Landsburg Frames the Minimum Wage Debate Very Strangely

Ahh, it seems Steve Landsburg is no longer cuddly. Instead of worrying about the unskilled inframarginal workers, he is now concerned about upper middle class college kids working at Wendy’s on their summer breaks.

There’s nothing wrong with Steve’s post as far as it goes, but it would be like Obama proposing to increase the sentencing on drug dealers by 6 months, and then economists have a big debate about whether this particular policy move will increase gun violence. Then Steve Landsburg chimes in and argues that it is wrong to worry about whether this particular marginal change will affect gun violence. Period.

In case I’m being too coy: Even if it were true that raising the federal minimum wage from $7.25 to $9 will have negligible effects on total employment (which I highly doubt), and even if it were true that every single person working right now for minimum wage would be willing to take the gamble (Steve’s point), it is odd that free-market economists wouldn’t still go ahead and make the broader point that there are hundreds of thousands (millions?) of people in the US right now with low skills who want to work, but are prevented by law. They aren’t the ones facing the “gamble” right now that Steve describes, because maybe they only have productivity justifying a wage rate of $5/hour.

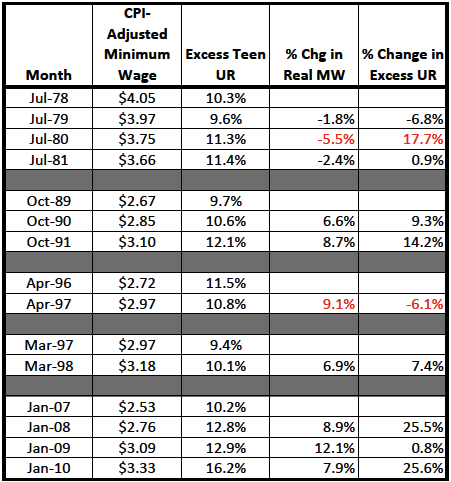

Anyway, I wasted yet another hour of my life in an empirical exercise that will not make anyone change his or her mind. I used this Department of Labor website to get every change in the federal minimum wage since 1978, and then I got the CPI-adjusted minimum wage for the 6th month before and the 6th month after each change. Then I got the national unemployment rate and the 16-19 year-old unemployment rates, to calculate the “excess teen unemployment rate.” Below are my findings:

(As always with Free Advice, this is stuff I’m whipping off instead of doing work for paying clients, so I’m not double-checking any of these numbers….Read at your own risk.)

Generally speaking the pattern holds up. I put in red the only two entries that surprised me, because they involved such a big move in the minimum wage and yet the excess teen UR rate went the “wrong” way. Of course we can come up with all kinds of stories to explain them away, but I wouldn’t have done so if they had shown what I wanted. So, I’ll just post the table and let you guys argue about it.

Paul Volcker made some significant changes to interest rates around 1980 and 1981 so I would regard that as a factor completely unrelated to minimum wage.

This is one of the rare occassions where I agree with Bob, not Steve. I gave reasons chez Landsburg so won’t go over them here. What’s really odd is that Steve already left a comment here showing just how compelling Bob’s data is. Steve’s irenic conclusion doesn’t seem quite right, given the strength of the argument and the data.

I will repeat one idea I had as I’m interested in Bob’s take.

In some sense I think the damage a minimum wage does can be cumulative. Those who would start at $5 and learn to be worth $8 don’t get the chance. So when the wage is raised from 6 to 9 they are not part of the measured effect. They don’t show up in your regressions. But they would, absent to $6 wage being too high already. Phantom losses of non-existent jobs, but I think they should matter.

Got to love interventionists. They believe enforcing a higher wage floor can raise wages and enable workers to buy more consumer goods at the same prices. Then when it doesn’t, they then demand the central bank inflate so that there can be an increased demand for labor in an environment of generally higher spending.

How many times do they gloss over the fact that wages are also a business cost, and for most manufactured goods a component to pricing?

This is all a gigantic waste of intellectual time and energy. There are far too many bright and intelligent minds devoted to wild goose chases created by anti-social goons who don’t understand economics.

It seems to me that the creation of a mandatory labor floor establishes a glass ceiling for those barely “worth” their former salary of $7.25. That job might have, at 7.25/hr (or less), served as a stepping stone for a marginally capable employee who had been determined to prove him/herself and gain entree into the workplace.

As opposed to an absolute minimum wage, there is an entire range of lower wage spectrum that could be considered … from slightly below the current minimum wage all the way down to internships in the extreme far end of the spectrum. Any of these wages do provide opportunity for those who are barely employable (for any number of reasons).

Why would a society choose to forgo market driven wages? It would seem a crucial option when there are dysfunctional swathes of the population dropping out in record number …. next step is gang economy and jail or government assistance, not a minimum wage job, because he/she has extremely slim chances of competing for work atba low skilled job at any artificially set minimum wage, even if the person desperately wanted to work.

So who does the minimum wage policy serve? Perhaps unions, through “their” Congressperson(s), are essentially creating a union employee cartel environment, closing ranks below that magic number. Of course, many union members work at rates far above the minimum wage skill set to be affected, but anyone who is trying to get work as a dishwasher is going to have stiff competition if a minimum wage is in effect.

1980 and 1997 are infamously known for the ridiculously bad weather that took place. Obviously the causation is not due to the minimum wage during those years.

If you run a regression with excess teen unemployment as the dependent variable and the minimum wage and # rainstorms as your independent variables, you’ll find quickly what I mean.

Either abolish the minimum wage or immediately increase it to 25 per hour.

The excess teen unempoyment rate rises during recessions and falls during expansions, independently of minimum wage increases.

Excess Teen Unemployment Rate.