plethora of factors in play when affecting investments of equities and commodities (especially when government is distorting everything, nothing is going to move in a straight line.

Nothing moves up in a straight line, especially not precious metals in a bull market. The bull market in gold began in 2001 or so. Its decline in 2008 was over 40%, so what is happening now is just a healthy correction to clear the market of weak hands. The gloating by Krugman and his ilk is evidence that the decline is closer to being over, rather than just beginning. One thing that everyone needs to remember is the economic results of a given policy can take several years to manifest themselves. Such policies, like QE and an ultra low FED funds rate, are like earthquakes in the middle of the Pacific Ocean. They happen at a certain time, and everything is just fine when it occurs. The devastation results some time later in the form of a tsunami. Make no mistake that the world will reap the consequences of nearly five years, or more, of credit expansion on such a scale as we have seen here in the U.S. A monetary tsunami is coming to us. When it happens, it will be of such a magnitude that gloating in Krugman’s face won’t even cross your mind. Personal survival will be higher on the priority list. Read Mises on the crack-up boom. The true financial crisis came in 2008, and instead of letting it happen, they expanded credit. And every time the crisis tries to rear its head again, they expand credit further. The U.S. currency will die from this. If it doesn’t, Mises’ theory will need reexamination.

You can see it zoomed up around September 2012, which was when QE3 was announced. I’m getting ready for a trip, but you guys can check and see if the timing of QE2 works also.

Sorry Bob, but I think that your eyeballing of the chart is off. Here is the gold price over the same timeline, but colour-sequenced according to the announcement of QE1 (red), QE2 (green), Operation Twist (orange), and QE3 (purple), respectively: http://research.stlouisfed.org/fredgraph.png?g=hAO

(Y-o-y growth version of the above here.)

As you can see, the “zoom” in the latter half of 2012 occurred some time before QE3 was announced. In general, the announcement of the QE’s was met with a fall in contemporaneous gold prices… Or flat-lining at best. (The notable exception being QE1.)

FWIW, and while I certainly don’t count myself as a “gold bug”, I was quite sceptical about Krugman’s use of Hotelling to explain the low interest rate / high gold price puzzle from the outset .

PS – I note that Menzie Chinn beat me to it.

Stickman, what are you talking about? QE3 was announced in mid-September 2012 right? look at the price of gold during September 2012. And it wouldn’t be surprising if that move leaked out a week or two early.

Argh, for some reason that link isn’t retaining my refinement of the dates… Anyway gold shot up more than $100/oz in September 2012.

Right, people anticipated these QEs. I don’t think a precise coincidence of the dates is really the point.

The only thing I’m skeptical about is whether this precipitous drop (as opposed to the slower downtick) is the result of recent QE news. How do we understand an April 10th Fed announcements relationship to a sharp drop several days later?

That, I think, is what makes people talk in terms of a gold bubble and some irrational behavior around gold (of which the Beck example is only the most colorful).

If people anticipated QE3 — which I certainly expect they did — then it’s still pretty hard to explain the sharp drop that so closely followed the actual announcement.

I agree that using the exact dates of the announcements is a rather imperfect measure. However, I don’t think we can say the evidence is *that* convincing either way… at least not w.r.t. the (anticipated or otherwise) announcements themselves. As it happens, I’m generally pretty sceptical about arguments regarding the correlation between money supply and gold.

PS – On retaining the dates for your FRED graphs. I think using the .png link should do the trick. (At least, that’s what I usually do.)

Maybe I can give some insight to support Bob. As someone who trades currency and metals regularly I can recall the day Bernanke dropped the QE3 bomb.

I was in my local barbershop waiting to get my hair cut here in Ireland. I had been anticipating the announcement for about 2/3 weeks as I follow financial news closely. It was common knowledge he was going to announce some kind of QE but nobody knew how open-ended it would be.

In anticipation, traders flocked to Gold in the preceeding weeks, knowing the value of the Dollar would drop against it as a result. When they announced the plan on the radio, that Bernanke had basically promised a buttload of new cash EACH MONTH – the price of Gold shot up.

I can recall at least a $90 increase before I even got to sit in the barber’s seat.

If the chart says otherwise, it’s wrong. Bare in mind, I’m only talking about QE3 – I don’t have first-hand experience trading during the others, but I don’t see why they wouldn’t have followed this same pattern.

I can recall at least a $90 increase before I even got to sit in the barber’s seat.

If the chart says otherwise, it’s wrong.

I love this guy already. It’s an Irish thing.

[sad face]

I’m Irish too.

Representing the Murph! (A lot of my family are Murphys).

If the chart says otherwise, it’s wrong.

Oh dear, CI you have a point. I’ve just spotted a mistake in the first chart above.

In light of recent events (#Rogoff #Reinhart), some of you may find this amusing: Rather than adding QE4 to the chart as a new series like I intended, I mistakenly replaced the QE3 series with it.

Here’s the corrected graph:

http://research.stlouisfed.org/fred2/graph/?g=hC0

(QE3 = Purple, QE4 = Gray)

PS – Looking at the (hopefully correct) graph, I still think my general point stands. QE announcements were met by varying responses. Sometimes gold prices rose, other times they fell or flat-lined.

PPS – I like the barber story, but a minor point is that these are daily fixing prices, rather than intraday.

