Boehner Boom Baby?

When he’s not trying to be the Moment of Zen clip on the next episode of the Daily Show, University of Rochester economist Steve Landsburg showers some love on Paul Krugman. After quoting Krugman saying:

Here’s a question I haven’t seen asked: If fear of future regulations and taxes is holding business back, as everyone on the right asserts, why didn’t the Republican victory in the midterms set off a surge in employment?

After all, if you really believed that fears of Obamanite socialism were the key factor depressing employment, the GOP victory — with the clear possibility that the party will take the Senate and maybe the White House next year — should greatly reduce those fears. So, where’s the hiring surge?

…Landsburg says to his readers:

…I can come back to the bit about the missing Boehner Boom. It’s a more-than-fair question. How would you respond to it?

Well Steve, the first thing to do is check to make sure the data aren’t the exact opposite of the story Krugman is pushing. “What the heck are you talking about, Bob?” you ask. Well, you tell me. Suppose that there were in fact a “Boehner boom.” What would the data look like?

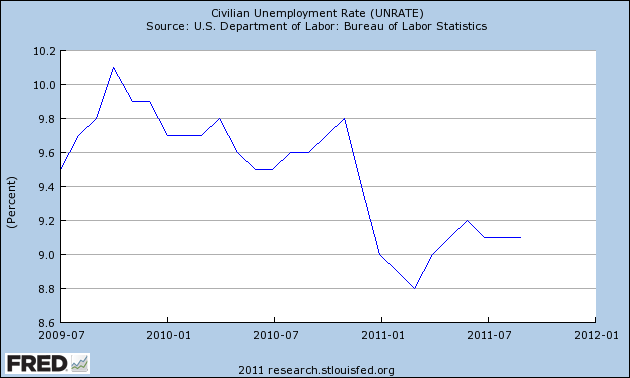

I suppose–hypothetically speaking here–that if, say, unemployment had been steadily rising, then stopped on a dime in the month when the Republicans won big in the 2010 elections, and then had the largest sustained drop of any period since the recession began, in fact far larger than any drop or surge that Krugman has used to vindicate his predictions regarding the stimulus coming and going…then that might be prima facie evidence for a “Boehner boom.” Of course it wouldn’t prove anything definitively, since there was QE2, people started anticipating a Republican rout as the elections got closer, everything in economics is ceteris paribus, etc.

Still, if unemployment had been steadily rising, then peaked in November 2010 and fell like a stone thereafter, dwarfing any other swings in unemployment since the recovery officially began, then surely that would put the Keynesians on the defensive, and it would bolster the people blaming the interventions of the Obama Administration for the sluggish economy, right?

Anyway, here’s the chart:

I actually have a surge in “real work” so I won’t be able to blog much for a while. I will let the professional pundits do what they will with the above, but I thought it was worth bringing up.

There was a Boehner Boom, it just doesn’t show up well in graphs because things would have been much worse otherwise. [/sarcasm]

Right, but Yancey, “our side” doesn’t need to say that. The unemployment rate dropped a whole point starting literally the month the Republicans got elected. Again, that doesn’t mean anything, but to the extent that we are going to “let the data talk,” it sure does seem like there’s a Boehner Boom. What else would it look like?

Oh, well, I see a few wags on Landsberg’s site already beat me to it.

Boehner and the House have passed many items the right believes will help the economy. None have been signed ino law. Overall, the House has passed bills to keep government running status quo with (maybe) promises of future cuts. The debt ceiling was increased repeatedly, the FAA continues to operate, … Boehner has largely been effective at stopping the Pelosi/Reid/Obama (and Bush43) agenda, but any observed Boehner Boom is not the result of a Republican-controlled House action plan. Those have all failed. Look elsewhere for proof of Republican success.

Craig, no matter how many times I try to qualify it, I knew someone would imply that I am saying Boehner is a great guy who reduced unemployment.

That’s not what I’m saying. Rather, I’m saying it’s a bit weird for Krugman to ask, “Why haven’t we seen a Boehner boom? Where’s the hiring surge?” when unemployment started dropping like a stone the moment the Republicans took power. Instead, Krugman should say, “On the surface it looks like a Boehner boom, but I think I can explain it away…”

Of course, calculation-killing near-zero interest rates don’t count as “regulation” to a Keynesian. How convenient.

calculation-killing near-zero interest rates

so the private sector is not borrowing because of low interest rates?

That’s hilarious!

Are you trying to compete with Murphy’s nonsense in his recent post about fiat money and the Euro crisis?

I’m referring to impairment of “economic calculation”, a key concept you cannot seem to grasp.

No, you are referring to near-zero interest rates killing economic calculation, which is nonsense as everything else you spout.

Remember you are no businessman, but just an attorney.

No, you are referring to near-zero interest rates killing economic calculation, which is nonsense as everything else you spout.

