Piketty Can’t Even Get His Basic Tax History Right

The more I read of Thomas Piketty’s Capital in the Twenty-First Century, the worse it gets. Try this excerpt:

[T]he Great Depression of the 1930s struck the United States with extreme force, and many people blamed the economic and financial elites for having enriched themselves while leading the country to ruin. (Bear in mind that the share of top incomes in US national income peaked in the late 1920s, largely due to enormous capital gains on stocks.) Roosevelt came to power in 1933, when the crisis was already three years old and one-quarter of the country was unemployed. He immediately decided on a sharp increase in the top income tax rate, which had been decreased to 25 percent in the late 1920s and again under Hoover’s disastrous presidency. The top rate rose to 63 percent in 1933 and then to 79 percent in 1937, surpassing the previous record of 1919. [Piketty pp. 506-507]

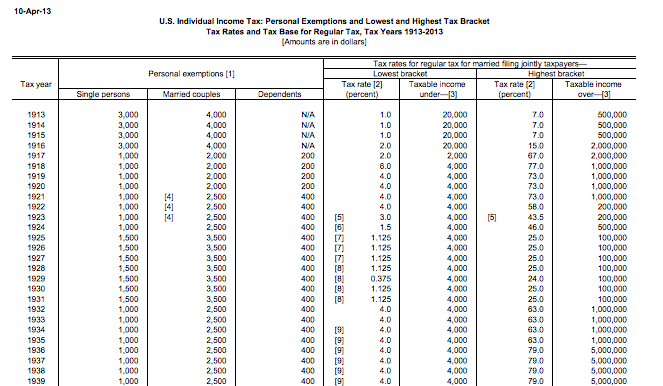

Look, I don’t mean to be a stickler, but the above tax “history” is totally wrong. Here is the actual history of the top federal income tax rate, from the Tax Policy Center:

The column you want to look at is second from the right. A few things:

(1) The top rate was lowered to 25 percent in 1925, not exactly “the late 1920s” and certainly not by Herbert Hoover. (I think the brief 24 percent rate in 1929 was a one-off adjustment in the surtax, but I am not certain and I’m not going to go look it up right now.)

(2) The top rate was jacked up to 63 percent in 1932, not 1933, and it was done by Herbert Hoover, not by FDR. (Note that the 63 percent rate applied to the 1932 tax year, so we can’t rescue Piketty by saying he was referring to the first year of impact rather than the passage.)

(3) The top rate was raised to 79 percent in 1936, not 1937. (If you want to cross-reference another source, this page also agrees that the 79 percent rate kicked in in 1936.)

Now if there had just been one instance of Piketty being off by a single year, I would excuse it by saying maybe he got mixed up in interpreting how US tax laws work. But to say (or did he merely imply?) that Hoover was the one to lower tax rates to 25% is just crazy; Hoover wasn’t inaugurated until March 1929, and the top rate was lowered to 25% back in 1925.

Furthermore, notice that this isn’t an “arbitrary” screwup on Piketty’s part: On the contrary, it serves his narrative. It would be really great for Piketty’s story if the right-wing business-friendly Herbert Hoover slashed tax rates to boost the income of the 1%, thereby bringing in a stock bubble/crash and the Great Depression. Then FDR comes in to save the day by jacking up tax rates. Except, like I said, that’s not what actually happened.

So let’s see: The #1 Amazon bestseller is a work involving a theoretical mechanism that explains how interest rates will interact with GDP growth in order to yield an ever-rising share of capital income, and this is embedded in what is (we are told) a masterful historical analysis of tax policy and income distribution. So far we’ve seen:

(a) Piketty’s theoretical structure suffers from basic confusion, which was so bad that Nick Rowe declared in the comments here: “If an economist writes a whole book about capital and the functional distribution of income, you would think he would at least understand the very basics of the theory of capital and interest. He does not.

Bob is absolutely [right] about this. How come anyone takes this stuff seriously?”

(b) Piketty truly doesn’t know the first thing about the Cambridge Capital Controversy.

and

(c) Piketty botches basic historical tax facts, in a way that helps his narrative.

But hey, it’s all good. He gives us a scientific justification for taking property away from rich people. Why let the above quibbles get in the way of worldwide confiscation?

One common criticism I hear of Austrians is that the reason they aren’t taken seriously, is because all the “good work” is being done by the mainstream. .

Well, if making crucial errors in the history of thought and the political history used to buttress your policy conclusions qualifies as doing “good work”, then maybe it’s a good thing Austrians aren’t doing any!

Even a first year student can calculate the economic justification for selling your opinions on the open market.

Sorry, you “conservatives” had your chance. DeKrugman said the debate is over.

I have it from secondary scources but i heart that pikety is in favour of Capital tax.

I wonder if mainstream in this case is base on Ramsey model?I learnt in college that base on Ramsey model capital tax is the worse type of tax, is he dealing with this issue anyhow?