😀 Fair enough G. Though I will say the end of day price didn’t land far off peak that day, I don’t recall any major intraday fluctuations – that $90 jump held and slowly grew for at least a month if I remember correctly – it wasn’t a once off.

I will also say that rumours of the announcements are almost as influencial over the shifting currencies – you can absolutely spot the correlation between conversations the chaps on Bloomberg/MSNBC/etc. have regarding the Fed, Treasurt, mine strikes, EU bailouts, etc. and the movements of gold against the dollar.

It’s impossible to put rumours into a chart., but I would look for the major jumps and dips – find their times (by the minute) and then google for stories about the Fed, Treasury sales or an EU bailout – 9 times out of 10 you’ll find a story on a major network.

Just my ever-devaluing two cents. 😀

http://www.federalreserve.gov/releases/H6/Current/

This chart is frequently updated, so the values will change over the long run, but as of now, the annualized rate of growth of M2 the past three months has declined significantly to just 1.7%. The last time M2 growth slowed down to a rate close to this was in the summer of 2008.

Was Googling cognitive dissonance and it brought me here.

We should all give thanks to AP “Economics of Control” Lerner. Otherwise, we might have never discovered the joys of the Economics of Control or how important it is for the government to arrive at and enforce the optimum distribution of goods and income.

http://www.flickr.com/photos/bob_roddis/5560086644/in/set-72157626353319778

The fake AP Lerner above has self-esteem, inferiority issues, which is why he finds it psychologically satisfying when power overrules reason.

Wow, I enjoyed Bob’s post, but I never thought it would establish Krugman’s bad analysis of gold prices as a prime example of ‘cognitive dissonance’ …

Check these out:

Gold Crush Started With 400 Ton Friday Forced Sale On COMEX

http://www.zerohedge.com/news/2013-04-15/gold-crush-started-400-ton-friday-forced-sale-comex

Mike Maloney: Today’s Low Gold & Silver Prices Are Not Realistic

http://www.zerohedge.com/news/2013-04-14/mike-maloney-todays-low-gold-silver-prices-are-not-realistic

No matter what the price of gold does, I still don’t think it should be a large part of anyone’s portfolio. Historical returns from actual productive assets will appreciate at a much greater rate over the long-term (20 + years) than a chunk of metal. In addition a good consumer staples company like Coca-Cola will actually provide income and a solid measure of inflation protection with substantially less volatility than precious metals.

Look at it this way. You could buy all the utilities and farmland in the United States for the same price as all the gold in the world. Which one would you rather own, one that provides power and food for millions of people or something that just sits there?

I would rather buy the gold. A lot less to manage.

Plus with that amount laying around you could build a house and live in it!

So much for gold not being really useful.

If I could afford enough gold to build a house, then I would certainly not buy any more gold. At that stage it would be time to buy beer… not for investment purposes neither.

John Becker wrote:

Look at it this way. You could buy all the utilities and farmland in the United States for the same price as all the gold in the world.

Generally speaking, John, is this a good way to evaluate the price of something?

You could own all the farmland and utilities in the US or own the dollar value of their combined worth. Which would you rather have the thing that produces food or the pile of dollars that they are currently valued at, that just sits there, mocking you?

Probably the value in dollars.

Utilities and farmland don’t produce anything unless there are people to work them.

People don’t work unless they have a payment system where they are confident they can get something useful in return for their efforts.

Gold is one payment mechanism that has proven the test of time, and tends to always find favour (or has done every time so far since the first civilizations).

Bob,

Everyone — Keynesians, Austrians, Marxists — agrees that creating more money through measures like QE3 decrease the value of the dollar. The Austrians — and their “models” — distinguished themselves by saying that this would result in hyperinflation. You got it crashingly wrong, bub, and it’s time to fess up.

What are you on about man? Are you saying Hyperinflation is now not going to happen? What evidence do you have? Not only this, but I don’t think the Austrians say hyperinflation is absolutely going to happen. They say that it’s one possible outcome of this silly printing nonsense. Another possibility they talk about is a default. Again, this could happen.

But to your point – please share how you discovered hyperinflation is now impossible?

There’s absolutely nothing regarding Austrian “models” to “fess up to”.

Austrian theory does not predict that if the money supply rises by X%, that price inflation will rise by k times X%, or that there will be “hyperinflation”.

Austrian theory takes into account demand for money holding as a factor determining how much of new money goes into spending.

Besides, the aggregate money supply from 2008-2010 *went into negative growth*. The Fed’s inflation was counter-acted by widespread credit deflation.

Hyperinflation requires people to actually abandon the paper currency, which requires that they either have a viable alternative, or they massively abandon economic activity altogether. Some Austrians predicted that, but not many.

Ordinary inflation requires that people keep using the devalued currency but just increase their prices… and indeed the prices of most things has increased, and continues to increase. The only question here is how much, and when. There are still deflationary forces at work (e.g. home loans are still under water) and the banks are sitting on the money rather than lending it out, but unless the Fed can pull that QE money back out of circulation when they need to, the prices must eventually start to reflect the available money in the system.

I think we have covered it already, that understanding the existence of a Cantillon effect is one thing, but accurately tracing out exactly where it falls is much more difficult.