It’s not nonsense. Near zero interest rates set by the central banks do in fact kill economic calculation, because it prevents investors (and consumers) from knowing the true rates of savings. Interest rates MEAN SOMETHING in the economy. They regulate production and consumption over time. When central banks manipulate interest rates, it prevents the price system from regulating temporal coordination, and thus kills economic calculation.

I think we long ago established that the MMTers and all the various gangs of Keynesians just can’t comprehend the central concept of economic calculation no matter how many times one tries to explain it. Of course, if they ever managed to comprehend it, they would see their “paradigms” go poof in the breeze.

Roddis!!! Where’s the graph? You couldn’t find in 40 years?

Hurry up, you are running out of time!

Not only that, but look at the machinations that big funds are undergoing to chase yield. It used to be that yield corresponded to a productive (in terms of real output) investment. Now it seems more like herd-chasing for the asset class du jour, which is mostly determined by pinhead economic policy rather than entrepreneurs.

My point is that a 0% interest rate policy does not kill economic calculation any more than any other policy, since, even if there was a market interest rate, it is unknown.

It’s amazing how people who are delusional enough to think economics is a deductive science fail to apply the most elementary logic.

Actually the private sector is not borrowing because they’re getting denied capital – rather than making loans to small businesses and entrepreneurs, banks are just giving them to the Treasury so they can flip the T-Bills back to the Fed at a profit. This is the misallocation of capital resources that Austrians are always talking about – rather than engaging in real capital investments, financiers are just speculating in the bond bubble.

Lower interest rates are great if you can still get a loan, but not if they’re the reason loan request is denied. It’s kindof like how a minimum wage increase is great if you keep your job, but not if it’s the reason you get laid off.

There is no bond bubble. It’s a financial impossibility that Austrians cannot grasp.

Banks are not lending because they are repairing their balance sheets, as pretty much the rest of the private sector is doing.

The point is no one’s economic calculation is impaired by a near 0 interest rate policy, any more than by a 5% or 50%. Except maybe Roddis, but then his thinking is impaired.

There is no bond bubble. It’s a financial impossibility that Austrians cannot grasp.

It’s not a financial impossibility. That it is not an impossibility is something MMTers cannot grasp because they believe in the myth that governments can forever hold interest rates low by inflation into the credit market.

Banks are not lending because they are repairing their balance sheets, as pretty much the rest of the private sector is doing.

Repairing them from the damage of previous errors made on the basis of previous artificially low interest rates. Imagine the errors they are making now with near zero rates.

The point is no one’s economic calculation is impaired by a near 0 interest rate policy, any more than by a 5% or 50%.

False. If the policy is set at anything other than market, which means if policy exists, then it prevents investor and consumer coordination over time. One cannot calculate what the true rates of savings are in the economy if the central bank is holding non-market rates via inflation.

A bond bubble is a financial impossibility: bond prices have an upper bound. Another simple concept Austrians are unable to grasp.

If banks are not lending, they are unlikely to be making any errors.

As I said, a 0% policy does not impair anything any more than any other interest rate target policy, even if the concept of a market interest rate was real, since it is unknown.

Unless the devil is behind the 0% policy to make us sin!

An upper bound? Yields have a lower bound, but the price doesn’t have to.

If yields have a lower bound, then price has an upper bound, and it’s price what defines a bubble.

A bond bubble is a financial impossibility: bond prices have an upper bound

Hahaha, that doesn’t mean bonds can’t go into a bubble. That just shows your inability to understand bubbles.

ALL prices have an upper bound you clueless buffoon. No price can be infinity. Every price is upper bounded by the quantity of money in the economy. No price can be higher than how much money exists.

Another simply concept that MMTers are unable to comprehend because they’re too busy trying to convince themselves and others that one can print their way to infinite prosperity.

If banks are not lending, they are unlikely to be making any errors.

Banks are lending.

Where did this myth that banks are not lending come from? Egad, any crude check on the St. Louis Fed website can confirm that banks have never stopped lending.

This nonsense is almost as bad as the Keynesian mantra that “when people don’t spend money on consumption, there is no profitable investment.” Well duh, except people do spend money on consumption, ALL THE TIME.

As I said, a 0% policy does not impair anything any more than any other interest rate target policy, even if the concept of a market interest rate was real, since it is unknown.

As I said, 0% DOES impair the economy because it prevents investors and consumers from coordinating with each other through the price system.

If voluntary savings would generate rates averaging 10%, but the central bank steps in and targets an overnight rate of zero percent that leads to rates averaging 5%, then because the market rates are unobservable, investors can’t know the true supplies of capital.

Unless the devil is behind the 0% policy to make us sin!

…

Only true trivially in that no price can rise to infinity, but you seem to be saying there is an upper bound linked to the lower bound in yields which is completely untrue. This mistake of your’s suggests you know nothing at all about bond prices and yields.

Now, if you are going argue that there are no bubbles in any asset, I might let you off the hook (you would at least be consistent, though still wrong), but if you acknowledge the existence of asset bubbles of any kind, then your argument about bonds is complete nonsense. Pick one- no such thing as asset bubbles, or bonds can be in a bubble.