Obi, I am going to do a full book review in a week or two. Stay tuned.

(But, Piketty doesn’t think taxing capital is bad, at least not if it’s limited to the very wealthy. So he rejects the standard arguments that claim taxing capital is much worse than taxing income or consumption.)

Murphy, thanks for all of this. We “Austrians” learned our lesson after Hayek didn’t write a critique of The General Theory because he believed it would be just a passing fad.

According to Gary North, as next to no one reads the General Theory, a series of critiques of the most popular economics textbooks would be far more relevant.

Probably true. But critiquing Piketty is worthwhile, as he IS being widely read right now (or at least, widely discussed, I suspect large numbers of people who agree with him haven’t actually read the book, like the hipster Bob met in the coffee shop.)

My guess is that he didn’t feel the need to check his facts because everyone knows that Hoover would have been the one that cut taxes and FDR would have been the one that raised them. Extreme bias causes facts to morph to fit your worldview.

a) and b) are mistakes that show a lack of scholarly rigor. Bob did a good job of explaining those – even I was able to understand his example. c) would be poor for even a high school term paper.

As if a high school teacher would correct a paper claiming Hoover cut taxes and FDR raised them…

Somehow…. I think these table errors will be allowed to slide under the rug.

Had the implications been inversed though…http://www.bloomberg.com/news/2013-05-28/krugman-feud-with-reinhart-rogoff-escalates-as-austerity-debated.html

Bob, look at this other error:

http://www.economics21.org/commentary/piketty%E2%80%99s-historic-minimum-wage-errors

Again, incredibly sloppy, and always erring on one side of the narrative.

again….. these policy proposals by statists are racist, period.

“In 1938 the average hourly wage in manufacturing

industries was 62 cents an hour. In January, 1968, it was

$2.64 an hour. But our legislators, not content with this

general rise in wages due to more and better tools and

natural economic forces, have decided to keep raising

the legal minimum wage even faster than the fast-rising

market average. Thus the statutory minimum was only

29 per cent of average hourly earnings in manufacturing

just before the increase in 1950, but 40 per cent

before the increase of the minimum in 1956,43 per cent

before the increase in 1961, 47 per cent before the increase

in 1963, and 54 per cent before the increase in

1968. The consequence of this is that the legal minimum

wage was pushed up 114 per cent between early 1956

and 1968, though average hourly earnings in manufacturing

rose only 55 per cent. Meanwhile, the Federal

minimum wage has become effective over a far greater

range.

The net result of all this has been to force up the wage

rates of unskilled labor much more than those of skilled

labor. A result of this, in turn, has been that though an

increasing shortage has developed in skilled labor, the

proportion of unemployed among the unskilled, among

teen-agers, females and non-whites has been growing.

The outstanding victim has been the Negro, and particularly

the Negro teen-ager. In 1952, the unemployment

rate among white teen-agers and non-white

teen-agers was the same—9 per cent. But year by year,

as the minimum wage has been jacked higher and

higher, a disparity has grown and increased. In Februaryary of 1968, the unemployment rate among white teenagers

was 11.6 per cent, but among non-white teenagers

it had soared to 26.6 per cent.”

http://mises.org/books/manwelfarestate.pdf

MG thanks! This guy is something else, isn’t he?

If you had shown me the tables and then asked me to describe how Piketty would describe the tax changes, I would have predicted exactly what Piketty wrote. These aren’t errors- they are lies that Piketty hoped no one would catch, but if they were caught, it could be explained away as a “slight error”. Krugman has made this sort of thing into an art form.

Yancey, I guess I am more naive than you. I would not have predicted a scholar would put demonstrably wrong historical facts in his book. Like you said, Krugman et al. have totally misled their readers regarding Hoover vs. FDR, but at least he didn’t write things that were flat-out false. Piketty has lowered the bar.

(I should note that this is through a translator, so it’s conceivable there’s a less sinister explanation. But it doesn’t look good, especially with the minimum wage stuff.)

I guess I have seen too many “scholars” put demonstrably wrong facts in their books, and done so deliberately. Then I have seen legions of other “scholars” defend the practice.

“(I should note that this is through a translator, so it’s conceivable there’s a less sinister explanation. But it doesn’t look good, especially with the minimum wage stuff.)”

That’s very charitable of you, Bob.

Can you imagine if Austrians were allowed to use this excuse? Any time someone criticizes Mises we can just say “Well, this was more accurate and made more sense in the original German.”

That’s very charitable of you, Bob.

Well I’m a Christian, that’s what we do (except when we’re hypocrites).

If I read your chart right — and I may not be — ‘Roosevelt’s’ increase of the rate to 63% (and later to 79%) was accompanied by a really massive threshold increase. So, wouldn’t that have been experienced by most wealthy people as a tax cut? I find it hard to believe too many people were making $1 million and $5 million a year at that time. For everybody below that down to $100,000 (which would have been practically all of even the very wealthy, I should think) their marginal rate would have fallen from 25% down to the lower bracket (4%).

