More Moves Against the Dollar

The problem with the USD being the world’s reserve currency is that it’s a situation where things could unravel very suddenly. So long as most investors think that the dollar will be OK next week, then it will be a self-fulfilling prophecy. But if people start to worry, then there could be a sudden crash as people head for the exits. Thus the USD system is like a giant commercial bank subject to a run, whenever the public loses confidence.

In that context, it’s interesting to relate three recent news items:

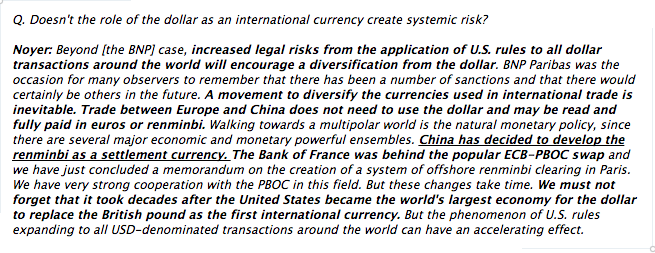

==> ZeroHedge reported on this exchange (in an interview in a French magazine) with Christian Noyer, governor of the French National Bank and member of the ECB’s governing board:

==> The German government recently decided to keep its gold stored in the US after all, but Gary North explains the irony of that decision.

==> Russia and China made a major energy deal that didn’t involve the US dollar. Here’s how a Telegraph article analyzes the significance:

With the dollar as the world’s petrocurrency, it also remains the reserve currency of choice for central banks globally. As such, the US is currently able to borrow with “exorbitant privilege”, as it has for decades, simply printing money to pay off foreign creditors.

With China now the world’s biggest oil importer and the US increasingly stressing domestic production, the days of dollar-priced energy, and therefore dollar-dominance, look numbered. Beijing has recently struck numerous agreements with major trading partners such as Brazil that bypass the dollar. Moscow and Beijing have also set up rouble-yuan swap facilities that push the greenback out of the picture.

If Russia and China now decide to drop dollar energy pricing totally, America’s reserve currency status could unravel fast, seriously undermining the US Treasury market and causing a world of pain for the West. This won’t happen tomorrow or next year. It’s unlikely even by 2020. But by announcing this deal, Russia and China turned the screw half a twist more.

Shortly before the invasion, Iraq started trading oil in Euros rather than dollars.

Fiat currency is protection money, a commodity backed medium of exchange where the commodity is violence.

The USA has the largest military in the world, so it gets the most advantage out of its currency. Pretty simple equation. I doubt it will end suddenly, but yeah some of that “exorbitant privilege” is going to fade.

It’s the other way around; The USA can “afford” the largest military *because* it prints the reserve currency:

War and the Fed | Lew Rockwell

http://www.youtube.com/watch?v=Tl9lS5k7H5M

The Germany gold story was hilarious. It really takes 7 years (or an infinite number, it appears) to move 100 tonnes of material from New York to Frankfort?

Nothing to see here! (Literally for the Germans at least… haha).

BTW: They wanted to move 674 tonnes over the 7 years.

Well, 674 explains it! Perhaps someday the transport technology will exist to do it.

Bullish for BTC!

I have been educating myself about this topic recently, and as alarming as it may be, I do wonder if there are long term incentives that our country offers rest of the world, that will help maintain keeping the USD as the world’s reserve currency. Aside from military might, which in my opinion is a two sided sword in terms of incentives for the rest of the world keeping the status quo, I would be interested in knowing more about how the US being one of the largest exporters of food and a significant exporter of coal affects the USD being the reserve currency.

So what?

OMG…

Who the f*** cares? The rumors of the dollars demise has been greatly exaggerated. Besides, the strength if a country’s economy has zero to do with the strength if it’s currency zilch nada.

Tell that to all those who argue for intentionally weaken a currency to “stimulate” and therefore strengthen an economy like….Krugman.

*weakening*

Off-topic.

Last year, remember everyone arguing that with the taper, U.S. interest rates had nowhere to go but up?

Hmmmmmmmm……….