“There is no bond bubble. It’s a financial impossibility that Austrians cannot grasp.”

It’s not impossible. It’s happening right now in Greece. The whole reason Merkel/Sarkozy are trying to bail them out is because the banks stand to lose a lot of money from this ‘bond bubble.’

I agree that debts can always be repaid nominally if you print enough money, but I’m trying to talk about ‘the real.’

What does the bond crisis in Greece got to do with a bond bubble?

It’s default risk plain and simple. If you can’t tell the difference between that and a bubble then you are more clueless than Major_Freedom.

And default risk raises yields, which is another way of saying that bond prices collapse, hence a “bubble.”

Sorry if this doesn’t fully answer your question, but I’m having trouble differentiating between your definition of a ‘bond crisis’ and a ‘bond bubble’

“Banks are not lending because they are repairing their balance sheets, as pretty much the rest of the private sector is doing.”

Under normal conditions, banks would be repairing their balance sheets by making loans and collecting the interest payments from said loans. Traditionally, this is how banks generate a profit. Today, however, the Fed is paying banks specifically NOT to make loans and to hold their funds in an interest-bearing account. Without this Fed-induced subsidy, it wouldn’t even make sense to say that banks are “repairing their balance sheets” by simply holding onto the cash they already have.

so the private sector is not borrowing because of low interest rates?

Not when the rates of profit are even lower! When a depression hits, net investment, and thus the rates of profit, includes a negative component.

Maybe Krugman is just consolidating his arguments to make less work for himself. He used to say “This evidence looks like it supports the Right, but let me twist it for you to show you why it really doesn’t.” (Think Rick Perry and Texas jobs… not saying his storyline is never more right than the GOP storyline.) But it’s much easier to just say, “There is no evidence supporting the Right.”

For example, it’s much easier to just claim that the behavior of the Occupy crowds has been much better than the Tea Party crowds than it is to have to bother to explain why threats of violence and the destruction of local business bathrooms actually is a type of better behavior.

If a congressman passes no bills into law, and there are no Keynesians around to whine about it, can the economy grow?

Krugman’s claim here relies, not for the first time, on people’s ignorance of how the modern U.S. Government works. He relies upon their faith in the 9th grade civics model.

The reality is most regulation does not originate in Congress in the first place, and even such regulation as Congress authorizes is simply a delegation of authority to agencies to fill in the blank. We’re still waiting to see what regulations will be put in place for the Health Care bill and Dodd-Frank. “The Administration” goes back and forth on how onerous to make their new environmental regulations (should they be greatly onerous? or merely sharlpy onerous?),

So even if there was a Boehner Boom, we would expect it to be short-lived as it slowly dawned on people that the 9th-gread civics model, the Schoolhouse Rock “I’m Just a Bill on Capital Hill” model has only the most tenuous relationship to reality today.

As for my part, I shouldn’t end on an ad hominem but it needs to be pointed out: I’m just old enough to remember a time when Krugman wasn’t a tool. He’s been living off the accumulated reputational capital of the past for a long time now; he’d have run out if he wasn’t right to assume his admirers will swallow almost any bovine fecal matter and call it champagne, because they’re more ignorant – or at least willing to behave as if they are more ignorant – than the people Krugman and his minions are always insinuating are ignoramuses.

Here’s an even easier solution: look at the actual data for why business are firing people.

http://bilbo.economicoutlook.net/blog/wp-content/uploads/2011/10/US_mass_layoffs.jpg

source:

http://www.bls.gov/schedule/archives/mslo_nr.htm

I guess this data doesn’t match the story of this post, so it gets excluded?

And it’s funny how demand started soaring right when the Republicans won.

Anyway AP, I’m not making an argument for or against Boehner. I’m saying that Krugman is demanding to know why the employment situation didn’t improve when the Republicans won big, and I’m pointing out that it did. Maybe it’s a coincidence, but prima facie the burden is on Krugman to explain it away, not ask why such evidence doesn’t exist.

MaMoTh and AP Lerner,

Despite being a committed Austrian, I think that MMT describes banking operations well. I’ll agree with the MMTers that the government, as a monopoly issuer of fiat currency, can’t fail to raise the necessary funds to spend whatever they want. However, it doesn’t mean that it’s beneficial or even stimulative for them to do so. Economic calcuation is important and prices matter. When the price of interest gets pushed down by fiat money injections, it doesn’t stimulate, it misleads entrepreneurs into thinking that the price of capital is cheaper than it actually is. They’ll go out, borrow money figuring that a project is profitable at current prices and interest rates, but eventually find their producer prices rising as their is now an insufficient supply of capital goods in relation to money. The projects cannot be completed and entrepreneurs have been misled.

I think the MMTers can agree with 3 key points

1. Low interest rates favor long term investments

2. The Fed and treasury can use money creating powers to push down interest rates

3. In a situation where this happens, there are insufficient capital goods to finish the increased amount of long term investments

I think that, at most, they can sort of agree with the first 2.