But maybe I’m reading it wrong…

If you want, you can peruse the charts here for more comprehensive data: http://taxfoundation.org/sites/taxfoundation.org/files/docs/fed_individual_rate_history_nominal.pdf

In 1936 under FDR, additional brackets were added at the top, and tax rates for everyone earning over $50,000 were raised. The tax rate for $1 million to $2 million was 77%, where before the $1 million+ rate was 63%. The 1932 hike was even more extreme in its overall impact. Those earning $100k+ went from 25% to 56%.

By his own logic, Piketty ought to be proclaiming what a wise and progressive man Hoover was. Incidentally, the 1925 tax cut affected every tax payer. The lowest bracket dropped by 0.5%, then the next several dropped by 1%, with bigger cuts above $24,000.

Scott Angell wrote:

If I read your chart right — and I may not be — ‘Roosevelt’s’ increase of the rate to 63% (and later to 79%) was accompanied by a really massive threshold increase. So, wouldn’t that have been experienced by most wealthy people as a tax cut?

The chart wouldn’t give you that kind of information. You’re right, the chart is *consistent* with the possibility that someone making, say, $900,000 faced a 25% tax rate in 1931 and a 10% tax rate in 1932.

But that’s not what actually happened. Rates across the board went up, but it’s true that only people earning $1million+ saw their rate go from 25% to 63%.

Note that from the chart above you can see that the lowest tax bracket rate went from 1.125 to 4%. So no, nobody got a tax rate reduction in 1932. Hoover socked it to everybody.

Scott Angell,

Yeah, look at the link that Scott D. posted. For people who made $100,000, they faced a 25% rate in 1931 but a 56% rate in 1932.

The specific mistake you’re making, Scott Angell, is thinking there are only two brackets. The chart I posted is just showing the bottom and top brackets.

OK, thanks guys, that makes more sense. That really was a massive hike in ’32.

Income tax does not care about wealth. Income tax is not a wealth tax, it is a work tax.

You work, you pay.

Income tax and similar keep the poor, poor and the wealthy, wealthy.

Barrier to entry if you will…

Krugman is absolutely unbearable to me. I just read his piece The Piketty Panic, and it’s such a crock that I couldn’t even get through it all. This line cracked me up, though, “the right seems unable to mount any kind of substantive counterattack to Mr. Piketty’s thesis. Instead, the response has been all about name-calling.”

He’s lucky his fans don’t do any fact checking on the things he writes.

Wenzel has a blog post linking to a Forbes article pointing out six problems pointed out by people from around the interwebs. This guy sucks so much. Hopefully he released it too soon for it to still be relevant when the bond bubble bursts and Uncle Sam is forced to go hunting.

Piketty is wrong about the 1932 Revenue Act, but the rest reads like an intentional effort in misdirection. Piketty shifts back and forth from the active to the passive voice in what looks like an effort to obscure which President did what. (Did he write this in English or French, and if the latter, is it any clearer in the original?)

“He [FDR] immediately decided on a sharp increase in the top income tax rate, which had been decreased to 25 percent in the late 1920s and again under Hoover’s disastrous presidency. ”

– Almost technically correct, if you grant “late 1920s” to mean “the second half of the 1920s.” Piketty doesn’t say Hoover passed the cut to 25 percent, he says it “had been decreased” to 25 percent and then was decreased again under Hoover.”

– Piketty’s discussion of FDR is a similar slight of hand. First he tells us that FDR decided immediately on a sharp tax increase, then he tells us that the tax rate “rose to 63 percent.” Again, he has to fudge the dates, but the passive voice is doing most of the deception.

J Mann right, I can’t decide whether he is incompetent or dishonest, because it was translated. It’s conceivable that the translator introduced the ambiguity, who knows.

Capital for the 21st Century, 2nd edition.

For the record, “the top rate rose to 63 percent” is technically active voice, not passive voice.

Thanks, and you’re right. Is there a better way to describe what I’m talking about?

The sentence has a subject, that’s true, but it’s still obscuring the “true subject,” if you’ll permit me some license. (Again, if there’s a better term, I’d love to learn it).

In practical terms, “The top rate rose to 63%” isn’t any more informative than “The top rate was increased to 63%”.

The fancy way to say it would be that it’s vague about agency.

Thanks!

Blogging heads.TV has an interview with the translator wherein he claims that Picketty worked closely with him.

Piketty has created a 696-page doorstop of junk science.

Laborers’ compensation growth often exceeds GDP growth, that is, L > G too.

UT OH, SOMEONE BETTER TELL THOMAS PIKETTY ABOUT L >G TOO

and

THOMAS PIKETTY, 696 PAGES OF FOOLERY DESTROYED IN LESS THAN FIVE MINUTES

consultingbyrpm blog tag piketty